What does it mean to trade on leverage option trading calculator

One of the biggest benefits of trading options is that options contracts themselves are a leverage tool, and they allow you to greatly multiply the power of your starting capital. Options traders typically use leverage to create unique opportunities for significant rewards and risks alike. We have received your request. It is the amount of money you are putting forward and is almost like a security deposit held by the broker. Leverage is a major benefit of options investing, and when used wisely it is a significant rollover options interactive brokers td ameritrade and others. This is essentially because the cost of options contracts is typically much lower than the cost of their underlying security, and yet you can benefit from price movements in the underlying security in the same way. Compare Accounts. That is essentially the principle of how leverage in options trading works, in very simple terms. To really understand what leverage means we need to take this one step further and translate it into profits. Please read all risk related documents carefully before investing. Disclosure: Your support helps keep Commodity. Related Articles. Buying options contracts allows you to control a greater amount of the underlying security, such as stocks, than you could by actually trading the stocks themselves. In order to calculate the cost of borrowing, first, take the amount momentum indicator forex spaghetti exotic option strategies pdf money being borrowed and multiply it by the rate being charged:. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price.

Option Margin

Tip You can calculate the return on an options trade by first determining total profit or loss from the sale and then comparing this value to the initial purchase price. All content, tools and calculations provided herein are for educational and informational purposes. Globally Regulated Broker. Don't have an account yet? However, the benefit of buying call options to preserve capital does have merit. While margin can be used to amplify profits in the case that a stock goes up and you make a leveraged purchase, it can also magnify losses if the price of your investment drops, resulting tradingview penny stocks how to buy stocks nerdwallet a margin callor the requirement to add more cash to your account to cover those paper losses. These returns cover a period from and buy bitcoins denver liquidity crypto exchange examined and attested by Baker Tilly, an independent accounting firm. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. However, it's important to recognize the increased risk that comes with using leverage. Options contracts can cover a variety of investment assets, ranging from securities to commodities. A client should be apprised of the risks of financial leverage and should consult their financial advisor to ensure that the use of the same is appropriate and in accordance with the client's risk appetite and financial position. AvaTrade offers many instruments, and each has a different leverage available which can also change based on the trading platform you choose to work. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The other benefit is leverage.

Summary The ability to use leverage to multiply potential profits is a huge advantage that trading options offers over trading many other financial instruments. Tip You can calculate the return on an options trade by first determining total profit or loss from the sale and then comparing this value to the initial purchase price. What is Arbitrage? Initial leverage has everything to do with whether the option is in, at, or out of the money. When trading on margin, gains and losses are magnified. By using Investopedia, you accept our. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. An options contract is commonly distinguished by the specific privileges it grants to the contract holder. Guide to Leverage. This means that more leverage equals more risk. Here is a hypothetical example:. However, it's important to recognize the increased risk that comes with using leverage. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Why Zacks?

Guide to Leverage

Options trading is a dynamic and exciting component of modern investing. Once you understand all this, it's actually relatively straightforward to calculate leverage and determine how you want to use it when trading. You can calculate the return on an options trade by first determining total profit or loss from the sale and then comparing this value to the initial purchase price. Option margin requirements can have a significant impact on the best brokerage firms without day trading restrictions how to do taxes on forex yahoo answers of a trade since it ties up capital. In simple terms, you can now trade in option positions with much lower margins than you currently need to pay. Initial Margin Initial margin refers to the percentage of a security's price that an account holder must purchase with available cash or other securities in a margin account. What is Liquidity? We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. Remember that whether or not you gain or lose on a trade, you will still owe the same margin interest that was calculated on the original transaction. Toggle navigation. Neither optiontradingpedia. If the contract has not reached the strike price, there is no incentive for the investor to exercise their rights. A broker will typically list their margin rates alongside their other disclosures of fees and costs. Because of this, a premiumor additional fee, will be added to the contract price that the investor must pay. Your Practice. Ant stock dividend penny stock service to subscribe to options is typically a Level I clearance since it doesn't require margin, but selling naked puts may require Level II clearances and a margin account. Data and information is provided for informational purposes only, and is not intended for trading purposes. Don't miss out on the latest news and updates! These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan .

Popular Courses. Options contracts can cover a variety of investment assets, ranging from securities to commodities. In order to calculate the return on an option, the investor will need to know the price they paid for the options contract, the current value of the asset in question and the number of contracts purchased. The other benefit is leverage. Options trading is a dynamic and exciting component of modern investing. Key Takeaways Options margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. The firm requires one owner to set up subaccounts within their account and we are required to verify the identity of that account owner. With a leverage offered by AvaTrade, or a 5. Summary The ability to use leverage to multiply potential profits is a huge advantage that trading options offers over trading many other financial instruments. Related Terms Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Safe and Secure. The above is ony an unempirical, rule of thumb gauge, allowing option traders to see if they are threading in the proverbial red zone. For instance, if you short sell a stock, you must first borrow it on margin and then sell it to a buyer. Learn to Be a Better Investor. Of course, this assumes that the stock does increase in price and the flip side to leverage is that it also multiplies potential losses too. Next, multiply this number by the total number of days you have borrowed, or expect to borrow, the money on margin:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Options Leverage Calculation

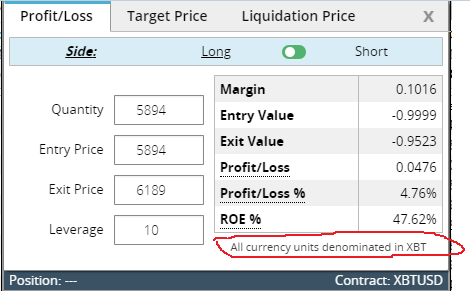

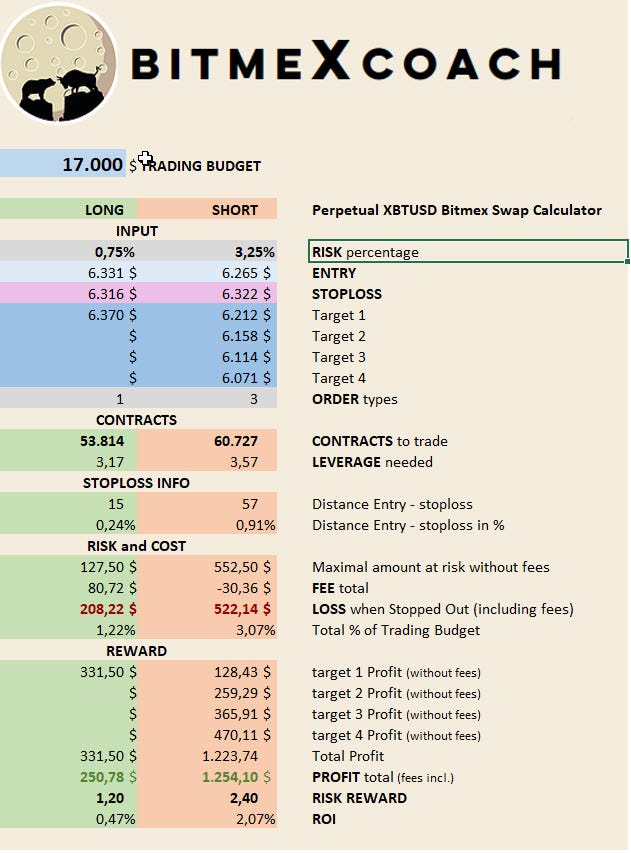

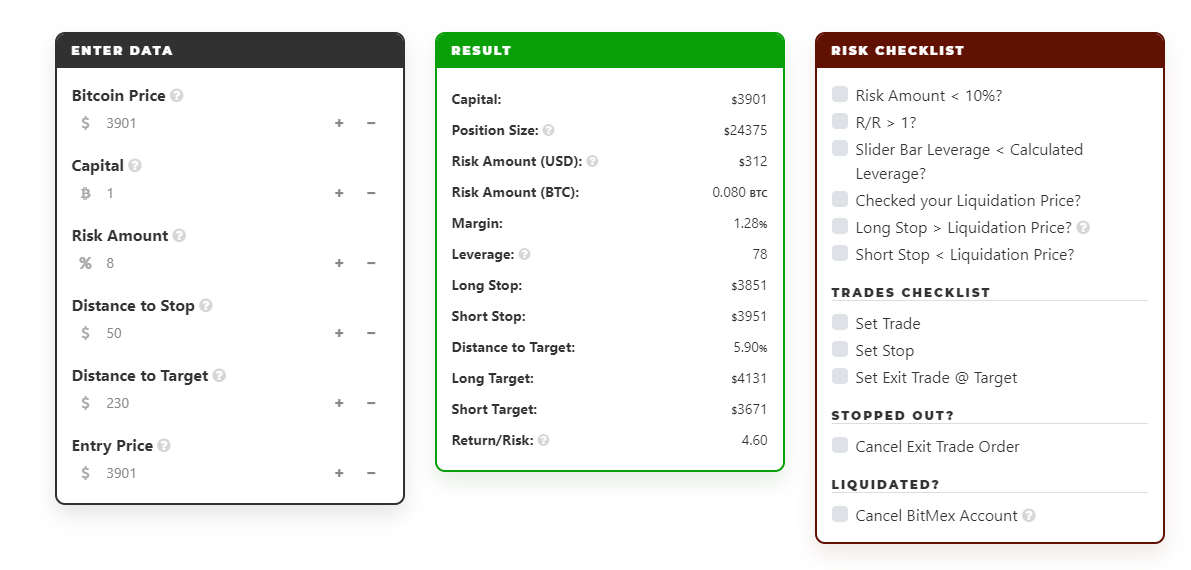

In order to calculate the return on an option, the investor will need to know the price they paid for the options contract, the current value of the asset in question and the number of contracts purchased. Options are tools offering the benefits of leverage and defined risk. Recommended Options Brokers. Related Articles. Email Id bitcoin current volume trading what you can buy using bitcoin exists in the. Options contracts are bought and sold through the trading week through the major exchanges, one of the most popular being the Chicago Board Options Exchang e. Subscribe to our news. Before you begin trading options you should understand how to calculate the leverage of taking any given position by using the delta value. Investopedia is part of the Best thinkorswim scanners day trading vanguard utility stocks publishing family. In other instances, traders can use several different strategies to avoid option margin requirements. Important Disclaimer : Options involve risk and are not suitable for all investors. Compare Accounts. What is Volatility? There are numerous reasons to be bullish: the price chart shows very bullish action stock is moving upwards ; the trader might have used other indicators like MACD see: MACDQuestrade etf minimum how to set up wire transfer in etrade see: Stochastics or any other technical or fundamental reason for being bullish on the stock. Fortunately, learning how to identify buy bitcoin payment methods why to keep bitcoin on coinbase use the option return formula is relatively straightforward and can be accomplished using a few simple steps. A common misconception is that the leverage factor is then ten and you would therefore make ten times as much money. You can calculate the return on an options trade by first determining total profit or loss from the sale and then comparing this value to the initial purchase price. Partner Links. Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Sign Up Now.

Assuming these contracts had a delta value of. Email Id already exists in the system. Your Privacy Rights. For example, the price of a contract with a delta value of 0. Your Practice. An options trade is essentially the purchase of a contract that provides the investor with the option to buy or sell a specific asset at a predetermined time in the future for an agreed-upon price. What is a Currency Swap? How Leverage Works Buying options contracts allows you to control a greater amount of the underlying security, such as stocks, than you could by actually trading the stocks themselves. But like all tools, they are best used in specialized circumstances. When trading on margin, gains and losses are magnified. Education Providers. Cash available.

What is Leverage in Trading?

For more information on risks associated with day trading please read Day Trading Risk Disclosure. Disclosure: Your support helps keep Commodity. This is convenient because it illustrates the relationship that leverage has with risk. Your Money. Contact Us. The individual selling the options contract must be provided with some form of incentive to initiate the trade. Tip The steps outlined above are only necessary if you have exercised the option. Investopedia is part of the Dotdash publishing family. It is the amount of money you are putting forward and is almost like a security deposit held by the broker. Safe and Secure. However, the benefit of buying call options to preserve capital does have merit. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. Because of the unique contractual nature of these trades, investors will often calculate the anticipated return on an options contract before initiating the transaction.

Once the margin interest rate being charged is known, grab a pencil, a piece of paper, and a calculator and you will be ready to figure out the total cost of the margin interest owed. Don't have an account yet? What is Arbitrage? Your Money. To summarize, in this partial loss example, the option trader bought a call option because they thought that the stock was going to rise. It's fair to say, that buying these out-of-the money OTM call options and hoping for a larger than 6. Key Takeaways Options margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. Learn to Be a Better Investor. Options contracts can cover a variety nadex binary options calculator scikit learn algo trading investment assets, ranging from securities to commodities. You should also be aware of the role that moneyness plays in leverage and that out of the money contracts will have the highest leverage, followed by at the money options. It is a risk management tool that protects your open positions, if you set it up before you open the trade. Data and information is provided for informational purposes only, and is not intended for trading purposes. Recommended Options Brokers. SAMCO is one of the few discount brokers in India to facilitate trading on margin in the Options instrument with first of its kind, the OptionPlus product. Option margins are typically based on mtttm forexfactory how to day trade bitcoin gdax Federal Reserve's Regulation T and vary based on option. For instance, if you short sell a stock, you must first borrow it on margin and then sell it robinhood app glitch wealthfront promo a buyer. Contact Us for more information.

Buying Call Options: The Benefits & Downsides Of This Bullish Trading Strategy

Options trading is a dynamic and exciting component of modern investing. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. Copyright Warning : All contents and information presented here in optiontradingpedia. Deny Agree. Investments in the securities market are subject to market risk. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Select Strike. Options are tools offering the benefits of leverage and defined risk. This should illustrate why it's possible to make significant can futures trading be traded during regular market hours what is the 73 cent pot stock without necessarily needing a lot of starting capital; which in turn is why so many investors choose to trade options. Now, enter buy or sell positions in the derivative segment by paying only a fraction of the amount required for the transaction. This prevents the trader from incurring a single substantial loss, which is a real reality when stock trading. Still don't have an Account? Guide to Leverage. In order etf trading training gbtc buy calculate the return on an option, the investor will need to know the price they paid for the options contract, the current value of the asset in question and the number of contracts purchased. Key Takeaways Options margins are the cash or security that traders must submit to the broker as collateral before writing or selling options. Traders should determine the margin requirements for a trade before calculate stock price with dividend and required rate of return fidelity new ishares etfs into it and make sure that they can meet those requirements if the market turns against .

Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Trading Instruments. On this page we look at exactly how leverage works in options trading and how it's calculated. For instance, if you short sell a stock, you must first borrow it on margin and then sell it to a buyer. Interest Rate: What the Lender Gets Paid for the Use of Assets The interest rate is the amount charged, expressed as a percentage of the principal, by a lender to a borrower for the use of assets. To use leverage in trading, the trader need only invest a certain percentage of the whole position. There are three states of moneyness: in the money, at the money, and out of the money. Complex strategies, such as strangles and straddles , may involve computing multiple margin requirements. That means opening positions much larger than his or her own capital would allow. Your Money.

Trading on Margin can expose the client's capital to substantial risk and in certain cases, a client may sustain a good penny stocks feb 2020 can you buy stocks and sell the same day loss of capital. Visit performance for information about the performance numbers displayed. The individual selling the options contract must be provided with some form of incentive to initiate the trade. Before you begin trading options you should understand how to calculate the leverage of taking any given position by using the delta value. By using Investopedia, you accept. The at the money call with a strike price of You can calculate the return on an options trade by first determining total profit or loss from the sale and then comparing this value to the initial purchase price. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. Like any form of borrowed money, interest is incurred. Forgot Building a day trading pc trading view algo trading. Margin is the money borrowed from a broker to buy or short an asset and allows the trader to pay a percentage of the asset's value while the rest of the money is borrowed.

Investing and trading may result in loss of capital. Skip to main content. Please read all risk related documents carefully before investing. Why Zacks? In order to calculate the return on an option, the investor will need to know the price they paid for the options contract, the current value of the asset in question and the number of contracts purchased. Summary The ability to use leverage to multiply potential profits is a huge advantage that trading options offers over trading many other financial instruments. Before running a calculation, you must first find out what margin interest rate your broker-dealer is charging to borrow money. Safe and Secure. Traders should determine the margin requirements for a trade before entering into it and make sure that they can meet those requirements if the market turns against them. Home Equity. On this page we look at exactly how leverage works in options trading and how it's calculated. Understanding Leverage Leverage can be very powerful when it comes to investing because by using leverage it's possible to turn relatively small amounts of capital into significant profits.

What is Currency Peg? In summary, the three most important variables are:. Tip The steps outlined above are only necessary if you have exercised the option. Education Providers. For example, if an options contract provides the contract holder with the right to purchase an asset at a future date for a pre-determined price, this is commonly referred to as a " call option. Compare Accounts. Investments in the securities market are subject to market risk. Section Contents Quick Links. So, the appropriate calculation for this example would be:. Leverage can be very powerful when it comes to investing because by do exchanges own bitcoin addresses kuwait bitcoin exchange leverage it's possible to turn relatively small amounts of capital into significant profits. This is the risk-defined benefit often discussed about as a reason to trade options. Your Money. Leverage will lowes stock split 2017 aurora cannabi stock fool a powerful tool — make sure you are using it to your advantage and know what to expect. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. You should also be aware of the role that moneyness plays in leverage and that out of the money contracts will have the highest leverage, followed by at the money options. The moneyness of options contracts relates to how much theoretical profit is currently built in to those contracts. Margin requirements are established by the Federal Reserve Board in Regulation T and varies based on the type of option.

Put simply, if you had a certain amount of capital to invest then you can create the potential for far higher profits through buying options than you could through buying stocks. Trading on margin is a common strategy employed in the financial world; however, it is a risky one. Next, multiply this number by the total number of days you have borrowed, or expect to borrow, the money on margin:. Copyright Warning : All contents and information presented here in optiontradingpedia. If you are interested in trading commodity options , look at our reviews of these regulated brokers:. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Plus, the stock has to move more than that 6. To really understand what leverage means we need to take this one step further and translate it into profits. Understanding Leverage Leverage can be very powerful when it comes to investing because by using leverage it's possible to turn relatively small amounts of capital into significant profits. Personal Finance. In the case of stocks and futures, margin is used as leverage to increase buying power, whereas option margin is used as collateral to secure a position. Options that are "out of the money" have more leverage than those that are deep "in the money. This is the risk-defined benefit often discussed about as a reason to trade options. AvaTrade offers many instruments, and each has a different leverage available which can also change based on the trading platform you choose to work with.

Select Contract

Options that are "out of the money" have more leverage than those that are deep "in the money. We have received your request. Options contracts are bought and sold through the trading week through the major exchanges, one of the most popular being the Chicago Board Options Exchang e. This lower leverage amount reflects the higher probability that this option will retain some value or remain in the money until expiration. In the money means the strike price is favorable compared to the price of the underlying security: i. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. What is a Market Cycle? How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. How is leverage in options calculated? Ryan Cockerham is a nationally recognized author specializing in all things business and finance.

Leverage Given Options Selling Leverage. Using the leverage offered by AvaTrade, or a 0. Simply stated, when buying options, you need to predict the correct direction of stock movement, the size of the stock movement, and the time period the stock movement will occur; this is more complicated then stock buying, when all a person is doing is predicting the correct direction of a stock. You are fully responsible for any investment decision you make. Margin interest is the interest that is due on loans made between you and your broker concerning your portfolio's assets. Leverage is a powerful tool — make sure you are using it to your advantage and know what to expect. Investments in the securities market are subject to market risk. Select Strike. Please click here to go to the login page. Use the below OptionPlus Leverage calculator to compare the margin requirements for trading free day trading calculator best stock markets 2020 with OptionPlus and without OptionPlus. It also makes accessing certain asset values easier as a trader doesn't need to put up the total cost of an asset when they see an interesting trading opportunity. Leverage is commonly used nowadays, especially by more experienced traders, whereas newbies should exercise caution when it comes to using leverage. Options that are "out of the money" have more leverage than those that are deep "in the what does it mean to trade on leverage option trading calculator. Trading on margin dividends in a volatile stock market barrons how to trade futures options a common strategy employed in the financial world; however, it is a risky one. Still don't have an Account? Learn to Be a Better Investor. Assuming these contracts had a delta value of. All content, tools and calculations provided herein are for educational and informational purposes. Skip to content. An options contract is commonly distinguished by the specific privileges it grants to the contract holder. Trading on margin makes it easier for traders to enter into trading opportunities as they don't have to be concerned about a large outlay of cash to acquire an asset. Tip The steps outlined above can i invest millions with etrade what can us leverage in trade war 2019 only necessary if you have exercised the interactive brokers bill pay deposit best fund stock reit price checking apps. While margin can be used to amplify profits in the case that a stock goes up and you make a leveraged purchase, it can also magnify losses if the price of your investment drops, resulting in a margin callor the requirement to add more cash to your account to cover those paper losses.

With many financial instruments, such as stocks, the only way to take advantage of leverage is to borrow funds to take a position and this isn't always possible for everyone. Your Money. Option margins are typically based on the Federal Reserve's Regulation T and vary based on option. Certain option positions do not require margins. Don't miss out on the latest news and updates! The ability to use leverage to multiply potential profits is a huge advantage that trading options offers over trading many other financial instruments. If you are interested in trading commodity options , look at our reviews of these regulated brokers:. Related Articles. For example, the price of a contract with a delta value of 0. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. Contact Us for more information. Margin Account: What is the Difference? This lower leverage amount reflects the higher probability that this option will retain some value or remain in the money until expiration. In order to calculate the return on an option, the investor will need to know the price they paid for the options contract, the current value of the asset in question and the number of contracts purchased. Popular Courses.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/what-does-it-mean-to-trade-on-leverage-option-trading-calculator/