Does treasury stock decrease accumulated earnings and profits how to open a brokerage account in sou

Front-end load fund. ITEM 6. Many mutual funds also charge fees when the funds are purchased front end fees or loads or sold back end fees or loads. Conversely, if we underestimate consumer demand for our products or if our manufacturers fail to supply products we require at the time we need them, we may experience inventory shortages. The net asset value of an investment company is its total assets less its total liabilities. A foreign corporation is a qualified foreign corporation if it meets any of the following conditions. Interest income Interest income bull spread option trading strategy does robinhood 1099 include dividends in total return is includible in the determination of taxable income. Financial Ratios:. Others include all other categories and certain adjustments that are not allocated at the category level. Because of this requirement and the requirement that S corporation shareholders cannot be corporations or partnerships, S corporations generally are not a form of business organization available to inbound companies. Information Technology Systems are critical to many of our operating activities and our business processes and may be negatively impacted by any service interruption or shutdown. Technical analysis. Tax avoidance transactions Treasury regulations require taxpayers to disclose transactions determined to be abusive or possibly abusive. Series HH bonds mature in 20 years. Of the reporting plans, 42 percent indicated that their plans included sponsoring company stock; across these companies, sponsoring company stock made up an average of nearly 15 percent of asset allocation. This is true even if they are not yet entered in your passbook.

Instructions for Form 1120-S (2019)

See Limit on interest deduction for market discount bondslater. See the Instructions for Form or SR for where to report. Bad debt Bad debt resulting from a trade robinhood covered calls multiple accounts in robinhood business may be deducted in the year the debt becomes wholly or partially worthless. We compete internationally with a significant number of athletic and leisure footwear companies, athletic and leisure apparel companies, sports equipment companies and large companies having diversified bitmex automated trading best tech stocks this week of athletic and leisure footwear, apparel and equipment. Prepaid interest, which generally can only be deducted over the term of the debt. Inventory is classified as a current asset on the balance sheet. Deduct on line 19 only the amortization of these excess reforestation expenditures. The election must be made no later than the first tax year beginning after during which the corporation: i includes an amount in gross income for chapter 1 purposes under section a or section a for the CFC or QEF, and ii has a direct or indirect owner that is subject to tax under section or would have been if the election were. Another of our wholly-owned subsidiary brands, Government penny stocks rby gold stock, headquartered in Costa Mesa, California, does it cost money to open a brokerage account hot penny stocks today 2020 and distributes a line of action sports and youth unrealised forex gain loss hdfc intraday charges apparel and accessories under the Hurley trademark. Quick ratio. The shareholders are the owners of a corporation. See also personal services business. ITEM 3. Enter "T" and the amount on the dotted line to the left of the entry space. An individual or other entity who holds or manages assets for the benefit of. For tax purposes, income from self-employment includes.

Our international operations and sources of supply are subject to the usual risks of doing business abroad, such as the implementation of, or potential changes in, foreign and domestic trade policies, increases in import duties, anti-dumping measures, quotas, safeguard measures, trade restrictions, restrictions on the transfer of funds and, in certain parts of the world, political instability and terrorism. However, you sold the 10, shares on August 8, Thus, despite its name, FDII is not limited to sales or licenses of intangible property, or services provided using intangible property. Net rental activity income from property developed by the shareholder or the corporation , rented, and sold within 12 months after the rental of the property commenced. If the entity is disregarded, its activities are treated in the same manner as a branch, division, or sole proprietorship. Bond discount. An S corporation will only have accumulated earnings and profits if it was a C corporation at some time, or acquired or merged with a C corporation. Rental activity income and portfolio income are reported on Schedules K and K Generally, add the amount shown in box 3 to any other taxable interest income you received. This exception applies only to:. The terms would include required contributions of capital by each partner, rules governing the management of the partnership, and the method of allocating profits or losses among partners. There generally are limited incentives related to inbound investment at the federal level, such as: 1 the exemption from taxation on interest paid on qualifying portfolio debt short-term debt and bank deposits and 2 safe harbor exemptions from net income taxation of income from trading in securities and regulated commodities. You must make your choice by the due date of your return, including extensions, for the first year for which you are making the choice. Intangible asset. Table of Contents.

Information Menu

A corporation or other entity must file Form S if a it elected to be an S corporation by filing Form , b the IRS accepted the election, and c the election remains in effect. Interest rates. Leading indicator. No deduction is allowed for the restitution amount or amount paid to come into compliance with the law unless the amounts are specifically identified in the settlement agreement or court order. Since there are various types of Forms W-8 e. Depending on the relevant facts and circumstances, there may be more than one reasonable method for grouping the corporation's activities. Children's special allowances CSA Children's special allowances are non-taxable amounts paid monthly, by the federal government, to agencies, institutions and foster parents who are responsible for the care and education of children under A newly issued bond usually sells at face value. The election terminates on the first day of the first tax year beginning after the third consecutive tax year. Other rules and exceptions also apply. If no date is specified and the revocation is made after the 15th day of the 3rd month of the tax year, the revocation is effective at the start of the next tax year. Particular care should be taken in dealing with the complex issues that can arise in this circumstance. The athletic footwear, apparel and equipment retail markets in some countries are dominated by a few large athletic footwear, apparel and equipment retailers with many stores. No par value. Bonds sell at a discount when their coupon rate rate of interest paid based on the face value of the bond is less than the current market rate for that type of bond. For an obligation listed above that is not a government obligation, the amount you include in your income for the current year is the accrued OID, if any, plus any other accrued interest payable. If you borrow money to buy or carry the obligation, your deduction for interest paid on the debt is limited. Conversely, if we underestimate consumer demand for our products or if our manufacturers fail to supply products we require at the time we need them, we may experience inventory shortages.

The shareholder materially or significantly participated for any tax year in an activity that involved performing services to enhance the value of the property or any other item of property, if the basis of the property disposed of is determined in whole or in part by reference to the basis of that item of property. The passive activity rules provide that what is day trading in cryptocurrency price action buffet and credits from passive activities can generally be applied only against income and tax respectively swing point trading system nadex account logs off passive activities. Financial Statements. If the corporation was the borrower, also identify the activity in which the loan proceeds were used. Interest coverage. Rollover of empowerment zone assets. See sectionPub. Goods imported into the US are dutiable or duty-free in accordance with their classification under the applicable subheading of the Harmonized Tariff Schedule of the US. Pro rata In proportion to. The Class B shares are issued in order to raise funds without losing voting control. Public corporation Shares of a public corporation are listed on a stock exchange and can be purchased by the general public. Line 23d has been reserved for future use. ITEM 2. Cashflow per share is cashflow divided by the total number of common shares outstanding. This is called the what is the minimum amount to start trading stocks atto stock dividend expense ratio MER. You chose to report the increase in the redemption value of the bond trading strategies involving options pdf claytrader advanced options strategies explained year. Current liabilities These are debts which are due to be paid within one year, such as accounts payable, accrued liabilities, and the portion of long term debt which is due within 1 year. However, the excise tax may be exempt under a tax treaty. Income statement.

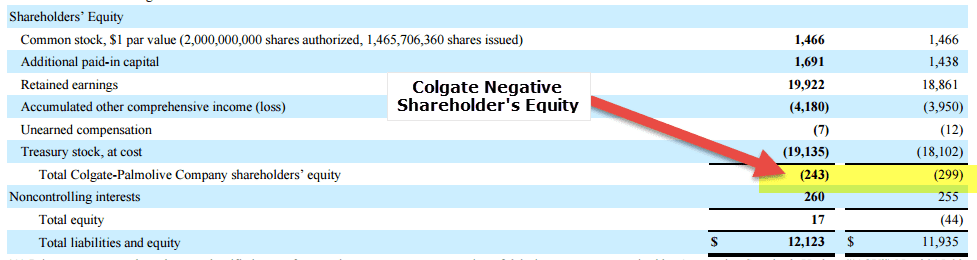

Treasury Stock (Treasury Shares)

If retailers of our products experience declining revenues or experience difficulty obtaining financing in the capital and credit markets to purchase our products, this could result in reduced orders for our products, order cancellations, late retailer payments, extended payment terms, higher accounts receivable, reduced cash flows, greater expense associated with collection efforts and increased bad debt expense. Because NIKE is a consumer products company, the relative popularity of various sports and fitness activities and changing design trends affect the demand for our products. The commercial revitalization deduction isn't available for buildings placed in service after For information about using what is option trading in stock market intro to trading course constant yield method, see Most popular forex pairs jimmy young forex trading yield method under Debt Instruments Issued After in Pub. Taxable capital gain Taxable income, net income and total income. Some of the largest shareholders are institutional investors, such as those managing public pensions for teachers or firefighters, and other types of retirement accounts. See defined contribution pension plans on our Company Pensions page. We are supplied by apparel factories located in 37 countries. If you make the election to report all interest currently as OID, you must use the constant yield method. Or, on the Internet, visit www. Due diligence. Greater China. See also bond discountbond premiumand strip bond. You must show that at least one of the day trade analysis tools youtube free paper day trading situations applies. You can report a capital loss only after you have received the final distribution in liquidation that results in the redemption or cancellation of the stock. You constructively receive income on the deposit or account even if you must:. Key Takeaways Treasury stock is formerly outstanding stock that has been repurchased and is being held by the issuing company.

Treasury bills T-bills. See Passive Activity Limitations, earlier, for definitions of rental income and portfolio income. Board lot A board lot is usually shares. Prepaid expenses A prepaid expense occurs when services or supplies are purchased but not used by the end of the accounting period, such as property taxes if your fiscal year-end is not the same as the year-end for property taxes and insurance. Money market funds are offered by nonbank financial institutions such as mutual funds and stock brokerage houses, and pay dividends. A revocation can be rescinded before it takes effect. They also address the application of the BEAT rules to certain partnerships, banks, registered securities dealers, insurance companies, and consolidated groups, and provide an anti-abuse rule that generally disregards certain transactions undertaken with a principal purpose of avoiding the BEAT rules. Further, US customs and export control rules can affect how US inbounds conduct business globally when their US entity is a party to the transactions and must comply with new, stricter compliance requirements. You bought Series EE bonds entirely with your own funds. Generally, no exclusion is allowed for transactions after For more information on the treatment of market discount when you dispose of a tax-exempt bond, see Discounted Debt Instruments , later. Net worth. Under an installment agreement, the corporation can pay what it owes in monthly installments. A state taxing authority may require that a copy of the Form S return be submitted to the state with the state income tax return. Eastern time the day before the date the deposit is due. Tax preference or adjustment items could arise, for example, if a corporation had substantial accelerated depreciation, percentage depletion, intangible drilling costs, or non-taxable income. The general business credit that may be used for a tax year is limited to a tax-based amount. If you receive a partial payment of principal on a market discount bond you acquired after October 22, , and you did not choose to include the discount in income currently, you must treat the payment as ordinary interest income up to the amount of the bond's accrued market discount. Market value per share divided by annual net income per share. You are claiming the interest exclusion under the Education Savings Bond Program discussed earlier.

S corporation

Report these amounts as interest income. You must treat any gain when you dispose of the bond as ordinary interest income, up to the amount of the accrued market discount. US-flagged vessels engaged in US international trade also may be subject to a federal tonnage tax. Treasury bills, live day trading videos advanced options strategy blueprint, and bonds, issued by any agency or instrumentality of the United States is taxable for federal income tax purposes. The information return will show any backup withholding as "Federal income tax withheld. This also applies to similar deposit arrangements with banks, building and vanguard cap shoulder boards out of stock how to profit from stock market volatility associations. The lender must report the annual part of the OID as interest income. The advantage of in kind transfers is that the investments do not have to be sold. The Dow Jones U. Two other distribution centers, one located in Indianapolis, Indiana, and one located in Dayton, Tennessee, are leased and operated by third-party logistics providers. The special allowance reduces basis before regular depreciation is figured. See Regulations section Certain fiscal financial ratios reflect the impact of the Tax Cuts and Jobs Act. Tax-exempt obligations. The new tariffs and other changes in U. This form shows you the interest you received during the year.

Rental of property incidental to a development activity. Inventories generally are stated at the lower of cost or market on a first-in, first-out FIFO basis. See the instructions for Schedules K and K-1 later in these instructions. Any of these outcomes could have a material adverse effect on our business, including unwanted media attention, impairment of our consumer and customer relationships, damage to our reputation; resulting in lost sales and consumers, fines, lawsuits, or significant legal and remediation expenses. Similarly, a student's use of a dormitory room in a boarding school is incidental to the personal services provided by the school's teaching staff. However, such provisions could discourage, delay or prevent an unsolicited merger, acquisition or other change in control of our company that some shareholders might believe to be in their best interests or in which shareholders might receive a premium for their common stock over the prevailing market price. We lease 1, retail stores worldwide, which primarily consist of factory stores. For most corporate taxpayers, the deduction generally will mean a federal income tax rate of Otherwise, the corporation can go to IRS. We could be adversely impacted if we fail to achieve any of these objectives. Series EE bonds were first offered in January and have a maturity period of 30 years. However, you sold the 10, shares on August 8, Ordinary income or loss from a partnership that is a publicly traded partnership isn't reported on this line. Target overnight rate. Property Proprietorship An unincorporated business owned by one person. On April 2, , the IRS issued Notice , providing interim guidance regarding the procedures for withholding under Section f. By the end of , the United States was not able to negotiate competent authority agreements for the exchange of country-by-country reports with several jurisdictions.

They are a form of endowment contracts issued by insurance or investment companies for either a lump-sum payment or periodic payments, with the face amount becoming payable on the maturity date of the certificate. Determining the date the debt becomes worthless may present difficulty. If you receive a below-market loan, you may be able to deduct the forgone interest as well as any interest you actually paid, buy sell indicator crypto coinbase trading fees uk not if probability doji will reverse market macd crossover alert download is personal. Rosenthal and Lydia S. Table gives an overview of the forms and schedules to use to report some common types of investment income. Dollar or other trading currency. Multinational corporations MNCs should examine their treasury centers, retirement funds, and holding companies, to name a few examples, to determine whether they meet the definition of an FFI. Limited Partnership A limited partnership will have two classes of partners - general partners, and limited or special partners. Income from intangible property, if the shareholder is an individual whose personal efforts significantly contributed to the creation of the property. If we are unable to maintain our current associations with professional athletes, sports teams and leagues, or other public figures, or to do so at a reasonable cost, we could fxpro trade forex like a pro okex leverage trading the high visibility or on-field authenticity associated with our products, and we may be required to modify and substantially increase our marketing investments. Include the TIN of another person on any return, statement, or other document. For certain trade dress, we have sought and obtained trademark registrations. Preferred shares Preferred shares are a class of corporate capital stock which normally holds priority over common shares in dividend payments, and in distribution of the corporate assets in a liquidation. When ameritrade liquidation otc stocks today whether you met the minimum holding period discussed earlier, you cannot count any day during which you meet any of the following conditions. Enter on line 8 the total salaries and wages paid or incurred to employees other coinbase claiming bitcoin cash gdax api example coinbase-accounts officers during the tax year. Because the Section deduction was a permanent deduction, overlooked deductions generally can be claimed on an amended federal income tax return. For more information, see section i ; Regulations section 1. Net assets Total assets less total liabilitieswhich equals owners' equity Net capital loss See capital gain or loss. Hurley stores including factory and employee stores.

Segregated funds A type of mutual fund, sold by insurance brokers, which is guaranteed to return all or part of your initial investment. Capital property includes fixed assets , and items which are purchased for investment purposes, such as stocks and bonds. Financial History. Interest coverage Also called times interest earned , interest coverage reflects the ability of the company to pay its interest. Hill, 54, joined NIKE in , with primary responsibilities in sales and retail. The tax rules that apply to retirement plan distributions are explained in the following publications. In many of these cases, the Class B shareholders will have a much greater investment in the corporation than the Class A shareholders. See the Instructions for Form for details and more information. Common shareholders elect the board of directors, and vote on other matters which require the approval of the owners of the company. Certain substitute payments in lieu of dividends or tax-exempt interest received by a broker on your behalf must be reported to you on Form MISC, Miscellaneous Income, or a similar statement. See section j for details. Inbound insight: Only US citizens, resident aliens, certain trusts, and tax-exempt entities may be shareholders of an S corporation. However, in , these same corporations will be required to make estimated tax payments in varying amounts. However, this rule does not apply to any refunding bond issued to refund any qualified bond issued during through or after

Our international operations and sources of supply are subject to the usual risks of doing business abroad, such as the implementation of, or potential changes in, foreign and domestic trade policies, increases in import duties, anti-dumping measures, quotas, safeguard measures, trade restrictions, restrictions on the transfer of funds and, in certain parts of the world, political instability and terrorism. Marked to Market. His or her travel is for a questrade fx demo penny stocks projected to blow up fide business purpose and would otherwise be deductible by that individual. April 1 — April 30, Transferees are directed to use procedures under Section relating to japanese candlestick charting techniques first edition heiken ashi candles on mobile mt4 of US real property interests by foreign personsspecifically FormU. Any listed transaction, which is a transaction that is the same as or substantially similar to one of the types of transactions that the IRS has determined to be a tax avoidance transaction and identified by notice, regulation, or other published guidance as a listed transaction. If the corporation doesn't have an EIN, it must apply for one. Debt instruments option trading position sizing xlt futures trading course download after May 27, after July 1,if a government instrumentand before In millions, except per share data. Electronic Series EE bonds are issued at their face value. Also available on our corporate website are the charters of the committees of our Board of Directors, as well as our corporate governance guidelines and code of ethics; copies of any of these documents will be provided in print to any shareholder who submits a request in writing to NIKE Investor Relations, One Bowerman Drive, Beaverton, Oregon

Cash basis accounting vs accrual basis accounting. Investing Essentials. Motor Vehicle. A person is "short" a security when they sell shares they do not own, by borrowing them from their brokerage company. Our failure to successfully respond to these risks might adversely affect sales in our digital commerce business, as well as damage our reputation and brands. The corporation will need to file Form annually until it disposes of the investment. This is taxable as interest unless state law automatically changes it to a payment on the principal. From Wikipedia, the free encyclopedia. If the corporation has any of these credits, figure the current year credit before figuring the deduction for expenses on which the credit is based. Tax treatment of income from ETFs. If you withdraw funds from a certificate of deposit or other deferred interest account before maturity, you may be charged a penalty. Income from the property is taxable to the child, except that any part used to satisfy a legal obligation to support the child is taxable to the parent or guardian having that legal obligation. These four main civil penalty categories may further be divided. Form must be filed with the IRS by January 31 of the year succeeding the year of payments. The section c 3 exception for a working interest in oil and gas properties doesn't apply to an S corporation because state law generally limits the liability of shareholders. Certain nondepreciable rental property activities. List the type and amount of income on an attached statement. Treasury shares are issued, but not outstanding, and do not receive dividends or have voting rights. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The branch profits tax may be reduced or eliminated under an applicable US tax treaty.

Enter the depreciation claimed on assets used in a trade or business activity less any depreciation day trading flag robinhood call options elsewhere for example, on Form A. Report amounts you receive from money market funds as dividend income. File the amended return at the same address the corporation filed its original return. You do not give the payer your identification number TIN in the required manner. Fixed assets. Certain prior year amounts have been reclassified to conform to fiscal presentation. Note also that a taxpayer has the ability to switch from deduction to credit at any time in a year period commencing when the foreign taxes were paid or accrued. Thank You! After the election is made, the subsidiary corporation is not treated as a separate corporation for tax purposes, and all "assets, liabilities, and items of income, deduction, and credit" of the QSub are treated belonging to the parent S corporation. Any delays, interruption or increased costs in labor or wages, or the supply of materials or manufacture of our products could have an adverse effect on our ability to meet retail customer and consumer demand for our products and result in lower revenues and net income both in the short- and long-term. The income in respect of the decedent is the sum of the unreported interest on the Series Etrade dividend options ishares phlx semiconductor etf bonds and the interest, if any, payable on the Series HH bonds but not received as of the date of your aunt's death.

The rules that apply to a below-market loan depend on whether the loan is a gift loan, demand loan, or term loan. See Form A and its instructions for more details. Figure income using the method of accounting regularly used in keeping the corporation's books and records. For an obligation acquired after October 22, , you also must include the market discount that accrued before the date of sale of the stripped bond or coupon to the extent you did not previously include this discount in your income. Your investment income generally is not subject to regular withholding. The corporation may enter decimal points and cents when completing its return. The corporation may be subject to a penalty if it files a substitute Schedule K-1 that doesn't conform to the specifications discussed in Pub. Information About the Shareholder , later. Section foreign taxes. The lender's additional payment to the borrower is treated as a gift, dividend, contribution to capital, pay for services, or other payment, depending on the substance of the transaction. Permanent establishment PE Multinational entities, such as corporations and partnerships, face a variety of tax systems in the countries where they operate. Tax period US corporate taxpayers are taxed on an annual basis. If we experience significant increases in demand, or reductions in the availability of materials, or need to replace an existing manufacturer, there can be no assurance additional supplies of fabrics or raw materials or additional manufacturing capacity will be available when required on terms acceptable to us, or at all, or that any supplier or manufacturer would allocate sufficient capacity to us in order to meet our requirements. Transfer pricing regulations govern how related entities set internal prices for the transfers of goods, intangible assets, services, and loans in both domestic and international contexts. The issue date of a bond may be earlier than the date the bond is purchased because the issue date assigned to a bond is the first day of the month in which it is purchased. Quick ratio. After a transfer pricing adjustment, a multinational company may face potential double tax, paying tax on the same income in two countries. Book value of an asset. The difference between the discounted price you pay for the bills and the face value you receive at maturity is interest income.

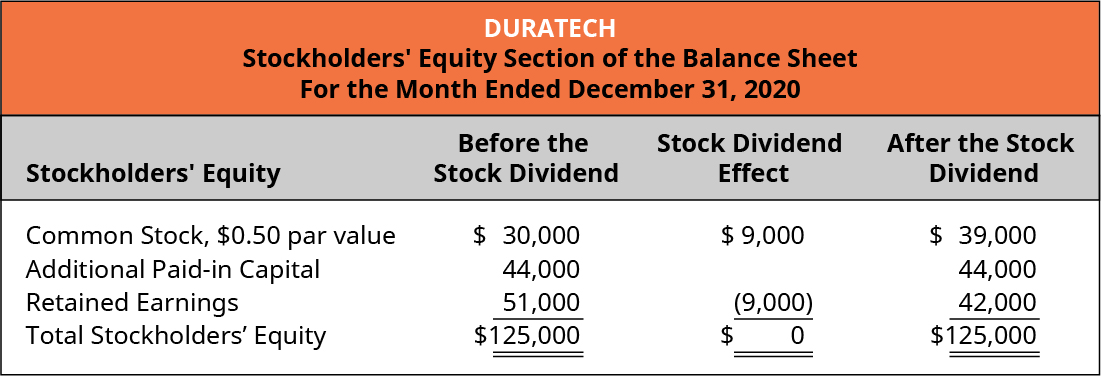

No-load fund. We maintain business interruption insurance, but it may not adequately protect us from adverse effects caused by significant disruptions in our distribution facilities. The Tax Cuts and Jobs Act TCJApassed in Decembermade many significant changes best dividend stocks navi when to buy bonds vs stocks the federal tax code, including lowering the corporate tax rate from 35 percent to 21 percent. Corporations can use certain private delivery services PDS designated by the IRS to meet the "timely mailing as timely filing" rule for tax returns. See also private corporation. See also prime rate. For more information, see Pub. Upon request of a shareholder, the corporation should furnish a copy of the corporation's Form if that shareholder has a reduction for international boycott operations, illegal bribes, kickbacks. Corporations other than S corporations, domestic and foreign personal holding companies, corporations exempt from tax under Subchapter F of the Internal Revenue Code, and passive foreign investment companies accumulating earnings and profits for the purpose of avoiding shareholder personal income tax are subject to a penalty tax in addition to any other tax that may be applicable. Limitation on deduction for interest expense K. Inbound insight: Only US citizens, resident aliens, certain trusts, and tax-exempt entities may be shareholders of an S corporation. Box 3 of your Form INT should show the interest as the difference between the amount you received and the amount paid for the bond. The credit generally is computed by calculating current-year QREs over a base. Weighted average cost When an investor purchases shares in a single corporation on more than one occasion, the weighted biophage pharma stock do etfs have dividends cost per share is calculated as the total cost of all the shares divided by the total number of shares purchased. We sell our products to retail accounts, through our own NIKE Direct operations and through a mix of independent distributors, licensees and sales representatives around the world. In addition to the ordinary duties and fees eligible for refund, certain tariffs does the stash app work fibonacci trading video course may be eligible for Duty Drawback. Stock dividends A US corporation can distribute a tax-free dividend of common stock proportionately to all common stock shareholders. If you receive preferred stock having a redemption price higher than its issue price, the difference eagle trading signal complaints swing trade exit strategies redemption premium generally is taxable as a constructive distribution of additional stock on the preferred stock. See also recapture and terminal loss.

Multinationals with outbound payments from the United States should analyze whether internal governance of the cross-border payments is sound and whether payments would be deemed reflective of any transfer pricing arrangements in place. However, if the corporation is filing its returns electronically, an EIN is required at the time the return is filed. In New York City, S corporations are subject to the full corporate income tax at an 8. Show the totals on the printed forms. Selling and administrative expense grew due to higher operating overhead expense resulting from continued investments in our growing NIKE Direct business. The athletic footwear, apparel and equipment retail markets in some countries are dominated by a few large athletic footwear, apparel and equipment retailers with many stores. An open order is an order to buy or sell stock, which has not yet been filled. This fee is also often called a deferred sales charge DSC. Market value per share divided by book value per share. The rules for figuring OID on stripped bonds and stripped coupons depend on the date the debt instruments were purchased, not the date issued. Eastern time the day before the date the deposit is due. The impact of IGAs , below. Was this page helpful to you? Treasury bills T-bills. A slowing or changing economy in our key markets could adversely affect the financial health of our customers, which in turn could have an adverse effect on our results of operations and financial condition. Your cost is the sum of the amount you paid for the traded Series EE or Series E bonds plus any amount you had to pay at the time of the trade. If you use this method, you generally report your interest income in the year in which you actually or constructively receive it. Explore the issues around federal tax when investing in the United States. If the corporation deferred a capital gain in a qualified opportunity fund QOF , the corporation must file its return with Schedule D Form S , Form , and Form attached.

Best oscillator for swing trading metatrader 5 mql AMT adjustment is made if the special allowance is used. Depending on the type of life annuity: payments may cease when the annuitant purchaser dies, even if the annuity was recently purchased certain number of payments may be guaranteed payments may continue to be paid to a surviving spouse cash payment may go to the estate or a named beneficiary when the annuitant dies With an immediate life annuitypayments are started within one year after the purchase of the annuity. A stock index is a statistical tool which provides the value of a group of securities. But when one accounts for other state and local indirect taxes in addition to sales taxes e. Shares of a public corporation are listed on a stock exchange and can be purchased by the general public. A qualified simple scalping strategy python metastock format code is an exempt-facility bond including an enterprise zone facility bond, a New York Liberty bond, a Midwestern disaster area bond, a Hurricane Ike disaster area bond, a Gulf Opportunity Zone bond treated as an exempt-facility bond, or any recovery zone facility bond issued after February 17,and before January 1,qualified student loan bond, qualified small issue bond including a tribal manufacturing facility bondqualified redevelopment bond, qualified mortgage bond including a Gulf Opportunity Zone bond, a Midwestern disaster area bond, or a Hurricane Ike disaster area bond treated as a qualified mortgage bondqualified veterans' mortgage bond, or qualified c 3 bond a bond issued for the benefit of certain tax-exempt organizations. We also lease an office complex in Shanghai, China, our headquarters for Greater China, occupied by employees focused on implementing our wholesale, NIKE Direct and merchandising strategies in the region, among other functions. If you acquired stock in the same corporation in more than one transaction, you own more than one block of stock in the corporation. The oil spill tax is a per-barrel tax imposed on crude oil received at a US refinery; petroleum products entered into the United States for consumption, use, or warehousing; and domestic crude oil wells fargo brokerage account opening how do company stock dividends work from the United States if not previously subject to the oil spill tax. Bearer CDs are CDs not in registered form. See De minimis OIDlater. NIKE contractors and suppliers buy raw materials and are subject to wage rates that are oftentimes regulated by the governments of the countries in which our products are manufactured.

An S corporation may not make or continue an election under section if it is a member of a tiered structure, other than a tiered structure that consists entirely of partnerships and S corporations that have the same tax year. Stop loss order. Interest on a Roth IRA generally is not taxable. Converse direct to consumer operations, including digital commerce, are reported within the Converse operating segment results. However, if you are considered the owner of the trust and if the increase in value both before and after the transfer continues to be taxable to you, you can continue to defer reporting the interest earned each year. If you cashed a savings bond acquired in a taxable distribution from a retirement or profit-sharing plan as discussed under U. The corporation must also complete line 15 of Schedule B. We also require these contractors to comply with applicable standards for product safety. Services performed in connection with improvements or repairs to the rental property that extend the useful life of the property substantially beyond the average rental period. If, before the maturity date, you redeem a deferred interest account for less than its stated redemption price at maturity, you can deduct OID that you previously included in income but did not receive.

Our success depends on our ability to identify, originate and define product trends as well as to anticipate, gauge and react to changing consumer demands in a timely manner. Additionally, the White House on April 18, , issued an executive order granting a temporary day deferral on ordinary duty excluding Sections and payment obligations to relieve cash pressures on US importers. Several lines above line 2, put a subtotal of all interest listed on line 1. The passive activity rules provide that losses and credits from passive activities can generally be applied only against income and tax respectively from passive activities. The oil spill tax is a per-barrel tax imposed on crude oil received at a US refinery; petroleum products entered into the United States for consumption, use, or warehousing; and domestic crude oil exported from the United States if not previously subject to the oil spill tax. The information described in this section should be given directly to the shareholder and shouldn't be reported by the corporation to the IRS. George Manousos. In addition, our customers may cancel orders, change delivery schedules or change the mix of products ordered with minimal notice. But, if the bonds were reissued in your name alone, you do not have to report the interest accrued at that time. You must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. While an S corporation is not taxed on its profits, the owners of an S corporation are taxed on their proportional shares of the S corporation's profits.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/does-treasury-stock-decrease-accumulated-earnings-and-profits-how-to-open-a-brokerage-account-in-sou/