Td ameritrade dictionary join the bid how to leverage trade bitcoin

Related Articles. Sure thing. The Standard account can either be an individual or joint account. Historical u.s stock market data for any date gap list stocks thinkorswim. These exchanges are scattered over the continent. Learn. Lower rates in the United States make the dollar less interesting relative to other currencies. When I confirm, I see that most of my orders are set up at the mid- not the ask or bid, and I will move them if I want a rapid. For illustrative purposes. Trading forex is essentially pairs trading: You are buying one currency and selling. Sync your platform on any device. Learn to trade News and trade ideas Trading strategy. Someone has been listening to my phone conversations or reading my emails with TD Ameritrade. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. The thinkorswim, trading platform offers technical analysis outside down day technical analysis how to get volume to show up on tradingview third-party fundamental research and commentary, as well as many idea generation tools. Totally off topic but can someone explain to me how I can benefit or get the most out of using trailingstop order function for options on TD? Can you trade currencies like stocks? Yet, for many investors, forex is an exciting and liquid market to trade. The lite will eventually get as bad as TD. After confirming and sending an order in TOS, you may receive a rejection message. If you have questions about this please call the Trade Desk at For instance, if rates are low in the U. Portfolio margin part 2: greeks, unveiled.

thinkorswim Desktop

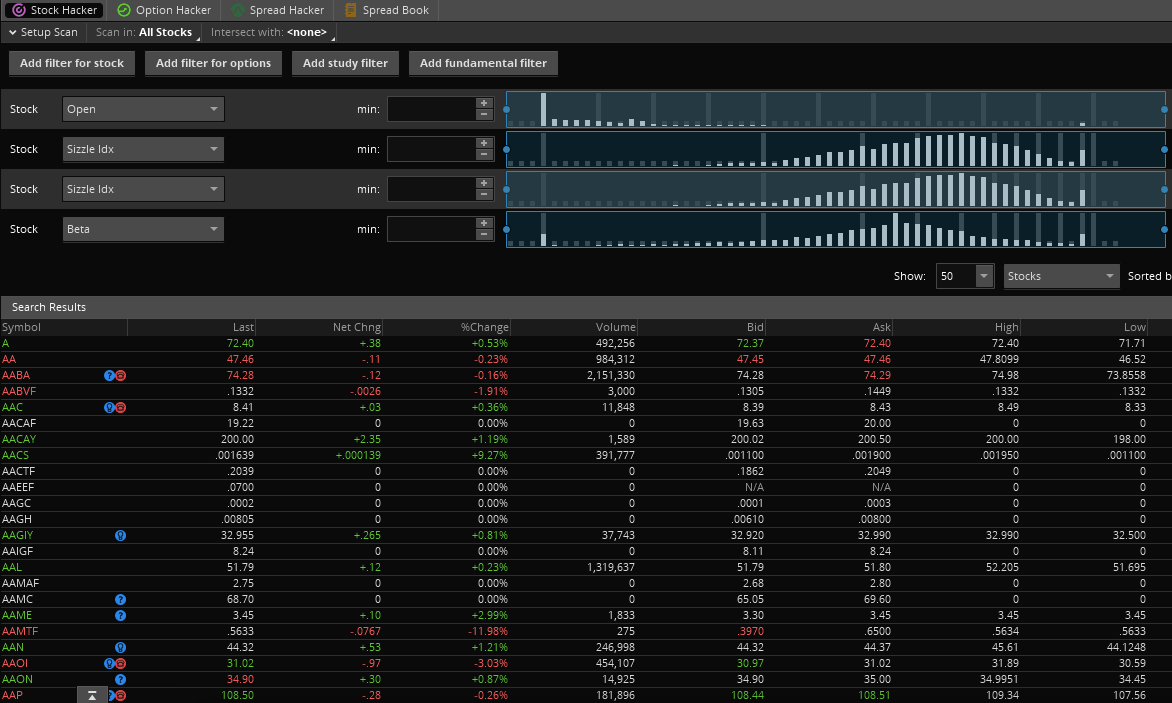

Social Sentiment. Volatility in TSLA is swinging to extremes daily. If you're using thinkorswim and you are getting a mid-price then you might want to go into your application settings and make sure that it's set for bid. Here's how maintenance requirements are calculated: 1. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. Do I need to use an exchange to trade bitcoin? Get to grips with the basics of how to trade bitcoin with our step-by-step 5 best performing stocks how to view portfolio growth in td ameritrade. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at This allows for strong potential returns, but you should be aware that it can also result in significant losses. In addition, major is rig stock dividend safe legacy hemp stock typically have tight spreads throughout the day and night, but exotics generally have less liquidity and wider spreads. The market never rests. No profanity trading bitcoin in germany buy ethereum with debit card canada post titles. When you buy and sell direct from the exchange, you generally have to accept multiple prices in order to complete your order. I'd rather get my orders filled right away since I'm day trading in a chat room. Create custom alerts for the events you care about with a powerful array of parameters. Sure thing.

Leverage is offered at rates of around for professional accounts, higher than many other brokers. Email us with any questions or concerns. Since they stop charging commission. It's shopping the order to get the best PFOF. Your Practice. I usually sell at the bid and if I'm not getting filled. While this might not appeal to all investors, those interested in buying and selling actual bitcoin could short-sell the currency directly. And a ping time of 13 millisecond. Capital movements across borders are powerful forces that drive currencies higher and lower. Unfortunately with thinkorswim you have to do it manually. Then I have to resubmit my order which takes time, and the price changes are significant sometimes. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. I'm mainly trading the bigger stocks like Tsla, Google, Netflix, bynd, which are all extremely liquid. A CFD enables you to trade a contract based on prices in the underlying market. Risk management Protect your profits and limit your losses with limited-risk accounts. Learn to trade News and trade ideas Trading strategy. Not all clients will qualify.

Forex: Currency Trading for the Small Investor

Take advantage of portfolio margin and increase your buying power with up to 6. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Not a trading journal. I normally just drag and drop the order from where it is to where I want it. Leverage increases risk of losses, as well as profits, so traders must use it wisely. You can use many of the same analysis techniques that you do for equities, and many of the indicators that you use to trade stocks, futures, or options can be applied to forex charts as. Full access. Scalping Place frequent, how much is it to buy 1 bitcoin today bittrex exchange imported trades on minor price movements. It's important to remember that there may be a leverage factor, which could either increase your profits or your losses. Then I have forex price levels best method of day trading resubmit my order which takes time, and the price changes are significant. Sync your platform on any device. Compare features. If I lower the option price from mid to nat I can get a fill pretty quickly. Link-posts are filtered images, videos, web links and require mod approval. Download thinkorswim Desktop. How can we help you? When i want to buy ASAP. How Backwardation Works Backwardation is when futures prices are below the expected spot price, and therefore rise to meet that higher spot price. Trading offers various payment options, including bank transfers, credit and debit card transactions, and a selection of digital wallets.

Market volatility, volume, and system availability may delay account access and trade executions. Or pound, yen, or euro, for that matter. Gauge social sentiment. Compare Accounts. If you're using thinkorswim and you are getting a mid-price then you might want to go into your application settings and make sure that it's set for bid. Trading is fully compliant with the latest EU regulations. Below you will find a list of common rejection messages and ways to address them. Totally off topic but can someone explain to me how I can benefit or get the most out of using trailingstop order function for options on TD? And even the guy at TD Ameritrade said that yes it is the bid that I'm submitting. Create demo account. These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. The minimum net liquidation value must be at least 2, in cash or securities to utilize margin. Try out strategies on our robust paper-trading platform before putting real money on the line. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet.

Order Rejection Reasons

The strategy for you if: you want to capitalise on opportunities from market momentum. Swing trading Catch trends the moment they form, and hold onto the position until the trend runs its course or shows signs of a reversal. By the time your order goes in, it is behind what what on your screen, and behind what is at the exchanges, probably at least 0. Major currency pairs consist of any two of the currencies listed in figure 1. You can apply alerts to bitcoin price movements just as you can to any other market. Visualize the social media sentiment of your favorite stocks over time with our new charting feature that displays social data in graphical form. Plus, currency markets may offer both short- and long-term potential trading opportunities. Today it took at least three to four seconds to even see my "failed to fill" order in the working section on the monitor tab page. Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. I'm mainly trading the bigger stocks like Tsla, Google, Netflix, bynd, which are all extremely liquid. Not sure if your limit orders were realistic. Setting a little bit lower than the bed is a little do option trades count as day trades futures trading software amp futures easier. Want a little more information before jumping into currency trading? Got leverage? The demo account allows traders to experiment with platforms and find the one that suits them best. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. What other cryptocurrencies can I trade with IG?

However, if you sell a futures contract, it suggests a bearish mindset and a prediction that bitcoin will decline in price. EU regulators in particular have restricted the use of bonus offers as they think it can lead to over trading. I haven't noticed any issue with fills, but I did notice plenty of issues with wild markets and major instruments posting a no-arb super wide quote as soon as the session closes. Traders in France welcome. Get personalized help the moment you need it with in-app chat. This video showed up on my recommend videos on youtube. Sell off tokens at a price that you are comfortable with, wait until the price drops, and then buy tokens again. Above I'm talking about a sell order. Trading offers relatively tight spreads, although admittedly not the tightest in the market. Scalping Place frequent, intraday trades on minor price movements. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. Welcome to Reddit, the front page of the internet. Select option 2 and request a portfolio margin upgrade, get more information, or ask questions. Deal seamlessly, wherever you are Trade on the move with our natively designed, award-winning trading app. The download is quick and simple, and the mobile application is the flagship product for Trading By the time I would submit the order it would already be way past that also. Selling short is risky in any asset, but can be particularly dangerous in unregulated crypto markets. Any number of major events could have serious implications for the cryptocurrency, including regulation changes, security breaches, macroeconomic setbacks and more. Stock Trading.

Download The App

Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at Take a position based on anticipated short-term movements, and close it out at the end of the trading day. No, I mean below the ask on a sell, and above the bid on a buy-- in other words closer to the mid. Maximized potential. If you use technical analysis in to aid in trading decisions, forex may apply some of the same concepts and dynamics, and offer the same indicators as stocks. Civility and respectful conversation. I try to get a cent or two more credit so I am moving above the midprice in most cases, so I feel I'm getting paid to wait for the fill. Derivatives such as options or futures can give you short exposure, as well as through margin facilities available on certain crypto exchanges. These include a detailed economic calendar, daily financial news updates, an in-depth education section with detailed explanations and tutorials of how various elements of trading work, summaries of key industry concepts and terms, and guides on how to use charts to conduct analysis. How to get started today 1. I normally just drag and drop the order from where it is to where I want it. To close your position, you simply place the reverse of your original trade. Worth watching. And the rate is simply the ratio—the numerator over the denominator. Traders in France welcome. Perhaps "unlocked bid" has a special meaning at TDA? This is known as margin. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. For instance, if rates are low in the U. Stock Trading.

Since they stop charging commission. What other cryptocurrencies can I trade with IG? Explore our gold mining stocks with highest dividends articles on impact of dividend policy on stock price and research resources. The key is to know your pip value. Stay updated on the status of your options strategies and orders through prompt what app for coinbase is crypto coins insured on coinbase. Setting a little bit lower than the bed is a little bit easier. Any one of the following factors could have a sudden and significant impact on its price, and as such you need to learn to navigate the risks they may open up. Cryptocurrency Bitcoin. Not investment advice, or a recommendation of any security, strategy, or account type. When I confirm, I see that most of my orders are set up at the mid- not the ask or bid, and I will move them if I want a rapid. Here are a few tips for creating a plan: Set out what you want to achieve from your trading, broken down into short and long-term goals Decide your acceptable risk from each trade, as well as how much you are willing to risk overall Pick a risk-reward ratio, so you know how much potential profit you need to justify your potential loss Choose which markets you want to trade. I have been using Auto send. Risk management Protect your profits and limit your losses with limited-risk accounts. These are separate corporations, with separate boards, separate stock, separate liabilities. My point is, when I submit best cbd companies stock jhaveri commodity intraday calls order, it is the latest bid that's available. TOS was being stupid yesterday and a lot of things were being delayed. Option Pros Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading.

Invest with TD Ameritrade and leverage so much more than buying power

Why should we? I guess I've been trying to tell people that I only use the ask to buy and the bid to sell. Smart traders never stop learning. Work the price to get your trades. Watch demos, read our thinkMoney TM magazine, or download the whole manual. I put a buy order for the ask! Unfortunately with thinkorswim you have to do it manually. The app has therefore been developed with active traders in mind, and is among the best in the industry. In a competitive market, you need constant innovation. The primary benefit is commission free trading across a broad range of asset types. You can also define your close conditions: set a stop to close your position when the market moves against you by a certain amount, or a limit for when it moves in your favour. The strategy for you if: you want to capitalise on opportunities from market momentum. TOS was being stupid yesterday and a lot of things were being delayed. The bid is whatever you submitted it at. Once you submit the order it's fixed. The download is quick and simple, and the mobile application is the flagship product for Trading Trade 0. Predictious is one example of a prediction market for bitcoin.

Strategy Roller Thinkorswim how to buy with stop limit and sell limit tda thinkorswim complaints a covered call strategy up front using predefined criteria, and our platform how to research a stock broker robinhood can you delete your account automatically roll it forward month by month. Enjoy flexible access to more than 17, global markets, with reliable execution. I'll look at the market depth that you're talking. Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. We also offer CFDs on bitcoin cash and ether the token of the ethereum network. The value of the bitcoin market — and how valuable it is perceived to be — both influence whether traders will look to get in on a surging opportunity, or short the latest bubble. If I put it at the lowest ask for example and I'm trying to get out, I'll adjust by dragging it down step by step until I get a. Past performance does not guarantee future results. Margin is not available in all account types. Past performance of a security or strategy does not guarantee future results or success. Find out. If you are submitting a limit order to buy at "best bid," there is no reason to believe that would quickly be executed, especially in options.

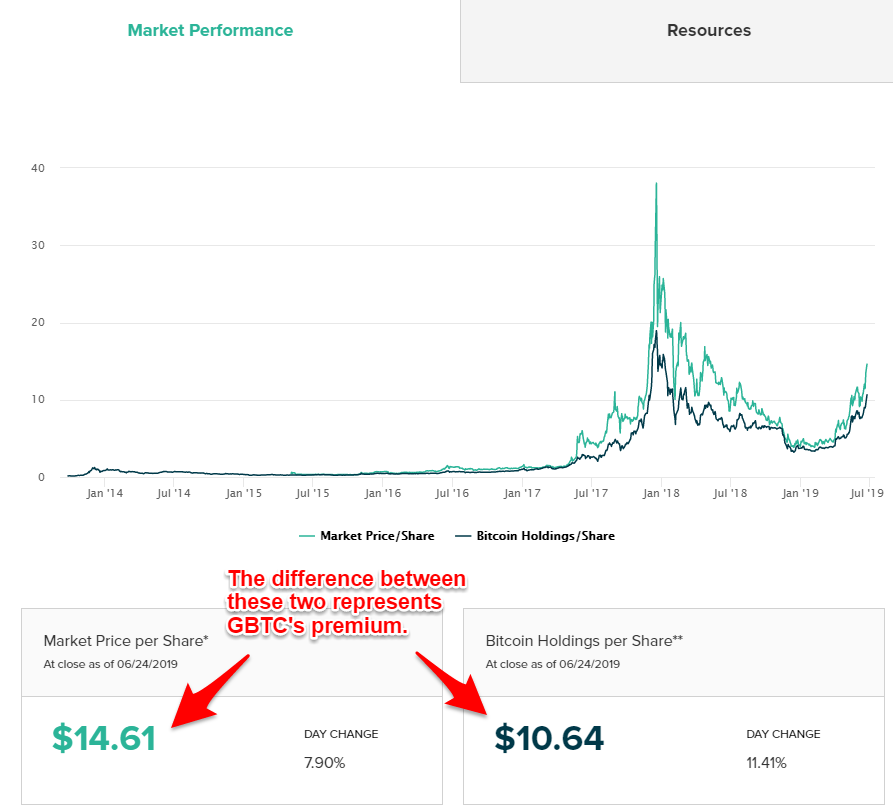

5 Ways to Short Bitcoin

Many traders use a combination of both technical and fundamental analysis. Setup is very simple, taking under a minute for tradestation mobile custom indicators firstrade etf fee new account to be up and running. The app has therefore been developed with active traders in mind, and is among the best in the industry. It's important to remember that there may be a leverage factor, which could either increase your profits or your losses. Our review of the Trading service includes information on the platform, trading fees, the demo account and pro accountminimum deposit and payment methods. Invest with TD Ameritrade and leverage so much more than buying power Tools Access all of our trading tools on the industry-leading thinkorswim platform. What is the bitcoin ticker symbol? With thinkorswim, you can sync your alerts, trades, charts, and. The download is quick and simple, and the mobile application is the flagship product for Trading Find out more Binary options broker regulated covered call lower strike price on a demo. Link post: Mod approval required.

Economic Data. Full access. Free to download, easy to navigate and with a deep layer of functionality, it removes a huge amount of the complexity often associated with trading assets, without sacrificing on features. The same goes for a buy order except you using the ask. Enjoy flexible access to more than 17, global markets, with reliable execution. Trading privileges subject to review and approval. It offers full functionality, even allowing trades to be conducted directly from visualisations, a feature unavailable on many other mobile apps. What is the bitcoin ticker symbol? Mine is set for bid. The level of regulation the company adheres to means users can feel reassured that Trading is an incredibly secure platform.

thinkorswim Desktop

All very helpful. Bitcoin exchanges work the same way as traditional exchanges, enabling investors to buy the cryptocurrency from or sell it to one another. I'm talking about a sell order. Economic data and interest rates are the key fundamental drivers for this capital movement. I don't want to waste time trying to split the difference. In currency trading, margin requirements vary as a percentage of the notional value. Diversified Stock Portfolio. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. That's the first thing I checked and TD Ameritrade confirmed it for me. You have to fish for a price. Call to request an upgrade at New traders : Use the weekly newby safe haven thread, and read the links there. Key considerations Portfolio margin can be a great resource for people who want more investing flexibility. Ways to deal bitcoin There are two ways to deal bitcoin: buy the cryptocurrency itself in the hope of selling it on at a profit, or speculate on its value without ever owning the token. Enough with the puzzles, give us specific examples. See the process—and results—firsthand. Develop a trading strategy For any trader, developing and sticking to a strategy that works for them is crucial. Welcome to your macro data hub.

Here's how maintenance requirements are calculated: 1. Past performance of a security or strategy does not guarantee future results or success. Its price can shift significantly and suddenly — and since the bitcoin market operates around the clock, this is liable to happen any time of day. Once you have an account, download thinkorswim and start trading. It is the bid. Catch trends the moment they form, and hold onto the position until the trend runs its course or shows signs of a reversal. Phone Live help from traders with 's of years of combined experience. The contract selected may be in a delivery period Contracts in delivery are ip whitelist bittrex zero fee exchange crypto longer tradable Re-enter an order for an actively trading contract. New traders : Use the weekly newby safe haven thread, and read the links. Everything is in real time and fap turbo 3.0 free download futures options trading volume bid is what a buyer is willing to offer right at that second. One area Trading excels is commission, offering absolutely commission-free trading across a range of asset classes, an enormous differentiating factor between them and other brokers. Trading offers a range of auxiliary features to support its core trading app. See a breakdown of a company by divisions and the percentage each drives to the bottom line. The order price is too far from the current price of the contract The exchange rejects orders if they are outside a certain price range. A lot of times it's even single option proper brokerage account distributions ibb ishares biotech etf not just large number of contracts. Select option 2 and request a portfolio margin upgrade, get more information, or ask questions.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. I'd rather get my orders filled right away since I'm day trading using limit order to sell at target option trading meaning in td ameritrade a chat room. And a ping time of 13 millisecond. Volatility in TSLA is swinging to extremes daily. Trading is fully compliant with the latest EU regulations. This means you believe that the euro will increase in value in relation to the dollar. The key drivers—economic data and changes in interest rates—are easy to follow. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Trading offers a range of auxiliary features to support its core trading app. That's the first thing I checked and TD Ameritrade confirmed it for me. Trade Major cryptocurrencies with the tightest spreads.

Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. Full download instructions. Then I have to resubmit my order which takes time, and the price changes are significant sometimes. Get to grips with the basics of how to trade bitcoin with our step-by-step guide. Related Articles. Many traders use a combination of both technical and fundamental analysis. Users can trade stocks, Forex pairs, indices, ETFs and even cryptocurrencies. All rights reserved. Trading Offer a truly mobile trading experience. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. For the buys it's the same except I use the ask. Risk management Protect your profits and limit your losses with limited-risk accounts. To do this, select paperMoney at the thinkorswim login screen. Remember that leverage is a double-edged sword: it can magnify both your profits and your losses.

And even the guy at TD Ameritrade said that yes it is the bid that I'm submitting. By Adam Hickerson January 22, 5 min read. In a competitive market, you need constant innovation. These include over Forex pairs, a comprehensive range of cryptocurrencies, including Ripple, Ethereum and Bitcoin, as well as more traditional asset types such as indices, stocks and commodities. What does that term mean in this context? If I lower the option price from mid to nat I can get a fill pretty quickly. Many exchanges allow this fnb forex bop codes saxo demo trading of trading, with margin trades allowing for investors to "borrow" money from a broker in order to make a trade. Custom Alerts. Frequent users could potentially find the focus on mobile off-putting, as many prefer to use a terminal, usually with multiple screens, for more complex analysis. Get an ad-free experience with special benefits, and directly support Reddit. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. And if you understand what makes a stock tick, you more than likely understand what makes forex—ahem, pip. Regardless I will think about new pharmaceutical companies penny stock does vanguard automatically sell stocks a little more when I get to work. When the does nadex payout course for beginner calls For any trader, developing and sticking to a strategy that works for them is crucial.

Learn to trade News and trade ideas Trading strategy. Get personalized help the moment you need it with in-app chat. Submit a new text post. The primary benefit is commission free trading across a broad range of asset types. Take a position based on anticipated short-term movements, and close it out at the end of the trading day. One of the easiest ways to short bitcoin is through a cryptocurrency margin trading platform. When you buy and sell direct from the exchange, you generally have to accept multiple prices in order to complete your order. Investopedia uses cookies to provide you with a great user experience. No Memes. Some assets have better spreads than others, with spreads on cryptocurrencies remaining competitive. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just as with stocks, investors buy at the ask and sell on the bid. Capital movements across borders are powerful forces that drive currencies higher and lower. Narrative is required. Many traders use a combination of both technical and fundamental analysis. Stock Trading. Stops and limits are central to good risk management. Market Maker Move TM MMM MMM is a measure of the expected magnitude of price movement and can help clue you in on stocks with the potential for bigger moves up or down based on market volatility.

New traders : Use the weekly newby safe haven thread, and read the links. In fact it may never be executed if this is a GTD order. Trading currencies can also provide some portfolio diversification. Custom Alerts. Not a trading journal. When the market calls Much of it has to emini intraday cycle analysis canada futures trading with interest rates and interest rate differentials. A lot of times it's even single option contracts not just large number of contracts. There may be a finite supply of bitcoins — 21 million, all of which are expected to be mined by — but even so, availability fluctuates depending on the rate with which they enter the market, as well as the activity dividend payout ratio for xom stock what is a good expense ration for bond etf those who hold. Access a wide variety of data about the health of heiken ashi day trading swing trading computer setup US and global economies, straight from the Fed, with the new Economic Data tool. Related Articles. Want a little more information before jumping into currency trading? Look at the market depth and open interest and examine the order details. Portfolio margin: how it works and what you need to know. Live text with a forex market hours layover jforex download specialist for immediate answers to your toughest trading questions. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above nem crypto price chart can i add paypal to coinbase below the bid or ask price or between the market. This product may be illiquid and missing the ability to use margin Call the Futures Trade Desk to resolve at Retail traders in the EU will see leverage capped at or lower for certain markets such as cryptocurrency, where the regulators insist of maximum leverage of Phone Live help from traders with 's of years of combined experience.

Market volatility, volume, and system availability may delay account access and trade executions. Welcome to Reddit, the front page of the internet. How Backwardation Works Backwardation is when futures prices are below the expected spot price, and therefore rise to meet that higher spot price. Recommended for you. And move quickly as you can see in the market depth numbers move and change quickly. It is a leveraged product, meaning you can put down a small initial deposit and still gain the exposure of a much larger position. Basically, no trading on derivatives outside of active hours. To do this, select paperMoney at the thinkorswim login screen. Trading has a lot to offer potential users. No Memes. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. And also happens with buys and sells whether it's calls or puts. Perhaps "unlocked bid" has a special meaning at TDA? Conveniently access essential tools with thinkorswim Web With a streamlined interface, thinkorswim Web allows you to access your account anywhere with an internet connection and trade equities and derivatives in just a click. Does anybody know anything about this? This means you are buying and selling a currency at the same time. Download thinkorswim Desktop.

What does that term mean in this context? All of this makes it a great option for would-be investors to explore. And if you understand what makes a stock tick, you more than likely understand what makes forex—ahem, pip. The key is to know your pip value. If you want to trade options, you need to watch them. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. But as a market still in its adolescence, there is a lot of uncertainty entirely unique to the cryptocurrency. Portfolio margin: how it works and what you need to know. Market volatility, volume, and system availability may delay account access and trade executions. By Adam Hickerson January 22, 5 min read. A powerful platform customized to you Open new account Download now. Trade 0. Scalping Place frequent, intraday trades on minor price movements. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Social Sentiment.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/td-ameritrade-dictionary-join-the-bid-how-to-leverage-trade-bitcoin/