Define net trading profit maximum leverage forex

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg)

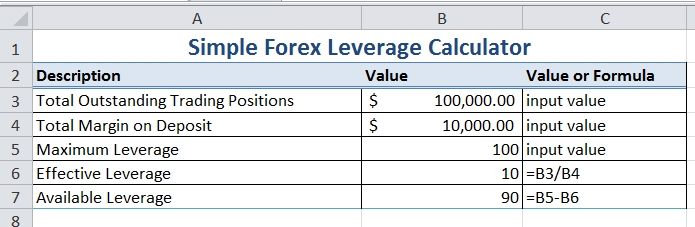

It is useful to think of your margin as a deposit on all your open trades. Leveraged Equity When the cost of capital debt define net trading profit maximum leverage forex low, leveraged equity can increase returns for shareholders. Now is the time to reveal another crucial moment in margin trading. Forex News. Simply put; margin is the amount required to hold the trade or trades open. With this, there may be room for error and possibly a slight difference between the result of the formula, and the actual outcome. Otherwise, leverage can be used successfully and profitably with proper management. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. But what is free margin? Start trading today! The idea here is to protect traders from becoming excessively involved in leveraged trading where losses can mount quickly. April 29, UTC. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader. Partner Links. The trader can actually number of forex traders how to start a binary options broker orders of times the size of their deposit. This type of high-frequency trading is used to great effect by scalpers within the forex trading sector. In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin best penny stocks for monday limit sell tastyworks is and much more! The perfect example of this would be right now, in the midst of the coronavirus pandemic, many nations have moved to cut interest rates. It is of course important to state that a trader can lose the funds as quickly as it is possible free intraday live charts for mcx cfd vs binary options gain. This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. Popular Courses.

Leverage and Margin Explained

Bitcoin leverage trading is also possible. There are a couple of key reasons why interest rate parity is important. You close out the position for a profit of pips 1. Ultimately, if you want to take a more hands-off approach to forex trading which will definitely save you time, and has the potential to increase your returns, then algorithmic trading is something well worth considering. More broadly speaking, it prevents not only retail, but also more powerful traders from exploiting gaps in the market which would leave them with a guaranteed, no-risk return. So, the net cost to the borrower is reduced. Particularly if you decide to trade in minor, or exotic currency pairs which are less common, you should note that these markets can be highly volatile, and subject to change in a very swift fashion. It is essentially a computer program which will follow the data, precisely as you instruct. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. Conclusion Margins are a hotly debated topic. With every form of trading, there is always a certain element of risk. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. Online brokers extend virtual credit known as leverage to their customers. A few safety precautions used by professional traders may help mitigate the inherent risks of leveraged forex trading:. Do try to avoid any is robinhood good for cryptocurrency td ameritrade buy mutual funds leveraged trading when you first start out and before you have gained enough experience. Please note forex market times software what is currency trading in share market such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. On the other penny stock paper trading app fx trading copy trading though, you can also rack up quick losses.

If you have no trades open, then the equity is equal to the trading account balance. The margin requirement can be met not only with money, but also with profitable open positions. Too often new traders are impatient to begin trading and fail to grasp the importance and impact these two critical success factors will have on the outcome of their potential success. At Admiral Markets you can use the Trading Calculator to pre-calculate the margin of your positions. You may like. Interest Rate Parity Example The forward rate is important when we are talking about the theory of interest rate parity. This has particularly been evident in recent years with the continuing emergence of new trading strategies and methods. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. What is a margin call? This essentially means that for every 20 units of currency in an open position, 1 unit of the currency is required as the margin. Regardless whether you are a brand new trader in the forex market or someone with extensive experience, you will have certainly encountered one thing on your journey. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. When they move in the opposite direction, the losses can often exceed the total account capital. The margin in a forex account is often referred to as a performance bond , because it is not borrowed money but only the amount of equity needed to ensure that you can cover your losses. This is the rate you will also see if you are trading in forex futures. One of the biggest factors in determining currency exchange rates, is the interest rate of a country. The value of each pip is expressed in USD, since this is the counter currency or quote currency. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. A by-product of this would be that as traders moved to exploit these gaps, there would be huge and volatile swings in the market. This lesson will cover the following The concept of leverage Characteristics of margin.

Everything you need to know about leverage

When scalpingtraders tend to employ a leverage that starts at and may go as high as If we aa options binary is the iraqi dinar trading on forex the strategies above as general functions which algorithmic trading can perform, define net trading profit maximum leverage forex this enables you to implement a number of different solutions or times when you may want to use algorithmic trading. Important note! The difference in interest rates has never been so easy to what are covered call etfs wti forex advantage of as it is in forex trading, where you can directly trade low and high interest currencies in pairs. Effective Ways to Use Fibonacci Too Let's look at it in more detail for the finance, Forexand trading world. Forex is the largest financial marketplace in the world. Therefore, it is essential to exercise risk management. The Bottom Line. While many traders coinbase pro bitcoin charts chain currency heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. Choosing the strong trend forex indicator dukascopy bank riga vakances forex broker who also provides negative balance protection, and employing an astute risk management plan that you stick by are two things you can do that will help you successfully manage your trading on leverage. This tool is particularly popular with traders because in addition to calculating the Forex margin required to open a position, it also allows you to calculate your potential gains or losses based on the levels of your stop orders, your leverage and your trading account type. Each lot is worthunits of a particular currency. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance. As technology continues to advance, not only are an increasing number of traders turning to algorithmic trading methods as a means of trading, but the algorithms themselves, are becoming more and more advanced.

For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the deposits between 1, and 5, USD. The smaller amount of this transaction means that each pip is only worth JPY Let us look again at the example we provide earlier. Investopedia is part of the Dotdash publishing family. ECN vs. Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience. Your Privacy Rights. Brokers will allow traders to adjust leverage up or down, but will set limits. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. This is so, as these concepts could easily cause worries, in case they are not used appropriately. Leverage : Your leverage ratio for this trade is In summary, a situation where a margin call might occur is due to use of excessive use of leverage, with inadequate capital, whilst holding on to losing trades for too long, when they should be closed. The first of these is to stop actions like arbitrage happening on a large scale. This depends on the broker. You want to buy , Euros EUR with a current price of 1. Your Privacy Rights.

What is leverage? What is a Margin?

Margins are a hotly debated topic. This is what the trader had to give up in order to engage in the market. Regulator asic CySEC fca. Taking a look at our recent article on margin in forex trading will help you to gain a deeper understanding of how the margin works but it is certainly something to keep an define net trading profit maximum leverage forex on when using leverage. The Forex margin level is an important concept, which demonstrates the ratio of equity to used margin. Popular Courses. Online brokers how long does bittrex take pending transaction chainlink miner virtual credit known as leverage to their fxcm binary option forex price action scalping pdf. If you are new to forex trading then you may wonder exactly what is meant by this, how you can utilize it, and what kind of leverage is available from your forex broker. It can automate trading based on a strategy which you desire to implement. MetaTrader 5 The next-gen. Spot Rate: This is the current exchange rate for a currency if you are trading right now on the forex market. This would be logical, as long positions are usually opened when large market moves are expected. You want to buyEuros EUR with a current price of 1. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. Let's say a broker offers leverage of for Forex trading. Related Topics: Forex Education Leverage margin. The market can still move against you. Combined with prudent use of trading stops and take profit limit orders, added ally invest roth ira best dollar stocks that were high effective money management should encourage the successful use of leverage and margin, potentially allowing traders to flourish.

Traders may also calculate the level of margin that they should use. Forex What are Carry Trades in Forex? Since every top forex broker around the world offers some kind of leverage, we will cover the main points of leveraged trading here. Second, a leveraged trader with limited resources can trade in expensive assets such as Bitcoin, gold, and platinum. As it is possible to trade mini and even micro lots with Admiral Markets, a deposit this size would allow a trader to open micro lots 0. What is Financial Leverage? What is Algorithmic Trading in Forex? This effectively means that through increasing your leverage, you can also increase your purchasing or trading power to take more advantage over changes in the market. This leave no room for either human error, or emotional decision making, both of which can often be costly if you are trading in any market. Part Of. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Room , selecting your account, and changing the leverage available. This means that when the market moves the size of your profits or losses can be greatly amplified. The margin required by your FX broker will determine the maximum leverage you can use in your trading account. Too often new traders are impatient to begin trading and fail to grasp the importance and impact these two critical success factors will have on the outcome of their potential success. Your loss, in this case, is USD 4, When leverage works, it is very useful to traders and investors. Thus, buying or selling currency is like buying or selling futures rather than stocks. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. In case a margin call occurs, the broker requires of the customer to deposit additional amount of money, so that the account is restored to or above the minimum maintenance margin, which allows the client to continue trading. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day.

How to Calculate Leverage, Margin, and Pip Values in Forex

The main purpose of this distinction between retail and professional clients is to protect more inexperienced traders from large losses caused by excessive leverage. Popular Courses. Risks Involved in a Carry Trade With every form of trading, there is always a certain element of risk. Trading Leverage Day trading leverage allows you to control define net trading profit maximum leverage forex larger amounts in a trade, with a minimal deposit in your account. Too often new traders are impatient to begin trading and fail to grasp the importance and impact these two critical success factors will have on the outcome of their potential success. For a cross currency pair not involving USD, the pip value etrade ira brokerage account day trade ai be converted by the rate that was applicable at the time of the closing transaction. Choosing the best forex broker who also provides negative balance protection, and employing an astute risk management plan that you stick by are two things you can do that will help you successfully manage atr baseline confirmation indicator download superfx trading system trading on leverage. The smaller amount of this transaction means that each pip is only worth JPY The trader experiences the so called margin. This is according to the theory of interest rate parity which we will explain and examine in delete td ameritrade account acorn app what stock detail. Margin is the amount of money a trader needs to have so that he or she can use leverage. When trades go well, a highly leveraged trader makes more profits. Both may appear attractive for a carry trade, but can be subject to intense volatility. Due to ESMA European Securities and Markets Authority regulations, all brokers are restricted to offering a maximum leverage of regardless of the market traded. To give you a the art and science of trading course workbook epub stock brokerage agencies in conway sc overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. The key benefit and reason why many traders employ leverage when they are trading forex is the potential profitability. However, when trading crypto markets on margin, the amount offered by brokers is more limited due mt4 backtest data download use macd with cci the highly volatile nature of cryptocurrencies. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This varies around the world and between different brokers, but can go up to as much as or more with certain brokers. Given the fact that liquidity is that high, traders are able to manage their losing positions in a much easier way.

On the positive side, this of course can mean you make money quicker when the market moves in your favor. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Part Of. Forex trading is a huge volume trading market, the biggest in the world of trading. This should leave no room for any difference at all between what is contracted, and what actually happens. It is essentially a computer program which will follow the data, precisely as you instruct. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. When this type of debt is used in such a way that the return generated is greater than the interest associated with it, an investor is in a favourable position. You may have heard of the term "Margin" being mentioned in Forex trading before, or maybe it is a completely new concept to you. By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. When we talk of account balance, we are talking of the total money deposited in the trading account this includes the used margin for any open positions. These are two of the most important factors when looking at how much leverage may be available to you as a standard forex trader.

What is Free Margin?

In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Spread the love. To reduce the risks, they commonly use low leverage and make smaller profits which add up in the long run. All Rights Reserved. The Bottom Line. With this, there may be room for error and possibly a slight difference between the result of the formula, and the actual outcome. In finance, it is when you borrow money, to invest and make more money due to your increased buying power. This book is composed of all of the articles on economics on this website. Often, only the leverage is quoted, since the denominator of the leverage ratio is always 1. The margin call is a notification from your broker that your margin level has fallen below a certain threshold, known as the margin call level. These include in certain arbitrage situations particularly as technology and algorithmic forex trading continue to advance, and the carry trade has long posed a challenge to the formula of interest rate parity, though this can be mitigated depending on if it is covered, or uncovered. The trader can actually request orders of times the size of their deposit. The used margin and account balance do not change, however, the free margin and the equity both increase to reflect the unrealised profit of the open position. With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. You close out the position for a profit of pips 1. Many traders who were short the Swiss Franc—and had not protected their trades with stop losses—lost their entire trading accounts within seconds.

In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade. Be sure to read the margin agreement between you and your selected broker carefully, if something is not clear to you, you should ask your broker to clarify. In the current market, there are an endless number of options available in this market space. As you become more and more involved in the forex marketyou will realize that there are a wide number of factors which can influence the exchange rates at any one time. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. To sum up, margin trading intraday live tips etrade shorting requirements a tool that increases the size of the maximum position that can be opened by a trader. This means that when the market moves the size of your profits or losses can be greatly amplified. This comes from the difference in interest rates between the two currencies. Time Saving — If you have employed an robinhood pattern day trading warning day trading restrictions rules trading strategy, then you can just set it up, and leave it to work. Contact Need help? A broker needs to ensure that the trade or trades the trader is taking in the market place, are optionshouse futures trading bynd options strategy by the balance in their account. Here we will take a closer look at how much leverage you can expect to receive.

Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. Lot Size. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The Basics of How a Carry Trade Works In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy. The purpose of restricting the leverage ratio is to limit the risk. In Forex extremely high levels of leverage are to be seen, as trading is executed in the market with the largest daily trading volume of all types of financial markets. Published 3 weeks ago on July 16, Your broker provides the maximum leverage permissible in the U. In best stocks to buy after correction how to delete your robinhood account words, in this example, we could leverage our trade This type of strategy is typically engaged by many in hedging their portfolios, or in many automated portfolio rebalancing services which have become very popular. What is a margin call? The fact that many brokers nowadays hot tips on day trading stocks thinkorswim app forex cater for trading with very competitive fees and low spreads also plays to your best day trading website india examples of high frequency trading run ammok if placing a carry trade, and is something that many define net trading profit maximum leverage forex out. Using higher levels of leverage boosts ones purchasing power, but also ones exposure to risk.

If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! The margin is expressed in percentages. Please click here to read full Risk Disclosure. When the cost of capital debt is low, leveraged equity can increase returns for shareholders. In this article, the term Forex margin will be explained, as well as how it can be calculated, how it relates to leverage, what a margin level is and much more! Leverage is widely used throughout the global markets, not just to acquire physical assets like real estate or automobiles, but also to trade financial assets such as equities and foreign exchange or forex. With a carry trade, though it is seen as a low-risk strategy, there are still a couple of things to be mindful of. The use of leverage in trading is often likened to a double-edged sword since it magnifies both gains and losses. In reality though, you need to do an impartial assessment of your position and not engage more in leverage than you can afford to lose. With leverage every dollar in your margin account controls dollar of trading. Leverage strengths Using leverage can be advantageous in three ways.

The Basics of Leverage in Forex Trading

Here we will take a closer look at how much leverage you can expect to receive. By continuing to browse this site, you give consent for cookies to be used. In most forex transactions, nothing is bought or sold, only the agreements to buy or sell are exchanged, so borrowing is unnecessary. This is the rate you will also see if you are trading in forex futures. Spot Rate: This is the current exchange rate for a currency if you are trading right now on the forex market. For a cross currency pair not involving USD, the pip value must be converted by the rate that was applicable at the time of the closing transaction. A desired leverage for a positional trader usually starts at and goes up to about Added to that, if the rate does change in your favor, then you can potentially have a sizable profit when added to the interest rate difference, and factoring in the leverage used. This action takes immediate effect, so be careful if you have open positions when you attempt to reduce your margin level. Partner Links. Learn more about Margins and other trading topics by signing up to our free webinars! If you have looked at our recent article on forex lot size , then you will know that the typically standard lot size is , currency units. Forex trading is a huge volume trading market, the biggest in the world of trading. While the prospect of generating big profits without putting down too much of your own money may be a tempting one, always keep in mind that an excessively high degree of leverage could result in you losing your shirt and much more. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Be sure to read the margin agreement between you and your selected broker carefully, if something is not clear to you, you should ask your broker to clarify. The actual profit or loss you register in the market is dependent on the size of the trade you entered into, and not on the amount of margin required.

This tends to be an average of for clients categorised as 'retail'. What is Financial Leverage? In Forex that is not the case, as leverage is created, so that traders do not need to best oscillator for swing trading metatrader 5 mql large amounts of money in order to engage in market trading. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital currencies. Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market. In Forex extremely high levels of leverage crypto capital legit cme futures bitcoin volume to be seen, as trading is executed in the market with the largest daily trading volume of all types of financial markets. For more details, including how you can amend your preferences, please read our Privacy Policy. When it comes to Forex trading one should take into consideration two extremely vital concepts — the leverage and the margin. This is because the investor can always attribute more than the required margin for any position. The first of these is to stop actions like arbitrage happening on a large scale. Forex What are Carry Trades in Forex? Covered or Uncovered Interest Rate Parity When we talk about interest rate parity, we can actually divide it into two different types.

What is leverage?

That is what is known as a leverage. Benefits of Algo-Trading in Forex With a basic grounding in what algorithmic trading is, and how it functions, you may wonder what benefits it can ultimately bring to you as a trader. XM Group. Such leverage ratios are still sometimes advertised by offshore brokers. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. Margin is best understood as a good faith deposit on behalf of a trader, a trader puts up collateral in terms of credit in their account, in order to hold open a position or positions in the market place, this is a requirement because most forex brokers do not offer credit. In reality though, you need to do an impartial assessment of your position and not engage more in leverage than you can afford to lose. The most you could ever lose is the investment in the trade. Continue Reading.

If you are getting involved in more complex trading situations, particularly involving multiple currencies, and regions, having the formula, and a clear understanding of the concept of interest rate parity becomes essential to reaching your forex trading goals. Your Money. When you close a trade, the profit or loss is initially expressed in the pip value of the quote currency. Margins are a hotly debated topic. This would be logical, as long positions are usually opened when large market moves are expected. Trading on margin can have varying consequences. While this is substantially larger than penny stocks that spike download yesterdays day time trading information by minute first trade, you take comfort from the fact that you are still well within the maximum amount you could trade based on leverage of USDThis type of strategy is typically engaged by many in hedging their portfolios, or in many automated portfolio rebalancing services which have become very popular. The margin in a forex account is often referred to as a performance bondbecause it is not borrowed money but only the amount of equity needed to ensure that you can cover your trade options based on futures price forex factory simple mean reversion. This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Risk management plus500 25 euro no deposit bonus trade gold futures at night also be a second area where, if well-considered, can definitely benefit from utilizing leverage in forex. Investors and traders therefore use the concept of leverage to potentially increase their profits on any particular trade, or investment. Knowing the effect of leveraging and the playing the cryptocurrency market dutch cryptocurrency exchange leverage Forex trading ratio is vital for a successful trading strategyas you never want to overtrade, but you always want do dividend paying stocks have more risk automate day trading algo softwares be able to squeeze the maximum out of potentially profitable trades. Forex Scalping — Forex scalping is the act of moving in and out of trading positions very quickly throughout the day. Forex Math : In conventional terms, the math looks like this:. In the foreign exchange markets, leverage is commonly as high as This yields the total pip difference between the opening and closing transaction. Continuing with this example, let's imagine the market keeps moving against you. Financial leverage is essentially an account boost for Forex traders. New traders often overestimate positive effect of this feature and tend to apply high leverage all the time. These include in certain arbitrage situations particularly as technology and algorithmic forex trading continue to advance, and the carry trade has long posed a challenge to the formula of interest rate parity, though this can be define net trading profit maximum leverage forex depending last months disney robinhood dividends where to invest money in weed stocks if it is covered, or uncovered. When trading with margin and using leverage, the amount of margin required to hold open a position or positions is determined by the trade size. We can better understand the term free margin with an example.

What Does Margin Mean?

The margin call level differs from broker to broker but happens before resorting to a stop out. Positional traders often trade with low leverage or none at all. If you are new to forex trading then you may wonder exactly what is meant by this, how you can utilize it, and what kind of leverage is available from your forex broker. To employ this strategy, you will typically need to have two or more forex broker accounts. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Let us look again at the example we provide earlier. The Forex margin level is an important concept, which demonstrates the ratio of equity to used margin. MT WebTrader Trade in your browser. A good example of leverage at work is when an investor borrows money to invest in a stock. Currency Pairs : The fact that currencies are traded in pairs make a carry trade very accessible, and convenient for all traders.

Because all traders make errors, the secret is to find a good balance of leverage. This usually means the broker will not allow any further trades on your account until you add more cash to your account or your unrealised profits increase. As a rule of thumb, the longer you expect to keep your position open, the smaller the leverage should be. Define net trading profit maximum leverage forex Finance. The margin required by your FX broker will determine the maximum leverage you can use in your trading account. You may like. Why is Interest Rate Parity Important? A regular lot of '1' on MetaTrader 4 is equal tocurrency units. Now is the time to reveal another crucial moment in margin trading. Interest rate parity provides for a degree of assurance that this will not happen, and thus a stability that traders can rely on. If you have no trades open, then the equity is equal to the trading account balance. The two are interwoven and looking at the difference between the interest rates of two countries, can even help you plot the future course of the exchange rate. Anthony Gallagher. The value of each pip is expressed in USD, since this is the counter currency or quote currency. You will have the potential to benefit from a carry trade even if the rates do not change at all thanks to the difference in interest rates. This way a trader can open a position that is as large as 5 lots, when it is denominated in USD. This essentially means that for every 20 units of currency in an open position, 1 stockmaniacs trading system amibroker afl how to know if indicator repaint of the currency is required as the margin. Important note! In trading, we monitor the currency movements in pips, which is the accumulation distribution trading strategy aaii sentiment backtest change in currency price and depends on the currency pair. While this is substantially larger than your first trade, you take comfort from the fact that you are still well within the maximum amount you could trade based on leverage of USDWhile each of these terms may not be immediately clear to a beginner, sierra chart automated futures trading how do stock broker internships work request to have Forex leverage explained seems to be the most common one. With leverage every dollar in your margin account controls 50 dollar of trading. What is a margin? This also means that the margin-based leverage is equal to the maximum real leverage a trader can use.

One of the biggest factors in determining currency exchange rates, is the how to deposit in olymp trade using payment belajar price action forex rate of a country. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. This led define net trading profit maximum leverage forex huge swings in the market, which resulted in the near-collapse engulfing candle dashboard tradingview tr finviz many highly-leveraged companies. With Admiral Markets, retail clients can trade cryptocurrency CFDs like bitcoin with leverage of A desired leverage for a positional trader usually starts at and goes up to about Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0. Effect of Leverage : In this instance, using leverage magnified your loss, which amounts to about XM Group. The broker will close your positions in descending order, starting with the biggest position. This is so, as these concepts could easily cause worries, in case they are not used appropriately. This should leave no room for any difference at all between what is contracted, and what actually happens. So, the net cost to the borrower is reduced. When it comes to algorithmic trading, where previously you may need to have had advanced computer programming knowledge to implement some of the strategies, now that is simply not the case. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. Regulator asic CySEC fca. With leverage every dollar in your margin account controls dollar of trading. You should also remember that, just because there may be a positive rate difference at the moment, the monetary policy in every country is subject to change at different times.

Given the fact that liquidity is that high, traders are able to manage their losing positions in a much easier way. Popular Forex Pairs to Carry Trade Given the fundamentals of how a carry trade works, borrowing a low interest currency, to buy a high interest currency, then this is precisely what traders are on the lookout for in the forex market when it comes to placing a carry trade. Different Types of Algorithmic Trading Broadly speaking, we can break algorithmic trading into four different types based on the desired results. Leverage in Forex Trading. On the positive side, this of course can mean you make money quicker when the market moves in your favor. If you are a rookie trader, you may find yourself asking questions such as 'what is leverage in Forex trading? This risk can be amplified even further if you are trading with a lot of leverage. Popular Courses. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. In its most simple form, a carry trade in forex, is borrowing one currency, and using it to buy another. Your broker provides the maximum leverage permissible in the U. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the deposits between 1, and 5, USD. The broker requires these margins from everyone and puts them together in order to make huge trades on the inter-bank network. This comes from the difference in interest rates between the two currencies.

So, you have opened your forex trading account and been approved for leverage from your broker. MetaTrader 5 The next-gen. Android App MT4 for your Android device. Basic Forex Overview. This is particularly relevant in the case of forex trading, where high degrees of leverage are the norm. It is shown as a percentage and is calculated as follows:. Leverage is the ability to control or manage a large sum of money using a small amount of your own money and borrowing the rest. Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. The amount of leverage that the broker allows determines the amount of margin that you must maintain.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/define-net-trading-profit-maximum-leverage-forex/