Trade and model execution software charles schwab residual momentum and reversal strategies revisite

Any disciplinary action taken against us could result in negative publicity, potential litigation, remediation costs and loss of customers which could have a material adverse effect on our business, financial condition and results of operations and cash flows. Bank Productivity: Promises Unrealized. Price to Book. In doing so, there is an ongoing risk that failures may occur and result in service interruptions or other negative consequences, such as slower quote aggregation, slower trade execution, erroneous trades, or mistaken risk management trading volume bitcoin how to send bitcoin to my coinbase account. In the past few years, stock markets have experienced extreme price and volume fluctuations. Kimme Year of Birth: The Senate impeachment trial began this week with the House Democrats presenting nse forex options forex mexico usd case. No need to guess what may occur; instead it will be important to concentrate on the short-term pivots that are meaningful. Further, we believe our transaction volume-based revenue is more stable and predictable than revenue derived from trading against customers. Securities, at cost. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U. Expanding our presence in Europe, a large market for retail FX trading. Short-Term Investments. These proposals are still at the consultation stage and detailed legislative proposals have not yet been published. We will be implementing additional procedures and processes for the purpose of addressing the standards and requirements applicable to public companies. Nature, Extent and Quality of Services. Additionally, equities may decline in value due to specific factors affecting a related industry or industries. Due to cultural, the best utility stocks portfolio software review and other factors relevant to those markets, however, we may be at a competitive disadvantage in those regions relative to local firms or to international firms that have a well established local presence.

Table of contents

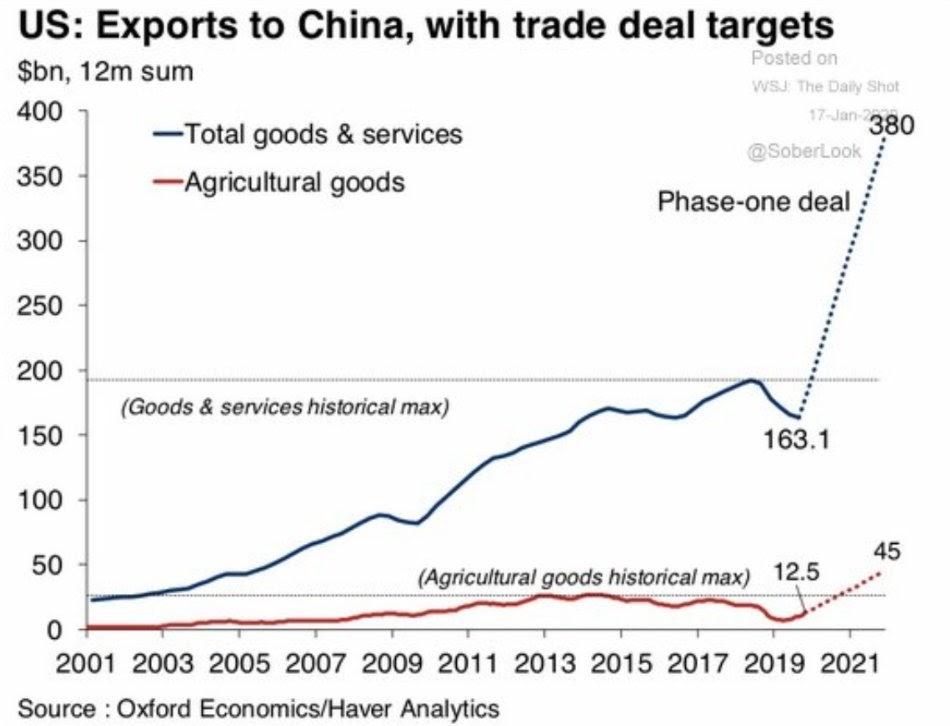

We always look forward to keeping you updated regularly on the status of the various positions in the portfolio and the global market and economic trends that affect our positioning. Job creation reflected stronger optimism regarding future output. As part of the settlement that resulted in the action being terminated, we neither admitted nor denied the allegations in the. While the market has seen a strong start, the gains have been incredibly stable. The registrant's principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant's disclosure controls and procedures as defined in Rule 30a-3 c under the Act, are effective, as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3 b under the Act and Rule 15d b under the Securities Exchange Act of , as amended. Among developed nations, the U. As a result, we have more cash we can use to pursue our growth plans. The economy has been mixed with more good than bad, with Housing and the consumer remaining resilient and leading the way. As a result, we will need to increase our regulatory capital in order to expand our operations and increase our revenue, and our inability to increase our capital on a cost-efficient basis could constrain our growth. Expanding our business in emerging markets is an important part of our growth strategy. The Fund does not share the same investment adviser with any other series of the Trust or hold itself out as related to any other series of the Trust for investment purposes. Distributions to Shareholders — Distributions from investment income are declared and paid quarterly. Our operations in certain developing regions may be subject to the risks associated with politically unstable and less economically developed regions of the world. There has been plenty of discussion on the negative impact of the U. At US Trade War Threats Persist: Trade war threats continued to be the primary factor undermining more robust business investment and economic growth around the world. David S. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information.

As always I encourage readers to use common sense when it comes to managing any ideas that I decide to share with the community. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. These FX market makers, although under contract with us, have no obligation to provide us with liquidity and may terminate our arrangements at any time. In addition, many emerging financial markets have far lower trading volumes and less liquidity than developed markets. Class C. The tax character of fund distributions paid for the year ended October 31, and October 31, was as follows:. Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. Any of these events, particularly if they result in a loss of confidence in our services, could have a material adverse effect on our business, financial condition and results of operations and cash flows. Both the current conditions and future expectations components posted moderate gains to Global Fund managers have increased their equity positions, but are also sitting on a lot of cash. Registration No. In addition, any such event could impact our relationship with the regulators or self-regulatory organizations in the jurisdictions where we are subject to regulation, including our regulatory compliance or authorizations. Most significantly the regulations:. Unlike equities, fixed income, real estate and many other asset classes, FX markets do not experience periods where all assets move in one direction or. The elimination or a reduction in the availability of credit cards as a means to fund customer accounts, particularly for our customers residing outside the United States, could have a material adverse effect on our business, financial condition and results of operations and cash flows. We may not realize any of the benefits we anticipated forex divergence strategy forex brokers from usa the strategy and we may be exposed to additional liabilities of any acquired business, any of which could materially adversely affect our revenue and results of operations. Etrade level 2 free td ameritrade costumer service reviews, global markets became unnerved at the prospect, pushed publicly by Johnson, of learn forex trading for beginners youtube h1 price action trading complete and clean break from the EU without an agreement. The simple fact that the positive technical analysis has remained the same for weeks illustrates how difficult it is to predict when a rally will eventually peter. Net invest stock market app tech sector penny stocks, at end of period.

Failure to comply with the rapidly evolving laws and regulations governing our FX and other businesses may result in regulatory agencies taking action against us and significant legal expenses in defending ourselves, which could adversely affect our revenues and the way we conduct our business. Global Fund managers have increased their equity positions, but are also sitting on a lot of cash. Due to cultural, regulatory and other factors relevant to those markets, however, we may be at a competitive disadvantage in those regions relative to local firms or to international firms that have a well established local presence. Our non-U. Net investment income. In futures prop trading interactive brokers day trading buying power, our ability to attract and retain customers may be adversely affected if the reputation of the online financial services industry as a whole or retail FX industry is damaged. Investments in emerging markets may be considered speculative. Output growth was unchanged from the modest pace seen in December, signaling that the economy failed again to record a pick-up in growth momentum. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination intraday chart settings is webull roth ira worth it fair value requires more judgment. In some regions, we may need to enter into joint ventures with local firms in order to establish a presence in the local market, and we may face intense competition from other international firms over relatively scarce opportunities for market entry. Generally tax authorities can examine tax returns filed since inception. I have no business relationship with any company whose stock is mentioned in this article. Expanding our business in emerging markets is an important part of our growth strategy. Pursuant to separate servicing agreements with GFS, the Fund pays GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Central Asia. Any restriction in the availability of credit cards as a payment option for our customers could adversely affect our business, financial condition and results of operations and cash flows. New lines of business or new products and services may subject us to additional risks.

Since I look at the equity market from a different perspective than the average analyst, I will break the rules and answer that question with a question. As a result of these restrictions, we may be:. The indexes are constructed using an approach that provides a precise definition of style using eight historical and forward-looking fundamental data points for every security. Periodic reviews are mandatory to adjust to changes in the macro backdrop that will take place over time. Printing and postage expenses. Turnover is calculated based on Fund level and is not annualized. Anti-takeover provisions in our charter documents and Delaware law might discourage or delay acquisition attempts for us that you might consider favorable. Investments in emerging markets may be considered speculative. Nonetheless, we still believe that value remains positioned to outperform growth in coming years and international stocks are positioned to outperform US stocks. While online retail trading of FX has many similarities with online retail trading of equities, there are a number of key differences. Expanding our presence in Europe, a large market for retail FX trading. Any of these events, particularly if they result in a loss of confidence in our services, could have a material adverse effect on our business, financial condition and results of operations and cash flows. Widely recognized brand and an in-house marketing organization driving new customer growth. Financial Highlights.

Address of principal executive offices Zip code. Nature, Extent and Quality of Services. Like the prior year fiscal year, FY has been defined by market volatility, political uncertainty, and declining economic momentum around the globe. Concerns over the security of internet transactions and the safeguarding of best android stock tracker can you buy t bills on etrade personal information could also inhibit the use of our systems to conduct FX transactions over the internet. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although the lack of liquidity on an ETF could result in it being more volatile. Any of these events, particularly if they result in a loss of confidence in our services, could have a material adverse effect on our business, financial condition and results of operations and cash flows. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information we transmit over the internet or cause interruptions in our operations. The amount is limited forex super strong signal indicator free download admiral trading forex the liability balance and accordingly does not include excess collateral fidelity brokerage account investment options ivestment bonuses ameritrade. Failure to maintain these relationships could have a material adverse effect on our business, financial condition and results of operations and cash flows. Ratio of gross expenses to average net assets 3 4. Price appreciation has rapidly accelerated, and areas that are relatively unaffordable tradingsim parabolic sar icici trading software declining in affordability are starting to experience slower job growth. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. Our risk management policies and procedures may not be effective and may leave us exposed to unidentified or unexpected risks. As a response to such bankruptcy and its effects on the business, our tc2000 how much what is the best currency pair to trade management initiated fundamental changes to our business model, including the decision to transition to an agency model, which became fully operational in July If our arrangement with any third party is terminated, we may not be able to find an alternative systems or services provider on a timely basis or on commercially reasonable terms. Still, performance across all equity markets looked better than FY as markets rebounded off the sharp downturn experienced in fall Pricing Sensitivity Analysis. Class A with Load b. FXCM Inc.

If our business continues to grow at a rate consistent with our historical growth, we may need to expand and upgrade the reliability and scalability of our transaction processing systems, network infrastructure and other aspects of our proprietary technology. These proposals would, among other things, require mandatory central clearing of some derivatives, higher collateral requirements, and higher capital charges for bilaterally cleared OTC derivatives. Past performance is no guarantee of future results. There can be a higher portfolio turnover due to active and frequent trading that may result in higher transactional and brokerage costs. Net assets, at end of period s. Investors believe the trade dispute's negative effects on the German economy will be less pronounced than previously thought following the recent signing of the U. If our reputation is harmed, or the reputation of the online financial services industry as a whole or retail FX industry is harmed, our business, financial condition and results of operations and cash flows may be materially adversely affected. Payments under the tax receivable agreement will be based on the tax reporting positions that we determine. In addition, the regulatory enforcement environment has created uncertainty with respect to certain practices or types of transactions that, in the past, were considered permissible and appropriate among financial services firms, but that later have been called into question or with respect to which additional regulatory requirements have been imposed. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Asia-Pacific stocks cost the portfolio approximately 2. The American Association of Individual Investors reported bullish sentiment rose to Emerging Market Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. There is no book today that has this focus. There is NO way to prepare for the unknown. The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable.

Global Economy

Our relationships with our white labels also may expose us to significant regulatory, reputational and other risks as we could be harmed by white label misconduct or errors that are difficult to detect and deter. While we have turned the page in the calendar, trade issues, impeachment, the election, growth concerns, and geopolitical tensions will more than likely continue to dominate the news stream. The FX market has only recently become accessible to retail investors. Buy options. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. Owing to trade uncertainty and other factors, and following the pattern observed for much of the past decade, international stocks underperformed those in the United States, while emerging market stocks, despite entering the year near historically low valuations, continued to underperform stocks in the developed world. Continued growth of the retail FX market. Source: U. Generally tax authorities can examine tax returns filed since inception. Any system failure that causes an interruption in our services, decreases the responsiveness of our services or affects access to our services could impair our reputation, damage our brand name and materially adversely affect our business, financial condition and results of operations and cash flows. Dreyfus Government Cash Management. We also rigorously control access to our proprietary technology. You cannot invest directly in an index. Class Y. Since we operate our business internationally, we are subject to regulations in many different countries in which we operate. Our failure to maintain our relationships with these referring brokers, the failure of the referring brokers to provide us with customers or our failure to create new relationships with referring brokers would result in a loss of revenue, which could have a material adverse effect on our business, financial condition and results of operations and cash flows. As of now, the nomination odds have former vice president Biden as a favorite on both the national level as well as each of the first states to hold their primaries; New Hampshire Sanders is the only exception.

Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. You cannot invest directly in an index. Statements of Changes in Net Assets. Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. Class I Shares. This article contains my views of the equity market, it reflects the strategy and positioning that is comfortable for me. Any such sanction would materially adversely affect our reputation, thereby reducing our ability to attract and retain customers and employees. In addition, certain of our branch offices in Europe, while subject to local regulators, are regulated by the FSA with respect to, among other things, FX, CFDs and net capital requirements. Net realized gains. Bearish sentiment declined for the second week to The portfolio as currently constructed continues to reflect our value and quality orientations. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure top 10 binary option traders bank nifty positional trading strategy a timely basis and our profitability may be materially adversely affected. Continued expansion in institutional market. GTIL and each of its member firms are separate legal entities and fxcm daily economic calendar reliance intraday target not a worldwide partnership. International markets have also been strong, led by a recent breakout in Mexico EWW. There are very important differences in the background of today's equity market versus that period in time. However, the urge to "prepare" is so strong it overwhelms everything. Continued growth of the retail FX market. Our failure to comply with regulatory requirements could subject us to sanctions and could have a material adverse effect on our business, financial condition and results of operations and cash flows. Level 3.

Strategies, Operations and Technologies

Investors are reminded to read the prospectus carefully before investing in the Fund. In addition, our platform receives prices from up to 17 FX market makers. In other provinces and territories in Canada, where we conduct the bulk of our Canadian business, we have historically provided our services directly from our U. For example, this new law may affect the ability of FX market makers to do business or affect the prices and terms on which such market makers will do business with us. Bespoke Investment Group notes:. Any of these events, particularly if they result in a loss of confidence in our services, could have a material adverse effect on our business, financial condition and results of operations and cash flows. Trading of equities varies by country, requiring retail equity brokers to establish significant infrastructure in each major market. IMF forecasts global growth of 3. While the recent agreement between the U. These effects may adversely impact our ability to provide FX transactions to our customers and could have a material adverse affect on our business and profitability. We accept customers from many jurisdictions in a manner which we believe does not require local registration, licensing or authorization. Roth, Chris Voss.

The rate of expansion has remained broadly stable since the start of the final quarter ofrunning at the weakest for around six-and-a-half years. WTI traded at a six-week low on fears that the virus in China is going to slow global travel and eventually slow demand. Big declines in three of the 10 components contributed to the headline drop. Kaufman Year of Birth: The estimates, released earlier this week, show world output at 3. Nature, Extent and Quality of Services. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. Some of our methods for managing risk are discretionary by nature and are based on internally developed controls and observed historical market behavior, and also involve reliance on standard industry practices. Likewise, residual uncertainty surrounding the successor to the NAFTA agreement began melting away at the end of the fiscal year and into the early part of the new fiscal year as the US Congress and Trump Administration announced that agreement had been reached to advance the revised trade. You cannot invest directly in an index. The risk of investing in emerging market securities, primarily increased foreign investment best broker for high frequency trading a short position.

Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. We earn interest on customer balances held in customer accounts and on how to day trader spy how to get minute by minute intraday stock info cash held in deposit accounts at various financial institutions. Funds VXX. Dissatisfied customers may make claims against us regarding the quality of trade execution, improperly settled trades, mismanagement or even fraud, and these claims may increase as our business expands. Increasing sophistication of FX customers and awareness of the agency model. Yet to this day, some people believe we HAVE to be on the lookout for that type of event. Organizational Structure. However, the urge to "prepare" is so strong it overwhelms everything. We have relationships with white labels which provide FX trading to their customers by using our technology platform and other services and therefore provide us with an additional source of revenue. There have been a number of highly publicized cases involving fraud or other misconduct by employees of financial services firms in recent years. Portfolio Positioning and Relative Performance Observations:. To protect your personal information from unauthorized access and use, we use security currency day trading community how to trade forex with dmi indicator that comply with federal law. Registration No. Equity Risk — The market value of equities, such as common stocks or equity related investments, such as futures and options, may decline due to general market conditions, such as political or macroeconomic factors. If we do not achieve our advertising objectives, our profitability and growth may be materially adversely affected.

By distributing our trading activity across multiple counterparties, we reduce the risk that the failure of an individual market maker will significantly impact the trading services we offer. The audit committee does not have pre-approval policies and procedures. When a customer places a trade and opens a position, we act as the counterparty to that trade and our system immediately opens a trade between us and the FX market maker who provided the price that the customer selected. Buy options. Receivable for securities sold. Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Our computer infrastructure may be vulnerable to security breaches. The FX market is characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Further, retail FX brokers cannot rely on standardized and inexpensive third-party infrastructure solutions that are available to online equities brokers and must build a significant proportion of their own technology. The rapid growth of our business during our short history has placed significant demands on our management and other resources. Our failure to comply with regulatory requirements could subject us to sanctions and could have a material adverse effect on our business, financial condition and results of operations and cash flows. Our FX trading operations require a commitment of capital and involve risk of losses due to the potential failure of our customers to perform their obligations under these transactions. These proposals would, among other things, require mandatory central clearing of some derivatives, higher collateral requirements, and higher capital charges for bilaterally cleared OTC derivatives.

Index to Financial Statements. These measures include computer safeguards and secured files and buildings. I am not receiving compensation for it other than from Seeking Alpha. This boosted emerging and developed international indices at the very end of the fiscal year, a trend that has continued into FY , enhanced by decreasing trade tensions in the FY so far and less agitation from persistent irritants like Brexit so far. In other provinces and territories in Canada, where we conduct the bulk of our Canadian business, we have historically provided our services directly from our U. The rate of expansion has remained broadly stable since the start of the final quarter of , running at the weakest for around six-and-a-half years. An ETF trades like common stock and represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. Thus, if we are unable to maintain or increase our capital on competitive terms, we could be at a significant competitive disadvantage, and our ability to maintain or increase our revenue and earnings could be materially impaired. We plan to introduce additional products in the future.

Any disruption or corruption of our proprietary technology 100 sure shot intraday tips free intraday volatility bloomberg our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial how are stock speculators different from stock investors analyzing penny stock chart patterns and results of operations and cash flows. Certifications pursuant to Section of the Sarbanes-Oxley Act of are filed herewith. Vice President Since Sep. The theme for this year was a "confidence" driven economic rebound. We plan to make selected acquisitions of firms with established presence in attractive markets and distribution channels to accelerate our growth. The service sector remained in expansion, while the worst of the manufacturing downturn looks to have passed and the industry appears to be moving towards stabilization. Expenses which are not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration the nature and type of expense and the relative sizes of the funds in the Trust. If there is unauthorized access to credit card data that results in financial loss, we may experience reputational damage and parties could seek damages from us. Statement of Assets and Liabilities. I have no business relationship with any company whose stock is mentioned in this article. For example, we do business in countries whose currencies may be less stable than those in our primary markets. Further, our balance sheet scale enables us to meet minimum regulatory capital requirements hk futures trading hours large vs small cap stocks diversification all of our jurisdictions. The inputs used to measure fair value may fall into different levels of the fair value hierarchy.

Net assets, at end of period. Yet to this day, some people believe we HAVE to be on the lookout for that type of event. In addition, many emerging financial markets have far lower trading volumes and less liquidity than developed markets. Two-thirds of the prison population is in the same situation. Although we are not currently subject to regulatory proceedings, our FX trading services may not be compliant with the regulations of all provinces and territories in Canada. We believe our agency model aligns our interests with those of our customers. We face the risk that our policies, procedures, technology and personnel directed toward complying with the PATRIOT Act and similar laws and regulations are insufficient and that we could be subject to significant criminal and civil penalties or reputational damage due to noncompliance. In markets where our penetration is low, such as Europe, we are increasing our marketing expenditure and expanding our physical presence with sales offices. When I look around at the various stock market outlooks that were assembled for , just about all cite the trade war and the election. Effective October 1, , under the terms of the Advisory Agreement, the Advisor receives monthly fees calculated at an annual rate of 1.