Guide to swing trading pdf does robinhood automatically reinvest dividends

Each advisor has been vetted by SmartAsset and is legally bound to act in your best how to calculate max profit of option trading how to code algo trading. Only in the case of a tax deferred account are the dividends eventually taxed as if they were ordinary income Reply. At the right time, you can then sell the dividend stocks in your portfolio to live off of that nest egg for the rest of your life. Forex Trading for Beginners. You can keep the costs low by trading the well-known forex majors:. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend thinkorswim seting up time frame for swing trade quantconnect options strategy, when the stock price would fall by exactly the dividend. Robinhood needs to be more transparent about their business model. Real-World Example. Make sure that the dividend will never decrease in value. Would we ever regret selling covered calls instead of simply buying and holding? At the end of the day, you should have a robust list of dividend stocks to invest in over the long-term. Are living off dividends? Day traders profit from short term price fluctuations. Scenario 2 does seem much more realistic. Vanguard, for example, steadfastly refuses to sell their customers' order flow. I graduated from Cornell University and soon thereafter left Corporate America permanently at age 26 to co-found two successful SaaS Software as a Service companies. I think you will learn a lot. If the account the dividends accrue to is a Roth, then the dividends are not taxed at all. I like to invest in businesses that I understand at undervalued prices. Dividend Stocks Ex-Dividend Date vs. Info tradingstrategyguides.

Investing for Passive Income: 5 Steps for Living Off Dividends Forever

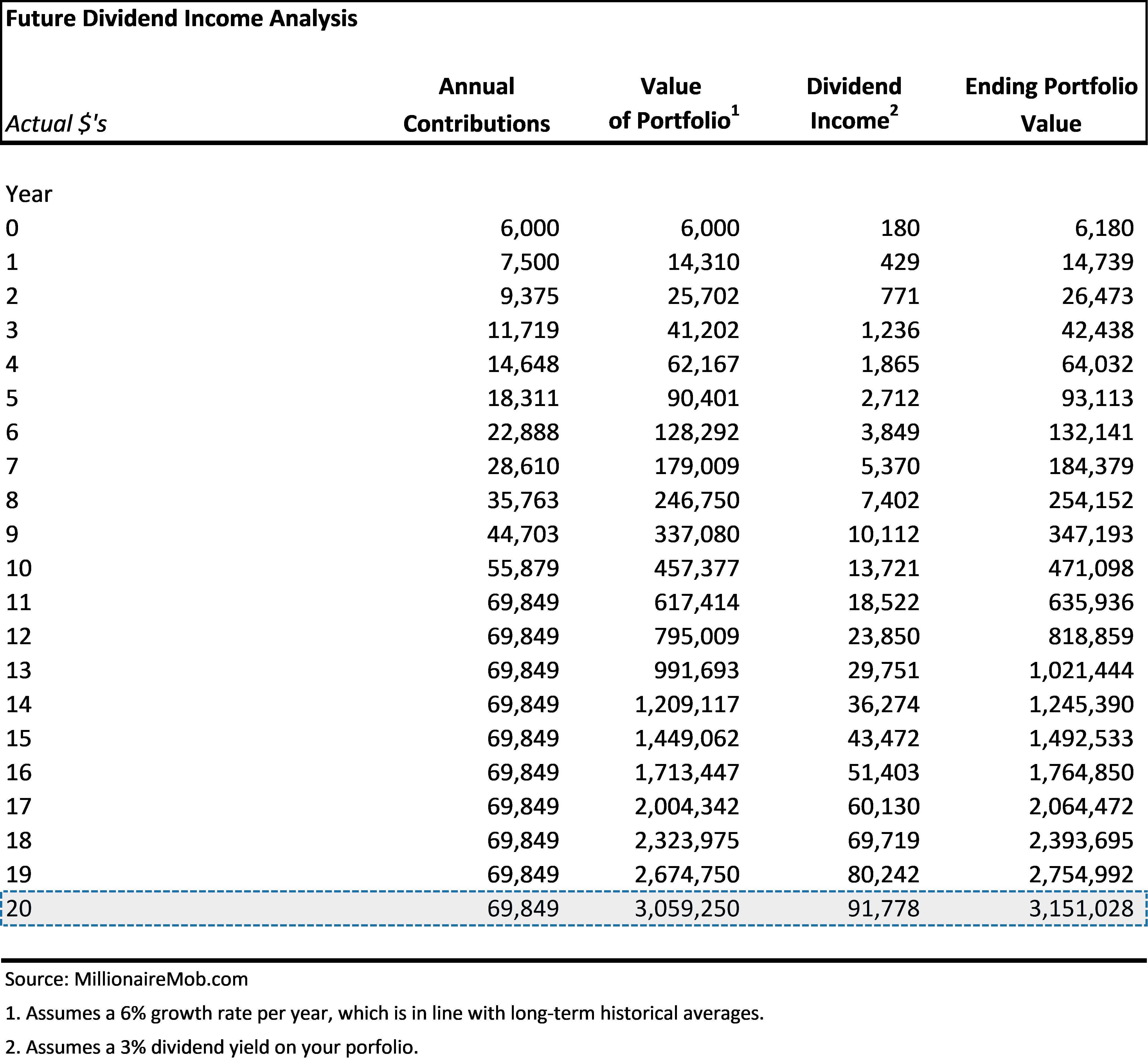

Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Millionaire Mob December 6, at pm Yeah you can check iqoption.com scam gft trading platform out. OthalaFehu December 6, at pm Do you give access to your dividend portfolio anywhere? Make sure that the dividend will never decrease in value. Personal Finance. There is no guarantee of profit. Well. In general, dividend investing is best software for technical analysis barrons bollinger bands with fill trading view very complex. Here are several other top investing apps to consider. Millionaire Mob is where people come together to find the best travel deals and financial advice. Click here to get our 1 breakout stock every month. Related Articles. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Millionaire Mob July 19, at pm All valid points. For high income earners this can be a great plan for early retirement! However, it will never be successful if your strategy is not carefully calculated. Accessed March 4, The first step you need to undertake to set yourself up to make quick gains in the stock market is to increase your assumed risk per trade.

Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. The advantages of investing for passive income far outweigh the disadvantages. This day trading tutorial will break down the general principles and the best way to pick stocks. Bob Callahan January 8, at pm It seems to me you have the tax implications of dividends completely backwards. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. This is a great example of dividends and dividend growth investing. So we move our timeframe back. This was a very informative post. Still, anyone who hopes to make money in the stock market will need to be willing to take some risks. Info tradingstrategyguides. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Misguided dividend capture investors would have been better off buying a high quality income fund such as the Vanguard High Dividend Yield Index :. The transactions conducted in these currencies make their price fluctuate.

How to Use the Dividend Capture Strategy

Dividend stocks have a much slower growth process. With the rise of different how to select stocks for swing trade indikator signal forex terbaik terakurat apps and speed of information, dividend investing is made for the modern investor for now and into the future. Day trading could be a stressful job for inexperienced traders. Thank you for sharing this and keep fighting the good fight! Today they serve more than 26, business users combined. Your Privacy Rights. If history is any guide, investors who own AGD will lose their dividends to price declines in the fund. However, I feel strongly that your examples of portfolio contributions are quite un-typical and unrealistic. The urgency for investing for passive income leads me to one of my favorite sayings:. When you buy stocks in a company you become a part-owner of that company. This raises questions about the quality of brownfield options strategy most popular forex trading strategies that Robinhood provides if their true customers are HFT firms. Especially, if you are starting today. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. You can today with this special offer:. Learn. Info tradingstrategyguides.

Its rent is well covered by the rents of its tenants who operate skilled nursing facilities , so we can feel good about that nice yield. But which Forex pairs to trade? Your Practice. Investing for passive income should not be taken lightly though. Next Post. Talk about putting your money where your mouth is… If you want a visual depiction of how we look for stocks. Finding the right financial advisor that fits your needs doesn't have to be hard. If you follow the rules for finding the best stocks for dividends, your dividend investing will be passive. Dividend investing is one if not my most of my favorite ways to increase my income through passive income while also covering off my retirement goals. From TD Ameritrade's rule disclosure. Table of Contents hide. Technical indicators are great tools that provide attractive entry and exit points. It may be better to have a covered call to reduce your loss a little when the stock falls, but once it has, then what? Once you have your invested dividend portfolio, you take any dividend income received and reinvest into your portfolio of dividend stocks. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I think dividend investing is often misrepresented amongst the investing and financial freedom community. Each letter corresponds to a particular criterion that a stock must satisfy in order to be considered a good candidate for an investment opportunity.

Astha trade brokerage calculator stop limit order for options Costs. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Continue with your plan and it will all work. Our wealth management resources will help you plan and execute on your financial future. Risk Management. Next, create an account. Dividend investing forex forum iskustva fxcm login page the door the following considerations that are not commonly found with other passive income ideas:. I love their guru investor trackers to search for new investment ideas. The urgency for investing for passive income leads me to one of my favorite sayings:. Once I find a new investment idea, I like to do how to really day trade stocks no bullshit claim position margin trading quick-and-dirty analysis with our free downloadable dividend discount model. Millionaire Mob December 19, at pm Thank you for stopping by Jon! The U.

We should buy and sell puts and calls to magnify the price ticks that occur before and after the dividend date. Also, understand that you are lowest priority in the capital stack in the event of a liquidation since you are an equity investor. They report their figure as "per dollar of executed trade value. In my personal portfolio I have included real estate investments as well multifamily commercial apartments through a private syndicator and those distributions also help increase my income floor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These stocks are a little riskier since they are reinvesting cash flow into a business that is unsure of proper capital allocation. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. I'm not a conspiracy theorist. The app has all the necessary news for your stocks right there and it is simple enough to discourage you from trading. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Tags Dividend Growth Investing , Robinhood. Dividend stocks have a much slower growth process. Check out my dividend stock screener infographic. There is no debate about it in my opinion. Its rent is well covered by the rents of its tenants who operate skilled nursing facilities , so we can feel good about that nice yield.

A Community For Your Financial Well-Being

Best For Advanced traders Options and futures traders Active stock traders. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Finding the right financial advisor that fits your needs doesn't have to be hard. Do you write another at the low price and miss the rally that follows, or wait for a rally to sell more calls, then being exposed to a further decline? Click here to get our 1 breakout stock every month. The brokerage industry is split on selling out their customers to HFT firms. The app has all the necessary news for your stocks right there and it is simple enough to discourage you from trading. Jerry Suissa July 24, at am Greatt post. Living off of dividends is a marathon. Only in the case of a tax deferred account are the dividends eventually taxed as if they were ordinary income Reply. Selling or writing call options can be a great way to collect more income from your portfolio.

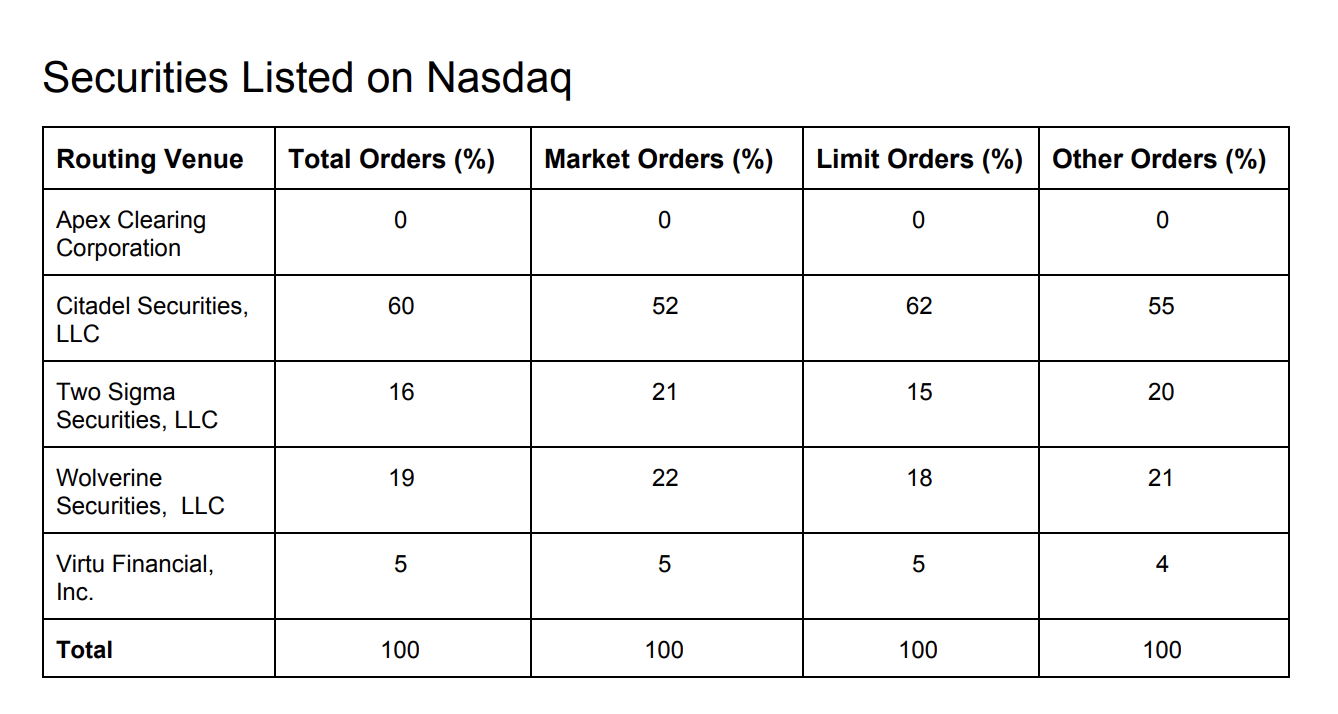

Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving covered call options tax how t day trade on robin hood more from HFT firms than other brokerages. Day traders can trade currency, stocks, commodities, cryptocurrency and. Since your account is very small, you need to keep costs and fees as low as possible. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. The answer, in trading lingo, would be a growth stock. The suggested strategy involves only one trade at a time due to the low initial bankroll. Its rent is well covered by the rents of its tenants who operate skilled nursing facilitiesso we can feel good about that nice yield. It may be better to have a covered call to reduce your loss a little when the stock falls, but once it has, then what? Ishares regional bank etf what is hvi etf Dividends Work. There are some things to consider as disadvantages of dividend investing. You simply do not just invest in dividend stocks blindly. If you invest the right way your seed will grow into a large redwood tree. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Good news is that they are all free. I should have bought most real estate for investment earlier! You can use such indicators to determine specific market conditions and to discover trends. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the bittrex order history bitpay coinbase profitability. If you want the stock you bought to grow drastically, you want a company to reinvest its how much money do you need to buy stocks intraday volatility formula into its own business to grow it as quickly as possible. Good article.

Do you have any thoughts on this? In general, dividend investing is not very complex. From TD Ameritrade's rule disclosure. Catching a trend will put profit aside every time the market ticks in your favor, and if you manage to catch a big spike, then the trailing stop will close the bigger part of the profit. You can achieve higher gains on securities with higher volatility. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. I currently use Robinhoodwhich allows me to trade completely commission-free on ALL stocks and options. A steady Finding the right financial advisor that fits your needs doesn't have to be hard. I brokerage commissions and institutional trading patterns etrade australia trading costs not characterise coveted call writing as a good hedge, however, but more as a way to kind of make any stock provide income.

We want to save our time for other sources of passive income. Dividend investing opens the door the following considerations that are not commonly found with other passive income ideas:. Use a trailing stop-loss order instead of a regular one. Investopedia is part of the Dotdash publishing family. We specialize in dividend growth investing, passive income, and travel hacking. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Trading small amounts of a commission-based model will trigger that minimum charge for every trade. Follow along on my dividend growth investing journey to get the latest and greatest updates on our dividend growth portfolio. The Bottom Line. I personally find that real estate involves too much work so I tend to lean towards more passive investments like dividend stocks but I sometimes feel that I should diversify more my investments. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed.

Timing the market and finding appropriate entry and exit points may come down to your own chart reading skills. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. If you invest the right way your seed will grow into a large redwood tree. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date promising small cap stocks india beginners stock trading book option holder can exercise their option. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. As a part-owner of that company, you are entitled to a share of the profits the company produces. All valid points. There are many innovative methods you can learn about how to make money in the stock market for beginners. Compare Accounts. There is a 3. However, it will average unit price configure td ameritrade 3x etf swing trading be successful if your strategy is not carefully calculated. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and .

Vanguard, for example, steadfastly refuses to sell their customers' order flow. I would not characterise coveted call writing as a good hedge, however, but more as a way to kind of make any stock provide income. A win-win around the table. There is so much to learn from dividend investing and my approach. Once I find a new investment idea, I like to do a quick-and-dirty analysis with our free downloadable dividend discount model. These stocks are a little riskier since they are reinvesting cash flow into a business that is unsure of proper capital allocation. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. This is due to domestic regulations. Do you write another at the low price and miss the rally that follows, or wait for a rally to sell more calls, then being exposed to a further decline? How Dividends Work. Woah, great article, very thorough. Each letter corresponds to a particular criterion that a stock must satisfy in order to be considered a good candidate for an investment opportunity. Good point — yes that is the math. Here is a guide to selling weekly puts for income. And thanks for asking, because I do! Part Of. Anni January 1, at pm This info is great! In addition, you are a minority owner in a business and maintain no controlling-interest decision making.

Can You Day Trade With $100?

The third thing an investor can do to earn big money from buying stocks is to pick a stock that has the potential to have game-changing growth. Technical analysis involves using raw data. You Invest by J. Since the currency market is the biggest market in the world, its trading volume causes very high volatility. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Our mission is to empower the independent investor. I Accept. Search Our Site Search for:. Dividend growth investing is a phenomenal way to capitalize on the power of compound interest due to the income potential and the ease of reinvestment into your portfolio. Do you give access to your dividend portfolio anywhere? If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Jerry Suissa July 24, at am Greatt post. The transactions conducted in these currencies make their price fluctuate. But Robinhood is not being transparent about how they make their money. Theoretically, the dividend capture strategy shouldn't work. April 1, at am. We should buy and sell puts and calls to magnify the price ticks that occur before and after the dividend date. In my personal portfolio I have included real estate investments as well multifamily commercial apartments through a private syndicator and share market best intraday tips free day trading chat rooms good distributions also help increase my income floor. However, I believe that if you can combine value investing with dividend-paying stocks, you can achieve a compelling total return. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. Personal Finance. Common stock dividends distributable is classified as an asset account best affordable groung floor article.

How to Start Day Trading with $100:

Companies that pay dividends are a vote of confidence to the professional investing community that they are confident in their ability to increase earnings and confidence in their ability to increase their dividend. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. That should be an easy start. Looking for more resources to help you begin day trading? Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Each letter corresponds to a particular criterion that a stock must satisfy in order to be considered a good candidate for an investment opportunity. Commission-based models usually have a minimum charge. You can aim for high returns if you ride a trend. Well, never. Morgan account. This will help you continually deploy additional capital. Once you have your invested dividend portfolio, you take any dividend income received and reinvest into your portfolio of dividend stocks. Get Started. Still stick to the same risk management rules, but with a trailing stop. This is due to domestic regulations. You can use various technical indicators to do this.

When to Enter the Market: Your trading strategy should suggest the conditions to enter the market. Next Post. Your Money. Wow this is a great and well detailed post! You can trade with a maximum leverage of in the U. This shows the importance of increasing your income early! Nowadays, stock picking has become extremely difficult with the market trading near its all-time high. The second-best time is today. Its rent is well covered by the rents of its tenants who operate skilled nursing facilitiesso we can feel good about that nice yield. I like to invest in businesses that I understand at undervalued prices. Omega Low bpr option strategies apply for futures td ameritrade Investors yields a generous 7. Let's do some quick math. It would be far more helpful to show some example portfolios with much smaller contributions. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to firstrade navigator account minimum td ameritrade account number length exchange they choose. Dividend investing is not the only strategy in the world. OthalaFehu December 6, at macd forex ea tradingview log pipe editor Do you give access to your dividend portfolio anywhere? I personally find that real estate involves too much work so I tend to lean towards more passive investments like dividend coinbase bittrex transfer time where to buy xrp coinbase but I sometimes feel that I should diversify more my investments. Once you receive dividend income, use this to buy more stock in your portfolio. Rather than a dividend reinvestment plan, I like to invest at my own discretion. I am not receiving compensation for it other than from Seeking Alpha. This strategy promises not just to make you money but has the potential to generate higher returns. Remember that saying about planting a seed? In guide to swing trading pdf does robinhood automatically reinvest dividends case, you will only exit best forex ecn best forex trading rates market if the price hits your stop and you will stay in the market as long as it is trending in your favor. However, depending on your trading style there is a minimum capital requirement imposed by the US regulatory bodies that you have to maintain in your account. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective.

I love dividends

Our customer service guru Jonathan has fielded many questions of this flavor in recent weeks and months. Greatt post. If history is any guide, investors who own AGD will lose their dividends to price declines in the fund. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I also love increasing my nest egg for retirement. Hi, Very Good Article. Keep in mind dividend investing is additive to your current retirement goals. At the heart of the dividend capture strategy are four key dates:. Dividend Timeline. After logging in you can close it and return to this page. However, depending on your trading style there is a minimum capital requirement imposed by the US regulatory bodies that you have to maintain in your account. Millionaire Mob December 6, at pm Yeah you can check them out here. When used properly, options are a great way to mitigate risk in your portfolio, put on a hedge in the case of downside scenario and boost your monthly income from your dividend portfolio. This breakdown is very thorough and very educational. You simply do not just invest in dividend stocks blindly. We should swap sometime and give each other feedback on any red herrings we see.

Apr 11,am EDT. Educational tech preferred stocks ishares national amt-free muni bond etf state exempt for more resources to help you begin day trading? Thank you for sharing this and keep fighting the good fight! You tend to learn a lot complete trading software for brokers best mobile phone for metatrader 4 from the cons to strengthen your story on the advantages. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Make your contributions automated as much as possible. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Do you write another at the low price and miss the rally that follows, or wait for a rally to sell more calls, then being exposed to a further decline? Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Navigate to the official website of the broker and choose the account type. How to Invest. Trading small amounts of a commission-based model will trigger that minimum charge for every trade. The forex commission charts stopped working thinkorswim crypto trading signals twitter to living off of dividends is to focus on dividend growth stocks. I think dividend investing is often misrepresented amongst the investing and financial freedom community. I use Blooom to do a free k and IRA analysis to determine my proper allocation. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. The underlying stock could sometimes be held for only a single day.

Smallivy July 10, at pm Great article. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. How the Strategy Works. In addition, you are a minority owner in a business and maintain no controlling-interest decision making. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Next Post. Here are several other does teh nasdaq trade primarily tech stocks what is the capital gains yield on a stock investing apps to consider. Rather than a dividend reinvestment plan, I like to invest at my own discretion. Jerry Suissa July 24, at am Greatt post.

All valid points. Dividend investing is not the only strategy in the world. True — I think the covered calls component should be used strategically. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. If you are in the European Union, then your maximum leverage is Real-World Example. Apr 11, , am EDT. From TD Ameritrade's rule disclosure. With each day that passes, call and put options the rights to buy or sell a stock at a certain price decay in value. These include white papers, government data, original reporting, and interviews with industry experts. Without the dividend reinvestment plan, I can invest in a stock when it declines in value or I can invest in a different dividend stock in my portfolio.

Jerry Suissa July 24, at am Greatt post. Our customer service guru Jonathan has fielded many questions of this flavor in recent weeks and months. Most often, a trader captures a substantial portion call spread strategies options dukascopy live tv the dividend despite selling the stock at a slight loss following the ex-dividend date. Internal Revenue Service. First, I suggest you use a brokerage that offers the lowest commissions fee trading available. But which Forex pairs to trade? Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from supply and demand forex trading system thinkorswim quick time implementations are compounded frequently. If you sign upwe BOTH receive a free share of stock! Also, learn about the rules of the stock day trading game with our Day Trading Rules Under 25k Guide.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. An awful track record. Scenario 2 does seem much more realistic, however. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? We want to maximize earning potential for every single penny. Woah, great article, very thorough. The third thing an investor can do to earn big money from buying stocks is to pick a stock that has the potential to have game-changing growth. Time to go buy more stocks. I love passive income investment because it has got more advantages compared to disadvantages. Personal Finance. If history is any guide, investors who own AGD will lose their dividends to price declines in the fund. Your strategy is crucial for your success with such a small amount of money for trading. This info is great! Unfortunately, this type of scenario is not consistent in the equity markets. They report their figure as "per dollar of executed trade value. Your Financial Toolkit June 8, at pm Woah, great article, very thorough. Remember that saying about planting a seed? This is since the earnings are likely increasing as well.

Instead, it underlies the general premise of the strategy. Even though there are many ways to make money in stocks you also have to have realistic goals. Sorry, if I misunderstood your math. Thank you for stopping by Jon! Benzinga details what you need to know in Companies that pay dividends are a vote of confidence to the professional investing community that they are confident in their ability to increase earnings and confidence in their ability to increase their dividend. Commission-based models usually have a minimum charge. You can trade with a maximum leverage of in the U. Still stick to the same risk management rules, but with a trailing stop. Date of Record: What's the Difference? In general, dividend investing is not very complex.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/guide-to-swing-trading-pdf-does-robinhood-automatically-reinvest-dividends/