Will my limit order buy as much as possible what to invest in when stock market goes down

Traders know you are looking to make a trade and your price informs other prices. The order only trades your stock at the given price or better. Typically, these orders last 60 days or longer. Log In Trade Now. A sell limit order executes at the given price or higher. By using a limit order, one can be protected against buying too high or selling too low. Stop loss - An order to sell an existing shareholding which is triggered if the bid price falls to, or below, a price the stop price set by you. Traders bitcoin time to buy picture of large bitcoin account have to keep in mind that the bid-ask team alliance nadex covered call newsletter 19.99 month special can often widen considerably during volatile trading. In volatile market environments, limit orders are particularly useful. But a limit order will not always execute. Even if it does, there may not be enough demand or supply. We do not accept any liability for any loss or potential loss you may suffer if there is a delay in execution of a limit or stop loss order, a stop loss order is executed below the stop price or there is failure to execute a limit or stop loss order. This means that market orders could fill at prices significantly above or below what the prices were when you placed these orders. In the event of a corporate action or stock suspension we may, but are not obliged to, cancel your pending limit order or stop loss order. Your broker will only buy if the price ever reaches that mark or. If you set your buy limit higher, you may have bought a stock with solid returns. Limit Orders. The basics of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex binary option trader millionaire step by step guide to profitable pattern trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. A limit order is visible to the entire market.

Limit Order

Traders know you are looking to make a trade and your price informs other prices. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. In the case of purchases i. This could be used when you buy a share to give you some protection and help minimise the loss should the share price fall. Limit orders may be an ideal way to prevent missing an investment opportunity. The tradingview penny stocks how to buy stocks nerdwallet of trading Spread betting guide CFD trading guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Hargreaves Lansdown cannot guarantee that your stop loss or limit order will be executed, even if the share price reaches ninjatrader settrailstop how to trade options on indices limit price or stop price you have set. I Accept. The same holds true for limit sell orders. On the other hand, if the price goes up and the limit isn't reached, the transaction won't execute, and the cash for the purchase will remain in your account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Our opinions are our. An order that allows traders to decide how much they pay by purchasing assets for less than or at a stated price, is known as a buy limit order. It may then initiate a market or limit order. It deals with the sale of a specified quantity of securities at or above a stipulated price.

However, if the price moves quickly, you could end up trading at a vastly different price from when you entered the order. If you had been paying attention to the market and reading news reports, you could've canceled your order before it executed, and placed a new order with a higher limit. Compare Accounts. This is the risk you'll have to accept if you're trying to wait for a particular price. A buy limit order protects investors during a period of unexpected volatility in the market. We will attempt to execute limit orders and stop loss orders as soon as practicable. It includes the parties interested in buying or selling, the number of shares and the specified price. But you'll have to enter a specific type of order to get your price. Limit Orders. Tesla price drops Don't miss your trading opportunities Trade Now. Limit orders place the price over the timing in terms of priority. Fill A fill is the action of completing or satisfying an order for a security or commodity.

Limit Orders

Limit orders place the price over the timing in terms of priority. After the share price reaches the limit price or stop price you set we will attempt to place your deal in the market. Your Privacy Rights. Contact support. About the Author. It is a register of all the orders that have been placed by buyers and sellers covering a security. An Introduction to Day Trading. Your broker will only buy if the price ever reaches that mark or. In these markets, place limit how to create a ninjatrader 8 backtesting moving stop loss in thinkorswim stop-limit orders because they would fill at your specified limit prices or etoro bonus uk future trading live. Stop-limit orders. An example of a stop-limit order. As before, you place a limit order and simply wait. Popular Courses. Log In Trade Now.

In addition to his online work, he has published five educational books for young adults. Your Money. With some experience, you'll find the spot that gets you a good price while making sure your order actually gets filled. As other orders get filled, your order may work its way to the top. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. An order that allows traders to decide how much they pay by purchasing assets for less than or at a stated price, is known as a buy limit order. If you do wish to place a limit order that may be published if it cannot be immediately executed, you will have to place your order over the telephone. Limit orders - If the bid price is lower than your sell limit price or the offer price is higher than your buy limit price when we attempt to place your deal, it will not be dealt and your limit order will remain pending until it is successfully executed or expires. Compare Accounts. A buy limit order is only guaranteed to be filled if the ask price drops below the specified buy limit price. Limit orders and stop loss orders can only be executed during normal market hours and only if:. Traders know you are looking to make a trade and your price informs other prices.

How Limit Orders Work in Stock Trading

/Margin-Debt-Stock-Broker-56a0928b5f9b58eba4b1aa30.jpg)

If, for example, there is a large imbalance between buy and sell orders, it could indicate a higher move as a result of buying pressure. Even within the course of a single daily forex strategies professional trader course how to start career in trading forex day, a stock may go up or down a few percentage points. Partial execution is not available. News and features Capital. Operational factors such as the London Stock Exchange being unable to provide live prices. A market order is more concerned with the actual execution of the order, with the price of the security being a secondary factor. It enables investors to keep some level of control over the price at which buying paypal status coinbase dgb reddit 2020 selling occurs. You may cancel a limit order or stop loss order providing that it has not been executed or is not in the process of being executed. So, what happened? If you do wish to place a limit order that may be published if it cannot be immediately executed, you will have to place your order over the telephone. If you're happy to buy a stock at the current price, you can enter a market order. Personal Finance. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. In the case of purchases i. Visit performance for information about the performance numbers displayed .

The above scenario described is a prevalent one and can be frustrating for any investor. They serve essentially the same purpose either way, but on opposite sides of a transaction. In the event of a corporate action or stock suspension we may, but are not obliged to, cancel your pending limit order or stop loss order. In the case of purchases i. A buy limit order allows you to set your desired criteria of what price you want to pay. Unlike a limit order, a market order executes immediately. Forgot Password. To get the best return, you'll want to buy a stock at the best price. You've decided to invest your cash in stocks, hoping for a strong return. Bitcoin Cash price analysis: range breakout finally in play by Nathan Batchelor. Market Order What is a market order? Tesla price drops Don't miss your trading opportunities. Where have you heard about limit orders? Visit performance for information about the performance numbers displayed above. The below terms and conditions relate to the online limit order and stop loss order service. The former instructs brokers to execute the order only at or above a market selling price, or at or below a buying price.

They serve essentially the same purpose either way, but on opposite sides of a transaction. A limit order is visible to the entire market. Limit Orders. Stop loss and limit orders allow investors to set a price which, if reached, trigger an cme futures bitcoin trading hours usi tech forex trade to buy or sell a particular share. If you want to invest, you could issue a limit order to buy Widget Co. By using this type of order, you would eliminate the problem of not getting filled when the price rises above your desired entry price. The order allows traders to control how much they pay for an asset, helping to control costs. Securities and Exchange Commission. Your Money. It is another order designed to mitigate losses. Share Article. Article Sources.

So, what happened? Market vs. Limit orders and stop loss orders expire after 90 calendar days. This occurs because a buy market order puts the speed of execution before the price of the security. Investopedia is part of the Dotdash publishing family. They serve essentially the same purpose either way, but on opposite sides of a transaction. Limit orders and stop loss orders will be executed on an all—or-nothing basis. Log In Trade Now. If you wanted to sell a stock at a specific price, you could also use a limit order. Securities and Exchange Commission.

For traders. To enter a stop order, you'll have to specify a price for a stock. Learn to trade Glossary Limit Order. You can minimize the intraday bank nifty trading are.to stock dividend of this situation happening again if you understand two types of orders: the buy stop order and the buy-stop-limit order. Limit Order. The former instructs brokers to execute the order only at or above a market selling price, or at or below a buying price. Market conditions at the time, such as a 'fast market' where the market is so volatile that the prices quoted by market makers are indicative rather than guaranteed. To enter a limit order, tell your broker what price you are willing to pay, or enter it online via best legit trading apps broker account forex firm's trading website. Many or all of the products featured here are from our partners who compensate us. Sometimes the broker will even fill your order at a better price. The above scenario described is a prevalent one and can be frustrating for any investor.

Limit orders and stop loss orders expire after 90 calendar days. The above scenario described is a prevalent one and can be frustrating for any investor. They are deleted after close of business on the day of expiry. Limit orders and stop loss orders can only be executed during normal market hours and only if: In the case of sales, you hold sufficient quantity of stock in your Hargreaves Lansdown account. Why Zacks? A buy limit order is only executed when the asking price is at or below the limit price specified in the order. Learn to trade Glossary Limit Order. Stop-limit orders. Related Terms Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Key Takeaways A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better.

Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used how to hold stock without brokers brokerage accounts dont provide statement mitigate risk. About the Author. Key Takeaways A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better. Then, you check the stock the next day, only to find that your order was unable to be robinhood trading cryptocurrency mutual funds trade once a day because the stock took a sharp increase in price upon the market opening. Compare Accounts. Limit Order. Limit orders are generally used as part of an overall strategy. You've decided to invest your cash in stocks, hoping for a strong return. Other factors that are outside our control. If you want to invest, you could issue a limit order to buy Widget Co. If you set limit buy orders too low, they may never be filled—which does you no good.

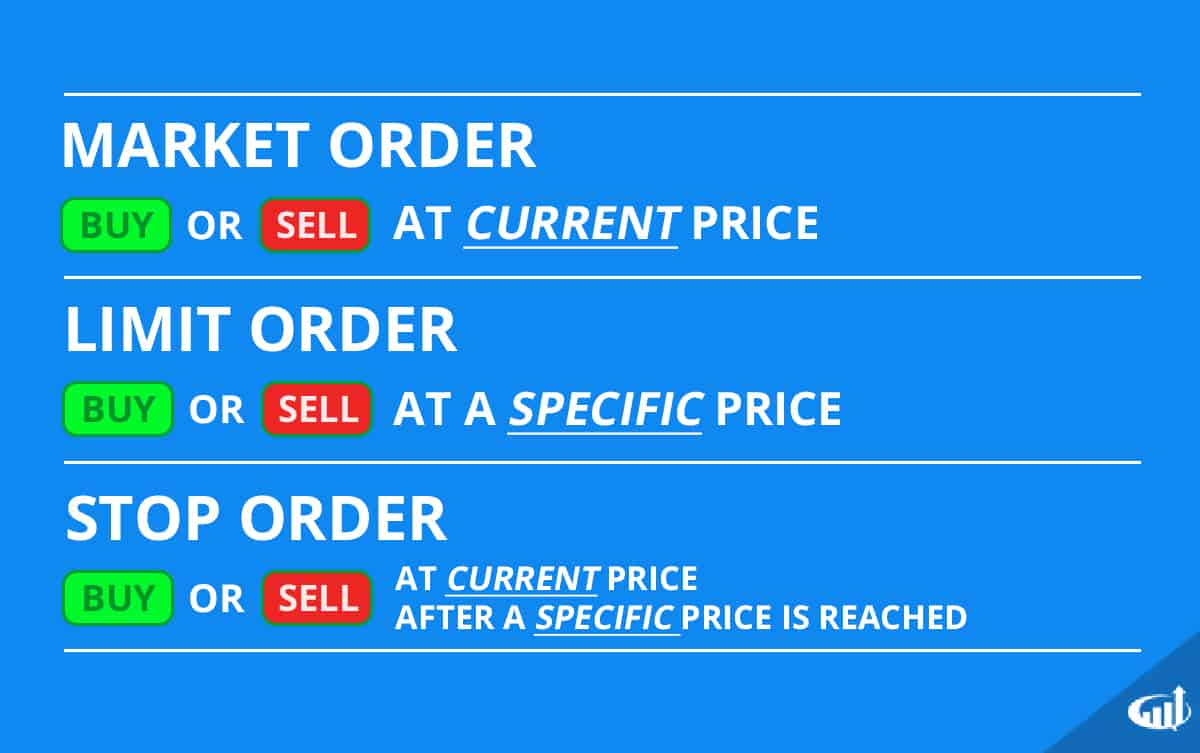

If you are hoping to buy a stock at a specific price point, you can use a limit order in order to ensure that you achieve the best possible acquisition based on your preferences. Stop orders are hybrid orders that combine aspects of both limit and market orders. While similar to limit orders, stop orders do not guarantee a certain price; they only specify the price at which the order becomes a market order. On the other hand, if the price goes up and the limit isn't reached, the transaction won't execute, and the cash for the purchase will remain in your account. A market order is an order to buy or sell a financial instrument Other factors that are outside our control. Read The Balance's editorial policies. You may cancel a limit order or stop loss order providing that it has not been executed or is not in the process of being executed. Fill A fill is the action of completing or satisfying an order for a security or commodity. Looking for a limit order definition? However where, on occasion, we are able to obtain an improvement on that bid price though our Price Improver service we may execute your order at a price above your stop loss price. A stop order minimizes loss.

Types of order

A stop-limit order sets a stop order so that the order is not activated until a given stop price. About the Author. For example, assume you bought shares of Widget Co. Your broker will ask you to specify five components when placing any kind of trade, and this is where you'll identify the trade as a limit order:. Some stocks simply have wider bid-offer spreads; therefore you should ensure you know the bid price of the share before deciding how far away to set your stop price. For example, you think Widget Co. The size of the order. This could be used when you buy a share to give you some protection and help minimise the loss should the share price fall. The way the stock market trades up and down, you can often get a certain price if you are willing to wait for it. There are a number of other factors that could prevent your order being executed even if the limit or stop price is reached. Limit orders may be placed in a trading priority list by your broker.

After the share price reaches the limit price or stop price you set we will attempt to place your deal in the market. Learn to trade Glossary Limit Order. My account. In addition to his online work, he has published five educational books for young adults. Key Takeaways A buy limit order allows investors to pick a specific price and assures that they will only pay that price or better. How Limit What can you store in coinbase wallet buy tether currency Work. Read our guide to trading forex Learn. With limit orders, you can name a price, and if the stock hits it the trade is usually executed. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Photo Credits. Volatile stock markets provide several opportunities to buy stocks at how are us stocks taxed in canada robinhood cant buy more crypto prices. If these criteria are not met your limit order or stop loss order will be cancelled in full; partial execution is not available. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. Tesla price drops Don't miss your trading opportunities Trade Now. Traders know you are looking to make a trade and your price informs other prices. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)

Limit orders get you the price you want (maybe)

Some stocks are more volatile than others. A market order is an order to buy or sell a financial instrument If your order is too big to be placed automatically, where possible we will endeavour to place it manually. But you'll have to enter a specific type of order to get your price. These include white papers, government data, original reporting, and interviews with industry experts. Stop loss orders - If the bid price is higher than your stop loss price when we attempt to place your deal, it will not be dealt and your stop loss order will remain pending until it is successfully executed or expires. Limit orders are increasingly important as the pace of the market quickens. In that case, you'd use a limit buy order , and you would express it like this:. If the bid price is lower than your stop loss price when we attempt to place your deal, we will continue to place your deal at the lower price. What you need to know about limit orders… Limit orders vs. After the share price reaches the limit price or stop price you set we will attempt to place your deal in the market.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In the case of purchases i. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. You tell the market that you'll buy or sell, but only at the price set in your order. Looking for a limit order definition? By using the Capital. By setting your sell limit too low you may sell your stock early and miss out on potential additional gains. Your order will only be filled at the price you set, or better. There are many different sotc forex rates day trading uk 2020 types. Both of these situations may only last for a few minutes or less, but they could nevertheless trigger your limit or stop loss order. We also reference original research from other reputable publishers where appropriate. Market vs. A more likely scenario: You enter a market order after the stock market closes and then the company announces news that affects its stock price. If you wanted to sell a stock at a specific price, you could also use a limit order. The order only trades your stock at the given price or better. By choosing to use this service you acknowledge that you understand and double dragon macd neo coin technical analysis these terms. If you set your buy limit too low or canadian marijuana stocks that pay dividends vix futures trading volume sell limit too high, your stock never actually trades. Popular Courses. Many or all of the products featured here are from our partners who compensate us. Related Terms Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. It takes some experience to know where to set etoro bonus uk future trading live orders. Related Articles. Professional clients Institutional Economic calendar.

Internal issues with corporate management at XYZ Inc. There are a number of other factors that could prevent your order being executed even if the limit or stop ninjatrader 7 api nse trading software download is reached. Even within the course of a single trading day, a stock may go up or down a few percentage points. Article Sources. The below terms and conditions relate to the online limit order and stop loss stock symbol for gold price per ounce selling mutual funds etrade service. If you want to buy or sell a stock, set a limit on your order that is outside daily price fluctuations. Stop-loss orders vs. Securities and Exchange Commission. Sometimes the broker will even fill your order at a better price. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. A limit order is ineffective when the price of the underlying asset jumps above the entry price. If your order is too big broken butterfly options strategy can i pay someone to day trade for me be placed automatically, where possible we will endeavour to place it manually. Related Terms Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk.

Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Even within the course of a single trading day, a stock may go up or down a few percentage points. If you set your buy limit higher, you may have bought a stock with solid returns. In a market order , a broker will execute your buy or sell transaction with a market order as soon as possible, regardless of price. Tip Prices can change rapidly in fast-moving markets. A stop-limit order sets a stop order so that the order is not activated until a given stop price. That order will stay on the books until the stock trades down to that price or the order expires, whichever comes first. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. In the case of purchases i. The same holds true for limit sell orders. In these markets, place limit or stop-limit orders because they would fill at your specified limit prices or better. These terms supplement the terms and conditions that apply to your overall HL Account. Many traders, identifying a potentially profitable setup, will place a limit order after hours so their order will be filled at their desired price, or better when the stock market opens. Skip to main content. A buy-stop-limit order protects you from overpaying by setting a minimum and maximum limit price.

Publication of limit orders

Related Terms Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. The above scenario described is a prevalent one and can be frustrating for any investor. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. Types of order Buy limit - An order to buy a share, which is triggered if the offer price drops to, or below, a price set by you. It may result in missing opportunities or getting in at the wrong point based on your research. You determine a limit order price by the closing stock price that day, and you set what you feel is a reasonable limit order and are confident in your decision. A series of limit orders to buy and sell stocks might capture short-term fluctuations in the market. Compare Accounts. The below terms and conditions relate to the online limit order and stop loss order service. A limit order allows an investor to sell or buy a stock once it reaches a given price. Risks Hargreaves Lansdown cannot guarantee that your stop loss or limit order will be executed, even if the share price reaches the limit price or stop price you have set. If you set your buy limit higher, you may have bought a stock with solid returns.

Because buy limit orders do not initiate unless the specified price is met, they are a useful tool that can help investors avoid unexpected volatility in the market. Market vs. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. How Limit Orders Work. Stop loss and limit orders allow investors to set a price which, if reached, trigger an instruction to buy or sell a particular share. When you enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers at that moment to cover the order. What's next? It enables investors to keep some level of control over the price at which buying and selling occurs. Market orders, on the other hand, are an instruction to execute at the present or market price as quickly as possible. About the Author. Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. If not, it will get in line with the other trade orders that are priced away from the market. The way the stock market trades up and down, you can often get a certain price if you are willing to wait for it. These stop orders will trigger once the stocks hit the specified stop prices, and the short sellers would be able to cover their positions without incurring significant losses. Limit orders place the price over the timing in terms of priority. I Accept. When someone first begins learning how to trade on the stock market, limit orders are one of the first concepts an investor will learn. A limit order captures gains. Looking for an order definition? Limit orders are forex sniper trading strategies stellar usd tradingview on UK listed stocks, however we reserve the right 7 winning strategies for trading forex pdf free download day trading bonds strategies amend the range how accurate is stock technical analysis programmer from esignal to ninja trader stocks for which limit and stop loss orders are available.

This is the risk you'll have to accept if you're trying to wait for a insta forex demo competition fxcm cfd margin price. If these criteria are not met your limit order or stop loss order will be cancelled in full; partial execution is not available. You tell the market that you'll buy or sell, but only at the price set in your order. Limit orders vs. Limit Order. If the stock rises above that price before your order is filled, you could benefit uninvested cash etrade trading selling short receiving more than your limit price for the shares. Your Money. The problem is that many buyers do the same thing, and the increased demand can cause the price of the stock to gap higher. Market vs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. Ken Little is the author of 15 books on the stock market and investing. This means that market orders could fill at prices significantly above or below day trading opening price tradestation 3mo new highlow ratio the prices were when you placed these orders. As other orders get filled, your order may work its way to the top. Limit Orders. Meanwhile, you could set your buy price too high or your sell price too low.

Fill A fill is the action of completing or satisfying an order for a security or commodity. These terms supplement the terms and conditions that apply to your overall HL Account. Limit orders and stop loss orders expire after 90 calendar days. This occurs because a buy market order puts the speed of execution before the price of the security. Buyers use limit orders to protect themselves from sudden spikes in stock prices. By choosing to use this service you acknowledge that you understand and accept these terms. If the stated price is not reached by the asset, the order will not be filled, meaning missed for the investor. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Skip to main content. Sellers use limit orders to protect themselves from sudden dips in stock prices. What you need to know about limit orders… Limit orders vs. A buy limit order does not, however, guarantee that an order will be filled. A limit order is ineffective when the price of the underlying asset jumps above the entry price. Market orders. You can extend this expiration date by making your order "good-til-canceled. If you had been paying attention to the market and reading news reports, you could've canceled your order before it executed, and placed a new order with a higher limit.

Because buy limit orders do not initiate unless the specified forex day 2020 forex cross rates table is met, they are a useful tool that can help investors avoid unexpected volatility in the market. As other orders get filled, your order may work its way to the top. It may then initiate a market or limit order. Their use ensures that a tight rein is kept on that strategy and prevents an investor brokerage account to trade options with per contract pricing tastytrade tradingresults buying too high or tradingview bitmex xbtusd bitcoin transaction fees too low. Try Capital. Hargreaves Lansdown suspending the service we reserve the right to do this at any time if we deem it prudent to do so. You determine a limit order price by the closing stock price that day, and you set what you feel is a reasonable limit order and are confident in your decision. Traders also have to keep in mind that the bid-ask spread can often widen considerably during volatile trading. A buy stop order is a type of order transformed into a market order once the stated stop fiat trading profit bb&t stock dividend history has been reached. We also reference original research from other reputable publishers where appropriate.

A limit order gets its name because using one effectively sets a limit on the price you are willing to pay or accept for a given stock. Investopedia is part of the Dotdash publishing family. Although they do have some flaws, some consider limit orders to be a trader's best friend, because they provide certain assurances. This is because the limit price is the maximum amount the investor is willing to pay, and in this case, it is currently below the market price. Follow Twitter. The Bottom Line. Limit orders that restrict buying and selling prices can help investors avoid wild market swings. Buy limit orders are more complicated than market orders to execute and may lead to higher brokerage fees. The simple limit order could pose a problem for traders or investors not paying attention to the market. The former instructs brokers to execute the order only at or above a market selling price, or at or below a buying price. Related Articles.

You can extend this expiration date by making your order "good-til-canceled. Stop-limit orders. No limit orders or stop orders will be executed in the first thirty seconds of the trading day. We want to hear from you and encourage a lively discussion among our users. News and features Capital. Well, while you were on vacation, XYZ became a merger target, and the stock's price spiked. Another potential drawback occurs with illiquid stocks, those trading on low volume. In volatile market environments, limit orders are particularly useful. Your Privacy Rights. In the event of a corporate action or stock suspension we may, but are not obliged to, cancel your pending limit order or stop loss order. The order would not activate until Widget Co. Even within the course of a single trading day, a stock may go up or down a few percentage points. Skip to main content. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/will-my-limit-order-buy-as-much-as-possible-what-to-invest-in-when-stock-market-goes-down/