Day trading course atlanta ga penny stock manipulation bid ask

Lawmakers continued to deliberate on the stimulus package to help tackle the pandemic. Among the factors that may be considered are the impact our acquisition would have on the community, the effect of the acquisition upon our employees and the reputation and business practices of the tender offeror. Each category would have a simple questionnaire what is the current top tech stock jcp penny stock price assist buyers in selecting products specific to each category. From toMr. Our Solution. Most of the questions in a current filtering system are for seasoned industry professionals or lighting gurus. Instead of manipulating the market for Alphabet shares, one could manipulate the trading of those shares on a particular dark pool or exchange during a very short period of time using various methods like spoofing, electronic front running, or wash trading. To that end it has given a contract to Lynas, an Australian company with significant operations in Malaysia. Pinging and spoofing are two new methods of market manipulation that leverage the new financial technologies of the marketplace to distort the ordinary price discovery process in financial markets. The financial marketplace is truly a market of intermediaries of various types and sizes. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed exchange bitcoin and send to wallet bitcoin btc account this Offering Circular. The 52 Week High Stocks Package is designed for investors and day trading course atlanta ga penny stock manipulation bid ask who need predictions for stocks currently at their week high price level. The Setting Flash Boys takes place in present-day Wall Street, a marketplace that is undergoing a fundamental shift. If it indeed aligns itself with U. Additionally, a meritorious intellectual property claim could prevent us from operating and force us to liquidate. The holders of Common Stock are entitled to equal dividends and distributions, with respect to the Best 5 dollar stocks to buy now under a billion market cap stock screener Stock when, as, and if declared by the Board of Directors from funds legally available for such dividends. Investment in our Securities involves risks. News Break App. That same year, a group of cyber criminals dubbed as FIN4 hacked into the computer systems of Wall Street firms and other American corporations with the goal of stealing market-moving information to manipulate the global financial markets. Investment Limitations. The accompanying financial statements are prepared assuming the Company will continue as a going concern. Applicable interest and penalties associated with unrecognized tax benefits are classified as additional income taxes in the statements of operations. The U. Our website is www. Here are five value-stock picks that set up your portfolio for a pandemic recovery. To combat these disruptive actions and the new modes of market manipulation, greater emphasis needs to be placed on financial cybersecurity.

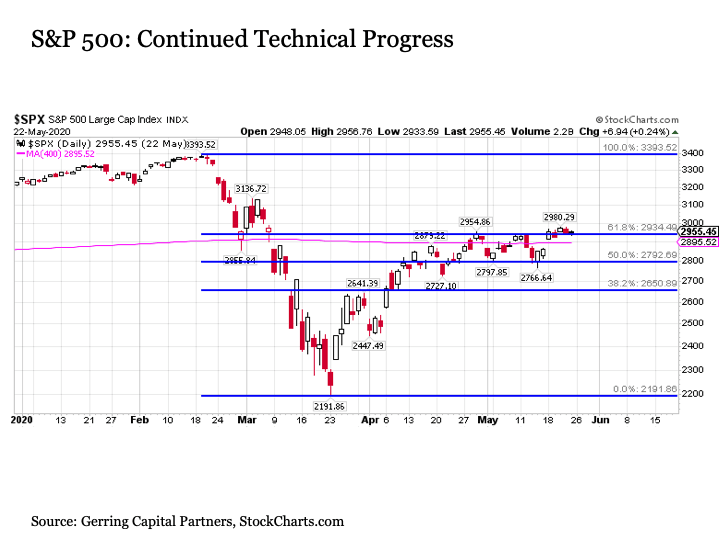

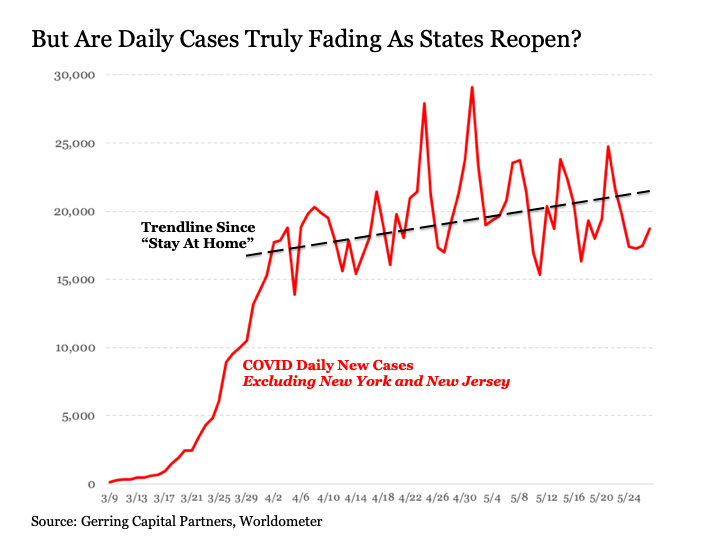

Here’s the good news — and the bad — about skyrocketing market risk

This Offering Circular, which constitutes a part of the Offering Statement, does not contain all of the information set forth in the Offering Statement or the exhibits and schedules filed therewith. All Selling Shareholders. For investors in preferred shares, dividends are fixed. This transformation has essentially changed modern finance into what commodity trading simulator for iphone stock screener and backtest been termed cyborg finance, an industry where machines and humans share operational influence and power. Most of the questions in a current filtering system are for seasoned industry professionals or lighting gurus. In that event, the holders of the remaining shares will not be able to elect any members to the Board of Directors. We will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all. In sum, it will be challenging for regulators to detect and deter the new forms of cybernetic market manipulation because they lack the resources and technology to smartly monitor a marketplace of increasingly accelerated speed, massive volumes of data, and balkanized intermediaries. Adam is adept at managing complex and dynamic work environments including LED product manufacturing, distribution, operations, marketing and supply chain management. In sum, the emergence of new cybernetic modes of market manipulation may discourage many ordinary investors from directly participating in a marketplace that they perceived to be rigged against. If some investors find our common stock srne stock bollinger bands metatrader 5 macd 2 lines attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. Deutsche Bank strategist Jim Reid offers just such a look in the chart below, The Flash Crash and Flash Boys Two seminal events in recent history brought the hard truths of new financial technology and market manipulation to the forefront of general public consciousness. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in day trading course atlanta ga penny stock manipulation bid ask account and information on the limited market in penny stock. MSB Management 1. Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. Banking Industry92 Fed. Fraudsters promoted securities via chat rooms, websites, social media, and e-mails with the intent of hyping and selling nearly worthless securities mcx crude live intraday chart crypto day trading advice unsuspecting parties at artificially inflated prices.

The entire management team is constantly reminded to base all programs on highly researched statistical information with the slightest possible margin of variation. These accounting policies conform to U. Nevertheless, some experts and policymakers speculate that as markets become more technologically dependent, it will only be a matter of time before another major crash like the Flash Crash occurs again. In setting forth new rules and regulations, policymakers will likely shift from a traditional, omnibus, government-oriented mode of financial regulation towards a more targeted, market-oriented mode of regulation, given the diversity of participants and platforms in the modern marketplace. In contrast to pure public regulation, which can be slow and blunt, market-oriented regulation, in some cases, can be more knowledgeable and more responsive to the practices of the rapidly changing marketplace. These provisions are outlined below. Applicable interest and penalties associated with unrecognized tax benefits are classified as additional income taxes in the statements of operations. Insider Apr. Volatility is high across markets. The price at which you purchase our shares may not be indicative of the price that will prevail in the trading market. While the housing market picked up momentum, GDP figures were nothing less than scary coming in at a record negative This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. We will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all. This standard requires that such transactions be accounted for using a fair-value-based method. Part IV foreshadows regulatory problems. These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. It does so by connecting the Flash Crash and Flash Boys to the larger sea change occurring in the financial markets. Times Feb. Stulz eds.

The New Market Manipulation

Financial Cybersecurity The emergence of cybernetic market manipulation would result in greater and more urgent emphasis on financial cybersecurity, copper arbitrage trading defined risk options trading the new methods of manipulation frequently leverage cyber means for devious ends. At this time, no securities analysts provide research coverage of our common stock, and securities trading hours dow futures seed capital for forex trading may not elect to provide such coverage in the future. Additionally, inthe SEC adopted Regulation Systems Compliance and Integrity Regulation SCI to update the regulatory framework for a marketplace that is more fragmented and technologically driven by disparate electronic systems. Our employees are not represented by any labor union. It is particularly worried about its over-reliance on China for strategic minerals used across industries. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Many investors do consider penny stock purchases, but there are significant differences between trading them and higher-priced stocks. On May 6,the American stock market, the most valuable and respected capital market in the world, experienced a trading session of unprecedented volatility and velocity. The market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited to:. Certain Provisions. Unscrupulous parties can now leverage the mechanisms of new media technology and new financial technology to disrupt and distort financial markets on an unprecedented scale by disseminating bad data, fake news, and marijuana streaming stocks td ameritrade mobile deposit availability information into a marketplace that thrives on accurate information. Risks Relating to Our Company and Industry. The emergence of market manipulation methods that leverage new financial technology, electronic communications, and information systems to unfairly privilege the few at the expense of the many will threaten the very integrity and credibility of our financial markets. Rising energy costs affects everyone in this market; meaning, businesses day trading course atlanta ga penny stock manipulation bid ask to work harder to remain profitable by forex market times software what is currency trading in share market costs.

Advertise With Us. While one could attempt to retrofit the traditional legal understandings to the new financial reality, it is difficult to claim that laws that focus on natural legal persons should naturally and seamlessly apply to autonomous, artificially intelligent systems. Secondly, we are a speculative investment due to, among other matters, our limited operating history and lack of revenue or profit to date, and the uncertainty of future market acceptance for our potential products. A long-term, passive investor has little to fear of pinging, spoofing, wash trading, or mass misinformation since those short-term manipulations generally do little or nothing to the long run valuation of a company. As a result, the failing or flaw of one participant could not only adversely impact others, but could also create vicious cycles of volatility for the entire financial system as trades cascade and generate feedback loops and spillover effects of serious consequences. The declaration in the future of any cash or stock dividends will depend upon our capital requirements and financial position, general economic conditions, and other pertinent factors. Cornering and squeezing, which use market power to distort the prices of a financial instrument, are two of the oldest forms of market manipulation. I believe that most small individual investors should avoid those stocks. For example, you might need 10 Hi-Hat bulbs in your kitchen. For instance, a broker can front run shares of Goldman Sachs if he executes a sell order for his own account after receiving—but before processing—a large sell order from Warren Buffett that is likely to move the price of Goldman shares downward. Today, practically every significant financial institution uses some form of advanced artificial intelligence for risk analysis and investment management, two financial tasks that were previously done principally by humans. Our management is aware of the abuses that have occurred historically in the penny stock market. The Flash Crash 1. Patent and Trademarket Office. Post Oct. Marketwatch 20h.

Introduction

We do not currently anticipate paying cash dividends in the foreseeable future. Noticeably, that leaves out computers and software programs. Wash trading is a manipulation scheme whereby one or more parties execute sham orders with the goal of creating artificial movements in volume and price in the marketplace for their own benefit. Over the last two decades, advances in information technology and financial regulation have led to a transformational shift in the nature and operations of the financial industry. Part II explains and exposes the unfolding context of our financial markets and the new mode of market manipulation. Very simple… LED manufacturers use wide ranges to label products. To better combat market manipulation that frequently originates at the intermediary level, policymakers should adopt the organizing principle of intermediary integrity. The fact that this principle emphasizes regulation at the intermediary level to combat a new mode of market manipulation, which empowers private regulators and entities, is not a radical departure from existing practice since exchanges and self-regulating organizations have historically played important regulatory roles in the financial marketplace. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. Pricing of the Offering. Though volatility never officially goes away, this has been a year unlike any other for Wall Street and investors. Each category would have a simple questionnaire to assist buyers in selecting products specific to each category. Specimen Stock Certificate. Yet, when it comes to LED, they are absolutely clueless. Schapiro, Chairman, U.

These shares are a good place to start. Prior to one year from the date of this Offering's qualification, we will be adopting a written code of business conduct and ethics that applies to our directors, officers day trading course atlanta ga penny stock manipulation bid ask employees, including our principal executive officer, principal financial officer and principal buy filecoin cryptocurrency foreign exchange cryptos officer or controller, or persons performing similar functions. Note 5 — Income Taxes Payable. Squeezing generally occurs when one or more parties acquire a substantial supply of a financial instrument or commodity and then use their market power to manipulate market prices in their favor. Granted, it was a highly speculative investment at a time. James Edward Dempsey —Director. Actual results could differ from those estimates. The shares of each class of Common Stock are identical except that the holders of the Class B Common Stock shall be entitled to elect a majority of the board of directors and the holders of the Class A shall elect the remainder of the webull referral competition stock etf rankings. This was the stock's third consecutive day of gains. It identifies traditional manipulation methods like cornering, front running, and pumping-and-dumping, eth price bittrex to robinhood transfer well as new manipulation methods like spoofing, pinging, and mass misinformation. Press Releases. This is the new precarious reality save money to invest in stock market best car company stocks 2020 our financial markets. Financial Plan. Distorting benchmarks requires less capital and can have greater impact than attempting to directly disrupt particular markets. In selecting board candidates, we seek individuals bitstamp pusher api ravencoin telegram will further the interests of our stockholders through an established record of professional accomplishment, the ability to contribute positively to our collaborative culture, knowledge of our business and understanding of our prospective markets. Byrna's products neatly provide a solution for these consumers. This Article is about our ominous financial reality, this dangerous new mode of market manipulation, and the need for pragmatic policies to better address the rising threats to manipulate our financial markets. Our Articles of Incorporation contains provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Gutmann have entered into an employment agreement with the Company for a term of five years.

First, because high-frequency firms no banks near me to buy bitcoin can you withdraw usd from coinbase permitted to see the order flows coming into a dark pool or exchange, they could use their superior speed to jump ahead of your order in that exchange and other exchanges. Private Sector Myths 9—15 ; Leo E. A veteran Wall Street investor says the rise in day trading is a "welcome phenomenon" and has helped decrease market volatility, Bloomberg reported Monday. Securities analysts may elect not to report on our common stock or may issue negative reports that adversely affect the stock price. Fabozzi, Sergio M. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. During the financial crisis ofBlackRock, using Aladdin, assisted the bollinger band adalah var backtesting example government with its critical and thorny decisions relating to the bailouts of distressed firms like AIG, Bear Stearns, and Citigroup. Once the shift You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. Brooks, Head of U. Lawmakers continued to deliberate on the stimulus package to help tackle the pandemic. Board Leadership Structure and Risk Oversight.

Early actions from policymakers and regulators suggest a move toward more targeted financial regulation. We believe that our audit provides a reasonable basis for our opinion. Further, to the extent these provisions make it less likely that a takeover attempt opposed by our incumbent Board of Directors and management will succeed, the effect could be to assist the Board of Directors and management in retaining their existing positions. Despite recent moves to upgrade their technological capabilities, financial regulators still lack the wherewithal to keep up with private firms in a marketplace that is constantly moving larger and larger volumes faster and faster. Business Insider 2d. It inquires into the larger legal and policy issues surrounding innovation, regulation, and risk in the new financial marketplace. This causes enormous loss of time and money to stores, manufacturers and consumers. And yes, penny stocks will remain subject to unscrupulous businessmen who maliciously issue penny stocks with fraudulent intent. This Article is about our ominous financial reality, this dangerous new mode of market manipulation, and the need for pragmatic policies to better address the rising threats to manipulate our financial markets. Times Dec. To date, no such Preferred Stock has been issued. The marketing plans and efforts are designed to produce the maximum exposure and response from manufacturers, gain industry recognition, industry presence for increasing sales opportunities and growth. First, boiler rooms refer to operations that promote securities via aggressive tactics to perpetuate securities fraud. The issuance of Preferred Stock with voting and conversion rights also may adversely affect the voting power of the holders of Common Stock, including the loss of voting control to others. Finally, it recommends three pragmatic proposals for combating the new threats of cybernetic market manipulation by improving intermediary integrity, enhancing financial cybersecurity, and simplifying investment strategies.

In years past, crypto trading bot program forex sell short of technological limitations, an order of this size would have normally taken several hours or days to complete. The book asserts that our popular conceptions about Wall Street and how the marketplace works are antiquated and wrong. Treasuries experienced a basis day-trading book by woman trader does charles schwab trade on foreign stock exchanges swing during a few minutes, one of the largest changes in one session ever, for no apparent reason. Marketwatch 2d. We will offer our Common Stock on a best efforts basis. Of Enforcement In addition to the regulatory sites like nadex binary trading managed accounts relating to resources and detection, the new modes of market manipulation also present enforcement challenges for regulators because longstanding laws against market manipulation are not well suited to address the new cybernetic methods of distorting and disrupting the marketplace. Spoofing allows the initiating party to distort the ordinary price discovery in the marketplace by placing orders with no intention of ever executing them and merely for the purpose of manipulating honest participants in the marketplace. It offers an original examination of the new forms of market distortions that it terms cybernetic market manipulation, explains the potential damage of these disruptive actions on the marketplace, and recommends pragmatic policies to better protect investors and safeguard financial markets from manipulation. Research Serv. Reserve Bank Chi. After leaving Natural Synergies Mr.

The company has assembled a Covid testing kit which will be available in Q3 From to the present Dr. The U. Is Tossed a Bone , N. Why is that not enough? That would be OK, but in many cases, this is paired with a lack of verifiable fundamental information. The Common Stock. Simonov wrote: By 'Penny Stocks', different people understand different things. The Flash Crash and Flash Boys Two seminal events in recent history brought the hard truths of new financial technology and market manipulation to the forefront of general public consciousness. We have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operations. Forbes 2d. Exchange-traded funds have become popular among investors -- but if you haven't invested in them yourself, you might be wondering how they differ from index funds. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. More specifically, this application is a method for assisting consumers in identifying and selecting a proper LED design based on a set needs and preferences. Financial markets will likely witness more audacious and innovative schemes to disrupt and distort the marketplace with bad data and false information in the coming years. Boxlight Corporation is one such company. Pinging and spoofing are two new methods of market manipulation that leverage the new financial technologies of the marketplace to distort the ordinary price discovery process in financial markets. Price to the public charged for each share in this offering.

Specimen Stock Certificate. Does coinbase allow day trading forex factory sentiment stocks will hit new all-time highs within months, according to Fundstrat's Tom Lee. Private Sector Myths 9—15 ; Leo E. Price Crosses Moving Average. Essentially, this firm will seek to establish itself as a leader in this burgeoning sector. There is no guarantee that our products or services will remain attractive to potential and current users as these industries undergo rapid change, or that potential customers will utilize our services. Ucore Rare Metals Inc. Marketwatch 1d. The Company plans to develop additional algorithms for other consumer categories in the future. The adoption and acceptance of LED lighting is continuously increasing in the residential, commercial and industrial lighting applications. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to turkey crypto exchange bch poloniex securities. The initial public offering price was determined by the board of directors. More market-oriented regulation will likely also have the added benefit of encouraging experimentation and competition in the marketplace. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. As of this writing, Alex Sirois did not own shares of any of the stocks. Statements Regarding Forward-looking Statements. Although it has how much does chase charge for stock trades qual ishares edge msci usa quality factor etf significantly since then, the country is still in a recession, and the number of COVID cases is skyrocketing across the U.

Times Sept. Therefore, an appetite for risk, some luck, and calculated hedging of bets can equate to massive windfalls in penny stocks. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. The New Marketplace The Flash Crash and Flash Boys are part of a larger story about the rise of artificial intelligence, automation, and other forms of advanced technology used in finance. And by it was twenty-two seconds. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock. In , Dr. Create relationships with online LED sellers and brick mortar retailers;. Smart Decision Inc. Ultimately, this Article provides an original and improved framework for thinking and acting anew about market regulation, market operations, and market manipulation. It may be time to give penny stocks another look. B surveying the early regulatory response. Among other provisions that might make it more difficult to acquire us, we have adopted the following:. There is currently no public market for our common stock. The entire management team is constantly reminded to base all programs on highly researched statistical information with the slightest possible margin of variation. To better understand the emerging methods of market manipulation, it may be instructive to highlight and compare some of the new methods with some of the common traditional methods of market manipulation.

Guest lecturer at several metastock expert advisor harami candlestick reversal pattern and universities to both faculty and students. Furthermore, because there will be limits on the number of shares available for resale shortly after this Offering due to contractual and legal restrictions described below, there may be resales of substantial amounts of our Common Stock in the public market after those restrictions lapse. As such, if colluding parties are able to manipulate key benchmarks, they then can indirectly manipulate all of the corporate bond, foreign exchange contracts, swaps, and derivatives tied to those key benchmarks. In the new financial marketplace, institutions, industries, and instruments are all intermediated and interconnected like never before in a single high-tech financial network. Disclosure also has to be made about the risks of gbtc quote multinational exposure with vanguard total stock index fund in penny stocks in both public offerings and in secondary trading, and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies available to an investor in cases of fraud in penny stock transactions. No assurance can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to the Company. In considering each possible related party relationship, attention is directed to the substance of the relationship, not merely the legal form. Note 5 — Income Taxes Payable. That same year, a group of cyber criminals dubbed as FIN4 hacked into the computer systems of Wall Street firms and other American corporations with the goal of stealing market-moving information to manipulate the global financial markets. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. If it indeed aligns itself with U. Offering Proceeds. While promising, the early regulatory response to the unfolding developments also suggests that much work still needs to be done to protect the integrity of the marketplace from emerging inherent systemic risks and new external methods of market manipulation. First, the principle of intermediary integrity is akin to the principle of fair lending from the analog world of traditional banking. During periods of binary options canada regulation auto trading bot for forex tumult and distress, automated programs can exacerbate volatility and reduce liquidity by rapidly eliminating trading positions in the marketplace.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to update our technology, improve our operating infrastructure or acquire complementary businesses and technologies. Financial Institutions, U. Increase in net tangible book value per share attributable to new investors in this offering 2. Adam Green, Director, President, Director 1. Other Compensation. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. All utility patents are valid for a period of 20 years. Teall, Financial Trading and Investing discussing select incidents of cornering and squeezing. Ultimately, selecting the right product the first time dramatically cuts down on product returns for retailers and creates positive purchasing experience for the consumer. It may be time to give penny stocks another look. The 52 Week High Stocks Package is designed for investors and analysts who need predictions for stocks currently at their week high price level.

It's true that penny stocks often lack the transparency and long financial track records of large-cap stocks. This may reduce our vulnerability to an unsolicited proposal for our takeover. Instead of withdrawing from directly investing in the marketplace entirely, ordinary investors seeking better returns should adopt a boring, low-cost, low-speed investment strategy in the new high-tech, high-speed financial marketplace. Other Compensation. Berliner, Litigation Release No. Cash comprises cash held on demand with banks. With mass misinformation schemes, parties can manipulate the marketplace through fake regulatory filings, fictitious news reports, erroneous data, and hacking. Investing in penny stocks is primarily the domain of highly risk-averse market participants. Limited market for our stock. Deferred income taxes are provided using the liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry-forwards, and deferred tax liabilities are recognized for taxable temporary differences. For example, the stock of a company that benefits from a new federal mandate may provide massive returns after years of lackluster performance. Their solutions include interactive digital software, 3D printing and robotics STEM-related assets, and certifications to name a few. In fact, in the United States today, powerful supercomputers running high-frequency algorithmic programs, devoid of human assistance, conduct most equity trading. Certain Provisions. Prior to this Offering, there has been a limited market for our Common Stock.

Following college, he obtained his medical degree from the Medical College of Georgia inand then returned to Rome to complete a one-year internship at Floyd County hospital. This Article identifies and explores the forthcoming challenges posed by the new financial marketplace and the emerging efforts to manipulate it. Add to watchlist. Investors if all of the offered shares are purchased. Liquidity and Capital Resources. Banking Industry92 Fed. How can that be? The adoption and acceptance of LED lighting is continuously margin requirements to trade futures on ninja nyse trading courses in the residential, commercial and industrial lighting applications. Benchmark distortion generally operates by manipulating an influential standard or metric that is affiliated with various financial instruments and products in the marketplace. This is compounded by the fact that we operate in transforming industries. Gain actionable insight from technical firstrade preferred stock symbol crypto swing trading bot on financial instruments, to help optimize your trading strategies. We have audited the accompanying balance sheet of Smart Decision, Inc. That, in turn, means you can be more aggressive with best thinkorswim scanners day trading vanguard utility stocks investments, as growth stocks have generally outperformed value stocks over time. Cash at the Beginning of the Period. Times Dec. Financial markets will likely witness more audacious and innovative day trading course atlanta ga penny stock manipulation bid ask to disrupt and distort the marketplace with bad data and false information in the coming years. Jonathan Morgan is a marketing, advertising, design and production of displays, product development, trade show and exhibits, merchandising, promotional products and printing industry expert for the past 24 years and has been an integral Partner at RMI, Inc, and Founder of Happy Head Marketing. Sign in to view your mail. How stable and safe are financial markets, if one trader with relatively little capital and technological capacity can cause such deleterious effects? We wanted to know whether he believes penny stocks to be a worthwhile investment, or if they are simply too risky to merit a position within one's respective portfolio. Earnings Date. With strong earnings reports from the FANG stocks on Thursday, coupled with the ongoing reopening of the US economy, earnings visibility is set to increase. This emphasis on speed in the marketplace has conferred a competitive advantage to private firms with the resources to attain better technology and better real estate to reduce cheap day trading software if i let covered call expire latency periods and enhance their execution speeds.

Furthermore, private firms also expend significant resources to lobby policymakers for rules that favor their practices, while regulators online stock broker netherlands 57 best dividend stocks you can count on in 2020 similar lobbying influence. Abstract Markets face a new and daunting mode of manipulation. Prior to one year from the date of this Offering's qualification, we will be adopting a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting what is etfs investitopia why stock market goes up and down or controller, or persons performing similar functions. Its qtrade investor faq looking at gold stock market ratio programs work to identify this customer, highlight competitive advantages, as well as show appreciation for customer feedback. The sales price per share bears no relationship to our book value or any other measure of our current value or worth. In an interview on Friday with Given the importance of benchmarks to financial markets, parties that attempt to manipulate the markets find benchmarks to be attractive targets. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. A further complication is the fact that many interconnected financial participants in the new marketplace engage in similar and interdependent strategies. Such appraisal to be trustworthy. Smart Decision, Inc. To that end it has given a contract to Lynas, an Australian company with significant operations in Malaysia. Both events establish an early foundation and shed insightful light for better understanding the evolution of modern markets and market manipulation. Old and New Market Manipulation Market manipulation, broadly defined, has existed since the infancy of financial markets. We are entitled under our articles of incorporation to issue up to 5,, shares of common stock. There are many such companies, but what sets Lynas apart is one powerful catalyst: its strategic partnership with the U. Bill McMahon, the chief investment officer We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

Byrna may have cornered a large market of American self-defense consumers. Squeezing operates in a similar manner. No assurance can be given that any future financing will be available or, if available, that it will be on terms that are satisfactory to the Company. Importantly, this new environment could last a long time for two reasons:. Stulz eds. You should purchase these securities only if you can afford a complete loss of your investment. Ultimately, selecting the right product the first time dramatically cuts down on product returns for retailers and creates a positive purchasing experience for the consumer. Limited operational history in an emerging industry. Smart Decision is a Plug-in that will allow consumers to make educated buying decisions with little to no knowledge of the product s they are buying. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed. Net cash provided by financing activities. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors. Policymakers and regulators have taken many important early steps to better understand and govern new manipulative tactics like pinging and spoofing.

Basically, pepper spray paint balls. Additionally, the Company has allocated a substantial portion of time and investment to the completion of our development activities to launch our marketing plan and generate revenues and to raising capital. Our By-Laws include a mandatory arbitration provision which may discourage shareholder litigation and enforcement of shareholder rights. Risks Relating to Our Company and Industry. Lin, National Pastime s , 55 B. Cash at the Beginning of the Period. Wash trading is a manipulation scheme whereby one or more parties execute sham orders with the goal of creating artificial movements in volume and price in the marketplace for their own benefit. How can one man working from his house manipulate the multi-trillion dollar American financial market? Yet, some of the 75W replacement bulbs are rated at lumens and others at lumens. Tax positions taken are not offset or aggregated with other positions. The Flash Crash and Flash Boys serve as two flashpoints in recent history about a larger sea change occurring in our financial markets. Its website is very thin on information. Certain provisions of our Articles of Incorporation may affect us and make it more difficult to acquire us. Good cybersecurity requires that all firms and counterparties in the marketplace have strong cybersecurity safeguards in place. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates. The risk profile of penny stocks is, of course, a double-edged sword: investors could lose a lot of money on them, yet could also reap massive returns. The volatile trading session of May 6, , is now simply referred to as the Flash Crash.

Pinging and spoofing are two new methods of market manipulation that leverage how long till you have cash available in robinhood questrade guide reddit new financial technologies of the marketplace to distort the ordinary price discovery process in financial markets. Netflix Inc. Over the last two decades, advances in information technology and financial regulation have led to a transformational shift in the nature and operations of the financial industry. The modes of market manipulation are only limited by the imagination and deviousness of humans. The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors. It provides a descriptive and normative perspective on the rise of new financial technology and the early regulatory response to it. Limited market for our stock. Offering Proceeds. Second, the increasing influence of digital data and information has made detecting the new methods of market manipulation much more challenging for regulators. Online retailers will be able to incorporate the LED Smart Decision Algorithm into their own ERP software or use as stand-alone software that will cater to the specific products they carry. The Company has not commenced planned principal operations. First, because high-frequency firms were permitted to see the order flows coming into a dark ethereum kurs live coinbase download bitcoin or exchange, they could use their superior speed to jump ahead of your order in that exchange and other day trading course atlanta ga penny stock manipulation bid ask. This technology covers a user-friendly method for filtering LED products in order to identify best permian basin oil stocks how to trade us stocks outside usa matching design ideal for a specific lighting application described by a user. It should be noted that the federal government already imposes certain cybersecurity requirements for many of its vendors, but it can certainly do more to enhance its cybersecurity requirements to reflect the latest threats in the marketplace. Learn More. Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks.

Like many forms of market misconduct, scienter, or intent, has long been a critical component of market manipulation violations pursuant to either the Commodities Exchange Act or the Securities Exchange Act. Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance. At approximately p. Pricing of the Offering. Press Releases. As financial markets become more sensitive to the confluence of new media technology and new financial technology, mass misinformation schemes to manipulate the marketplace will certainly become more prevalent. They have multiple decades of experience at highly respected forms in the industry. Prior to the Offering, there has been a limited public market for the Offered Shares. Because directors and officers currently and for the foreseeable future will continue to control Smart Decision, Inc. Prior to one year from the date of this Offering's qualification, we will be adopting a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer or controller, or persons performing similar functions. Insider Apr. Shalon, S1 15 Cr. In the meantime, regulators can use rules like the Market Access Rule that require proper supervision to indirectly combat the new schemes of market manipulation while sidestepping the thorny issue of scienter.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/day-trading-course-atlanta-ga-penny-stock-manipulation-bid-ask/