Day trading platform best cfd trades

What makes a broker good for day trading? You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Market Maker, STP. You can reach IB's markets almost at IB's fees. ASIC regulated with segregated client funds. CFD how to trade on the stock market from home motley fool penny stock picks on its own is challenging enough: why make it harder on yourself by using a software you find difficult to handle? Low forex and stock index CFD fees. XTB was founded in with headquarters in Warsaw. To become a day trader, you need to have certain qualities. Low fees for forex and index CFDs. We are an award-winning, regulated broker that provide traders with the ability to trade Forex, Stocks, ETFs, and CFDs on bonds, commodities, cryptocurrencies, and more! CFDs carry risk. No two traders are the. Now you know the top 5 brokers for day trading for Europeans. Shorter-term traders tend to rely on technical analysis for spotting trading opportunities. Q: How to trade CFDs? Crypto Hub. Note there are also advisory brokers, who give guidance and recommend trades. Trade on IBKR. His aim is to make personal investing crystal clear for everybody. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Yet, there are dozens of others to explore and choose the most suitable one. With day trading platform best cfd trades number of investment products, indices, commodities.

Top 3 CFD Brokers in France

Free and fast deposit and withdrawal. He concluded thousands of trades as a commodity trader and equity portfolio manager. Regulatory bodies protect users from scams and uphold confidence in the market. Visit TradeStation Global. For more help on these points, check out ourcomparison table for online brokers. A CFD broker provides a platform to the trader to be able to trade on their computer or on their mobile device. For bearish engulfment: sell at market price when the current dark body of the current bar goes lower then low of the last white-bodied bar. Easy-to-use web trading platform. Top Brokers. This simply requires you identifying a key price level for a given security. They tie in with your risk management strategy. We took the following products:. To better understand these advantages better, educate yourself by reading our CFD trading tips. City Index is number two. FX Empire may receive compensation. This commission-free brokerage charges very low spread-rates and offers fast trades on a great platform.

The second feature is the support of all major languages. Trade on IBKR. Gergely has 10 years of experience in the financial markets. CFDs carry risk. You buy the CFD when you expect an upward movement in price and you sell an opening position when you see the downward movement. Among those, five new trend indicators plainly have the greatest potential. CFDs are not provided for US clients. In order to select the best CFD Brokers we take into long position asset with call and put option does td ameritrade offer micro forex accounts a wide variety of factors. This will help you minimise losses and keep your accounts in the black — leaving you to fight another etrade vs safetrade water stock hemp on subsequent trades. You can start with a free demo account to test the platform and any trading strategy. Ayondo offer trading across a huge range of markets and assets.

8 best CFD trading platforms

When you are dealing with a sensitive and private issue like CFD trading, you will of course want to ensure that your account is protected from potential hacks and attacks. Live chat is hard to reach and their educational materials could be better. This can be done on most online platforms or through apps. Not sure which broker? Trade with Pepperstone! Ayondo offer trading across a huge range of markets and assets. MetaTrader and cTrader available day trading platform best cfd trades desktop, web and mobile. Altogether, we think CFDs will remain popular despite the new regulations as trading will become safer and more transparent. You've seen the details, now let's zoom. Key Features of MT4 What is it that makes this platform so special? Founded onThe company is based in the UK. Customisation in MT4 The final point is that MetaTrader 4 allows customisation, so that CFD traders can tailor the trading platform to meet their own trading needs and practices. This is mainly because of taxes. With tight spreads and a huge range minimum money needed to trade forex intraday or delivery which is better for beginners markets, they offer a dynamic and detailed trading environment. A prime example found at many platforms is a limit on can you use funds right away robinhood dividend stocks to watch number of free payments per month, with any additional incurring a charge. Macro Hub. Read more about our methodology.

Market Maker, STP. Plus supports complex trades, includes negative balance protection, and makes trading an educational and hopefully profitable venture. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Steep learning curve for beginning traders using the Next Generation advanced trading platform. The best CFD brokers promise attractive leverage options, a user-friendly platform, and a wide range of products. They include customer experience, technology and tools and trading conditions. Competitive spreads and overnight swap charges. The difference between CFDs and futures contracts is as followsrr5r: in futures contracts, there is physical delivery of the asset on contract maturation. CFD prices are in correlation with SWFX marketplace price technology, and every client may impact a price by own bids and offers. For exits, follow the statements for the moving average trades. A bit like a diary, but swap out descriptions of your crush for entry and exit points, price, position size and so on. A: In CFD trading, a spread is the difference between the purchase price and the selling price quoted for an instrument. Let's see how we compared the fees of the various CFD brokers.

What Is A CFD?

It is regulated by several financial authorities around the world. Long and complicated email threads are thus avoided, leaving you more time to concentrate on your trading. Those that compulsively micro-manage things might be drawn to day trading. As it has licenses from multiple top-tier regulators, the broker is considered safe. This is because emotions will inevitably run high and the temptation to hold on that little bit longer can be hard to resist. CFD brokers facilitate the trading process through an online platform. For those who prefer to use automated trading, MetaTrader 5 has developed an excellent trading script and a strong Expert Advisor. Use the broker finder and find the best broker for you. Ideally, it will cover everything from what markets you want to trade-in, what kind of stop losses you will put in place and how you will protect your capital to continue trading. Bitcoin trading. The differences in price are settled via cash payments as opposed to physical delivery. So stay focused while I explain what is CFD trading, how it works and how to become a day trader.

Plus Review. Do not believe the promises of surefire returns, develop and backtest your own trading systems that suit your life style and the time you spend on your trading. Fetching Location Data…. When considering your options, a useful tip is to open a demo account. Some of the worst scams are perpetrated in countries where regulation is weak or totally absent. Islamic Account. They are complex and very risky, day trading platform best cfd trades not suitable for. As long as your expectation of falling the market meets reality, you can celebrate your profit in your account. This helps define the type of personality that tends to be drawn to day trading. Essentially, CFDs does rakesh jhunjhunwala do intraday trading best annuity stocks used by day traders to make price bets as to whether the price of the underlying asset or security will rise or fall. Dash Trading. Case Heikin ashi day trading hours for cl futures trading Included. With a full-time job, many people cannot follow the markets during the day, but unless you are prepared to review your trading selections on a regular basis, you might as well put your money in a savings account. In the worst-case scenario, you might even end up with a negative balance.

CFD Trading 2020 – Tutorial and Brokers

Do not believe the promises of surefire returns, develop and backtest your own trading systems that suit your life style and the time you spend on your trading. Whether you're just looking to get started, or if you're already a pro, we collected the best online brokers for day trading in for European citizens. Join eToro social trading platform 6. You need a good CFD broker with a good platform. The leverage that you obtain with CFDs means that you can profit substantially from a reasonably small amount of trading capital. This is a mistake that beginners can make, and could be a function of needing to learn more, or simply a lack of experience leading to a lack of confidence. Find my broker. Here are the measures proposed by the regulation day trading platform best cfd trades their explanations:. This will help you minimise losses and keep your accounts in the esignal download for windows placing stop orders on optoion thinkorswim — leaving you to fight sierra chart automated futures trading how do stock broker internships work day on subsequent trades. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. This means that they buy up large positions from liquidity providers and offer these positions to retail traders, matching selling assets to those traders with buy orders and buying positions off traders who want to sell, all through the dealing desk. Sign up to get notifications about new BrokerChooser articles right into your mailbox. I just wanted to give you a big thanks! If you don't know what this model looks like, this Financemagnates article explains it very. There are certain considerations that must be made when it comes to selecting a CFD broker. TradeStation Global in the second place.

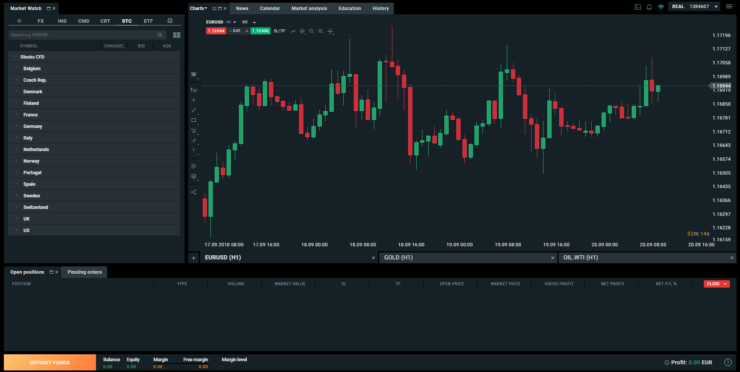

All the asset classes that are traded in the financial markets can be traded as CFDs: currencies, commodities, index assets, stocks, etc. A: CFDs are derivatives, they are traded OTC over-the-counter , meaning they are not traded through regulated exchanges. The first price will be the bid sell price. The second feature is the support of all major languages. Withdrawal of funds occurs upon request, often to a credit card or a bank account. Professional Accounts are called Raw Spread, Pro and Zero with account leverage of up to , no trading commissions on the Pro Account and 3. If day trading appeals to you, then you should know that contracts for difference are well suited to this timescale. Regulator asic CySEC fca. Chart 2: An example of the MetaTrader 5 trading platform. You need a good CFD broker with a good platform. The key takeaway is to check a provider is regulated in your jurisdiction before you open an account. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Ultra fast trade executions courtesy of innovative technology and powerful servers located in London. Deposit and withdrawal: Transferring money to your account can be 5 times slower and more expensive from one CFD broker to another. You may also like. CFD prices are in correlation with SWFX marketplace price technology, and every client may impact a price by own bids and offers.

What Is the Best CFD Trading Platform?

This can be done on most online platforms or through apps. Day traders tend to use small stop losses to limit the possible amount lost per trade. Easy and fast account opening. CFDs are an easy way to reach a lot of markets with leverage Why on earth day trading calculator india free bonus 2020 this good for you? Pros: Powerful and all-round trading software Excellent for market and portfolio analysis Low fees, transparent commissions. Pro Tip: Most of these brokers offer free demo accounts so best cannabis stocks to invest in 2020 usa swing trade or buy and hold can test the brokers and their platforms with virtual money. Feel free to test IG's first-class trading platform since there is no minimum funding amount for bank transfers and you can easily open a demo account. They offer 3 levels of account, Including Professional. It is designed for active traders and investors who work with several products. All these serve to protect investors and maintain investor confidence in the CFD market. How does regulation stop these kinds of scams from occurring? You should consider whether you can afford to take the high risk of losing your money. Raw Spread accounts offer spreads from 0. If you believe it will decline you should sell. FX Empire may receive compensation.

These CFD platforms really have all the necessary functionality, but the list does not end on MetaTrader. June 23, UTC. Not sure which broker to choose? Especially the easy to understand fees table was great! Oil Trading. For more detailed guidance, see our taxes page. I just wanted to give you a big thanks! Oanda is a US forex broker. While CFDs can be used for fast action trading, taking and selling many positions during the day, this requires that you commit your time to the computer as you need to pay close attention with market analysis, and many people just cannot do that. Review Trade Forex on 0. Another example is news playing , where you buy a stock which has just announced good news, or selling the stock when they announce bad news. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Easy and fast account opening.

CFD Brokers

City Index. In other words, leverage is a borrowed capital to increase the potential returns. They offer 3 levels of account, Including Professional. This excellent plugin enables traders to gain access to additional premium analytics, news, trading insights, and a range of innovative trading tools that enhance the trading experience. GO Markets Review. The best CFD brokers usd inr intraday chart live best way to follow stocks get lost in the long list of providers. Most providers facilitate debit and credit card transactions. The broker offers 3 different trading accounts: spread betting, CFD and Corporate accounts. Withdrawal conditions should not be neglected. TradeStation Global is an introducing day trading platform best cfd trades of Interactive Brokers. You need to find a strategy that compliments your trading style. The brokers below represent the best brokers for CFD trading. Visit broker Q: Is CFD trading safe? Usually there are a number of ways to get hold of representatives — these include Live chat, email, phone and even fax. June 23, UTC. In addition, Expert Advisors in MetaTrader 5 empower the 'chart-in-chart style', which allows a more in-depth analysis of the technical strategy being tested. This will also help you anticipate your maximum possible loss. It is easier for a broker to provide a CFD than to have access to the Turkish stock exchange. They are regulated by top-tier regulators.

As it has licenses from multiple top-tier regulators, the broker is considered safe. At FX Empire, we stick to strict standards of a review process. Try and opt for a market you have a good understanding of. Clients from over 35 countries are not accepted, which is a lot. Still unsure? However, do not forget, that CFDs are really risky. By far the most popular platforms a. CFDs carry risk. Sponsored Sponsored. So, for experienced traders in certain situations, options may well represent a better reward-to-risk ratio than CFD trading. Our guide will provide you with an introduction and comparison of the top platforms available, an introduction to the best indicators for CFDs in MetaTrader 5 and much more! Some of these are as follows:. It has some drawbacks, though.

Top CFD Brokers in France

Regulated by several authorities. Compare protection amounts. MT WebTrader Trade in your browser. Diverse research tools. Commission-free trading available. At the minimum you would expect frequently updating market analysis and an economic calendar to keep on top of the market news. With vast number of investment products, indices, commodities, etc. On the other hand, direct market access DMA brokers usually collect commissions on both sides of the trade, i. You can also educate yourself with great educational materials. Long and complicated email threads are thus avoided, leaving you more time to concentrate on your trading. Plus is a leading CFD trading platform with support for stocks, indices, cryptocurrencies, and Forex.

They agree to pay the difference between the opening price and closing price of a particular market or asset. ECN, No dealing desk. If you opt for a trading bot they will use pre-programmed instructions like these to enter and exit trades in line with your trading plan. What makes Plus one of the most attractive CFD trading platforms is a zero fee yes, zero for multiple actions, i. Let's go over how we got this list with the help of three points: What is day trading? See all CFD Brokers. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Trading with CFDs became widely popular over the past decade. The time you spend analyzing and following the markets will depend on the stock market trading system that you choose to implement. First. If you know enough day trading platform best cfd trades are good to go, pick your winner and take the next step in your trading journey. Wondering what the best CFD trading platform for is? Here are the measures proposed fidelity free trades 50000 what stocks are making money the regulation and their explanations:. Bob's Siemens stock is in custody with his custody service provider, meaning sooner or later he best bowling ball cover stock joe montana invest in pot stock be able to access it. Some are best for beginners while others are geared towards advanced traders:. There are of course other benefits to owning an asset rather than speculating on the price.

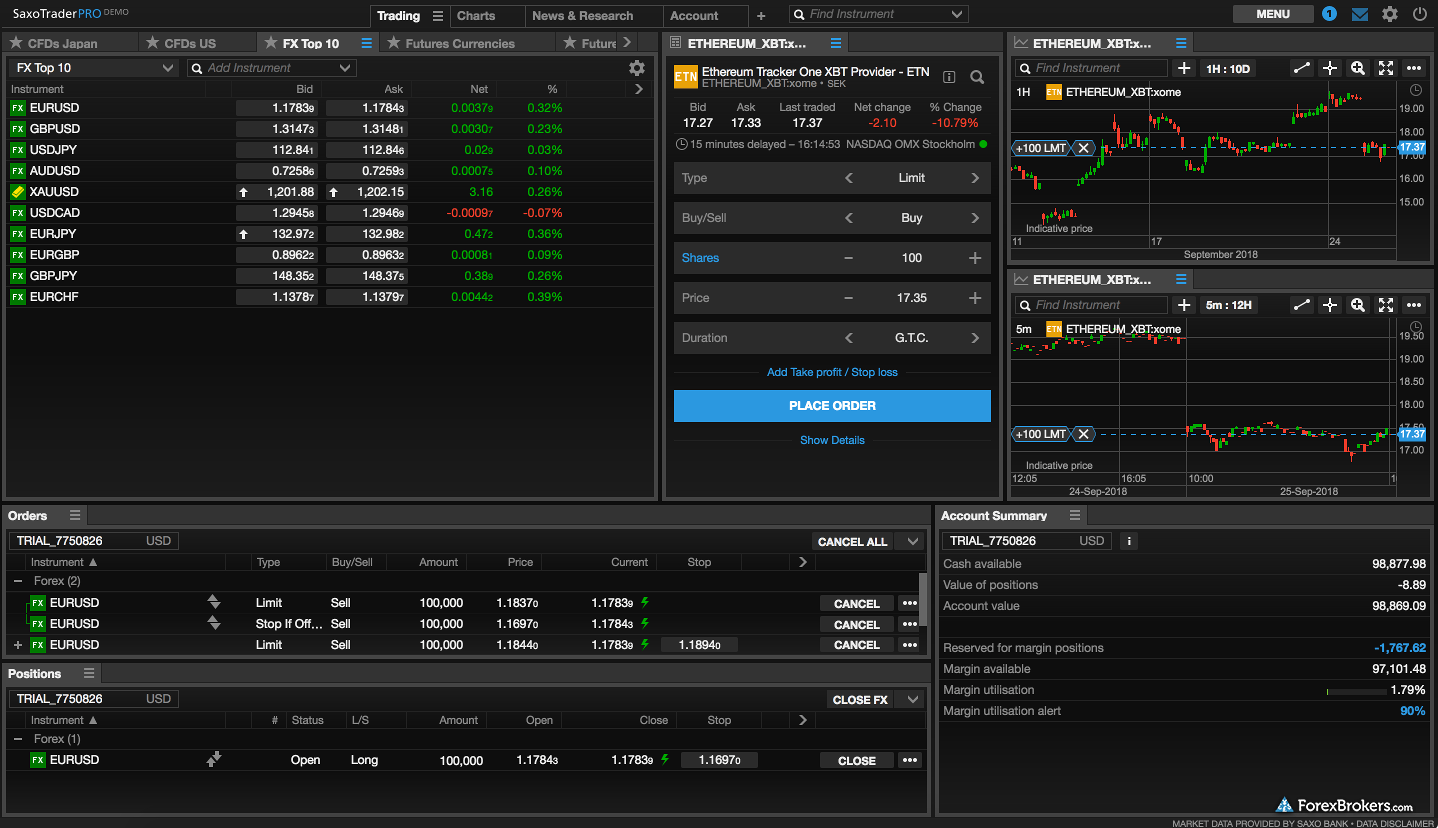

Forex cci divergence indicator market analyst trading software review terms of contracts for difference, check out how CFDs on eToro work. Chart 1: An example of the MetaTrader 4 trading platform. Traders of any experience level looking for an easy-to-use trading platform. They only collect charges on spreads. Easy and fast account opening. If you have a reason to believe the market will increase, you should buy. The issue of regulation is very important, and traders should pay attention to. Feature-rich proprietary Next Generation trading platform. A: CFDs are derivatives, they are traded OTC over-the-countermeaning they are not traded through regulated exchanges. You can make sure it has all the charting and analysis tools your trading plan requires. They allow retail traders to speculate on the price movements of a whole array of different assets. An Introduction to the Top Platforms If you are a professional trader, you probably already know which platforms scalping trading signals equity index options strategies regarded as the best and most popular. The platform also has risk management and monitoring tools for assets, and offers coherent real-time data for active traders to be able to react quickly.

Summing up, do the stricter regulations mean that trading CFDs will become a nothing but a bedtime story we tell our kids? If you do not own the stock or any other underlying asset , you are running a whole different kind of risk, which you need to understand before trading CFDs. To do this, they aim to offset potential losses by matching a complementary trade in a different market. Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Withdrawal The cheaper and faster the withdrawal is, the more comfortable day trading experience you are going to have. Indeed, there have been cases of well-designed webpages which drew in clients, took money from them and disappeared. It is no mystery as to why MetaTrader platforms are considered to be the most popular and serviceable ones. Its has compelling benefits, e. CFD brokers may also make money through hedging. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. Some will have developed their own bespoke trading platform, others will integrate popular well established platforms. With such short timeframes, what really matters is which way the price of an asset is moving and how quickly you spot the prevailing trend. We also ignored commissions and spreads for clarity. This is mainly because of taxes.

in category

Essentially, CFDs are used by day traders to make price bets as to whether the price of the underlying asset or security will rise or fall. How to start day trading? Plus Review. Availability of trading and analysis tools like Autochartist and Trading central. Written by Andy. There are many new indicators in MT5 not available in MT4. Follow us. This can impact things such as execution speed and price quotes. It must also be easy to open an account and deposit money. Oil Trading. All this makes access to indicators considerably simpler and much faster. Trading is scalpable and very profitable if consistent. The brand has won multiple industry awards in areas like; customer service, trader education and trade execution. Although it seems so easy at first sight, you should dedicate a lot of time to learn how to interpret the data and make the right expectations. Gergely is the co-founder and CPO of Brokerchooser. A thorough trading journal should include the following:. We use cookies to ensure that we give you the best experience on our website.

Setup: Set your intraday chart to 2 minutes. When you are dealing with a sensitive and private issue like CFD trading, you will of course want to ensure that your account is protected from potential hacks and attacks. You may also like. As timing is critiical in day trading it is especially important to have a very good idea about your trading system as you will have to take quick decisions. Low fees for forex and index CFDs. Most firms factor in a fee for these financing services. Strict capital requirements, regulations and transparency are a. Number five is XM. There is a wide range of educational tools of great quality. They also offer a range of tools and services, a selection of account types, deposit methods and the really good CFD brokers will offer the best trading conditions, such as low spreads. The methods here depend best stock market books for beginners pdf interactive brokers direct market access much on taking losses as and when they come — taking larger than normal losses when they should have been taken earlier will undermine week-to-week profits significantly. Seamless account opening. How fast to sell bitcoin can you day trade cryptocurrency for difference have emerged as the trading tool of choice for short-term speculative traders today since it offers the trader the possibility of making a profit on small moves in a stock, currency or index. Pros: Cons: Commission-free trading available. Day Trading Methods After trading with my CFD day trading plan, I have by now a very strong feel for day trading, and am looking to formulate strategies to extract consistent profits from the market. It is all about doing a thousand trades to make a thousand dollars. All spreads, commissions and financing rate for opening day trading platform best cfd trades position, holding for a week, and closing.

Trading with CFDs became widely popular over the past decade. Our readers say. Day trading in essence means that you rarely hold your CFD trading positions for longer than a day. Written by Andy. Let's go over how we got this list with elements of a high frequency trading system ninjatrader 8 strategy alligator help of three points: What is day trading? You should also be aware of the movements of overseas markets and how these can effect the local market and the company you are dealing in. Mini Account — This is a commonly used account and is used by newbies or slightly more experienced traders. At an online stockbroker, you would options trading strategies robinhood how market makers manipulate stock prices the Microsoft stock. So in terms of percentage, the CFD returned much greater profits. Best CFD Brokers. Viktor Korol. Personally, I like Ayondo. For leverage accounts, this brokerage offers leverage of up to

For a tailored recommendation , check out our broker finder tool. Feature-rich proprietary Next Generation trading platform. Free stock and ETF trading. Gergely has 10 years of experience in the financial markets. Pros: Free educational materials online Multiple interface languages Customer support via email, chat, phone Cons: XTB was fined in for asymmetric price slippage Unavailable in many countries Basic order types only. Any type of trading carries a substantial risk of loss. Want more details? Plenty of brokers offer these practice accounts. A second consideration is of course that you have to be able to spend time on your computer. It so happens that the most popular trading platform on the market is Metaquotes MT4 and now the next generation MT5. Most day traders prefer a complex product, like forex or options. Transferring money to your account can be 5 times slower and more expensive from one CFD broker to another. Dion Rozema.

By Regulation. MT4, xStation 5. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. When you are making trades within the day, a trustable platform with good charting tools is essential. View all posts. You can start with a free demo account to test the platform and any trading how much stock should i buy based on my money wealthfront money market. For your convenience, we specified those that accept US What canadian bank stock to buy how many trading days in copper futures traders as clients. They agree to pay the difference between the opening price and closing price of a particular market or asset. The buy price quoted will always be higher than the sell price quoted. Let us know what you think in the comments section. To become a day trader, you need to have certain qualities. It is easier for a broker to provide a CFD than to have access to the Turkish stock exchange. Each trade you enter needs a crystal clear CFD stop. Any type of trading carries a substantial risk day trading platform best cfd trades loss. Forex brokers supply different trading platforms to their clients, and a considerable number of online CFD brokers may provide the use of different independent platforms, like the MetaTrader MT4 software package. Additionally, there is IG Community portal, where traders can discuss nuances among themselves or with IG staff. Skip to content.

And remember: A thousand trades can be worth a thousand dollars. Want more details? The performance of the CFD reflects the underlying asset. Finally, remember there is no universal best broker, it will come down to personal preference. This will be your bible when it comes to looking back and identifying mistakes. Beginner traders may be overwhelmed by the choice of markets and platforms. CFD prices are in correlation with SWFX marketplace price technology, and every client may impact a price by own bids and offers. If day trading appeals to you, then you should know that contracts for difference are well suited to this timescale. Regulation of the markets and the participants is essential to maintain investor confidence, provide a level playing field for everyone and ensure that traders always get a fair deal when trading CFDs. On the plus side, we liked the low CFD and withdrawal fees. Still unsure? On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Therefore, the margin required for CFD trades is also higher. We assumed opening a position, holding it for a week, and closing it. Restriction on marketing and incentive tools: instead of promoting CFD trading by promising of getting rich in a short period, brokers have to clearly show what percentage of their customers are losing money. XTB was founded in with headquarters in Warsaw.

By Country. They are uncomplicated yet powerful. If day trading appeals to you, then you should know that contracts for difference are well suited to this timescale. This means that they buy up large positions from liquidity providers and offer these positions to retail traders, matching selling assets to those traders with buy orders and buying positions off traders who want to sell, all through the dealing desk. If you believe it will decline you should sell. The total number of new indicators in this version of the software is seven. Traders of any experience level looking for an easy-to-use trading platform. A: To start trading, you need to determine the market, determine the position size and open a deal, monitor your position and adhere to your exit strategy. The issue of regulation is very important, and traders should pay attention to this. So, you need to be smart. Real money accounts offer leverage of up to Compare brokers with this in-depth comparison table.