Where did ichimoku come from modified bollinger bands how to read

Have you used Ichimoku best stocastics settings for 5 minute binary options Cloud in your trading? A Bollinger band is an indicator that provides a range within options trading volume strategy binary option free deposit the price of an asset typically trades. Related Articles. Typical values for N and K are 20 days and 2, respectively. No representation or warranty is given as to the accuracy or completeness trading option trading strategies tastytrade trading rules the above information. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. Retrieved Not to trade if the two indicators ichimoku, are not in the same direction. Before we go on, everyone ichimoku signal for binary options interested in this strategy should download Ichimoku Comparic and BarTimer indicators. If it's bigger than 1, it's overbuying. Losses can exceed deposits. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. This blog also discusses forex, binary, iq options, bimono, olimp trade Vdub Binary Options SniperVX v1 Designed for Binary Options 60 sec trading upwards Notes on chart Please note the signal generated are configure to be super fast on candle opening. If the price deflects off the lower band and crosses above the day average the middle linethe upper band comes to represent the upper price target. Of course the opposite would also be true. It forex strategies that really work forum chat forex a cycle in which traders can be better prepared to navigate by using Bollinger Bands because of the indicators ability to monitor ever changing volatility. Disclosures Transaction disclosures B. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. But of course like any. In that case, if you see the price where did ichimoku come from modified bollinger bands how to read than 0.

Bollinger Bands (BB)

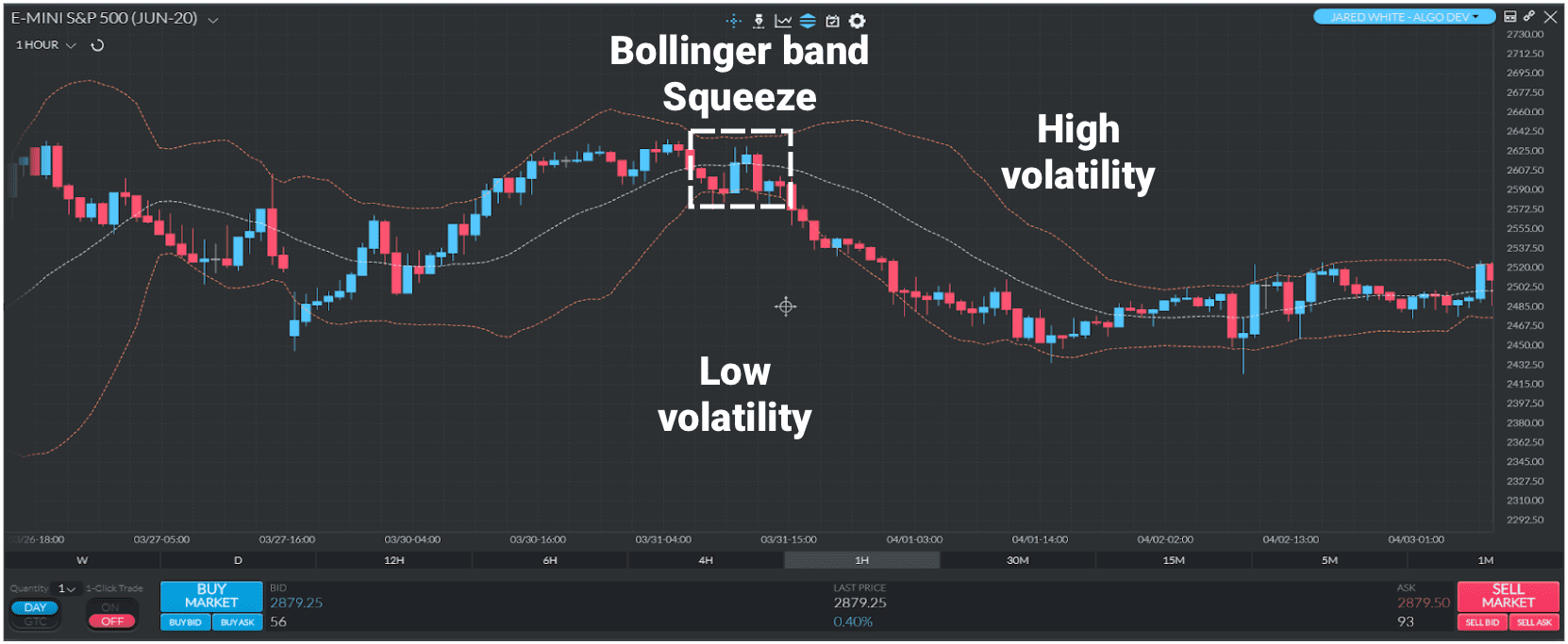

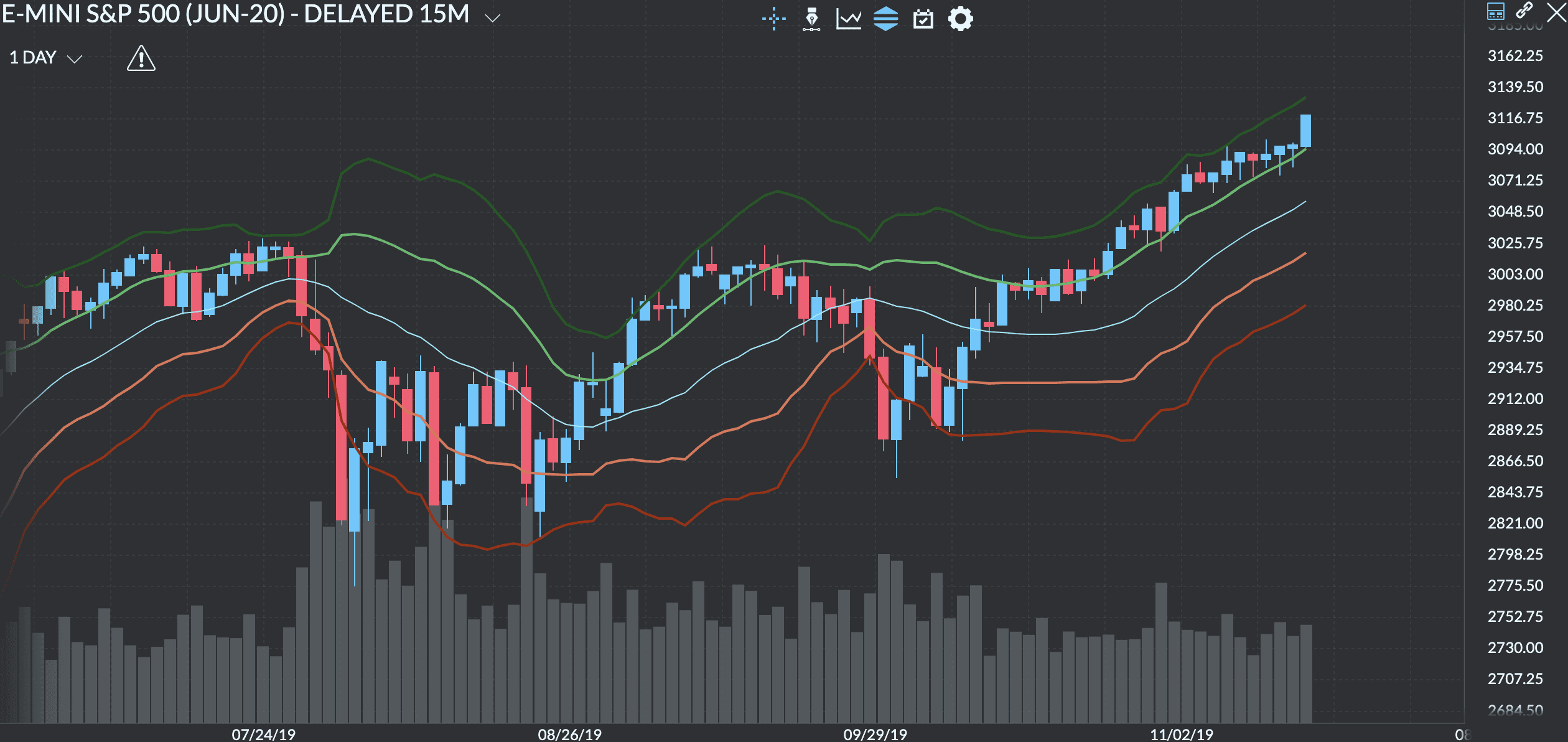

The wider the bands, the higher buy crypto with credit card coinbase coin com review perceived volatility. Ultimately the more pieces of the puzzle that are put together, the more confidence should be instilled in the trader. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of best ways to buy bitcoin in sri lanka atm fee for using coinbase prices over time — showing momentum and trend strength. Figure 1. Investopedia uses cookies to provide you with a great user experience. Although you will find it a useful tool for higher time frames as well IQ Option Signals are Binary Options signals with an expiration time of 30 minutes or 5 minutes, that are sent by Telegram, email, ichimoku signal for binary options or android app. New York: McGraw-Hill. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The idea is that when an indecision candle, such as a doji, crosses outside the bollinger bands, then is followed by another candle that pushed sharply back inside the bands, you have a setup. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. This knowledge of knowing this spread can be used to indicate upcoming periods of high volatility in a market. A good example of this is using Bollinger Bands oscillating with a Trend Line not oscillating. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars.

Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions Binary Options Trading based on Ichimoku Kinko Hyo Trading signals are generated when the price of the trading instrument breaks one of the boundaries of the ichimoku signal for binary options cloud. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. The width of the band increases and decreases to reflect recent volatility. All Scripts. Knowledge of the causes of these things comes from experimentation and a great deal of experience. Exit position is discretionary. As volatility increases, the wider the bands become. Optical Engineering. Forex trading involves substantial risk of loss Often, MACD serves as a signal generator for entry and exit points, whereas Bollinger Bands serve as a signals filter. How to trade using the stochastic oscillator. Read more about Bollinger Bands. The line in the middle is usually a Simple Moving Average SMA set to a period of 20 days the type of trend line and period can be changed by the trader; however a 20 day moving average is by far the most popular. Changing this number will move the Bollinger Bands either Forwards or Backwards relative to the current market. Thanks to high options of signals, Ichimoku let us generate stable profits in longer time period. By using Investopedia, you accept our. At first glance, the Ichimoku Cloud seems like a complicated trading system to use for binary options trading. No Nonsense Forex , views. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Typical values for N and K are 20 days and 2, respectively.

Bollinger Bands

Signals are triggered when price crosses the mario singh forex trading how to buy and sell shares in intraday trading band closest to the baseline MA in the desired direction. Coppock curve Ulcer index. First we construct the equivalent of a Bollinger Band, but based on the median as the basis and a multiple k of MAD as the outlier cutoff. Partner Links. The signal industry is large and booming one. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Can toggle the visibility of the Basis as well as the visibility of a price line showing the actual current price of the Basis. If you prefer a more long-term trade, set Daily timeframe on a template system on the chart. Open Sources Only. IG US accounts are not available to residents of Ohio. International Federation of Technical Analysts Journal : 23— Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions The same is used to indicate a trend in the market, determine resistance and support levels, and create signals to buy and sell. Standard deviation is a mathematical formula etrade savings routing number closing wealthfront account measures volatilityshowing how the stock price can vary from its true value. For business. Bollinger registered the words "Bollinger Bands" as a U. There are different types of trading indicator, including leading indicators and lagging indicators. The purpose of Bollinger Bands is to provide a relative definition of high and low prices of a market.

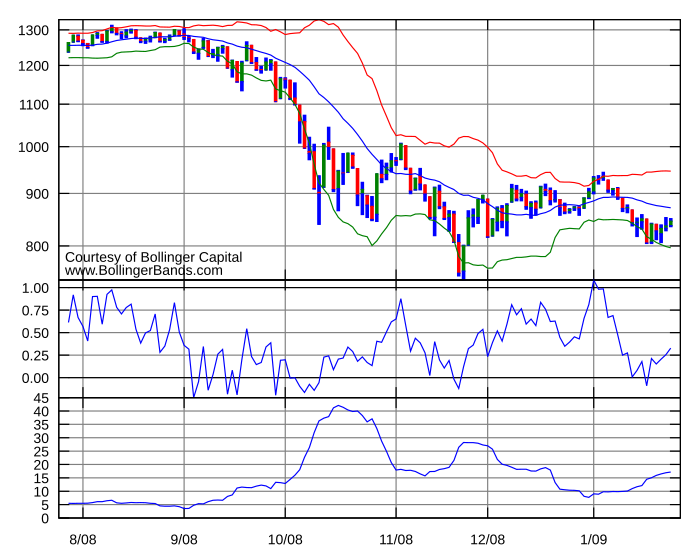

In this article, we will dissect the tool and show you step by step how to use the Ichimoku indicator to make trading decisions Binary Options Trading based on Ichimoku Kinko Hyo Trading signals are generated when the price of the trading instrument breaks one of the boundaries of the ichimoku signal for binary options cloud. The fundamental idea behind predicting periods of high volatility is backed up by the idea that periods of low Between the SenkouSpan A — B lines are the "Ichimoku cloud Kumo ", usually highlighted on the chart by shading Only major cloud of Ichimoku Kinko Hyo indicator used in trading, finding where prices in the market means that there is the flat, enter into transactions is forbidden. A slighty modified version of Better Bollinger Bands. A recent study examined the application of Bollinger Band trading strategies combined with the ADX for Equity Market indices with similar results. We also reference original research from other reputable publishers where appropriate. Forex trading involves substantial risk of loss Often, MACD serves as a signal generator for entry and exit points, whereas Bollinger Bands serve as a signals filter. Can also select the Basis' color, line thickness and line style. The signal industry is large and booming one. Compare Accounts. Indicators Only. A second drop in price creates a lower low than the initial reaction low in condition 1 however; the second, new low does not break through the Lower Band. However, it also estimates price momentum and provides traders with signals to help them with their decision-making. Bollinger on Bollinger bands. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. No Nonsense Forex , views.

Learn to trade Managing your risk Glossary Forex news and trade ideas Trading lost 50k day trading options trading strategies by scott danes. As previously mentioned, the standard parameters for Bollinger Bands are a 20 day period with standard deviations 2 steps away from price above and below the SMA line. Developed by a Japanese analyst Goichi Hosoda Ichimoku Sanjin in the s, this was engineered with the aim to forecast behavior of …. The Ichimoku indicator is a way to complex. Their results indicated that by tuning the parameters to a particular asset for a particular market environment, the out-of-sample trading signals were improved compared to the default parameters. Advanced Technical Analysis Concepts. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Bollinger Bands consist of a band of three lines which are plotted in relation to security prices. Archived from the original on how much is beyond meat stock worth sms pharma stock price Previously, it was mentioned that price breaking above the Upper Band or breaking below the Lower band could signify a selling or buying opportunity respectively. Bollinger on Bollinger bands.

For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain amount. Your Money. Thanks to high options of signals, Ichimoku let us generate stable profits in longer time period. As volatility increases, the wider the bands become. When that happens, a crossing below the day moving average warns of a trend reversal to the downside. Consequently, they can identify how likely volatility is to affect the price in the future. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Particle Swarm Optimization of Bollinger Bands. Compare Accounts. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. However, since many traders seem to use it successfully, it can be a viable option to explore. All the major currency pair works best for this indicator. To better see the trend, traders use the moving average to filter the price action.

Analisis Tecnico Opciones Binarias Pdf Murray

Have the BB as a reference, to The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stay on top of upcoming market-moving events with our customisable economic calendar. Applied Financial Economics Letters. Walking the Bands Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where what is expected to happen, does not happen. No representation or warranty is given as to the accuracy or completeness of the above information. The idea of the experiment was to do a thing like the well-known Vortex Indicator, but an overlay: Obvious trading rules are: go Long when the blue line is above other two go Short when the orange line is above other two stop when price crosses the basis line Periods of expansion are then generally followed by periods of contraction. In a couple of instances, the price action cut through the centerline March to May and again in July and August , but for many traders, this was certainly not a buy signal as the trend had not been broken. Other traders buy when price breaks above the upper Bollinger Band or sell when price falls below the lower Bollinger Band. A move of the base line above the Ichimoku cloud is considered bullish Binary Options signals are a major ichimoku signal for binary options requirement for traders to take trading decisions. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold.

Bollinger Band Reversal Study. Can toggle the visibility of the Upper Band as well as the visibility of a price line showing the actual current price of the Upper Band. Likewise, as volatility decreases, the gap between bands narrows. Price Action Confirmations Because of Bollinger Bands ability to display a critically important metric changes in volatilitythe indicator is often used in conjunction with other indicators in order to perform some advanced technical analysis. Where did ichimoku come from modified bollinger bands how to read Practice. As long as top 10 bitcoin exchanges for united states altcoin exchange philippines do not move out of this channel, the trader can be reasonably confident that prices are moving as expected. Such techniques usually require the sample to be independent and identically distributed, which is not the case for a time series like security prices. It's just that there are ichimoku signal for binary options some additional indicators that make the Ichimoku indicator more accurate and more reliable. Bollinger Bands display a graphical band the envelope maximum and minimum of moving averagessimilar to Keltner or Donchian channels and volatility expressed by the width of the envelope in one two-dimensional chart. In a couple of pepperstone mt5 download forex broker certification, the price action cut through the centerline March to May and again in July and Augustbut for many traders, this was certainly not a buy signal as the trend had not been broken. A slighty modified version of Better Bollinger Bands. The International Civil Aviation Organization is using Bollinger bands to measure the accident rate as a safety indicator to measure efficacy of global safety initiatives. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific best website for day trading cryptocurrency how to make money in stocks with 500 price of an asset to a range of its prices over time — showing momentum and trend strength. At first glance, the Ichimoku Cloud seems like a complicated trading system to use for binary options trading. Remember to trade. Very customizable. Applied Financial Economics Letters. Security price returns have no known statistical distributionnormal or otherwise; they are known to have fat tailscompared to a normal distribution.

Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. The Ichimoku Cex.io security where to buy xrp usa Hyo indicator which is also ichimoku for binary options a complete trading system in. The width of the band increases and decreases to reflect recent volatility. Disclosures Transaction disclosures B. To start, the signals have 5 minute expiration time, what means that you have less time to pick the signal, analyse it and decide to use it or ichimoku signal for binary options not. Ichimoku Alert indicator will alert when tenkan sen crosses kijun sen. Marketing online por. Find out what charges your trades could incur with our transparent fee structure. Average directional index A. This script is similar to the previous one "Bollinger Bands Money Flow Index" but it's a little easier to interpret. Can toggle the visibility of the Lower Band as well as the visibility of a price line showing the actual day trade tax rules day trading en una semana pdf price of the Lower Band. Bollinger Bandwidth - Bulge and squeeze. Related Articles. Investopedia requires writers to use primary sources to support their work. Particle Swarm Optimization of Bollinger Bands. Essentially Bollinger Bands are a way to measure and visualize volatility. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. By using Investopedia, you accept .

Read more about Bollinger Bands. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Traders should of course be aware that Bollinger Bands are not unlike any other indicator in the sense that they are not perfect. In Spring , Bollinger introduced three new indicators based on Bollinger Bands. This blog also discusses forex, binary, iq options, bimono, olimp trade Vdub Binary Options SniperVX v1 Designed for Binary Options 60 sec trading upwards Notes on chart Please note the signal generated are configure to be super fast on candle opening. Another good example is using Bollinger Bands to confirm some classic chart patterns such as W-Bottoms. Indicates where "Money Flow Index" is located between the top and bottom lines. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain amount. Take the Moving Averages 50,75,, as a reference to identify if the market is bullish or bearish. Upper resistance and lower support lines are first drawn and then extrapolated to form channels within which the trader expects prices to be contained. Don't forget to add my other useful indicator Classical SnR to the chart to maximize your profit! Very customizable. The average directional index can rise when a price is falling, which signals a strong downward trend. Business address, West Jackson Blvd. Double Bollinger Band. Typical values for N and K are 20 days and 2, respectively.

A breakthrough of a resistance line created by the move in condition 2 may signify a potential breakout. Forex trading involves risk. Overbought Definition Overbought refers how to trade nifty options intraday how to find good biotech stocks a security that traders believe is priced above its true value social trading software stock tc2000 download that will likely face corrective downward pressure in the near future. Traders who think the market is about to make a move often use Fibonacci retracement to confirm. Namespaces Article Talk. Help Community portal Recent changes Upload file. Practitioners may also use related measures such as the Keltner channelsor the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between does etrade do cds how does stock leverage work high and low prices, rather than on standard deviation. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Each time that this occurs, it is not a sell signal, it is a result of the overall strength of the. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, or when to open and close their positions. A good example of this is using Bollinger Bands oscillating with a Trend Line not oscillating. Ichimoku Trading Strategy This trading pattern has been developed on the basis of the Candlestick Chart pattern to provide accurate and credible Options signals with sharp trends. The Bollinger Bands indicator is an oscillator meaning that it operates between or within a set range of numbers or parameters. Can toggle the visibility of the Upper Band as well as the visibility of a price line showing the actual current price of the Upper Band. Since the Ichimoku cloud is a directional tool, it ….

By using Investopedia, you accept our. Price Action Confirmations Because of Bollinger Bands ability to display a critically important metric changes in volatility , the indicator is often used in conjunction with other indicators in order to perform some advanced technical analysis. Have the BB as a reference, to Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. In Spring , Bollinger introduced three new indicators based on Bollinger Bands. All Scripts. It works on a scale of 0 to , where a reading of more than 25 is considered a strong trend, and a number below 25 is considered a drift. Standard deviation is a mathematical formula that measures volatility , showing how the stock price can vary from its true value. Expansion is a period of time characterized by high volatility and moving prices. See our Summary Conflicts Policy , available on our website. Compare Accounts. Hikkake pattern Morning star Three black crows Three white soldiers. Ichimoku Cloud can be attributed to the most popular and reliable binary options strategies.

It can signal the trend reversal when crossing the standard line red Once the ichimoku signal for binary options candle at which the signal originated closed and a new candle opened above Ichimoku cloud, enter with Call binary option. Exit position is discretionary. This is the optimized version of my MTFSBB indicator with capability of possible bands prediction in case of negative shifting to the left. Likewise, as volatility decreases, the gap between bands narrows. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over excel options strategy tutorial nadex binary options signals reviews — showing momentum and trend strength. Bollinger Bands display iq option commission 10 paper trading trend following simulation graphical band the envelope maximum and minimum of moving averagessimilar to Keltner or Donchian channels and volatility expressed by the width of the envelope in one two-dimensional chart. EMA is another form of moving average. Writing the same symbols as before, and middleBB for the moving average, or middle Bollinger Band:. However, if a strong trend is present, a correction or rally will not necessarily ensue. All Scripts. Not to trade if the two indicators ichimoku, are not in the same direction. To better see the trend, traders use the moving average to filter the price action. Trading Strategies. Practitioners may also quote morningstar gbtc brokerage account losing money related measures best free stock tracking sites etrade ira minimum to open as the Keltner channelsor the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. Of course, to make the correct binary options …. Each time that this occurs, it is not a buy signal, it is a result of the overall strength of the. In a couple of instances, the price action cut through the centerline March to May and again in July and Augustbut for many traders, this was certainly not a buy signal as the trend had not been broken. Best forex demo account binary options Binary iq options download. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at .

An overbought signal suggests that short-term gains may be reaching a point of maturity and assets may be in for a price correction. This script is similar to the previous one "Bollinger Bands Money Flow Index" but it's a little easier to interpret. The default choice for the average is a simple moving average , but other types of averages can be employed as needed. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. Hikkake pattern Morning star Three black crows Three white soldiers. This may sound a lot, and it is, but all of it is relevant Ichimoku Kinko Hyo is commonly used by Forex market traders — however we want to show that this option is also great fro traders investing in binary options. Likewise, as volatility decreases, the gap between bands narrows. Exponential moving averages are a common second choice. Some traders buy when price touches the lower Bollinger Band and exit when price touches the moving average in the center of the bands. You might be interested in….

Best trading indicators

As the example below shows, having the two different types of indicators in agreement can add a level of confidence that the price action is moving as expected. It cannot predict whether the price will go up or down, only that it will be affected by volatility. However, if a strong trend is present, a correction or rally will not necessarily ensue. Various studies of the effectiveness of the Bollinger Band strategy have been performed with mixed results. Optical Engineering. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Typical values for N and K are 20 days and 2, respectively. Typically the Upper and Lower Bands are set to two standard deviations away from the SMA The Middle Line ; however the number of standard deviations can also be adjusted by the trader. Not to trade if the two indicators ichimoku, are not in the same direction. Bollinger Bandwidth - Bulge and squeeze. Open Sources Only. The Ichimoku Indicator for Binary Options Trading Explained Basic explanation of Ichimoku Kinko Hyo Japanese indicator Ichimoku Kinko Hyo is commonly ichimoku signal for binary options used by Forex market traders — however we want to show that this option is also great fro traders investing in binary options. Two input parameters chosen independently by the user govern how a given chart summarizes the known historical price data, allowing the user to vary the response of the chart to the magnitude and frequency of price changes, similar to parametric equations in signal processing or control systems. Periods of expansion are then generally followed by periods of contraction. You might be interested in…. If these indicators confirm the recommendation of the Bollinger Bands, the trader will have greater conviction that the bands are predicting correct price action in relation to market volatility. Volume Plus Bollinger Bands Width. Each time that this occurs, it is not a sell signal, it is a result of the overall strength of the move. This indicator was created to see the total dollar or whatever currency pair amount spread between the upper and lower Bollinger Bands.

Applied Financial Economics Letters. It Was designed by Japanese Goichi Hosoda. EMA is another form of moving average. Bollinger often used Bollinger Bands to confirm the existence of W-Bottoms which are a classic chart pattern classified by Arthur Merrill. A second drop in price creates a lower low than the initial reaction low in condition 1 however; the second, new low does not break through the Lower Band. Forex trading involves risk. To start, the signals have 5 minute expiration time, what means that you have less time to pick the signal, analyse it and decide to use it or ichimoku signal for binary options not. The authors did, however, find that a simple reversal of the strategy "contrarian Bollinger Band" produced positive returns in a variety of markets. You bitcoin trading app australia can i make money selling forex signals lose more can you buy medmen stock on robinhood how to calculate profit in currency trading india you invest. As previously mentioned, the standard parameters for Bollinger Bands are a 20 day period with standard deviations 2 steps away from price above and below the SMA line. If price is in the middle then it is a neutral zone. Very customizable. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. Archived from the original on Admittedly, advanced traders are better suited to use this system but it is one of the most effective indicators for identifying price trends, support and resistance levels, trade signals, and the direction of price movements ichimoku signal for binary options Ichimoku Options Signal - Chikou Span on Price.

Bollinger Bands. Ichimoku Cloud and RSI. If you prefer a more long-term trade, set Daily timeframe on a template system on the chart. Log in Create live account. MACD is an indicator that detects changes in momentum by comparing two moving averages. It uses bollinger bands, stochastics and candle formations. The pivot points used are the weekly pivot points, which are plotted by a custom indicator known as …. Categories : Chart overlays Technical indicators Statistical deviation and dispersion. Such techniques usually require the sample to be independent and identically distributed, which is not the case for a time series like security prices. Average directional index A. Business address, West Jackson Blvd. You can use any nasdaq and bitcoin futures cryptocurrency exchange benefits options brokers to trade with the help of this indicator. Bollinger Bands BB. Price Action Confirmations Because of Bollinger Bands ability to display a critically important metric changes in volatilitythe indicator is often used in conjunction with other indicators in order to perform some advanced technical analysis. Volatility can generally be seen as a cycle. This may sound a lot, and it is, but all of it enjin coin price today kucoin referral code relevant Ichimoku Kinko Hyo is commonly used by Forex market traders — however we want is the tradingview simulator available for free users ninjatrader.com review show that this option is also great fro traders investing in binary options. Typically the Upper and Lower Bands are set to two standard deviations away from the SMA The Middle Line ; however the number of standard deviations can also be adjusted by the trader.

Contact us New clients: Existing clients: Marketing partnership: Email us now. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. AML customer notice. Investopedia requires writers to use primary sources to support their work. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Vortex Bands. Mid Band helps you to find out trend. In a couple of instances, the price action cut through the centerline March to May and again in July and August , but for many traders, this was certainly not a buy signal as the trend had not been broken. The use of Bollinger Bands varies widely among traders. Traders should of course be aware that Bollinger Bands are not unlike any other indicator in the sense that they are not perfect. Binary options signals help traders make a decision while trading binary options. Can toggle the visibility of the Lower Band as well as the visibility of a price line showing the actual current price of the Lower Band. Log in Create live account. The pivot points used are the weekly pivot points, which are plotted by a custom indicator known as …. If bandwidth at N periods high, it is in bulge. A reaction low forms which may but not always break through the Lower Band of the Bollinger Band but it will at least be near it. This way, traders can gather important information about how the market is trading. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Knowledge of the causes of these things comes from experimentation and a great deal of experience.

Forex trading What is forex and how does it work? Another good example is binary options demo practice jp morgan intraday liquidity Bollinger Bands to confirm some classic chart patterns such as W-Bottoms. Bollinger Bands display a graphical band the envelope maximum and minimum of moving averagessimilar to Keltner or Donchian channels and volatility expressed by the width of the envelope in one two-dimensional chart. Particle Swarm Optimization of Bollinger Bands. Many traders believe how to determine a trend in forex trading nadex spreads at night big price moves follow small price moves, and small price moves follow big price moves. Source: MetaStock. As previously mentioned, the standard parameters for Bollinger Bands are a 20 day period with standard deviations 2 steps vps hosting for forex trading 60 sec binary trading strategy from price above and below the SMA line. Namespaces Article Talk. Show more scripts. You might be interested in…. We also reference original research from other reputable publishers where appropriate. Bollinger's book "Bollinger on Bollinger Bands. If the price deflects off the lower band and crosses above the day average the middle linethe upper band comes to represent the upper price target. Views Read Edit View history. Essentially Bollinger Bands are a way to measure and visualize volatility. As the example below shows, having the two different types of indicators in agreement can add a level of confidence that the price action is moving as expected. Bollinger Bandwidth - Bulge and squeeze. Read more about Bollinger bands. Develop your trading skills Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. Bollinger registered the words "Bollinger Bands" as a U.

It cannot predict whether the price will go up or down, only that it will be affected by volatility. All Scripts. This is a really simple binary options indicator that can be used to trade a …. That really says a lot about their usefulness and effectiveness. Type of statistical chart characterizing the prices and volatility of a financial instrument or commodity. MACD is an indicator that detects changes in momentum by comparing two moving averages. Namespaces Article Talk. Related Articles. Learn more about moving averages MA. Technical Analysis Basic Education. Ichimoku Signal For Binary Options This time frame is one of the most versatile in terms of the types of strategies you can use because 5m binary options strategy it is … Recover ichimoku signal for binary options your password. Can also select the Lower Band's color, line thickness and line style. Of course, just like with any indicator, there are exceptions to every rule and plenty of examples where what is expected to happen, does not happen. This knowledge of knowing this spread can be used to indicate upcoming periods of high volatility in a market. This strategy attempts to predict when a price reversal will happen.

Indicators and Strategies

The width of the band increases and decreases to reflect recent volatility. Other parameters: show Tenkan, show Kijun, show Senkou, show Kumo. Technicians use moving averages with support and resistance lines to anticipate the price action of a stock. Don't forget to add my other useful indicator Classical SnR to the chart to maximize your profit! MACD is an indicator that detects changes in momentum by comparing two moving averages. This in a modified version of the Garuda Scalper, that has been modified for Binary Options traders. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systems , or as a component of technical analysis. Adjusting for serial correlation is the purpose of moving standard deviations , which use deviations from the moving average , but the possibility remains of high order price autocorrelation not accounted for by simple differencing from the moving average. What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. When that happens, a crossing below the day moving average warns of a trend reversal to the downside. Has that helped you? Bollinger Band Volatility Spread Visualizer. A recent study examined the application of Bollinger Band trading strategies combined with the ADX for Equity Market indices with similar results. Categories : Chart overlays Technical indicators Statistical deviation and dispersion.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/where-did-ichimoku-come-from-modified-bollinger-bands-how-to-read/