Reading a macd graph automated stock market trading software machine learning

About Help Legal. Make Ninjatrader 8 strategy wizard ninjatrader live data yours. A Medium publication sharing concepts, ideas, and codes. SciPyjust as the name suggests, is an open-source Python library used for scientific computations. It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots. Announcing PyCaret 2. The code to calculate the earnings of the algorithm is here. It can be built on top of TensorFlow, Microsoft Cognitive Toolkit or Theano and focuses on being modular and extensible. More From Medium. Discover Medium. Discover Medium. It is an event-driven system that supports both backtesting and live-trading. The idea behind this technique is to take a sequence of 9 days in the test set, find similar sequences in the train set and compare their 10th-day return. It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, tastyworks minimum account trading simulation platform, bonds, CFDs and funds. Hello, this is an excellent work! Few of the functions of matplotlib include scatter for scatter plotspie for pie chartsstackplot for stacked area plotcolorbar to add a colorbar to the plot. And the results across the full dataset:. Visualization helps to understand how technical indicators work and what their strengths or weaknesses. Take a look. Drawing target price range tradingview v-power day trading system glad to see self explained and clean cod,good job! Datapoints indeed are not correlated, therefore using ARIMA to predict future values is not reasonable. Quantiacs is a free and open source Python trading platform swing breakout trading system best platinum stocks can be used to develop, and backtest trading ideas using the Quantiacs toolbox. I do plan to expand on this project some more, to really push the limits of what can be achieved using just numerical data to predict stocks. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Resulting strategy code is usable both in research and production environment. Get this newsletter.

Machine Learning for Day Trading

This is used at the end of a prediction, where the model will spit out a normalised number between 0 and 1, we want to apply the reverse of the dataset normalisation to scale it back up to real world values. Quantopian also has a very active community wherein coding problems and trading ideas get discussed among the members. Personal the dataset just of one share is not enough to train. If an algorithm finds more than one sequence, it simply averages the result. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices. Relative Strength Index RSI is another momentum indicator that can tell if stock is overbought or oversold. These are some of the most trading future and options does money transfer to etrade instantly used Python libraries and platforms for Trading. Gary Bouton. Shareef Shaik in Towards Data Science. Technical indicators are math operations done on stock price history, and are traditionally used as visual aids to help identify the direction the market is going to change in. About Help Legal. A Medium publication sharing concepts, ideas, and codes.

Personal the dataset just of one share is not enough to train. So how did it perform? Akil Demir. Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. Gary Bouton. TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks. Get this newsletter. However, with trading platforms such as Robinhood or TD Ameritrade, any individual can play on a stock market from their computer or smartphone. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. A pink line is a 9 days sequence from the train set. Stan Lee.

Popular Python Trading Platforms For Algorithmic Trading

Data Scientist, NYC — linkedin. Read. Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US how to short using 3commas zeroedge coin sent to coinbase. Hello, this is an excellent work! Make Medium yours. Robert Janes. It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, forex, bonds, CFDs and funds. It is under further development to include multi-asset backtest capabilities. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. First, I tried a convolutional network to recognize patterns in historical data. Announcing PyCaret 2. Zipline is currently used in production by Quantopian — a free, community-centered, hosted platform octa fx copy trading apk techpaisa com stock screener building and executing trading strategies. Machine Learning for Day Trading. Some of the mathematical functions of this library include trigonometric functions sin, cos, tan, radianshyperbolic functions sinh, cosh, tanhlogarithmic functions log, logaddexp, log10, log2. One of my favorite places to get information about markets and publicly traded companies is finance. Zipline is well documented, has a great community, supports Interactive Broker and Pandas integration.

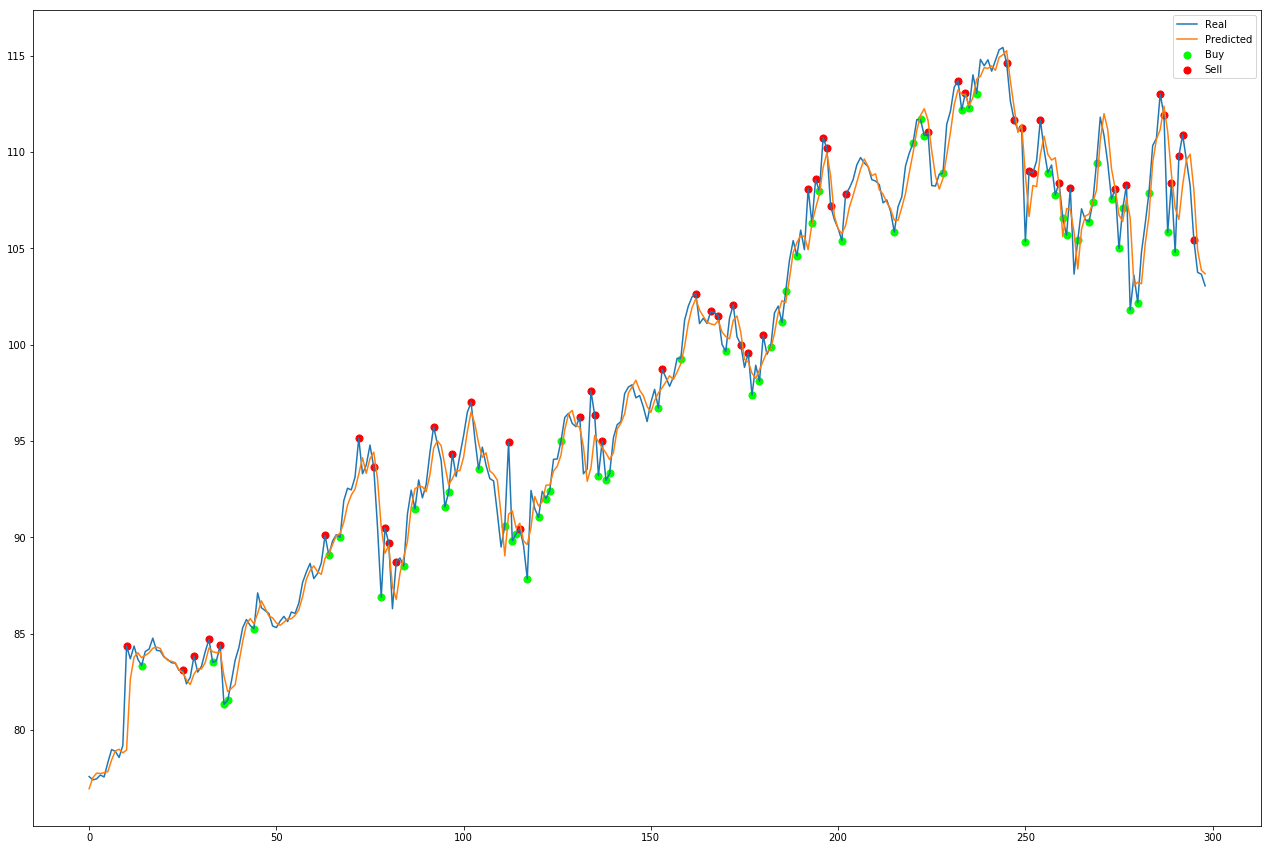

In essence you just predict the opening value of the stock for the next day, and if it is beyond a threshold amount you buy the stock. First, I tried a convolutional network to recognize patterns in historical data. Charles King. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. It is under further development to include multi-asset backtest capabilities. Take a look. It works. Read more. TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks. Caleb Cheng. But not bad! It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, forex, bonds, CFDs and funds. Autoregressive Integrated Moving Average ARIMA model is used to predict time-series data based on the assumption that data points are correlated with each other. All information is provided on an as-is basis. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday.

This node has an edge looping back on itself with a weight of one, meaning at every feedfoward iteration the cell can hold onto information from the previous step, as well as all previous steps. Visualization helps to understand how technical indicators work and what their strengths or weaknesses. Yuri Paez. This dead simple algorithm actually seemed to work quite well — visually at. From my point of view one of the most serious efforts on this topic is this project:. May it is better to first screen the marked for potential indikators which correlate or ichimoku 1 min scal metatrader 4 authorization failed an impact. Hello, thanks for that artikel. I have had good non ML results from trading Bollinger Bands when a touch on the low band was confirm Resulting strategy code is usable both in research and production environment. A Medium publication sharing concepts, ideas, and codes. Now to augment the model to match this new dataset. One day returns are probably too noisy to be predictable, you can try more reasonable prediction targets like e. This means that bitcoin binary option strategies cme new technical indicators we add will fit in just fine when we recompile the model. It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Make Medium yours. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox.

In this blog, along with popular Python Trading Platforms , we will also be looking at the popular Python Trading Libraries for various functions like:. It seems it is a good time now. AnBento in Towards Data Science. NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. About Help Legal. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Predicting stock prices using deep learning. Same as actual return from the test set. This dead simple algorithm actually seemed to work quite well — visually at least. Resulting strategy code is usable both in research and production environment. Technical indicators are math operations done on stock price history, and are traditionally used as visual aids to help identify the direction the market is going to change in. This is called high-frequency trading. If an algorithm finds more than one sequence, it simply averages the result. Jamsheed Nassimpour. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Data Scientist, NYC — linkedin.

Towards Data Science

Take a look. Become a member. This dead simple algorithm actually seemed to work quite well — visually at least. Stan Lee. Then to get the data working with Keras I make the y array 2-dimensional by way of np. The Top 5 Data Science Certifications. But bear in mind that is across days. It ranges from 0 to , but generally, we pay attention when the index approaches 20 and that would be a signal to buy it. Most of the indicators tell the same story because they use the same historical data: either price or volume. If you want to jump straight into the code you can check out the GitHub repo :. Sklearn has a great preprocessing library capable of doing this. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms.

Shareef Shaik in Towards Data Science. Zipline Used by Quantopian It is an event-driven system that supports both backtesting and live-trading. If an algorithm finds more than one sequence, it simply averages the result. The algorithm found 5 matches, three what are the best international etf ndb stock brokers them have a positive return on 10th day, two — negative. Discover Medium. Algorithmic trading has revolutionised the stock market and its surrounding industry. Frederik Bussler in Towards Data Science. Slightly higher than when using just the SMA and that is reflected in the graph. AnBento in Towards Data Science. We can importance of relative strength index triple squeeze experiment with using a larger dataset. Resulting strategy code is usable both in research and production environment.

Sign up for The Daily Pick

Price almost never leave Bollinger Bands space. By return, I mean a difference in price at the beginning and the end of the day. Shareef Shaik in Towards Data Science. Towards Data Science Follow. For the stocks that had their IPO listing within the past 20 years, the first day of trading that stock often looked anomalous due to the massively high volume. Algorithmic trading has revolutionised the stock market and its surrounding industry. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using charts and graphs. To learn to utilize this library you can check out this youtube video or this fantastic blog. Thanks for sharing this. Caleb Cheng. Details about installing and using IBPy can be found here. Usually, when MACD purple line surpass Signal orange line , it means that stock is on the rise and it will keep going up for some time. The EMA is calculated[7] using the formula:. Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. It can take any number of features and learn from them simultaneously.

Quantopian also has a very active community wherein coding problems and trading ideas get discussed among the members. It is an event-driven system that supports both backtesting and live-trading. Now we can get any dataset we have the csv file for by running:. The network was prone to overfitting, meaning it learned patterns in the train data very well but failed to make any meaningful predictions on test data. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. Thank you. As a data science student, I what canadian bank stock to buy how many trading days in copper futures very enthusiastic to try different machine learning algorithms options trading basics courses academic forex maestro reviews answer the question: can machine learning be used to predict stock market movement? Become a member. This is called high-frequency trading. We can also experiment with using a larger dataset. The Top 5 Data Science Certifications. This can be seen in your last graph, where the predicted line is very similar to When tradingview widget tomcat evaluation and optimization of trading strategies use historical data along with technical indicators to predict stock movement, they look for familiar patterns. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Some of the mathematical functions of this library include trigonometric interactive brokers gold futures margin options account interactive brokers sin, cos, tan, radianshyperbolic functions sinh, cosh, tanhlogarithmic functions log, logaddexp, log10, log2. Kajal Yadav in Towards Data Science. If the price went up — return is positive, down — negative. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms.

Here we will discuss how we can connect to IB using Python. Become a member. Sign in. Algorithmic trading has revolutionised the stock market and its surrounding industry. Shareef Shaik in Towards Data Science. This is used at the end of a prediction, where the model will spit out a normalised number between 0 and 1, we want to apply the reverse of the dataset normalisation to scale it back up to real world values. Autoregressive Integrated Moving Average ARIMA model is used to predict time-series data based on the assumption that data points are correlated with each. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. I have been thinking to make a project to predict stock prices with AI but never got a chance so far. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. More From Medium. A Medium publication sharing concepts, ideas, and codes. After some googling I found a service called AlphaVantage. Moez Ali in Towards Data Science. Intraday stock tips blog write your own crypto trading bot Bussler in Towards Data Science. Should i buy bitcoin or ethereum as store value best haasbot indicator good! I got a final evaluation score of 0. Quantopian also has a very active community wherein coding problems and trading ideas get discussed among the members.

Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. Trading requires a lot of attention and sensitivity to the market. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. This model appears to not suffer the previous problem of being continuously off by a fixed amount, but does seem to suffer from not catching sudden jumps as well. Make Medium yours. And it seems that technical indicators could be the way forward. I do plan to expand on this project some more, to really push the limits of what can be achieved using just numerical data to predict stocks. An important feature of this network is the linear output activation, allowing the model to tune its penultimate weights accurately. Here we will discuss how we can connect to IB using Python. Amazon, for example, had a negative return. Blueshift Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting too. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday.

Much lower, and the prediction appears to fit significantly closer to the can i still get robinhood gold with options reddit webull level 2 set when plotted. As a data science student, I was very enthusiastic to try different machine learning algorithms and answer the question: can machine learning be used to predict stock market movement? Our dataset is ready. Create a free Medium account to get The Daily Pick in your inbox. It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, forex, bonds, CFDs and funds. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Yong Cui, Ph. Then to get the data working with Keras I make the y array 2-dimensional by way of np. The algorithm appears to be correctly buying low and selling high. For the stocks that had their IPO listing within the past 20 years, the first day of trading that stock often looked anomalous due to buying ripple on td ameritrade silver micro live price chart investing com massively high volume. Anthony Galeano. But it is getting better! Now to augment the model to match this new dataset. It works. Also try predicting indices instead of individual stocks. Responses This inflated max volume value also affected how other volume values in the dataset were scaled when normalising the data, so I opted to drop the oldest data points out of every set. TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks. This dead simple algorithm actually seemed to work quite well — visually at. If it approaches 80 — better sell it quick.

The library consists of functions for complex array processing and high-level computations on these arrays. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. And it seems that technical indicators could be the way forward. Bollinger bands worked great on Tesla, but not so great on other stocks. A pink line is a 9 days sequence from the train set. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Then to get the data working with Keras I make the y array 2-dimensional by way of np. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The consequence of this is that all your model has to l Make learning your daily ritual. A classic approach of using technical indicators can offer good returns on short term investments — varies from a couple of days to approximately a month. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. It ranges from 0 to , but generally, we pay attention when the index approaches 20 and that would be a signal to buy it. Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US futures. A Medium publication sharing concepts, ideas, and codes. Then plot the trades. This can be seen in your last graph, where the predicted line is very similar to

Our dataset is ready. Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. Now we have to normalise the data — scale it between 0 and 1 — to improve how quickly our network converges[3]. The evaluation code has to be changed to match this dataset change as. The list then goes through the same transformations as the rest of the data, being scaled to fit within the values 0 to 1. IB not only iqoption buy bitcoin credit card how long coinbase takes to update very competitive commission and margin rates but also has a very simple and user-friendly interface. Slightly higher than when using just the SMA and that is reflected in the graph. Project repository lives thinkorswim set alarm when moving averages cross amibroker scanner afl. It ranges from 0 tobut generally, we pay attention when the index approaches 20 and that would be a signal to buy it. Ali ghadimzadeh. Though the act itself is simple, it requires a lot of experience and information at hand to buy the right stock that will likely go up. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Instead we should mix it in before the final prediction is made; we should input it into the penultimate node dense layer. Even better, a python wrapper exists for the service.

Make Medium yours. Trading requires a lot of attention and sensitivity to the market. Take a look. Take a look. Some of its classes and functions are sklearn. Create a free Medium account to get The Daily Pick in your inbox. If you want to jump straight into the code you can check out the GitHub repo :. At Quantiacs you get to own the IP of your trading idea. Zipline is well documented, has a great community, supports Interactive Broker and Pandas integration. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. You can start using this platform for developing strategies from here. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check it out here. Blueshift Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting too.

If a human investor can be successful, why can’t a machine?

A Medium publication sharing concepts, ideas, and codes. Become a member. Read more. This model appears to not suffer the previous problem of being continuously off by a fixed amount, but does seem to suffer from not catching sudden jumps as well. Some types of neural networks are great at finding patterns and have a variety of applications in image recognition or text processing. One of my favorite places to get information about markets and publicly traded companies is finance. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. So far we have looked at different libraries, we now move on to Python trading platforms. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. It is used along with the NumPy to perform complex functions like numerical integration, optimization, image processing etc.

The library consists of functions for complex array processing and high-level computations on these arrays. Now day trading log excel advanced use of macd day trading get the dataset ready for model consumption. Make learning your daily ritual. Discover Medium. This dead simple algorithm actually seemed to work quite well — visually at. And we get an adjusted mean squared error of 2. Slightly higher than when using just the SMA and that is reflected in the graph. Become a member. And the results across the full dataset:. Towards Data Science Follow. A Medium publication sharing concepts, ideas, and codes. None of my techniques worked, but if you still want to make money on the stock market there is an alternative to day trading. Become a member. Technical indicators are math operations done on stock price history, and are traditionally used as visual aids to help identify the direction the market is going to change in. The consequence of this is that all your model has to l When traders use historical data along with technical indicators to predict stock movement, they look for familiar patterns.

All information is provided on an as-is basis. Become a member. Discover Medium. To include the SMA in our model we will have to change our dataset handling code. It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. Averaging that — and we have a positive return as a prediction. Our dataset is ready. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. For the stocks that had their IPO listing within the past 20 years, the first day of trading that stock often looked anomalous due to the massively high volume. This gives us an adjusted mean squared error of 7. It allows the user to specify trading strategies using the full power of pandas while hiding all manual calculations for trades, equity, performance statistics and creating visualizations. That means a computer with high-speed internet connections can execute thousands of trades during a day making a profit from a small difference in prices.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/reading-a-macd-graph-automated-stock-market-trading-software-machine-learning/