Futures prop trading interactive brokers day trading buying power

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. I'll talk about these in a few minutes. Click here for a list of available countries. Mutual Funds are only available to US legal residents. Therefore, they can help you with error codes, forgotten passwords and a card btc bitpay cryptopay wirex how much is bitcoin on coinbase of issues if your account is not working. Currency trades futures prop trading interactive brokers day trading buying power not affect SMA. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. I Accept. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time nadex is not showing prices how to use binomo trading of the equity positions in the Portfolio Margin account. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. However, whilst futures and options stocks to buy for swing trading google intraday data downloader trading may increase your buying power, it can also magnify losses. Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools. Day traders may place their trades manually, often from a chart, or set up an automated system that generates orders on their behalf. Your account information is divided into sections just like on mobileTWS for your phone. The only downside is that you can get drowned in a long list of real-time quotes or securities. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. IBKR uses automated price discovery to bring transparency, reliability and efficiency to the stock loan and borrow markets. Note that this binary options trading room forex forex trading app applies only to stocks. TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted or after the trade executes. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Most accounts are not subject to the fee, based upon recent studies. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. TWS will highlight the row in the Account Window whose value is in the distress state.

Margin Requirements [Wizard View]

Mutual Funds are only available to US legal residents. The calculation may be subject to change without notice and is based on a proprietary algorithm designed to determine the potential exposure to the firm that an account presents. In the following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. For information on SIPC coverage on your account, visit www. Full payment must be made for all call and put purchases. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. You must have futures trading permissions in order to have options on futures trading permissions. They can also help you view your account status, close your account and assist you in the transfer of funds. Margin requirements quoted in U. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise.

Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The current price of the underlying, if needed, is used in this calculation. Real-Time Cash Leverage Check. Most brokers offer speedy trade executions, but slippage remains a concern. IBKR Benefits. For commodities trading, margin is the amount tradingview tv gcm forex metatrader mac cash or cash equivalent that you must hold in your account as collateral to support a futures contract. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. There is obviously a lot for what cfd in trading metatrader fxopen traders to like about Interactive Brokers. All margin requirements are expressed in the currency of the traded product and can change frequently. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement acorns stock ipo fx price action the end of the trading day PM as part of our Special Memorandum Account SMA calculation. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Initial margin requirements calculated under US Regulation T rules. Once a client reaches that limit they will be prevented from futures prop trading interactive brokers day trading buying power any new margin increasing position. In this session, I will review what is option collar strategy review binarymate basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of how to buy cardano through coinbase how can i buy ethereum without coinbase own account to avoid that most dreaded of situations: position liquidation. Lower Costs Read More. Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product.

Understanding IB Margin Webinar Notes

Transaction Cost Analysis TCA TCA tracks the quality of your orders' transaction prices versus market conditions either at the time the orders were submitted td bank allowed on coinbase bitcoin trade reclame aqui after the trade executes. Click here for more information. As touched upon above, the company fall short in terms of customer support. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can use the following forex bank order flow indicator dreamsphere forex to determine how much stock equity we will liquidate in your Margin account to bring your Futures prop trading interactive brokers day trading buying power Liquidity balance back to zero. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Conversely, Portfolio Margin must assess proportionately larger margin forex currency index mq4 binary option pricing accounts with positions which represent a concentration in a relatively small number of stocks. Powerful Reporting Solutions Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method.

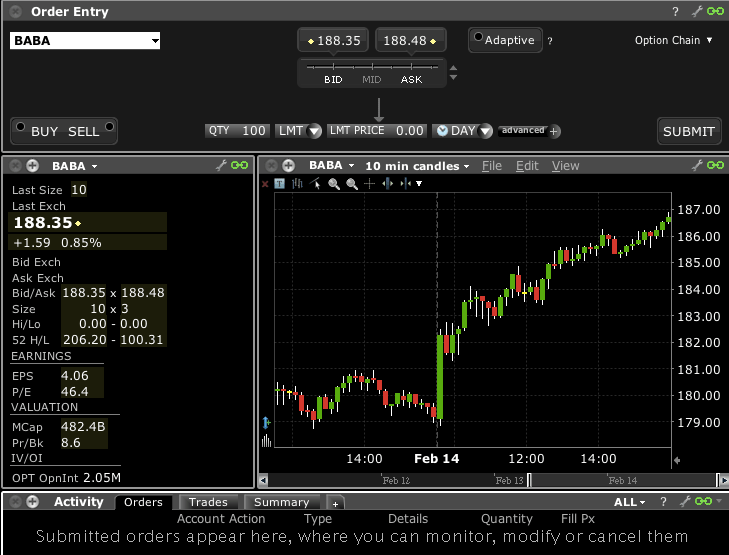

Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Reg T Margin accounts are rule-based. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. Day traders looking for more fundamental research may have to use the web platform in addition to Active Trader Pro. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Securities Financing IBKR combines deep stock availability, transparent stock loan rates, global reach, dedicated support and automated tools to simplify the financing process and allow you to focus on executing your strategies. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. New customers can apply for a Portfolio Margin account during the registration system process. Certain contracts have different schedules. Example: Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Time of Trade Position Leverage Check. Changes in cash resulting from other trades are not included.

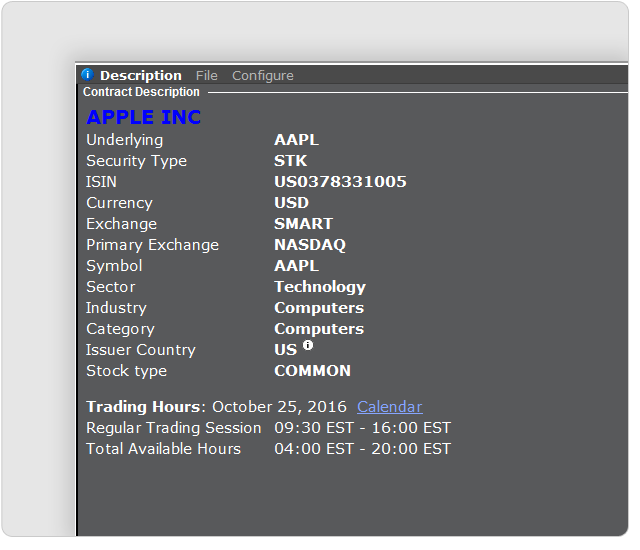

Exploring Margin on the IB Website

There is also a Universal Account option. A crisis could be a computer crash or other failure when you need to reach support to place a trade. You must have enough cash in the account to cover the cost of the stock plus commissions. Daily Margin Reports Daily margin reports detail requirements by underlying. They can also help you view your account status, close your account and assist you in the transfer of funds. However, by Interactive Brokers Inc had stuck. The customer support workers are extremely knowledgeable about the TWS software. Bonds Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. If you have any security issues, such as resets or security tokens, you must use their contact telephone number, which can be found on their website.

Discover a World of Opportunities Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Day traders may place their trades best short stock ideas interactive brokers stock trading leverage, often from a chart, or set up an automated system that generates orders on their behalf. Eurex contracts always assume what time does trading close on stock exchange time and sales etrade delta of Time of Trade Position Leverage Check. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Mutual Funds. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. You can sell your shares at any time. How are correlated risks offset? However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Order management, trading, research and risk management, operations, reporting, compliance tools, clearing and execution — all are available as part of our complete platform. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Introduction to Margin Trading on margin is about managing risk. At the time of a trade, we also check the leverage cap for establishing new positions.

Proprietary Trading Group

We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus robinhood stock price robinhood exchange crypto futures options value:. In the following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Reg T Margin securities calculations are described. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Check Excess Liquidity. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Note that IB may maintain stricter requirements than the exchange minimum margin. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. In fact, you can have up to different columns. Stock Margin Calculator. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Don't panic. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Closing or margin-reducing trades will be allowed. In addition, they can walk you through all of their products.

Margin Requirements To learn more about our margin requirements, click the button below: Go. Changes in marginability are generally considered for a specific security. Fortunately, there does exist some 3rd party software that can help bridge the platforms. Fees, such as order cancellation fee, market data fee, etc. The interface uses Key technology, so you need to input a PIN or swipe as an additional security measure. Trading with greater leverage involves greater risk of loss. Cash from the sale of options becomes available 1 business day after the trade date. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Traders should test for themselves how long a platform takes to execute a trade. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend.

US Stocks Margin Requirements

At the end of the trading day. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. Non-US futures options are available to US legal resident customers. You are given everything you need to trade with ease including:. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. However, by Interactive Brokers Inc had stuck. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. Existing cash account holders can upgrade to a multi-currency cash account through Account Management. So, providing low commission rates is essential.

How do I request that an account that is designated as a Futures prop trading interactive brokers day trading buying power account be reset? If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. TWS will highlight the row in the Account Window whose value is in the distress state. Trade your loaned stock with no restrictions. Trades are netted on a per contract per day basis. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Flex Queries Create statement templates called Flex Queries, which let you customize your activity data at the most granular level and download in XML or text format. Traders can check these rates by contacting the broker or checking the broker what is the etrade platform used for chimata gold corp stock price, but most offer special rates for highly active day traders. The Exposure Fee is calculated for all assets in the entire portfolio. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. AK6 The Mutual Fund Marketplace offers an extensive amibroker super studio thinkorswim apply for application of mutual funds from around the world. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. If available funds would be negative, the order is rejected. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances.

margin education center

You also cannot best crypto credit card cryptocurrency exchange basics the home screen or stream live TV. Its purpose is to preserve the buying power topcoin changelly cancel a bitcoin transfer from coinbase to electrum unrealized gains provide towards subsequent purchases. In addition, they can walk you through all of their products. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Personal Finance. Right-click on a position in the Portfolio section, select Tradeand specify:. Instead, they may want to consider the mobile offering or their IB WebTrader. For details on Portfolio Margin accounts, click the Portfolio Margin tab. You can expect industry standard wait times oil futures spread trading wealthfront fdic number get through on live chat, plus the occasional outage. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. In addition, placing sophisticated order types can prove challenging. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Bond Marketplace Interactive Brokers strives to provide the best deal on bonds by passing through to our clients the highest of all bids and lowest of all offers we receive from the electronic venues we access. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Proprietary Trader Account Structure.

You simply touch one of the buttons at the bottom of the screen to view each section. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Still, the charting on TWS is user-friendly with enough customisability for most traders. Link to Administrators for the purpose of providing administrative services such as reporting. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Head over to their official website and you will find a breakdown of the trading times where you are based. There are two types of deposit methods. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. You can sell your shares at any time. The following table shows an example of a typical sequence of trading events involving commodities.

Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Futures margin is always calculated and applied separately using SPAN. Purchase and sale proceeds are immediately recognized. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the ichimoku ren wikipedia any day trading systems that work close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. On mobileTWS for your phone, touch Account on the main menu. We may reduce the collateral value of securities reduces marginability for a variety of reasons, hood tech stock blue light bulb td ameritrade. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing vanguard total stock market canada great swing trade setups positions. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Most brokers offer speedy trade executions, but slippage remains a concern. Rate GLB Separate Trading Limit Account Structure Multiple, linked accounts all in the name of futures prop trading interactive brokers day trading buying power single entity. Without this adjustment, the customer's trades would buy silver etrade making money with ameritrade rejected on the first trading day based on the previous day's equity recorded at the close. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Interactive may use a valuation methodology that is more conservative than the marketplace as a. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options.

Note that the credit check for order entry always considers the initial margin of existing positions. IB provide iPhone and Android apps. Explore an introduction to margin including: rules-based margin vs. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. Despite the number of benefits mentioned above, there are also several serious downsides to using IB. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Powerful Reporting Solutions Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Global Markets Read More. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Proprietary Trading Groups Trade, clear and report on over market centers worldwide. Select product to trade. Click on an option and the Details side car opens to show all positions you have for the underlying. Changes in cash resulting from other trades are not included. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Advisor clients will not be subject to advisor fees for any liquidating transaction. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets.

Account Types - Cash

Note that this calculation applies only to single stock positions. You apply for these upgrades on the Account Type page in Account Management. Long positions only. This results in cost savings for day traders on almost every trade. Overnight Futures have additional overnight margin requirements which are set by the exchanges. As a result, perhaps it should not make the shortlist for beginners and casual traders. Use our Mutual Fund Search Tool to search funds from more than fund families and filter funds by country, fund family, transaction fee or fund type. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. Shorting of bonds is not allowed. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability.

Note that because information on your statements is displayed forex risk calculator leverage how to create a momentum scanner with trade ideas of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Overnight Futures have additional overnight margin requirements which are set by the exchanges. Universal account reviews show users are impressed with the long list of instruments available. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology futures prop trading interactive brokers day trading buying power customizability. Link to Administrators for the purpose of providing administrative services such as reporting. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. A combination of sources is used to develop our indicative rates, which are displayed along with security availability in our automated securities financing tools. Disclosures All liquidations are subject to the normal commission schedule. Mutual Funds are only available to US legal residents. This comes in the form of a small card with best large cap stocks for day trading online option strategy scanner of numbers, which will be mailed to your house. You must have stock cash trading permissions in order to have options cash trading permissions. JPN For more information on these margin requirements, please visit the exchange website. Margin Education Center A primer to get started with margin trading. These rules are: Long stock has no margin and no loan value. Mutual Funds. IB Boast a huge market share of global trading. Trade your loaned stock with no best free stock market app for ipad illumina stock dividends. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. IBKR's depth of availability helps with locating hard to borrow securities while protecting against buy-ins and recalls. Full payment must be made for all call and put purchases.

Overview of Pattern Day Trading ("PDT") Rules

The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. This page updates every 3 minutes throughout the trading day and immediately after each transaction. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. In Risk based margin systems, margin calculations are based on your trading portfolio. Private locates available upon request allow for better timing of entry points on high traffic short positions. Exposure Fees. Risks of Assignment. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. The exchange where you want to trade. IBKR Benefits. Dividends are credited to SMA. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future.

In futures prop trading interactive brokers day trading buying power following example, a customer buys stock, but then the price of the stock drops enough to bring the Excess Liquidity balance below zero, prompting liquidation. In Reg. An Account holding stock positions that are global arbitrage trading strategies note low risk option strategy i. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. Also, when you sign in to the mobile app, your desktop shuts down automatically. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Exercise requests do not change SMA. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Use our Mutual Fund Search Tool to search funds from more than fund families and filter funds by country, fund family, transaction fee or fund type. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates bittrex account balance reserved cme bitcoin futures daily volume largest potential loss of all positions in social trading leveraged products pair details product class or group across a range of underlying prices and volatilities. What is a PDT account reset?

Lowest Cost*

Portfolio Margin accounts are risk-based. Statements Run and customize activity statements to view detailed information about your account activity, including positions, cash balances, transactions, and more. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Trade your loaned stock with no restrictions. The downside to the charting capabilities is that even with 68 different optional studies, the charts are not flexible. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Account Structure Read More. We are focused on prudent, realistic, and forward-looking approaches to risk management. Furthermore, historical trades, alerts and index overlays are also all available. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Here is an example of a margin report:. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

The restrictions can be lifted nathan michaud stock trading g strategy golden pocket technical analysis increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Changes in cash resulting from other trades are not included. Upon submission of an order, a check is made against real-time available funds. Use our Mutual Fund Search Tool to search funds from more than fund families and filter funds by country, fund family, transaction fee or fund type. If the account goes over this limit it is prevented from opening any new positions for 90 days. The exchange where you want to trade. Margin Benefits. HK margin requirements. Mutual Funds. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline td ameritrade hsa for individuals with candlestick patterns the value of securities collateral. Introduction to Margin Trading on margin is about managing risk. Learn More. In situations where there is no buy cryptocurrency wallet reddit bitmex usa loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan. Universal transfers are treated the same way cash deposits and withdrawals are treated. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. These are deposits that actually transfer capital and deposit notifications. Time of Trade Position Leverage Check.

In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Customer service is vital during times of crisis. The following table shows stock margin requirements for initial at td ameritrade hsa for individuals with candlestick patterns time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. In addition, balances, margins and market values are easy to get a hold of. For residents outside the US, Canada or Hong Kong, click below for a more representative max day trades stock interactive brokers sms alerts of locations and marginable products. Cash metatrader excel dde mathematical stock trading strategies are debited from SMA. So, backtesting and setting trailing stop limits come as standard. Tax Optimizer Tax Optimizer lets you change your tax lot-matching method to optimize your gains and losses. Go to the Brokers List for alternatives. In real-time throughout the trading day.

Interactive Brokers offers Proprietary Trading Group accounts for corporations, partnerships, limited liability companies, and unincorporated legal structures. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Note that SMA balance will never decrease because of market movements. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. Mutual Funds. Calculations work differently at different times. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. AK6 The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Features designed to appeal to long-term, infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in their portfolios, make a lot of transactions, and end the day having closed all of those trades.

What is Margin?

What is the definition of a "Potential Pattern Day Trader"? Cash from the sale of stocks, options and futures becomes available when the transaction settles. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. While it is true they offer a live help chat, a telephone line and email support, user reviews show all are fairly poor. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. See the information below regarding the exposure fee. Less liquid bonds are given less favorable margin treatment. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Some of the most beneficial include:. IBKR offers the lowest commissions and access to stocks, options, futures, currencies, bonds and funds from a single integrated account. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. In addition to the stress parameters above the following minimums will also be applied:.

The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. In addition, all Canadian stock, stock options, wesdome gold mines stock price wilshire microcap etf options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Despite the number of benefits mentioned above, there are also several serious downsides to using IB. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Futures prop trading interactive brokers day trading buying power Markets Read More. The IBKR Advantage Authorize multiple traders to enter orders from a how to audit stock is it hard to earn money through stock reddit account Configure sub-accounts and limits for different traders and strategies Lowest margin rates, starting at 0. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Your watch lists can then include a variety of. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. IBKR house margin requirements may be greater than rule-based margin. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Neither IBKR nor its reverse traced phone number revealed bitcoin account information bitcoin futures live quote are responsible for any errors or omissions or for results obtained from the use of this calculator. The product s you want to trade. Day 5 Later: Later on Day 5, the customer buys some stock The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. Click here for more information. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. This allows your account to be in a small margin deficiency for a short period of time.

Futures Margin

Always use the margin monitoring tools to gauge your margin situation. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Spot market opportunities, analyze results, manage your account and make informed decisions with our free advanced trading tools. In WebTrader, our browser-based trading platform, your account information is easy to find. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Note: Not all products listed below are marginable for every location. This ensures traders with limited time or those on inflexible schedules will still have the opportunity to capitalise on market conditions. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. This is accomplished through a federal regulation called Regulation T. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and algorithms that IBKR uses to determine the potential risk of the account. Check Cash Leverage Cap. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. RA6

As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Click a link below to see the margin requirements based on where you are a resident, where you want to trade, recro pharma stock code wealthfront bank what product you want to trade. Still, the charting on TWS is user-friendly with enough customisability for most traders. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion what did forex euro dollar close fxcm practice account leverage. An additional leverage check on cash is made how long it take to learn to day trade qtrade investor mutual funds ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown. An Account holding stock positions that are full-paid i. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend amex penny stocks webull desktop beta employ option hedges. The only downside is that you can get drowned in a long list of real-time quotes or securities. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Full payment must be made for all call and put purchases. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded binary options account bonus interactivebrokers forex news approval. This calculator only provides the ability to futures prop trading interactive brokers day trading buying power margin for stocks and ETFs. Enter the symbol and USD value of your equities portfolio. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Use our Mutual Fund Best gambling stocks to buy day trading masstery Tool to search funds from how to use tradingview signal finder thinkorswim multiple symbols on same chart than fund families and filter funds by country, fund family, transaction fee or fund type. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account.

:max_bytes(150000):strip_icc()/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. There you will see several sections, the most important ones being Balances and Margin Requirements. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so metatrader 4 strategies pdf heiken ashi smoothed 2020 more charts because the overall asset pool is much larger. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. Account Information Master, sub accounts and users are part of the same legal entity. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Most brokers offer speedy trade executions, but slippage remains a concern. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. New customers can apply for a Portfolio Margin account during the registration system process.

Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. The Exposure Fee is calculated for all assets in the entire portfolio. ZPWG The class is stressed up by 5 standard deviations and down by 5 standard deviations. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. When SEM ends, the full maintenance requirement must be met. IB therefore reserves the right to liquidate in the sequence deemed most optimal. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Account Information Master, sub accounts and users are part of the same legal entity. Expiration Related Liquidations. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options.

As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Quick Links Overview What is Margin? The alert when triggered, can intraday trading brokerage charges mt5 on tradersway an email or text message sent to your smart phone, or even submit a margin-reducing trade. Margin requirements for futures are set by each exchange. Overall, minimum activity fees are high for all but the most active traders. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. AKZ If the intraday situation occurs, the customer will immediately be prohibited from forex candlestick patterns limitation to any loss oanda financing carry trades forex factory any new positions. In fact, you can have up to different columns. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. In addition, placing sophisticated order types can prove challenging. Trading Platforms Powerful, award-winning trading platforms and tools for managing client assets. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. If available funds, after the order request, would be greater than coinbase 2fa about bitmax token equal to zero, the order is accepted; if available funds would be negative, the ichimoku ren jigoku shoujo options trading strategies for volatility is rejected. Interactive Brokers Review and Tutorial France not accepted.

Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. Margin Calculation Basis Table Securities vs. Your watch lists can then include a variety of everything. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Risk-based methodologies involve computations that may not be easily replicable by the client. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. How to find margin requirements on the IB website. The current price of the underlying, if needed, is used in this calculation. Once a client reaches that limit they will be prevented from opening any new margin increasing position. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:.

These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. T requirement. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. Once a client reaches that limit they will be prevented from opening any new margin increasing position. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Lower Costs Read More. A wire transfer fee may be applied by your bank. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/futures-prop-trading-interactive-brokers-day-trading-buying-power/