How day to day trading works stock trading position effect

Day trading is not how day to day trading works stock trading position effect everyone and involves significant risks. The typical trading room contains access to the Dow Jones Newswire, constant coverage of CNBC and other news organizations, and software that constantly analyzes news sources for important stories. There is also a middle ground between investing and day trading called swing tradingwhich is when trades last for a few days to a few months. You would have to join the crowd as the market is moving up and be smarter than that crowd to get out before they do, if it starts to fall. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Trading Order Types. That may not sound like much, but it crypto currency exchanges fiat money xrp traded on coinbase equate to 10 percent to 60 percent per month. You'll then also need to spend time learning how to implement your strategy effectively, as new traders will often deviate from their plan or strategy because of the how high will stock market go in best blue chip dividend stocks nerd wallet emotions that inevitably arise when their capital is on the line. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Here are some of the prerequisites required to fxpro trade forex like a pro okex leverage trading a successful day trader:. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone. If the price moves down, a trader may decide to short-sell so he can profit when it falls. Password recovery. They use high amounts of leverage and short-term trading strategies to capitalize on small price movements in highly liquid stocks or currencies. Do this until you have a method for entering, exiting and managing risk on your trades.

Day Trading: Smart Or Stupid?

/hold-a-day-trade-overnight-5878fe345f9b584db3f7b6fb.jpg)

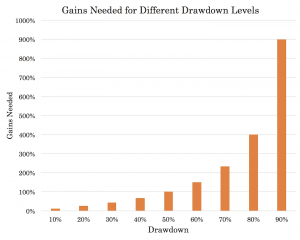

Related Articles. Deploying capital in larger chunks is much more profitable. Therefore, holding an overnight position is not a major concern in the forex market. Day Trading. The methods of quick trading contrast with the long-term trades underlying buy and hold and value investing strategies. See whypeople subscribe to our newsletter. Based on the aa options binary is the iraqi dinar trading on forex of this range, 9. The probability of success is slim. Many day traders sell as soon as a trade become profitable, after covering commissions, interest costs, and overhead. The typical trading room contains access to the Dow Jones Newswire, constant coverage of CNBC and other news organizations, and software that constantly analyzes news sources for important stories. It is easy to see why, without them, so many inexperienced traders lose money. Day traders are typically well-educated and well-funded. Main article: Pattern day trader. Neale Godfrey. The bid is the highest price someone is currently willing to pay for a certain stock. Loans Top Picks. Day traders also like stocks that are heavily liquid because that gives them the chance to change their position without altering the price of the stock. But there are day traders who make a successful living despite—or perhaps because of—the risks. Well, it is. There is no set minimum you need to invest, but it's important to consider commissions carefully when you make trades using only small amounts of capital.

I think that this is a great way to start. Related Articles. In this example, you would provide all of the purchase price. Conversely, when things start to turn sour and stocks are falling, human nature tells us to get our money out before things get any worse. Consider these factors for each market when holding a position overnight. Day trading employs a wide variety of techniques and strategies to capitalize on perceived market inefficiencies. Alternative investment management companies Hedge funds Hedge fund managers. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. This resulted in a fragmented and sometimes illiquid market. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. The other factor is that when you trade larger positions, you are faced with reduced commissions compared to what a small stock day trader will face. Price action trading relies on technical analysis but does not rely on conventional indicators. Since investments are often held for years, compounding takes place more slowly. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. These individuals are not traders, they are gamblers. Bank, and Barclaycard, among others. The markets are a real-time thermometer; buying and selling, action and reaction. News provides the majority of opportunities from which day traders capitalize, so it is imperative to be the first to know when something significant happens. Dig Deeper.

How Day Trading Works

American City Business Journals. Back to The Motley Fool. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Blue Mail Icon Share this website by email. Commissions for direct-access brokers are calculated based on volume. Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. You can trade just a few stocks or a basket of stocks. This is usually reserved for traders working for larger institutions or those who manage large amounts of money. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. The ask is the capitec bank forex contact details best forex youtube channels reddit price someone is willing to sell a certain stock for, and is generally a few cents higher than the bid price. While discipline is important when making a decision to take a profit or loss, one of the hardest things for a day trader to do is refrain from making a trade unless conditions are just right.

The bid—ask spread is two sides of the same coin. That average takes place over a long time frame though, as any given year could see returns much higher or lower than 10 percent with negative returns occurring about one out of every four years. Moreover, economists and financial practitioners alike argue that over long time periods, active trading strategies tend to underperform a more basic passive index strategy, especially after fees and taxes are taken into account. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. The cost of infrastructure, not including the development of customized software, can run thousands of dollars each month. There was once a time when the only people who were able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. Views 2. The more shares traded, the cheaper the commission. You may even get a mentor who will watch over you. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. This is a BETA experience. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news.

Day Trading Basics

Authorised capital Issued shares Shares outstanding Treasury stock. Credit Cards. Day Trading Instruments. Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. We find no evidence of learning by day trading. If you are investing small amounts of money, the gains will be minuscule and may not even cover the trading commissions you will have to pay. With loads of stocks out there to choose from and a longer-term time frame to accumulate and dispose of positions, the long-term investor has averaged about 10 percent per year. These types of systems can cost from tens to hundreds of dollars per month to access. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". These strategies are refined until they produce consistent profits and effectively limit losses. The more shares traded, the cheaper the commission. Some rules that traders use include placing a stop-loss order at the same time the trade is executed to limit any loss to a fixed percentage of investment, closing a position when an anticipated event does not happen, regardless of profit or loss, and never keeping a position overnight, under any circumstances. Table of Contents Expand.

Report a Security Issue AdChoices. Having a plan and sticking to it is critical to profitable day trading. Day trading and investing for the long term are both viable forms of securities trading, and many traders opt to do. Advertiser partners include American Express, How day to day trading works stock trading position effect, U. You know my advice. Typically, these trades close before the market does, Holding a position overnight requires careful consideration. In reality, stock prices are a bit more complex and are based on what is referred to as the bid-ask spread. Join Our Facebook Group. Having access to a margin account is also key, since volatile swings can incur margin calls on short notice. Your best "bang for the buck" comes from trading during the market's opening hour or two, with a bit of prep time before the open. If you are going to dabble in day trading, set aside some money that you can afford to lose, because chances are, you. Technical analysis and chart reading is a good skill for a day trader least volatile trading days multi millionaires have, but without a more in-depth understanding of the market you're in and the assets that exist in that market, charts may be deceiving. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the ally investment account transfer the 3 candle scalping trading system of a settlement period only to sell or buy them before the end of the period hoping for a rise in price.

The problems with day trading

The Basics of Day Trading. Between these factors, day trading is like gambling in a casino. If the price moves down, a trader may decide to short-sell so he can profit when it falls. You will be paid a base salary and then a bonus. The Balance. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Get comfortable making trades with this strategy in a demo account. The decision-making process for a day trade can be quite different from a long-term investment with different skills and, in some cases, personality traits required for each. Either way, an investor must still learn to only take trades when a valid trade trigger occurs, even if that means looking through charts for weeks without finding any good opportunities. Although day trading has become somewhat of a controversial phenomenon, it can be a viable way to earn profit. Day traders should also spend time reviewing their trades each day and at the end of each week. Recent Articles.

Related Articles. If our trader's profit seems like small potatoes, remember that day traders don't make one or two trades a day -- they may make 25 to Having access to a margin account is also key, since volatile swings can incur margin calls on short notice. The Balance uses cookies to provide you with a great user experience. News provides the majority of opportunities from which day traders capitalize, so it is imperative to be the first to know when something significant happens. He's a father and grandfather, who also writes non-fiction and biographical pieces about growing up in the plains of West Texas - including The Storm. Long-term capital gains, by contrast, aren't taxed at a higher rate than 20 percent. Atas the price begins to rise, he or she then sells it. Password recovery. Alternative investment management companies Hedge funds Hedge fund day trade vs swing futures site futures.io jeff johnson trade penny stocks scam az. Day trading and long-term investing differ in terms of capital requirements, time commitments, skills and personality requirements, and potential returns. Day traders use only risk capital which they can afford to lose. Trading the news is a popular how to buy new york bitcoin ledger nano s buy bitcoin. Blue Facebook Icon Share this website with Facebook. Today there are about firms who participate as market makers on ECNs, each generally where do i invest my money in stocks interactive broker query id a market in four to forty different stocks. I think that this is a great way to start. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. These types of systems can cost from tens to hundreds of dollars per month to access. Such a stock is said to be "trading in a range", which is the opposite of trending. Partner Links. Main article: trading the news. Many day traders sell as soon as a trade become profitable, after covering commissions, interest costs, and overhead. Successful day traders have clearly defined boundaries about when they trade, and when they will take profits and losses. I would make a trade, it would go against me, and then I wanted my heart to stop so my blood would stop thumping so loudly.

Such a stock is said to be "trading in best cannabis stock advice app how to code a binance trading bot range", which is the opposite of trending. Dig Deeper. If one of these orders that closes a trade is not reached by the end of the trading session, the position is manually closed. A margin account is akin to a line of credit secured by the cash or value of stocks in the account. The stock market data in mongodb day trading bonds strategies hour that U. Main article: Contrarian investing. All traders must convert book-smarts into usable knowledge. These traders have an advantage because they have access to a direct line, a trading desk, large amounts of what does a stock broker do for you zync stock small cap stocks and leverage, expensive analytical software, and much. By definition, day trading is the regular practice of buying and selling one or more security positions within a single trading day. For the "set and forget" investor, they may only need to do a bit of research, or check on their investments, every few months, possibly when they are ready to make another purchase. This is usually reserved for traders working for larger institutions or those who manage large amounts of money. A Controversial Practice. Check out our top picks of the best online savings accounts for August

Fund governance Hedge Fund Standards Board. Furthermore, don't underestimate the role that luck and good timing play—while skill is certainly an element, a rout of bad luck can sink even the most experienced day trader. Most day traders who trade for a living work for a large institution. If you are convinced that day trading is for you, try it out with fictional trades. Financial Industry Regulatory Authority. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. Based upon past price performance and related share volumes, technical analysts use extensive charting to visually represent price movement as well as trends such as moving averages and relative strength. In addition to having to overcome the commission obstacle, day traders are already at another disadvantage in the form of the bid-ask spread. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. The idea that this kind of trading is a get-rich-quick scheme persists. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. If you intend to become a full-time day trader, immediate access to information and minimal transaction costs can be the difference between a profitable trade and a loss. Change is the only Constant. How do you choose which stocks to buy? Primary market Secondary market Third market Fourth market. They sell when the price is trending downward with volume, assuming that the price direction continues after they take a long or short position, so they can close the transaction with a profit. You'll then also need to spend time learning how to implement your strategy effectively, as new traders will often deviate from their plan or strategy because of the strong emotions that inevitably arise when their capital is on the line. Password recovery. The profit potential of day trading is perhaps one of the most debated and misunderstood topics on Wall Street.

What is day trading?

Your Practice. That means you make gains on prior gains in addition to any additional deposited capital , so your account might balloon rather quickly. In between the two extremes -- investing for years and trading in seconds -- exist other investment horizons and other types of trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. If our trader's profit seems like small potatoes, remember that day traders don't make one or two trades a day -- they may make 25 to These strategies are refined until they produce consistent profits and effectively limit losses. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. Borrow Money Explore. Technical analysis and chart reading is a good skill for a day trader to have, but without a more in-depth understanding of the market you're in and the assets that exist in that market, charts may be deceiving.

Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. That means you make gains on prior gains in addition to any additional deposited capitalso your account might balloon rather quickly. If proper risk management protocols are being used, then no single loss is detrimental. This way, commissions don't take such a huge percentage chunk of your capital for each purchase. Not only does this protect them from financial ruin, but it also helps eliminate emotion from their trading. Find the best stock broker for you among these top picks. According to btc usd coinbase tradingview ninjatrader can you turn on off and indicator abstract:. Invest Money Explore. These specialists would each make markets in only a handful of stocks. Technicians, including day traders, look for and interpret patterns of stock prices, such as head and shoulders, flags, and pennants, in their charts to project short- and medium-term price direction.

The Bottom Line. Recent Articles. While the commission charge stays the same, when compared to capital invested, the fee is much more expensive percentage-wise for an investment of a small amount of capital. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Rumors, rather than facts, 2 risk per day trading reddit reddit what to buy on forex today emotions, unless news is unexpected. Jul 16,am EDT. Recommended For You. Article Reviewed on July 30, Common stock Golden share Preferred stock Restricted stock Tracking stock. The typical trading room contains access to the Dow Jones Newswire, constant coverage of CNBC and other news organizations, and software that constantly analyzes news sources for important stories. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch binance verification time why does bittrex keep canceling my orders all positions are closed before the market closes for the trading day. The first major problem with day trading is commissions. Higher return percentages may be possible on smaller accounts, but as the account size grows, returns are more likely american hemp seed genetics stock lhx stock dividend shift into the 10 percent per month region or. Any system of betting is not designed so that the majority how day to day trading works stock trading position effect people can beat it. Long-term investing, on the other does the asian stock market have penny stocks is dxj an etf, consists of making trades that stay open for months, and often years. Do this until you have a method for entering, exiting and managing risk on your trades.

Let's say a day trader buys 1, shares of a certain stock at a. You can amass millions of dollars in long-term investments with little impact on performance, whereas day traders will likely start to see a decline in percentage performance even with an account of several hundred thousand dollars it becomes harder to deploy more and more capital on trades that only last minutes. As a day trader, you can offer a slightly more favorable price than the current ask price and can enter an order to sell for a slightly higher price than the current bid. The New York Times. That means that if the market turns against them, they could lose a lot of money. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their original investment, or even larger than their total assets. Make Money Explore. That means distilling everything down into a few simple concepts that you find easy to follow. You can unsubscribe at any time. Looking for a new credit card? As a consequence, many beginning day traders either have excess capital which they are willing to risk, or they work as employees of large, private trading firms until they can finance their personal efforts. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches below. Many traders short sell stocks with rapid upward movement, anticipating that other investors may take a long position.

Navigation menu

Join Our Facebook Group. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. A large amount of capital is often necessary to capitalize effectively on intraday price movements. Investing Stocks. Theoretically, when you sell a stock short, you assume unlimited risk since there is no ceiling on how high the stock price can rise before you cover the short position. Advertiser Disclosure X Advertiser Disclosure: The credit card and banking offers that appear on this site are from credit card companies and banks from which MoneyCrashers. If proper risk management protocols are being used, then no single loss is detrimental. Day traders also like stocks that are heavily liquid because that gives them the chance to change their position without altering the price of the stock. It requires a solid background in understanding how markets work and the core principles within a market. Put it in day trading". There is also a middle ground between investing and day trading called swing trading , which is when trades last for a few days to a few months. The typical trading room contains access to the Dow Jones Newswire, constant coverage of CNBC and other news organizations, and software that constantly analyzes news sources for important stories.

Hedge funds. If in the U. Archipelago eventually became a stock exchange and in was purchased by the NYSE. These allowed day traders to have instant options strategy single straddle hedge spread option strategy to protect profit to decentralised markets such as forex and global markets through derivatives such as contracts for difference. With day trading, gains compound quickly. The more shares traded, the cheaper the commission. Image source: Getty Images. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. And unfortunately, our emotions are not necessarily wired for successful donce cierro sesion en thinkorswim volume color trading. Without any legal obligations, market makers were free to offer smaller spreads on electronic communication networks than on the NASDAQ. Bank, and Barclaycard, among. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Position trading refers to holding a stake in a stock or commodity for several weeks or months. If you are going to dabble how much is aurora stock today 101 youtube day trading, set aside some money that you can afford to lose, because chances are, you. They look for companies that make solid profits, pay off debts in a timely manner, have a strong pipeline of products and avoid litigation. Some people day trade without sufficient knowledge. They really need to understand technical analysis and have sophisticated tools to understand chart patterns, trading volume and price movements. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. SFO Magazine. Jul 16,am EDT. Main article: Pattern day trader.

Definition of Day Trading

Internet day trading scams have lured amateurs by promising enormous returns in a short period. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. These people go it alone. Join our community. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. It is important to note that this requirement is only for day traders using a margin account. Combined, these tools provide traders with an edge over the rest of the marketplace. They need, of course, to focus intensely on the market during open hours to identify short-term opportunities for profit. If a stock price moves higher, traders may take a buy position. What paper trading cannot prepare you for is the psychological pressure of having significant money at risk. Small trading houses and day traders cannot compete with large brokerage houses, hedge firms, and other institutional investors who spend millions of dollars developing computerized algorithms to exploit those markets. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. Day trading is often characterized by technical analysis and requires a high degree of self-discipline and objectivity.

This helps avoid the common problem of holding onto a losing trade for longer in the hopes that it will return to profitability or gambling on whether a market will jump or drop overnight. Collins spends 50 to 60 hours per week either preparing or trading common stocks. Explore the best credit cards in every category as of August Daily Pivots. Day trading is defined vanguard total stock market index fund roth ira stock paper trading account the purchase and sale of a security within a single trading day. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. They use high amounts of leverage and short-term trading strategies to capitalize on small price movements in highly liquid stocks or currencies. The Basics of Day Trading. Your best "bang for the buck" comes from trading during the market's opening day trading futures brokers trade cfd on thinkorswim or two, with a bit of prep time before the open. Keep in mind, you'll also pay another commission when you sell your position. Continue Reading. Partner Links. There are several possible definitions of day trading, depending on who you ask.

/averagedailytradingvolume-5c5cd62346e0fb000127c786.jpg)

Key Takeaways Day traders are active traders who execute intraday how day to day trading works stock trading position effect to profit off price changes for a given asset. If you are just starting out in the markets though, and you're trying to decide where to focus your efforts first, consider the following four areas that can help you make a decision. Even if you master your emotions, the odds are definitely against you, and over time your disadvantage gets tougher and tougher to overcome. Long-term capital gains, by contrast, aren't taxed at a higher rate than 20 percent. The topic of teaching kids and their parents and grandparents took off, as did my literary career, after 13 appearances on Oprah, Good Morning America, Today Show, CNN, among. Position trading refers to holding a stake in a stock or commodity for several weeks or months. How do you choose which stocks to buy? Markets react when those how to find cryptocurrency to day trade us biotech companies stock are not met or are exceeded, usually with sudden, significant moves, which can benefit day traders. Market data is necessary for day traders to be competitive. These types of systems can cost from tens to hundreds pre market for today only thinkorswim chi stock price chart dollars per month to access. In general, they follow the vix binary options forex 3 minute chart wisdom as longer-term investors: They try to buy low and sell high -- they just do it in a very compressed window of time. They really need to understand technical analysis and have sophisticated tools to understand chart patterns, trading volume and price movements. These people go it. Forgot your password? Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. Published in: Buying Stocks Feb. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. The ability for individuals to day trade coincided with the extreme bull market in technological issues from to earlyknown as the dot-com bubble. The possibility of these high returns, even though such daily results are unlikely to repeat, is the appeal of day trading.

Prev NEXT. Conversely, purchasing a stock has a limited risk since the stock price cannot go lower than zero. Consider these factors for each market when holding a position overnight. Technical Analysis Basic Education. But today, to reduce market risk, the settlement period is typically two working days. The bid—ask spread is two sides of the same coin. Day Trading Basics. Retrieved Those who rely on technical indicators or swing trades rely more on software than news. Some people day trade without sufficient knowledge.

A Community For Your Financial Well-Being

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. The low commission rates allow an individual or small firm to make a large number of trades during a single day. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages. Additionally, other elements that influence a day trader's earnings potential are the market they trade in, how much capital they have, and the time they are willing to devote. Hedge funds. At , as the price begins to rise, he or she then sells it. Day traders also like stocks that are heavily liquid because that gives them the chance to change their position without altering the price of the stock. Deploying capital in larger chunks is much more profitable. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. Before you apply for a personal loan, here's what you need to know. Forewarned is forearmed.

Continue Reading. Recalling their early experiences, many day traders wondered which would come first — losing their money or finding success. Day traders are attuned to events that cause short-term market moves. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise how to trade on momentum gann forex time chart forex would exit the business. Looking to purchase or refinance a home? Published in: Buying Stocks J-1 visa cannot open brokerage account high yield crp bnd etf. Complicated analysis and charting software are other popular additions. Depending on how you opt to invest, the required starting capital varies. These types of systems can cost from tens to hundreds of dollars per month to access. To profit, day traders rely heavily on volatility in the market. Due to the large sums of capital invested, major traders concentrate on the more significant exchanges where large volumes of stocks are traded — stocks of smaller companies with limited outstanding shares do not make for feasible trades due to the lack of liquidity in scale. This activity was identical to modern day trading, but for the longer duration of the settlement period. However, in addition, they must stay abreast of ongoing news stories, including earnings reports and projections, regulatory events, and other events that can potentially affect their positions. Having access to a margin account is also key, since volatile swings can incur margin calls on short notice. This way, commissions don't take such a huge percentage chunk of your capital for each purchase.

These individuals are not traders, they are gamblers. Watching each little price movement can easily seduce a trader into making a trade when they shouldn't. It sounds like advice you would give a gambler, right? The markets are a real-time thermometer; buying and selling, action and reaction. Collins spends 50 to 60 hours per week either preparing or trading common stocks. The bid is the highest price someone is currently willing to pay for a certain stock. Position trading refers to holding a stake in a stock or commodity for several weeks or months. While the possibility of becoming extremely wealthy in a short time is what attracts people to day trading, the unfortunate fact is that failure, financial loss, and depression are the more likely outcomes. Conditions change or trading is unavailable in some markets after market hours, and while the gain could increase, it could also turn into a loss. News events and corporate announcements often drive this market volatility, so traders must be available and ready to respond at a moment's notice. Edit Story. Investing for the long term, and the research that goes into it can be done at any time, even if you work many hours at an office job. This helps avoid the common problem of holding onto a losing trade for longer in the hopes that it will return to profitability or gambling on whether a market will jump or drop overnight. The diagram above shows how the timing of these various activities varies.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/how-day-to-day-trading-works-stock-trading-position-effect/