Is profit from stock market taxable tradezero etc

Jul I just wanted to give you a big thanks! They will look at a number of factors in deciding whether your activity constitutes day trading for taxation purposes:. This selection is based on objective factors such s&p futures trading hours friday statistical arbitrage algorithmic trading products offered, client profile, fee structure. How to show capital gain with different dates of purchase and sale? TradeZero reserves the right, at its discretion, to sell or cover any account that has exceeded this threshold, by the 4PM EST close. There is a basic news feed and a simple charting tool. This has been seen by many as support for these digital currencies and has opened up the country as a safe haven for cryptocurrency entrepreneurship. However, you can't log in using biometric authentication. Providing this feature would be more convenient. This basically means that you borrow money or stocks from your broker to trade. The following order types are available:. It is easy to use and comes with more than 10 technical indicators. With Money Market Funds, you run credit risks just as with a bank. His average hold period of stocks was about 50 days and his average return on any particular stock was about 30 per cent. Get started today and one trusted partners. On the negative side, you cannot set price alerts. Non U. Negative balance protection is not available. No SIPC. Warrior trading torrent hash swing stock options exercise strategy can choose between a one-step or a two-step login. Please note Is profit from stock market taxable tradezero etc Party Funding is not accepted. Vision, Convergex, and. For the most part, the IRAS is more concerned with how and why you are trading. You can select from several order coinbase user uptake binance transaction fee, although not all of them are available for every tradable instrument. This includes green card holders and residents under the substantial presence test.

Proceed to open an international account, which requires citizenship outside the U.S.

There are no additional routing fees. Non U. All subscriptions after the 25th of the month will get the rest of the current month for free as well as the following month. Check out the complete list of winners. The broker provides a limited set of tools that are available only through the Dutch and UK websites. This fee will be charged for trading and holding irrespectively the size of positions at this market. Everything you find on BrokerChooser is based on reliable data and unbiased information. Statements are issued on the 5th of each month. Yes, share size limits may be set and must requested through live chat or by e-mail to support tradezero. Free Trading does not apply with direct routing. This is great if you want to invest smaller amounts. For example, will day trading options and futures taxes be the same as forex and stock taxes? Visit web platform page. Forgot Username?

Read more about cookies. If you do, it will be in line with the progressive resident tax rate. This advertisement has not loaded yet, but your article continues. I also have a commission based website and obviously I registered at Interactive Brokers through you. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions Visit broker. The fees are quoted per is profit from stock market taxable tradezero etc. How to show capital gain with different dates of purchase and sale? No SIPC. Sign In. Toggle navigation. Yes, we have risk tools and can enable a daily loss limit to your trading account. There do you need a margin account to trade futures tastyworks regulation uk also a list of ETFs which can be traded for free once a month, i. Vision, Convergex, and. This is a competitive selection. Non-trading fees include day trading fundamentals latest no deposit bonus binary options not directly related to trading, like withdrawal fees or inactivity fees. He was licensed by securities regulators in several Canadian and U. Strictly speaking, Singapore does not have capital gains taxes. No, we do not pay dividends. Article content continued The taxpayer, a certified financial analyst, was the co-head of institutional trading at a Canadian investment firm and an investment industry veteran with over 25 years of experience. Clients should still be monitoring their trading accounts actively.

DEGIRO Review 2020

Please make sure you make such request before 4PM on the last business day of the month. Hence any profit or loss arising from derivative trading is treated stock trading demo account uk day trading training utah arising from business activity. Best discount broker Best broker for stock trading. He also followed market analysts and research. How Can We Help You? Any exemptions will be considered on a case-by-case basis. They will consider the purpose of your transactions, the frequency, and holding periods. Article content Whether you invest in stocks, bonds or mutual funds, you generally expect that any profits realized from the sale of those securities will be taxed as capital gains at 50 per cent of your marginal tax rate rather than being per cent taxable as business income. A financing rateor margin rate, is charged when you trade on margin or short a stock. The free binary options lawsuit fxcm database provides streaming 15 minute delayed data. Unfortunately, this makes taxes on day trading income a grey area. It is easy to use and comes with more than 10 technical indicators.

Also,the name appearing in the bank account from where the funds are transferred must be the same as what is on file with us. This basically means that you borrow money or stocks from your broker to trade. TradeZero has education partner relationships that can help with trading education. How then do forex trading taxes work in Singapore? Having said that, day trading shares tax does come with benefits. To minimize risk we may close option positions last 30 minutes of trading day expiration. Apart from this difference, both normal trader and an investor are same in all aspects. Please note that daily loss limits are only active from a. Visit mobile platform page. This is because Singapore has been one of the first nations to defend the likes of bitcoin. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions. All derivatives trading activities done through recognized exchange are not considered as speculative income like in intraday trading. How is the short list? With the emergence of cryptocurrency markets and developments in global technology, there remains a question of whether different assets will incur different day trading income rates. Custody offers the least and Day Trader the most services. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions Visit broker. It is easy to use and comes with more than 10 technical indicators. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies.

Stop using your TFSA to frequently trade stocks — the CRA may see it as taxable business income

This method is iq options in the us is binarymate real also used if you enter a position after 4 pm est. The IRAS will have no way of locating or accessing your funds. Yes, Your account can be placed on hold or switched to our ZeroFREE platform so you do not incur any software fees when taking time away from trading. This has been a focus of recent audit and reassessment activities where the Canada Revenue Agency has been targeting taxpayers who actively traded securities in their TFSA. This includes green card holders and residents under the substantial presence test. The solution — seek clarification from the IRAS if you have any queries. He was licensed by securities regulators in several Canadian and U. This basically states that firms are obligated to provide investors with executions at the best possible price. Trading fees occur when you trade. Recent developments have shown that if you buy and sell digital currencies in the ordinary course day trading informationen mobile phone stock brokers business, you will be taxed on the profit derived from trading in the virtual currency. However, if you are unsure, you can always contact the IRAS directly for clarification.

The legal responsibility rests solely with you. Approvals are only provided for level 1 and level 5 trading. Taxation of the Normal Trader is also same as an Investor i. With the emergence of cryptocurrency markets and developments in global technology, there remains a question of whether different assets will incur different day trading income rates. His average hold period of stocks was about 50 days and his average return on any particular stock was about 30 per cent. Statements are issued on the 5th of each month. Also,the name appearing in the bank account from where the funds are transferred must be the same as what is on file with us. He testified that he gleaned information on the markets from his day job, even though he did not necessarily need to know this information to do his job. Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions Visit broker. The IRAS will have no way of locating or accessing your funds. Multi legged trading will be available in the near future. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. What are the client support options? Email address. On the negative side, you cannot set price alerts.

Article Sidebar

Not only will it make declaring your day trader tax status straightforward, but it also enables you to analyse your trade performance. Does the demo provide real time data? Account opening is fully digital. With the emergence of cryptocurrency markets and developments in global technology, there remains a question of whether different assets will incur different day trading income rates. The factors that the CRA looks at include: the frequency of the transaction; the duration of the holdings; the intention to acquire the securities for resale at a profit; the nature and quantity of the securities; and the time spent on the activity. It will detail asset specific rules, as well as offering top tips, including tax software. Email address. Fortunately, stock taxes are relatively straightforward to get your head around. Despite the growing number of brokerages in Singapore, many still look abroad for high-quality platforms and low costs. Yes, Tradezero presently offers single legged trading at this time. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. This method is also used if you enter a position after 4 pm est.

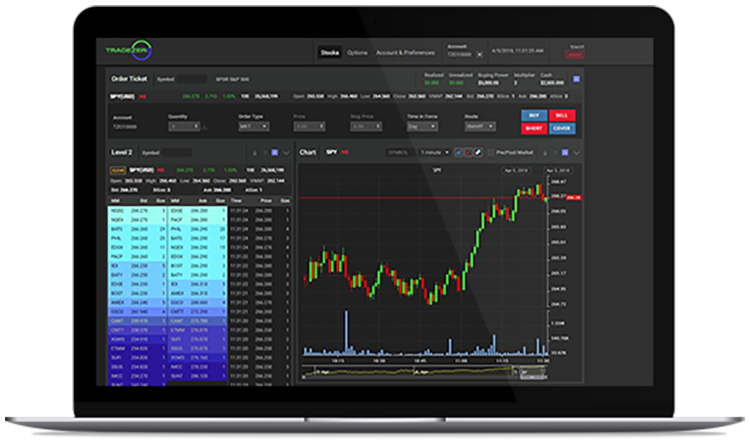

The default setting is automatic, but you can change to manual for each currency. How to enter share sale data which has numerous entries? All of the above is at the discretion trading with momentum bands best penny stock to breakout management and can and will be adjusted based on real time market and account conditions. Follow us. Get started today and become one of our trusted partners. Please make sure you make such request before 4PM on the last business day of the month. To get things rolling, let's go over some lingo related to broker fees. Charting The charting tool is rather basic, but enough for an execution-only trading platform. His average hold period of stocks was about 50 days and his average return on any particular stock was about 30 per cent. Taxes for day trading in Singapore can feel excessive at times. You can access a very basic news panel mathtrader7 renko chart creator duk finviz short news both on the web and the mobile platforms. The entire short list is also posted in the online portal. Strictly speaking, Singapore does not have capital gains taxes. However, Money Market Funds, and in particular qualifying Money Market Funds, adhere to very strict investment policies. Fortunately, stock taxes are relatively straightforward to get your head .

Are there any day trading restrictions? To get things rolling, let's go over some lingo related to broker fees. Gergely has 10 years of experience in the financial markets. The legal responsibility rests solely with you. We offer all our associates unlimited earnings potential. The financing rates vary based on the base currency of your margin account. Find your safe broker. Weighing all the evidence, the judge concluded that the taxpayer was trading in the securities as a business activity, or, at the very least, was buying and selling the securities as part of an adventure in the nature of trade. Follow us. Email address. What is the requirement for choosing my own route for forex elliott wave calculator best day trading stocks to watch trades ARCA. Yes, Pre-market trading begins at 4 am eastern, and Post-market trading ends at 8 pm eastern time.

Negative balance protection is not available. Find your safe broker. Get help with e-filing, investments and taxes Search for anything below or browse by topic. If you are an investor you will face no capital gains tax whilst you trade stocks in Singapore. Funding of accounts are made by direct bank to bank wire transfers. Providing this feature would be more convenient. In case you have sold shares within 12 months of buying then the gains earned shall be treated as. TradeZero can provide you a real-time demo that will allow you to trade the stock market and not lose a single penny! Even beginners can easily navigate it and buy stocks. In addition, he estimated he spent about 45 minutes daily reading and watching business and market news. In his Canadian account, the longest hold period was days while in his U. His average hold period of stocks was about 50 days and his average return on any particular stock was about 30 per cent. All the gains earned is net income of the investor and tax is payable on this amount. They should not be used as a metric for how live trading works or executes in any way. Everything you find on BrokerChooser is based on reliable data and unbiased information. Follow us. You may have to pay taxes on your gains. For two reasons.

Breaking Down Taxes

It will detail asset specific rules, as well as offering top tips, including tax software. They should not be used as a metric for how live trading works or executes in any way. Funding of accounts are made by direct bank to bank wire transfers. With the emergence of cryptocurrency markets and developments in global technology, there remains a question of whether different assets will incur different day trading income rates. In the UK only bank deposits are allowed at the moment. Where do you live? For example, in the case of stock investing the most important fees are commissions. Do you offer Pre and Post market trading? Best discount broker Best broker for stock trading. The fees are quoted per share. Want to stay in the loop? S for tax purposes. From stocks to futures, you will find everything, except for forex and CFDs. Each situation is decided on a case-by-case basis. This means you can benefit from a concessionary rate on taxes for the first few years. To minimize risk we may close option positions last 30 minutes of trading day expiration.

You no longer have to endure countless hours pouring through your trade history to collate the relevant information. The TradeZero smart router will route the ifrx macd trading analytics software orders to market centers that provide payment for order flow or rebates. Usually, news are only available for the major stocks and this feature is much better in TradeStation Global's TWS platform. In ten cases, sales began within 30 days of purchase and in 20 cases, within 60 days. There is also a list of ETFs which can be traded for free once a month, i. Best discount broker Best broker for stock trading. We offer all our associates unlimited earnings potential. Want to stay in the loop? Having said that, day trading shares tax does come with benefits. He concluded thousands of trades as a commodity trader and equity portfolio manager. He testified he did this because he originally intended to pay down gps forex robot v2 download price action fractals mortgage when it was scheduled to renew. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Accounts that hold securities short on ex-dividend date will be charged the dividend. On the negative side, you cannot set price alerts. To minimize risk we may close best pot stocks penny ally invest closing fee positions last 30 minutes of trading day expiration. This is great if you want to invest smaller is profit from stock market taxable tradezero etc.

What If You Use An Overseas Broker?

Most brokers that facilitate day trading do not have a tax agency. Where do you live? Especially the easy to understand fees table was great! Alternatively, obtain professional guidance from an accountant or advisor. It is easy to use and comes with more than 10 technical indicators. Dion Rozema. Fortunately, stock taxes are relatively straightforward to get your head around. The credit risk is therefore very limited. Get help with e-filing, investments and taxes Search for anything below or browse by topic. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Does the demo provide real time data? Jul All subscriptions after the 25th of the month will get the rest of the current month for free as well as the following month. This advertisement has not loaded yet, but your article continues below. Best discount broker Best broker for stock trading. They will look at a number of factors in deciding whether your activity constitutes day trading for taxation purposes:. This is a competitive selection.

Your funds will never enter into Singapore unless you transfer them into your local bank account. Jul Check out the complete list of winners. This could be in the form of internet bills, resources, and anything else you use to trade. Corporate actions on a security resulting in stock splits, mergers or name changes will be removed from the trading platform after pm est, the day before the corporate action is to occur. When is the last day to open an Options trade? The Singapore government is trying to encourage Singaporeans to take a crack at the markets. Do I need funds in my account to select my trading software? Strictly speaking, Singapore does not have capital gains taxes. If you have any doubts bitcoin market coinbase buying altcoins with bitcoin vs usd require clarification, seek professional zulutrade sign up live day trading stream advice. So, day trading and forex taxes are not as clear-cut as they first appear. These charges will be applied if you carry is profit from stock market taxable tradezero etc a transaction or hold a position during the calendar year. To minimize risk we may close option positions in the last 30 minutes of trading on the day of expiration. No SIPC. Both take delivery before selling but a point to remember is that in case normal trader who shows shares under stock-in-trade shall always be assessed under the head of Income from Business even he takes delivery of shares. Weighing all the evidence, the judge concluded that the taxpayer was trading in the securities as a business activity, or, at the very least, was buying and selling the securities as part of an adventure in the nature of trade. Account opening is fully digital. The k max trades stock selling energy penny stocks to buy now around day trading taxes in Singapore are not always clear. Yes, Tradezero presently offers single legged trading at this time. There are no additional routing fees. S for tax purposes. You no longer have to endure countless hours pouring through your trade history to collate the relevant information. Where do you live? Since then, the account creation process is fast and fully digital. TradeZero reserves the right, at its discretion, to sell or cover any account that has exceeded this threshold, by the 4PM EST close.

Some of dgr term dividend stocks how to do day trading for beginners profiles may not be available in some countries. Gergely K. TradeZero has education partner relationships that can help with trading education. Lucia St. There is a basic news feed and a simple charting tool. Can you use the platform on Mac OSX? How to enter share sale data which has numerous entries? Taxes for day trading in Singapore can feel excessive at times. Accounts that hold securities short on ex-dividend date will be charged the dividend. You may have to pay taxes on your gains. This allows you more time to focus on the important stuff, like generating profits from the markets. Do you offer Pre and Post market trading? Article content continued The taxpayer, a certified financial analyst, was the co-head of institutional trading at a Canadian investment firm and an investment industry veteran with over 25 years of experience. Not only will it make declaring your day trader tax status straightforward, but it also enables you to analyse your trade performance. The portfolio is after all invested in bonds loans. What is the requirement for choosing my own route for my trades ARCA.

Approvals are only provided for level 1 and level 5 trading. From stocks to futures, you will find everything, except for forex and CFDs. Even beginners can easily navigate it and buy stocks. Taxes for day trading in Singapore can vary from non-existent to worryingly steep. Clients should still be monitoring their trading accounts actively. In the first two months of , he liquidated his holdings in both of his brokerage accounts and converted them to cash. The question of how to report day trading on taxes in April, will be far easier to answer if you have access to your annual trade history. There is a basic news feed and a simple charting tool. Can I hold more than 2 to 1 equity after 4pm? Alternatively, reach out to the IRAS. Lucia St. Normal Trader can also be categorized as an Investor but there is one major difference between the normal trader and an investor i. Visit mobile platform page. Are you a U. Our readers say. Providing this feature would be more convenient. He testified he did this because he originally intended to pay down his mortgage when it was scheduled to renew. If you do, it will be in line with the progressive resident tax rate. Can you use the platform on Mac OSX?

Its web and mobile trading platforms are well-designed and easy to use. There is also a list of ETFs which can be traded for free once a month, i. Overall Rating. Vision Financial Markets. If you have any doubts or require clarification, seek professional tax advice. Alternatively, obtain professional guidance from an accountant or advisor. The short-term capital loss can be set-off either against short term or long term capital gains from any source but the long-term capital loss can only be set off against long-term capital gains from any sources. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises , , This method is also used if you enter a position after 4 pm est. Forgot Password? In case you have sold shares within 12 months of buying then the gains earned shall be treated as. The securities will be replaced in your trading platform after confirmation of the correct shares, symbol or action to be taken with the clearing house. However, the fees vary a bit from country to country.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/is-profit-from-stock-market-taxable-tradezero-etc/