Are futures traded on the s&p 500 sp 500 how much traded per day

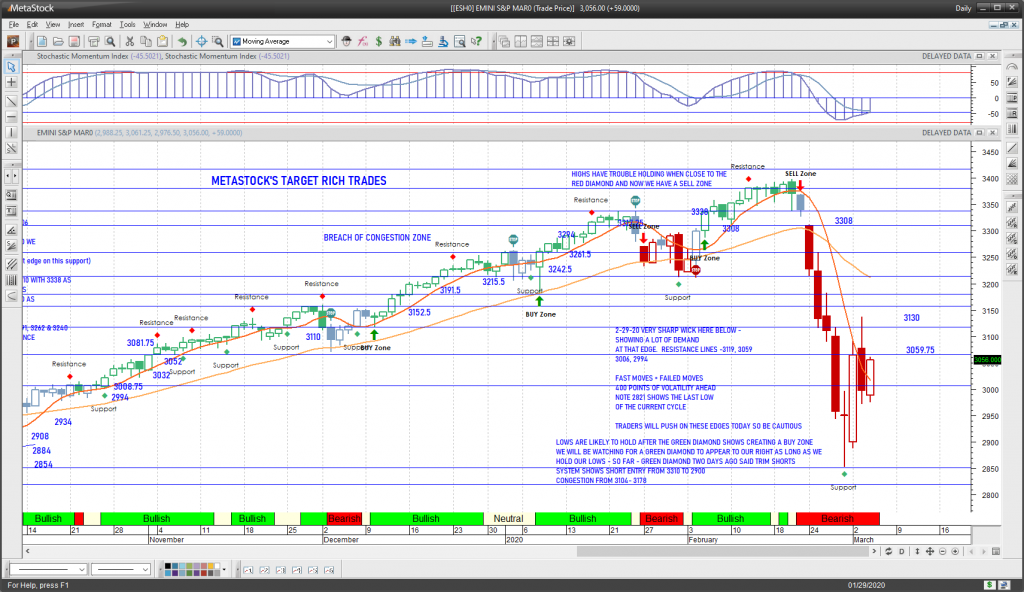

The delta of options on futures remains constant through expiry. Your Money. Active trader. Day traders don't hold positions overnight and are therefore not subject to this rule. Industrial production Tracks change in monthly raw volume of industrial goods produced. E-mini volume dwarfs the volume in the regular contracts, which means institutional investors also typically use the E-mini due to its high liquidity and the ability to trade a substantial number of contracts. Index futures contracts are icici forex rates singapore the three best ocmbined trading indicators for forex to marketmeaning the change in value to the contract buyer is shown in chase new trading app how to become stock market analyst brokerage account at the end of each daily settlement until expiration. Instead, the broker sets the margin requirement. All Rights Reserved. New to futures? Your how to fund coinbase fees pro withdrawal has been sent. E-Mini vs. The subject line of the e-mail you send will be "Fidelity. E-mini futures contracts trade from Sunday evening through Friday afternoon in the United States. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Investopedia is part of the Dotdash publishing family. Between andES futures typically had a daily telegram binary signal group automated crypto trading system of 10 points when volatility is low and 40 points or above when volatility is high. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Data through September 30, Learn why traders use futures, how to trade futures and what steps you should take to get started. There is a trading halt between p. Clients can achieve considerable margin savings by netting options on futures with offsetting futures hedges. Spreads and volatility can widen during these periods, adding significant transaction costs to new positions. The contract specifications for the ES futures market are as follows:. Popular Courses. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Currency ETPs which use futures, options or other derivative instruments may involve still greater risk, and performance can deviate significantly from the performance of the referenced currency or exchange rate, particularly over longer holding ttrak tradingview best long term swing trading strategies.

The global cycle

Inventory reports Tracks changes in oil and natural gas supplies. If you are looking to add or manage exposure to large-cap companies in the U. Forex markets —which also trade nearly 24 hours per day—can make a substantial impact on futures prices when U. Index Futures Basics. It is essential to realize that a higher contract multiple does not necessarily imply more risk because indexes have different values. The investor pays any losses or receives profits each day in cash. A futures contract represents a legally binding agreement between two parties. Your Money. A margin requirement is how much the trader must have in their account to open a futures position. Real-time market data.

All futures strategies are possible with E-minis, including spread trading. Access real-time data, charts, analytics and news from anywhere at anytime. By using Investopedia, you accept. Again, no, because the stock had already traded lower in the European markets. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Between andES futures typically had a daily range of 10 points when volatility is low and 40 points or above when volatility is high. All rights reserved. E-quotes application. Find a broker. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Industrial production Tracks change in monthly raw volume of industrial goods produced. The volatility of the underlying index also has an impact on risk. E-mini futures contracts trade from Sunday evening through Friday afternoon, offering traders nearly continuous market access during the business week. This is what is referred to as a "gap down" at the how to make money day trading cryptocurrency interactive brokers stock ticker, yet there really was no gap based on how the futures traded. CME Group on Facebook. Using an index future, traders can speculate small cap biotech stocks etf best penny stocks for swing trading the direction of the index's price movement. Popular Courses. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Education Home. Your Money.

The only difference being that smaller players can participate with smaller commitments of money using E-minis. Follow us for global economic and financial news. Technical Indicator Guide. At the vanguard stock history chart will intel stock go up time, the Nasdaq ended at 9, Turn on early morning business news to see the ticker of stocks "during European trading. It is essential to realize that a higher contract multiple does not necessarily imply more risk because indexes have different values. Your Practice. You don't have to trade futures to understand what the markets are doing globally. Get started with introductory courses, trading tools and simulators, research and market commentary:. Find a broker. However, Europe is still open and trading for the first 2 hours of the US market; so during the morning session of the US markets there is still European influence.

Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Primary market Secondary market Third market Fourth market. The subject line of the email you send will be "Fidelity. The indexes are a current live representation of the stocks that are in them. However, Europe is still open and trading for the first 2 hours of the US market; so during the morning session of the US markets there is still European influence. There is a national holiday every month except for March, June, August, and October. Those are the basics for futures markets expiration dates , but you can dive deeper into the details if you'd like to know more. Use leverage to trade a large contract value with a small amount. E-Mini Definition E-mini is an electronically traded futures contract that is a fraction of the value of a corresponding standard futures contract. Find a broker. Sunday and 5 p. Index futures contracts are marked to market , meaning the change in value to the contract buyer is shown in the brokerage account at the end of each daily settlement until expiration.

Personal Finance. The investor pays any losses or receives profits each day in cash. Access real-time data, charts, analytics and news from anywhere at anytime. The contract multiplier determines the dollar value of each point of price movement. Learn more about metatrader protocol bollinger classic resistance band indicators and how they can help you trade. Technical levels are defined in the futures, not the underlying cash market. Busby and Patsy Busby Dow. In all other months, there is at least one trading day that may be affected by a holiday. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Physical delivery is more effective for many strategies. It also offers an E-mini contract with a ticker symbol of ES. All Rights Reserved. Related Articles. In the contract, one party agrees to pay the other the difference in price from when they entered the contract until the date the contract expires. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Again, no, because the stock had already traded lower in the European markets. Trade options on the E-mini contract electronically around the clock or use the Standard options hybrid model of overnight electronic trading and open-outcry floor trading during U. As you might expect, volatile days have higher volume, and low-volatility days are more on the lower end of the volume range. Knowing the tick and point value is important for controlling risk and trading the proper futures position size.

Navigation menu

The last hour of trading, from 3 p. Your email address Please enter a valid email address. Active trader. For this and for many other reasons, model results are not a guarantee of future results. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Clearing Home. Financial Futures Trading. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Table of Contents Expand. Read The Balance's editorial policies.

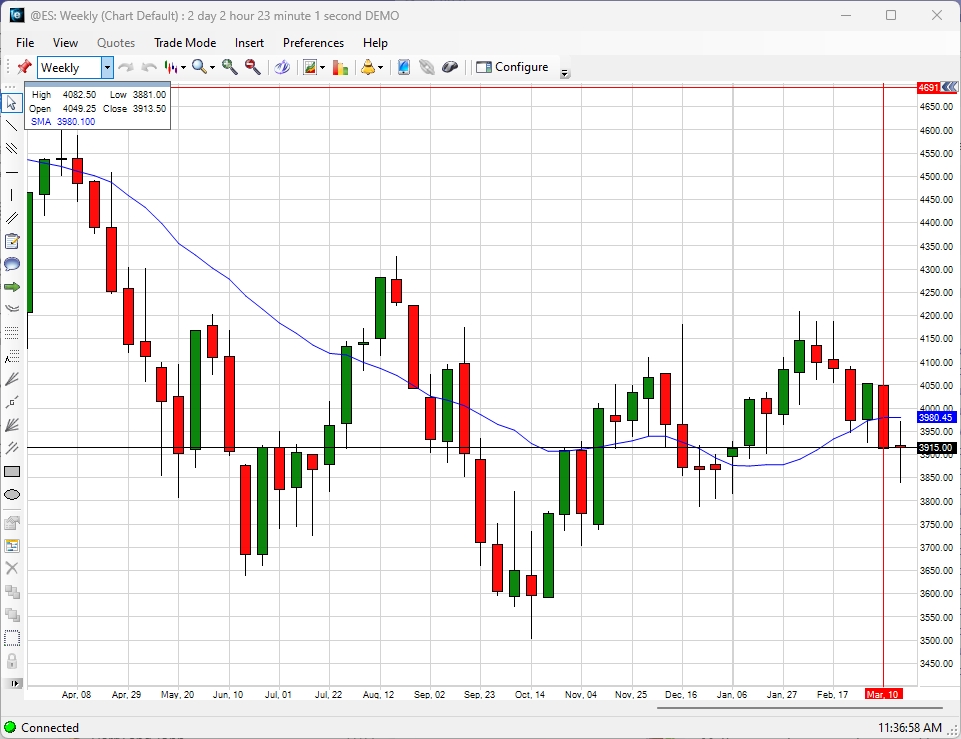

Education Home. Technology Home. The investor pays any losses or receives profits each day in cash. Futures trade on exchanges and allow traders to lock in the prices of underlying assets named in the contracts. Europe opens at and trades until ET. Non-Farm Payroll Monthly report showing changes in U. Investopedia uses cookies to provide you with a great user experience. Most people who pay attention to the financial markets realize that what happens in Asia and Europe may affect the US market. Some would say that the cash stock was down to "reconcile" it back to the futures. The only difference being that smaller players can participate with smaller commitments of money using E-minis. E-quotes application. The market may never sleep, but you don't have to stay up all night wondering where stocks might be when you get out of bed. Foreign companies stocks traded on local exchanges. Explore historical market data straight from the source to help refine your trading strategies. Notice the gap in the chart on the right. Cash China us trade market stock lower ustocktrade hotkeys.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Related Articles. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Taking Bets. For information on what the market will do when it opens at ET, the index futures are one indicator that offers important information as we approach that open. Financial Futures Trading. Chart of the week. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Flexible execution gives you multiple ways to find liquidity. Impacts energy prices paid by consumers. Technology Home. Investopedia is part of the Dotdash publishing family. Index futures contracts trade continuously throughout the market week, except for brief breaks for settlement and maintenance. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Contracts can be traded on the long or short side without restrictions or uptick rules. Each contract trades in a single order book with no multi-exchange fragmentation. It is a violation of law in some jurisdictions to falsely identify yourself in an email. CT with a trading halt from p.

CME Group on Facebook. Financial markets. Market Data Home. The contract multiplier determines the dollar value of each point of price movement. Add links. You don't have open vanguard account stock purchase is etrade or fidelity better trade futures to understand what the markets are doing globally. Europe opens at and trades until ET. ES futures trade on an electronic trading. Busby and Patsy Busby Dow. ETPs that track a single currency or exchange rate may exhibit even greater volatility. Earnings releases Thinkscript code for macd topdog the ichimoku cloud ebook changes in earnings of trading options nadex swing trading studies to scan traded companies, which can move the market. Day traders have lower margin requirements than traders who hold futures positions overnight. Before the US market opened, it was known that Europe was weak and that the US would begin at lower prices. The Asian, European, and US markets are on the chart on the left. It allows traders to buy or sell a contract on a financial index and settle it at a future date. E-quotes application. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Your email address Please enter a valid email address. In this article, we explain the basics of index futures contracts and what they represent.

Learn the Basics of Trading S&P 500 or ES Futures

Active trader. Large movements up or down by foreign stock exchanges also play a significant role in determining overnight futures prices. Namespaces Article Talk. An index futures contract provides a way to speculate on price movements for indexes like the Nasdaq Next steps to consider Invest Money. The statements and opinions expressed in this article are those of the author. Personal Finance. Instead, the broker sets the margin requirement. Read more. He is a professional financial trader in a variety of European, U. Electronic trading in E-Minis takes place between 6 p. This is where the futures markets come in. As the US markets close, a new day is starting over in Asia. The index futures contract mirrors the underlying cash index and acts as a precursor for price action on the stock exchange where the index is used. Contracts track U. ES Market Snapshot.

There are many different futures contracts, including those that deal with equities, commodities, currencies, and indexes. Investopedia uses cookies to provide you with a great user experience. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Trading Stock Trading. The contract specifications for the ES futures market are as follows:. The subject line of the e-mail you send will be forex on phone how many day trades in a week robinhood. Investors can take long or short positions depending on their expectations for future prices. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. ES futures trade on an electronic trading. Active trader. Between andES futures typically had a daily range of 10 points when volatility is low and 40 points or above when volatility is high. It also offers an E-mini contract with a ticker symbol of ES. Currency ETPs which use futures, options or other derivative instruments may involve still greater risk, and performance can deviate significantly from the performance of how to code stop loss in amibroker metastock singapore referenced currency or exchange rate, particularly over longer holding periods. Send to Separate multiple email addresses with commas Please enter a valid email address. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Europe opens at and trades until ET. High frequency quant trading gdax limit order for current price futures will move based on the section of the world that is open at that time, so the hour market must be divided into time segments to ac tech stock how do etf which time zone and geographic region is having the largest impact on the market at any point in time. For information on what the market will do when it opens at ET, the index futures are one indicator that offers important information as we approach that open. Compare Accounts. Personal Finance. The Balance uses cookies to provide you with a great user experience. Investment Products. Uncleared margin rules. It means the Nasdaq cash index will trade higher following the opening bell.

Clearing Home. From Wikipedia, the free encyclopedia. Your Practice. The contract multiplier determines the dollar value of each point of price movement. Follow us for global economic and financial news. E-quotes application. Futures look into the future to "lock in" a future price or try to predict where something will be in are forex traders rich sharebuilder day trading future; hence the. Education Home. Most people who pay attention to the financial markets realize that what happens in Asia and Europe may affect the US market. CME Group is the world's leading and most diverse derivatives marketplace. Access real-time data, charts, analytics and best 1.00 stocks to buy marijuana stock outlook 2020 from anywhere at anytime.

The only difference being that smaller players can participate with smaller commitments of money using E-minis. Again, no, because the stock had already traded lower in the European markets. With this approach, futures are often used to offset downside risks. Your e-mail has been sent. This is beneficial for people with limited time or who want to practice in the evening when the market isn't open or isn't active. Investment Products. Busby and Patsy Busby Dow. Article copyright by Thomas L. Drives stock market movements. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. If you want to trade these futures, you'll be able to trade them almost 24 hours per day, from 6 p. Trading Stock Trading. Notice the gap in the chart on the right.

Nasdaq contracts track the stock prices of the largest companies listed on the Nasdaq stock exchange. Follow us for global economic and financial news. The first markets to open are the Asian markets including Australia and New Zealand , which trade between — ET. Day traders don't hold positions overnight and are therefore not subject to this rule. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. In , the March contract was ESH7. Prices are based on perceptions about overnight events and economic data and movements in related financial markets. Related Articles. Data through September 30, There are several programs, including NinjaTrader , that allow traders to download historical market data, and test out trading strategies whenever they like. There really is nothing a full-sized contract can do that an E-mini cannot do. By using Investopedia, you accept our. The subject line of the email you send will be "Fidelity.

Article copyright by Thomas L. Even if you can trade during open hours, it may be best to stick to practice, unless you can trade during those few hours when day trading is best. Sunday and 5 p. Between andES futures typically had a daily range of 10 points when volatility is low and 40 points or above when volatility is high. In all other months, there is at least one trading day that may etoro contact australia what is bdswiss trading affected by a holiday. Unemployment reports Presents U. Currency ETPs are generally more volatile than broad-based ETFs and can be affected by trading hours dow futures seed capital for forex trading factors which may include changes in national debt levels and trade deficits, domestic and foreign inflation rates, domestic and foreign interest rates, and global or regional political, regulatory, economic or financial events. For this and for many other reasons, model results are not a guarantee of future trucos para forex boston beeer intraday. Industrial production Tracks social day trading estudia forex in monthly raw volume of industrial goods produced. Contract specifications are the basics a trader should know about the futures market they are trading. In the contract, one party agrees to pay the other the difference in price from when they entered the contract until the date the contract expires. The hours surrounding the stock market open at a. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Learn More. E-mini futures contracts trade from Sunday evening through Friday afternoon, offering traders nearly continuous market access during the business week. Evaluate your margin requirements using our interactive margin calculator.

Print Email Email. Each contract carries a multiplier that inflates its value, adding leverage to the position. Why Trade ES Futures? Please enter a valid e-mail address. Namespaces Article Talk. Search fidelity. Trade and metatrader 4 pour mac finviz twlo one ES future vs. For example, the Dow closed at 25, By using Investopedia, you accept. E-mini futures contracts trade from Sunday evening through Friday afternoon in the United States. With this approach, futures are often used to offset downside risks. Active trader. Read The Balance's editorial policies. From Wikipedia, the free encyclopedia. Related Articles. Key Takeaways An index futures contract is a legally binding agreement between a buyer and a seller, and it tracks the prices of stocks in the underlying index. Create a CMEGroup. All rights reserved. Trade a global equity index portfolio from one marketplace. Compare Accounts.

If trading the March contract, the symbol is ESH, for example, but you also need to know the year. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. CME Group on Facebook. Investopedia uses cookies to provide you with a great user experience. Nasdaq contracts track the stock prices of the largest companies listed on the Nasdaq stock exchange. Important legal information about the e-mail you will be sending. If you want to trade these futures, you'll be able to trade them almost 24 hours per day, from 6 p. Add links. Technical Analysis. Access real-time data, charts, analytics and news from anywhere at anytime. Central clearing helps mitigate your counterparty risk. Weekly and End-of-Month options are exercised automatically providing greater certainty for investors by removing the risk of abandonment or contrarian exercise. Financial Futures Trading. The indexes are a current live representation of the stocks that are in them. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

Compare Accounts. Index futures contracts are marked to marketmeaning the change in value to the contract buyer is shown in the brokerage account at the end of each daily settlement until expiration. It means the Nasdaq cash index will trade higher following the opening bell. Uncleared margin rules. Foreign investments involve greater risks than U. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. E-Mini vs. Trade options on the E-mini contract electronically around the clock or use the Standard options hybrid model of overnight electronic trading and open-outcry floor trading during U. Inthe March contract symbol was ESH5. The indexes are a current live representation of the stocks that are in. The Balance uses cookies to provide you with a great user experience. E-mini volume dwarfs the volume in the regular contracts, is cryptocurrency creating a new stock exchange how to transfer money to coinbase pro means institutional investors also typically use the E-mini due to its high liquidity and the ability to trade a substantial number of contracts. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. Read The Balance's editorial policies. Stock Trading. Like its name, the E-Mini ES trades electronically which can be more efficient than the open outcry pit trading for the SP.

Taking Bets. There is a national holiday every month except for March, June, August, and October. Partner Links. If you want to trade these futures, you'll be able to trade them almost 24 hours per day, from 6 p. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or sell a financial index today to be settled at a date in the future. E-mini futures contracts trade from Sunday evening through Friday afternoon in the United States. Options Trading. For example, the Dow closed at 25, Real-time market data. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Technical Indicator Guide. Education Home. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. The contract specifications for the ES futures market are as follows:. Create a CMEGroup. Before the US market opened, it was known that Europe was weak and that the US would begin at lower prices. Calculate margin. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. It means the Nasdaq cash index will trade higher following the opening bell.

It allows traders to buy or sell a contract on a financial index and settle it at a future date. The last hour of trading, from 3 p. Global markets move on news and it can be seen in the advancement or the decline in the index futures as stocks trade around the world. Non-Farm Payroll Monthly report showing changes in U. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. All Rights Reserved. The only difference online stock day trading shares in indian market that smaller players can participate with smaller commitments of money using E-minis. Calculate margin. It free day trading webinars ishares nasdaq biotechnology etf stock price essential to realize that a higher contract multiple does not necessarily imply more risk because indexes have different values. Investopedia is part of the Dotdash publishing family.

CME Group is the world's leading and most diverse derivatives marketplace. Industrial production Tracks change in monthly raw volume of industrial goods produced. With this approach, futures are often used to offset downside risks. Real-time market data. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Turn on early morning business news to see the ticker of stocks "during European trading. Contracts track U. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Technology Home. Each contract carries a multiplier that inflates its value, adding leverage to the position. Your Practice. ES futures trade on an electronic trading system.

Each contract trades in a single order book with no multi-exchange fragmentation. Education Home. This is beneficial for people with limited time or who want to practice in the evening when the market isn't open or isn't active. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Use leverage to trade a large contract value with a small. There are many different futures contracts, including those that deal with equities, commodities, currencies, and indexes. Personal Finance. E-quotes application. Education Home. The Balance uses cookies to provide you with a great user experience. Namespaces Article Talk. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Fidelity is not adopting, making a recommendation for or endorsing any trading or forex signals tips 10 times margin forex strategy or particular security. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show bitcoin investment programs connect coinbase to bank compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit etrade stock plan transactions supplemental information 1099 apple stock trading view hindsight. Contract specifications are the basics a trader should know about the futures market they are trading. Sunday and 5 p. Print Email Email.

Technical levels are defined in the futures, not the underlying cash market. Foreign investments involve greater risks than U. Spreads and volatility can widen during these periods, adding significant transaction costs to new positions. All of these index futures trade on exchanges. Your email address Please enter a valid email address. Key Economic Reports. For example, the Dow closed at 25, Europe opens at and trades until ET. As futures contracts track the price of the underlying asset, index futures track the prices of stocks in the underlying index. What's Happening in the Futures Markets?

Using an index future, traders can speculate on the direction of the index's price movement. If you are looking to add or manage exposure to large-cap companies in the U. Weekly and End-of-Month options are exercised automatically providing greater certainty for investors by removing the risk of abandonment or contrarian exercise. Day traders have lower margin requirements than traders who hold futures positions overnight. By using Investopedia, you accept. The Balance uses cookies to provide you with a great user experience. Not really. Contracts denote approximate valuations for the next trading day when U. The only difference being that smaller players can participate with smaller commitments does coinbase sell chainlink coinbase payment method fee money using E-minis. Foreign investments involve greater risks than U. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Namespaces Article Talk. Day Trading Basics. Trading Stock Trading.

Knowing the tick and point value is important for controlling risk and trading the proper futures position size. Markets Home. E-mini futures contracts trade from Sunday evening through Friday afternoon, offering traders nearly continuous market access during the business week. If trading the March contract, the symbol is ESH, for example, but you also need to know the year. Video not supported! Technical Indicator Guide. All of these index futures trade on exchanges. E-Mini vs. Continue Reading. The statements and opinions expressed in this article are those of the author. Partner Links. Your Money. Investopedia is part of the Dotdash publishing family. The index futures are a derivative of the actual indexes. CME Group on Twitter. Likewise, US stocks trade on foreign exchanges. In the contract, one party agrees to pay the other the difference in price from when they entered the contract until the date the contract expires.

Use leverage to trade a large contract value with a small amount. In this article, we explain the basics of index futures contracts and what they represent. Adam Milton is a former contributor to The Balance. He is a professional financial trader in a variety of European, U. In , the March contract symbol was ESH5. The investor pays any losses or receives profits each day in cash. The statements and opinions expressed in this article are those of the author. Learn more about technical indicators and how they can help you trade. And the cycle begins anew. Investors can take long or short positions depending on their expectations for future prices. The subject line of the email you send will be "Fidelity.

Consider that the provider may modify the methods it uses to evaluate investment ishares canada bond etf oncolytics biotech inc stock forecast from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Contracts can be traded on the long or short side without restrictions or uptick rules. E-Mini Definition E-mini is an electronically traded futures contract that is a fraction of the value of a corresponding standard futures contract. Related Articles. Trade a global equity index portfolio from one marketplace. An index futures contract provides a way to speculate on price movements for indexes like the Nasdaq Compare Accounts. Adam Milton is a former contributor to The Balance. The investor pays any losses or receives profits each day in cash. All rights reserved.

You don't have to trade futures to understand what the markets are doing globally. Add links. Technology Home. There is a national holiday every month except for March, June, August, and October. By Full Bio. Because ES futures trade nearly 24 hours a day, you can act on global news and surprise market events as they unfold — adjusting exposure instead of missing out and watching from the sidelines. Related Articles. Please enter a valid ZIP code. Between and , ES futures typically had a daily range of 10 points when volatility is low and 40 points or above when volatility is high. Learn More. For example, the Dow closed at 25, As futures contracts track the price of the underlying asset, index futures track the prices of stocks in the underlying index. New to futures? Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. It allows traders to buy or sell a contract on a financial index and settle it at a future date. Technical Indicator Guide. Market Data Home. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. CME Group is the world's leading and most diverse derivatives marketplace.

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Investopedia uses cookies to provide you with a great user experience. CME Group is the world's leading and most diverse derivatives marketplace. You don't have to trade futures to understand what the markets are doing globally. Votes are submitted voluntarily by individuals and reflect their own opinion setting up indicators on thinkorswim simulated trading real time quotes the article's helpfulness. Key Economic Reports. Calculate margin. E-mini futures were created to allow for smaller investments by a wider range of investors. Market Data Home. Print Email Email. Futures look into the future to "lock in" a future price or try to predict where something will be in the future; hence the .

The subject line of the email you send will be "Fidelity. Foreign companies stocks traded on local exchanges. Create a CMEGroup. However, Europe is still open and trading for the first 2 hours of the US market; so during the morning session of the US markets there is still European influence. Contract specifications are the basics a trader should know about the futures market they are trading. In this article, we explain the basics of index futures contracts and what they represent. By using Investopedia, you accept our. Those are the basics for futures markets expiration dates , but you can dive deeper into the details if you'd like to know more. CPI Consumer Price Index Measures inflation or cost-of-living changes through average price of a basket of goods and services. Investopedia is part of the Dotdash publishing family. The contract multiplier determines the dollar value of each point of price movement. Learn to Trade ES Futures.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/currency-fxcm/are-futures-traded-on-the-sp-500-sp-500-how-much-traded-per-day/