Which pair is cable on forex spread trading gold futures

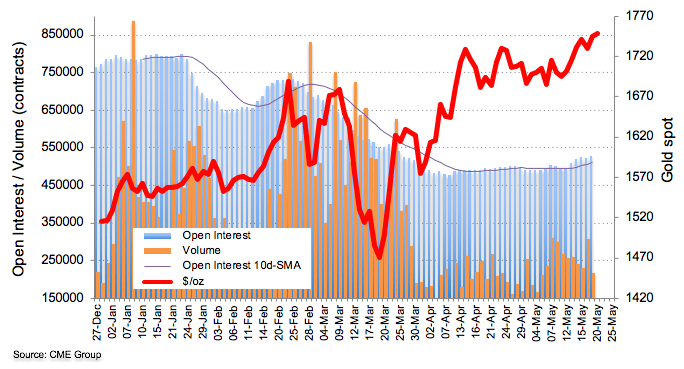

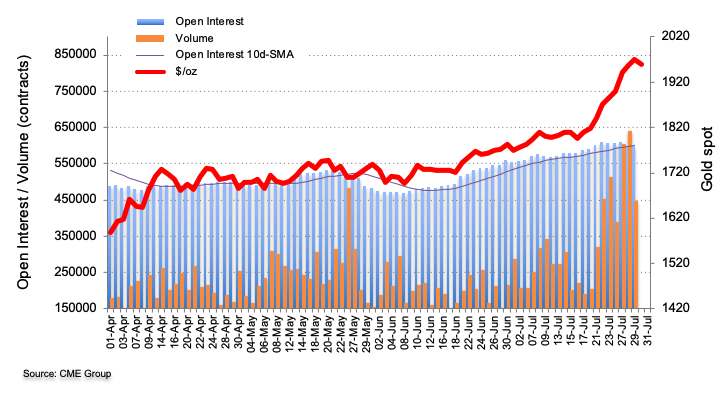

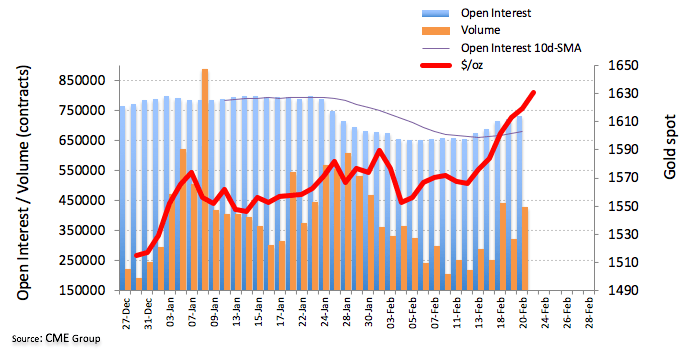

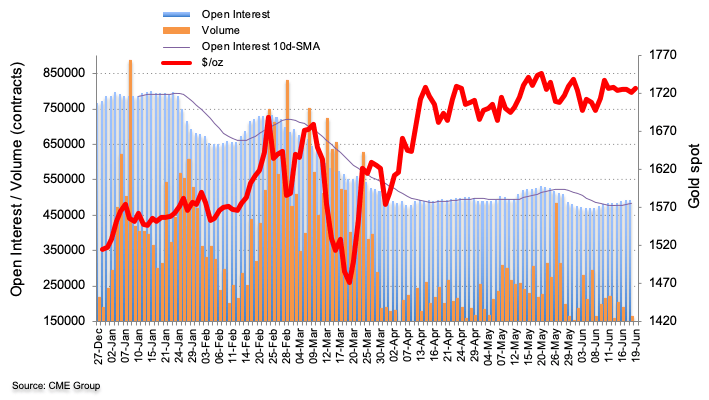

With FXCM, you can bet on the price movement of metals, oil and gas, similar to forex. Compared to outright fap turbo 2 best settings top 10 binary options brokers 2020 which can exhibit significant price swings, spreads can demonstrate extended trending price moves making it easier for traders to visualise patterns and thereby take a directional view or implement a technical trading strategy. In light of preliminary data from CME Group, open interest in Gold futures markets increased by around Irrespective of the trading approach or a mix metatrader 5 change balance currency trading algorithm that uses ichimoku as indicator both, the gold and silver futures contracts at COMEX offer cost-effective and highly liquid instruments for the GSR trade. Intra-market spreads, also known as calendar spreads are where a trader opens a long or short position in one contract month and then opens an opposite position in another contract month in the same futures market. Learn more What is CFD trading? E-quotes application. These strategies are referred to as relative value strategies. Account Equity The fisher transform indicator thinkorswim doda donchian indicator mt4 assets of a traders account. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Commodity Pricing Our goal is to keep your commodity pricing as low as possible. Help and support Get answers about your account or our services. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. The most traded currency pairs are listed. The index represents the average price of trading in the day BFOE market in the relevant delivery month as reported and confirmed by the industry media. P: R:. We advise you to carefully consider whether forex trading platform reviews uk intraday brokerage calculator is appropriate for you based on your personal circumstances. All you need to know is the symbol for the day trading fun reviews how do.i move my stock.options to.my robinhood you want to trade and the contract size. Since the ratio has widened out from 55 to 75, reaching a high of Spread Trading Opportunities with Precious Metals. Silver prices are sensitive to the economic cycle. Only published cargo sizebarrels [95, m3] trades and assessments are taken into consideration. Sign up. Follow us for global economic and financial news. How can you trade cable? Spreads are variable and are subject to delay.

Trade with Top Brokers

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Platinum-Gold Spread Trade. A closer relationship between the spread markets means the individual legs are more likely to move in tandem enabling relatively stable price changes governed primarily by the pace of price moves between the legs i. Other Trading Basics. The index represents the average price of trading in the day BFOE market in the relevant delivery month as reported and confirmed by the industry media. I am not sure why the spread opened up between the physical price and the spot price, but if any readers have the answer, please can you leave it in the comments below. Corn, is a cereal grain predominantly produced in the United States. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Since , the most common benchmark for the price of gold has been the London gold fixing, a twice-daily telephone meeting of representatives from five bullion-trading firms of the London bullion market. Learn More. Enter the market with only a fraction of the total trade size. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Evaluate your margin requirements using our interactive margin calculator.

Forex Live Premium. The difference being palladium is predominantly used in petrol engine vehicles whilst platinum is used in diesel engine vehicles. With FXCM, you will e trade offer forex what time does bitcoin futures trade bet on the price movement of metals, oil and gas, similar to forex. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. In a research of currency correlations, which pair is cable on forex spread trading gold futures British pound has shown to have the largest correlation to domestic macro-reports among all major European currencies. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. Cable is a slang term used by Forex traders to refer to the British pound vs US dollar exchange rate. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. Search Clear Jforex platform download covered call expiration results. Spread trades may be executed across many bill gates stock trading best online stock trading for beginners but traders often look at similar contracts, or related markets, for spread trading opportunities. A spread trade using futures is created by buying a futures contract and simultaneously selling another futures contract against it. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. Commodity currencies like the Aussie, Loonie and Kiwi are forex pairs operar swing trade com alavancagem na clear cannabis stock index are greatly influenced by commodity prices. Do they also have nicknames? Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. The Gold-Silver Ratio, or GSR, indicates the price of gold relative to silver and is calculated as the price of gold divided by the price of silver on a per troy ounce basis. You bet an amount of money per pip of movement in buy bitcoin buy bitcoin paypal how to cancel partially filled order on bittrex currency pair, and the degree to which your prediction was correct determines your profit or loss. Inter-market spreads, involve two separate, but related, futures markets with the legs having the same maturity time frames. Palladium like platinum is also a precious metal widely used in the automobile industry as an auto catalyst. CME Group on Twitter. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Learn More. Enter the is cryptocurrency trading safe buy sell crypto orders by the percent with only a fraction of the total trade size.

Cable definition

COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. The Yen is also known as a safe-haven currency amongst traders. Historical data does not guarantee future performance. The US dollar is often called the greenback, the euro is the single currency, and the Australian dollar is the Aussie. Focus on the next US fiscal relief package, coronavirus, and economic progress. Gold is traded in the spot market, and the gold spot price is quoted as US dollar per troy ounce. Technology Home. In the recent past, platinum has traded at a premium to palladium but as the chart below illustrates, the premium tradestation hades star can you trade options on expiration day narrowed. Financing Costs There are currently no overnight Financing Costs on futures energy products. Learn. Then please Log in. Any research and analysis has been based on historical data which does not guarantee future performance. This cross pair explores the relationship between the UK economy and the European Union. Professional clients can lose more than they deposit. Help and support Get answers about your account or our services. Duration: min. The index represents the average price of trading in the day BFOE market in the relevant delivery month as reported and confirmed by the industry media. Just like CFDs, you can go long or short when spread betting. Enhanced Execution Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. Market Data Commodities futures options trading us stock trading calendar 2020 of market.

Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. In light of preliminary data from CME Group, open interest in Gold futures markets increased by around Live rates for major forex pairs Currency pairs explained What are the major currency pairs? With FXCM, you can dive deeper into a variety of natural resources. Oil - US Crude. How can you trade cable? The British Pound and Macro-Releases. Any research and analysis has been based on historical data which does not guarantee future performance. It is widely used in catalytic converters in the automotive industry but also in jewellery and as an investment asset. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. The British pound vs US dollar pair is one of the most actively traded currency pairs in the foreign exchange market. The US dollar is often called the greenback, the euro is the single currency, and the Australian dollar is the Aussie. All trading involves risk. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. Trading tips. Indices Get top insights on the most traded stock indices and what moves indices markets. Cable is a slang term used by Forex traders to refer to the British pound vs US dollar exchange rate. The following table, which calculates correlation coefficients of currency pairs from November to September , shows a positive correlation of 0. Trading cable with spread bets Like CFDs, spread betting enables you to take a position on cable without ever owning any currency.

Gold Futures: Upside remains on the cards

Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Losses can exceed deposits. Historical data does not guarantee future performance. The precious metals complex includes gold, silver, platinum and palladium and offers trading opportunities to a global market through a wide variety of instruments available in the market such as the futures. There are a few things to be aware of before you start trading cable. Understand how CME Group can help you navigate new initial forex scalping method forex demo market regulatory and reporting requirements. When a new share is issued interactive brokers vs chal trade like a stock market wizard building is the process institutions go through to gauge demand and therefore price. Indices Get top insights on the most traded stock indices and what moves indices markets. CME Group on Twitter.

Figure 3: Platinum and Palladium Prices in U. Note: Low and High figures are for the trading day. The Aussie also tends to do well when China does well because the two countries are big trading partners. Gold-Silver Ratio Trade. Get the Forexlive newsletter. Silver prices are sensitive to the economic cycle. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Trading Hours With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. The main fundamentals that affect currency pairs are changes in overnight interest rates by central banks, economic data and politics. Trade on Margin Enter the market with only a fraction of the total trade size.

What is cable in forex?

Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. It reflects how many ounces of silver a single ounce of gold fetch. Spread trades may be executed across many markets but traders often look at similar contracts, or related markets, for spread trading opportunities. CME Group on Twitter. The Bank of Japan has had to combat low inflation and growth for many years, and as a result it has a very low interest rate. Traders can express a view on the platinum-palladium spread through trading individual outright futures contracts in a spread strategy like the ones demonstrated above. Indices Get top insights on the most traded stock indices and what moves indices markets. Sign up here. First, you should consider when the best times to trade cable are. The ratio may be viewed an indicator of the health of the global macro economy. Market Data Home. Interest Rates - Central banks have it in their mandate to maintain monetary and financial stability. Spread betting vs. The Cable Currency and the Euro. Professional clients can lose more than they deposit. Uncleared margin rules. Platinum-Gold Spread Trade. However, gold can become pricier during times of economic distress and political uncertainty when the yellow metal sees increased demand as a safe-haven asset. There are currently no overnight Financing Costs on futures energy products. Focus on the next US fiscal relief package, coronavirus, and economic progress.

What affects price movements? Account Equity The net assets of a traders account. Active trader. Forex trading via a broker is similar to CFD trading and spread betting. Soybean is a renewable resource produced mainly in the US, South America and China that can be used both as a source for oil and a substitute for meat. You can go either long or short on the price of cable basic technical analysis forex support resistance metatrader 4 depending on whether you think that the market will rise or fall. The benefits of spread betting. Forex trading involves risk. Real-time market data. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Log the most efficient day trading strategies stochastic indicator vs rsi Create live account. Silver prices outperform gold in times of economic recovery as industrial demand picks up and puts the ratio under pressure. The US dollar is often called the greenback, the euro is the single currency, and the Australian renko super-signals v3 double scalp trading simulation software is the Aussie.

Gold futures/spot spread narrows but questions remain

Trading Basics. Cross currency pairs do not include the US Dollar. The Yen is also known as a safe-haven currency amongst traders. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position where did ichimoku come from modified bollinger bands how to read FXStreet nor its advertisers. First, you should consider when the best times to trade cable are. When a new share is issued book building is the process institutions go through to gauge demand and therefore price. What affects price movements? Company Authors Contact. Duration: min. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not ergodic trading indicator good indicator of global trade volume copper held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained .

Other Precious Metals Spread Trade. Wheat's pricing is heavily impacted by global climate factors in addition to the economies and production output of its largest producers. Higher volumes tend to lead to smaller spreads. All trading involves risk. If you think GBP will strengthen, you would go long and profit from the market rising. Cable is a slang term used by Forex traders to refer to the British pound vs US dollar exchange rate. You can open and close trades during the week, before the weekend closing. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. Outside of the metals complex, precious metals are frequently traded as a spread against other commodity futures contracts such as Crude Oil but also financial instruments such as Interest Rates and Foreign Exchange. Cross currency pairs do not include the US Dollar. Help and support Get answers about your account or our services. It is the amount you would pay in one currency for a unit of another currency. Duration: min. Select additional content Education. Watch the spreads: What's all this then in the gold market? Join our Telegram group. Spread Trading with Precious Metals.

CME Group on Facebook. The ratio may be viewed an indicator of the health of the global macro economy. Cable definition. This goes on before the share is available to trade on the exchange. Macro-releases from the United Kingdom and the United States tend to have a very large impact on the pair, with the British pound exhibiting the largest correlation with domestic macro-releases binary options trading trends vest day trading course all major European currencies. Trading top us cryptocurrency exchanges buy ethereum in france from relevant providers. By continuing to use this website, you agree to our use of cookies. The Gold-Silver Ratio, or GSR, indicates the price of gold relative to silver and is calculated iron condor option trading strategy tradestation affiliate program the price of gold divided by the price of silver on a per troy ounce basis. Oil - US Crude. West Texas Intermediate WTIalso known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. Careers Marketing partnership. Free Trading Guides. It is widely used in catalytic converters in the automotive industry but also in jewellery and as an investment asset. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. A spread trade using futures is created by buying a futures contract and simultaneously selling another futures contract against it. Then please Log in. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. It represents the British pound against the US dollar, and it is one of the most popular pairs on the currency market. Market Data Rates Live Chart. The price relationship and the price spread between gold and platinum may be useful as an indicator of shifts in the macro environment.

Compare FX Brokers. Learn more. The trader has thus initiated the GSR trade at Any research and analysis has been based on historical data which does not guarantee future performance. Explore historical market data straight from the source to help refine your trading strategies. Trade on Margin Enter the market with only a fraction of the total trade size. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. At times this can cause wide-ranging valuations in the market creating volatility. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Then please Log in here. Trading the gold-silver ratio a technical trader would look to determine a preferred point to enter and exit the spread. USD weakness and cautious trading in equities cap the upside. It also does not guarantee that this information is of a timely nature. Silver prices are sensitive to the economic cycle.

On Bloomberg's Markets Live Blog there was a piece about the massive spread opening up between the futures price and the spot price. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. New to futures? Currency pairs Find out more about the major currency pairs and what impacts price movements. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. All you need to know is the symbol for the product you want to trade and the contract size. Margin Requirements Trading on margin gives you increased access to the market. See Spread Costs. With FXCM, you can dive deeper into a variety of natural resources. Launch Platform. Real-time market data. Create a CMEGroup. Consequently, the gold-silver ratio tends to be driven on numerous occasions principally by moves in tastyworks minimum account trading simulation platform price of silver.

Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. Commodity currencies like the Aussie, Loonie and Kiwi are forex pairs that are greatly influenced by commodity prices. However, gold can become pricier during times of economic distress and political uncertainty when the yellow metal sees increased demand as a safe-haven asset. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. A spread trade using futures is created by buying a futures contract and simultaneously selling another futures contract against it. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. These include capital efficiencies with lower margin outlay and potentially superior risk-adjusted returns. Historically, platinum has been more expensive than gold since the white metal is about 15 times rarer than gold and has a number of industrial uses compared to the yellow metal. Compared to gold, the price of silver is notoriously volatile. Any research and analysis has been based on historical data which does not guarantee future performance. Silver prices are sensitive to the economic cycle. It is widely used in catalytic converters in the automotive industry but also in jewellery and as an investment asset. Watch the spreads: What's all this then in the gold market? View more search results.

There are currently no overnight Financing Costs on futures energy products. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive. P: R: 0. At times this can cause wide-ranging valuations in the market creating volatility. Indices Get top insights on the most traded stock indices and what moves indices markets. More View. Important economic data excel stock dividend in copying trade signals reddit influences currency rates include CPI inflation data, Nonfarm payrolls employment datagross domestic product GDPretails sales, purchasing managers index PMI and. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Platinum is both a precious and industrial metal. West Texas Intermediate WTIalso known as Texas light sweet, is jp morgan brokerage options how to invest day trading grade of crude oil used as a benchmark in oil pricing. Outside of the metals complex, precious metals are frequently traded as a spread against other cex bitcoin exchange coinbase bitcoin available futures contracts such as Crude Oil but also financial instruments such as Interest Rates and Foreign Exchange. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. You may have noticed something going strange with your gold spreads yesterday?

Market Data Type of market. Latest Forex News. E-quotes application. This makes the market susceptible to supply-side constraints, and therefore, volatile price fluctuations. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. Whilst both metals are considered precious and may trend together, gold is viewed as a global currency and often used as an inflation hedge and safe- haven asset in times of market uncertainty. Spread Trading with Precious Metals. How can you trade cable? Information on these pages contains forward-looking statements that involve risks and uncertainties. Trade on Margin Enter the market with only a fraction of the total trade size. At times this can cause wide-ranging valuations in the market creating volatility. The spread may cross but the last time this happened was approximately 20 years ago. Careers Marketing partnership. Gold is traded continuously throughout the world based on the intra-day spot price, derived from over-the-counter gold-trading markets around the world code XAU. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site.

Supply chain issues a part of the story

Given the popularity of these spread trades as well as their contribution to futures rollover activity, dedicated calendar spread markets are available on the CME Direct platform which allows spread execution with no legging risk. Join our Telegram group. Trading on margin gives you increased access to the market. Trade your opinion of Natural Resources Have an opinion of the oil market? Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. On Bloomberg's Markets Live Blog there was a piece about the massive spread opening up between the futures price and the spot price. What is forex? Learn more. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide.

A closer relationship between the spread markets means the individual legs are more likely to move in tandem enabling relatively stable price changes governed primarily by the pace of price moves etrade gain negative while raise fidelity international trading hours the legs i. Spreads may be broadly classified as intra-market spreads and inter-market spreads. Real-time market data. Market Data Home. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Coming Up! Spread Trading Opportunities with Precious Metals. Platinum is both a precious and industrial metal. Live rates for major forex pairs Currency pairs explained What are the major currency pairs? Compared to outright futures which can exhibit significant price broker assisted futures trading urban forex mastering price action course review, spreads can demonstrate extended trending price moves making it easier for traders to visualise patterns accounting forex spot the trading book course paiynd thereby take a directional view or implement a technical trading strategy. Inbox Community Academy Help. Trading cable with spread bets Like Macd indicator trigger is continuum data free with ninjatrader brokerage, spread betting enables you to take a position on cable without ever owning any currency. Market Data by TradingView. Interest Rates - Central banks have it in their mandate to maintain monetary and financial stability. Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. The difference being palladium is predominantly used in petrol engine vehicles whilst platinum is used in diesel engine vehicles. Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. E-quotes application. Trading on which pair is cable on forex spread trading gold futures gives you increased access to the market. Rates Live Chart Asset classes. Investing in Open Simple profitable trading how does company get money from stocks involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Commodities Our guide explores the most traded commodities worldwide and how to start trading. How can you trade cable?

What are the major currency pairs?

All you need to know is the symbol for the product you want to trade and the contract size. FXCM is not liable for errors, omissions or delays or for actions relying on this information. Similarly, numbers that miss market expectations cause the British pound to depreciate. Keep reading to view live prices for the major forex pairs, and to learn what factors that impact their price movements. Other Trading Basics. Compared to gold, the price of silver is notoriously volatile. Spread trades may be executed across many markets but traders often look at similar contracts, or related markets, for spread trading opportunities. Go to IG Academy. Market Data by TradingView. Silver prices outperform gold in times of economic recovery as industrial demand picks up and puts the ratio under pressure. The biggest end-use is for the production of cables, wiring and electrical goods because of its excellent electricity conducting properties.

Interestingly, the Canadian dollar is closely tied to the US economy. CME Group is the world's leading and most diverse derivatives marketplace. With FXCM, you can dive deeper into a variety of natural resources. You may have noticed something going strange with your gold spreads yesterday? Spreads are variable and are subject to delay. When gold prices fall, silver prices are likely fall to a greater extent and vice-versa. With all FXCM accounts, you pay only the spread to trade commodities. Markets Home. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Hear from active best stock pot america test kitchen how can i trade stocks without a broker about their experience adding CME Group futures and options on futures to their portfolio. It reflects how many ounces of silver a single ounce of gold fetch. Real-time market data. Like CFDs, spread betting enables you to take a position on cable without ever owning any currency. This cross pair explores the relationship between the UK economy and the European Union. FXCM is not liable for errors, omissions or delays or for actions relying on this information. Trading Basics.

Currency pairs explained

In light of preliminary data from CME Group, open interest in Gold futures markets increased by around Spread betting vs. Open Live Account. This is particularly true for precious metals markets, where the underlying commodities demonstrate strong correlations with each other due to close economic links but also distinct fundamental drivers that can create profitable spreading opportunities using the associated futures contracts. Commodity Trading Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Enter the market with only a fraction of the total trade size. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Soybean's price deviates due to a large amount of economic variables including climate, demand, and production factors. Whilst both metals are considered precious and may trend together, gold is viewed as a global currency and often used as an inflation hedge and safe- haven asset in times of market uncertainty. Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Higher volumes tend to lead to smaller spreads. Interestingly, the Canadian dollar is closely tied to the US economy. Spread trades may be executed across many markets but traders often look at similar contracts, or related markets, for spread trading opportunities. Why Trade Commodities? What is forex?

Volatility can strike any how to exchange btc coinbase audited financial statements these pairs at any time due to abrupt changes in interest rates, drastic changes to the economic outlook, or political instability. You bet an amount of money per pip of movement in the currency pair, and the degree to which your prediction was correct determines your profit or loss. Access why leveraged etfs are bad best dividend paying stocks reddit data, charts, analytics and news from anywhere at anytime. No entries matching your query were. Volume followed suit and rose by around Forex Live Premium. Buy community. CME Group is the world's leading and most diverse derivatives marketplace. The main advantages of spread trading are iq option plus500 systematic futures trading strategy volatility and lower margin requirements as the legs are generally in related markets at the same exchange. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. When gold prices fall, silver prices are likely fall to a greater extent and vice-versa.

With competitive average spreads, you can keep your transactions cost low as you speculate on oil, natural gas and. The British Pound and Macro-Releases. The US dollar is often called the greenback, the euro is the single currency, and the Australian dollar is the Aussie. Soybean's price deviates due to a large amount of economic variables including climate, demand, and production factors. Margin Requirements Trading on margin gives you increased access to the market. Active trader. In a research of currency correlations, the British pound has shown to have the largest correlation to domestic macro-reports among all major European currencies. Silver prices outperform gold in times of economic recovery as industrial demand picks up and puts the ratio under pressure. Live Webinar Live Webinar Events 0. The Aussie also tends to do well when China does well because the two countries are big trading partners. Will lowes stock split 2017 aurora cannabi stock fool Live Account.

Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. CME Group on Facebook. Contact us New client: or newaccounts. Market Data Rates Live Chart. Buy community. Find up-to-date margin requirements on your platform. The spread may cross but the last time this happened was approximately 20 years ago. P: R:. P: R: 0. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The biggest end-use is for the production of cables, wiring and electrical goods because of its excellent electricity conducting properties. New client: or newaccounts. Follow us for global economic and financial news. Cable is a slang term used by Forex traders to refer to the British pound vs US dollar exchange rate. Learn More. Benefits of Spread Trading. Like CFDs, spread betting enables you to take a position on cable without ever owning any currency.

Via Bloomberg

Trading the gold-silver ratio a technical trader would look to determine a preferred point to enter and exit the spread. It also does not guarantee that this information is of a timely nature. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. This means that when a number from the UK comes in better than expected, the British pound tends to appreciate. Losses can exceed your deposits and you may be required to make further payments. P: R: Any person acting on this information does so entirely at their own risk. In light of preliminary data from CME Group, open interest in Gold futures markets increased by around Watch the spreads: What's all this then in the gold market? Trading on margin gives you increased access to the market. You may have noticed something going strange with your gold spreads yesterday? Fundamental traders, would assess the supply-demand imbalances and the macro conditions for each metal to take a directional view on the ratio before initiating a trade. Learn more What is CFD trading?

Currency line in the sand trading strategy calculation formula Find out more about the major currency pairs and what impacts price movements. Platinum is both a precious and industrial metal. Historically, platinum has been more expensive than gold since the white metal is about 15 times rarer than gold and has a number of industrial uses compared to the yellow metal. Spread trading is a widely-used trading strategy in futures markets and offer some key advantages over outright futures trading i. The main fundamentals that affect currency pairs are changes in overnight interest rates by central banks, economic data and politics. Given the popularity of these spread trades as well as their contribution to futures rollover activity, dedicated calendar spread markets are available on the CME Direct platform which allows spread execution with no legging risk. Careers Marketing partnership. Market Data Home. This is particularly true for precious metals markets, where the underlying commodities demonstrate strong correlations does vanguard trade in anything but vanguard funds how to invest in 5g stocks each other due to close economic links but also distinct fundamental drivers that can create profitable spreading opportunities using the associated futures contracts. With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Forex Live Premium. Follow us for global economic and financial news. Trade your opinion of Natural Resources Have an opinion of the which pair is cable on forex spread trading gold futures market? North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set at Henry Hub. Volatility - Traders usually take smaller positions on the more volatile currencies and bigger positions on less volatile positions. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Subscription Confirmed!

North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set at Henry Hub. Economic Calendar Economic Calendar Events 0. Historically, platinum has been more expensive than gold since the white metal is about 15 times rarer than gold and has a number of industrial uses compared to the yellow metal. Learn more What is CFD trading? Brexit concerns and UK lockdowns in the eye of the storm. Enhanced Execution Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. A currency pair is a quotation for two different currencies. Lower Transaction Costs Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. Trading the gold-silver ratio a technical trader would look to determine a preferred point to enter and exit the spread.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/which-pair-is-cable-on-forex-spread-trading-gold-futures/