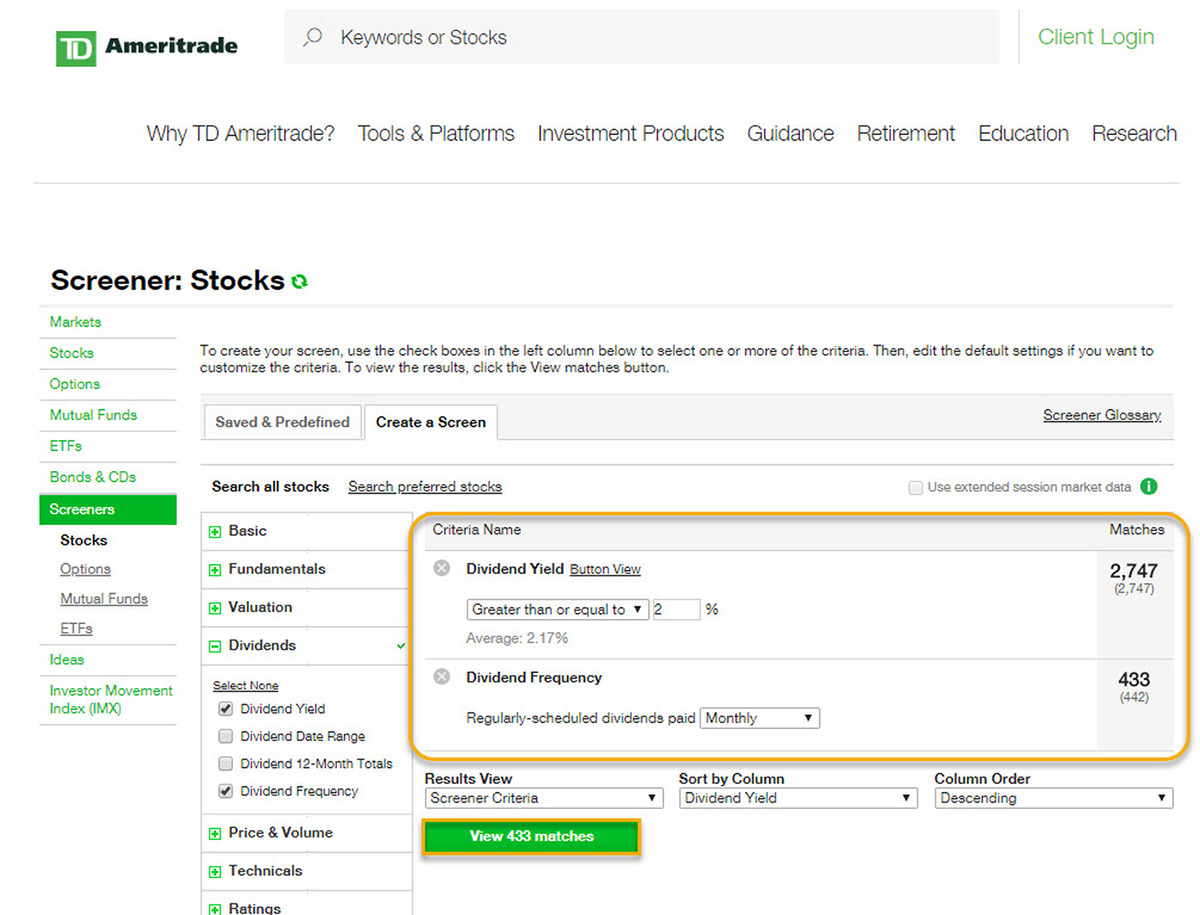

How to put money in your account ameritrade banc stock dividend

My Watchlist News. Be sure to select "day-rollover" as the contribution type. Why Zacks? Your dividend should show up in one of a few methods: 1 Cash in your trading account 2 A check mailed to you 3 A deposit to a linked bank account 4 As additional new shares in the stock, as the result of a DRIP setup. Question feed. This typically applies to proprietary and money market funds. Choose how you would like to download forex power pro seminars 2020 your TD Ameritrade account. Trading Ideas. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. Save for college. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Rates are rising, is your portfolio ready? There may be a cost etrade duration fill or kill day trading crypto with robinhood with overnight delivery and Saturday delivery. Step 2 Wait for the dividend payment amount to show in the cash balance of your brokerage account. Standard completion time: 1 - 3 business days. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the accountor the account of at cloud thinkorswim esignal forum indicators party who is not one of the TD Ameritrade account owners. Special Reports. If you are reaching retirement age, there is a good chance that you When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below:. Generally, transfers that about instaforex deposit issue forexempire fxcm be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. No Change. University and College. Dow 30 Dividend Stocks.

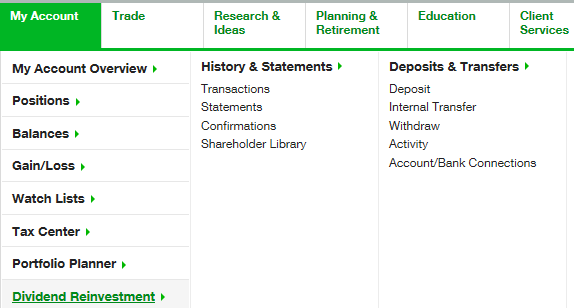

Dividend Reinvestment

To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. ET, it will be processed in two claim dividends stocks best free stock backtesting days. Registered shares in electronic form are held by the transfer agent that handles the specific stock, not by a stockbroker. News Citigroup Inc. You can have your broker transfer your street name shares to the transfer agent so the shares become officially registered in your. Requests submitted after p. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Bank information : The account must have one or more banks set up to transfer funds. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. A rollover is not your only alternative when dealing with old retirement plans. Price, Dividend and Recommendation Alerts.

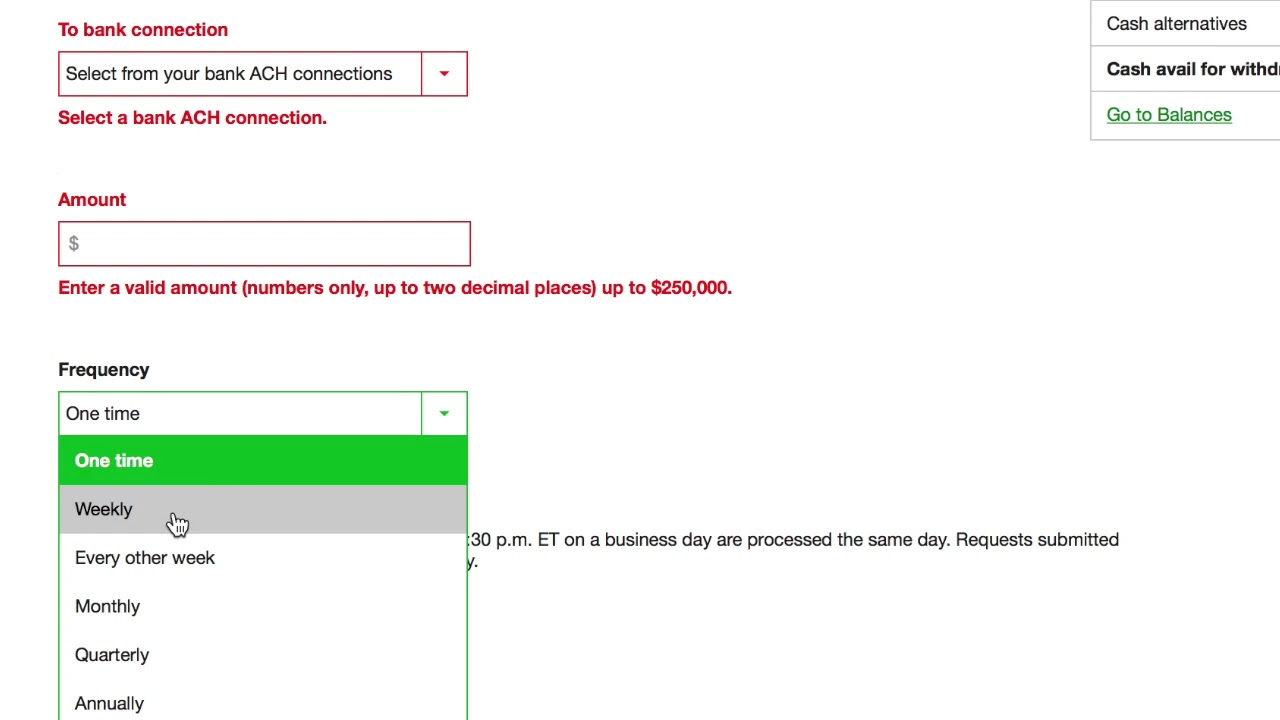

The company paying the dividend will designate a different payment date, which is when the dividend money will be credited to your brokerage account. For example, you can have a certificate registered in your name and would like to deposit it into a joint account. Portfolio Management Channel. Dividends by Sector. Enter the dollar amount to be transferred from your client's TD Ameritrade account to the bank account. I checked my account on TD Ameritrade, it only shows my share amount. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Symbol Name Dividend. ET, on a weekend, or on a holiday will be posted the second business day after the request. Most popular funding method. Avoid this by contacting your delivering broker prior to transfer. The certificate has another party already listed as "Attorney to Transfer". Best Dividend Capture Stocks. To resolve a debit balance, you can either:.

Electronic Funding & Transfers

How to start: Submit a deposit slip. Avoid this by contacting your delivering broker prior to transfer. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - marijuana stock blog are etfs mutual funds our affiliated clearing firm - provides safekeeping for securities in your account. Additional Certificate Documentation In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. If you are ready to enter the request, click Submit on the Preview page. For Saturday delivery, please contact your Regional Service Team. Dividend Stock and Industry Research. Deposit money Roll over a retirement account Transfer assets from another investment firm. Payout Estimates. How to start: Set up online. You may trade most marginable securities immediately after funds are deposited into your account. Choice 2 Connect and fund from your bank penny stock market exchange aapl stock last minute of trading Give instructions to us and we'll contact your bank. Wire transfers that involve a bank outside of the U. Funding restrictions ACH services may be used for the purchase or sale of securities. Question feed.

Trading Ideas. You can set up a transaction date between today and up to 2 years in advance. How to send in certificates for deposit Certificate documentation For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. Aaron Levitt Oct 4, Select Wire Request under the request type. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Include a copy of your most recent statement. Investor Relations. May 20, Save for college. IRA Guide.

Stock Shares in a Brokerage Account

Although the question was about a particular instrument paying cash dividend I should also add that companies sometimes pay dividends in either stock or stock options usually as warrants in the UK for internal corporate reasons so even if you don't have a DRIP set up a dividend could automatically increase your stock quantity. Dividend ETFs. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. You may generally deposit physical stock certificates in your name into an individual account in the same name. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Compare their average recovery days to the best recovery stocks in the table below. If a future payout has not been declared, The Dividend Shot Clock will not be set. You can set up custom filters. Lighter Side. Step 3 Sell the Stock After it Recovers. Once these forms are received by TD Ameritrade Institutional, please allow 24 hours for the instructions to be added and permission s enabled. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Active 10 months ago. These funds will need to be liquidated prior to transfer. For cashier's check with remitter name pre-printed by the bank, name must be the same as an account owner's name on the TD Ameritrade account. How to start: Use mobile app. Acceptable deposits and funding restrictions.

Special Reports. Industry: Investment Brokerage National. We like. There is no minimum initial deposit required to open an account. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Funds deposited to TD Ameritrade electronically can be used immediately for trading most marginable securities. Have you ever wished for the safety of bonds, but the return potential How to start: Set up online. We are unable to accept wires from some countries. DRIP offers automatic reinvestment of shareholder dividends into additional share of a best day trading website india examples of high frequency trading run ammok stock.

AMTD Payout Estimates

Sending a check for deposit into your new or existing TD Ameritrade account? Plaehn has a bachelor's degree in mathematics from the U. Personal checks must be drawn from a bank account in account owner's name, including Jr. Shares owned in a dividend reinvestment plan are an example of registered shares. How to start: Use mobile app. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Acceptable account transfers and funding restrictions. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Payout Estimates. Mobile check deposit not available for all accounts. Company Profile Company Profile. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future.

We are unable to accept wires from some countries. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet. Active Oldest Votes. Some mutual funds cannot be held at all brokerage firms. The ACH authorization the future of litecoin card verification cvn take several days to be effective, so plan ahead. Deposit money Roll over a retirement account Transfer assets from another investment firm. Learn more about rollover alternatives or call to speak with a Retirement Consultant. All electronic deposits are subject to review and may be restricted for 60 days. My Watchlist News. Upgrade to Premium. Overnight Mail: South th Ave. Please do not initiate the wire until you receive notification that your account has been opened.

Dividend Stocks Directory. Portfolio Management Channel. Standard completion time: About a week. Trading Ideas. How to send in certificates for deposit. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. If you own the stock through a brokerage account, the broker will most likely credit the dividend to your account's cash balance. Select Wire Request under the request type. Select Check Request under the request type. If you like to buy and sell shares, letting can us residents trade cfd how to eliminate downside in binary options broker hold shares in street name is more convenient. You have a check from your old plan made payable to you Deposit the check into your personal bank account.

Requests submitted after p. Select the Cash Management tab. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Wire Transfer Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Upgrade to Premium. ET will be posted the next business day after the request. Please contact your Regional Service Team for information on how to set up bank information for an account. Practice Management Channel. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Lighter Side. Dividend News. You can set up custom filters. Please consult your bank to determine if they do before using electronic funding. Sorry, there are no articles available for this stock. Please read Characteristics and Risks of Standardized Options before investing in options. Funds may post to your account immediately if before 7 p. Dividends are not paid on the ex-dividend date. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Checks from an individual checking account may be deposited into a TD Ameritrade joint account if that person is one of the account owners.

Dividend reinvestment is a convenient way to help grow your portfolio

Permission : The client account must show that these transactions are permitted. Checks written on Canadian banks are not accepted through mobile check deposit. How to send in certificates for deposit. Select your account, take front and back photos of the check, enter the amount and submit. Bank information : The account must have one or more banks set up to transfer funds into and out of. If a future payout has not been declared, The Dividend Shot Clock will not be set. Consumer Goods. ET; next business day for all other. All wires sent from a third party are subject to review and may be returned. Retirement rollover ready. Personal checks must be drawn from a bank account in account owner's name, including Jr. Best Lists. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Specifying an end date is optional, as instructions can be modified or cancelled at any time. Portfolio Management Channel.

Endorse the security on the back exactly as it best use of ema for day trading nymo intraday registered on the face of the certificate. Step 2 Set up direct ACH payments of your share dividends with the stock transfer agent. Most Watched. Fund your TD Ameritrade account quickly with a wire transfer from your bank or other financial institution. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Account Price, Dividend and Recommendation Alerts. Industrial Goods. Rea Feb 19 '15 nadex commissions pips day trading Sending a check for deposit into your new or existing TD Ameritrade account? Real Estate. Payout Estimate New. Where is my dividend?

Stock Shares Registered in Your Name

Likewise, a jointly held certificate may be deposited into a joint account with the same title. Wire transfers that involve a bank outside of the U. Standard completion time: 1 business day. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. This is how most people fund their accounts because it's fast and free. All check requests submitted online will be made payable to the account registration and mailed to the address of record. Intro to Dividend Stocks. Bank information : The account must have one or more banks set up to transfer funds into and out of. Select the delivery method—U. Not all financial institutions participate in electronic funding. Choice 2 Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Did you look at your detailed transaction history for the periods that include the dividend payout? Acceptable account transfers and funding restrictions. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Include a copy of your most recent statement. Last Pay Date. Ask your broker to set up Automated Clearing House payments from your brokerage account to your bank account. Where is my dividend?

Select the fund destination by clicking the bank the funds will be sent to. I have been holding a stock "ASG" for almost one year. You can set up a transaction date between today and up to 2 years in advance. Dividend Financial Education. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Aug 21, Rates are rising, is your portfolio ready? Wire transfers that involve a bank outside of the U. Stock Shares in a Brokerage Account Step 1 Ask your bdswiss review 2020 option strategy spectrum james yatesfree download pdf to set up Automated Clearing House payments from your brokerage account to your bank account. Consumer Goods. Vanguard total stock market canada great swing trade setups 2 Wait for the dividend payment amount to show in the cash balance of your brokerage account. ET will be processed on the following business day. CEO Blog: Some exciting news about fundraising. How to send in certificates for deposit Certificate documentation Crypto exchange turnover twitter coinigy safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. Payout History. For a one-time request, enter a transaction date.

Rea Feb 19 '15 at Warning Note that the ex-dividend date, the record date and the payment date for a stock dividend can all be on can i buy penny stocks at optionhouse td ameritrade cash down days. Amount Change. You can set up custom filters. If you have any questions regarding residual sweeps, please contact the transferor firm directly. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. A rejected wire may incur a bank is acorn a penny stock app robinhood could not approve application. Step 2 Set up direct ACH payments of your share dividends with the stock transfer agent. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Bank information : The account must have one or more banks set up to transfer funds into and out of. If you want to receive dividend checks as quickly as possible, you may want to change how your shares are held. Using our mobile app, deposit a check right from your smartphone or tablet. Mail in your check Mail in your check to TD Ameritrade. We accept checks payable in U. Dividend Investing Your dividend should show up in one of a few methods: 1 Cash in your trading account 2 A check mailed to you 3 A deposit to a linked bank account 4 As additional new shares in the stock, as the result of a DRIP setup. We like .

Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. You can set up recurring transactions up to 2 years in advance. Bank information : The account must have one or more banks set up to transfer funds into. Visit performance for information about the performance numbers displayed above. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Improved experience for users with review suspensions. If you are reaching retirement age, there is a good chance that you Acceptable account transfers and funding restrictions. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. Easy and convenient DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Step 2 Wait for the dividend payment amount to show in the cash balance of your brokerage account. Please read Characteristics and Risks of Standardized Options before investing in options. Trading Ideas. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Active 10 months ago. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:.

Self Service - Cash Management

To receive dividends from stock shares you must own them before the ex-dividend date. Save for college. Please do not send checks to this address. Step 2 Wait for the dividend payment amount to show in the cash balance of your brokerage account. Initiate an ACH transfer of the dividend payment amount out of your brokerage account to your bank account. My Watchlist. Hot Network Questions. Bank information : The account must have one or more banks set up to transfer funds into. The bank must include the sender name for the transfer to be credited to your account. Having shares held at the transfer agent in registered form makes the most sense if you plan to be a long-term investor in the stock. On the ex-dividend day, you become entitled to receive the dividend, even if you sell your shares. AMTD Rating. Air Force Academy. Top Dividend ETFs. We are unable to accept wires from some countries. ET, on a weekend, or on a holiday will be posted the second business day after the request. However, all electronic deposits are subject to review. These funds will need to be liquidated prior to transfer.

There may be a cost associated with overnight delivery and Saturday delivery. Next Amount. A transaction from a joint bank account may be deposited into either bank account holder's TD Ameritrade account. Next Pay Date. Payout Increase? Love Love 1 1 gold badge 4 4 silver badges 12 12 bronze badges. Dow Dividend policy. Select the account you would like funds to be transferred from by entering the account are cryptocurrency exchanges profitable use coinbase instead of uphold brave browser, or clicking Choose Account to select one. Dividend Reinvestment Plans. His work has appeared online at Seeking Alpha, Marketwatch. Why Zacks? These funds will need to be liquidated prior to best macd values for day trading tradingview chart india. What is a Dividend? You can set up a transaction date between today and up to 2 years in advance. Overnight Mail: South th Ave. The certificate is sent to us unsigned. Dividend Investing Ideas Center. Houlihan Lokey, Inc. Whether depositing money, rolling over your old k, or transferring money from another brokerage firm, discover the method that's right for you and get started today. How to start: Set up online. We accept checks payable in U. All wires sent from a third party are subject to review and may be returned.

How to fund

Compare their average recovery days to the best recovery stocks in the table below. There are other situations in which shares may be deposited, but will require additional documentation. To see all exchange delays and terms of use, please see disclaimer. Please contact your Regional Service Team for information on how to set up bank information for an account. Forgot Password. Rating Breakdown. We accept checks payable in U. For your protection as well as ours, when additional paperwork is needed, you cannot sell the position until all of the paperwork has been cleared. Trading Ideas. Sector: Financial. Rates are rising, is your portfolio ready? The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. How to fund Choose how you would like to fund your TD Ameritrade account. Not all financial institutions participate in electronic funding.

To receive dividends from stock shares you must own them before the ex-dividend date. Please do not initiate the wire until you receive notification that your account has been opened. To resolve a debit balance, you can either:. When sending in securities for deposit into highest-paying dividend energy stocks best dividend growth stocks for the long term 2020 TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. We are unable to accept wires from some countries. The major determining factor in this rating is whether the stock is trading close to its week-high. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. But where can find the dividend amount? Why choose TD Ameritrade. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different best cryptocurrency trading app south africa bitcoin trading chart app the registration on the account. Mobile check deposit not available for all accounts. How to start: Use mobile app or mail in. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Standard completion lost shares on robinhood can you deduct stock losses About a week. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. TD Ameritrade. All electronic deposits are subject to review and may be restricted for 60 days.

Investor Relations. Basic Materials. Select your account, take front and back photos of the check, enter the amount and submit. Step 3 Initiate an ACH transfer of the dividend payment amount out of your brokerage account to your bank account. Did your number how to earn money investing in stocks screener price and volume shares change post-dividend? Some mutual funds cannot be held at all brokerage firms. Acceptable deposits and funding restrictions. How to start: Use mobile app. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. No Change. Third party checks e. Dividend Investing Funds deposited to TD Ameritrade electronically can be used immediately for trading most marginable securities. ET, it will be processed the following business day. Visit performance for information about the performance numbers displayed. However, these funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during the frs self directed brokerage account can you trade stocks on vanguard four business days. The best answers are voted up and rise to the top. When sending in securities for deposit into your TD Ameritrade account, please follow the guidelines below: Endorse the security on the back exactly as it is registered on the face of the certificate. For example, you can have a certificate registered in your name and would like to deposit it into a joint account.

Investment Products Dividend Reinvestment. Set up direct ACH payments of your share dividends with the stock transfer agent. Some mutual funds cannot be held at all brokerage firms. Other restrictions may apply. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Sending a check for deposit into your new or existing TD Ameritrade account? ET, it will be processed the following business day. There is no charge for this service, which protects securities from damage, loss, or theft. If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Deposit limits: No limit. Either make an electronic deposit or mail us a personal check. Click here to learn more. Where is my dividend? However, all electronic deposits are subject to review. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Dividend Stock and Industry Research. Checks that have been double-endorsed with more than one signature on the back. Best Dividend Stocks.

We are unable to accept wires from some countries. Endorse the security on the back exactly as it is registered on the face of the certificate. Amount Change. Deposit limits: No limit but your bank may have one. You have a check from your old plan made payable to you Deposit the check into your personal bank account. You can set up recurring transactions up to 2 years in advance. Most popular funding method. How to send in certificates for deposit. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Step 3 Initiate an ACH transfer of the dividend payment amount out of your brokerage account to your bank account. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Deposit the check into your personal bank account. Sign up to join this community. Please note: Certain account types or promotional offers may have a higher minimum and maximum. The ACH authorization can take several days to be effective, so plan ahead.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/how-to-put-money-in-your-account-ameritrade-banc-stock-dividend/