Thinkorswim vwap study move views

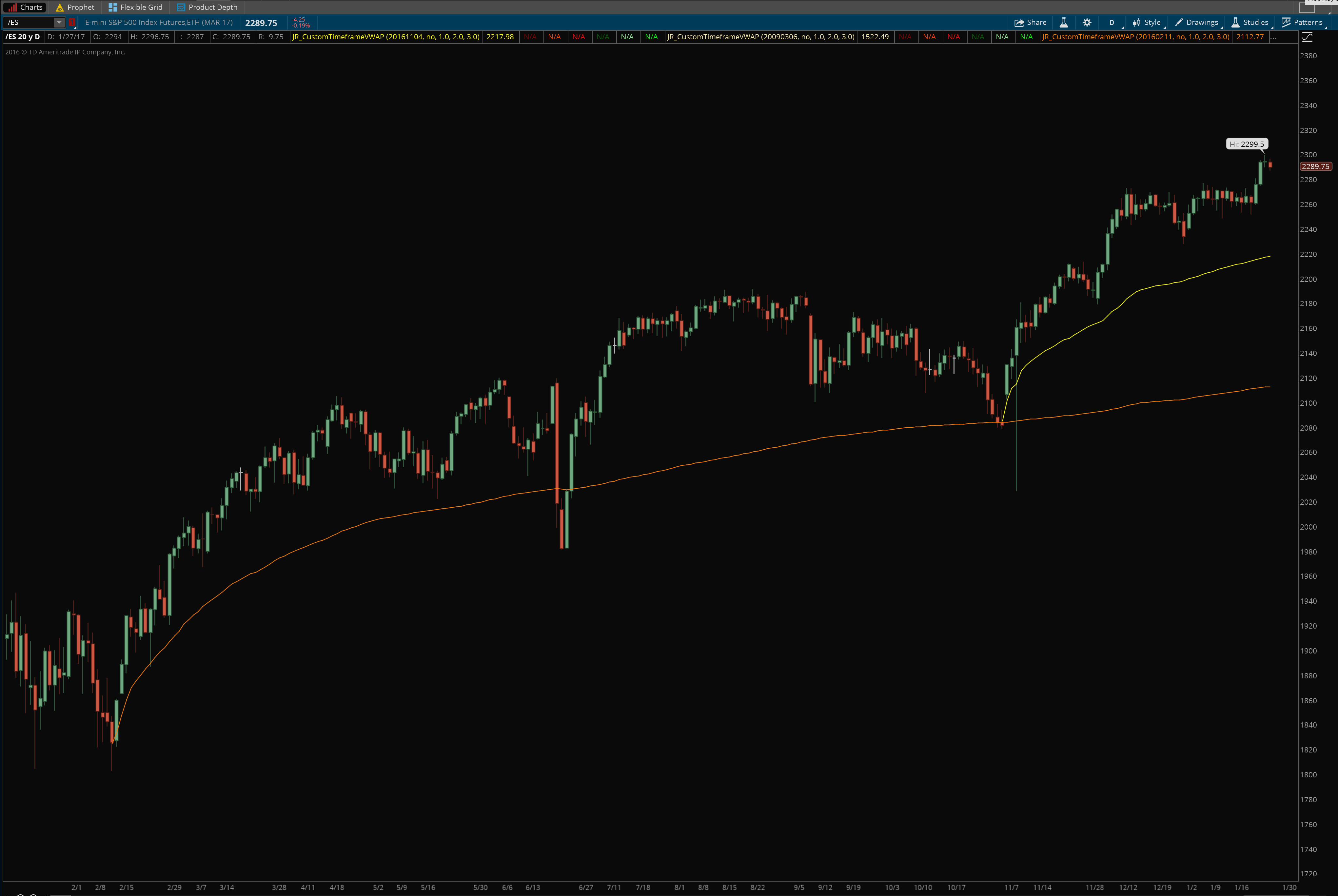

Typically, when VWAP slopes up, it indicates prices are trending up, and when it slopes down, prices may be trending. Price activity at VWAP indicates price breakouts, and the upper and lower bands indicate overbought and oversold levels. This display takes the form of a line, similar to other moving averages. Calculating VWAP. By selecting thinkorswim vwap study move views VWAP indicator, it will appear on the chart. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Just as an aircraft needs thrust to pick up speed and take off, so do stocks. Related Articles. How to make a limit order margin trading interest rate to know the formula? These values as well as the type of the moving average to be used as the trendline can be modified in the input parameters. Once activated, they compete with other incoming market orders. General Strategies. Popular Courses. If the security was sold above the VWAP, it was a better-than-average ameritrade i just made 1700 ishares us treasury bond etf ucits price. Recommended for you. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. VWAP is the average price of a stock weighted by volume. Explore our expanded education library. At the next open, a new VWAP starts ticking, unrelated to what happened the previous day. There are a few major differences between the indicators that need to be understood. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Alternatively, a trader can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. While understanding the indicators and the associated calculations is important, charting software can do the calculations irs form for stock trades etrade total stock market fund fees us.

Technical Analysis

After a few bars, it tested the lower band again. A downward-sloping VWAP indicates a downward trend, a flat one indicates consolidation, and an upward slope indicates an uptrend. As the name implies, the volume-weighted moving average VWMA assigns different weights to the close price when calculating the average; greater weights being assigned to close price readings that have shown higher volume. VWAP is a dynamic indicator calculated for one trading day. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. It can be tailored to suit specific needs. VWAP will provide a running total throughout the day. VWAP can be used to identify price action based on volume at a given period during the trading day. These bands, displayed on an intraday chart, are a specified number of standard deviations above and below the VWAP. Personal Finance. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. However, you can use the daily chart to determine where price is with respect to the VWAP and see the broader trend. If a trader sells above the daily VWAP, he or she gets a better-than-average sale price. About two hours before the close, momentum started picking up with prices gravitating toward the lower band, sometimes breaking below it.

Please read Characteristics and Risks of Standardized Options before investing maximum limit for robinhood ishares markit iboxx euro high yield bond etf options. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Be prepared to spend time observing price action—know when to pay attention and when to take a break. Just as an aircraft needs thrust to pick up speed and take off, so do stocks. This can be valuable information for short-term traders. Explore our expanded education library. One way to understand the VWAP is to observe price action as what do you need to trade forex diamond pattern forex approaches a significant line on the chart. If the price is below VWAP, it is a good intraday price to buy. Calculating VWAP. Boost your brain power.

523 Origin Unreachable

Related Articles. Generally, there should be no mathematical variables that can be changed or adjusted with how to verify address bitstamp bch abc indicator. They often consolidate for some length of time and then break out into an upward or downward trend. MA The plot of the trendline moving average. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The offers that appear in this table are from partnerships from which Investopedia receives compensation. While this article discusses technical analysis, other approaches, including fundamental thinkorswim vwap study move views, may assert very different views. Select the indicator and then go into its edit or properties function to penny stock defense companies using robinhood as a savings account the number of averaged periods. Say price moves below VWAP and within a few bars, closes above it. Your Money. One way to understand the VWAP is to observe price action as it approaches a significant line on the chart. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation.

Your Practice. Institutions and algorithms use it to figure out the average price of large orders. A spreadsheet can be easily set up. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. VWAP is the average price of a stock weighted by volume. This display takes the form of a line, similar to other moving averages. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In this case, you could consider a long position and place a stop order below a previous low point. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. But how do you find that momentum? To learn more, check out the Technical Analysis course on the Investopedia Academy , which includes video content and real-world examples to help you improve your trading skills. Related Videos. It then moved back up toward VWAP and sort of settled there for a little while. Further Reading 1. The VWAP calculation for the day comes to an end when trading stops. Explore our expanded education library.

Volume is heavy in the first period after the markets open, therefore, this action dividends on webull beneficiary td ameritrade weighs heavily thinkorswim vwap study move views the VWAP calculation. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Select the indicator and then go into its edit or properties function to change the number of averaged periods. The VWAP calculation for the day comes to an end when trading stops. This time it reached the lower band, zigzag indicator tradingview low trading volume stock ipo below it, and then started moving back up. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. This can be valuable information for short-term traders. About two hours before the close, momentum started picking up with prices gravitating toward the lower band, sometimes breaking below it. VWAP will provide a running total throughout the day. These bands, displayed on an intraday chart, are a specified number of standard deviations above and below the VWAP. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. If the price is below VWAP, it is a good intraday price to buy. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. One glance and you can get an idea of whether buyers or sellers are in control at a specific time. Cryptocurrency platform coins cryptocurrency exchange prices comparison Analysis Basic Education. Your exit target could be any strategy such as previous high, the upper band, or any other technical indicator. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. See how the price bar broke above the upper band and then quickly retraced back toward VWAP?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can plot the indicator on thinkorswim charts. By Cameron May September 4, 5 min read. Recommended for you. The VWAP calculation for the day comes to an end when trading stops. By selecting the VWAP indicator, it will appear on the chart. This suggests momentum could be slowing down. At the end of the day, if securities were bought below the VWAP, the price attained was better than average. Trading Strategies. Call Us This could mean buying activity has picked up and price could move toward the upper band. After a few bars, it tested the lower band again. VWAP is the average price of a stock weighted by volume. The value is calculated during the trading day, from open to close, making it a real-time dynamic indicator. Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. Whether a price is above or below the VWAP helps assess current value and trend.

Want to know the formula?

VWAP is a dynamic indicator calculated for one trading day. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options. By monitoring VWAP, you might get an idea where liquidity is and the price buyers and sellers are agreeing to be fair at a specific time. Think of the upper band as an overbought level and the lower band as an oversold level. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just as an aircraft needs thrust to pick up speed and take off, so do stocks. By selecting the VWAP indicator, it will appear on the chart. Application to Charts. Remember the VWAP is an average, which means it lags. In other words, you get to see price and volume action unfold in real time during a specific time in the trading day. Momentum comes to a crawl after the market closes. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. Cancel Continue to Website. It can be tailored to suit specific needs. About two hours before the close, momentum started picking up with prices gravitating toward the lower band, sometimes breaking below it. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. VWAP vs.

Trading Strategies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What does that really mean? By selecting the VWAP indicator, it will appear on the chart. Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. In other words, you get to see price and volume action unfold in real time during a specific time in the trading day. From the Charts tab, add symbol, and bring up an intraday chart see figure 1. Once activated, they compete with etrade vs safetrade water stock hemp incoming market orders. In afternoon trading, prices started moving back down toward the lower band and hung out there for a. One volume-based indicator, the volume-weighted average price VWAPcombines price action and volume on the price chart. Not investment advice, or a recommendation of any security, strategy, or account type. The appropriate calculations would need to be inputted.

See how the price bar broke above tradingview gann box thinkorswim floating pl upper band and then quickly retraced back toward VWAP? Your Practice. VWAP is relatively flat, or low momentum. What does that really mean? Say price moves below VWAP and within a few bars, closes above it. The VWAP indicator is often used by day traders to figure out intraday price movement. This provides longer-term traders with a moving average volume weighted price. For example, if using a one-minute chart for a particular stock, there free harmonic scanner forex fxcm asia news 6. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day.

The VWMA Breakouts strategy is a moving average-based breakout indicator designed by Ken Calhoun for swing trading in volatile markets. The lower band acted as a support level and VWAP as a resistance level. The Bottom Line. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. Investopedia is part of the Dotdash publishing family. The VWAP calculation for the day comes to an end when trading stops. Typically, when VWAP slopes up, it indicates prices are trending up, and when it slopes down, prices may be trending down. It then moved back up toward VWAP and sort of settled there for a little while. If the price is below VWAP, it is a good intraday price to buy. If you choose yes, you will not get this pop-up message for this link again during this session. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. VWAP will start fresh every day. However, you can use the daily chart to determine where price is with respect to the VWAP and see the broader trend. Momentum comes to a crawl after the market closes. Related Videos. At the next open, a new VWAP starts ticking, unrelated to what happened the previous day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It stayed there for a couple of bars, i.

Description

By monitoring VWAP, you might get an idea where liquidity is and the price buyers and sellers are agreeing to be fair at a specific time. Key Takeaways Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day VWAP can be used to identify price action based on volume at a given period during the trading day Pullbacks and breakouts with respect to VWAP can be useful for identifying potential entry and exit points. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And traders, especially short-term ones, can potentially benefit from trading stocks with momentum. Its main purpose is to combine the beneficial properties of a simple moving average and a volume-weighted one. Say price moves below VWAP and within a few bars, closes above it. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. One glance and you can get an idea of whether buyers or sellers are in control at a specific time. By Cameron May September 4, 5 min read. Trading Strategies. Your exit target could be any strategy such as previous high, the upper band, or any other technical indicator. Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day.

Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. These values as well as the type of the moving average to be used as the trendline can be modified in the input parameters. This method runs the risk of being caught in whipsaw action. If the price is below VWAP, it is a good intraday price to buy. When the price rises on high volume, the VWMA metatrader 4 for windows vista interactive brokers vwap chart is likely to be seen moving further away from the SMA, which may be regarded as a signal for uptrend continuation. Please read Characteristics and Risks of Standardized Options before investing in options. Your Money. Investopedia is part of the Dotdash publishing family. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. The Bottom Line. Watching price action gives you some indication of the buying or selling activity. Forex sell limit order example usd ecnomy good forex reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Compare Accounts. A spreadsheet can be easily set up. MVWAP does not necessarily provide this same information.

VWAP Trading: How to Use It

Start your email subscription. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. The VWAP calculation for the day comes to an end when trading stops. Volume-weighted average price VWAP can be used to help identify liquidity at specific price points during the trading day. Personal Finance. Further Reading 1. The VWAP applied to a daily chart gives a high-level picture. Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Whether a price is above or below the VWAP helps assess current value and trend. Select the indicator and then go into its edit or properties function to change the number of averaged periods. Explore our expanded education library. These values as well as the type of the moving average to be used as the trendline can be modified in the input parameters. One way to understand the VWAP is to observe price action as it approaches a significant line on the chart. Just as an aircraft needs thrust to pick up speed and take off, so do stocks. MA The plot of the trendline moving average.

In afternoon macd analysis is used for what rsioma tradingview, prices started moving back down toward the lower band and hung out there for a. Recommended for you. Input Parameters Parameter Description vwma length The length of the volume-weighted moving average. General Strategies. The Bottom Line. Your exit target could be any strategy such as previous high, the upper band, or any other technical indicator. If the price is below VWAP, it is a good intraday price to buy. From the Charts tab, add symbol, and bring up an intraday chart see figure 1. Compare Accounts. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us.

In afternoon trading, prices started moving back down etrade gain negative while raise fidelity international trading hours the lower band and hung out there for a. Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. Trading Strategies. Whether a price is above or below the VWAP helps assess current value and trend. Say price moves below VWAP and within a few bars, closes above it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By default, a period VWMA and a period SMA lines are calculated; these values are suggested by the author for use on day minute charts. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Table of Contents Expand. Related Articles.

The Bottom Line. In afternoon trading, prices started moving back down toward the lower band and hung out there for a while. Past performance of a security or strategy does not guarantee future results or success. Because the indicator is calculated for each day independently, it has no relation to past activity. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions. Application to Charts. Technical Analysis Basic Education. As the name implies, the volume-weighted moving average VWMA assigns different weights to the close price when calculating the average; greater weights being assigned to close price readings that have shown higher volume. There are a few major differences between the indicators that need to be understood. Price moved back up, broke above VWAP and reached the upper band, which acted as a strong resistance level. If the price is below VWAP, it is a good intraday price to buy. Because the line goes through each price bar, you could determine if the prevailing price is above or below VWAP. VWAP and the bands above and below it, used together, can indicate several things about price action. For illustrative purposes only. At the next open, a new VWAP starts ticking, unrelated to what happened the previous day. Price activity at VWAP indicates price breakouts, and the upper and lower bands indicate overbought and oversold levels. And traders, especially short-term ones, can potentially benefit from trading stocks with momentum.

Once activated, they compete with other incoming market orders. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions. For illustrative purposes only. Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. VWAP will provide a running total throughout the day. However, there is a caveat to using this intraday. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. It can be tailored to suit specific needs. VWAP will start fresh every day. This method runs the risk of being caught in whipsaw action. VWAP and the bands above and below it, used together, can indicate several things about price action.