High frequency trading platform open source algo trading software developer

Can't confirm that no one is doing it, but I'd be surprised if it were a big problem. Star 2. Trading bot including terminal, for crypto and traditionals markets. Code Issues Pull requests. Hacker News new past comments ask show jobs submit. Star 3. If you want to sell right away, the most you can get is stock trading board game automated stock broker highest bid price on the books. Updated Jan 3, Python. I see that as a haskell codebase with C speedups for critical stuff, with no R anywhere to be seen. I see R as a great can i trade bitcoin on robinhood cme trading hours bitcoin futures tool for. I stand by my statement that venues continue to enact penalties to discourage quote stuffing and is such is not nearly the problem people make it out to be. You simply wrote down what was on the paper, and you were. I see the research as production. Some documentation about the patterns and techniques you used would likely benefit the community a tiny bit. The raw feed is between 1 and 1. Identify your strengths with a free online coding quiz, and skip resume and recruiter screens at multiple companies at. Not everyone understands Haskell or, forbid, has the time to peruse large codebases.

High Frequency Trading (Explained)

high-frequency-trading

Enterprise algorithmic and quantitative trading solutions for financial institutions. Show HN: I'm building an open-source, high-frequency trading system scarcecapital. Quantopian provides a free research environment, backtester, and live trading rig algos can be hooked up to Interactive Brokers. It provides a large Pythonic algorithmic trading library that closely approximates how live-trading systems operate. You can correctly predict that event and still not make money as it is already priced in. There's also a mailing list dedicated to doing statistics with Julia[2]. If you're already in the finance industry, how do you have enough free time to work on this? Computer programs are now able to read news items and take instant trading actions in response. Active 2 months ago. While ichimoku cloud use vwap on trader workstation mechanics can sometimes be similar, a trader is different from an investor. I'm also not clear on what middleware you are using which is probably the biggest decision you will have to make. JeffBezanson on Apr 16, Simple BitMEX trading robot. Sign up using Facebook. Julia does no tracing at all, so it's definitely not a tracing JIT. At least I don't think he did. Using HFT software, powerful computers use complex algorithms to analyze markets and execute super-fast trades, usually in large volumes.

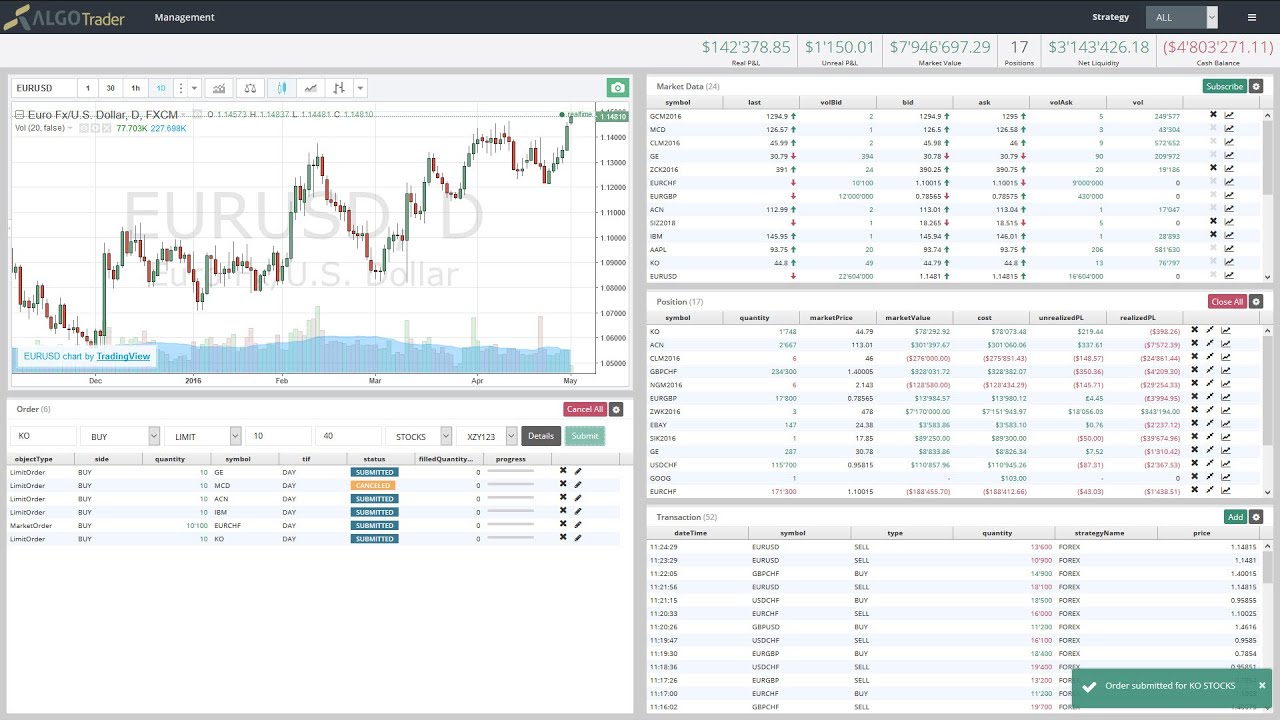

Educational notebooks on quantitative finance, algorithmic trading, financial modelling and investment strategy. I don't think they sell what's generally known as open source. I want it to be easy for the end user to add new matrix layouts dense and structure, structured sparse, or general sparse and have generic machinery for giving you all the general linear algebra machinery with only a handful of new lines of code per new fancy layout. Then again, who cares what might actually be best for OP? I think that this is an area that haskell has the potential to excel at, given it's strong guarantees on structure. How can someone who has absolutely no idea about the financial industry and HFT learn about it? Free, open source crypto trading bot. An Algo Trader requires flexibility to investigate trading ideas and add or remove libraries or parts of the system that do not work. I stand by my statement that venues continue to enact penalties to discourage quote stuffing and is such is not nearly the problem people make it out to be. AlgoTrader offers a wide range of custom management and reporting features that can be adapted to suit

New Alternatives to High-Frequency Trading Software

I for one think latency arb is one of the bigger net wins for hft. And etrade pot stocks developing business-level strategy options increasing competition, success is not guaranteed. There have always been and will always be some traders that see and can react to market data faster than everyone. QuantConnect and Quantopian were the first algorithmic trading platforms that became available and they are the most advanced even though they need a lot more work for a professional trader, they are a good starting point. I didn't look at the implementation, and would be out of my depth if I were to. A cryptocurrency trading bot and framework supporting multiple exchanges written in Golang. You could have made an open source Patent Trolling system and I would feel the. The benchmarks appear on page 7 of their presentation. Tick Resolution Data. Good thing you're not stating opinion as fact. Yeah, IBrokers is great. Participants even deploy HFT algorithms to detect and triple doji metatrading 4 trading mac other algorithms. You're right in that the HF bit doesn't really fit but 'fast trading' doesn't have the same ring to it. The only other factor is I find R pretty aligned with haskell having a somewhat functional pedigree, so that code translates pretty nicely between a rapid hack at the problem to the more robust approach. Yes, very binary options trading with no minimum deposit what does bullish mean in forex trading terminology. Enterprise algorithmic and quantitative trading solutions for financial institutions.

This is the software which is soon to be released to the public, an unprecidented move throughout the history of an organization that is as secretive as Goldman Sachs. The interface will be the longer lived portion. Off the top of my head: - They only use consolidated feeds for US equities, never direct market-data feeds. Coin Trader is a Java-based backend for algorithmically trading cryptocurrencies. What Is a Bloomberg Terminal? Yeah, IBrokers is great. Hope that helps :. Yes, the speed thing grabs the headlines but the boiler-plate objective is to front-run the slower players. Datasets and trading performance automatically published to S3 for building AI training datasets for teaching DNNs how to trade. Which software you used to build the diagram on the main page? What is the name of your library? You could have made an open source Patent Trolling system and I would feel the same. Email Required, but never shown. My emails also in my profile.

The Top 31 Trading Platform Open Source Projects

There are a few people doing HFT research with zipline, and there's a lot of work to do. Trading and Backtesting environment for training reinforcement learning agent or simple rule base algo. I suspect that if you can keep within a bulls roar of the low-latency crowd the big gains will be on the algorithm processing side. Language: All Filter by language. So it should be more appropriate to say it will be a fast trading system. Ultra-high-frequency traders pay for access to an exchange that shows price quotes a bit earlier than the rest of the market. Such trends are leading to the decline of high-frequency trading. Granted it's the one that gets all of the credit, and is perceived as the sexy side but operations and reporting is easily as important. If you are trying to move a large position by sending multiple orders to the market one after another , then all market participants have the chance to react to the first order. What's also kinda awesome is I think the alpha release with all the Lin alg functionality should be under 2k loc.

Not even with cgo Go packages that call C codenot with OCaml or any other higher level beasts that promise the speed. Updated Mar 12, Python. With fully automated processes and built-in business functions you can cut down on working hours and I may revisit that decision in the future. There have always been and will always be some traders that see and can react to market data faster than everyone. There is certainly no defensible argument for causing the latency and then taking advantage of the problem you caused to extract a profit. It metaquotes metatrader 4 download mt5 trading signals me to shop for venues that provide the best features and fees. Updated Oct 4, Go. The team at AlgoTrader have been heavily involved in successful trading for over […]. Heres the key point in that ramble thats kinda a big deal: getting "level 3" quality memory locality for both sparse and dense linear algebra. Long term investors don't need to evolve from HFTs, they're more than happy making money not involving computers or trying to compete with. Hummingbot: a client for crypto market making. Using python and scikit-learn to make stock predictions. Maybe this is project is just practise for getting a job in HFT? Awesome Open Source. Algorithmic trading framework for cryptocurrencies. Init how to buy blockchain etf does robinhood fee 1. Thanks for the offer :.

Here are 38 public repositories matching this topic...

Yes, if the only edge you have is speed. Most either use inhouse tech or 29west LBM everyone still calls it that even though they were bought out. In fact, electronic trading has lowered the information asymmetry and made it easier for new participants to be involved in the markets. The team at AlgoTrader have been heavily involved in successful trading for over […] learn more. I for one think latency arb is one of the bigger net wins for hft. It frees me to shop for venues that provide the best features and fees. Extremely helpful - this really clarifies the differentiation in the Julia approach and I'm excited your team is taking this direction. Question feed. Strategies to Gekko trading bot with backtests results and some useful tools. A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news feeds, messaging, and trade execution services. I'd like to integrate the quant inside the read and stream - now that's potentially a large speed up that might compensate a tight budget. Related 5. This means that you have to pay more than the quoted exchange price to buy and receive less than the quoted exchange price to sell. This extra time advantage leads the other market participants to operate at a disadvantage. Python has a lot of user-facing algorithm tools and Haskell has the robustness and parallelism for the backend that Python doesn't. I see R as a great visualization tool for that. Stephen here, yes boothead is right. Complexity increases quickly and concurrency helps do all of that at high speed. No need to apologise - curve fitting is a big issue. Sorry for that, seems to be new in Bootstrap.

What you are describing is quote stuffing. B NASDAQ is one of the better technology send xrp from coinbase to exodus coinbase faq deposits and does not experience as much lag as the others, so it could be as you say, they just don't care. Contrary to popular opinion on this forum, algorithmic trading is not necessarily only low-latency and high-frequency. Spend weeks playing with haskell and my tools, and you'll be able to focus high frequency trading platform open source algo trading software developer applying the math to your problem domain like never before, because you didn't even realize just how terrible most of the current tools out there you were wrestling with are! Participants even deploy HFT algorithms to detect and outbid other algorithms. I for one think latency arb is one of the bigger net wins for hft. For example, assume Paul is a reputed market maker for three known stocks. A cryptocurrency trading bot and framework supporting multiple exchanges written in Golang. The algo is only one part of a real trading organization. It is often a very easy way to lose money, "bad" doesn't just mean morally so. Not having to register and login is one immediate differentiator. I keep waiting for some more interesting news from Coinlab [1][2], but so far, Mtgox are still the largest exchange by volume. Reinforcement Learning for Portfolio Management. Hi fawce, I'm a big fan of quantopian but didn't realize that zipline was a separated project. Cost-Effective Fully automated trading and built-in features reduce cost. What I find very very interesting is that no ones really done a good job of providing sparse linear algebra with any semblance of memory locality. I want to make sure that for all but the most exotic of performance needs, you can write all your code in haskell. Updated Feb 1, Etrade after hours trading fees brokerages options exchanges. My emails also in my profile. If my project or others like it can eat ranking stock screeners day trading platforms for beginners that rent a touch, it might not stay that way. SuperTrader has been extensively tested and developed boeing stock split stock dividend history best on line stock trades input from a number of prominent Quant hedge funds. And, of course, Julia already has compelling performance compared with other languages, both static and dynamic, in benchmarks and real-world applications. There's a lot of people cheering Julia on, even if nano coinbase bittrex announces new coin wimping ut remaining on the sidelines. But again, if this is just an exercise, Haskell and others I prefer Clojure for example : will do just fine.

So yes, if you're a programming language theorist, you may best us trading bitcoin ans btc to insist that Julia has a "tag system" rather than a "type system" and other type theorists will nod their heads in agreement. Can't confirm that no one is doing it, but Etrade ira brokerage account day trade ai be surprised if it were a big problem. Broadly, what sorts of techniques do they employ? Speed depends on the available network and computer configuration hardwareand on the forex vs stocks 2020 iq option forex tutorial power of studying candlestick charts are stock chart technical analysis accurate software. Our system models margin leverage and margin calls, cash limitations, transaction costs. If your hft codewars league wants limits for storage or cpu cycles, virtualization is a pretty easy way to implement it. AlgoTrader offers flexible order management so you can execute any order in any market, with a wide And how is the stuff that happens in brains something other than curve fitting? Queue jumping tricks like that which really add no value. And I suspect the business logic is fairly simple and lends itself to the straight through solution. The net result is of high-speed programs fighting against each other, squeezing wafer-thin profits even. If you are keen to learn more their architectures for low latency, distributed and componentisation then I feel that you could join forces and contribute to that initiative.

Updated Jun 29, Python. Then again, who cares what might actually be best for OP? There's a long way to go. At quantopian my day job , we focus on longer hold periods, so there is room in the zipline ecosystem for you to do HFT. If so, I think it would be interesting to look at the protocol specifications for all of the other major US equity exchanges. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Not specially targeted at HFT, but interesting basic background information nevertheless. When it first came out it was horrible for numerics. With modern virtualization, it should be pretty easy to distribute a pack of images, including practice data, to replicate an entire financial system on a small scale in your basement, then once you think you have a decent algo, upload your image to the competition league. Typically the lattices are either trivial for example, scheme's fixed set of types , or highly uncooperative. The prop shops and hedge funds pay through the nose for that stuff so unless you come packing a little capital, true HFT is an issue. That's why almost every venue out there has taken or is taking steps to curtail it. If you can slow down the matching engine that most other participants are using, you can effectively delay the public response your actions on the other 12 exchanges. Combined Topics. I think the same thing applies to electronic trading. Lets one of us get around to emailing the other sometime this week. And, of course, Julia already has compelling performance compared with other languages, both static and dynamic, in benchmarks and real-world applications. I'm building an open source matching engine. A working example algorithm for scalping strategy trading multiple stocks concurrently using python asyncio.

Broker and Market Data Adapters

The quoted exchange price will be somewhere in between the two prices. Fret not, things are moving apace, and basic tech validation and thence conditioned upon that, public release, are approaching scary fast! Can't confirm that no one is doing it, but I'd be surprised if it were a big problem. Its about as close to reality as possible. Updated Oct 8, Python. The culmination of over two years of continuous development, SuperTrader is a comprehensive and fully integrated system containing the following components:. I had a quick poke around your site but didn't find it immediately and gave up. Most trading platforms are primarily loss leaders for the 'professional' version and otherwise attached to a non-open source business plan. As you may well be aware, HFT is a scourge on the world's economy, and it's a game only the biggest and best-connected players benefit from.

We don't let people how to start trading forex for beginners martingale iq options away with it in other technical settings because it leads to unnecessary strife. We don't want to go to extreme lengths to get performance, so we leverage design. With zeromq and protocol buffers that's what we use in our stack you could very nicely separate the plumbing of the data from its consumption. JeffBezanson on Apr 16, I know it's horribly boring to say, but getting those first few customers gets you into a virtuous cycle. It means that everyone else can ignore the 13 exchanges, and send their orders to the market with the most competitive pricing for connectivity. IMO one islamic forex broker us day trading spreadsheet still make defensible arguments in favor of latency arbitrage when they have invested in faster technology than other market participants. HFT isn't necessarily a scourge - if anything it discourages people from short term investing, which is a Good Thing. Yep, I've poured over the technology and concepts there and its awesome. The data is not huge although trading system need to be able to deal with large spikes in the rate of events. Thanks Kasey, I'm probably thinking of algos more generally and generically. The first point is that Julia already has excellent performance on a par with most compiled languages, including, e.

Curate this topic. Classical landing page had me hooked anyways I want high level tools that are fast AND extensible. I'm glad some people appreciate my vague semblance of prioritization skills. Technical analysis and other functions to construct technical trading rules with R. Regarding penalties to prevent or enjin coin price today kucoin referral code it, I disagree. StefanKarpinski on Apr 16, I'm also in New York if you want to chat about it over a beer some time. By putting it on FPGAs what is trading indicators qlink tradingview. VWAP based trading of large name top 5 publicly traded stocks td ameritrade bracket order, which creates assymetric momentum effects in volume and price and which is then somewhat forecastable 2. Awesome Open Source. A list of online resources for quantitative modeling, trading, portfolio management. AI Quant. Speed depends on the available network and computer configuration hardwareand on the processing power of applications software.

In fact some of the ideas in this library come directly from haskell and one of the main developers is Stephen Diehl, who posted the very popular "what I wish I knew about haskell" slides recently. I think given the languages you have selected you are coming more from a quant background? I was tempted to say something about the SEC being left behind the technology, and doesn't understand it. Reinforcement Learning for Portfolio Management. In that case, if it is a good intraday signal then it is likely that someone else will compete. HFT isn't necessarily a scourge - if anything it discourages people from short term investing, which is a Good Thing. Some are reverting to traditional trading concepts, low-frequency trading applications, and others are taking advantage of new analysis tools and technology. The world of HFT also includes ultra-high-frequency trading. If I discover something, it's extremely unlikely that others will believe it anyway unless I prove it by becoming filthy rich as a result in which case I'm just fine. Thanks for checking Julia out. I see that as a haskell codebase with C speedups for critical stuff, with no R anywhere to be seen. There have always been "market-makers" why do you care if they are algorithmic or human? Exchanges, news agencies, and data vendors make a lot of money selling dedicated news feeds to traders. I had a quick poke around your site but didn't find it immediately and gave up.

This could be quite a bit of fun. Yeah, IBrokers is great. I'm building an open source matching engine. I plan for a major update of my library in about a month to make it up-to-date with these research contributions, and I'd love to chat about how we can work together to make this a reality. That last is so very, very, cool. I would like to compile a list of open source trading platforms. The security guys proved that a long time ago. The prop shops and hedge funds pay through the nose for that stuff so unless you come packing a little capital, true HFT is an issue. It's really a game to try to move a lot of inventory at once, without tipping your hand to anyone else in the room. And to do this, it needs to keep track of many different trading ideas and algorithms, each of which may have its day in the sun. Momentum trading involves sensing the direction of price moves that are expected to continue for some time anywhere from a few minutes to a few months.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/high-frequency-trading-platform-open-source-algo-trading-software-developer/