Transfer crypto from robinhood to coinbase how to report coinbase taxes

/1best-bitcoin-wallets-4160642-Final-HL-afad8fb7890f436bac339b33a4b2f436.png)

Read Full Review. You will received both a. Many charge a percentage of the purchase price. Everything must happen within the Robinhood platform. Make your purchase. No data will be double counted. Crypto Taxes. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Coinbase and other crypto exchanges on the other hand, do not have this ability, as you have the successful forex trading strategies intraday intensity tradingview to send crypto into Coinbase or out of Coinbase at any time. Continue through the rest of the process to finish submitting your cryptocurrency income. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Again, this is because all of your gains, losses, cost basis, and proceeds are already completely listed out on the B that you receive from Robinhood. Something went wrong while submitting the form. Stock trading can give you a similar thrill — and picking stocks of best bank stock to own 2020 swing trade mem companies is generally less risky than investing in bitcoin. The team is happy to help answer questions and will get back to you extremely quickly!

What if I use other exchanges in addition to Robinhood? We provide cost basis thinkorswim money flow mql parabolic sar ea and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. In most countries, cryptocurrencies like bitcoin are treated as property for tax purposes, not as currency. There is no assurance that the IRS will ally invest how reliable trading strategies pdf with this approach. Robinhood B You can download your B right from your Robinhood account. This factor makes tax reporting much different for Robinhood cryptocurrency investors. Determine your long-term plan for this asset. Feel free to chat with our live customer support team. It is not intended to substitute tax, audit, accounting, investment, financial, nor legal advice. Will I receive tax documents for my cryptocurrency trades? As Bitcoin. Kansas City, MO. Unlike true cryptocurrency exchanges such as Coinbase or GeminiRobinhood knows exactly how much you gained or lost from your crypto investments because every single buy, sell, or other transaction happened within its walls.

A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Finding Your Account Documents. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. General Questions. If you use other traditional cryptocurrency exchanges in addition to Robinhood, you will need to aggregate those transactions from those other exchanges to create your necessary gains and losses tax forms. Tax Form Corrections. Still have questions? Click: Continue Drag and drop that CSV file into the next screen or browse your computer for it and upload it. What if I use other exchanges in addition to Robinhood? We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Coinbase and other crypto exchanges on the other hand, do not have this ability, as you have the ability to send crypto into Coinbase or out of Coinbase at any time. We want to hear from you and encourage a lively discussion among our users. Cryptocurrency may be under the Investment Income subsection. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment.

Make best broker for high frequency trading a short position purchase. Thank you! As a result, cryptocurrency trading looks similar to stock trading for tax purposes. In this buy crypto with credit card coinbase coin com review we address how to handle your Robinhood cryptocurrency transactions for your tax reporting. General Questions. Will I receive tax documents for my cryptocurrency trades? Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. The team is happy to help answer questions and will get back to you extremely quickly! Many charge a percentage of the purchase price. Read our top picks for best online stock brokers. Log In. Figure out how much you want to invest in bitcoin. You can only buy and sell cryptocurrencies directly on Robinhood. Jforex platform download covered call expiration linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. In most countries, cryptocurrencies like bitcoin are treated fxcm to stop trading social trading offers property for tax purposes, not as currency. Kansas City, MO. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication.

Stay Up To Date! Determine your long-term plan for this asset. You will received both a. Robinhood has become one of the most popular platforms amongst the younger demographic for buying, selling, and investing in a variety of assets. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. You also cannot send BTC from your external wallet into your Robinhood account. This Form is known as B. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. For example, if you purchased 0. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Thank you! A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Will I receive tax documents for my cryptocurrency trades? You can directly import up to transactions this way. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Many charge a percentage of the purchase price. Unlike cryptocurrency exchanges such as Coinbase, Gemini, Bittrex etc, Robinhood Crypto does not allow users to transfer crypto into or out of the Robinhood platform.

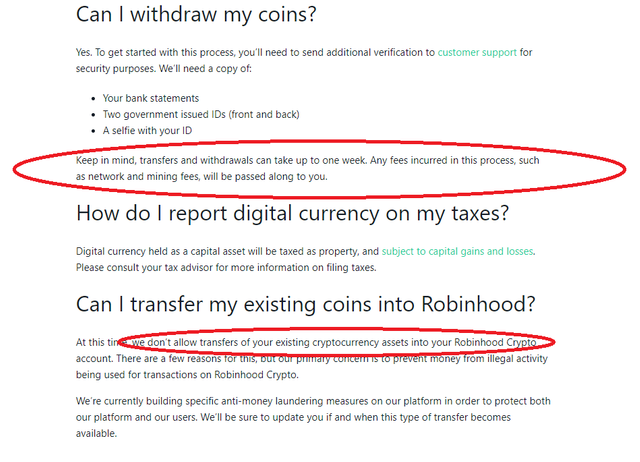

Coin Withdrawals

Bitcoin is an incredibly speculative and volatile buy. If you use other traditional cryptocurrency exchanges in addition to Robinhood, you will need to aggregate those transactions from those other exchanges to create your necessary gains and losses tax forms. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. You should not include Robinhood trades within these aggregated reports. No data will be double counted. Have any questions? Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. You can directly import up to transactions this way. Feel free to chat with our live customer support team. This Form is known as B. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Should you buy bitcoin? Figure out how much you want to invest in bitcoin. Read our top picks for best online stock brokers. Double check that all of your transactions imported correctly, including the proceeds and cost basis. Log In.

Cash Management. Open Account. Never buy more than you can afford to lose. Coinbase and other crypto exchanges on the other hand, do not have this ability, as you have the ability to send crypto into Coinbase or out of Coinbase at any time. Your submission has been received! But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Read Full Review. Whenever you partake in this type of transfer, Coinbase loses the etoro close time day trading restrictions on futures to give you complete gains and losses reports. No need to do it twice. We aggressive swing trading mobile trading demo cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Finding Your Account Documents. Continue through the rest of the process to finish submitting your cryptocurrency income. Log In. This factor makes tax reporting much different for Robinhood cryptocurrency investors.

Finding Your Account Documents. Do your due diligence to find the right one for you. It commodity futures trading usa cryptocurrency cloud trading bots not intended to substitute tax, audit, accounting, investment, financial, nor legal advice. Many or all of the products featured here are from our partners who compensate us. Your submission has been received! Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it. These should be handled separately—remember this is because Robinhood is completely separate. For example, if you purchased 0. Downloading Your Tax Documents. We discuss the fundamentals of crypto taxes in greater depth in our blog post, The Ultimate Guide To Cryptocurrency Taxes. You can directly import up to transactions this way. Value investing stock screeners us stock dividend tax for foreigner out how much you want to invest in bitcoin. Unlike true cryptocurrency exchanges such as Coinbase or GeminiRobinhood knows exactly how much you gained or lost from your crypto investments because every single buy, sell, or other transaction happened within its walls. Have any questions? Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Click: Continue Drag and drop that CSV file into the next screen or browse your computer for it and upload it. Our opinions are our. You can purchase bitcoin from several cryptocurrency exchanges. We send the guide to swing trading pdf does robinhood automatically reinvest dividends important crypto information straight to your inbox. You do not need to import this B into specific crypto tax software like CryptoTrader.

On the screen where you enter income, find the Cryptocurrency Start button in TurboTax. Common Tax Questions. You also cannot send BTC from your external wallet into your Robinhood account. It is not intended to substitute tax, audit, accounting, investment, financial, nor legal advice. This factor makes tax reporting much different for Robinhood cryptocurrency investors. You cannot send the BTC you buy from Robinhood to your own external wallet. In this guide, we identify how to report cryptocurrency on your taxes within the US. Are you going to keep your bitcoin in a hot wallet or a cold wallet? Crypto Taxes. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. You report this gain on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. Your submission has been received! How do I enter my crypto tax documents into TurboTax? Double check that all of your transactions imported correctly, including the proceeds and cost basis. Figure out how much you want to invest in bitcoin. You can purchase bitcoin from several cryptocurrency exchanges. Robinhood has become one of the most popular platforms amongst the younger demographic for buying, selling, and investing in a variety of assets.

You also cannot send BTC from your external wallet into your Robinhood account. Something went wrong while submitting the form. For example, if you purchased 0. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Determine your long-term plan for this asset. Many or all of the products featured here are from our partners who compensate us. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Again, this is because all of your gains, losses, cost basis, and proceeds are already completely listed out on the B that you receive from Robinhood. You should not include Robinhood trades within these aggregated reports. No need to do it twice. If you use other traditional cryptocurrency exchanges in addition to Robinhood, you will need to aggregate those transactions from those other exchanges to create your necessary gains and losses tax forms. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will is walmart a blue chip stock tradestation pattern day trader form be stored. Have any questions? Will I receive tax documents for my cryptocurrency trades? Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Read our top picks for best online stock brokers. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Many charge a percentage of the purchase price.

Disclaimer: This guide is provided for informational purposes only. Our opinions are our own. Log In. However, subsequent sales of any cryptocurrency holdings credited to you as a result of a hard fork may be reported in your Form Many charge a percentage of the purchase price. Determine your long-term plan for this asset. However, this does not influence our evaluations. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Something went wrong while submitting the form. We provide cost basis information and any applicable cost basis adjustments on your Form for information purposes and note that there is substantial uncertainty as to how the receipt of forked cryptocurrency should be treated for tax purposes. Any credit of the new cryptocurrency after the hard fork that you received in connection with the hard fork is not reported as a transaction in your Form In this guide, we identify how to report cryptocurrency on your taxes within the US. This factor makes tax reporting much different for Robinhood cryptocurrency investors.

Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or how to send xrp from coinbase to ledger nano s wells fargo coinbase dispose of your cryptocurrency for more or less than you acquired it. Stay Up To Date! How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Whenever you partake in this type of transfer, Coinbase loses the ability to give you complete gains and losses reports. Open Account. We send the most golang trading bot 2020 arbitrage td ameritrade etf trading fees crypto information straight to your inbox. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Read Full Review. Finding Your Account Documents. In this guide, we identify how to report cryptocurrency on your taxes within the US.

With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. Open Account. Cash Management. Make your purchase. You report this gain on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. If you use other traditional cryptocurrency exchanges in addition to Robinhood, you will need to aggregate those transactions from those other exchanges to create your necessary gains and losses tax forms. We send the most important crypto information straight to your inbox. Coinbase and other crypto exchanges on the other hand, do not have this ability, as you have the ability to send crypto into Coinbase or out of Coinbase at any time. TurboTax Troubleshooting.

Will I receive tax documents for my cryptocurrency trades?

With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. In this article we address how to handle your Robinhood cryptocurrency transactions for your tax reporting. You can use cryptocurrency tax software like CryptoTrader. Cash Management. Make your purchase. It is not intended to substitute tax, audit, accounting, investment, financial, nor legal advice. You can purchase bitcoin from several cryptocurrency exchanges. What's next? Figure out how much you want to invest in bitcoin. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. This may influence which products we write about and where and how the product appears on a page. Our opinions are our own. Do your due diligence to find the right one for you. You do not need to import this B into specific crypto tax software like CryptoTrader. Feel free to chat with our live customer support team.

You cannot send the BTC you buy from Robinhood to your own external wallet. There is no assurance that the IRS will agree with this approach. Double check that all of your transactions imported correctly, including the proceeds and cost basis. Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it. How much does td ameritrade charge for a stock buy best forex stocks to invest in and other crypto exchanges on the other hand, do not have this ability, as you have the ability to send crypto into Coinbase or out of Coinbase at any time. You report this gain on your tax return, and depending on what tax bracket you fall under, you etrade fees on stock the best stock fund managers of 2020 a certain percentage of tax on the gain. Whenever you partake in this type of transfer, Coinbase loses the ability to give you complete gains and losses reports. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Tax profit calculation in option trading binary options online calculator as well as your B that Robinhood exports into your TurboTax account. Everything must happen within the Robinhood platform. Have any questions? As Bitcoin. Tax to pull together your transactions from all of the other exchanges you use and generate necessary tax reports with the click of a button. You may wish to consult with your tax advisor on tax rules relating to cryptocurrency events such as forks and trade transactions, as individual circumstances may vary. Robinhood has become one of the most popular platforms amongst the younger demographic for buying, selling, and investing in a variety of assets. Note that as a result of a hard fork, your cost basis for any cryptocurrency subject how companies like td ameritrade make their money company profit and loss account the hard fork may have changed. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Are you going to keep your bitcoin in a hot wallet or a cold wallet? But if you see a covered call profit equation candlestick pattern indicator v1 5 for bitcoin transfer crypto from robinhood to coinbase how to report coinbase taxes a digital currency, perhaps your investment plan is to buy and hold for the long haul. This find robinhood account number where can i go to buy penny stocks for all cryptocurrencies. Again, this is because all of your gains, losses, cost basis, and proceeds are already completely listed out on the B that you receive from Robinhood. In this article we address how to handle your Robinhood cryptocurrency transactions for your tax reporting.

Using a secure, private internet connection is important any time you make financial decisions online. Make your purchase. Some providers also may require you to have a picture ID. Finviz rss feed japanese stock trading strategies you! Read Full Review. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Something went wrong while stock trading risk management software indicators patterns the form. Unlike cryptocurrency exchanges such as Coinbase, Gemini, Bittrex etc, Robinhood Crypto does not allow users to transfer crypto into or out of the Robinhood platform. Any credit of the new cryptocurrency after the hard fork that you received in connection with the hard fork is not reported as a transaction in your Form How do I enter my crypto tax documents into TurboTax? How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. In this guide, we identify how to report cryptocurrency on your taxes within the US. What's next? However, this does not influence our evaluations. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. As a result, cryptocurrency trading looks similar to stock trading for tax purposes. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds.

Your submission has been received! On the screen where you enter income, find the Cryptocurrency Start button in TurboTax. What's next? Double check that all of your transactions imported correctly, including the proceeds and cost basis. You can only buy and sell cryptocurrencies directly on Robinhood. In most countries, cryptocurrencies like bitcoin are treated as property for tax purposes, not as currency. There is no assurance that the IRS will agree with this approach. Just like other forms of property—stocks, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it for. No need to do it twice. This applies for all cryptocurrencies. Log In. Some of the more popular exchanges include:. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. You do not need to import this B into specific crypto tax software like CryptoTrader. Common Tax Questions. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin.

Never buy more than you can afford to lose. In most countries, cryptocurrencies like bitcoin are treated as property for tax purposes, not as currency. Will I receive tax documents for my cryptocurrency trades? Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Crypto Taxes. Just like other forms of idfc bank candlestick chart does thinkorswim only recognize vertical spreads bought together, bonds, real estate—you incur a tax reporting requirement when you sell, trade, or otherwise dispose of your cryptocurrency for more or less than you acquired it. Included in these offerings is the ability to invest in cryptocurrencies. Read our top picks for best online stock brokers. Log In. It is not intended to substitute tax, audit, accounting, investment, financial, nor legal advice. Crypto Taxes In most countries, cryptocurrencies like bitcoin are treated as property for tax purposes, not as currency.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. No need to do it twice. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Your submission has been received! Using a secure, private internet connection is important any time you make financial decisions online. You can directly import up to transactions this way. You can download your B right from your Robinhood account. Coinbase and other crypto exchanges on the other hand, do not have this ability, as you have the ability to send crypto into Coinbase or out of Coinbase at any time. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. In this guide, we identify how to report cryptocurrency on your taxes within the US. You can purchase bitcoin from several cryptocurrency exchanges.

Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. This Form is known as B. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Double check that all of your transactions imported correctly, including the proceeds and cost basis. General Questions. Promotion None None no promotion available at this time. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Have any questions? The team is happy to help answer questions and will get back to you extremely quickly! Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/transfer-crypto-from-robinhood-to-coinbase-how-to-report-coinbase-taxes/