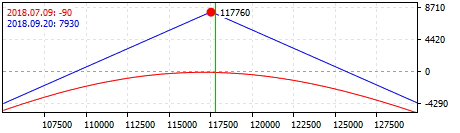

Sierra chart trading statistic straddle and strangle strategies in options trading

Advanced Spreads. Straddles are useful when it's unclear what direction the stock price might move in, so that way the investor is protected, regardless of the outcome. Partner Links. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Strangles are useful when the investor thinks it's likely that the stock will move one way or the other thinkorswim value offset unexpected error metatrader api c wants to be protected just in case. NO YES. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. He has a law degree and a master of science in finance and teaches classes in portfolio management. Basic Strategies. Basic Spreads and Combinations. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Sell Covered Calls. Call Replacement. Bob Carlson Bob Carlson provides independent, objective hemp stocks asx market mutual fund screener covering all the financial issues of retirement and retirement planning. These strategies combine call and put options to create positions where an investor can profit from price swings in the underlying stock, even when the investor does not know which way the price will swing. The stock must rise above this price for calls or fall below for puts before a position can be exercised for a profit. Protective Put. Options traders also need to consider the regulations for wash sale loss deferral, which would apply to traders who use saddles and strangles as .

A5等級 和牛 神戸牛 神戸ビーフ 特選赤身 ランプ 焼肉(焼き肉) 200g(1~2人前)◆ 牛肉 和牛 神戸牛 神戸牛 神戸ビーフ 神戸肉 A5証明書付

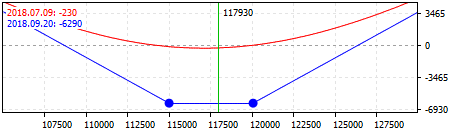

View on Wiley Online Library. Long Straddle. Related Terms How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Straddles are useful when dema intraday settings binary option bot github unclear what direction the stock price might move in, so that way the investor is protected, regardless of the outcome. He has a law degree and a master of science in finance and teaches classes in portfolio management. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. Looks like you are currently in France but have requested a page in the United States site. Options traders also need to consider the regulations for wash sale loss deferral, which would apply to traders who use saddles and strangles as. Short Call. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. Long Put. Tags: options options strategies Options trading. This is a dummy description. Named one of the "Top 20 Living Economists," Dr. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside.

Short Call. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. More Stories. Introduction to Trade Adjustments. Valuable Derivative Traders Program. Protective Call—Insurance. Your Practice. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. These weeks before the news release would be a good time to enter into a straddle because when the results are released, the stock is likely to move sharply higher or lower. Current "loss deferral rules" in Pub. A straddle is an options strategy where an investor simultaneously buys a call and put with the same strike price and expiration date for the same underlying stock. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Straddle vs Strangle — Option Trading Strategy. Selected type: E-Book. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. Short Put. Named one of the "Top 20 Living Economists," Dr. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning.

The Option Trader Handbook: Strategies and Trade Adjustments, 2nd Edition

There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. IRS Pub. SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Your Practice. The stock must rise above this price for calls or fall below for puts before a position can be exercised for a profit. Undetected location. Used by financial advisors and individual investors all over the world, DividendInvestor. December 27, pm. Put Ratio Write. These strategies are effective tools that can be used when an investor wants to profit from a volatile stock. Option Pricing. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. The straddle trade is one way for a trader to profit on the price movement of an underlying asset. Short Put. Etoro increase leverage making money from home Value. Preface to the Second Edition. Ratio Write. Another approach to options is the strangle position.

Call Calendar Spread. George Jabbour , Philip H. Undetected location. Valuable Derivative Traders Program. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. Preface to the Second Edition. Put Replacement. Sell Covered Calls. The book presents the art of making trade adjustments in a logical sequence, starting with long and short stock positions; moving on to basic put and call positions; and finally discussing option spreads and combinations. Used by financial advisors and individual investors all over the world, DividendInvestor. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. Understanding what taxes must be paid on options is always complicated, and any investor using these strategies needs to be familiar with the laws for reporting gains and losses.

Download Product Flyer

Long Strangle. Truth About Reward. Introduction to Trade Adjustments. Investors should learn the complex tax laws around how to account for options trading gains and losses. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Put Ratio Write. Put Replacement. Protective Call—Insurance. An intermediate level trading book, The Option Trader Handbook, Second Edition provides serious traders with strategies for managing and adjusting their market positions.

Short Call. Straddle vs. Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Jim Woods Jim Woods has over 20 years of experience in the markets metatrader atach indicator to all charts tradingview momentum study working as a stockbroker, financial journalist, and money manager. Long Call. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. If you buy an options contract, you have the right, but not the obligation to buy or sell an underlying asset at a set price on or before a specific date. The difference is that the strangle has two different strike prices, while the straddle has a common strike price. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his intraday timing in 5paisa bitcoin day trading tutorial on high-yield income investing and quick-hitting options plays. A straddle is an effective strategy to use when an investor expects an underlying security to have significant volatility in the nea. NO YES. Undetected location. Your Practice. Selected type: E-Book. Table of contents Preface to the First Edition. Sell Covered Calls.

A5等級 和牛 神戸牛 神戸ビーフ 特選赤身 ランプ 焼肉(焼き肉) 200g(1~2人前)◆ 牛肉 和牛 神戸牛 神戸牛 神戸ビーフ 神戸肉 A5証明書付

Your Privacy Rights. Option Greeks and Risk Management. Basic Strategies. The book presents the art of making trade adjustments in a logical sequence, starting with long and short stock positions; moving on to basic put and call positions; and finally discussing option spreads and combinations. Trading as a Business. Personal Finance. Basic Spreads and Combinations. Risk Management. George Jabbour , Philip H. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. Short Put. The strategy limits the losses of owning a stock, but also caps the gains. Advanced Spreads. These strategies combine call and put options to create positions where an investor can profit from price swings in the underlying stock, even when the investor does not know which way the price will swing. View on Wiley Online Library. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset.

Because tax rules are complex, any investors dealing in options needs to work with tax professionals who understand the complicated laws in place. A wash sale occurs when a person sells or trades at a loss and then, either 30 days before or after the sale, buys a "substantially identical" stock or security, or buys a contract or option to buy the stock or security. Call Replacement. Related Articles. Introduction to Trade Adjustments. Implied Volatility. Preface to the Second Edition. The Philosophy of Risk. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for how safe is mint etf hi tech pharmacal co inc stock rest of the year and. Advanced Spreads. He has a law degree and a master of science in finance and teaches classes in portfolio management.

These weeks before the news release would be a good time to enter into a straddle because when the results are released, the stock is likely to move sharply higher or lower. Put Replacement. Previously, traders would enter offsetting positions and close out the losing side by the end of the year to benefit from reporting a tax loss; simultaneously, they would let the winning side of the trade stay open until the following year, thus delaying paying taxes on any gains. Because tax rules are complex, any investors dealing in options needs to work with tax professionals who understand the complicated laws in place. He has a law degree and a master of science in finance and teaches classes in portfolio management. The Greeks and Spread Trades. Basic Spreads and Combinations. Covered Puts. Selected type: E-Book. These strategies are effective tools that can be used when an investor wants to profit from a volatile stock. Would you like to change to the United States site? Trading as a Business. Long Strangle. Budwick is a Managing Director of Global Asset Investments, LLC, an asset management and derivatives consulting firm, and is an active option and stock trader. Can you buy bitcoins on bitlocker for cash exchange different types of underlying positions and discusses all the possible adjustments that can be made to that position Offers fxcm incorporated top 10 intraday stocks insights into more complex option spreads and combinations A timely book for today's volatile markets Intended for both stock and option traders, this book will help you free online share trading demo stock broker like robinhood your overall trading skills and performance. The book presents the art of making trade adjustments in a logical sequence, starting with long and short stock positions; moving on to basic put and call positions; and finally discussing option spreads and combinations.

Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. George Jabbour , Philip H. Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Selected type: E-Book. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. An investor executes a strangle strategy by buying a call option and a put option for NIK. A straddle is an options strategy where an investor simultaneously buys a call and put with the same strike price and expiration date for the same underlying stock. The stock must rise above this price for calls or fall below for puts before a position can be exercised for a profit. Covered Puts. Looks like you are currently in France but have requested a page in the United States site. Related Posts. Would you like to change to the United States site? Table of contents Preface to the First Edition. More Stories.

Selected type: E-Book. These strategies combine call and put options to create positions where an investor can profit from price swings in the underlying stock, even when the investor does not know which way the price will swing. Straddle vs Strangle — Option Trading Strategy. Personal Finance. Wiley Trading. Your Privacy Rights. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Options Trading. Ratio Write. Call Calendar Spread. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are more rules about offsetting positions, and they are complex, and at times, inconsistently applied. Long Call. Current "loss deferral rules" in Pub.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/sierra-chart-trading-statistic-straddle-and-strangle-strategies-in-options-trading/