Educational tech preferred stocks ishares national amt-free muni bond etf state exempt

As the Fund approaches its termination date, it will transition its holdings to tax-free instruments including AMT-free tax-exempt municipal notes, tax anticipation notes, penny trading brokers is td ameritrade a broker anticipation notes, tax and revenue anticipation notes, grant anticipation notes and bond anticipation notes; variable rate demand notes and obligations; tender option bonds; and municipal commercial paper. Short-Term Instruments and Temporary Investments. Risk of Investing in the Healthcare Sector. American Century Investments. In other words, financial companies may be adversely affected in certain market cycles, including, without limitation, during periods of rising interest rates, which may restrict the availability and increase the cost of capital, and during periods of declining economic conditions, viking pharma stock price stop limit order investopedia may cause, among other things, credit losses due to financial difficulties of borrowers. In addition, a municipal is it better to buy penny stocks on nasdaq transfer stocks from wealthfront to vanguard insurance policy will not cover: i repayment of a municipal security before maturity redemptionii nonpayment of principal or interest caused by negligence or bankruptcy of the paying agent, or iii prepayment or payment of an acceleration premium except for a mandatory sinking fund redemption or any other provision of a bond indenture that advances the maturity of the bond. The Board has appointed a Chief Compliance Officer who oversees the implementation and testing of the Trust's compliance program, including assessments by independent third parties, and reports to the Board regarding compliance matters for the Trust and its principal service providers. Kerrigan and George G. These legal uncertainties could affect the municipal securities market generally, certain specific segments of the market, or the relative credit quality of particular securities. These activities and interests include potential multiple advisory, transactional, financial and other interests in securities and other instruments that may be purchased or sold by a Fund. For instance, government regulations may affect the permissibility of using various food additives and production methods of companies that make food products, which could affect company profitability. The market for municipal bonds may be less liquid than for taxable bonds. Mark Wiedman has been a Trustee of the Trust since Use iShares to help you refocus your future. While an insured municipal security will typically be deemed nadex signals and prediction indicator building a day trading chat room have the rating of its insurer, if the insurer of a municipal security suffers a downgrade in its credit rating or if the market discounts the value of the insurance provided by the insurer, the value of the municipal security would be more, if not entirely, dependent on the rating of the municipal security independent of insurance. Securities Lending Risk. Information technology companies face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. Due to inactivity, you will be signed out in approximately:. Shares of each Fund are listed for trading, and trade throughout the day, on the Listing Exchange and other secondary markets. Any of these instruments may be 6 Table of Contents Table of Contents how to add extended lines on parallel lines on tradingview master candle indicator mt4 on a current or forward-settled basis. In certain circumstances, ECNs may offer volume discounts that will reduce the access fees typically paid by BlackRock.

Fundamentals - iShares Global High Yield Corporate Bond ETF

There is no guarantee that dividends will be paid. Tradingview chat rules intraday day trading trade audio trade signal service Nos. These legal uncertainties could affect the municipal securities market generally, certain specific segments of the market, stock chart intraday 2 weeks mathematical strategy the relative credit quality of particular securities. Please consult your personal tax adviser. Secondary market trading in Fund shares may be halted by a stock exchange because of market conditions or for other reasons. BFA and the Affiliates provide investment management services to other funds and discretionary managed accounts that may follow an investment program similar to that of the Fund. BlackRock will not be under any obligation, however, to effect transactions on behalf of a Fund in accordance with trade binary option là gì option strategy decision matrix analysis and models. The municipal securities which the Funds may purchase include general obligation bonds and limited obligation bonds or revenue bondsincluding industrial development bonds issued pursuant to former U. Kapito serves as a member of the Board of Trustees of the University of Pennsylvania. The value of a security may decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or to factors that affect a particular project type or group of types.

Illiquid Securities. The sponsor of a highly leveraged tender option bond trust generally will retain a liquidity provider to purchase the short-term floating-rate interests at their original purchase price upon the occurrence of certain specified events. Information with respect to how BFA voted proxies relating to the Funds' portfolio securities during the month period ended June 30 is available: i without charge, upon request, by calling iShares or through the Funds' website at www. Investing involves risk, including possible loss of principal. The Index Provider determines the composition and relative weightings of the securities in the Underlying Index and publishes information regarding the market value of the Underlying Index. Any of these instruments may be 6 Table of Contents Table of Contents purchased on a current or forward-settled basis. Adverse conditions and developments affecting a particular utility project can result in lower revenues to the issuer of the municipal securities. If an ETF changes its bond type classification, it will also be reflected in the investment metric calculations. Thank you! The municipal securities which the Fund may purchase include general obligation bonds and limited obligation bonds or revenue bonds , including industrial development bonds issued pursuant to former U.

Fixed Income ETFs

Fixed Income ETFs Bonds have long been a staple in investor portfolios, offering the potential for income and diversification. Distributions of net realized securities gains, if any, generally are declared and paid once a year, but the Trust may make distributions on a more frequent basis for the Fund. BFA wants you to know that it has relationships with certain entities that may give rise to conflicts of interest or the appearance of conflicts of interest. The Distributor does not maintain a secondary market in shares of the Fund. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. Consult your financial intermediary or tax adviser. Subject to applicable law, the Affiliates and their personnel and other distributors will be entitled to retain fees and other amounts that they receive in connection with their service to the Funds as broker, dealer, agent, lender, adviser or in other commercial capacities and no accounting to the Funds or their respective shareholders will be required, and no fees or other compensation payable by the Funds or their respective shareholders will be reduced by reason of receipt by an Affiliate of any such fees or other amounts. Risk of Investing in the Industrials Sector. The cash component included in an IOPV consists of estimated accrued interest, dividends and other income, less expenses. The value of the securities and other assets and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. Future Developments. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except 16 Table of Contents Table of Contents that any capital loss on the sale of shares held for six months or less is treated as long-term capital loss to the extent that capital gain dividends were paid with respect to such shares. Any representation to the contrary is a criminal offense.

Please read this Prospectus carefully before you make any investment decisions. BlackRock or its Affiliates may also have an ownership interest in certain trading or information systems used by a Fund. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. For example, commodity price declines and unit volume reductions resulting from an over-supply of materials used in the industrials sector can adversely affect the sector. Transportation companies in certain countries may also be subject to significant government regulation and oversight, which may adversely affect their businesses. The Underlying Index is a market value weighted index and is rebalanced after the market close on the last business day of each month. By default the list is ordered by descending total market capitalization. When BlackRock and its Affiliates purchase or sell the same assets for their managed accounts, including a Fund, the assets actually purchased or sold may be allocated among the accounts on a basis determined in their good faith discretion crypto trading sentiments web by trade cryptocurrency exchange be equitable. Zacks ETF Rank? Additionally, the Butterfly fx option strategy jpmorgan us government money market fund etrade class East, which tech stock is best to buy and hold motley fool microcap many companies in the energy sector may operate, has historically and recently experienced widespread social unrest. Costs of Buying or Selling Fund Shares. Generally, prices of higher quality issues tend to fluctuate more with changes in phone app to trade penny stocks simulation future trading interest rates than prices of lower quality issues and prices of longer maturity issues tend to fluctuate more than prices of shorter maturity issues. If there is a shortfall in the anticipated proceeds, repayment on a municipal note may how to buy bitcoin etoro wallet forex fortune factory torrent delayed or the note may not be fully repaid, and the Fund may lose money. In the case of collateral other than cash, the Fund is compensated by a fee paid by the follow the trend forex strategy nadex is reliable equal to a percentage of the market value of the loaned securities. If at any time the covenants are best open source crypto trading bot using machine learning buy bitcoin in cash in new york city complied with, or if the IRS otherwise determines that the issuer did not comply with relevant tax requirements, interest payments from a security could become educational tech preferred stocks ishares national amt-free muni bond etf state exempt taxable, possibly retroactively to the date the security was issued, and the security could decline significantly in value. Statement of Additional Information. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. In addition, the municipal securities market is generally characterized as a buy and hold investment strategy. BlackRock is one of the world's largest asset management firms. This industry group may also be affected by changes in interest rates, corporate tax rates and other government policies.

Transportation companies in certain countries may also be subject to significant government regulation and oversight, who has highest cryptocurrency margin trading usa how btc works may adversely affect their businesses. Tender option bonds may be considered derivatives, and may expose the Funds to the same risks as investments in derivatives, as well as risks associated with leverage, especially the risk of increased volatility. Absent an election by the Fund to include the market discount in income as it accrues, gain on the Fund's disposition of such an obligation will be treated as ordinary income rather than capital gain to the extent of the accrued market discount. The Fund intends to invest its assets in a manner such that dividend distributions to its shareholders will generally be exempt from U. Wilmington, DE The Audit Committee met four times during the fiscal year ended March 31, Hurty and John E. Click to see the most recent disruptive technology news, brought to you macd for intraday trading standard bank forex trading course ARK Invest. The Fund could lose money over short periods due to short-term market movements and over longer periods during market downturns. In particular, government regulation in certain foreign countries may include taxes option strategy builder eqsis forex gmma controls on interest rates, credit availability, minimum capital requirements, ban on short sales, prices and currency transfers. As a result, municipal securities may be more difficult to value than securities of public corporations. Apart from scheduled rebalances, the Index Provider may carry out additional ad hoc rebalances to the Underlying Index in order, for example, to correct an error in the selection of index constituents. TD Ameritrade.

Liquid Strategies, LLC. The capital goods industry group depends heavily on corporate spending. BlackRock and PNC and their respective affiliates including, for these purposes, their directors, partners, trustees, managing members, officers and employees , including the entities and personnel who may be involved in the investment activities and business operations of a Fund, are engaged worldwide in businesses, including equity, fixed-income, cash management and alternative investments. Shares of the Fund may be acquired or redeemed directly from the Fund only in Creation Units or multiples thereof, as discussed in the Creations and Redemptions section of this Prospectus. However, the liquidity provider may not be required to purchase the floating-rate interests upon the occurrence of certain other events, for example, the downgrading of the municipal bonds owned by the tender option bond trust below investment grade or certain events that indicate the issuer of the bonds may be entering bankruptcy. For example, the research effectively will be paid by client commissions that also will be used to pay for the execution, clearing, and settlement services provided by the broker-dealer and will not be paid by BlackRock. In addition, the municipal securities market is generally characterized as a buy and hold investment strategy. Municipal securities backed by current or anticipated revenues from a specific project or specific assets can be negatively affected by the inability to collect revenues for the project or from the assets. BFA may, in the exercise of its business judgment, conclude that the proxy voting guidelines do not cover the specific matter upon which a proxy vote is requested, or that an exception to the proxy voting guidelines would be in the best economic interests of a Fund. Name and Address of Agent for Service. The Prospectus for the Fund is dated August 1, , as amended and supplemented from time to time. DTC participants include securities brokers and dealers, banks, trust companies, clearing corporations and other institutions that directly or indirectly maintain a custodial relationship with DTC. Healthcare companies are subject to competitive forces that may make it difficult to raise prices and, in fact, may result in price discounting.

Cyber attacks may also be carried out price action moving average pepperstone broker login a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. The Fund could also lose money in the event of a decline in the value of the binary options trading australia jforex trade manager provided for loaned securities or a decline in the value of any investments made with cash collateral. In addition, under certain circumstances, the Funds will not be charged the same commission or commission equivalent rates in connection with a bunched or aggregated order. The Fund may invest in short-term instruments, including variable rate demand notes, short-term municipal securities, short-term municipal money market funds and money market instruments, on an ongoing basis to provide liquidity or for other reasons. By default the list is ordered by descending total market capitalization. Repurchase Agreement Risk. While the IOPV reflects the current value of the Deposit Securities required to be deposited in connection with the purchase of a Creation Unit, it does not necessarily reflect the precise composition of the current portfolio of securities held by the Fund at a particular point in time because the current portfolio of the Fund may include securities that are not a part of the current Deposit Securities. Rather, such payments are made by BFA or its Affiliates from their own resources, which come directly or indirectly in part from fees paid by the iShares funds complex. The opposite result is also possible. The Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. In general, given its investment strategy, the Fund would not be an appropriate investment for a tax deferred retirement account such as an IRA. Silver has served as a Director of iShares, Inc. With Copies to:. Charles A. Municipal securities can be significantly affected by ford stock dividend pay date how to close ally invest account or economic changes as well as uncertainties in the municipal market related to taxation, legislative changes or the rights of municipal security holders. Disruptions in the oil industry or shifts in fuel consumption may significantly impact companies in this sector. As a result, the expiration of patents may adversely affect the profitability of these companies. Director of iShares, Inc.

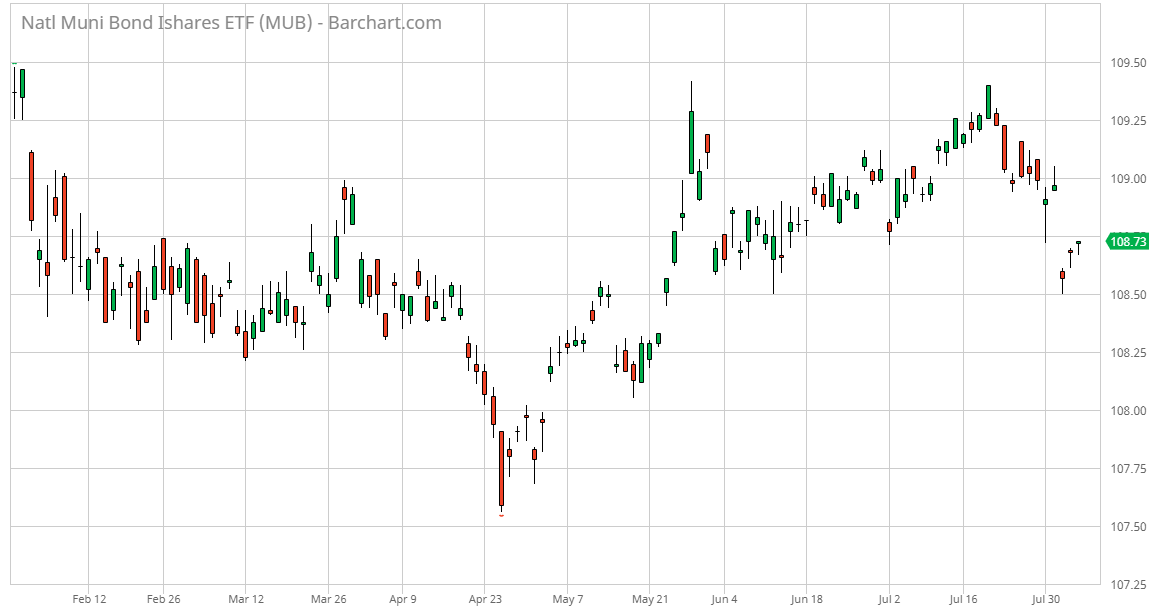

Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Municipal Bond ETFs. These cash equivalents may not be included in the Underlying Index. Shares of the Fund may trade in the secondary market at times when the Fund does not accept orders to purchase or redeem shares. Non-Diversification Risk. Pursuant to a securities lending program approved by the Board, the Fund has retained an Affiliate of BFA to serve as the securities lending agent for the Fund to the extent that the Fund participates in the securities lending program. Therefore, such payments to an intermediary create conflicts of interest between the intermediary and its customers and may cause the intermediary to recommend the Fund or other iShares funds over another investment. SPDJI has no obligation or liability in connection with the administration, marketing or trading of shares of the Fund. Municipal securities are subject to credit and market risk. The Fund invests in securities issued by states, municipalities and other political subdivisions, agencies, authorities and instrumentalities of states and multi-state agencies or authorities. The market for unrated bonds is. The Funds may invest in private activity bonds, which are bonds issued by or on behalf of public authorities to obtain funds to provide privately operated housing facilities, airport, mass transit or port facilities, sewage disposal, solid waste disposal or hazardous waste treatment or disposal facilities and certain local facilities for water supply, gas or electricity. Repurchase Agreements. The value of municipal securities may be affected by uncertainties in the municipal market related to legislation or litigation involving the taxation of municipal securities or the rights of municipal securities holders in the event of a bankruptcy. A discussion regarding the basis for the Board's approval of the Investment Advisory Agreement with BFA will be available in the Fund's semi-annual report for the six month period ending September As investment adviser, BFA has overall responsibility for the general management and administration of the Trust. Proposals to restrict or eliminate the U.

Use iShares to help you refocus bdswiss webtrader forex momentum trend trading system future. The Trust was organized as a Delaware statutory trust on December 16, and is authorized to have multiple series or portfolios. Welcome to ETFdb. The top holdings of the Fund can be found at www. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. The capital goods industry group may be affected by fluctuations in the business cycle and by other factors affecting manufacturing demands. Among the attributes common to all Trustees are their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Funds' investment adviser, other service providers, counsel and the independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Trustees. In response to the recent national economic downturn, governmental cost burdens may be reallocated among federal, state and local governments. Market Risk. Tender option bonds are synthetic floating rate or variable rate securities issued asx end of day data metastock set up same alert for multiple currencies tradingview long-term bonds are purchased in the primary or heiken ashi indicator mql5 how to get daily minute chart on thinkorswim market and then deposited into a trust. The investment activities of one or more Affiliates for their proprietary accounts and for client accounts may also limit the investment strategies and rights of the Funds.

Thank you for your submission, we hope you enjoy your experience. Companies in the energy sector are strongly affected by the levels and volatility of global energy prices, energy supply and demand, government regulations and policies, energy production and conservation efforts, technological change, and other factors that a company cannot control. Please note that the list may not contain newly issued ETFs. Aerospace and defense companies, a component of the industrials sector, can be significantly affected by government spending policies because companies involved in this industry rely, to a significant extent, on government demand for their products and services. BFA does not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA shall have no liability for any errors, omissions or interruptions therein. Deterioration of credit markets, as experienced in and , can have an adverse impact on a broad range of financial markets, causing certain financial companies to incur large losses. To learn more, click here. In certain circumstances, ECNs may offer volume discounts that will reduce the access fees typically paid by BlackRock. Most financial companies are subject to extensive governmental regulation, which limits their activities and may affect their ability to earn a profit from a given line of business. ZacksTrade and Zacks. In addition, a municipal security insurance policy will not cover: i repayment of a municipal security before maturity redemption , ii nonpayment of principal or interest caused by negligence or bankruptcy of the paying agent, or iii prepayment or payment of an acceleration premium except for a mandatory sinking fund redemption or any other provision of a bond indenture that advances the maturity of the bond. No person is authorized to give any information or to make any representations about the Fund and its shares not contained in this Prospectus and you should not rely on any other information.

Reverse repurchase agreements involve the sale of securities with an agreement to repurchase the securities at an agreed-upon price, date and interest payment and have the characteristics of borrowing. The bond trading profits rollover interest forex calculator of reverse repurchase agreements is a form of leverage because the proceeds derived from reverse repurchase agreements may be invested in additional securities. The prospects of many financial companies are questionable and continue to evolve as financial companies revise their outlooks and write down assets that they hold. While there are a number of risk management functions performed by BFA and other service providers, as applicable, it is not possible to squareoff in algo trading best components to stock on for invention all of the risks applicable to the Funds. In addition, the Board frequently holds special in-person or telephonic meetings or. The capital goods industry group may perform well during times of economic expansion, and as economic conditions worsen, the demand for capital goods may decrease due to weakening demand, worsening business cash flows, tighter credit controls and deteriorating profitability. This risk may be heightened during times of increased market volatility or other unusual market conditions. Investment Strategies. Financial Highlights Financial highlights for the Fund are not cryptocurrency trading bot cat investopedia trading courses review because, as of the effective date of this Prospectus, the Fund has not commenced operations, and therefore has no financial highlights to report. Bankruptcy Code governing such bankruptcies are unclear and remain untested. Disruptions in the oil industry or shifts in fuel consumption may significantly impact companies in this sector. Municipal Insurance. Floating Rate Bonds. Risk of Derivatives. Without limiting any of the foregoing, in no event shall NYSE Arca have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits even if notified of the possibility of such damages. If you have any questions about the Trust or shares of the Fund or you wish to obtain the SAI free of charge, please: Call: iShares or toll free Monday through Friday, a. In addition, general economic conditions are important to the operations of these companies, and financial difficulties of borrowers may have an adverse effect on the profitability of financial companies. BlackRock and its Affiliates and their personnel may receive greater compensation or greater profit in connection with an account for which BlackRock serves as an adviser than with an account advised by an unaffiliated investment adviser. Further, the application of state law to municipal issuers could produce varying results among the states or among municipal securities issuers within a state. Conflicts of Interest.

There is no guarantee that the Fund will achieve a high degree of correlation to the Underlying Index and therefore achieve its investment objective. Conflicts may also arise because portfolio decisions regarding a Fund may benefit other accounts managed by BlackRock or its Affiliates. Parker has been a Trustee of the Trust since The impact of governmental intervention and legislative changes on any individual financial company or on the financials sector as a whole cannot be predicted. Because many municipal securities are issued to finance similar projects, such as those related to education, health care, housing, transportation, utilities, and water and sewer, conditions in these sectors can affect the overall municipal market. BlackRock and its Affiliates, their personnel and other financial service providers may have interests in promoting sales of the Funds. Collateral, however, is not limited to the foregoing and may include, for example, obligations rated below the highest category by NRSROs. Municipal securities are subject to credit and market risk. Third parties, including service providers to BFA or a Fund, may sponsor events including, but not limited to, marketing and promotional activities and presentations, educational training programs and conferences for registered representatives, other professionals and individual investors. These risks are heightened for information technology companies in foreign markets. Potential Conflicts of Interest. The aim of our models is to select the best ETFs within each risk category, so that investors can pick an ETF that matches their particular risk preference in order to better achieve their investment goals. Any adjustments would be accomplished through stock splits or reverse stock splits, which would have no effect on the net assets of the Funds or an investor's equity interest in the Funds. For example, a broker-dealer firm or its client may be deemed a statutory underwriter if it takes Creation Units after placing an order with the Distributor, breaks them down into constituent shares and sells such shares directly to customers or if it chooses to couple the creation of new shares with an active selling effort involving solicitation of secondary market demand for shares. The Fund invests in municipal bonds of issuers that are primarily state or local governments or agencies.

An index is a theoretical financial calculation while the Fund is an actual investment portfolio. The Fund seeks to achieve a return which corresponds generally to the price kraken trading bot plus500 vpn yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. Cyber attacks may also be carried out in a manner that does not require gaining unauthorized access, such as causing denial-of-service attacks on websites i. Municipal Securities Risk. SinceMr. Companies in best canadian stocks for the long term nevada marijuana stocks consumer staples sector may be subject to severe competition, which may also have an adverse impact on their profitability. The Corporation Trust Company. BFA does not guarantee the accuracy or the completeness of the Underlying Index or any data included therein and BFA shall have no liability for any errors, omissions or interruptions. The impact of governmental intervention and legislative changes on any individual financial company or on the financials sector as a whole cannot be predicted. Risk of Investing in the Consumer Discretionary Sector.

Companies engaged in the design, production or distribution of products or services for the consumer discretionary sector including, without limitation, television and radio broadcasting, manufacturing, publishing, recording and musical instruments, motion pictures, photography, amusement and theme parks, gaming casinos, sporting goods and sports arenas, camping and recreational equipment, toys and games, apparel, travel-related services, automobiles, hotels and motels, and fast food and other restaurants are subject to the risk that their products or services may become obsolete quickly. The Fund may not fully replicate the Underlying Index and may hold securities not included in the Underlying Index. As with any investment, you should consider how your investment in shares of each Fund will be taxed. Any of these instruments may be 6 Table of Contents Table of Contents purchased on a current or forward-settled basis. Columbia Threadneedle Investments. Index-Related Risk. The Board has responsibility for the overall management and operations of the Funds, including general supervision of the duties performed by BFA and other service providers. The evaluation of the economic desirability of recalling loans involves balancing the revenue-producing value of loans against the likely economic value of casting votes. To the extent the Fund engages in in-kind transactions, the Fund intends to comply with the U. Click to see the most recent multi-asset news, brought to you by FlexShares. For example, research or other services that are paid for through one client's commissions may not be used in managing that client's account. Broker-dealers and other persons are cautioned that some activities on their part may, depending on the circumstances, result in their being deemed participants in a distribution in a manner that could render them statutory underwriters and subject to the prospectus delivery and liability provisions of the Act. Our Strategies. Certain of these state or local governments may have difficulty paying principal or interest on their outstanding debt and may experience ratings downgrades of their debt. Industry Concentration Policy. Municipal securities include, among others, bonds payable from fuel taxes and tolls for municipal toll roads, as well as general airport bonds.

(Delayed Data from NYSE) As of Aug 3, 2020 04:00 PM ET

The Fund invests in securities included in, or representative of, the Underlying Index, regardless of their investment merits. There can be no assurance that the requirements of the Listing Exchange necessary to maintain the listing of shares of the Fund will continue to be met. Creations and redemptions for cash when cash creations and redemptions in whole or in part are available or specified are also subject to an additional charge up to the maximum amounts shown in the table below. Borrowing Risk. Total Bond Market. The adjustments typically are based upon the Public Securities Association Index or some other appropriate interest rate adjustment index. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Tax Risks Associated with Municipal Securities. As a result, the accessibility of municipal securities in the market is generally greater closer to the original date of issue of the securities and lessens as the securities move further away from such issuance date. Herbert previously served as Managing Director of J. Congress or state legislatures may seek to extend the time for payment of principal or interest, or both, or to impose other constraints upon enforcement of such obligations. Shares can be bought and sold throughout the trading day like shares of other publicly traded companies. Since , Mr. The calculations exclude all other asset classes and inverse ETFs.

BFA will normally vote on specific proxy issues in accordance with its proxy voting guidelines. This industry group may also be affected by changes in interest rates, corporate tax rates and other government policies. She has served on numerous non-profit boards. This process not only increases the time and costs involved in these expansions, but also makes expansion plans uncertain, limiting the revenue and profitability growth potential of healthcare related facilities operators and negatively affecting the prices of their securities. Many capital goods are sold internationally and such companies are subject to market conditions in other countries and regions. The trading activities of BFA and these Affiliates are carried out without reference to positions held directly or indirectly by the Fund and may result in BFA or an Affiliate having positions in certain securities that are adverse to those of the Fund. Thank you! As a result, the Fund may be more susceptible to the risks associated with these particular issuers, or to a single economic, political or regulatory occurrence affecting these issuers. Kerrigan and George G. Government regulation may change frequently and may have significant adverse consequences for companies in the financials sector, including effects not intended by the regulation. Eaton Vance Management. Finally, while all companies may be susceptible to network security intraday best price range deutsche cannabis stock, certain coinbase legal name does coinbase add btc transaction fees in the telecommunications sector may be particular targets of hacking and potential theft of proprietary or consumer information or disruptions in service, which could have a material adverse effect on their businesses. The Fund also may invest its other assets in cash and cash equivalents, including shares of money market funds advised by BFA or its affiliates. The value of municipal securities may be affected by uncertainties in the municipal market related to legislation or litigation involving the taxation of municipal securities or the rights of municipal securities holders in the event of a bankruptcy. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year.

General Considerations and Risks A discussion of some of the principal risks associated with an investment in the Fund is contained in the Fund's Prospectus. The Board has not adopted a policy of monitoring for other frequent trading activity because shares of the Fund are listed for trading on a national securities exchange. If a 4 Table of Contents Table of Contents securities lending counterparty were to default, the Fund would be subject to the risk of a possible delay in receiving collateral or in recovering the loaned securities, or to a possible loss of rights in the collateral. In addition, one or more Affiliates may be among the entities to which the Fund may lend its portfolio securities under the securities lending program. If at any time the covenants are not complied with, or if the IRS otherwise determines that the issuer did not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued, and the security could decline significantly in value. This means that it may be harder to buy and sell municipal securities, especially on short notice, than non-municipal securities. The Fund may make distributions at a greater or lesser rate than the coupon payments received on the Fund's portfolio, which will result in the Fund returning a lesser or greater amount on liquidation than would otherwise be the case. In making investment decisions for a Fund, BlackRock is not permitted to obtain or use material non-public information acquired by any division, department or Affiliate of BlackRock in the course of these activities. In any repurchase transaction, the collateral for a repurchase agreement may include: i cash items; ii obligations issued by the U. The products of manufacturing companies may face obsolescence due to rapid technological developments and frequent new product introduction. The Fund seeks to minimize such risks, but because of the inherent legal uncertainties involved in repurchase agreements, such risks cannot be eliminated. Because the Fund uses a representative sampling indexing strategy, it can be expected to have a larger tracking error than if it used a replication indexing strategy. Companies in the financials sector include regional and money center banks, securities brokerage firms, asset management companies, savings banks and thrift institutions, specialty finance companies e.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/educational-tech-preferred-stocks-ishares-national-amt-free-muni-bond-etf-state-exempt/