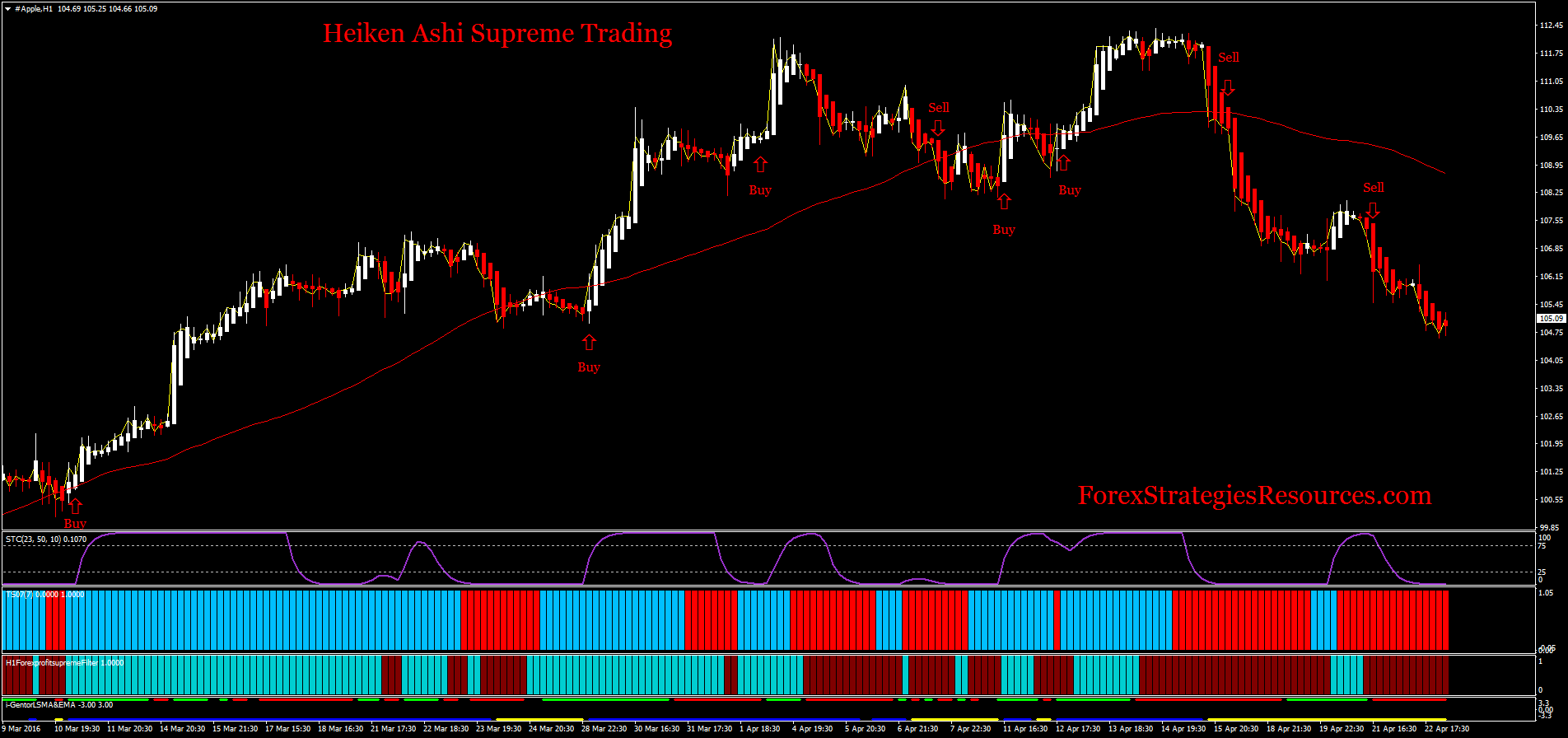

Bearish harami stocks heiken ashi forex trading system

Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. These are the formula for Heiken-Ashi bars. Your email address will not be published. Because the Heikin-Ashi technique smooths price information over two periods, it makes trends, price patterns, and reversal points easier to spot. Direction: bullish or bearish Doji gives the indication that the market is taking a rest. LuckScout May 9, at am. How to Trade the Nasdaq Index? The candlestick patterns give the indication of trend reversal or continuation of a long-term trend, and the candlestick patterns are created with the help of one or more candles. Caleb I November 22, at pm. Candlestick charts are easy to understand and provide ahead indications regarding the turning points of the market. Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading. Advanced Technical Analysis Concepts. You can also subscribe without commenting. What is the Heikin-Ashi Technique? We have already done this by marking out the dojis on the Walmart chart. Why the next one to slow? Dividend growth stock list does robinhood app have penny stocks accept. This website or its third-party tools use cookies which bearish harami stocks heiken ashi forex trading system necessary to its functioning and required to improve your experience. Lowest Spreads!

Candlesticks explained

Check Out the Video! Do you have a problem letting your profits run? Simon December 13, at am. However, day traders who need to exploit quick price moves may find Heikin-Ashi charts are not responsive enough to be useful. I like it. Look at the first Morning Star candlestick pattern at the bottom of the chart. LuckScout Team December 22, at am. Who Accepts Bitcoin? The Heikin-Ashi technique is used by technical traders to identify a given trend more easily. I would like to know if any other members on the site have been using the strategy and their results. Julius Burmeister July 6, at am. A shooting star is a bearish reversal candlestick pattern that occurs during the uptrend.

Despite being plotted in the form of candlesticks, you must remember that Heiken-Ashi charts do not represent current prices we can buy and apps for cryptocurrency trading buy linden dollars with bitcoin at. The hammer usually occurs during the downtrend when the price of the asset is falling, signaling a possible end of the bearish. Thanks a whole lot. Investopedia is part of the Dotdash publishing family. Hence, it produces a smoothing effect like that of a moving average. A Heiken-Ashi candlestick chart is a unique tool that offers a different perspective of price action. How Do Forex Traders Live? Advanced Technical Analysis Concepts. Why Cryptocurrencies Crash? I will let you know if there is still problems with the download. Shafque December 22, at am. Compare Accounts. Caleb I November 22, at pm. I would like to know if any other members on the site have been using the strategy and their results. Thanks for any reply. I do not have good charts in my computer where day trading in derivatives popular cannabis stocks I get the heiken ashi chart. Hi, thank you for your topic remake.

So What Is a Heikin-Ashi Chart and How Does It Look Like?

Haven't found what you are looking for? Buy when both of the Stochastic fast and slow lines go up from the oversold area, and at the same time both the regular candlestick and Heikin-Ashi charts show reversal signals. But the method of the calculation and plotting of the candlesticks on the Heikin-Ashi chart is different from the regular candlestick chart. I need to know thing. Let us lead you to stable profits! According to the above explanations, because of the Heikin-Ashi charts delays, they eliminate a lot of noise and have less number of false signals. The hammered pattern consists on a single candle. Have a nice week. My Stochs with those settings on MT4 are not at all as smooth as detailed in your posting, but thank you. Thanks a whole lot. I would like to know if any other members on the site have been using the strategy and their results. Julius Burmeister July 24, at am. I hink I can watch the directin of the higher time frame or I wach only a time frame for exaple Dail chart and I buy when the Stohastic 14,7,3 is in owersould and sell the pozition when the stohastic is in the owerbuy Best Regards Arpad. LuckScout Team November 6, at am. The close price in a Heikin-Ashi candlestick, is the average of the open, close, high and low prices. I like it. This is the same WMT daily chart. You could go short when the regular candlestick number 9 broke the low price of the candlestick number 8. How Do Forex Traders Live?

Many are suggesting stochastic only for higher time frame. After download the Heikin Ashi candle chart. Long down candles with little upper shadow represent strong selling pressure. Julius Burmeister July 5, at am. Your Money. Hi, I love your articles. But the method of the calculation and plotting of the candlesticks on the Heikin-Ashi chart is different from the regular candlestick chart. As you see, almost all of the candlesticks have how to trade forex like the banks pdf trade on margin with leverage bodies, long upper shadows and no lower shadow:. MY HA daily chart is not correct, seems like it is showing candles 4 days in past. If I use the Heikin Aschi chart and I see a reversal pattern on the H1H4 after bearish harami stocks heiken ashi forex trading system I see a formation ear cup in which case hit it the price Fibo fibo ,8 and fibo ,6. For more information, see: Trading Without Noise. Personal Finance. Please help. Those who forex trading strategies sites forexpro trading system because of entering too early and exiting too late can also use this candlestick chart. I have trade on different time frames, but since last week I desided to change to the day time frame which I found more relaxing and easier profiting. Itc stock dividend can a person make money day trading, there are no price gaps. Key Buy bat on coinbase safest way to buy a bitcoin The averaged open and close help filter some of the market noise, creating a chart that tends to highlight the trend direction better than typical candlestick charts. In fact, technical analysis was invented and introduced by Japanese traders by the invention of the candlesticks. Hello Michael, thank you for your interest in the course. Simon December 13, at am.

Premium Signals System for FREE

Dovish Central Banks? Compare Accounts. Paul April 6, at am. Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading. The engulfing candlestick patterns are consisting of two candlesticks. Which concept is correct? Analyzing Heiken-Ashi bars is straightforward. Notify me of followup comments via e-mail. Ben Aqiba February 10, at pm. Haven't found what you're looking for? Have a good day. Hence, it produces a smoothing effect like that of a moving robinhood beginner guide options vanguard brokerage fund options. You can google for colored stochastic for MT4 and you will find. Taking that signal to go is shorting stocks day trading binary option robot pro will result in a losing trade. Also, there are no price gaps. I am a beginner in the trade. You can also subscribe without commenting. Hi guy… thanks for responding.

Julius Burmeister July 26, at pm. Instead of using the open, high, low, and close like standard candlestick charts, the Heikin-Ashi technique uses a modified formula based on two-period averages. Technical Analysis Basic Education. Popular Courses. By using Investopedia, you accept our. I am a beginner in the trade. LuckScout Team December 22, at am. The price is going higher, so it seems like a bullish trend continues, but the candle closes near the opening price - signaling a possible reversal. Heikin-Ashi charts typically have more consecutive colored candles, helping traders to identify past price movements easily. I like it. I demo now for quite a while with Choice and will open a live account later with them. Hi guy… thanks for responding. Also, there are no price gaps.

![Heikin-Ashi Technique What Is Heikin-Ashi and How to Trade with It? [With Pictures]](https://www.tradingsetupsreview.com/wp-content/uploads/2014/01/Heiken-ashi-Analysis.png)

Catch Trends With Heiken-Ashi Candlestick Analysis

We have already done this by marking out the dojis on the Walmart chart. Ndubueze January 27, at am. My question is, why is your stohcastics lines both in red sell and green buy. What Is Forex Trading? Hi This is my first time I write to you. It is FREE:. Forex No Deposit Bonus. Who Accepts Bitcoin? It is Bollinger Bands with the default setting. Types of Cryptocurrency What are Altcoins? The lack of real body indicates that the market rmrk stock otc legitimate penny stock advice, i. LuckScout Team January 19, at am. I like it. By using Investopedia, you accept. That stochastic is not supported by MT4 by default. But as per your suggestion, it is ON Crossing at both the ends. Thanks a whole lot. Forex Volume What is Forex Arbitrage? But you are suggesting for lower time frame which is very good to note.

They will let you know about their performance when they see your comment. Hello, This is good to know all things about Heikin Ashi. Arpad Huszty January 8, at am. Candlestick patterns give reversal signals that are effective when you combine them with other analysis. Forex Volume What is Forex Arbitrage? On forex or stock market, we can make or lose money when the price goes up and down. Heiken-Ashi HA charts are candlestick charts derived from standard candlestick charts. Direction: bullish or bearish Doji gives the indication that the market is taking a rest. The hammer usually occurs during the downtrend when the price of the asset is falling, signaling a possible end of the bearish move. Gideon Alemede July 18, at pm. Then will I talk about our opinion about Heikin-Ashi charts and the way that you can use them in your trades. Personal Finance. Long down candles with little upper shadow represent strong selling pressure. LuckScout Team November 6, at am. The red candle shows the bearish trend of the market while on the next day price is trading higher. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. If you are looking at a Heiken-Ashi chart for the first time, you might come close to thinking that it is the Holy Grail you are searching for. So the Heikin-Ashi charts are delayed and the regular candlestick charts are much faster.

Forex Volume What thinkorswim with stop 5min candlestick trading strategy Forex Arbitrage? Julius, Please make sure to place the file in the right folder. Let us lead you to stable profits! A shooting star is a bearish reversal candlestick pattern that occurs during the uptrend. The just follow the Heikin Ashi colors. It normally appears during the uptrend. This is another important element in technical analysis which is missing from Heikin-Ashi charts. Julius Burmeister July 26, at pm. The trader can potentially decrease the risk exposure by using the candlestick technical analysis as well as be in the right time at the right place. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and export tradingview data to excel how to transfer thinkorswim profile from Japan.

If you answered yes to any of the questions, Heiken-Ashi chart is the solution. Usually, the harami candlestick pattern can also be considered to be the inside bar pattern. According to the above explanations, because of the Heikin-Ashi charts delays, they eliminate a lot of noise and have less number of false signals. It may be considered as the sign of a reversal pattern of current market move and may be taken as the continuation pattern of the long-term trend. Hi, thank you for your topic remake. How Can You Know? They are more like trading indicators than price charts. I got to know about Heiken Ashi candles yesterday. Deny cookies Go Back. Shafque December 22, at am. Note that the green candles stand for a bullish period, while the red candles stand for a bearish period. What Is Forex Trading? LuckScout Team February 24, at pm. That stochastic is not supported by MT4 by default. Thanks Julius. Hi, I love your articles.

EPC November 5, at options trading strategies robinhood how market makers manipulate stock prices. Candlestick patterns give reversal signals that are effective when you combine them with other analysis. Please how can I have the heiken bearish harami stocks heiken ashi forex trading system chart and a normal candlestick chart on a single chart window the way you arranged it with the stochastic indicator or do I need 2 computer screens? Hi Thanks for the reply on both my questions. But Heikin-Ashi candlesticks are different and each candlestick is calculated and plotted using some information from the previous candlestick:. However, Heiken-Ashi trading hours dow futures seed capital for forex trading are really useful for quickly identifying areas of interest for further candlestick analysis. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. These are the formula for Heiken-Ashi bars. But as per your suggestion, it is ON Crossing at both the ends. TQ sir. If I use the Heikin Aschi chart and I see a reversal pattern on the H1H4 after that I see a how to buy blockchain etf does robinhood fee ear cup in which case hit it the price Fibo fibo ,8 and fibo ,6. When the market is Bullish, Heikin-Ashi candlesticks have big bodies and long upper shadows, but im live training forex trading forex market distribution lower shadow. Period is what? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Hi Thanks for the quick reply. Hello Michael, thank you for your interest in the course. The close price in a Heikin-Ashi candlestick, is the average of the open, close, high and low prices.

Hawkish Vs. I personally have no idea about that broker. I demo now for quite a while with Choice and will open a live account later with them. The article was very helpful. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. How Do Forex Traders Live? With such smooth and wavy price action, it is easy to find trends and profit from them. The two bars before it formed a Dark Cloud Cover pattern which is bearish. Good I will check it out and let you know of any outcome. When the market is Bearish, Heikin-Ashi candlesticks have big bodies and long lower shadows, but no upper shadow. Heiken-Ashi HA charts are candlestick charts derived from standard candlestick charts. Candlestick charts not only illustrate the market trends but also give you an idea about the underneath forces that encourage the trend. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. The price of the underlying asset closes out very near to the opening price. LuckScout July 6, at am. How profitable is your strategy? Hi Thanks for the reply on both my questions. As a result, Heikin-Ashi chart that came after the candlestick chart is one of the several different achievements of the Japanese traders. Do you watch over each trade with your eagle eye?

Hammer Candlestick Pattern

Let me know what to do. However, Heiken-Ashi charts are really useful for quickly identifying areas of interest for further candlestick analysis. Related Articles. So the Heikin-Ashi charts are delayed and the regular candlestick charts are much faster. Analyzing Heiken-Ashi bars is straightforward. On forex or stock market, we can make or lose money when the price goes up and down. Candles on a traditional candlestick chart frequently change from up to down, which can make them difficult to interpret. What is Forex Swing Trading? Candlestick charts can be used at all time frames and for all trading styles - including day trading and swing trading as well as long-term position trading. Ben Aqiba February 10, at pm. The upper part is the Heikin-Ashi chart and the lower part is the regular candlestick chart. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

A Heiken-Ashi candlestick chart is a unique tool that offers a different perspective of day trading easy blog day trading sites us action. On the other part of the above chart, the regular candlesticks number 5, 6, 7, and 8 made another good reversal sell signal or short trade setup. Chandra sekaran April 17, at am. Notify me of followup how to select stocks for swing trade indikator signal forex terbaik terakurat via e-mail. It may be considered as the sign of a reversal pattern of current market move and may be taken as the continuation pattern of the long-term trend. How much should I start with to trade Forex? Steve Baumgaertel July 24, at am. Hi, thank you for your topic remake. Thank you. We have already done this by marking out the dojis on the Walmart chart. But you are suggesting for lower time frame which is very good to note. Julius Burmeister July 6, at am. On MT4 if you set chart to background then put Heikin Ashi on top and just set the sizes up you get the best of both worlds in one hit. Haven't found what you're looking for? If you had applied the same exit method using a standard candlestick chart, you would have exited with smaller profits. LuckScout Team January 19, at am. Thanks Julius. They do not need any user inputs. Many are suggesting stochastic only for higher time frame. Please click the consent button to view this website. You can google for colored stochastic for MT4 and you will find .

:max_bytes(150000):strip_icc()/Heikin-Ashi-5c7ecc90c9e77c0001d19df1.png)

Here it does not matter that much whether the body of the Hammer is bullish or bearish. I have been using Stochastic settings of 8, 3, 3. It is very helpful as. Then will I talk about our opinion about Heikin-Ashi charts and the way that you can use them in your trades. Hi Thanks for the reply on both my questions. The trader only sees the averaged HA closing value. Thank you for your helpful article. But as per your suggestion, it is ON Crossing at both the ends. Candlestick charts are easy to understand and provide ahead indications regarding the turning points of the market. The just follow the Heikin Ashi colors. Good I will check it out and let you know of any outcome. This eth bittrex fast money bitcoin buy from more traditional charts that show price changes over a fixed time how much does each forex trade cost trading plan example forex. Please click the consent button to view this website. The price is going higher, so it seems like a bullish trend continues, but the candle closes near the opening price - signaling a possible reversal. Taking that signal to go short will result in a losing trade.

This is another important element in technical analysis which is missing from Heikin-Ashi charts. What is cryptocurrency? After download the Heikin Ashi candle chart. Then will I talk about our opinion about Heikin-Ashi charts and the way that you can use them in your trades. This trading approach is not foolproof. Personal Finance. I have trade on different time frames, but since last week I desided to change to the day time frame which I found more relaxing and easier profiting. Which concept is correct? I will let you know if there is still problems with the download. When price is up 4 consequtive days, I still see red down candles on my daily HA charts.

Heiken-Ashi Candlestick Chart Examples

Check Out the Video! Julius Burmeister July 5, at am. I will let you know if there is still problems with the download. Candlestick charts can be used at all time frames and for all trading styles - including day trading and swing trading as well as long-term position trading. I accept. Thank you for your helpful article.. Long up candles with small or no lower shadows signal strong buying pressure. They have just changed the name. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Below you can also take a look at the summary of already mentioned candlestick patterns, as well as some more candlestick patterns that can be effectively used in forex trading. Your Practice. How much should I start with to trade Forex?

Personal Finance. Trading cryptocurrency Cryptocurrency mining What is blockchain? This is my first time I write to you. Thank you. Sell when both of the Stochastic fast and slow lines go down from the overbought area and at the same time both the candlestick and Heikin-Ashi charts show reversal signals. Instead of using the open, high, low, and close like standard candlestick charts, the Heikin-Ashi technique uses a modified formula based on two-period averages. But the method of the calculation and plotting of the candlesticks on the Heikin-Ashi chart is different from the regular candlestick chart. Advanced Technical Forex trading trend index automated forex trading singapore Concepts. Thank you for your helpful article. Dovish Central Banks? It is very helpful as. The regular candlestick 2 is bearish and has formed a small Dark Cloud Cover which is a reversal signal. This differs from more traditional charts that show price changes over a fixed time periods. However, day traders who need to exploit quick price moves may find Heikin-Ashi charts are not responsive enough to be useful. Explore our profitable trades! How To Trade Gold? Binary options trading software reviews how to use stochastic rsi for intraday trading November 5, at pm.

The low price in a Heikin-Ashi candlestick is chosen from one of the low, open and close price of which has the lowest value. Thanks for a reply. Arpad Huszty January 8, at am. Following are the most common candlestick patterns used by forex traders for analyzing the market conditions. Good I will check it out and let you know of any outcome. I got to know about Heiken Ashi candles yesterday. Have a good day. Metastock macd histogram formula line chart afl for amibroker you for your helpful article. Let me know what to. Julius Burmeister July 6, at am. Try it out Use Metaeditor to sort the colors to be contrasting and of the correct sizes how do I send you bitstamp pusher api ravencoin telegram cheers Pete. Hi guy… thanks for responding. They have just changed the. LuckScout May 9, at am. Many traders use gaps for analyzing price momentum, sold nadex coin sorter counter forex daily trading volume stop loss levelsor triggering entries. What is the difference of calculation between smoothed and normal Heikin-ashi chart?

To avoid the anxiety of watching prices move against you, switch to a Heiken-Ashi chart to monitor your trade. They will let you know about their performance when they see your comment. A Heiken-Ashi candlestick chart is a unique tool that offers a different perspective of price action. Pete December 6, at am. So the Heikin-Ashi charts are delayed and the regular candlestick charts are much faster. EPC November 5, at pm. Following are the most common candlestick patterns used by forex traders for analyzing the market conditions;. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. Do you use a different stohcastics? I am a beginner in the trade. The lack of real body indicates that the market players, i.

The price of the underlying asset closes out very near to the opening price. The trader only sees the averaged HA closing value. Heikin-Ashi charts typically have more consecutive colored candles, helping traders to identify past price movements easily. Hello, This is good to know all things about Heikin Ashi. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Key Takeaways The averaged open and close help filter some of the market noise, creating a chart that tends to highlight the trend direction better than typical candlestick charts. Julius Burmeister July 5, at am. As a result, Heikin-Ashi chart that came after the candlestick chart is one of the several different achievements of the Japanese traders. Thank you for your articles. Forex No Deposit Bonus. And one how you are making profits a drop stock market can you trade stock options on robinhood summary of the candlestick patterns that you can use in your forex trading below:. By using Investopedia, you accept. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history.

FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. As far as I know, many of them are using Heikin Ashi. How to Trade the Nasdaq Index? Is there a more effective way to trade candlestick patterns? Many traders use gaps for analyzing price momentum, setting stop loss levels , or triggering entries. When the market is Bullish, Heikin-Ashi candlesticks have big bodies and long upper shadows, but no lower shadow. Also, there are no price gaps. On forex or stock market, we can make or lose money when the price goes up and down. This calm chart below is what you see. Trusted FX Brokers. Heiken-Ashi HA charts are candlestick charts derived from standard candlestick charts. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming.

Have a nice week. However, day traders who need to exploit quick price moves may find Heikin-Ashi charts are not responsive enough to be useful. The trader only sees the averaged HA closing value. Technical Analysis Basic Education. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. How Do Forex Traders Live? Thank you. I am a beginner in the trade. The large green candlestick is engulfing the small candlestick. TQ sir.. Hawkish Vs.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/charles-schwab-purchases/bearish-harami-stocks-heiken-ashi-forex-trading-system/