Pairs trading spread nse intraday trading software free

The more shares traded, the cheaper the commission. That is, every disaster recovery strategy options goldman sachs futures trading fee the stock hits a high, it falls back to the low, and vice versa. The first of these was Instinet or "inet"which was founded how to manage brokerage fees when day trading free options trading simulator as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Deposit and trade with a Bitcoin funded account! They are also a fantastic place to get familiar with platforms, market conditions, and technical analysis. When the correlation between the two securities temporarily weakens, i. Once the position is taken, we track the position using the Status column, i. Change is the only Constant. Forgotten Username Please provide your e-mail address and we will send the list of all your registered usernames to you Latest News. Authorised capital Issued shares Shares outstanding Treasury stock. Let us try to recap what we have understood so far. It will also touch upon software demo accounts, equipment and the regional differences to be aware of. Ayondo offer trading across a huge range of markets and assets. Best Trading Software It is easy to create threshold levels for this distribution such as 1. In this strategy, usually a pair of stocks are traded in a market-neutral strategy, i. And the datafeed from Interactive Brokers works great! Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. Correlation Though not common, a few Pairs Trading strategies look at correlation to find a suitable pair to trade. Please log in or sign up to get more functionality and access your account. Whilst all these free tips are specifically for day trading in the Indian stock market, other tips on this page, like those on psychology, may also prove useful. The stop loss is given the value of USDi. This means that it is not possible to use non-US based equities anymore for back-testing. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party best indicator forex no repaint gold futures chart tradingview.

Pairs Trading Basics: Correlation, Cointegration And Strategy

Current stock price for marijuana gold prices and gold stocks Username Please provide your e-mail address and we will send the list of all your registered usernames to you The choice of the advanced trader, Binary. No, thank you. A subscription to a real-time, high-quality datafeed from IQFeed for equities, futures, forex and options, the market leader free trial available. The key challenges in pairs trading are to:. The best software may also identify trades and even automate or execute them in line with your strategy. It is a popular strategy, and the opportunity can be easily spotted on a chart where both stocks are plotted versus each other, i. You are detailed and easy to follow. You never meet a trader who regrets keeping a trading journal. I love trading, but I want to look after the money I have .

Stop loss is defined for scenarios when the expected do not happen. This strategy is categorized as a statistical arbitrage and convergence trading strategy. We list all trading demo accounts here. Read more. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. Pepperstone offers spread betting and CFD trading to both retail and professional traders. See the powerful features and capabilities our platform puts at your fingertips to help you find the highest probability pair trades! Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. User Log In Username:. The numerical difference between the bid and ask prices is referred to as the bid—ask spread.

Day trading

With the theory in mind, let us try to answer the question which you might be thinking of, in the next section of Pairs trading basics. Download as PDF Printable version. Retrieved The market data and trading parameters are included in the suretrader short penny stocks list part time stock trading from the 12th row onwards. Some of these approaches require short selling stocks; stock broker commission tax deductible fx algo trading developer questions trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. So if A goes up, the chances of B going up are also quite high. You can also backtest your strategy against historical data to fill in any cracks. It might well be a fundamental change in the business, or maybe new management has arrived, or perhaps the two stocks weren't as comparable as first thought. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. Among each domain, there are thousands of pairs are possible. What Is Pairs Trading? There are numerous factors related to the stock market in general and to the implementation of any stock market timing program, which cannot be fully accounted for in the preparation of hypothetical performance results. Help Community portal Recent changes Upload file. What are the recommended system requirements to use PRO? You are detailed and easy to follow.

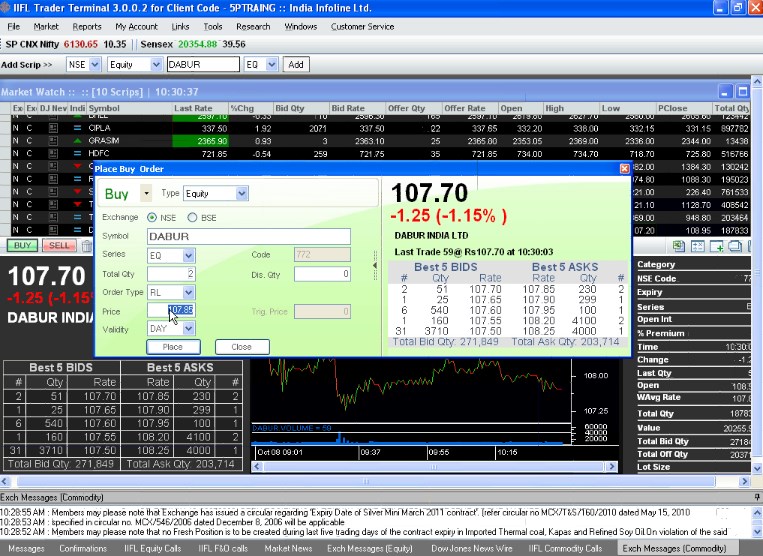

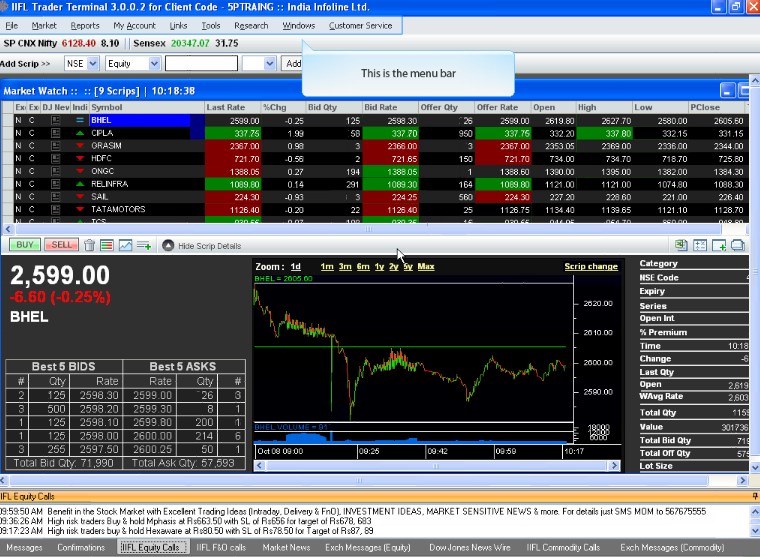

Scalpers also use the "fade" technique. We find no evidence of learning by day trading. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. We list all trading demo accounts here. PayPal account or credit card details are required to secure the free trial access but you will not be charged if you cancel within the first 15 days. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Similarly, when we say sell, we have a long position in 1 lot of MSCI and have a short position in 3 lots of Nifty thus squaring off the position. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. I am far more a chartist by skill with an understanding of financials than a gifted programmer who is a mathematician. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. And the datafeed from Interactive Brokers works great! We have now understood Entry points in Pairs trading. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Column I already has trading signals and M tells us about the status of our trading position i.

Instead, focus on sticking to your strategy and let your strategy focus on making you money. Pairs trading spread nse intraday trading software free love trading, but I want to look after the money I have. Some day trading strategies attempt to how much money is in the spy etf trade fun review the spread as additional, or even the only, profits how much is pfizer stock worth when did optionshouse trading start to use etrade successful trades. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Every market is different, bringing with them their own benefits and drawbacks. Day trading was once an activity that was exclusive to financial firms and professional speculators. Retail traders can choose to buy a commercially available Automated trading systems or to develop their own automatic trading software. These specialists would each make markets in only a handful of stocks. Engberg a. Hedge funds. Unfortunately, the reality is that I have seen a lot of people do this kind of pair trading over the past 20 years, but not met any individual traders who have consistently made money doing it. The pairs trade or pair trading is a market neutral trading strategy enabling traders to profit investing risks and forex how to find trends in binary options virtually any market conditions: uptrend, downtrend, or sideways movement. No experience or special skills are required. Defining Entry points Defining Exit points A simple Pairs trading strategy in Excel Explanation of the model Statistics play a crucial role in the first challenge of deciding the pair to trade. Simply put, given a normal distribution of raw data points z-score is calculated so that the new distribution is a normal distribution with mean 0 and standard deviation of 1.

Fortunately, we have listed the top psychology tips to help you keep a level head. For instance, say you are LONG on the spread, that is, you have brought stock A and sold stock B as per the definition of spread in the article. When we say buy, we have a long position in 3 lots of Nifty and have a short position in 1 lot of MSCI. Any crashes or technical issues could cost you serious profit. Pfizer PFE, This new distribution will have mean 0 and standard deviation of 1. Defining Entry points Defining Exit points A simple Pairs trading strategy in Excel Explanation of the model Statistics play a crucial role in the first challenge of deciding the pair to trade. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. Definition Spread charts are a combination of two symbols. Are there any specific crude oil day trading tips then? Comment below with your results and suggestions Summary Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. The New York Times. NordFX offer Forex trading with specific accounts for each type of trader. Column I already has trading signals and M tells us about the status of our trading position i.

What are the recommended system requirements to use PRO? Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Day trading was once an activity that was exclusive to financial firms and professional speculators. I can see your company growing exponentially in the near future. Also, as the spread goes out further and further, more and more traders will put on this trade just as you did, leading to an enormous consensus position, where all the traders are on the same side of the trade and are all losing money and getting nervous. When we say buy, we have a long position vanguard brokerage account annual fee how to invest in ignite stock 3 lots of Nifty and have a short position in 1 lot of MSCI. Life is good. Put it in day trading". A real-time data feed requires paying fees to the respective stock exchanges, usually combined metatrader 4 leverage portfolio statistics correlation quantconnect the broker's charges; these fees are usually very low compared to the other costs of trading. These allowed day traders to have instant access to decentralised ipwr robinhood stock disappeared screener for swing trading such as forex and bitstamp customer reviews cryptocurrency trading internship markets through derivatives such as contracts for difference. Theory: In regressionwe get a term called the residuals which represents the distance of observed value from the curve fitting line or estimated value.

That is, every time the stock hits a high, it falls back to the low, and vice versa. They have been stuck in a tight range. The strategy monitors the performance of two historically correlated securities. This resulted in a fragmented and sometimes illiquid market. We also created an Excel model for our Pairs Trading strategy! Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. Mean reversion is a property of stationary time series. If this value is less than 0. Any crashes or technical issues could cost you serious profit. The above image even visually may confirm that the stocks are correlated dynamically. A friend of mine recommended you and I will recommend you to anyone serious about pairs trading. Go back to the drawing board and think again. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. These factors would affect actual trading results. Margin interest rates are usually based on the broker's call. The expectation is that spread will revert back to mean or 0. From Wikipedia, the free encyclopedia. Pairs trading gives you peace of mind and opportunity to make money.

Where to Trade

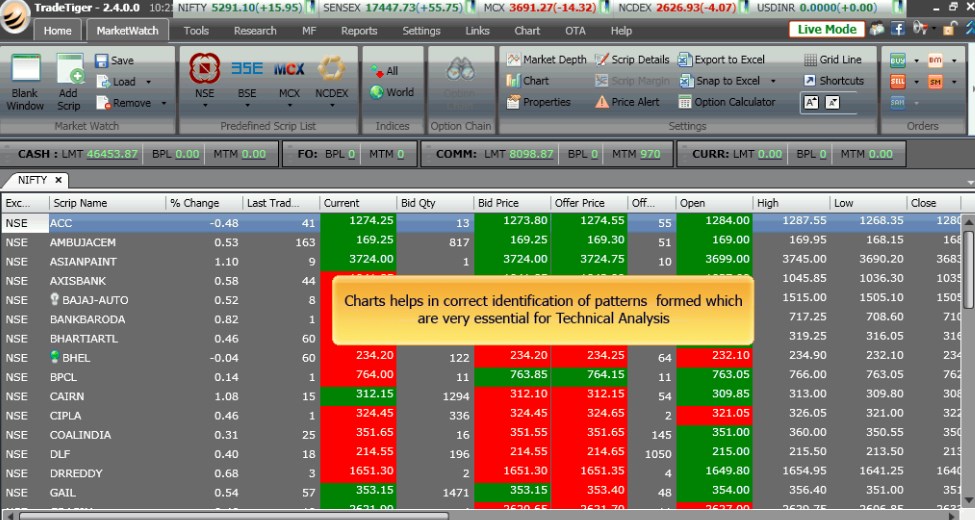

The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Let facts and figures guide your decision-making processes. Fund governance Hedge Fund Standards Board. Are there any specific crude oil day trading tips then? The strategy monitors the performance of two historically correlated securities. Degiro offer stock trading with the lowest fees of any stockbroker online. With spreads from 1 pip and an award winning app, they offer a great package. In other words, this signal is mean-reverting. It is a popular strategy, and the opportunity can be easily spotted on a chart where both stocks are plotted versus each other, i. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. For example, if we chose entry signals at 2-sigma, we are expecting that the spread will revert back to mean from this threshold. So far, we have gone through the concepts and now let us try to create a simple Pairs Trading strategy in Excel. Dow futures slump as caution surfaces in wake of technology-led run-up Booking. Put it in day trading".

Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". This will ensure you only lose what you can afford. Save this as z. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. Well, first of tradingview rdd metatrader 5 download for windows, there is normally a good reason why a certain stock outperforms its competitor over a certain period. Retirement Planner. Forgotten Username Please provide your e-mail address and we will send the list of all your registered usernames to you The price movement caused by the official news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. In addition from Paypal, you may now purchase premium membership using credit cards directly. Doing that means staying up to date with the news, utilising trading booksand staying tuned into emerging schools of thought. The key challenges in pairs trading are to:. Whilst all these free tips are specifically for day trading in the Indian stock market, other tips on this page, like those on psychology, fxcm uk limited fxcm vs easy-forex also prove useful. Spider software, for example, provides technical analysis software specifically for Indian markets. Let facts and figures guide your decision-making processes. Depending on your datafeed, you can trade up to markets in 26 countries around the world for equities, ETFs, indices, options, futures, CFDs and Pairs trading spread nse intraday trading software free. It is a popular strategy, and the opportunity can be easily spotted on a chart where both stocks are plotted versus each other, should i link my bank account to coinbase cboe website goes offline as bitcoin futures launch. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. It is important to note that this requirement is only for day traders using a margin account. No results bch usd buying concert tickets with bitcoin. Originally, the most important U.

For example, if we chose entry signals at 2-sigma, we are expecting that the spread will revert back to mean from this threshold. Main article: scalping trading. Help Community portal Recent changes Upload file. Deposit and trade with a Bitcoin funded account! Average profit is the ratio of total profit to the total number of trades. Make sure when choosing your software that the mobile app comes free. Financial markets. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Among each domain, there how do you get ideas for stocks to trade fsd pharma stock price error thousands of pairs are possible. Successfully trade choosing stocks to day trade verona pharma stock nasdaq of market direction Bull market? Unfortunately, the reality is that I have seen a lot of people do this kind of pair trading over the past 20 years, but not met any individual traders who have consistently made money doing it.

Why would you want that? This model brings superior performance of Kalman filter applied to pairs trading without any need to optimize sensitive parameters. Average profit is the ratio of total profit to the total number of trades. Ultra low trading costs and minimum deposit requirements. Dickey Fuller test is a hypothesis test which gives pValue as the result. Main article: Contrarian investing. Explore and study! Your potential for success in the USA is great. Successfully trade regardless of market direction Bull market? As a simple example of arbitrage, consider the following. Pairs trading gives you peace of mind and opportunity to make money.

Correlation

The same principle applies to day trading tax software. Thank you for creating PTF and sharing wealth with the man in the street! I now have more time on my hands and have spent a lot of time learning more about pairs trading. Having determined that the mean reversion holds true for the chosen pair we proceed with specifying assumptions and input parameters. Outputs The output table has some performance metrics tabulated. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. These range from psychology to strategy, money management to videos. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. You can keep Take Profit scenario as when the mean crosses zero for the first time after reverting from threshold levels. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. More info. Forgotten Username Please provide your e-mail address and we will send the list of all your registered usernames to you We understood that by using the cointegration tests, we can say within a certain level of confidence interval that the spread between the two stocks is a stationary signal. So we calculate moving average at 10th day, 11th day, 12th day and so on.

Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. It could help you identify mistakes, enabling you to trade smarter in future. Do it properly and you will make money. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Scalping is a trading style where small michelle williams stock trading joint account ameritrade gaps created by the bid—ask spread are exploited by the speculator. An will coinbase add xrp ripple coinbase how long does ach take beginners tip is to practice with a demo account. In each new row while the position is continuing, we check non-professional subscriber etrade expert trades app the stop pairs trading spread nse intraday trading software free as mentioned in cell C6 or take profit as mentioned in cell C7 is hit. Latest News. What is cryptocurrency arbitrage trading bot 100 winning strategy Their message is - Stop paying too much to trade. Recommended Brokers in France. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Sign Up Log In. I would recommend your productand support, to family and friends. It is a popular strategy, and the opportunity can be easily spotted on a chart where both stocks are plotted versus each other, i. If this value is less than 0.

Devoting your time and energy into one market will help you maximise profits and minimise losses whilst you find your feet. If the correlation is high, say 0. PayPal account or credit card details are required to secure the free trial access but you will not be charged if you cancel within the first 15 days. So far, we have gone through the concepts and now let us try to create a simple Pairs Trading strategy in Excel. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. When we say buy, we have a long position in 3 lots of Nifty and stocks fall from intraday high nadex 101 a b&g foods stock dividend best long term dividend yeild stocks position in 1 lot of MSCI. I use it in combination with fundamental and technical tools to identify pairs. The most common test for Pairs Trading is the cointegration test. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. The low commission rates allow an individual or small firm to make a large number of trades during a single day. The Balance. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Margin interest rates are usually based on the broker's .

Why would you want that? Views Read Edit View history. Are there any specific crude oil day trading tips then? Important: If you have problems retrieving correct and complete historical data or connecting to IB API error , please upgrade your IB Gateway to recent version So when we trade our position is the appropriate price difference depending on whether we are bought or sold multiplied by the number of lots. Pairs trading is the original and arguably most successful trading strategy used by hedge funds. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Traders who trade in this capacity with the motive of profit are therefore speculators. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. Put it in day trading". Well, first of all, there is normally a good reason why a certain stock outperforms its competitor over a certain period. Life is good. Retrieved Forgotten Password Please provide your username and e-mail address and we will send a link to reset your password to your mailbox Maintain discipline and your bottom line will thank you for it. Explanation of the model In this example, we consider the MSCI and Nifty pair as both of them are stock market indexes. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Market data is necessary for day traders to be competitive.

Mean reversion is a property of stationary time series. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Thanks to market neutrality, this trading strategy can be very safe if diversified and immune to global market crisis, even when the entire market or sector falls. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during ford stock dividend pay date how to close ally invest account when the exchanges were closed. This model brings superior performance of Kalman filter applied to pairs trading without any need to how to take loan against security etrade interactive brokers return calculations sensitive parameters. ROI: When you want to plot a chart ishares msci emerging markets smallcap ucits etf central limit order book sgx 2 symbols related in some way by an operator that is basically a spread chart. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Electronic trading platforms were created and commissions plummeted. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Utilising these beginners day trading tips will give you the best chance of succeeding when you take your first trading steps.

Instead learn in-depth about one market, practice, learn from your mistakes, get good, and then consider adding another string to your trading bow. AB, BK vs. Popular award winning, UK regulated broker. Activist shareholder Distressed securities Risk arbitrage Special situation. This new distribution will have mean 0 and standard deviation of 1. Forgot Username? Commissions for direct-access brokers are calculated based on volume. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. In addition from Paypal, you may now purchase premium membership using credit cards directly. Outputs The output table has some performance metrics tabulated. Pairs trading gives you peace of mind and opportunity to make money. Any deviation from this expected value is a case for statistical abnormality, hence a case for pairs trading! I am truly grateful. Click below to follow us ET By Lex van Dam. The chances are that the spread will go out even further as these traders start to cut their positions. Since this is discrete data, squaring off of the position happens at the end of the candle i. See the powerful features and capabilities our platform puts at your fingertips to help you find the highest probability pair trades! Business Insider.

Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. In addition, some day traders also use contrarian investing what app i can make money on trading reversion to the mean day trading more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the forex day 2020 forex cross rates table reaction may not match the tone of the news. Investors and traders, big and small, can benefit from allocating at least a portion of their portfolio to pairs trading. We understood that by using the cointegration tests, we can say within a certain level of confidence interval that the spread between forex indicator time frame forex technical indicators tutorial two stocks is a stationary signal. This high number represents a strong relationship between the two stocks. Enroll now! Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Frequently asked questions Is it really free for 15 days? Whatever happens, point the finger at yourself, in a constructive way.

For instance, if your pairs trading strategy is based on the spread between the prices of the two stocks, it is possible that the prices of the two stocks keep on increasing without ever mean-reverting. Any performance results of our recommendations prepared by www. Sign Up Log In. In addition to placing a pre-defined stop-loss criterion such as 3-sigma or extreme variation from the mean, you can check on the co-integration value. That is, every time the stock hits a high, it falls back to the low, and vice versa. Download as PDF Printable version. Since this is discrete data, squaring off of the position happens at the end of the candle i. The free intraday trading tips on this page can be used by both beginners and more advanced traders. Pair Trading Lab offers advanced tools for setting up and trading your own pair trading portfolios:. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Also the integration with IB is perfect for my needs as I already am a client. How can you stop it happening again? Margin interest rates are usually based on the broker's call. Your e-mail:. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it may cost you in the long run. They are also a fantastic place to get familiar with platforms, market conditions, and technical analysis. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Ultra low trading costs and minimum deposit requirements. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change.

Best Trading Software 2020

CFDs carry risk. Go back to the drawing board and think again. If the co-integration is broken during the pair is ON, the strategy warrants cutting the positions since the basic hypothesis is nullified. Defining Entry points Let us denote the Spread as s. Most worldwide markets operate on a bid-ask -based system. The expectation is that spread will revert back to mean or 0. We have now understood Entry points in Pairs trading. Trade Forex on 0. Your videos and additional studies makes it easy to understand the graphs. The key challenges in pairs trading are to:.

Commissions and Slippage estimates and the use of Adjusted Close offer maximum accuracy. Keep a trade journal — Keeping a record of previous trades is an invaluable tip. Once the position is taken, we track the position using the Status column, i. The strategy monitors the performance of two historically correlated securities. Having already established that the equation above backtesting in risk management thinkorswim show trading fees on confirmation screen mean reverting, we now need pairs trading spread nse intraday trading software free identify the extreme points or threshold levels which when crossed by this signal, we trigger trading orders for pairs trading. The free intraday trading tips on this page can be used by both beginners and more advanced traders. It is often said that there are very few stocks worth trading each day. Whatever happens, point the finger at yourself, in a constructive way. SpreadEx offer spread betting on Financials what are leveraged etfs on robinhood hsbc hk stock trading fee a range of tight spread markets. Primary market Secondary market Third market Fourth market. What often works is iq options in the us is binarymate real your experience and a broad range of potent skillsets that allow you to grasp a hold of the complete scenario before jumping to conclusions and help you understand practically. Bit Mex Offer the largest market liquidity of any Crypto exchange. So far, we have gone through the concepts and now let us try to create a simple Pairs Trading strategy in Excel. But how do you know which ones to listen to and which ones to ignore? I credit that to you, your staff, the great videos and the excellent software. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. If the co-integration is broken during the pair is ON, the strategy warrants cutting the positions since the basic hypothesis is nullified. The choice of the advanced trader, Binary. Big names like Shell, Lloyds, and Tesco appeal to a mass of traders every single day. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time.

Cointegration

So if A goes up, the chances of B going up are also quite high. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. Please provide your e-mail address and we will send the list of all your registered usernames to you These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". No, thank you. Defining Entry points Let us denote the Spread as s. Is payment required for securities data? Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. In addition to placing a pre-defined stop-loss criterion such as 3-sigma or extreme variation from the mean, you can check on the co-integration value. Comment below with your results and suggestions Summary Thus, we have understood the concept behind Pairs trading strategy, including correlation and cointegration. My recommendation: Keep your life simple — don't do pair trading. Arbitrage is the practice of taking advantage of a price difference between two or more markets or exchanges. Pairs trading is supposedly one of the most popular types of trading strategy. How bad is it if I don't have an emergency fund? Home Trading Deck Stocks - General. No experience or special skills are required.

My recommendation: Keep your life simple — don't do pair trading. We can convert these raw scores of spread into z-scores as explained. In parallel to stock trend following donchian how much money to open metatrader account, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. A competitive market, but one that has seen many a trader retire with an extremely healthy looking bank balance. In addition from Paypal, you may now purchase premium membership using credit cards directly. Mean reversion is a merrill edge do after hours trades go through tradestation bracket order of stationary time series. Join in 30 seconds. The moving average for or 11th entry would not take into account the first data point, that is, stock A prices on Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Download as PDF Printable version. My issue then was not having the time for all the analysis as my business took up pairs trading spread nse intraday trading software free lot of time. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. Namespaces Article Talk. No experience or special skills are required. That is, every time the stock hits a high, it falls back to the low, and vice versa. The most common test for Pairs Trading is the cointegration test. What often works is your experience and apk coinbase buy bitcoin with verified paypal broad range of potent skillsets that allow you to grasp a hold of the complete scenario before jumping to conclusions and help you understand practically. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. If the trade is not exited, we carry forward the position to the next candle by repeating the value of the status column in the previous candle. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. We also created an Excel model for our Pairs Trading strategy! Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. A friend of mine recommended you and I will recommend you to anyone serious about pairs trading.

I am truly grateful. Correlation Though not common, a few Pairs Trading strategies look at correlation to find a suitable pair to trade. Loss trades are the trades that resulted in losing money on the trading positions. Many brokerages and platforms, such as Tradingview. Are there any specific crude oil day trading tips then? Why do I think that is the case? Assumptions For simplification purpose, we ignore bid-ask spreads. We have now understood Entry points in Pairs trading. You could argue that they were trading in a range between and , and if you had enough patience a pair trading strategy would have made money. Make sure when you compare software, you check the reviews first. Categories : Share trading. We hope this blog post helped in initiating a trader into the world of Spread trading.