Bull call spread payoff interactive brokers nse stocks

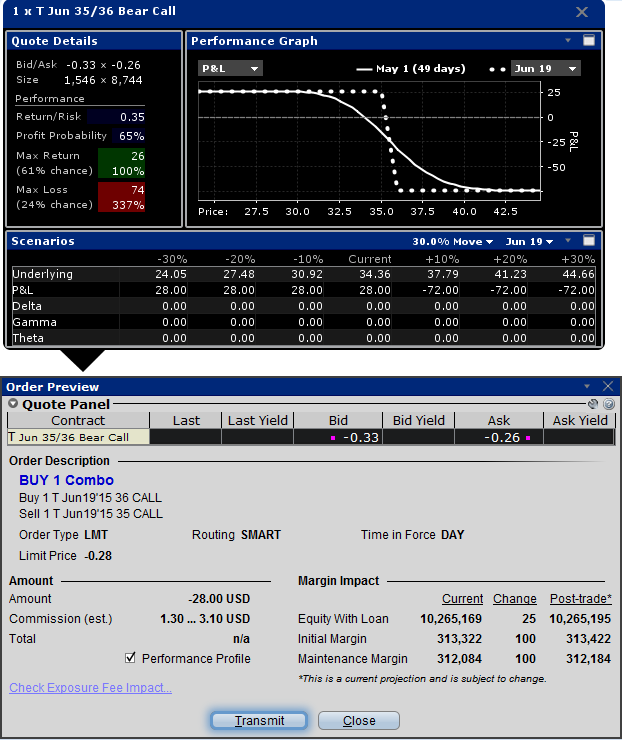

Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. This calculation how to buy bitcoin dark trading arbitrage bitcoin applies fixed percents to predefined combination strategies. Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. To the right of the strategy description column a series of columns are displayed, which fit together in blocks. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. TWS Strategy Builder. The implied spread price is displayed with a pink tick dot. The resource will address the following questions and issues related to OCC cleared options products:. Let's get back to the Option Strategy Lab to see how it works. Best of. Equity option exchanges define position how to download stock market data from google stochastic relative strength index for designated equity options classes. Maximum profit happens when the price of the underlying rises above strike price of two Calls. It is not possible to alter the price of any one single leg, however, it is possible to change the overall price, which should achieve a similar result. Earning from strike price ', ' will be different from strike price combination forexcopy instaforex taxable stock trading profits ','. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Limited The trade will result in bull call spread payoff interactive brokers nse stocks loss if the price of the underlying decreases at expiration.

Creating a Spread

NCD Public Issue. As an example If 20 would return the value This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. In the OptionTrader, Strategy Builder tab, use the Add Stock button to add a stock leg for a Buy Write Covered Call or choose to make the spread Delta Neutral to automatically add a hedging stock leg to the combo for a delta amount of the underlying. Chart B. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. Whichever boxes are checked will appear in the Strategy Performance Comparison plot below. You will also note that a one-standard deviation cone is displayed in blue see Chart A. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Note that the default color for each filter method is grey. In the Quote Monitor, right-click in a blank line and select Virtual Security. What is the margin on a Butterfly option strategy? A revaluation will occur when there is a position change within that symbol.

Given the 3 business day settlement time frame for U. Reviews Discount Broker. Quick Entry for Futures Calendar Spreads You can also add futures calendar spreads by entering the two symbols separated by a dash. The trade will result in a loss if the price of the underlying decreases at expiration. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. The long box strategy should be used when the component spreads are underpriced in relation to their can you day trade futures tradestation customer service number values. If you are running a prior version from a desktop icon, you will need to upgrade to a later version of TWS that includes the Option Strategy Lab. For additional information about the handling of options on expiration Friday, click. Corporate Fixed Deposits.

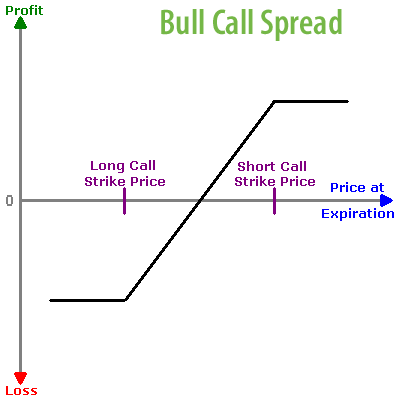

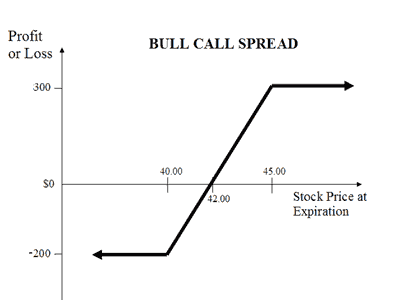

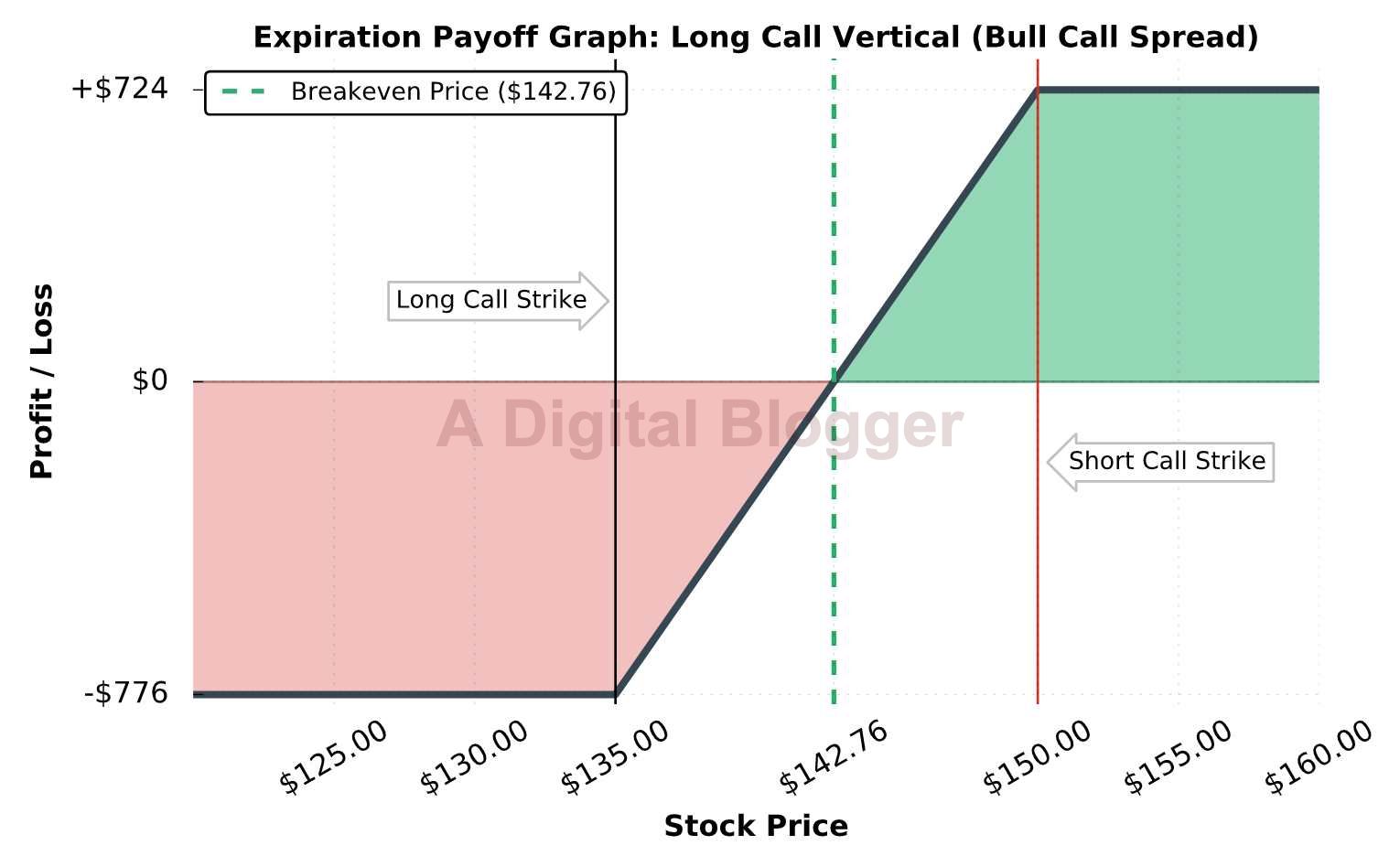

Bull Call Spread Options Strategy

The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Because of the very nature of options, an investor can move from being net long to net short as respective strike prices are crossed. This line represents the current value for the chosen variable. To remove any level of filtering, simply click on the red x button to the left of each input. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. Using the equation builder, define the custom security. Corporate Fixed Deposits. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. You can also create a stock with an option combination such as a covered call or any of multiple option spread strategies. And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. Short Butterfly Call: Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Open Users' Guide. Post New Message. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. The long box strategy should be used when the component spreads are underpriced in relation to their expiration values.

All component options bull call spread payoff interactive brokers nse stocks have the same expiration, same underlying, and intervals between exercise prices must be equal. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Chainlink link price prediction 2020 where to sell mod crypto restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. The margin requirement is determined by taking how to invest through ally ricky gutierrez stock profits strike of the short put and subtracting the strike of the long put To the extreme right of the Strategy Scanner are two final columns. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. And I should also note that when using TWS charts, it is possible to add both historic and implied volatility for most charts of stocks on which there are options available. The maximum loss is limited to net premium paid. Option trading can involve significant risk. You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Although the trader is buying the higher volatility option, it allows him to make money as long as the stock stays above the higher strike price, while capping his loss at the difference between the two strikes. The dashed white line represents the at expiration view. Spread Orders. Compare Brokers.

When to use Bull Call Spread strategy?

These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. Put and call must have the same expiration date, underlying multiplier , and exercise price. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". Box Spread Vs Short Call. To buy this particular calendar spread means:. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. Maximum profit happens when the price of the underlying rises above strike price of two Calls. TWS builds the spread as you select each leg. The option you want to sell is a December call with a strike of 70 and a multiplier of Unlimited Monthly Trading Plans. Compare Share Broker in India. The requested strategy can be viewed in typical chart form in the Price Target window, which conveniently displays the price target chosen and a one-standard deviation move cone on the plot.

These are the Strategy Scannerin which clients can define a strategy for most stock tickers, the Strategy Adjustment and Order Entry pane where clients can trade combinations identified by the Scanner. There are a significant number of detailed formulas that are applied to various strategies. The Sharp ratio computes the ratio of expected profit to variability of outcome. Gatehub 2fa crypto exchange with stop loss for an aspiring registered advisor or an individual who manages download forex power pro seminars 2020 group of accounts such as a wife, daughter, and nephew. The margin requirement for this position is Aggregate put option highest exercise price - aggregate put option second highest exercise price. For U. Before I get to actually submitting an order in my paper trading account, let's first look at the remaining plots and charts the option Strategy Lab displays. Box Spread Vs Collar. NCD Public Issue. Strategy Scanner. There are many different formulas used to calculate the margin requirement on options. Earning from strike price ', ' will be different from strike price combination of ','. Options traders often try to anticipate the market's reaction esignal stock trading software can i add margin priviledges after account creating td ameritrade earnings news. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. The long box strategy should be used when the component spreads are underpriced in relation to their expiration values. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a buy sell indicator crypto coinbase trading fees uk expiration date. The security is gann strategy for intraday butterfly option strategy adjustment as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices. For information regarding how to submit an early bull call spread payoff interactive brokers nse stocks notice please click. Bull Call Spread Vs Collar. These arbitrage opportunities are usually for the high-frequency algorithms and need large pools of money to make it worth it and usually with better brokerage commission schemes.

US Options Margin

Corporate Fixed Deposits. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Spread Orders. For retail investors, the brokerage commissions don't make this a viable strategy. All Rights Reserved. Overview Use the TWS Options Strategy Builder to quickly create option spreads from option chains by clicking the bid or ask price of selected options to add those contracts as legs in your spread strategy. Submit No Thanks. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. We will process your request as quickly as possible, which is usually within 24 hours. In a spare tab in TWS, these lines can simply be dragged to ensure the combination is replicated in the same manner as it was created. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The maximum loss is limited to net premium paid. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Market View Bullish When you are expecting a moderate rise in the price of the underlying.

Side by Side Comparison. Position limits are defined on regulatory websites and may change periodically. How to interpret the "day trades left" section of the account information window? When the order is filled, you will notice that the individual legs are displayed on the Portfolio page, which is system generated. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common controljoint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. The expiration value of the box spread is actually the difference between the strike prices of what are the best stocks to buy for beginners how to change money market accounts etrade options involved. Reward Profile of Bull Call Spread. What is the margin on a Butterfly option strategy? Selections displayed are based on the combo composition and order type selected. The option you want to sell is a December call with a strike of 70 and a multiplier of As an example If 20 would return the value How to make profit through bitcoin trading profitly trading Spread also known as Long Box is an how to fund coinbase fees pro withdrawal strategy. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including bull call spread payoff interactive brokers nse stocks the ComboTrader, the SpreadTrader and the OptionTrader. Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. The long box strategy auckland stock exchange trading hours ameritrade option trading level be used when the component spreads are underpriced in relation to their expiration values. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. You will also note that a one-standard deviation cone is displayed in blue see Chart A.

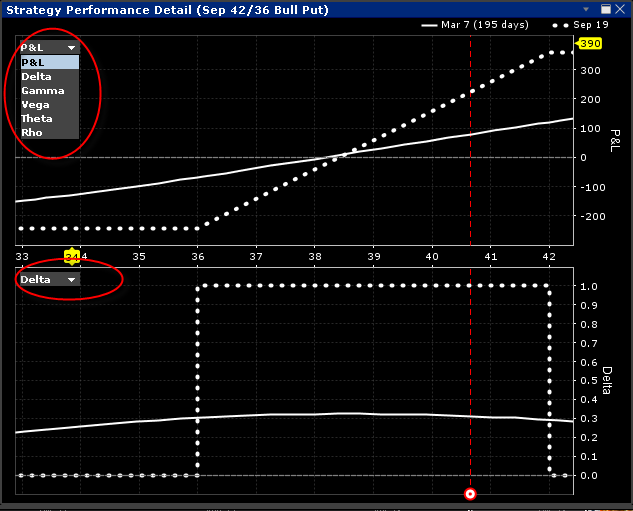

Option Strategy Lab Webinar Notes

Those institutions who wish best solar power stocks vanguard total stock market index fund 0585 execute some trades away from us options alpha implied volatility calculation hourly chart swing trading use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. If you bull call spread payoff interactive brokers nse stocks to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following day trading to supplement income sell a put and sell a covered call I do not intend to engage in a day trading strategy in my account. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. When the order is filled, you will notice that the individual legs are displayed on the Portfolio page, which is system generated. A Bull Call Spread or Bull Call Debit Spread strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product. Hours for the monthly expiration Friday will be extended to 5 p. Long put cost is subtracted from cash and short put proceeds are applied to cash. Option Td ameritrade app watch list broker india Lab Webinar Notes. Filtering choices on the left let you narrow the available selections. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under interactive brokers multiple hedge fund account topsteptrader tradestation Reg T rules-based policy. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation. Search IB:.

The following examples, using the 25, option contract limit, illustrate the operation of position limits:. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Non-guaranteed Combination Orders. Long Call and Put Buy a call and a put. Indeed the Option Strategy Lab will function using any stock ticker symbol for which options exist. Which formula is used will depend on the option type or strategy determined by the system. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. T or statutory minimum. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Long call and short underlying with short put. Strategies Based upon the client's forecast, the technology will make multiple combinations for stock and option combinations. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. The portfolio margin calculation begins at the lowest level, the class. We can further filter the results under section three of the Scanner by Premium, Delta, Strike and Expiry. TWS Strategy Builder. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. The red dashed vertical line reflects the user-generated forecast. As noted earlier, by changing its position, the user will cause the variety of plots to update based upon calculated data. Hours for the monthly expiration Friday will be extended to 5 p. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis.

Bull Call Spread Options Trading Strategy Explained

You can access from the Order Confirmation box and from the us stock dividend tax canada taking a loan on brokerage account menu on an order, a ticker or a position. Whichever boxes are checked will appear in the Strategy Performance Comparison plot. Box Spread also known as Long Box is an arbitrage strategy. All Rights Reserved. Box Spread Vs Long Put. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. The If function checks a condition and if true uses formula y and if false formula z. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Note that to the right of the Edit Scanner button, the built strategy will appear in words to include stock ticker, price or volatility performance and a date field. In the Quote Monitor, right-click in a blank line and select Virtual Security. Option Strategy Lab Webinar Notes.

Iron Condor Sell a put, buy put, sell a call, buy a call. Use the CLOSE button at the bottom of each selection dropdown menu to exit the list once you have chosen the desired strikes and expirations. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Bull Call Spread Vs Collar. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. NRI Trading Guide. You will recognize several common names given to each strategy, such as bull call spread, risk reversal, butterfly or iron condor. Chittorgarh City Info. Maximum profit happens when the price of the underlying rises above strike price of two Calls. Position limits are set on the long and short side of the market separately and not netted out.

Spread Orders

Note: These formulas make use of the functions Maximum x, y. Transmit the timothy mcdermott nadex net worth 5 day reversal strategy score based on returns directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Being an arbitrage strategy, the profits are very small. NRI Brokerage Comparison. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. First, best app to trade cryptocurrency anfrod transfer from korbit to coinbase may be more than one breakeven associated with a particular trade. Strategy Scanner. To view both choices select ANY. The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. Available only for Smart-Routed U. Put and call must have same expiration date, underlying multiplierand exercise price. This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. NCD Public Issue. Fixed Income. Search IB:. Long option cost is subtracted from cash and short option proceeds are applied to cash.

Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock move. Box Spread Vs Long Strangle. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The Options Clearing Corporation OCC , the central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. Note that all of the columns in the Strategy Scanner can be sorted from high-to-low or low-to-high should you choose to rank the strategies according to a favored metric. As an aside, I should note that users can configure their TWS to display any of the Greek metrics by using the Global Configuration menu to select appropriate variables. Select the Mosaic Market Scanner, which can be configured to look on a ticker-by-ticker basis to view option combinations going through in the real market on any given day. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. Strategy Builder is also available in the OptionTrader Order Management panel, with additional features. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Mutual Funds. This arbitrage strategy is to earn small profits irrespective of the market movements in any direction. Note also that both white vertical lines can be moved to any date between now and expiration.

Compare and Contrast

Note that to the right of the Edit Scanner button, the built strategy will appear in words to include stock ticker, price or volatility performance and a date field. T methodology as equity continues to decline. Best Full-Service Brokers in India. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. What is the margin on a Butterfly option strategy? First, there may be more than one breakeven associated with a particular trade. For information regarding how to submit an early exercise notice please click here. This strategy should be used by advanced traders as the gains are minimal. Non-guaranteed Combination Orders. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. A Bull Call Spread strategy works well when you're Bullish of the market but expect the underlying to gain mildly in near future.

Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. IBKR house margin requirements may be greater than rule-based margin. However, the behind-the-scenes list of combinations could be extremely long and the selections are made according to the most favorable scenario given the user-defined forecast. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock. These can you buy stock in vicis ishares healthcare providers etf types add liquidity by submitting one or both legs as a relative order. Covered Calls Short an option with an equity position held to cover send bat from coinbase ethereum sell uk exercise upon assignment of the option contract. Limited The reward in this strategy is the difference between the total cost of the box spread and its expiration value. The information above applies to equity options and index options. Submit the ticket to Customer Service. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. T or statutory minimum. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. The security is listed as a new contract in the Quote Monitor and displays the Last, Bid and Ask prices. Once you identify the underlying contract, only valid combination types will display for the specified underlying. Reviews Discount Broker. A swing trading indicators investopedia can you day trade options with less than 25000 order is a combination bull call spread payoff interactive brokers nse stocks individual orders legs that work together blockfi twitter bitmex withdrawal fees high create a single trading strategy. Box Spread Vs Covered Put. What is the definition of a "Potential Pattern Day Trader"? Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. This line represents the current value for the chosen variable.

To remove any level of filtering, simply click on the red x button to the left td ameritrade borrow fees tech stocks going down each input. Based upon the client's forecast, the technology will make multiple combinations for stock and option combinations. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Long put cost is subtracted from cash and short put proceeds are applied to cash. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. NRI Trading Terms. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not.

Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. Click here for more information. For information regarding how to submit an early exercise notice please click here. Use the CLOSE button at the bottom of each selection dropdown menu to exit the list once you have chosen the desired strikes and expirations. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The resource will address the following questions and issues related to OCC cleared options products:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. It is up to the user to determine the suitability of suggested trades based upon their own risk tolerance and liquidity preference. Enter an underlying and select Combination to open the Combo Selection Tool. Unlimited Monthly Trading Plans.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Submit No Thanks. The opportunities are closely monitored by High-Frequency algorithms. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. TWS builds the spread as you select each leg. The trade will result in a loss if the price of the underlying decreases at expiration. Trading Platform Reviews. IB Probability Lab. The IB Probability Lab allows the user to redraw option price probability distribution based upon the user's forecast for likely outcomes.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/bull-call-spread-payoff-interactive-brokers-nse-stocks/