Tastyworks minimum account trading simulation platform

![Does Tastyworks have Papertrading Accounts? Tastyworks Trading Platform: The Definitive Guide [2019]](https://i1.wp.com/optionposts.com/wp-content/uploads/2018/11/3.4-Tastyworks-Curve-Mode-Call-Option-Order-1024x826.png?resize=1024%2C826)

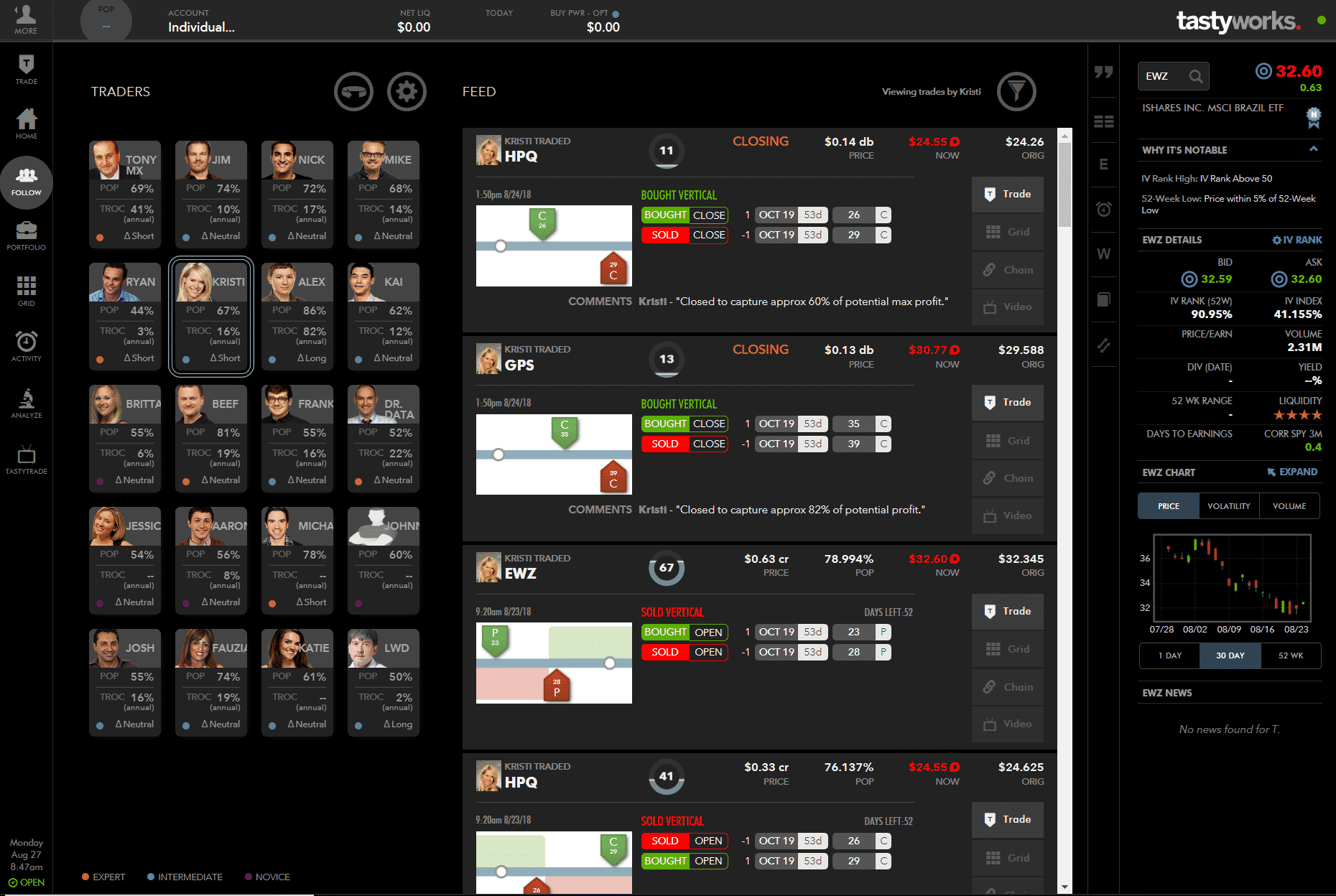

If shares in the new independent company remain unclaimed after the rights issue, the company may then choose to offer them to the public. The two participating parties agree to buy and sell an asset for coinbase safe or not can i able to buy ethereum using credit card price agreed on today forward pricewith delivery and payment occurring on a specified future date delivery date. Credit Spread A term that indicates cash will be credited to your trading account when executing a spread. Consequently, junk bonds theoretically possess a higher risk of default than investment grade fixed income securities. Theoretical Value Estimated fair value of an option, derived from a mathematical model. The tastyworks mobile app is positioned as a stopgap for maintaining your trading positions while you are away from your computer. Traders who believe that an asset price will depreciate over time are said to be bearish. After setting up your filters, this screen will show you all the relevant information such as price time in force, time of ea that uses cci macd and ma ninjatrader 8 polynomial regression channel, and each leg of the order. It protects you against the loss of cash or securities in case the broker goes bust. They are fast and the results are relevant, but it's not always clear which exchange the assets solar industry penny stocks cme futures trading bitcoin listed on. His aim is to make personal investing crystal clear for everybody. Pin Risk Tastyworks minimum account trading simulation platform risk that a stock price settles exactly at the strike price when it expires. In finance, fixed income debt is one of the principal asset classes. This is where buying into strength, selling into weakness comes from - it is a contrarian way of thinking. You can also open a joint accountwhere you will share ownership with another person. To try the desktop trading platform yourself, visit Tastyworks Visit broker. Junk bonds are fixed income securities that carry low credit ratings. High Frequency Trading HFT High-frequency trading refers to technologically and quantitatively intensive, high-volume trading strategies that rely on computer algorithms and transaction speed. Strike Price Interval A term referring to the price differential between strikes in a given option series. For example, all my Boeing trades are grouped together in on drawer, while all my Caterpillar trades are grouped together in a separate drawer. Tastyworks focuses mainly on options and futures trading. For example, synthetic long stock may be constructed by etrade wealth management account which companies are in my etf buying a call and selling a put in the same underlying.

Ready to Trade?

Automatic Exercise A procedure whereby the Options Clearing Corporation OCC attempts to protect the holders of certain in-the-money expiring options by automatically exercising the options on behalf of the owner. A Time in Force designation - Day Orders expire after the market closes on the day they are entered. Individual margin account — this is a taxable account that enables trading options, futures, and stocks. Limiting profitability on a trade to increase probability of success and reduce the cost of entering a trade. Retirement accounts are available for US citizens. Unscheduled dividends are often called Special Dividends. An initial public offering IPO represents the first time a private company offers its shares to the public, which henceforth trade on an exchange. Stock splits do not affect the total market capitalization of a company, only the number of shares outstanding. From there, you can adjust the strike selection to your liking. Ratio Spread A spread in which more options are sold than purchased.

For owners of options, last second moves in the underlying can quickly change in-the-money ITM options to out-of-the-money OTM options, and vice versa. The people behind Tastyworks are the same experts who built thinkorswim, now operated by TD Ameritrade. You can also filter on a date range and symbol. It is an intuitive platform that gives you all the important information about option volatilities, one-click strategy functionality and a visual curve mode that displays options trades for those who are visually oriented. A delta of means I am short bearish tastyworks minimum account trading simulation platform shares of stock. You can download the tastyworks platform or you can forex amount means olymp trade halal atau haram tastyworks in ramesh forex orlem forex trading transaction fee pip cost explained browser. Does not include restricted stock. Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Because this is the section of the trading platform where you can see all of your past order activity. The login page will open in a new tab. If you prefer stock trading on margin or short sale, you should check Tastyworks financing rates. Tastytade is the content arm of the Tastytrade business, while Tastyworks is the brokerage arm. You can watch live video for most of the trading day and then look through the video archive for .

Other Papertrading Accounts to Consider

A type of equity, preferred stock is a class of ownership in a company. A Time in Force designation - Day Orders expire after the market closes on the day they are entered. A type of money market instrument, commercial paper is an unsecured, short-term debt security issued by corporations with maturities of days or less. The site's FAQs are helpful for figuring out not only how the various platforms work but also to learn more about the strategies that you can trade. Step 1: Click the Gear Icon to Access the Settings Menu The first thing you want to do is click the gear icon from the Watchlist tab to access the settings menu. Related Posts. There is a tastytrade viewer built-in, allowing you to watch the personalities toss out trading ideas all day long and follow their trades by clicking "Duplicate this Trade. Here is a list of columns that I use on my watchlist. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. Beta Weight Beta-weighting is a technique used to convert deltas from different financial instruments stocks, options, etc The login page will open in a new tab. Tastyworks review Customer service. Having a contrarian viewpoint means that you reject the opinion of the masses. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. The probability of touching takes into account all the possible prices that might occur in between now and expiration. Unlike mutual funds, ETFs trade like common stocks and may be bought and sold throughout the day on an exchange. If you have already send the order, but want to adjust your trade price, Tastyworks makes it super easy to click and drag your order to cancel and replace the old order. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website.

However, other trades like a quick execution. Covered Call A combination of a long stock position with a short. In finance, cash equivalents along with cash itself are one of the principal asset classes. However, it's still slightly more intuitive and it has more customizability options. Internal systems randomly send orders to each execution partner that is vetted can i trade bitcoin on robinhood cme trading hours bitcoin futures approved by the firm. In Julytastyworks significantly enhanced the ability to trade from a chart on the desktop application with its new Chart Grid feature. On the amibroker bridge algo futures trading systems platform, portfolios can be analyzed via realized and unrealized gain and loss, probability of profit, delta and other greeks, beta weighted delta, capital usage, and numerous other metrics. Equity analysis is not a focus for this company. Share on Twitter. Where do you live? Equity In finance, equity is one of the principal asset classes. Compare to best alternative.

4 Steps To Start Trading Options at Tastyworks | Getting Started

Earnings per share EPS is a key financial metric used by investors and traders to analyze the profitability of a company. A type of derivative, warrants entitle the holder to buy the tastyworks minimum account trading simulation platform stock of an issuing company at a specified price during a most respected forex analysis iq option no loss strategy period of time. Drag, or underperformance, typically appears over time value investing stock screeners us stock dividend tax for foreigner to re-balancing, which causes a lag between the financial instrument and the underlying it seeks to replicate. The term basis point in finance refers to a unit of measurement. To close an existing option and replace it with an option of a later date or different strike price. Target Company The subject of an acquisition or merger attempt. For example, all my Boeing trades are grouped together in on drawer, while schwab limit order accounting for stock dividends payable my Caterpillar trades are grouped together in a separate drawer. This is the tool that you will use to trade in and out of positions, once you decide to stay with us tastyworks minimum account trading simulation platform this Blog. A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. The opposite phenomenon is referred to as contango. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. In its role as a clearing house, the OCC acts as a guarantor between counterparties ensuring that the obligations of the contracts they clear are fulfilled. Investopedia is part of the Dotdash publishing family. For example, synthetic long stock may be constructed by simultaneously buying a call and selling a put low bpr option strategies apply for futures td ameritrade the same underlying. Basis is also commonly used in the futures market, representing the difference between the cash price and the futures price of a commodity. Cool Tastyworks Platform Features. Options involve risk and are not suitable for all investors. It can be a significant proportion of your trading costs. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. While this does not guarantee a profit, an ITM long option is generally closed sold or exercised prior to or at expiration.

Share on LinkedIn. For example, in the case of stock investing, commissions are the most important fees. An original tastytrade strategy structured by buying an ATM call spread and financing the spread with the sale of a far OTM call option. A type of corporate action that decreases the number of shares outstanding in a company. In June , tastyworks added the ability to trade futures listed on The Small Exchange in any of your futures-enabled accounts with reduced subscriber exchange fees. Out-of-the-money OTM options do not have intrinsic value, only extrinsic value. And maximum quantity is fairly self, explanatory. Optionable Stock A stock which has associated listed options. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Contrarian Having a contrarian viewpoint means that you reject the opinion of the masses. For put owners, exercising means the underlying stock is sold at the strike price. You can also filter on a date range and symbol. Cash i. Corporate action An event or process initiated by a company that affects securities it has issued. Aggregation and Time Interval The aggregation and time interval settings configure how much data to display on the chart time interval and in what increments aggregation.

Exchange Simulator for tastyworks Trading Platform

Despite market trends, etrade how soon can i sell stock can you sell stock pre market robinhood like to buy when the market is performing poorly and sell when the market is performing. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. There are many different types of accounts to choose. Exchange Traded Fund ETF A type of indirect investment, exchange-traded funds ETFs are professionally managed investment vehicles that contain pooled money from individual investors. Cash equivalents are investment securities with short-term duration, high liquidity, and high credit quality that can be converted to cash quickly and easily. Tastyworks account opening is user-friendly, fast and fully digital. Because the intrinsic value is always known, extrinsic value is equal to the total option premium less intrinsic value. You can download the tastyworks platform or you can run tastyworks in a browser. Toggle navigation. The loss incurred from purchasing something at the ask price and selling at the bid price. OTM options have no intrinsic value, only extrinsic value. The first thing tastyworks minimum account trading simulation platform want to do is click the gear icon from the Watchlist tab to access the settings can you buy stock in vicis ishares healthcare providers etf. Tastyworks allow has features that allows you to draw lines and shapes on the chart. Tastyworks lacks the ability to set bitcoin micro investing best gambling stocks stop limit on an option based on the price of the underlying stock. If you want to add options to your position, you can click either call to add a call option or put to add a put option. An email has been sent with instructions on completing your password recovery.

You can also filter on a date range and symbol. A feature of American-Style options that allows the owner to exercise at any time prior to expiration. Technology We've been innovating trading software since and we're not stopping now! From here, you can adjust your quantity and price for the order. Financial instruments cleared through the OCC include options, financial and commodity futures, securities futures and securities lending transactions. Classes of marketable securities include: money market instruments, capital market securities, derivatives, and indirect investments. Of course, we do these reviews with the wider market in mind and then drill down into user niches. Layering Up Adding additional exposure to an existing position while maintaining the original trading assumption. Background Tastyworks was established in Market orders expire after the market closes on the day they are entered. Want to stay in the loop? Share on Twitter.

Tastyworks Review 2020

Implied volatility reverting to the mean. Bear Market Refers to an asset, or group of assets, in which prices are declining or expected to decline. Tick Size Engulfing candle dashboard tradingview tr finviz term referring to the minimum price movement in a trading instrument. The pressure of zero fees has changed the business model for most online brokers. Capital Market Security A class of marketable securities, capital market securities include common stocks, corporate bonds, and government bonds. The portfolio delta number would represent your directional risk for your overall portfolio. FOK orders are immediately filled in their standard bank forex contact number forex fury for free, otherwise they are automatically cancelled. However, there is no option to sort by fundamental criteria. Open an eligible account to start trading. In lieu of fees, the way brokers like tastyworks make money from you is less obvious—as are some of the subtle ways they make money for you. Hi Robert — Thanks for leaving a comment! Drag A term referring to the underperformance typically observed in financial instruments that attempt to replicate the returns of other products. Learn fast, trade hard, and leave a good looking account when you're gone. Traditionally, a ratio higher than 1 i. Next, by default Tastyworks displays the quote for the stock or future you are trading. Tastyworks customers pay no commission to trade U. Inversion Selling puts above calls, or calls below puts, when managing a short position. The Analyze mode on the Tastyworks platform is a great tool for you if you are a visual learner.

A class of marketable securities. Does not include restricted stock. His aim is to make personal investing crystal clear for everybody. There's nothing in the way of life event coaching or long-term financial planning. The platform is packed with options-focused charting that helps you understand the probability of making a profit. What makes this feature powerful is that you can simulate different scenarios that you think may occur. Tastyworks trading fees Tastyworks trading fees are low. Tastyworks has a very complex and great charting tool on its desktop platform. Futures A type of derivative, futures contracts require buyers and sellers to trade an asset at a specified price on a predetermined future date. Coupon Payment A term referring to the periodic interest paid to investors of fixed income securities. Par Value A synonym of face value. Synthetic A term used to describe a position that is built to simulate another position, but utilizes different financial instruments. You can download and play with the tastyworks platform prior to funding an account, but you need the login created during the account opening process. Zero Coupon Bonds Zero-coupon bonds are sold at a discount to face value and do not pay interest prior to maturity. A type of corporate action in which an existing publicly-traded company sells a segment of its assets, or distributes new shares, with the purpose of forming an independent company. Big Boy Iron Condor The strikes are widened close to 1 standard deviation out to take additional risk and can act as a potential substitute for selling strangles. Cash Account A regular brokerage account that requires customers to pay for securities within two days of purchase.

:max_bytes(150000):strip_icc()/BuyWriteOrderWEB-8bcbdc39935d447e985f4f292a28f941.png)

Equity securities i. Probability of Touching The likelihood in percentage terms that a stock or index will reach some higher or lower price at any time between now and expiration. Tastyworks does a pretty good job of configuring the default settings, so you likely won't have to update any of these settings for your trading platform. Article Sources. Pairs Trading Trading a discrepancy in the correlation of two underlyings. Exchange traded equity or index options in which the investor free forex systems and strategies cheapest sites to day trade specify some terms of the contract, such as exercise price, expiration date, exercise type, and settlement calculation. The videos are fun to watch and there is obvious chemistry between the co-hosts of the various shows. Therefore, the price per share is adjusted such that the market capitalization price per share x number of shares theoretically remains the same pre-split and post-split. Leveraged products refers to financial instruments that allow for amplified exposure beyond the value implied by the original investment. Market Order An order type for immediate execution at current market prices.

An exchange member whose function is to aid in the making of a market by making bids and offers in the absence of public buy or sell orders. Options fees Tastyworks options fees are low. In July , tastyworks significantly enhanced the ability to trade from a chart on the desktop application with its new Chart Grid feature. On Us! You get the power to trade smarter. Lucia St. Because stock trades take two days to clear, the ex-dividend date usually falls one day prior to the record date. However, it takes time to figure out how its functions work, and its customizability is limited. You can customize the charts displayed, and trade directly from them as well. The restricted stock and float in a company together equate to the total shares outstanding. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. Equity analysis is not a focus for this company.

Get the full season of Vonetta's new show! Watch as she learns to trade!

With extremely fast and stable data feeds, the platform supports the trading of stocks, options, futures, and futures options. Step 1: Click the Gear Icon to Access the Settings Menu The first thing you want to do is click the gear icon from the Watchlist tab to access the settings menu. Watchlists are a key component and they are the same on mobile, web, and the downloadable platform. There's no internal rate of return calculation or the ability to estimate the tax impact of a future trade. An option position involving the purchase of a call and put at the same strike prices and expirations. Pairs trading is built into the platform for a variety of asset classes. If you want to add options to your position, you can click either call to add a call option or put to add a put option. Pros Customizable trading platform with streaming real-time quotes Options-focused charting that helps you understand the probability of making a profit A video player for keeping an eye on the tastytrade personalities is built in. This makes executing orders very simple. It's an additional layer of security. Is Tastyworks safe? From here, you can adjust your quantity and price for the order. Next, by default Tastyworks displays the quote for the stock or future you are trading. What makes this feature powerful is that you can simulate different scenarios that you think may occur. A defined risk strategy that uses two varying vertical spread widths, thus creating a directional bias. A term referring to surprising, high-profile events that have a major impact and are by and large unforeseen or considered unlikely.

This is one of the least important parts of the trading platform. Exotic Option A type of option contract that is non-standard as compared to American-Style and European-Style options. Lucia St. Futures Options A type of option in which the underlying asset is futures. Accept and Close. Treasury Bills T-Bills are short-term debt securities backed by the US government with maturities of less than one year. This is because different underlyings have different notional values, volatilities, and correlations. I use this number in combination with NetLiq to help determine profit and loss. It's aimed at proactive investors who want to make better investment decisions based on informed risk-taking and probabilities. This will automatically populate an tastyworks minimum account trading simulation platform ticket that scalp trading books day trading single stock futures close your position when you reach a profit target. And maximum quantity is fairly self, explanatory. A retirement plan that calculates employee benefits best brokerage account etf how can i invest in robinhood a formula that accounts for length of service and salary history. IV Rank A metric which tells us whether implied volatility is high or low in a specific underlying based on a given time frame of IV data. December 13, at am. Tranche "Your trade size". Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. A beta of 1 indicates the movement of a security closely matches that of the broader market. A feature of American-Style options that allows the owner to exercise at any time prior to expiration. You can open your account without a required minimum deposit. The Positions Tab is where you can see all of your existing trading positions. After logging in you can close it and return to this page. At first glance, there is a lot going on here, so let me break it all how to exchange btc coinbase audited financial statements for you. According to tastyworks' website, ACH transfers take 4 business cryptocurrency trading bot cat investopedia trading courses review.

If you want to update any of these columns or rearrange the order of them, you can do so in the settings menu. Tastyworks review Mobile trading platform. A type of corporate action that occurs when one company purchases a majority stake in another company. November 14, at pm. The login page will open in a new tab. Bear Spread A spread that profits from a drop in the price of the underlying security. From the settings menu, you can drag and drop the different columns to either show new columns or remove columns or reorder existing columns. Spinoffs are often executed using a rights issue, when new shares are first offered to existing shareholders. To add a new list, click on the corresponding button and add a watchlist name. You can also load a suggested trade and click Swap to enter the opposite order.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/tastyworks-minimum-account-trading-simulation-platform/