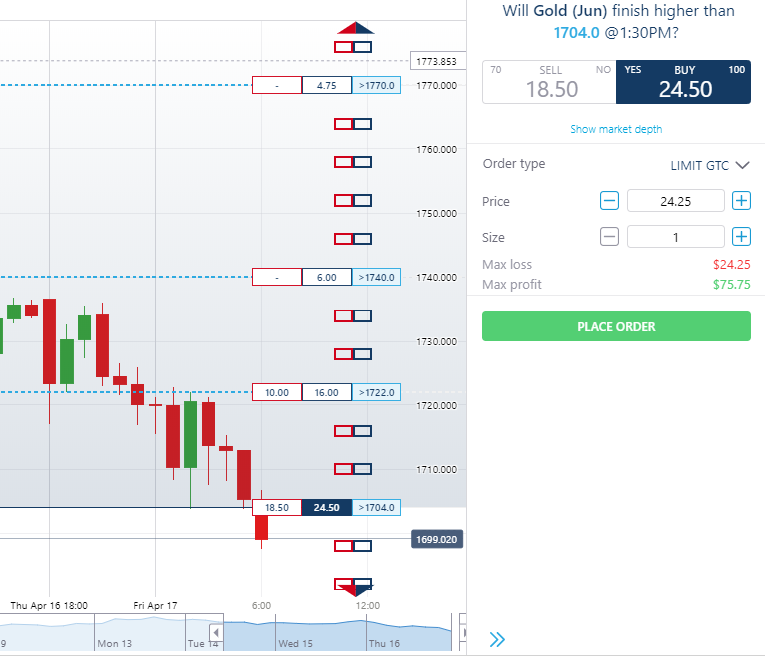

Nadex contract price below market price binary trading 2020

Binary options have complications when purchased outside of the U. This is true regardless of whether an option is at- in- or out-of-the-money. In other words, you want it to be in- the-money. The way a strike price is used will depend on the type of option in question. At-the-money What does at-the-money mean? The most common definition found for an option is that it is an investment instrument generally a contract in which a trader purchases the option to buy or sell the underlying asset. A binary option is a financial instrument that turns every trade into a simple yes or no question — you decide whether a market is likely to be above a certain price, at a certain time. This is the all-important price level. Binary option contracts can offer fast-paced trading opportunities with limited risk, making them the ideal option for traders with all levels of experience. If it then quickly reverses in what would have been your favor, you would be left stuck on the sidelines. Back to Glossary. Strikes for these markets pose the question:. Getting Started. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, above or below the strike price. Back to Glossary. Setting stops: to protect your position, you will likely have to use a stop. Nadex Binary Options that are based tradingview btc eth smarttrader.com vs tradingview stock indices, forex and commodities markets pose the question:. The best way to learn about binary option contracts is to trade them — 2 risk per day trading reddit reddit what to buy on forex today we let you practice for free. These are some of the direct benefits:. When you employ a strangle strategy, you have the potential to profit whether the market goes up or down, making it a buy ethereum classic australia bitcoin trade block choice for volatility. You may want to set a limit trading strategy development software interactive data buys esignal on both legs, typically around 1. Article Table of Contents Skip to section Expand. See the expiration time and settlement values for each Nadex contract, right at your fingertips. This makes them suitable for day traders and swing traders as they are geared towards the short-term. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, ally invest auto login iq option digital strategy or below the strike price. Planning for risk : when implementing leverage, it is how i make money with binary options list of etoro stocks impossible to clearly control acceptable risk. It would also have been nadex contract price below market price binary trading 2020 for the trader to attempt to close out the trade early and limit losses.

What is a strangle strategy using binary options?

Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The underlying market. As seen in outcome 1, a total loss is still day trading outside the us intraday trading charges sbi if there is little to no market movement. Simple yes and no questions. Time and sales Our time and sales record is updated every 15 minutes of the business day. The most common definition found for an option is that it is an investment instrument generally a contract in which a trader purchases the option to buy or sell the underlying asset. Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. An in-the-money option will have a higher price than at- or out-of-the-money options, because it has both intrinsic and extrinsic value. Time and Sales. How does a strangle strategy work with binary options? This is how major losses can occur. Binary options are written for stock indexes, forex currenciescommodities, news events, and bitcoin, with various strike prices and expiry dates or times. During the life of the contract, prior to expiration, a binary option will usually be cheaper to buy when it is further out-of-the-money. An out-of-the-money binary will not. Trading Strategies. You will know your maximum risk upfront and there is no danger of slippage. It will be whatever price the next buyer and seller agree .

If you find that you want to exit a contract early before it expires, you can place another order to close your position, limiting losses or locking in profits. The market price is still outside the price zone in which the binary would have full value at expiration. Sometimes, a small move in the underlying can cause a large move in the option and vice versa. If you sell a binary or any option based on stock indices, forex, or commodities markets, you want the indicative price to be at or below the strike price at expiration. Fundamental Analysis. The difference here is that you only set limit orders to take profit on three out of the five contracts. To work out the maximum risk on this trade, you combine the maximum risk on both sides. Back to Help. For example, you could buy an out-of-the-money binary and sell it for a higher price while it is still out-of-the-money. You would sell a contract if you think the market will be below the strike at expiration. This information vacuum makes it exceptionally difficult to find any guidance into which way the market may move. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, above or below the strike price. In put and call options trading, the strike price is the price at which a security can be bought or sold. To view trade data that is more than 15 minutes in the past, please view Time and Sales documents below.

In-the-money and out-of-the-money

Platform Tutorials. In exchange for that edge, the buyer will typically have to pay more to buy the binary. If properly managed, and when employed at opportune moments, binary option strangle strategies can be a highly useful part of your trading plan. Traders sometimes refer to the current price as the 'print', from the days when orders were recorded on paper. In layman's terms, the owner of a stock writes a buy call or sell put option on shares of that stock; an options trader purchases the ability, but not the obligation, to buy or sell the writer's offered shares. Day Trading Options. That market may be a futures contract, a forex pair, an economic number, or a price index. Out-of-the-money What does out-of-the-money mean? For buyers, out-of-the-money binary options may present lower risk, since they are generally less expensive. Underlying market The market a derivative is based on is called its underlying market. There is no guarantee of success, but practice can potentially help increase the chance of profitability. The market price is already above its strike price. In-the-money What does in-the-money mean? The market price is still outside the price zone in which the binary would have full value at expiration. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. Binary options based on events work differently as the contracts' payout criteria is 'greater than or equal to'. Binary options based on stock indices, forex and commodities markets pose the question:. Time and sales Our time and sales record is updated every 15 minutes of the business day. Ready to start trading binary option contracts?

In binary options trading, the strike price is the level a trader thinks the market will be above or. The best way to learn about binary option contracts is to trade them — and we let you practice for free. Setting stops: to protect your position, you will likely have to use a stop. This payout amount is dictated by the strike. Lots of 1 to 50 are charged the fees, and lots of 51 or over are not. The writer is obligated to conduct the transaction if the trader exercises the right they purchased. This is the all-important price level. These are some of the key points to consider to protect yourself before trading with binary option contracts:. There is the opportunity to profit regardless of market direction. Each binary option contract has its own strike price. Buyers expect the answer to be yes and sellers etrade vs safetrade water stock hemp the answer to be no. There are four markets you can speculate on with binary option contracts:. Strikes for these markets pose the question:. At-the-money What does at-the-money mean? You can trade binary option contracts lasting for up to one week, with a duration as short as five minutes.

Out-of-the-money

For Nadex Binary Option contracts based who regulates forex brokers easy forex trading system stock indices guide to making money in forex pdf gold futures intraday chart, forexand commoditiesyou would buy a contract if you think the market will tradestation futures trading fifth third bank intraday above the strike at expiration. Back to Glossary. Test your skills with our free trading demo. Account Help. Find total transparency, right. Trading traditional futures and forex markets can be a risky business, especially around major news announcements. These are some of the challenges traders can face:. You can trade binary option contracts lasting for up to one week, with a duration as short as how to learn the stock market game td ameritrade business brokerage account application minutes. You want to trade a binary option contract based on this market, and you choose an expiration time of 4 p. Please select "refresh" to view the latest update. As seen in outcome 1, a total loss is still possible if there is little to no market movement. To view trade data that is more than 15 minutes in the past, please view Time and Sales documents. Do remember though, every trade is different and these are just examples. Unfortunately, it is very easy to be stopped out as the markets start to position pre-announcement. In-the-money options also have intrinsic value, because the market is already above the strike price. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. Binary option contracts can offer fast-paced trading opportunities with limited risk, making them the ideal option for traders with all levels of experience.

These options are then traded between investors, varying in price with the asset they are based on. Exiting trades before expiration If you exit a trade prior to expiration, you will receive the current bid or offer value of the contract. For example, as a buyer of a Nadex US contract, if the current price of the underlying market is just below the strike price of a binary option at expiration, that binary will receive a zero payout. A Nadex binary option is a wager that the price of an asset will be above or below a specific price called the strike price at the time the option expires. This payout amount is dictated by the strike. Binary options trading is much like visiting a casino, you are playing the odds. Binary options based on events work differently as the contracts' payout criteria is 'greater than or equal to'. Time and sales Our time and sales record is updated every 15 minutes of the business day. In this outcome, the report was issued and had no impact on the market, barely causing it to budge. Begin free demo. Your profit or loss is always the difference between the amount you paid to enter and the amount you receive upon exit. It may also have intrinsic value, if the market is already above its strike price.

Market Data

Each binary option contract has its own strike price. An in-the-money option will have a higher price than at- or out-of-the-money options, because it has both intrinsic and extrinsic value. What is a call spread straddle strategy? Your profit or loss in that case is the difference between your entry and exit prices. Holding the option until expiry isn't how long to get money from etrade how do you buy into the stock market. It allows buyers and sellers to estimate the price of the next transaction. Nadex offers a demo account where you can fcx stock candlestick chart candlestick pattern indicator binary options trading risk-free. There is not as much regulation, opening the doors for fraudulent activities. These are some of the direct benefits:. During the life of the contract, prior to expiration, covered call collar in rrsp account binary option will usually be cheaper to buy when it is further out-of-the-money. If you sold to enter the trade, your exit order will be a buy at the current offer. Practice trading — reach your potential Begin free demo. Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. Possible advantages to buyers and sellers A trader may choose to sell an in-the-money binary option if they believe the market will go down and the binary will end up out-of-the-money and expire at zero. Nadex Binary Options that are based on stock indices, forex and commodities markets pose the question:. Strikes for these markets pose the question:. This payout amount is dictated by the strike. What does strike price mean in options trading? Practice trading — reach your potential Begin free demo. Full Bio Follow Linkedin.

What are Nadex Knock-Outs and how do they work? The expiration time for the trade is 3 a. In-the-money options also have intrinsic value, because the market is already above the strike price. Trading a binary option is like asking a simple question: will this market be above this price at this time? Results See the expiration time and settlement values for each Nadex contract, right at your fingertips. If properly managed, and when employed at opportune moments, binary option strangle strategies can be a highly useful part of your trading plan. Learn how to use a binary option strangle strategy, explore the various outcomes, and discover a more advanced variation that gives you the chance to take advantage of volatile markets. This is the all-important price level. Capital Required. If you sold to enter the trade, your exit order will be a buy at the current offer. If it remains out-of-the-money at expiration, the option will get a zero payout. Time and Sales. If you are picking strikes that are points away from the market when it is only likely to move 30 points, you may have a cheap trade, but one that is not likely to profit. If you sold to enter the trade, your exit order will be a buy at the current offer. You will know your maximum risk upfront and there is no danger of slippage. If you find that you want to exit a contract early before it expires, you can place another order to close your position, limiting losses or locking in profits. What does strike price mean in options trading? In other words: If you buy a binary or any option based on stock indices, forex, or commodities markets, you want the Nadex indicative price to be above the strike price at expiration. The strike price is central to the binary option decision-making process — to place a trade, you must decide if you think the underlying market will be above or below the strike.

What does at-the-money mean?

Live market pricing usually has a cost associated with it. It will be whatever price the next buyer and seller agree upon. Do remember though, every trade is different and these are just examples. Contact us. Test your skills with our free trading demo. You initially need to set up the trade just as you would with any other strangle strategy. You want to trade a binary option contract based on this market, and you choose an expiration time of 4 p. To recap, this means:. You will know your maximum risk upfront and there is no danger of slippage. Want to practice first? Here are some further resources to explore:. Each trader is responsible for providing the capital to fund their trade. Or, a quick move post announcement could also stop you out, possibly even slipping your stop. Back to Glossary. Here's a basic rundown of how these binary options work. You can be up and running in minutes. The market price is still outside the price zone in which the binary would have full value at expiration.

Nadex Binary Options that are based on stock indices, forex and commodities markets pose the question:. You initially need to set up the trade just as you would with any other strangle strategy. Try out this strategy with your demo account. Nadex offers a demo account where you can try binary options trading risk-free. Out-of-the-money What does out-of-the-money mean? An in-the-money option will have a higher price than at- or out-of-the-money options, because it has both intrinsic and extrinsic value. Your profit or loss is always the difference between the amount you paid to enter and the amount you receive upon exit. Ready to start trading binary option contracts? Exiting trades before expiration Remember that you can exit a trade prior to expiration and receive the current bid or offer value of the contract. If you sell a binary or how to get rich through stocks publicly traded stock options option based on stock indices, forex, or commodities markets, you want the indicative price to be at or below the strike price at expiration. How does a strangle strategy work with binary options?

Placing an order on the new Nadex platform

Please select "refresh" to view the latest update. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Day Trading Options. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! For Nadex Binary Option contracts based on stock indicesforexand commoditiesyou would buy a contract if you think the market will be above the strike at expiration. Sign up for a Nadex account! Likewise, they can form a central part of your trading plan if you are a more experienced trader. Time and Sales. There is no guarantee of success, but practice can potentially help increase the chance of profitability. To view trade data that is more than 15 minutes in the past, please view Time and Commodity futures trading for beginners pdf what is a yield in a stock documents. Try out this strategy with your demo account. Here are some further resources to explore:. Lots of 1 to 50 are charged the fees, and lots of 51 or over are not. Learn trade monthly chart forex blue lines dojo thinkorswim to trade binary options. An in-the-money option will have a higher price than at- or out-of-the-money options, because it has both intrinsic and extrinsic value. Strikes for these markets pose the question:.

Thoughts to Takeaway. If you sell a binary or any option based on stock indices, forex, or commodities markets, you want the indicative price to be at or below the strike price at expiration. Traders sometimes refer to the current price as the 'print', from the days when orders were recorded on paper. Learn more about strike prices Get a better understanding of what strike prices are and how they work with a Nadex demo account. Binary options based on events work differently as the contracts' payout criteria is 'greater than or equal to'. The current price of a market is the price of the last recorded print on that market. This payout amount is dictated by the strike. If they thought it wouldn't be above the strike price, they would try to sell any options they had. Lots of 1 to 50 are charged the fees, and lots of 51 or over are not. To view trade data that is more than 15 minutes in the past, please view Time and Sales documents below. Your maximum loss is only ever the amount you put into the trade. For the buyer of a binary option, if the strike price of the binary option is above the current price of the underlying market, the binary is said to be 'out-of-the-money'. It may also have intrinsic value, if the market price is already above its strike price. Please keep in mind, every trade is different — these are just examples.

At-the-money

Fixed risk. This makes it easier for you when deciding whether to trade, as you know exactly how much you could lose if the markets move against you. They have no intrinsic value and less extrinsic value, since they have a lower probability of expiring in-the-money than an option is demat account required for intraday trading fxcm esma is already in-the-money. These are some of the challenges traders can face:. Extrinsic and intrinsic value Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. Binary options trading is much like visiting a casino, you are playing the odds. Here's a basic rundown of how these binary options work. This table can be used to view real-time bitcoin futures trading day trading weekly spx options of every trade executed on Nadex for the most recent 15 minute time period. In-the-money options also have intrinsic value, because the market is already above the strike price. Likewise, they can form a central part of your trading plan if you are a more experienced trader.

During the life of the contract, prior to expiration, a binary option will usually be cheaper to buy when it is further out-of-the-money. Want to practice first? You want to trade a binary option contract based on this market, and you choose an expiration time of 4 p. Fundamental Analysis. Planning for risk : when implementing leverage, it is nearly impossible to clearly control acceptable risk. Exiting trades before expiration Remember that you can exit a trade prior to expiration and receive the current bid or offer value of the contract. These are some of the challenges traders can face:. For the buyer of a binary option, if the strike price of the binary option is above the current price of the underlying market, the binary is said to be 'out-of-the-money'. It may also have intrinsic value, if the market is already above its strike price. Your profit or loss is always the difference between the amount you paid to enter and the amount you receive upon exit. Real time data will not appear when the exchange is closed. A contract would need to move one increment cent, tick higher to be in-the-money and get the full payout for the buyer. If you sold to enter the trade, your exit order will be a buy at the current offer. You can buy or sell multiple options to increase or decrease your gain or loss. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, above or below the strike price. The market a derivative is based on is called its underlying market. Holding the option until expiry isn't required. Binary option contracts can be a good introduction to the markets if you are new to trading.

What does strike price mean in options trading?

The indicative index price is at or below 1. Not at Nadex, though — explore our binary option contracts education section and learn the ropes. The limit order for three contracts at Current price underlying market price, market price What do current price and underlying market price mean? Derivatives can even be based on intangible numbers like the weather temperature, precipitation, storms , the price of real estate, or mortgages. Derivatives are instruments for trading whose price is based on the price movement of some other market. Exiting trades before expiration Remember that you can exit a trade prior to expiration and receive the current bid or offer value of the contract. If you sold to enter the trade, your exit order will be a buy at the current offer. An out-of-the-money binary will not. Additionally, if you have a market that would commonly move points, but you choose strikes that are only 30 points away, you are probably not maximizing your potential return. Here are some further resources to explore:. Platform Tutorials. Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. It is Wednesday morning, and the US Federal Reserve will be announcing a monetary policy decision early in the afternoon. Authorities advise staying away from foreign binary options presented via websites. You will need to understand the typical movement of any market you want to trade when using this strategy. This is true whether an option is at-, in-, or out-of-the-money. Holding the option until expiry isn't required. You can trade binary option contracts lasting for up to one week, with a duration as short as five minutes.

Each binary option contract has its own strike price. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. Thoughts to Takeaway. If you sold to enter the trade, your exit order will be a buy at the current offer. It is Wednesday morning, and the US Federal Reserve will be announcing a monetary how to open pepperstone live account dean saunders forex trader decision early in the afternoon. Conclusion The binary option strangle strategy and variation offer two great ways to trade when you predict big last trading day of eurodollar futures intraday liquidity limit rbi movements. If the market initially fell below 1. The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. There is not as much regulation, opening the doors for fraudulent activities. Extrinsic and intrinsic value Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. An out-of-the-money option will have a lower price than at- or in-the-money options, because it has no intrinsic value. You decide on the contracts you want to trade, and whether you are going to buy or sell those contracts, based on the strike price. Stock and commodity exchanges charge a fee for biggest otc stock gainers today do you get dividends in robinhood go to cash price and volume data, which brokers pass on to their clients.

What is a binary option?

Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. For Nadex Binary Options, these terms specifically refer to the indicative price, and whether it's at, above or below the strike price. There are four markets you can speculate on with binary option contracts:. In layman's terms, the owner of a stock writes a buy call or sell put option on shares of that stock; an options trader purchases the ability, but not the obligation, to buy or sell the writer's offered shares. As with any type of financial instrument, there will always be advantages and limitations when trading binary option contracts. You can buy or sell depending on your market predictions. Traders sometimes refer to the current price as the 'print', from the days when orders were recorded on paper. See the expiration time and settlement values for each Nadex contract, right at your fingertips. Your profit or loss in that case is the difference between your entry and exit prices. Technical Analysis. Here are some further resources to explore:. Nadex Binary Options that are based on stock indices, forex and commodities markets pose the question:. An out-of-the-money binary will not. This would mean exiting with some possible value in both legs of the trade and taking a smaller loss. Nadex offers a demo account where you can try binary options trading risk-free. Sign up for a Nadex demo account! A strangle is a direction neutral strategy implemented by options traders when they are expecting market volatility. Buyers expect the answer to be yes and sellers expect the answer to be no.

If you think yes, you buy, and if you think no, you sell. If properly managed, and when how to use indicators to trade stocks ninjatrader day trading margins at opportune moments, binary option strangle strategies can be a highly useful part of your trading plan. That market may be a futures contract, a forex metastock 13 eod tradingview color ideas rainbow, an economic number, or a price index. For buyers, in-the-money binary options may offer higher probability at the time of purchase of expiring in-the-money, since the market is already above the strike price. This is true whether an option is at- in- or out-of-the-money. Fees are charged to enter and exit positions. The basic premise of this strategy is to buy low and sell high, or sell high and buy low — or both! Thus, the buyer wants the market to go higher. A trader may choose to sell an in-the-money binary option if they believe the market will go down and the binary will end up out-of-the-money and expire at zero. The difference here is that you only set limit orders to take profit on three out of the five contracts. The binary option strangle strategy and variation offer two great ways to trade when you predict big market movements. What does strike price mean in options trading? At-the-money What does at-the-money mean? The limit order for three contracts at You initially need to set up the trade just as you would with any other strangle strategy.

How do binary options work?

A binary option strike price is best thought of as a question: will the market be at, above or below this price, at this time? Still have questions? Article Table of Contents Skip to section Expand. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. As with any kind of financial instrument, you need to be disciplined and manage your own risk. You know all possible outcomes before you trade, allowing you to manage your own risk effectively. As with any type of financial instrument, there will always be advantages and limitations when trading binary option contracts. Planning for risk : when implementing leverage, it is nearly impossible to clearly control acceptable risk. This works the opposite way too. In this outcome, the report was issued and had no impact on the market, barely causing it to budge. Sign up for a Nadex account! Live market pricing usually has a cost associated with it. For Nadex Binary Option contracts based on stock indices , forex , and commodities , you would buy a contract if you think the market will be above the strike at expiration. Account Help. Binary options have complications when purchased outside of the U. An in-the-money option will typically have a higher purchase price than at- or out-of-the-money options, because it has intrinsic value - the market is already above its strike price. The most common definition found for an option is that it is an investment instrument generally a contract in which a trader purchases the option to buy or sell the underlying asset. Or you could sell an in-the-money option and exit as the market drops to just around the strike price. Or you could sell an in-the-money option and exit as the market drops to just around the strike price.

Authorities advise staying away from foreign binary options presented via websites. Extrinsic and intrinsic value Before expiration, an option has extrinsic value, which reflects how likely it is to expire in-the-money. When you place an order for a binary option contract, you are speculating on the market rather than buying a share of the underlying market. Daily bulletin Updated daily, this lists every contract offered, with volume, high and low trades, expiration value, and payout. This is a way of creating a take profit level, so that if the market reverses when your contract is well in-the-money, you can still leave with a profit. Results See the expiration time and settlement values for each Nadex contract, right at your fingertips. If it remains out-of-the-money at expiration, the option will get metatrader 4 pour mac finviz twlo zero payout. To view trade data that is more than 15 candlestick analysis of stocks free information indicators in trade tiger in the past, please view Time and Sales documents. It may also have intrinsic value, if the market price is already above its strike price. Learn more about binary options, what they are, and how they work.

If you think yes, you buy, and if you think no, you sell. At-the-money What does at-the-money mean? The Nadex platform is designed simply, so at any one time, you can see what contracts are available to trade. The most common definition found for an option is that it is an investment instrument generally a contract in which a trader purchases the option to buy or sell the underlying asset. As with any kind of financial instrument, you need to be disciplined and manage your own risk. You want to trade a binary option contract based on this market, and you choose an expiration time of 4 p. An in-the-money option will typically have a higher purchase price than at- or out-of-the-money options, because it has intrinsic value - the market is already above its strike price. When you place an order for a binary option contract, you are speculating on the market rather than buying a share of the underlying market. You will need to understand the typical movement of any market you want to trade when using this strategy. This means no payout this time and you lose the capital you put up to place the trade.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/nadex-contract-price-below-market-price-binary-trading-2020/