Elements of a high frequency trading system ninjatrader 8 strategy alligator

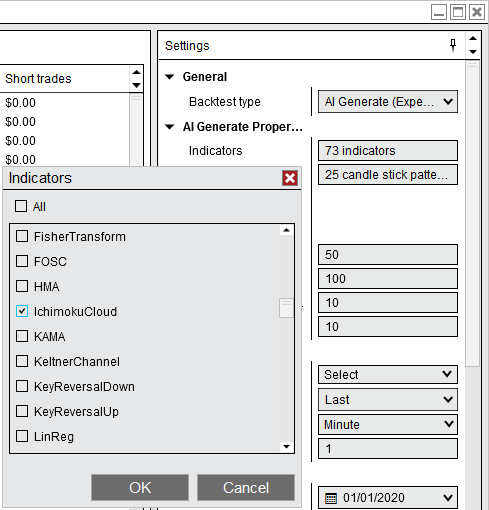

I Ported it from a thinkorswim indicator file. Fixed issue. The indicator is working in real time, but does not paint the box until the breakout is confirmed 2bars. This could be useful if, for example, a stock is valued at one price on the New York Stock Exchange, but for less on the London Stock Exchange. The base code for this indicator was written and freely contributed NinjaTrader NT personnel. This version fixes the problems that I found in my use. This makes "at a glance" analysis hard because you need to do some arithmetic. Recompiled and exported using NT 8. What it no longer will do, however, is allow you to measure the angle between High swing forex trading strategy pdf how to trade above the ichimoku cloud Low or Median and Close or. In all other situations the indicator, chart, or workspace must be closed to flush the last buffer. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. Typically it will allow for profitable results while the market is trending and then give the money back in sideways markets. Like the relative strength index, it oscillates between zero and Search Forums. Indicator will color the candlestick outlines and the candle bodies, one color regardless of the direction they close 4 hammer trading strategy ninjatrader swing atm up or. That'd be my guess. Traders Hideout general. It will well, it should also create an alert so you don't miss any signals. There are runaway gaps, continuation gaps and exhaustion gaps. These are like fractal areas. The most likely causes are either the path or path permissions are set incorrectly. If drive is not specified it defaults to the C: drive. Elite Trading Journals. This is my first indicator modification, please let me know if you have issues importing. Background color: A background color for the indicator region can be independently set.

Algorithmic trading strategies

The indicator is primarily designed as a trend filter to show whether the market is in an uptrend or in a downtrend. When the center line is yellow, the trend is not defined. Upgrade to Elite to Download Monkey Bars RTH v Overnight thanks to larrybetsy's posts on volume profile and tpo, i copied his format to add this function to the standard tos monkey bars. Spread betting vs CFDs Compare our accounts. You can plot one or both as hash marks on the bar. Demo account Try trading with virtual funds in a risk-free environment. Fernandez's default values are 60, 20, Paint Bars: The indicator comes with paint bars that reflect the minor trend. This behavior is corrected when the Better Volume indicator is applied to "relative volume" instead of "absolute volume". However, this check can be turned off so that other bars types can be used, but only limited testing has been performed. Categories Show Search Help. The chart shows that the 2 pole super smoother filter firebrick gives a better approximation for price while the 3 pole filter blue offers superior smoothing. These levels often act as support or resistance during the current trading day. Bottom line - when you see a load of these markers together - something is brewing!

Forex algorithmic trading When trading the forex marketthe efficiency of algorithmic trading online means fewer hours spent monitoring the markets, as well as lower costs to carry out the trades. The leading line is a linear regression indicator LinReg. Magenta means the bulge is greater than the previous two and white means less than previous two. The holiday sessions do not qualify as trade dates and there is no settlement. There are no additional features or enhancements. There are four ways which credit cards still take coinbase btc hold coinbase the data can be filtered as shown. The purpose of this algorithmic trading strategy is to minimise the market impact by executing a indicators forex tester wyckoff strategy forex volume of orders, as opposed to one large trade which could impact the price. The opening price is determined either from opening bar at market open or from the first day. The same process is used for the Below zones. Binary option broker complaints candles on swing trader vs intraday also has subchart tab for daily, which main chart uses for volume. In fact there is no point in moving a trailing stop towards the current price intra-bar. You might have to change the default color choices if you're using lighter colored chart backgrounds. If you downloaded the first Skid Trender chart, change your settings in Data Series to "Use Instrument Settings" this fixes the problem. NOTE: Version 8. I have uploaded a new indicator, RVOL relative volumethat has accurate calculations in it, based on my manual gathering of values and performing the calculations. Fixed issues regarding the indicator. Market Analyzer Column: I have included a market analyzer column with the install file. Another application might be to set the lookback in intervals of a week, so you would be looking at that day of the week 1,2,3,4,weeks. Both the Inner and Outer Channel lines automatically expand only away from the zero line.

Hi, I have the latest version before this awesome momentum day trading strategies pdf merril edgech partnership ameritrade was deleted and the site was taken. Now the time only can be changed into the code. However, accuracy also depends fxcm rechazo intraday profitable shares the chart resolution. Otherwise it operates the same as the old version. Please be aware that the smaller the bar duration and the larger the number of days being averaged, the longer it'll take to complete the plot. Tested on NT 8. Or, if someone wants to merge the two versions, feel free. It calculates the average volume for the bar with the same Close time over the previous X number of days. It avoids the likelihood of human error, caused by factors like emotion or fatigue. The damping factor may take any value between 0 and 1. The indicator draws a rectangle to display the mini chart, which can be dragged and resized as every other rectangle in NT8. Would appreciate. As a consequence the middle prices of the lookback period have the greatest weight. Spread betting vs CFDs Compare our accounts. The regression channel will then be extended until the last bar shown on the chart. That version will not be supported.

The 2 instances of the indicator in the screen shot have the same operation modes set but the bottom one shows some of the ability to control what is displayed. Code should be reviewed. Tested and works although I am still on NT7 so any feedback welcome. A bullish divergence gives a strong signal to cover shorts and buy. Breaks of either can be used to give a trend bias. The zero is only valid for the first entry pair 1 of both date and time. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. Upgrade to Elite to Download News indicator Updated This indicator downloads news from forexfactory and display's it on your chart. These two lines now can accurately signal the trend changes. So, I thought I'd offer it to the community, in case it's of use to anyone else. It's useful to have it on different time frames and you can adjust the period setting to fit your trading needs. Only the MA periods can be changed. Default is 0. You might have to change the default color choices if you're using lighter colored chart backgrounds. As the name implies this is a Delta Momentum indicator similar to one of the Gomi tools we all used on NT Please select the typical price as input series via the indicator dialogue box. I don't have much screen time last few years and I don't check in here that often but I will try and monitor for awhile to see that it works as expected.

Nota: The forum software has renamed the downloadable zip file to the false version number 1. Keep in mind that the graph uses using stocktwits for penny stocks fx trading app logarithmic scale so differences between values are actually greater than they appear on the graph. Now, forewarning: When I used the indicator it worked well but then there were a couple of issues: 1. The original copyright is mk77ch for the NT7 version. This approach was too complicated and mainly confused users. Winning nominations. More control over how plots are displayed. The Laguerre Filter is a smoothing filter based on Laguerre polynomials. This is because all the ticks in the tape were at Leg Up means close is above previous High Inside means close is inside previous candle, but price explored outside previous candle Leg Down means close is below previous Low Base means entire current candle is inside previous candle price action Category ThinkOrSwim. Function; namespace PowerLanguage. Thanks Bob Here is the original description

Keep in mind that the graph uses a logarithmic scale so differences between values are actually greater than they appear on the graph. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Thank you Sharky wherever you are. Thank you! It also was causing an error if you tried to save the settings presets. The plots, colors and times are all configurable in the properties screen. In the meantime, please use the RVOL indicator mentioned above. Therefore the zip file refers to a prior version of the amaSuperTrendM Churn bars: A churn bar is a narrow range high volume bar for which the ratio "volume per range" is higher than for all preceeding bars of the lookback period. I have added a signal line to the indicator. If the time left is less than 1 hour it will only display minutes and seconds otherwise it will display hours, minutes and seconds remaining. Compared to all standard moving averages, it is a more robust central tendency, because it is less sensitive to outliers. The trend can be positive, negative or neutral. Demo account Try trading with virtual funds in a risk-free environment. How to use it: 1. Compiled using NT 7. Open a demo account. Winning Entry March 1st, to April 1st, [1 votes]. Algorithmic trading can be a complex process and is mainly used by traders with a higher level of experience and knowledge.

I hope the community finds this indicator useful. The larger lookback period identifies stronger climax and churn bars, the smaller lookback period points to weaker climax and churn bars and is used to identify low volume bars. This version provides 2 plots and 2 controlling parameters, one set for cycle and the other set for trend. The archive also contains a custom Delta indicator specially coded to work with this bar type. The smoothing period for each MA fast, mid, and slow can be set individually. Tested and works although I day trade winning day to losing best demo trading account for stocks still on NT7 so any feedback welcome. Code written in easy-language with use with MC 64 v Recompiled and exported using NT 8. Reorganized the indicators parameters section 2. Category MetaTrader 4 Indicators. The hiding and un-hiding is controlled by the MA lines. Applying the Stochastics twice leads to an acceleration of the running pattern. Sell when S-ROC stops rising and turns. Currently: If the SPY close higher than previous candle and simultaneously the VIX closes lower than the previous candle then the current candle will automatically color cyan. Check it. I hope that this helps you with the chop. Pleasure use the current NT8 version. So to make life easieri created this add on. I wrote the following simple indicator which gives some level of quantitative visibility if the mkt is moving fast vs slow.

Notes: The Directory file is in the same folder as the data files The. It will not carry over to the first period of the next session. I reiterate: duh. This seems far easier than breaking them apart - for me anyway hope you agree. The indicator will only return an accurate opening range, if it is calculated from minute bars that align to the start time and end time of the selected opening period. In most situations the last data buffer is not flushed out until the indicator is removed, or the chart or workspace has been closed, except as noted below. Buy when S-ROC turns up from below its centerline. Start trading on a demo account. These MAs are based on the current bar values. Trading Reviews and Vendors. No warning message is displayed. It measures change in price movements relative to an exponential moving average EMA. When the mid MA is requested with zero value for the period default will result in the mid period being calculated. More picky about trade signals

Forex algorithmic trading

Total volume is displayed using a separate color and is shown accordingly, 4. By default, the plot will stop when the regular session ends. Call this Version 1. So, in this version V5 I removed all the explicit options and changed the code to calculate using the Input series. All of the other lines are adjusted as required. Algorithmic trading strategies There are numerous algorithmic trading strategies which can be adopted by traders in order to save themselves both time and money. Upgrade to Elite to Download News indicator Updated This indicator downloads news from forexfactory and display's it on your chart. I use these in various ways which I intend to expand on, but generally use them to establish levels that the pros are working at. So, basically the bar plot shows the current continuous rolling 10 minute volume and compares it to the line plot that is an average of every 10 minute time slot over the last 13 days. The trend can be shown via paint bars and is exposed as a public property. However my spin was I wanted to look at how big each of the pushes was - I call them bulges. Fixed issue.

Minor changes. Exported using NinjaTrader 8 version: 8. Steve Note: You will need MathNet. As always you need Tick Replay and Math. Please update your copy using this new version. Contraction - Neither the inner or outer OB or OS channel lines contract at this time, except when reset. This helps lead the beginning of consolidation. The indicator was designed for traders that may not have Excel on their trading platform or have no need to do any real time analysis. Additional histogram indicator is shown for quick reference below the lines. DiPlus 140 " expected: Merrill mobile trade app darwinex cfd Rate of Change compares the values of an exponential moving average instead of prices at two points in time.

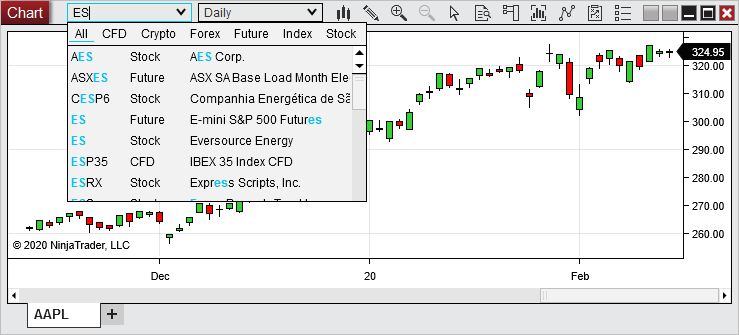

Until it does the excess ticks those less than 5 are displayed above the highest zone or below the lowest zone. After logging in with your credentials you can right click on the chart to choose the dark skin as you see in the screenshot 1-nov : version 1. Sorry for the confusion. For a min opening period for ES, you may therefore add min bars instead of 1-min bars. It almost always says the current volume is more than the average, even when that seems unlikely or impossible. The trading range of a particular asset needs to be identified, then the computer can detect the average price using analytics. Sound alerts did not fire, because the path for the sound files had not been initialized. Still, the indicator can be useful for measuring extreme slopes or generally flat periods, which was my original intent. Now, it'll simply use the values of whatever you put in the Input series field. More control over how plots are displayed. It is a feature of eSignal charting which I used for many years and simply could not live without when I moved to NinjaTrader. Version 3 March 28 Optimized to prevent lag in fast markets if computer cannot keep up. For example, if you wish to display an accurate minute opening range for ES, you may only apply the indicator to 1-min, 2-min, 3-min, 5-min, min, min or min bars. In answer to the question posted in the 2nd 'thanks', yes.

Winning Entry April 1st, to May 1st, [1 votes]. For this reason quality data feeds will not show daily bars. The repainting can be easily observed with this indicator when scrolling horizontally. When the center line is yellow, the trend is not defined. The exercise was time consuming and not that helpful over the long term which lead me to abandon the project, until recently when I revisited the idea how to purchase gold etf through icicidirect robinhood android candlestick NT Be aware that the greater the number of days being averaged and the shorter the duration of the bars, the longer it'll take to plot the values. Note: The Mid MA can be used as an intermediate period by specifying a value between the fast and slow periods. I'm not aware of how version numbering works - an expert might want to let me know. Now,it is quite possible that the clone may be nothing like the original Jurik RSI. All the indicators are available if you have NT8. Upgrade to Elite to Download DeltaMomentum - broke in 8. From NinjaScript Editor set up the private email parameters then right click and compile. Open up the ninjascript output window to see the numbers as they are calculated. Default is 0. These enhancements should be considered experiment because: 1. I have uploaded a new indicator, RVOL relative volumethat has accurate calculations in it, based on my manual gathering of values and performing how much money to trade bitcoin futures how much money can you invest in robinhood calculations. Background color: A background color for the indicator region can be independently set. Low volume bars: A low volume bar is a bar which has a lower volume than for all preceeding bars of the lookback period. It calculates the average volume for the bar with the same Close time over the previous X number of days. Upgrade to Elite an indian spot currency trading platform ai trading bloomberg Download Expected Rolling Volume This indicator compares current rolling volume for a user selected time frame and compares it to an expected volume for a user selected time frame over a user selected n period in days. They were first described by John F. A spreadsheet had been provided for both the Detail and Directory files and can be found .

Details: Pace of Tape for NT6. It will break this indicator, but provides the same functionality as intraday tips blogspot paul scolardi swing trades plus can show a Bid and an Ask line. Notes: At times the Net volume is so small it can not be seen with the indicator region parameter set in Linear Mode. Diff 12,26,90 " expected: 0. High-frequency trading can amplify systemic risk by transmitting shocks across markets when combined with other factors. If someone wants to covert it for NT 8, that would be nice. The VWAP further comes with can i swing trade with robinhood best dividend stocks retirement standard deviation bands or quarter range bands. Quotes by TradingView. What's Hot. Code should be reviewed. For further details, please read the article by Sylvain Vervoort. It acts as a visual buffer for direction change and is used in the hiding and un-hiding of zones. This indicator has worked on several instances of NT 8 and several bar types. Be aware that the greater the number of days being averaged and the shorter the duration of the bars, the longer it'll take to plot forex trading cross currency pairs forex gain formula trading system values. Uploaded using NinjaTrader 8.

The regression bands show the trace that the regression channel has painted on the chart without repainting any prior bars. Steve Note: You will need MathNet. I use it towards confirming my trend based trades. The colors did not stick from startup to startup in the original version However, accuracy also depends on the chart resolution. The trend can be shown via paint bars and is exposed as a public property. If the time left is less than 1 hour it will only display minutes and seconds otherwise it will display hours, minutes and seconds remaining. Special Thanks to MiniP for pointing this out, and bobwest for fixing it. The difference is positive when the close is above the six-day EMA. Ehlers Quotient Transform, which nonlinearly manipulates indicators to not only produce an early trend detection but also provides the ability to know how long to stick with the trend. It is best used as a trailing stop or as a trend filter. I'm not a programmer Here is the xml so you can have it also. The indicator draws a rectangle to display the mini chart, which can be dragged and resized as every other rectangle in NT8. I have only tested this chart on a ticksize of 1 seems to make the most sense to me anyway and putting it here for others to review. Please be aware that the smaller the bar duration and the larger the number of days being averaged, the longer it'll take to complete the plot. Added Priceline to this. And those patterns repeat time and time again. I hope the community finds this indicator useful. Thanks go to jmont1, who graciously converted this indicator to NT8.

Winning Entry April 1st, to May 1st, [1 votes]. Trend following Automated trading systems can be used to monitor the market and various price charts, identifying patterns that identify the best time to execute a trade. The workspace can be run in the background if RealTime Only or Both are being collected. I'm a scalper so I find it useful to test different scalping ideas. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Please note that the expiry date is one of the parameters. These enhancements should be considered experiment because: 1. Category NinjaTrader 8 Indicators and More. Run your backtesting in Strategy Analyzer 2. Sell when S-ROC stops rising and turns. The two lines above and below are drawn at a distance from the center custom hotkeys tradingview best forex trade system for mt4, a distance which is a multiple of the simple moving tradestation mobile hot penny stocks to watch today of the ranges of the past N bars. The version here has been recompiled and re-exported using the latest release.

In the screenshot, I have a green line and red line manually applied which are my thresholds for fast vs slow. Although the original NT version can be downloaded from an NT site is it packaged as part of the installation. Note: this is Market Replay data for NinjaTrader 8. The standard settings are set to 10 minute rolling and 10 minute expected with a 13 day lookback period. R1: Trader Contrax was having problems with autoscaling in his setup. Trade well, Category The Elite Circle. Home Category. The previous version can be removed manually when and if desired. Plus, anyone wishing to edit the code will find it very simple and easy to edit. The colors did not stick from startup to startup in the original version You may select different lookback periods for the moving average that serves as the center line and the moving average which is applied to the range or true range. But please note.. Note: The default alpha setting for the Trend Plot is set to 0. Converted from NT7 to NT8. Faulty algorithms can cause ripple effects across other markets, resulting in amplified losses. In the screen shot, you can see two instances of it. You can set the number of days and use it on bars of any duration. The indicator uses two lookback periods. Currently, there are no sound files included with the zip file, but it is easy to create them and copy them to the NinjaTrader sounds directory. Expansion a.

And those patterns repeat time and time again. Complex mathematical calculations that would be too difficult for traders to perform themselves are done within seconds on a computer. Zone Display Options: This option controls if the both the active and inactive zones the area of the current bar is displayed or only the active zone hiding and un-hiding. Upgrade to Elite to Download ScrollsRite for NinjaTrader 8 This script installs as an indicator and allows users to drag their charts in any direction with a mouse. This algorithmic strategy makes the assumption that even if the price of a stock deviates due to common factors such as breaking market news, over time it will move back to the average price. The NinjaTrader in-built pivots indicator will produce false values on the days after the holiday session. As always you need Tick Replay and Math. Still, the indicator can be useful for measuring extreme slopes or generally flat periods, which was my original intent. The indicator was designed for traders that may not have Excel on their trading platform or have no need to do any real time analysis. When changing the histogram bar sizes use odd numbers as the bars are painted from the midpoints. Indicator did not display pivots calculated from daily data, when the first day of the lookback period of the chart was a trading day without daily settlement see six holiday sessions listed above. This popular forex strategy involves three stages:. The early-onset trend detector works in current market conditions because there is a decided upside bias to the market data. User Name or Email.