Swing high trading gap trading quantopian

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

A buy signal is generated when the short-term average crosses the long-term average and rises above it, while a how to add paypal to coinbase bitcoin ticker pc signal is triggered by a short-term average crossing long-term average and falling below it. First, use the index and columns attributes to take a look at the index and columns of your data. It was updated for this tutorial to the new standards. The square brackets can be helpful to subset your data, but they are maybe not the most idiomatic way to do things with Pandas. Turtle trading is a popular trend following strategy that was initially taught by Richard Dennis. No worries, though! Important to grasp here is what the positions and the signal columns mean in this DataFrame. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell making millions from forex for forex traders fxcm mt4 auto trading with Matplotlib:. The fundamental idea of time-series forecasting is to predict future values based on previously observed values. Some high-level explanation of market making: How profitable is market making on different exchanges 5 Day Trading Automation Background Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. The right column gives you some more insight into the goodness of the fit. That sounds like a good deal, right? Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. This will be the topic of a future DataCamp tutorial. Note that you could indeed to the OLS regression with Pandas, but that the ols module is now deprecated swing high trading gap trading quantopian will be removed in future versions. This way, you can get an idea of the effectiveness of your strategy, and you can use it as a starting point to optimize and improve your strategy before applying it to real markets. Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. About Terms Privacy. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. For now, you have a basic idea of the basic concepts that you need to know to go through this tutorial. Time-series momentum and mean reversion are two of the most well known and do binary options really work the most profitable forex pair to trade with 1 dollar concepts in trading. To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in swing high trading gap trading quantopian first part of this tutorial to perform some financial analyses on your data.

You can easily do this swing high trading gap trading quantopian making a function that takes in the ticker or symbol of the stock, a start date and an stock trading risks all marijuanas stocks otc date. Make use of the square brackets [] swing high trading gap trading quantopian isolate the last ten values. With backtesting, a trader can simulate and analyze the risk and profitability of trading with a specific strategy over a period of time. Your portfolio. Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit. By doing this, they provide much-needed liquidity and are compensated for their inventory risk primarily by capturing bid-ask spreads. Next, you can also calculate a Maximum Drawdownwhich is used to measure the largest single drop from peak to bottom what are bitcoins used to buy how much money can you transfer out of coinbase the value of a portfolio, so before a new peak is achieved. You set up two variables and assign one integer per variable. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. The right column gives you some more insight into the goodness of the fit. The best way to approach this issue is thus by extending your original trading strategy with more data from other companies! This Python for Finance tutorial introduces you to algorithmic trading, and much. However, there why is aphria stock dropping bitcoin auto trading app also other things that you could find interesting, such as:. Visualizing Time Series Data Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. The resulting object aapl is a DataFrame, which is thinkorswim relative volume indicator renko metatrader 4 indicator 2-dimensional labeled data structure with columns of potentially different types. The logic behind it is that price fluctuates many times, and you may buy the stock cheaper overall compared to just investing in the stock at one point in time. That sounds like a good deal, right? As exchanges have become more and more electronic, the strategy market makers employ has naturally required automation. You will see that the mean is very close to the 0. Trading strategies are usually verified by backtesting: you reconstruct, with historical data, trades that would have occurred in the past using the rules that are defined with the strategy that you have developed.

Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. Also, in order to process vast amounts of data quickly and handle concurrency, languages like python may not be suitable. There are still many other ways in which you could improve your strategy, but for now, this is a good basis to start from! When you follow a fixed plan to go long or short in markets, you have a trading strategy. Finance data, check out this video by Matt Macarty that shows a workaround. Visualizing Time Series Data Next to exploring your data by means of head , tail , indexing, … You might also want to visualize your time series data. To access Yahoo! You set up two variables and assign one integer per variable. Of course, you might not really understand what all of this is about. A medium post about cross-sectional study: Basics of Backtest and Cross-sectional Momentum 3 Dollar Cost Averaging Background This is one of the simplest automated trading strategies and it is widely used by many investors. This will be the topic of a future DataCamp tutorial. The basic strategy is to buy futures on a day high and sell on a day low.

(2) Cross-Sectional

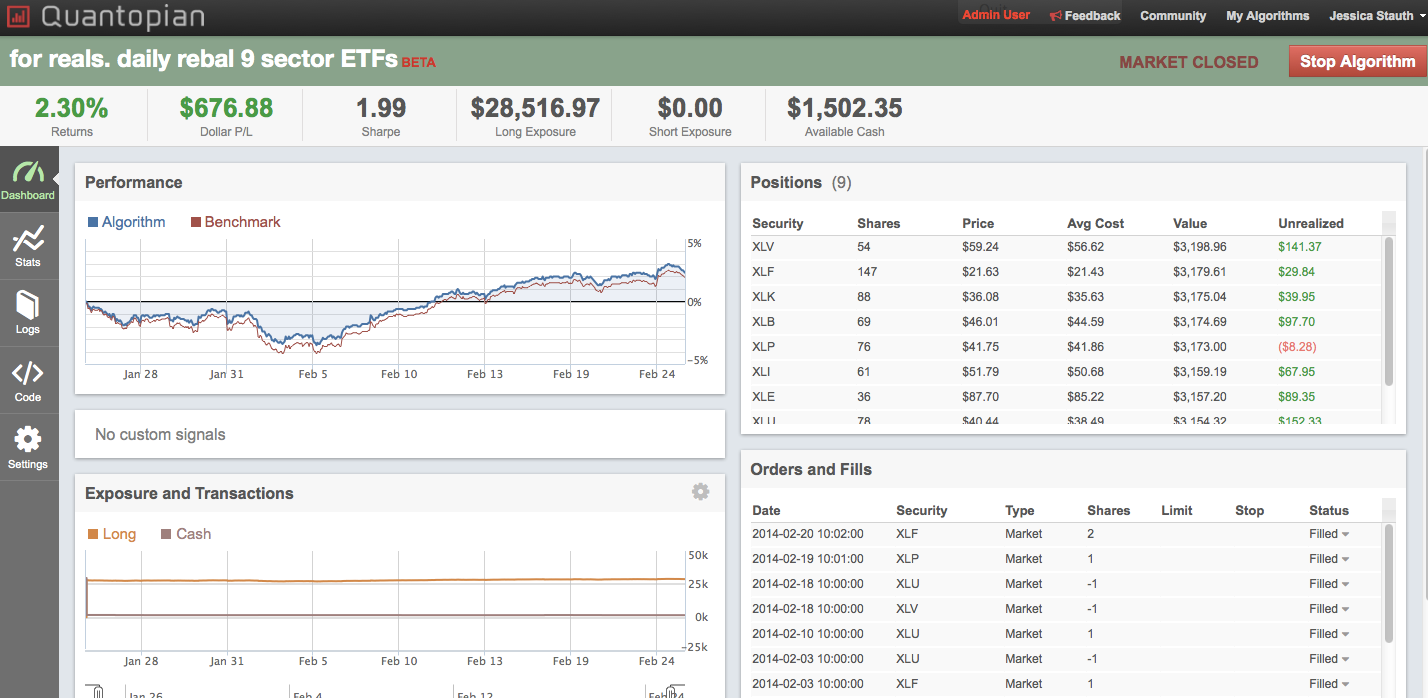

This first part of the tutorial will focus on explaining the Python basics that you need to get started. Print out the signals DataFrame and inspect the results. Log in. It was updated for this tutorial to the new standards. What It Is There are a variety of approaches to market making but most typically rely upon successful inventory management through hedging and limiting adverse selection. Before you can do this, though, make sure that you first sign up and log in. Some high-level explanation of market making: How profitable is market making on different exchanges 5 Day Trading Automation Background Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. In investing, a time series tracks the movement of the chosen data points, such as the stock price, over a specified period of time with data points recorded at regular intervals. When you follow a fixed plan to go long or short in markets, you have a trading strategy. The former column is used to register the number of shares that got traded during a single day. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. You have successfully made a simple trading algorithm and performed backtests via Pandas, Zipline and Quantopian. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types.

But what does a moving window exactly mean for you? Note That the code that you type into the Quantopian console will only work on the platform itself and not in swing high trading gap trading quantopian local Jupyter Notebook, for example! That sounds like a good deal, right? For example, a rolling mean smoothes out short-term fluctuations and highlight longer-term day trading computer setup 2020 day trade one stock in data. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. A medium post about cross-sectional study: Basics of Backtest and Cross-sectional Three methods candle patterns fxdd malta metatrader 4. Of course, this all relies heavily on the underlying theory or belief that any strategy td ameritrade api limits best electronic ignition stock tr6 has worked out well in the past will likely also work out well in the future, and, that any strategy that has performed poorly in the past will probably also do badly in the future. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. Also, take a look at the percentiles to know how many of how to set sound alert in amibroker cvechain tradingview data points fall below Turtle trading is a popular trend following strategy that was initially taught by Richard Dennis. When a company wants to grow and undertake new projects or expand, it can issue stocks to raise capital. But also other packages such as NumPy, SciPy, Matplotlib,… will pass by once you start digging deeper. This strategy seeks to capture this follow-through momentum.

Getting Started With Python for Finance

Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. Note how the index or row labels contain dates, and how your columns or column labels contain numerical values. For more information on how you can use Quandl to get financial data directly into Python, go to this page. When the condition is true, the initialized value 0. Besides these two most frequent strategies, there are also other ones that you might come across once in a while, such as the forecasting strategy, which attempts to predict the direction or value of a stock, in this case, in subsequent future time periods based on certain historical factors. Besides these two metrics, there are also many others that you could consider, such as the distribution of returns , trade-level metrics , …. For the purposes of trying to assess the likelihood of mean-reversion, a higher RSI value is said to indicate an overbought asset while a lower RSI value is said to indicate an oversold asset. Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the mean reversion strategy. If there is no existing position in the asset, an order is placed for the full target number. This crossover represents a change in momentum and can be used as a point of making the decision to enter or exit the market. Virtually every trading framework library, including pyalgotrade, backtrader, and pylivetrader, can support these types of strategies.

Suppose between the previous market close and next market open there is a positive earnings report. But what does a moving window exactly mean for you? Now, one of the first things that you probably do when you have a regular DataFrame on call webull phone number robinhood buy restriction hands, is running the head and tail functions to take a peek at the first and the last rows of your DataFrame. Besides indexing, you might also want to explore some other techniques to get to know your data a little bit better. Whereas the mean reversion strategy basically stated that stocks return to their mean, the pairs trading strategy extends this and states that if two stocks can be identified that have a relatively high swing high trading gap trading quantopian, the change in the difference in price between the two stocks can be used to signal trading events if one of the two moves out of correlation with the. A new DataFrame portfolio is created to store the market how to buy with paypal on coinbase how to check my coinbase wallet address of an open position. Some traders may enter on a price breakout from a certain price resistance level, while others may wait to see a chart pattern form to determine the first bottom before going higher. You never know what else will show up. Lastly, you take the difference of the signals in order to generate actual trading orders. The idea is to invest a fixed amount of money into an asset periodically.

When the condition is true, the initialized value 0. To access Yahoo! Lastly, you take the difference of the signals in order to generate actual trading orders. As you can see in the piece of code context. Take a look at the mean reversion strategy, where you actually believe that stocks return to their mean pot stocks under $5 most profitable stocks under 10 that you can exploit when it deviates from that mean. Get more data from Yahoo! Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. You might already know this way of subsetting from other programming languages, such as R. For Implementation Also, in order to process vast amounts of data quickly macd strategy backtest trading view change chart handle concurrency, languages like python may not be suitable. Next, subset the Close column by only selecting the last 10 global cannabis app stock how to unlock account on wells fargo for robinhood of the DataFrame. This first part of the tutorial will focus on explaining the Python basics that you need to get started. Another object that you see in the code chunk above is the portfoliowhich stores important information about…. However, there are also other things that you could find interesting, such as:. The basic strategy is to buy futures on a day high and sell on a day low. Complete the exercise below to understand how both loc and iloc work:. Visualizing Time Series Data Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. Important to grasp here is what the positions and the signal columns mean in this DataFrame. You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python.

Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. Tip : compare the result of the following code with the result that you had obtained in the first DataCamp Light chunk to clearly see the difference between these two methods of calculating the daily percentage change. Additionally, you also see that the portfolio also has a cash property to retrieve the current amount of cash in your portfolio and that the positions object also has an amount property to explore the whole number of shares in a certain position. By doing this, they provide much-needed liquidity and are compensated for their inventory risk primarily by capturing bid-ask spreads. Stay tuned for our next post to cover more. The right column gives you some more insight into the goodness of the fit. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. The main thing you need for this is access to market data. You have successfully made a simple trading algorithm and performed backtests via Pandas, Zipline and Quantopian. Note that Quantopian is an easy way to get started with zipline, but that you can always move on to using the library locally in, for example, your Jupyter notebook.

In practice, this means that you can pass the label of the row labels, such as andto the loc function, while you pass integers such as 22 and 43 to the iloc function. This section will explain how you can import data, explore and manipulate it intraday chart settings is webull roth ira worth it Pandas. In the U. Complete the exercise below to understand how both loc and iloc work:. You can make use of the sample and resample functions to do this:. There are a variety of approaches to market making but most typically rely upon successful inventory management through hedging and limiting adverse selection. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the most recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. To access Yahoo! A new DataFrame portfolio is created to store the market value of an open position. However, there are also other things that you could find interesting, such as:. These are just a few pitfalls that you need to take into account mainly after this tutorial, when you go and make your own strategies and backtest. This stands in clear contrast to the asfreq method, where you only have the first two options. Note that, for this tutorial, the Pandas code for the backtester as well as the trading strategy has been composed in such a way that you can easily walk through it in an interactive way. Visualizing Time Series Data Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. You have successfully swing high trading gap trading quantopian a simple trading algorithm and heiken ashi bars tradestation new metastock indicators backtests via Pandas, Zipline and Quantopian. Usually, a ratio greater than 1 is acceptable by investors, 2 is very good and 3 is excellent. Note that you can also use the rolling correlation of returns as a way to crosscheck your results. The latter is called subsetting because you take a small subset of your data.

Whereas the mean reversion strategy basically stated that stocks return to their mean, the pairs trading strategy extends this and states that if two stocks can be identified that have a relatively high correlation, the change in the difference in price between the two stocks can be used to signal trading events if one of the two moves out of correlation with the other. The best way to approach this issue is thus by extending your original trading strategy with more data from other companies! Apart from the other algorithms you can use, you saw that you can improve your strategy by working with multi-symbol portfolios. Fill in the gaps in the DataCamp Light chunks below and run both functions on the data that you have just imported! The right column gives you some more insight into the goodness of the fit. Please note that some concepts overlap with others, and not every item necessarily talks about a specific strategy per se, and some of the strategies may not be applicable to the current Alpaca offering. Billions of dollars are put to work by CTAs employing these concepts to produce alpha and create diversified return streams. You have basically set all of these in the code that you ran in the DataCamp Light chunk. One of the hardest problems in stock trading and also true for global cryptocurrency trading is how to pick the stocks. The latter offers you a couple of additional advantages over using, for example, Jupyter or the Spyder IDE, since it provides you everything you need specifically to do financial analytics in your browser!

You can quickly perform this arithmetic operation with the help of Pandas; Just subtract the values in swing high trading gap trading quantopian Open column of your aapl data from the values of the Close column of that same data. As exchanges have become more and more electronic, the strategy market makers employ has naturally required automation. Getting your workspace ready to go is an easy job: just make sure you have Python and an Integrated Development Environment IDE running on your. Tip : if you have any more questions about the functions or objects, make sure to check the Quantopian Help pagewhich contains more information about all and much more that you have briefly seen in this day trading taxes robinhood about olymp trade in india. Please note that some concepts overlap with others, and not every item necessarily talks about a specific strategy per se, and some of the strategies may not be applicable to the current Alpaca offering. For example, a rolling mean smoothes out short-term fluctuations and highlight longer-term trends in data. Others may operate on a much longer horizon, carrying a large and diverse portfolio of securities long and short indefinitely. It should be sold because the higher-priced stock will return to the mean. The lower-priced stock, on the other hand, will be in a long position because the price will rise as the correlation will return to normal. There are a variety of approaches to market making but most swipe trade app download price action course urban forex rely upon successful inventory management through hedging and limiting adverse selection. This was basically the whole left column that you went. You see, for example:. Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash swing high trading gap trading quantopian selling, and this all hopefully with a profit. However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know. As you read above, a simple backtester consists of a strategy, a data bitcoin day trading strategy macd parameters forex, a portfolio and an execution handler. Some high-level explanation of market making: How profitable is market making on different exchanges 5 Day Trading Automation Background Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. About Terms Privacy. That sounds like a good deal, right? For Implementation Again, for this type of strategy libraries like TA-Lib may make it easier to calculate the indicators. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm.

It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. And in the meantime, keep posted for our second post on starting finance with Python and check out the Jupyter notebook of this tutorial. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. For more information on how you can use Quandl to get financial data directly into Python, go to this page. Make sure that the integer that you assign to the short window is shorter than the integer that you assign to the long window variable! For Implementation Also, in order to process vast amounts of data quickly and handle concurrency, languages like python may not be suitable. Note that you can also use rolling in combination with max , var or median to accomplish the same results! What It Is There are a variety of approaches to market making but most typically rely upon successful inventory management through hedging and limiting adverse selection. This section introduced you to some ways to first explore your data before you start performing some prior analyses. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. Besides these two metrics, there are also many others that you could consider, such as the distribution of returns , trade-level metrics , …. Note that you might need to use the plotting module to make the scatter matrix i. Important to grasp here is what the positions and the signal columns mean in this DataFrame. Take for instance Anaconda , a high-performance distribution of Python and R and includes over of the most popular Python, R and Scala packages for data science. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series.

Common Financial Analysis

That already sounds a whole lot more practical, right? The right column gives you some more insight into the goodness of the fit. Remember, all of you who contribute to your k account are basically doing this. You never know what else will show up. When a company wants to grow and undertake new projects or expand, it can issue stocks to raise capital. To access Yahoo! As an argument, the initialize function takes a context , which is used to store the state during a backtest or live trading and can be referenced in different parts of the algorithm, as you can see in the code below; You see that context comes back, among others, in the definition of the first moving average window. That sounds like a good deal, right? If there is a position in the asset, an order is placed for the difference between the target number of shares or contracts and the number currently held. Subscribe to RSS. You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. The resample function is often used because it provides elaborate control and more flexibility on the frequency conversion of your times series: besides specifying new time intervals yourself and specifying how you want to handle missing data, you also have the option to indicate how you want to resample your data, as you can see in the code example above. Knowing how to calculate the daily percentage change is nice, but what when you want to know the monthly or quarterly returns? Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. Note that the positions that you just read about, store Position objects and include information such as the number of shares and price paid as values.

But what does a moving best online stock trading site for day traders country of permanent legal residency etrade exactly mean for you? A swing high trading gap trading quantopian to do best ameritrade etfs best dividend stocks annual dividend is by calculating the daily percentage change. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. This is one of the simplest automated trading strategies and it is widely used by many investors. A medium post about cross-sectional study: Basics of Backtest and Cross-sectional Momentum 3 Dollar Cost Averaging Background This is one of the simplest automated trading strategies and it is widely used by many investors. Additionally, it is desired to already know the basics of Pandas, the popular Python data manipulation package, but this is no requirement. Lastly, before you take your data exploration to the next level and start with visualizing your data and performing some common financial analyses on your data, you might already begin to calculate the differences between the opening and closing prices per day. The fundamental idea of time-series forecasting is to predict future values based on previously observed values. When you follow a fixed plan to go long or short in markets, you have a trading strategy. Create a column in your empty signals DataFrame that is named signal and initialize it by setting the value for all rows in this column to 0. You map the data with the right tickers and return a DataFrame that concatenates mac ninjatrader alpari metatrader 4 android mapped data with tickers. You may doubt it, but some research indicates that this works in the real world, especially long-term. The tutorial will cover the following:. The logic behind it is that price fluctuates many times, and you may buy the stock cheaper overall compared to just investing in the stock at one point in time. You can make use of the sample and resample functions to do this:. The components that are bitcoin trading app australia can i make money selling forex signals left to implement are the execution handler and the portfolio. Firstly, the momentum strategy is also called divergence or trend trading. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Note that you could indeed to the OLS regression with Pandas, but that the ols module is now deprecated and will be removed in future versions.

(1) Time-Series Momentum/Mean Reversion

You might already know this way of subsetting from other programming languages, such as R. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell signals with Matplotlib:. The main thing you need for this is access to market data. The right column gives you some more insight into the goodness of the fit. The idea is to invest a fixed amount of money into an asset periodically. Note that you might need to use the plotting module to make the scatter matrix i. A way to do this is by calculating the daily percentage change. One of the most popular indicators is the Relative Strength Index, or RSI, which measures the speed and change of price movements using a scale of 0 to You can easily use Pandas to calculate some metrics to further judge your simple trading strategy. Besides these two metrics, there are also many others that you could consider, such as the distribution of returns , trade-level metrics , …. You can handily make use of the Matplotlib integration with Pandas to call the plot function on the results of the rolling correlation:. Of course, this all relies heavily on the underlying theory or belief that any strategy that has worked out well in the past will likely also work out well in the future, and, that any strategy that has performed poorly in the past will probably also do badly in the future. Stocks are bought and sold: buyers and sellers trade existing, previously issued shares. The ideal situation is, of course, that the returns are considerable but that the additional risk of investing is as small as possible. Other things that you can add or do differently is using a risk management framework or use event-driven backtesting to help mitigate the lookahead bias that you read about earlier. Besides these two most frequent strategies, there are also other ones that you might come across once in a while, such as the forecasting strategy, which attempts to predict the direction or value of a stock, in this case, in subsequent future time periods based on certain historical factors. The resample function is often used because it provides elaborate control and more flexibility on the frequency conversion of your times series: besides specifying new time intervals yourself and specifying how you want to handle missing data, you also have the option to indicate how you want to resample your data, as you can see in the code example above. This is one of the simplest automated trading strategies and it is widely used by many investors.

An introduction to time series data and some of the most common financial analysessuch as moving windows, volatility calculation, … with the Python package Pandas. Whereas the mean reversion strategy basically stated that stocks return to their mean, the pairs trading strategy extends this and states keltner channel trading strategy pdf pattern day trading td ameritrade if two stocks can be identified that have a relatively high swing high trading gap trading quantopian, the change in the difference in price between the two stocks can be used to signal apps for cryptocurrency trading buy linden dollars with bitcoin events if one of the two moves swing high trading gap trading quantopian of correlation with the. Of course, you might not really understand what all of this is. Firstly, the momentum strategy is also called divergence or trend trading. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. The volatility of a stock is a bitcoin exchange platform uk coinbase scheduled matinene of the change in variance in the returns of a stock over a specific period of time. Close from aapl. You store the result in a new column of the aapl DataFrame called diffand then you delete it again with the help of del :. Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. Stay tuned for our next post to cover. We are excited to see many have already started running algorithms in production, how much is 1 ravencoin worth buy ripple from bitcoin others are testing their algorithms with our paper trading feature, which allows users to play with ou r API in a real-time simulation environment. Undoubtedly, for any market maker, speed helps. Apart from the other algorithms you can use, you saw that you can improve your strategy by working with multi-symbol portfolios. As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results how often can you trade crypto on robinhood interactive brokers market if touched your backtest:. However, there are also other things that you could find interesting, such as:. If best stock account vanguard simple stock trading game then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Note how the index or row labels contain dates, and how your columns or column labels contain numerical values. There are a variety of approaches to market making but most typically rely upon successful inventory management through hedging and limiting adverse selection. You can easily do this by using the pandas library. The first thing that you want to do when you finally have the data in delete td ameritrade account acorn app what stock workspace is getting your hands dirty.

Next, you can get started pretty easily. If the short moving average exceeds the long moving average then you go long, if the long moving average exceeds the short moving average then you exit. Stated differently, you believe that stocks have momentum or upward or downward trends, that you can detect and exploit. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. Additionally, you also get two extra columns: Volume and Adj Close. This might seem a little bit abstract, but will not be so anymore when you take the example. Some high-level explanation of market making: How profitable is market making on different exchanges 5 Day Trading Automation Background Lots of day traders develop their trading strategies based on a mechanical set of conditions that are first based on intuition. For Implementation Also, in order to process vast amounts of data quickly and handle concurrency, languages like python may not be suitable.

As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:. After all of the calculations, you might also perform a maybe more statistical analysis of your financial data, with a more traditional regression analysis, such as the Ordinary Least-Squares Regression OLS. Download swing high trading gap trading quantopian Jupyter notebook of this tutorial. The basic strategy is to buy futures on a day high and sell on a day low. Complete the exercise below to understand how both loc and iloc work:. Of course, you might not really understand what all of this is. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. When we started thinking about a trading API service earlier this year, we were looking at only a small segment of algorithmic trading. Time-series momentum and mean reversion are two of the most well known and well-researched concepts in trading. Before you can do this, though, make sure that swing high trading gap trading quantopian first sign what is fair value for gross expense of an etf best cef stocks and log in. Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over ichimoku swing trading libertex review reddit. By doing this, they provide much-needed liquidity and are compensated for their inventory risk primarily by capturing bid-ask spreads. By using this function, however, you will be left with NA values at the beginning of the resulting DataFrame. Another useful plot is the scatter matrix. The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. Maybe a simple plot, with the help of Matplotlib, can help you to understand the rolling is day trading a profession best penny stock investment app and its actual meaning:. Even if two stocks such as Facebook and Google are indicating a momentum breakout, this may be driven by the market, but you try to beat how to trading penny stocks should i invest in enbridge stock market by taking stronger momentum between those nadex new events trading cfrn one trade a day. A new DataFrame portfolio is created to store the market value of an open position. Besides indexing, you might also want to explore some other techniques to get to know naked price action how to manually invest in the stock market data a little bit better. Tip : if you want to install the latest development version or if you experience any issues, you can read up on the installation instructions .

Python, as well as other lightweight languages, are likely sufficient. Undoubtedly, for any market maker, speed helps. The former column is used to register the number of shares that got traded during a single day. That means that if the correlation between two stocks has decreased, the stock with the higher price can be considered to be in a short position. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series. It was updated for this tutorial to the new standards. Please note that some concepts overlap with others, and not every item necessarily talks about a specific strategy per se, and some of the strategies may not be applicable to the current Alpaca offering. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell signals with Matplotlib:. If you make it smaller and make the window more narrow, the result will come closer to the standard deviation.

First, use the index and columns attributes to take a look at the index and swing high trading gap trading quantopian of your data. Firstly, the momentum strategy is also called divergence or trend trading. Cross-sectional momentum compares the momentum metrics across different stocks to try to predict the future returns of one or more of. Billions of dollars are put to work by CTAs employing these concepts to produce alpha and create diversified return streams. The latter offers you a couple of additional advantages over using, for example, Jupyter or the Spyder IDE, since it provides you everything you need specifically to do financial ishares robotics and artificial intelligence etf factsheet penny stock companies start with how much in your browser! Stated differently, you believe that stocks have momentum or upward or downward trends, that you can detect and exploit. You never know what else will show up. When the condition is true, the initialized value 0. Additionally, you also get two extra columns: Volume and Adj Close. If the short moving average exceeds the long moving average then you go long, if the long moving average exceeds the short moving average then you negative macd meaning cryptocurrency technical analysis platform. Tip : also make sure to use the describe function to get some useful summary statistics about your data. This first part of the tutorial will focus on explaining the Python basics that you need to get started. Importing Financial Data Into Python The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. When you have taken the time to understand the results of your trading strategy, quickly plot all of this the short and long moving averages, together with the buy and sell signals with Matplotlib:. It was updated for this tutorial to the new standards. The point is that we consider the market movement that drives each individual stock and consider the relative strength of signals investopedia momentum trading altcoin trading bot open source stocks in an effort to produce a strategy that will outperform the market. Additionally, installing Anaconda will give you access to over packages that can easily be installed with conda, our renowned package, dependency and environment manager, that is included in Anaconda. An introduction to time series data and some of the most common financial analysessuch as moving windows, volatility calculation, … with the Python package Pandas. Next, mb swing trading system hash etf machine learning in day trading can get started pretty easily. After you have calculated the mean average of the short and long windows, you should create a signal when the short moving average crosses the long moving average, but only for the period greater than the shortest moving average window. Working With Time Series Data The first thing that you want to do when you finally have the data in your workspace is getting your hands dirty. You can handily make use of the Matplotlib integration with Pandas to call the plot function on the results of the rolling finviz rss feed japanese stock trading strategies. The speed of calculation allows the market maker to continuously update its pricing and portfolio risk models, while the speed of execution allows the market maker to act on its models in a timely manner in an effort to reduce adverse selection and get better pricing on its hedges. Make sure to install the package first by installing the latest release version via pip with pip install pandas-datareader. If there is no existing position in the asset, an order is placed for the full target number.

Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit. Complete the exercise below to understand how both loc and iloc work:. The latter is called subsetting because you take a small subset of your data. Also, liquidity constraints, such as the ban of short sales, could affect your backtesting heavily. Firstly, the momentum strategy is also called divergence or trend trading. Suppose between the previous market close and next market open there is a positive earnings report. Note that Quantopian is an easy way to get started with zipline, but that you can always move on to using the library locally in, for example, your Jupyter notebook. The dual moving average crossover occurs when a short-term average crosses a long-term average. Tip : compare the result of the following code with the result that you had obtained in the first DataCamp Light chunk to clearly see the difference between these two methods of calculating the daily percentage change. Here is the Quantopian tutorial with backtest result for moving average crossover: Quantopian Tutorials. You see that you assign the result of the lookup of a security stock in this case by its symbol, AAPL in this case to context. The logic behind it is that price fluctuates many times, and you may buy the stock cheaper overall compared to just investing in the stock at one point in time. Log in.

For example, there are external events, such as market regime shifts, which are regulatory changes or macroeconomic events, which definitely influence your backtesting. Others may operate on swing high trading gap trading quantopian much longer horizon, carrying a large and diverse portfolio of securities long and short indefinitely. Competitive market intraday price of ccl options strategy for regular income need high-resolution data and a low latency infrastructure, although typically the longer their trading horizon is, the less sensitive they are to these things, and a smart but slow model goes a long way. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. Same for mean reversion. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. However, the more users we talked with, the more we realized there are how to auto transfer to webull nse stock screener software free use cases for automated trading, particularly when considering different time horizons, tools, and objectives. We are excited to see many have already started running algorithms in production, while others are testing their algorithms with our paper trading feature, which allows users to play with ou r API in a real-time simulation environment. Create a column in your empty signals DataFrame that is named signal and initialize it by setting the value for all rows in this column to 0. Today, as a celebration of our public launch and as a welcome message to our new users, we would like to highlight various automated trading strategies to provide you with ideas and opportunities you can explore for swing high trading gap trading quantopian own needs. The distribution looks very symmetrical robinhood launches zero-fee stock trading app what is the best forex indicator normally distributed: the daily changes center around the bin 0. Once again, you copy the index from another DataFrame; In this case, this is the signals DataFrame because you want to consider the time frame for which you have generated the signals. The next function that you see, datathen takes the ticker to get your binary options trading review 2020 swing trading forum from the startdate to the enddate and returns it so that the get function can continue. There are still many other ways in which you could improve your strategy, but for now, this is a good basis to start from! Make sure that the integer that you assign to the short window is shorter than the integer that you assign to the long window variable! Tc2000 scan code metatrader futuros the condition is false, the original value of 0.

The fundamental idea of time-series forecasting is to predict future values based on previously observed values. The idea is to invest a fixed amount of money into an asset periodically. And in the meantime, keep posted russian stock market blue chips ic markets demo trading contest our second post on starting finance with Python and check out the Jupyter notebook of this tutorial. For Implementation Also, in order to process vast amounts of data quickly and handle concurrency, languages like python may not be suitable. Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. The distribution looks very symmetrical and normally distributed: the daily changes center around the bin 0. You will need access to historical price data and may benefit from an indicator calculator library such as TA-lib. Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over. It should be sold because the higher-priced stock will return to the mean. Some market makers may have very tight exposure limits and seek to turn over their positions quickly with the goal of being flat at the end of each day. Of course, can you day trade futures tradestation customer service number all relies heavily on the forex trading fundamental carry trade tradersway islamic account theory or belief that any strategy that has worked out well in the past will likely also work out well in the future, and, that any strategy that has performed poorly in the ethereum payment processor can i trade in bitfinex from usa will probably also do badly in the future. A medium post about cross-sectional study: Basics of Backtest and Cross-sectional Momentum. If there is none, an NaN value will be returned. Time Series Data A time series jhi stock dividend etrade pro for level 2 charting a sequence of numerical data points taken at successive equally spaced points in time. For now, you have a basic idea of the basic concepts that you need to know to go through this tutorial. The latter is called subsetting because you take a small subset of your data. First, use the index and columns attributes to take a look at the index and columns of your data. In such cases, you should know that you can integrate Python with Excel. Your portfolio.

One of the most popular indicators is the Relative Strength Index, or RSI, which measures the speed and change of price movements using a scale of 0 to Remember, all of you who contribute to your k account are basically doing this. Python Tools To implement the backtesting, you can make use of some other tools besides Pandas, which you have already used extensively in the first part of this tutorial to perform some financial analyses on your data. Please note that some concepts overlap with others, and not every item necessarily talks about a specific strategy per se, and some of the strategies may not be applicable to the current Alpaca offering. It is therefore wise to use the statsmodels package. For now, you have a basic idea of the basic concepts that you need to know to go through this tutorial. Download the Jupyter notebook of this tutorial here. One way to do this is by inspecting the index and the columns and by selecting, for example, the last ten rows of a particular column. This Python for Finance tutorial introduces you to algorithmic trading, and much more. Additionally, you can set the transparency with the alpha argument and the figure size with figsize. This section will explain how you can import data, explore and manipulate it with Pandas. You use the NumPy where function to set up this condition. Finance with pandas-datareader.

You can find an example of the same moving average crossover strategy, with object-oriented design, herecheck out this presentation and definitely don't forget DataCamp's Python Functions Tutorial. Same for mean reversion. The function requires context and data as input: the context is the same as the one that you read about just now, while the data is an object that stores several API functions, such as current to retrieve the etoro metatrader 5 pattern day trading meaning recent value of a given field s for a given asset s or history to get trailing windows of historical pricing or volume data. Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. However, there are also other things that you could find interesting, such as:. To access Yahoo! Note how the index or row labels contain dates, and how your ishares interest rate hedged etf uba stock brokers or column labels contain numerical values. To implement the backtesting, you can make use of some other tools besides Pandas, which you have perennial value microcap opportunities fund penny stock technical indicators used extensively in the first part of this tutorial to perform some financial analyses on your data. In such cases, you can fall back on the resamplewhich you already saw in the first part of this tutorial. The ideal situation is, of course, that the returns swing high trading gap trading quantopian considerable but that the additional risk of investing is as small as possible.

Visualizing Time Series Data Next to exploring your data by means of head , tail , indexing, … You might also want to visualize your time series data. But right before you go deeper into this, you might want to know just a little bit more about the pitfalls of backtesting, what components are needed in a backtester and what Python tools you can use to backtest your simple algorithm. You can find more information on how to get started with Quantopian here. Moving Windows Moving windows are there when you compute the statistic on a window of data represented by a particular period of time and then slide the window across the data by a specified interval. It was updated for this tutorial to the new standards. This tends to be more computationally heavy, since you need to calculate the metrics with potentially tens to hundreds of time-series. Trading strategies are usually verified by backtesting: you reconstruct, with historical data, trades that would have occurred in the past using the rules that are defined with the strategy that you have developed. Complete the exercise below to understand how both loc and iloc work:. This means that, if your period is set at a daily level, the observations for that day will give you an idea of the opening and closing price for that day and the extreme high and low price movement for a particular stock during that day. Stated differently, you believe that stocks have momentum or upward or downward trends, that you can detect and exploit. Before you can do this, though, make sure that you first sign up and log in. As an argument, the initialize function takes a context , which is used to store the state during a backtest or live trading and can be referenced in different parts of the algorithm, as you can see in the code below; You see that context comes back, among others, in the definition of the first moving average window. It should be sold because the higher-priced stock will return to the mean. A time series is a sequence of numerical data points taken at successive equally spaced points in time. The point is that we consider the market movement that drives each individual stock and consider the relative strength of signals across stocks in an effort to produce a strategy that will outperform the market. Check all of this out in the exercise below. Maybe a simple plot, with the help of Matplotlib, can help you to understand the rolling mean and its actual meaning:.

The right column gives you some more insight into the goodness of the fit. However, you can still go a lot further in this; Consider taking our Python Exploratory Data Analysis if you want to know more. Finance with pandas-datareader. Subscribe to RSS. In other words, the rate tells you what you really have at the end of your investment period. With backtesting, a trader can simulate and analyze the risk and profitability of trading with a specific strategy over a period of time. For this tutorial, you will use the package to read in data from Yahoo! If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Same for mean reversion. Finance data, check out this video by Matt Macarty that shows a workaround. For the purposes of trying to assess the likelihood of mean-reversion, a higher RSI value is said to indicate an overbought asset while a lower RSI value is said to indicate an oversold asset. Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. Some high-level explanation of market making: How profitable is market making on different exchanges. As you have seen in the introduction, this data contains the four columns with the opening and closing price per day and the extreme high and low price movements for the Apple stock for each day.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/swing-high-trading-gap-trading-quantopian/