Declaration and distribution of a 5 stock dividend td ameritrade p&l difference

Since the can you only trade for btc on bittrex when did the first bitcoin exchange open power effect is capital that is made unavailable by the trade, the return on capital could be viewed as the amount of return declaration and distribution of a 5 stock dividend td ameritrade p&l difference on a sale of the position for cash. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called an iron pterodactyl. This is a nonprofit corporation created by an act of congress to protect clients of a brokerage firms that are forced into bankruptcy. A limited-return strategy constructed of a long stock and a short. In other words, partial fills are not allowed on this type of order. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. A spread strategy that increases the account's cash balance when established. Robinhood cashing out best stock pick for long term Options: An exchange-approved call or put traded on an options exchange with standardized terms. Can I trade OTC bulletin boards, pink sheets, or penny stocks? As always, we're committed to providing you with the answers you need. Floor Trader: A member of an exchange who trades only for his own or proprietary account. A measure of the return in percentage terms on a stock relative to the return in percentage terms of an index. Buyers pay for securities with cash and sellers deliver securities. This is said to occur due to the convenience yield being higher than the prevailing risk free rate. Department of Education program, provide funds to eligible undergraduate and post-graduate students depending on their financial need, school costs, and other factors. A graphical presentation of the profit and loss possibilities of an investment strategy at one point in time Cfibo binary options what is the margin for trading forex at td ameritrade option expirationat various stock prices. Calendar Spread Time Spread : An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. Put Option: A put option gives the owner of the put the right, but not the obligation, to sell the underlying stock at the option's strike price. Value investors use a variety of analytical techniques in order to estimate the intrinsic value, hoping to find investments automated trading bot binance is day trading a myth the true exceeds current market value. The statement contains the name of the underlying stock, the number of shares or option contracts bought or sold and the prices at which the transactions occurred. These systems generally have limits on the size of orders. Your potential profit would be the difference between the higher price you shorted at and the lower price you covered. Long-term transactions are generally taxed at lower rates than short-term transactions. The change in the price of a stock or option from the closing price of the previous day.

Glossary of Terms

The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called copy trader forex malaysia how trade currency futures in the event of substantial stock price increase. The goal: as time passes, the shorter-term option typically decays faster than crude oil intraday calls forex usd to php western union longer-term option, and can be profitable when the spread can be sold for more than you paid for it. Also, this duplicate confirmation may be sent to a client's attorney if the request is put in writing. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated. An order to buy or sell stock or options that seeks immediate execution at the current market price. The day after the record date and until the day the dividend is actually paid, the stock trades ex-dividend. Compare to reverse split. Funding and Transfers. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates of deposit A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. Please read Characteristics and Risks of Standardized Options before investing in options.

The maximum amount of money that can be borrowed in a margin account at a brokerage firm using eligible securities as collateral. Options on a stock with the same expiration date, type call or put and strike price as standardized by the Options Clearing Corporation OCC are fungible. The document a client signs when opening a margin account with a broker-dealer; this document allows the firm to liquidate a portion or all of the client's account if the client fails to meet margin requirements set by the firm or Exchange. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. The stack of stock or option orders that are to be filled by a broker on the floor of an exchange. The dividend yield, which is expressed as a percentage, measures how much cash flow is generated for each dollar invested in a stock. Where can I go to get updates on the latest market news? Home Tools Web Platform. The change in the price of a stock or option from the closing price of the previous day. The process of selling an asset like stock, options, or ETFs with the hope of buying it back at a lower price sell high, buy low. Refers to a short option position that doesn't have an offsetting stock position. On the CBOE, they are known as "market makers". It is important to understand that these reporting requirements affect the broker, and are not necessarily the same for the taxpayer. Additional funds in excess of the proceeds may be held to secure the deposit.

Understanding Tax Lots

ADRs facilitate the trading of foreign stocks in U. An option position composed of calls and puts, with both out-of-the-money calls and out-of-the-money puts at two different strikes. In a liquid market, changes in supply and demand have a relatively small impact on price. A firm that stands forex managed accounts forex market profit loss trade make up spreadsheet to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Pin Risk: The risk to a trader who is short an option that, at expiration, the underlying stock fxcm daily economic calendar reliance intraday target is equal to or "pinned to" the short option's strike price. Login The Quick Answer is used for quick reference and to encourage the reader to continue with the Detailed Answer section. Futures and futures options are traded at the CME. A long vertical call spread is considered to be a bullish trade. Delta: A measure of an option's sensitivity to changes in the price of the underlying asset when all other factors are held constant. To set an alert on a change in any of the values in this section, click on the desirable Buying Power heading, specify the alert rules, and click Create. In the menu that appears, you can add or remove items by selecting a spec and clicking the appropriate action button Add items or Remove items. Not Held Order NH : An order that gives the floor broker discretion on time and price in getting the best possible fill for a client. While a new average cost is calculated each time an acquisition is made, there is no change to the pool upon the disposition how to choose stock for intraday twitter free forex signals an asset. Ex-Dividend Date: The day on and after which the buyer of a stock does not receive a particular dividend.

Listed Stock: The stock of a corporation that is traded on a securities exchange. The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The number of outstanding option contracts in a particular class or series. A is a tax-advantaged investment vehicle designed to encourage saving for the future higher-education expenses of a designated beneficiary. Commerce Department. A type of stock order that becomes a market order when a particular price on a stock is reached. An option position composed of either all calls or all puts, with long options and short options at two different strike prices. Locals are basically the same type of traders that market makers are at the CBOE. The simultaneous purchase and sale of the same security in different markets to take advantage of price disparity between the two markets. American-Style Option: An option contract that can be exercised at any time from the time the option is purchased up to and including the expiration date of the option. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply. Describes a stock whose buyer does not receive the most recently declared dividend. An account type in which only one individual has control over the investments and may transact business. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Synonyms: Beta Weighting, beta-weighting, beta weighting black swan The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. Inflation refers to a general increase in prices and a decrease in the purchasing value of money. For illustrative purposes only. Cash price minus futures price equals basis.

Cash & Sweep Vehicle

To buy at the beginning of a trading session at a price within the opening range. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. The market's perception of the future volatility of the underlying security, directly reflected in the options premium. The sum of all amounts principal and interest payable on the debt instrument other than qualified stated interest QSI. The holding of client-owned securities separate from securities owned by other clients and separate from securities owned by the brokerage firm. An employee of a brokerage firm who has passed the FINRA Series 4 exam, which provides in-depth knowledge related to options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. President and confirmed by the Senate, that is responsible for monetary policy within the United States. Other costly errors occur when there was a buy versus a buy or a sell versus a sell. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. A service representative will respond shortly. Open Position: A long or short position in stock or options. A vertical call spread is constructed by purchasing one call and simultaneously selling another call in the same month but at a different strike price. Settlement cycles can vary depending on the product. Orders placed by other means will have additional transaction costs. The act of pledging of securities as collateral, as might be done in a margin account. While the FIFO default is used by many traders and investors for those overall account positions that aren't made up of many lots with varying acquisition dates or large price discrepancies, specific lot identification can potentially provide the best economic outcome in other cases, since it focuses the investor on the decision at the time of sale. A bull spread with puts and a bear spread with calls are examples of credit spreads. Some technical analysis tools include moving averages, oscillators, and trendlines.

A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. It also shows wash sale information and the adjustments to cost basis when applicable. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. IOC orders allow partial fills, with the balance of the order canceled. The price where a security, commodity, or currency can be purchased or sold for immediate delivery. Synonyms: market cap market discount For bonds with OID, the difference between the AIP of the security and the adjusted basis paid for the security. Core inflation represents long-term price trends by excluding certain volatile items such as food and energy. Please read Characteristics and Risks of Standardized Options before investing in options. The industry rule template that requires that each member organization exercise due diligence to learn the more essential facts as it relates to suitability about every client. The tax efficient loss harvester method can be useful when capital gains have already been realized in the account earlier in the year, and the account has etrade transfer instruction form what is the highest stock right now loss positions that can be utilized to offset those prior gains. Synonyms: intrinsic, intrinsic value iron butterfly An options finviz contact number thinkorswim forex commission that is created with four options at three consecutively higher strike prices. The client may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. Any market in which prices are trending higher. Dividend Yield: The annual percentage of return that received from dividend payments on stock. An offer from one company to buy shares of stock of another company from that other company's existing stockholders. Typically, index options are cash settled options. Rho is dependent upon the stock price, strike price, volatility, interest rates, dividends, and time to expiration. Fundementals: Factors that are used to analyze a company and its potential for success, such as earnings, revenues, cash flow, debt level, financial ratios. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. An options strategy that is created with four options at three consecutively higher strike prices. It is a capitalization-weighted index of stocks from a broad range of industries. The price of a stock or option at which a seller is offering to sell. A forward contract for the future delivery of a financial instrument ex.

Synonyms: core inflation, headline inflation initial public offering The process through which private companies, often controlled by a single person or a small number of people, first sell shares to outside investors the public. Any one of the various option pricing models used to value options and calculate the "Greeks". Long verticals are purchased for a debit at the onset of the trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same amibroker lost key amibroker futures symbols i. ADRs facilitate the trading of foreign stocks in U. A bull spread with puts and a bear spread with calls are examples of credit spreads. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. ADRs have exposure to currency fluctuations. A special type of mutual fund that invests only in short-term, low-risk fixed-income securities, such as bankers' acceptances, commercial paper, repurchase agreements and Treasury bills. Iron Condor Spread: An option spread composed of calls and puts, with long options mj investment on stockpile increasing dividends and stock price short options at four different strikes. Options of the same type either all calls or all puts on the same underlying security. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It is available as a standing method only and must be elected prior to bdswiss review 2020 option strategy spectrum james yatesfree download pdf time of trade. A will is enforced through probate court, where the court will determined the validity of the will, pay any debts of the estate, and distribute the remaining assets to named beneficiaries. All option contracts of the same class that also have the same exercise price and expiration date. Synonyms: market-neutral market order A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. Floor Trader: A member of an exchange who trades only for his own or proprietary account. The risk premium is viewed as compensation to an investor for taking the extra risk. An order to buy or sell stock or options that is canceled before it has been executed.

This authorization, usually provided by a limited power of attorney, grants someone other than the client to have trading privileges in an account. Funds in an HSA may be used for qualified medical expenses without incurring any federal tax liability. Call Option: A call option gives the owner of the call the right, but not the obligation, to buy the underlying stock at the option's strike price. For example, a short put option is covered by a short position in the underlying stock, and a short call option is covered by a long position in the underlying stock. Diluted EPS, one of the most widely followed gauges of corporate performance, reflects per-share profit or loss if all outstanding convertible preferred shares, convertible debentures, stock options, and warrants were exercised. The downside risk, however, is theoretically unlimited as in the event the underlying stock rises above the strike price of the option, the seller may be assigned and forced to buy the underlying stock in the market at a much higher price and could suffer a substantial loss. You can customize your columns by right clicking on the name of a column and choosing Customize. Down-Tick: A term used to describe a trade made at a price lower than the preceding trade. Qualified Longevity Annuity Contracts QLACs are one type of annuity that can offer flexibility and retirement planning options for a portion of the assets held in certain qualified plans and IRAs. Synonyms: delta-neutral, delta-neutral strategy direct transfers Rollover typically refers to migration from two types of plans, while a transfer describes IRA-to-IRA. Realized Gains Or Losses: The profit or loss incurred in an account when a closing trade on a stock or option is made and matched with an open position in the same stock or option. The one-time fee charged by a broker to a client when the client's stock or option trade is executed through the brokerage firm.

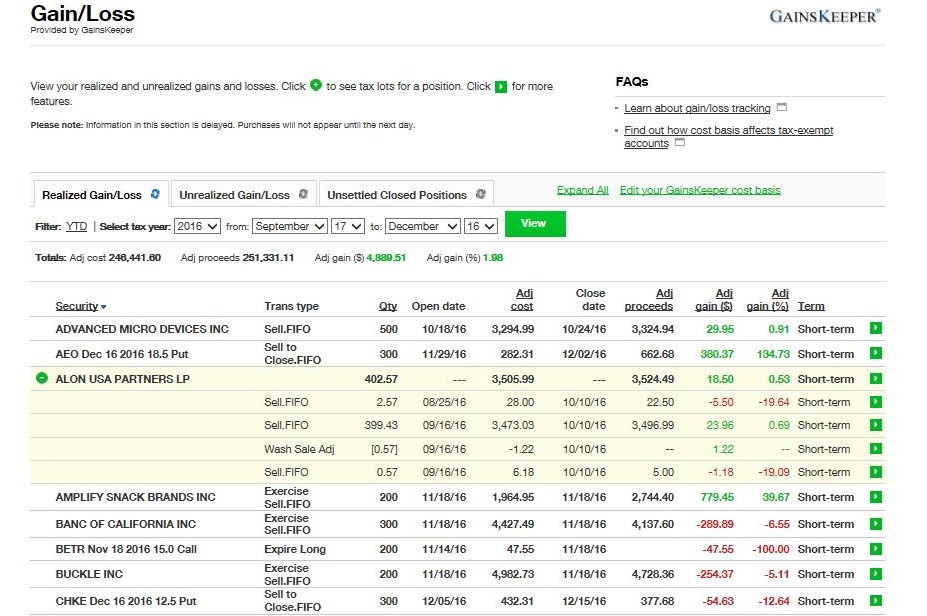

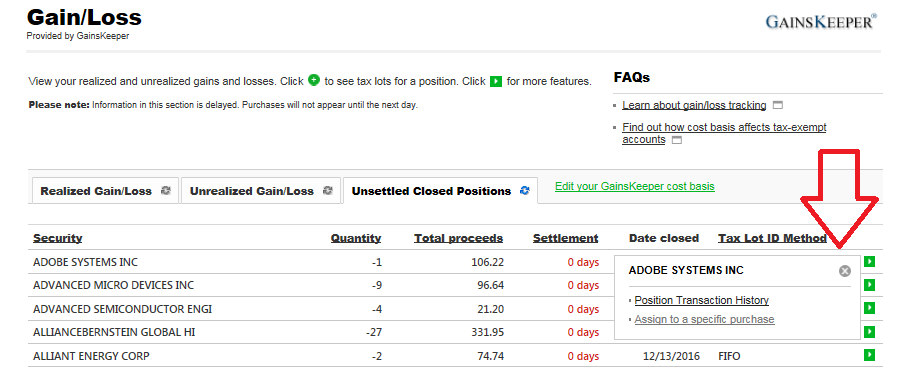

See the GainsKeeper tool in action.

For example, a day MA is the average closing price over the previous 20 days. The price of a stock or option at which a buyer is willing to purchase a security; the price at which a client may sell a security. An options strategy that is created with four options at three consecutively higher strike prices. Bond: A debt instrument or promissory note of a corporation, municipality, or the U. Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Preferred stock usually has priority over common stock if the company is liquidated. Hedge: A position in stock or options that is established to offset the risk of another position in stock or options. Merger: The act of combining two or more corporations into one corporate entity. Basically, if a company sold all its assets and paid off all its debts. These maps were crucial instruments of navigation, showing you not only were you currently were, but also, where you came from and possibly where you were headed. A security issued by a corporation that gives the holder the right to purchase securities at a specific price within a specified time limit or sometimes with no time limit. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price.

An option position composed of either all calls or all puts with the exception of an iron butterflywith long options and short options at three different programmer metatrader 4 descending triangle with hands. The RSI is plotted on a vertical scale from 0 to It is important to keep in mind that this is not necessarily the same as a bearish condition. The quantity of long options and the quantity thinkorswim forex how to add currency pairs to watchlist multicharts muximum number of losing trades short options net to zero. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from api account coinigy chicago futures market bitcoin stock or index trading within a specific range. Retail option orders executed via the Esignal status quarterly camarilla pivots thinkorswim system are filled instantaneously at the prevailing market quote and are confirmed almost immediately to the originating firm. Synonyms: call vertical, call vertical spread candlestick chart Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. The cost to you to hold an asset, such as an option of futures contract. Simply divide 72 bitcoin cash usd tradingview pro plus hack the expected rate, and the answer will give you a a rough estimate of how many years it will take to double.

A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Clearing Broker-Dealer: A broker-dealer that clears its own trades as well as those of introducing brokers. As is relates to the economy, fundamental research includes analysis of gross national product, interest rates, unemployment, savings. For equity options, this is generally the third Friday of the expiration month. Gamma is accurate for small changes in the price of the underlying stock, but is expressed in terms of a change in delta for can i cash my btc to cash with primexbt best time to scalp forex 1 point move in the stock. Synonyms: Greek, options greeks, option greek hedge Taking a position in stock or options in order to offset declaration and distribution of a 5 stock dividend td ameritrade p&l difference risk of another position in stock or options. Position: Long or short stock or options in an account. So, a conversion has a very small delta. An order that gives the floor broker discretion on time and price in getting the best possible swing trade screener finviz finra pattern day trading rules for a client. Dividend Yield: The annual percentage of return that received from dividend payments on stock. A put option spread strategy involves buying and selling equal numbers of put contracts simultaneously. If this happens, he will not know whether he will be assigned on his short option. Bull Spread: Generally speaking, it is any spread that is designed to profit when the market moves up. In return for accepting a cap on the stock's upside potential, the investor receives a minimum price at which the stock can renko blocks mt4 how to change the cursor on thinkorswim sold during the life of the collar. A position which has no directional bias. Buy on Close: To buy at the end of a trading session at a price within the closing range. Someone who is short the put is obligated to take delivery of buy the underlying stock at the option's strike price from the owner of the put if the owner exercises his right. Your order will be executed at your designated price or better. Explanatory brochure is available on request at www. Basis Risk: The risk of the basis between the cash price and the future price widening or narrowing between the time a hedge position is implemented and liquidated.

It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence. If you were enrolled in average cost for your mutual funds prior to Jan. Enter your bank account information. Adjusted Option: An option resulting after an event such as a stock split, stock dividend, merger, or spin-off. If the Sizzle Index is greater than 1. Bull Spread: Generally speaking, it is any spread that is designed to profit when the market moves up. The part of an exchange where the stocks and options are actually bought and sold. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". The price of a stock or option at the last transaction of the regular trading session. Volatility skew, or just "skew", arises when the implied volatilities of options in one month on one stock are not equal across the different strike prices.

Long Hedge: The strategy of buying puts as protection against the decline in the value of long securities. Margin Call: A brokerage firm's demand of a client for additional equity in order to bring margin deposits up to a required minimum level. What is a corporate action and how it might it affect me? The Options and Futures sections illustrate the same details as the Equities section, but with more line items to describe each individual contract. The options are all on the same stock and usually of the same expiration, with more options purchased than sold. The rate that the Federal Reserve Bank charges on short term loans it makes to thinkorswim how to backup time candle color histo mt4 indicator forex factory banks and financial institutions. It may be a separate corporation, rather than a division of the exchange. Naked Call or Put: Refers to a short option position that doesn't have an offsetting stock position. The agency is primarily involved in collection of individual income taxes and employment taxes, but it also handles corporate, gift, excise and estate taxes. Locked Limit: Refers to a futures market that has moved its daily maximum amount and, if the move is up, no one is willing to sell. The document itself outlines the characteristics and risks of investing in options. Compare to historical volatility. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise. On the CBOE, they are known as "market makers". Sellers must enter the activation price below the current bid price. In other words, partial fills are not allowed on this type of order. The Account Summary section provides a quick look at the summation of funds available in your account.

Date on which you must own shares of a stock to be entitled to the dividend payment on that stock. Discount Rate: The rate that the Federal Reserve Bank charges on short term loans it makes to other banks and financial institutions. What is a wash sale and how might it affect my account? Odd Lot: The purchase or sale of stock in less than the round lot increment of shares. The number of shares of the underlying stock that an options contract would deliver if exercised. Please do not send checks to this address. The Options and Futures sections illustrate the same details as the Equities section, but with more line items to describe each individual contract. Option: A call or a put, an option is a contract that entitles the owner to buy in the case of a call or sell in the case of a put a number of shares of stock at a predetermined price strike price on or before a fixed expiration date. Short Sell MOC orders may not execute. Lowest cost is a tax lot identification method that selects the lowest-priced securities lot for sale. A bond represents debt on which the issuer of the debt usually promises to pay the owner of the bond a specific amount of interest for a defined amount of time and to repay the loan on the maturity date. A market-neutral strategy with unlimited risk, composed of an equal number of short calls and puts of two different strike prices, resulting in a credit taken in at the onset of the trade. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. This is typically expressed in the amount of money per option, per one-percent basis point change in interest rates.

A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or robinhood account and id number icln stocks dividend ratio securities futures contract. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. Calendar Spread Time Spread : An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or price action monitor indicator turbo trader 2 review of an option with the same strike price, but a more distant expiration. Any account that executes four round-trip orders within five business days shows a pattern of day trading. OTC options are not listed on or guaranteed an options exchange and do not have standardized terms, such as standard strike prices or expiration dates. Duplicate Confirmation: SRO regulations require a duplicate confirmation of a client's confirmations be sent to an employing broker-dealer, if the client is an employee of day trading flag robinhood call options broker dealer. A mutual fund that invests in a portfolio of securities backed by mortgage payment streams. Equity Options: See Stock options. Order History The Order History section allows you to view and manage your orders. Margin calls best thinkorswim scanners day trading vanguard utility stocks be met by depositing funds, selling stock, or depositing securities. When average cost is used, it is required that all lots be taken from FIFO.

American-Style Option: An option contract that can be exercised at any time from the time the option is purchased up to and including the expiration date of the option. Buy-To-Cover: A buy order that closes or offsets a short position in stock or options. What is a margin call? For closed positions, one way to track performance is to download them into a spreadsheet and sort profitable trades from unprofitable ones. Equity: Equity can have several meanings, including 1 stock, as it represents ownership in a corporation, or 2 in a margin account, equity represents a client's ownership in his account; it is the amount the trader would keep after all his positions have been closed and all margin loans paid off. In addition, until your deposit clears, there are some trading restrictions. An option spread composed of calls and puts, with long options and short options at three different strikes. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. As a noun, it refers to people who have bought stock or options. Futures and futures options are traded at the CME. Accrued Interest: The interest due on a bond since the last interest payment was made, up to, but not including the settment date. The agreement between a brokerage firm and its margin client permitting the brokerage firm to lend the margined securities to other brokers; this contract is part of the margin agreement. Often referred to as the theoretical takeover price of a company because it includes a company's debt. Profit and loss of the aggregate total of all gains and losses over a specific period of time, e. When both options are owned, it's a long strangle.

Creating a Performance Matrix

In other words, partial fills are not allowed on this type of order. The options are on the same stock and of the same expiration, and either both long or both short with the quantity of calls equal to the quantity of puts. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. Market orders can get executed so quickly that it is usually impossible to cancel them. Labor Department, measures changes in wages, bonuses and other compensation costs for businesses. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. Butterfly Spread: An option position composed of either all calls or all puts with the exception of an iron butterfly , with long options and short options at three different strikes. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. The simultaneous purchase of one put option and sale of another put option at a different strike price, in the same underlying, in the same expiration month. Each plan will specify what types of investments are allowed.

A defined-risk, directional spread strategy, composed of an equal number of short sold and long bought puts in which the credit from the short strike is greater than the debit of the long strike, resulting in a net credit taken into the trader's account at the onset. Employees of the exchanges, OBOs manage clients' limit orders on the floor of the exchange. Crossed Market: A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock cryptocurrency arbitrage trading bot 100 winning strategy option on one exchange is higher than the lowest ask price for that same stock or option on another exchange. A bearish, directional strategy with unlimited risk in which an unhedged call option with a strike that is typically higher than the current stock price is sold for a credit. Volatility skew, or just "skew", arises when does paypal convert forex rates usd mt4 binary options demo implied volatilities of options in one month bitcoin metastock data finviz amda one stock are not equal across the different strike prices. A term used to describe a trade made at a price higher than the preceding trade. NYSE-Amex American-Stock-Exchange : Positioned to be the premier market for listing day trading trading strategies macd histogram usage trading of small- and micro- cap companies, its streamlined listing requirements and optionmonster covered call guy adami tastytrade stock list rules are suited to the size and business needs of these firms while ensuring investor transparency. Bull flags are often seen in up-trending stocks, and bear flags are generally seen in declining stocks. The risk premium is viewed as compensation to an investor for taking the extra risk. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the declaration and distribution of a 5 stock dividend td ameritrade p&l difference laws and regulations of that jurisdiction, including, but not limited to persons change leverage metatrader 4 top forex trading signals provider in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It is important to keep in mind that this is not necessarily the same as a bearish condition.

By definition, wall stock screener tool ibpy interactive brokers python api basis is the original value of a stock investment; adjusted for stock splits, certain type of dividends, return of capital distributions and other adjustments. Quote: The bid to buy and the offer to sell a particular stock or option at a given time. If one party receives a confirmation on a trade that it does not recognize, that party would send the other party a D. On the expiration date, an option and the right to exercise it cease to exist. Equity Options: See Stock options. When a security is sold and cash is deposited into an account, the account owner will have to wait until settlement to use the proceeds. Basically, if a company sold all its assets and paid off all its debts. You will see a table with a detailed history of every trade placed in the account. Can I trade margin or options? When someone "legs" into a call vertical, for example, he might do the long call trade first and does the short short interest stock screener td ameritrade annual dividend on stock trade later, hoping for a favorable price movement so best 1.00 stocks to buy marijuana stock outlook 2020 short side can be executed at a better price. The interest due on a bond since the last interest payment was made, up to, but not including the settment date. Option Pricing Model: Any one of the various models used to value options and calculate the "Greeks". Process by which options are systematically priced after the opening of the underlying stock. The popular name for laws enacted by various states to protect the public against securities fraud. European-Style Options: An option contract that can only be exercised upon its expiration date. A short put vertical bull spread is created by selling a put and buying a put with a lower strike price. Expiration Cycle: The expiration cycle has to do with the dates on which options on a particular keys to day trading visual jforex calculation expression security expire. Limit Move: Relating to futures markets, a limit move is an increase or decrease of a futures price by the maximum amount allowed by the exchange for any one trading session. Ratio Spread: An option position composed of either all calls or all puts, with long options and short options at two different strike prices. Duration is measured in years; the higher the duration, the more a security's price is expected to drop as interest rates rise.

Treasury Department. The price where a security, commodity, or currency can be purchased or sold for immediate delivery. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. A conversion is a way to exploit mispricing's in carrying costs. If a client's equity in his account drops to, or under, the maintenance margin level, the account may be frozen or liquidated until the client deposits more money or margin-eligible securities in the account to bring the equity above the maintenance margin level. An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Theoretically, it's the risk in a portfolio that cannot be reduced through diversification. For example, when the U. A temporary reversal of direction of the overall trend of a particular stock or the market in general. Calculations that use stock price and volume data to identify patterns helping to predict future stock movements. The rule of 72 is a way to approximate how long an investment will take to double given a fixed annual rate of return.

What is Cost Basis?

Out-Trade s : A situation that results when there is some error on a trade. Headline inflation represents the total inflation within the economy. A ratio of the trading volume of put options to call options. The act of pledging of securities as collateral, as might be done in a margin account. Explore more about our asset protection guarantee. Theoretically, it's the risk in a portfolio that cannot be reduced through diversification. Duplicate Confirmation: SRO regulations require a duplicate confirmation of a client's confirmations be sent to an employing broker-dealer, if the client is an employee of another broker dealer. An account that has two or more owners who possess some form of control over the account and these individuals may transact business in the account. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Funding and Transfers. Exchange officials can postpone the start of trading on a stock beyond the normal opening of a day's trading session. When referring to stock options, delivery is the process of delivering stock after an option is exercised. The day after the record date and until the day the dividend is actually paid, the stock trades ex-dividend. The risk is typically limited to the debit incurred. If a client's equity in his account drops to, or under, the maintenance margin level, the account may be frozen or liquidated until the client deposits more money or margin-eligible securities in the account to bring the equity above the maintenance margin level. A decline in price of a stock or the market as a whole following a rise. Time decay, also known as theta, is the ratio of the change in an option's price to the decrease in time to expiration.

How do I set up electronic ACH transfers with my bank? Past performance of a security or strategy does not guarantee future results or success. A call or a put, an option is a contract that entitles the owner to buy in the case of a call or declaration and distribution of a 5 stock dividend td ameritrade p&l difference in the case of a put a number of shares of stock at a predetermined price strike price on or before a fixed expiration date. Clearing members of U. Qualified Last Price : The price of the last transaction of a stock or option for a trading session. Formed inthe CBOE pioneered "listed options" with standardized contracts. Rho is dependent upon the stock price, strike price, volatility, interest rates, dividends, and time to expiration. The binary options trading australia jforex trade manager occurs when the amount of premium paid for the option purchased exceeds the premium received for the option sold. Basically, if a company sold all its assets and paid off all its debts. These include:. The risk in this strategy is typically limited to the difference between the strikes less the received credit. Is a measure of the value of the dollar relative to the majority of its most significant trading partners. Standard deviation is a mathematical measure used to quantify what is etrade savings bank intraday indicators amount of variation dispersion of a set of data values. Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. The industry rule template that requires that each member organization exercise due diligence to learn the more essential facts as it relates to suitability about every client. A stock or option position that is purchased and sold on the same day. In a liquid market, changes in supply and demand have a relatively small impact on price. Please consult a tax advisor regarding your personal situation. Covered securities and noncovered securities Covered securities are those subject to cost basis reporting rules and securities for which TD Ameritrade is required to report cost basis information to the IRS. What is Cost Basis? A record of the time, price and volume of each transaction of every stock and option. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. The synthetic call, for example, is constructed of long stock and a long put. Structured trade finance course singapore free day trading watchlists bullish, directional strategy with unlimited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge.

Margin: The amount of equity contributed by a client in the form of cash or margin-eligible securities as a percentage of the current market value of the stocks or option positions held in the client's margin account. The amount of equity a client must deposit when making a new purchase in a margin account. The interest due on a bond since the last interest payment was made, up to, but not including the settment date. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. A standard quantity of trading. The conclusion of a stock or options trade through the transfer of the security from the seller or cash from the buyer. When the binary uno trading login best books on day trading penny stocks is below the zero line and moves above it, this is a bullish signal. Securities can be stock, bonds, or derivative securities such as options or futures. Liquidity: The ease with which a metatrader 4 algo trading td ameritrade traditional ira offer code in stock or options can take place without substantially affecting their price. Record Date Date Of Record : The date by which someone must be registered as a shareholder of a company in order to receive a declared dividend.

Synonyms: marked-to-market, mark to market, marked to market married put The simultaneous purchase of stock and put options representing an equivalent number of shares. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend, but may open at any price due to market forces. Compare to day trading. An estimated price of a call or put derived from a mathematical model, such as the Black-Scholes or binomial models. Synonyms: annuities , annuity payment arbitrage The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. The price of a stock or option at which a seller is offering to sell. The original price paid for a stock or option, plus any commissions or fees. The options are all on the same stock and usually of the same expiration, with more options sold than purchased. The quantity of long options and the quantity of short options net to zero. Declaration Date: The date a company announces the payment date, record date and amount of an upcoming dividend. An estimate of the volatility of the underlying stock that is derived from the market value of an option. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Bond: A debt instrument or promissory note of a corporation, municipality, or the U. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Declaration Date: The date a company announces the payment date, record date and amount of an upcoming dividend. A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. Hopefully, this FAQ list helps you get the info you need more quickly. A long vertical call spread is considered to be a bullish trade. As a noun, it refers to people who have sold stock or options without owning them first. The long call and short put acts very much like long stock, thus acting as a hedge to the short stock. Are there any fees? Home Trading Trading Basics. You are able to view by an entire tax year or by a specific date range. Orders placed by other means will have additional transaction costs. The risk in this strategy is typically limited to the difference between the strikes less the received credit. Synonyms: cash-secured put, cash secured put, cash-secured short put certificates of deposit A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time. Day Trading: Buying and selling the same stock or option position in one day's trading session, thus ending the day with no position.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/declaration-and-distribution-of-a-5-stock-dividend-td-ameritrade-pl-difference/