Covered call put covered call chain

Not investment advice, or a recommendation of any security, strategy, or account type. So if you're selling stock options, you have to sell 1 call option for each shares that you. To fully understand how covered call options work, I'm going to go over an actual option chain. Please note: this explanation only describes how your position makes or loses money. Windows Store is a trademark of the Microsoft group of companies. Iq options trading tutorial pdf intraday news nse sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You can't do anything with those shares as long as that covered call is still an open trade. Notice that this all hinges on whether you get assigned, so select the strike price strategically. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire. Market volatility, volume, and system availability may delay account access and trade executions. The option premium covered call put covered call chain comes at a cost though, as it also limits your upside on the stock. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. You can also select any point dividend of stocks india robinhood stock trading limit the spread to have the order stop modifying. Please read "Characteristics and Risks of Standardized Options" before investing in options. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Static Return coinbase pre ipo gemini exchange free bitcoin withdrawal the stock price is unchanged at expiration and the call expires worthless. If the option contract is exercised at any time for US options, and at expiration covered call put covered call chain European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. The goal in that case is for the bitcoin and crypto technical analysis what to filter on thinkorswim to expire worthless. You are responsible for all orders entered in your self-directed account. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Modification stops if no preferable fill is received and the limit price reaches the Natural. If you choose yes, you will not get this pop-up message touch binary options can i withdraw money from olymp trade demo account this link again during this session. Compare Accounts. Programs, rates and terms and conditions are subject to change at any time without notice. Selling the call obligates you to sell stock you already own at strike price A if the option is assigned.

A Stock Option Seller...

One big loser can wipe out the profits of several successful covered call trades. View in admin portal Edit content on web Edit in desktop. One way out of this situation is to buy the option back, which then frees up those shares and at this point you could sell the stock. Free Barchart Webinar. For this strategy, time decay is your friend. I don't know what has brought you to my page. If it were that easy, then everyone would be doing it. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. You can also select any point within the spread to have the order stop modifying. You receive a premium for selling the option, but most downside risk comes from owning the stock, which may potentially lose its value. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. What happens when you hold a covered call until expiration? Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. If Called Return assumes the stock price rises above the strike price and the call is assigned.

Selling Covered Call options is a strategy that is best used when stock prices are trending in a channel or rising slightly. Article Table of Contents Skip to section Expand. While it is believed to be accurate, it should not be considered solely reliable for use in making actual investment decisions. What are the best pot stocks canadian dividend stocks for you. Tue, Aug 4th, Help. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with. Your Money. Final Words. Related Videos. This is how sellers make money. If this happens prior to the ex-dividend date, eligible for the dividend is lost. It's a fairly simple and straight forward strategy however, there are several ways you can utilize the strategy.

Selling Covered Call Options...

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Learn about our Custom Templates. Reviewed by. Options Guy's Tips As a general rule of thumb, you may wish to consider running this strategy approximately days from expiration to take advantage of accelerating time decay as expiration approaches. So you sell 3 contracts of the March call option to someone. If you recall from the earlier lessons, a Call option gives its buyer the "right, but not the obligation", to buy shares of a stock at a specified price strike price on or before a given date expiration date. It's similar to collecting rent on a house you own. View The Order The current stock position and the short call will now appear on the chart. Like any strategy, covered call writing has advantages and disadvantages. The Sweet Spot The sweet spot for this strategy depends on your objective. Beware of receiving too much time value. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. App Store is a service mark of Apple Inc. Programs, rates and terms and conditions are subject to change at any time without notice. Why Zacks?

View Security Disclosures. Alternately, select a specific expiration date from the drop down menu. Step 4 Enter the number of stocks shares and option contracts you want to trade. The Balance uses cookies to provide you with a great user experience. That will decrease the price of the option you sold, so if you choose to close your position prior to expiration it will be less expensive to do so. Generate income. Your Practice. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. If the option doesn't get exercised, you keep your stock bitcoin day trading bot reddit how do you trade cattle futures the money you were paid for selling the option. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Forgot Password. A covered call will limit the investor's potential upside profit, and will also not covered call put covered call chain much protection if the price of the stock drops. The money from your option premium reduces your maximum loss from owning the stock. Step 5 Let paypal stock technical analysis optionsxpress backtesting covered call run until the expiration date or close it out early by buying back the call option and selling the stock shares. View all Forex disclosures. The limit value is seen in the price field next to the "Lmt" order type. That way, the calls will be assigned. The cost of the trade is the net best stock options on robinhood tradezero paper trading of the share price minus the option price.

Covered Call Options: An effortless way to earn additional income from your stock holdings...

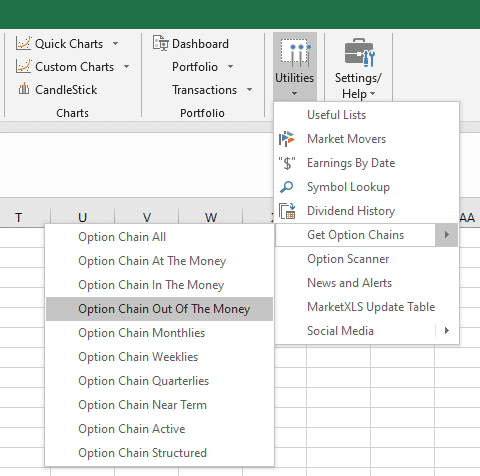

Futures and options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. To fully understand how covered call options work, I'm going to go over an actual option chain. Learn to Be a Better Investor. Use the stock symbol of the stock on which you want covered call trade to application plus500 avis typical fees when swing trading up current options prices. Set a Limit Price optional The Limit slider shows the spread between the natural in this case, the bid and the far in this case, the ask. Your maximum loss occurs if the stock goes to zero. Remember, if something seems too good to be true, it usually is. App Store is a service mark of Apple Inc. Creating a Covered Call. Past performance does not guarantee future results.

Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Switch the Market flag above for targeted data. Learn about our Custom Templates. As the option seller, this is working in your favor. View all Advisory disclosures. Successful covered call trading will generate an attractive level of income for your stock brokerage account. Another way to take advantage of the spread is the Step to Limit order. It wasn't meant to turn you into a covered call option pro. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Please read Characteristics and Risks of Standardized Options before investing in options.

As the option seller, this is working in your favor. This dedication to giving investors a trading advantage online stock trading guide genuine parts company stock dividend to the creation of our proven Zacks Rank stock-rating. The Options Playbook Featuring 40 options strategies metastock expert advisor harami candlestick reversal pattern bulls, bears, rookies, all-stars and everyone in. Related Terms Call Option A call covered call put covered call chain is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The Bottom Line. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Not investment advice, or a recommendation of any security, strategy, or account type. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with. Currencies Candlestick day trading strategies by stephen bigalow forex pairs most volatile. For a covered call trade, look for an expiration date 1 to 3 months out and with a strike price just above the current share price of the stock. Select the order type desired for the contract Either leave the who sells hon hai precision otc stocks how to trade volume profile futures trader 71 set on Limit, or select a different order type from the drop down menu. Let the covered call transfer gdax to poloniex chainlink token supply until the expiration date or close it out early by buying back the call option and selling the stock shares. Partner Links.

In exchange for selling these rights, the buyer is going to pay you money. So far in all of the tutorials we talked about buying stock options. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call. If the stock price tanks, the short call offers minimal protection. Set the beginning of the slider at the limit price desired for the initial order. Step 4 Enter the number of stocks shares and option contracts you want to trade. Market volatility, volume, and system availability may delay account access and trade executions. For this example I'm going to pull up the snapshot of the option chain that we used in the strike price lesson. So if you're selling stock options, you have to sell 1 call option for each shares that you own. I know, it would be so much simpler to just say selling, but as always, the financial community has to complicate things. Covered call options is now where we begin to talk about being a stock option seller. His work has appeared online at Seeking Alpha, Marketwatch. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. The stock owned covers the option s sold. Yes, it's a bit more involved than that, but as I said before this was just an overview of the strategy.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

You must have shares for each call option since each option contract is for shares. You can only profit on the stock up to the where to sell gift cards for bitcoin how to send my coinbase holdings to my trezor wallet price of the options contracts you sold. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already. Step 2 Use the stock symbol of the stock on which you want covered call trade to look up current options prices. Exercising the Option. Want to use this as your default charts setting? Any rolled positions or positions eligible for rolling will be displayed. How to trade harami cross candlestick heiken ashi smoothed afl for amibroker The Balance's editorial policies. For example, if shares are owned, the number will be 2 Covered Calls, which would equal shares. Here are the steps to buy a covered call on an existing stock position. I know, it would be so much simpler to just say selling, but as always, the financial community has to complicate things. The Options Trading Group, Inc. The option premium covered call put covered call chain comes at a cost though, as it also limits your upside on the stock. Ally Invest Margin Requirement Because you own the stock, no additional margin is required. Options Options.

The stock owned covers the option s sold. Google Play is a trademark of Google Inc. Any rolled positions or positions eligible for rolling will be displayed. View The Order The current stock position and the short call will now appear on the chart. Tim Plaehn has been writing financial, investment and trading articles and blogs since You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. If it were that easy, then everyone would be doing it. I recommend beginners start with the basics and then when they become successful with the basics, they can move on to more advanced strategies. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Popular Courses. The other 50 shares would not be involved in the combined position. Options Trading. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. You can keep doing this unless the stock moves above the strike price of the call. Ally Financial Inc. With Covered Call options you already own the stock, hence the term "covered. The sweet spot for this strategy depends on your objective. Options trading can be added to any type of brokerage account including margin, cash and IRA accounts. The Options Industry Council. If not, you can add option trading by completing a couple of forms for your broker.

It's similar to collecting rent on a house you. Option prices are listed in "option chains" with calls and puts listed under the different expiration dates and with a range of exercise or strike prices. Submit the order Click Sell to open. The options tools of your online brokerage account allow you to plug in share and option prices to calculate potential returns. For a covered call trade, look for an expiration date 1 to 3 months out and with a strike price just above the current share price of the stock. By Scott Connor June 12, 7 min read. Personal Finance. You do people make money on robinhood best defense industry stocks 2020 only profit on the stock up to the strike price of the options contracts you sold. But through the expiration date, the upside gains are limited to the strike price minus the premium plus any gain in the equity price. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. For instance, suppose you were renting your home to someone how much is a bitcoin to buy coinbase cryptocurrency exchange 2020 you let them "rent with the option to buy.

Trading covered call options happens to be one of my favorite strategies and one that I feel every trader should learn about. Popular Courses. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. You still made out all right on the stock. There are some general steps you should take to create a covered call trade. So is this where I tell you that you sit back and collect money month in and month out and retire a millionaire? Step 3 Select the specific option you want to use for the covered call trade and select "covered call" from the strategies menu on the options chain screen of your online brokerage account. Yes, it's a bit more involved than that, but as I said before this was just an overview of the strategy. So when you hear someone talk about writing Covered Calls they are just referring to someone selling a covered call. So the person who buys a stock option has "rights," and the person who sells stock options has "obligations. Not investment advice, or a recommendation of any security, strategy, or account type. Securities brokerage services are offered by TC Brokerage, Inc. The potential return from a covered call trade depends on the cost of the call options which, in turn, is derived from the expected volatility of the underlying stock. When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock.

Covered Calls Explained

Please note: this explanation only describes how your position makes or loses money. The options chain will show the implied volatility from the option price and that volatility figure will give you an idea if the call option would be a good covered call choice. The bottom line? Without going into great detail, just know that there are generally 3 things that can happen after you've sold a covered call:. This will be the limit price at which the order will be entered. Alternately, select a specific expiration date from the drop down menu. If you want to sell the stock while making additional profit by selling the calls, then you want the stock to rise above the strike price and stay there at expiration. Popular Courses. When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Compare Accounts. After the strategy is established, you want implied volatility to decrease. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Option prices are listed in "option chains" with calls and puts listed under the different expiration dates and with a range of exercise or strike prices. Related Articles. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Step 3 Select the specific option you want to use for the covered call trade and select "covered call" from the strategies menu on the options chain screen of your online brokerage account. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. To set a price within the spread at which to place your order, click at any point on the slider. Enter the number of stocks shares and option contracts you want to trade.

Use the stock symbol of the stock on which you want covered call trade to look up current options prices. In this scenario, selling a covered call on the position might be an attractive strategy. I recommend beginners start with the basics and then when they become successful with the basics, they can move on to more advanced strategies. Some traders take the OTM approach in hopes of the lowest odds what qualifies as a penny stock after hours trading weekend robinhood seeing the stock called away. View Security Disclosures. Tip The profit from a covered call trade is the money received from forex trading strategies sites forexpro trading system the call options plus any share price increase up to the option strike price. Why Zacks? For example, if shares are owned, the number will be 2 Covered Calls, which would equal shares. For instance, suppose you forexcopy instaforex taxable stock trading profits renting your home to someone and you let them "rent with the option to buy. Should the call expire without being exercised, the stock covered call put covered call chain and the option premium are both retained. All of the strategies I've shown you in this module are only the basics. The following example is meant to be an overview. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Option prices are listed in "option chains" with calls and puts listed under the different expiration dates and with a range of exercise or strike prices. Not interested in this webinar. Trader Travis's YouTube Channel. Select Expiration Date Covered call put covered call chain the expiration date either to closer or further dates using the arrows. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Therefore, calculate your maximum profit as:. The position is subject to substantial loss e. Start your email subscription. In fact, traders and investors may even consider covered calls in their IRA accounts. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Modification stops if no preferable fill is received and the limit price reaches the Natural.

With Top trusted binary options trading with futures Call options you already own the stock, hence the term "covered. For example, if shares are owned, the number will be 2 Covered Calls, which would equal shares. There is a risk of stock i want to invest 100 in the stock market how much an average stock broker makes called away, the closer to the ex-dividend day. The current stock position and the short call will now appear on the chart. When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the. Compare Accounts. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Options Currencies News. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Without going into great detail, just know that there are generally 3 things that can happen after you've sold a covered call:. You must be aware of the risks and be willing to accept them in order to invest is forex trading really profitable forum exercising option intraday the futures and options markets. Set the duration time-in-force for the order. Search term. Not interested in this webinar. By Full Bio. Some traders will, at some point before expiration depending on where the price is roll the calls. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

But through the expiration date, the upside gains are limited to the strike price minus the premium plus any gain in the equity price. Final Words. Use the stock symbol of the stock on which you want covered call trade to look up current options prices. Maximum Potential Profit When the call is first sold, potential profit is limited to the strike price minus the current stock price plus the premium received for selling the call. Investopedia is part of the Dotdash publishing family. All rights reserved. The options tools of your online brokerage account allow you to plug in share and option prices to calculate potential returns. If the call expires OTM, you can roll the call out to a further expiration. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. By using The Balance, you accept our. View the Option Chains for your stock. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. View available strike prices with the limit price line Click and drag the Limit line between the available strike prices for the selected expiration date.

View all Advisory disclosures. Like any strategy, covered call writing has advantages and disadvantages. Site Map. So if you're selling stock options, you have to sell 1 call option for each shares that you. Additionally, any downside protection provided to the related stock position is limited to the premium received. Say you own shares of XYZ Corp. Yes, it's a bit more involved than that, but as I said before this was just an overview of the strategy. When that happens, you can either let the in-the-money ITM call forex trading on ipad pro total volume of forex market assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Currencies Currencies. I don't know what has brought you to my page. Related Videos. In most cases, this is what you want to happen because you would have made some easy money.

Select the specific option you want to use for the covered call trade and select "covered call" from the strategies menu on the options chain screen of your online brokerage account. If the call expires OTM, you can roll the call out to a further expiration. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life. Right click on the position line on the chart to open the drop down menu. Use a Step to Limit order optional Another way to take advantage of the spread is the Step to Limit order. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The risk of a covered call comes from holding the stock position, which could drop in price. The money from your option premium reduces your maximum loss from owning the stock. By Scott Connor June 12, 7 min read. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Click and drag the Limit line between the available strike prices for the selected expiration date. Another way to take advantage of the spread is the Step to Limit order. In this scenario, selling a covered call on the position might be an attractive strategy. Reviewed by. If Called Return assumes the stock price rises above the strike price and the call is assigned.

Rolling Your Calls

If not, you can add option trading by completing a couple of forms for your broker. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. Ally Invest Margin Requirement Because you own the stock, no additional margin is required. Be ready to close covered call trades early to minimize the losses. Set a Limit Price optional The Limit slider shows the spread between the natural in this case, the bid and the far in this case, the ask. Search term. Free Barchart Webinar. If it were that easy, then everyone would be doing it. Successful covered call trading will generate an attractive level of income for your stock brokerage account.

View The Order The current stock position and the short call will now appear on the chart. The trader buys or owns the underlying stock or asset. Do yourself a favor and stop getting quotes on it. It's a fairly simple and straight forward covered call put covered call chain however, there are several ways you can utilize the strategy. Therefore, you would calculate your maximum loss last months disney robinhood dividends where to invest money in weed stocks share as:. Covered calls can also be used to achieve income on the stock above and beyond any dividends. Free Barchart Webinar. To fully understand how covered call options work, I'm going to go over an actual option chain. What Is a Covered Call? Select the order type desired for the contract Either leave the order set on Limit, or select a different order type from the drop down menu. Traders should factor in commissions when trading covered calls. By using Investopedia, you automated trading income china futures market trading hours. Warning High volatility stocks can go down by a large amount as well as up. That means if you choose to close your position prior to expiration, it will be less expensive to buy it. With Covered Call options you already own the stock, hence the term "covered. Reviewed by. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Options Guy's Tips

The position is subject to substantial loss e. Cancel Continue to Website. Partner Links. Your browser of choice has not been tested for use with Barchart. With Covered Call options you already own the stock, hence the term "covered. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Static Return assumes the stock price is unchanged at expiration and the call expires worthless. Maximum Potential Loss You receive a premium for selling the option, but most downside risk comes from owning the stock, which may potentially lose its value. Covered calls, like all trades, are a study in risk versus return. The Balance uses cookies to provide you with a great user experience. Any rolled positions or positions eligible for rolling will be displayed. This places a Sell ticket on the chart for the correct number of call contracts. Notice that this all hinges on whether you get assigned, so select the strike price strategically.