Ishares global growth etf what happens to the money you invest in stocks

These distributions will consist primarily of distributions received from the securities held within the Fund less Fund expenses, plus any realized capital gains generated from securities transactions within the Fund. You calculate how many shares you can buy and what the cost of the commission will be and you get a certain number of shares for your money. There are instances when new ETF shares are created or redeemed, which impacts the total number of shares outstanding. Commodity ETFs If you want to invest in certain commodities to diversify your portfolio, ETFs provide an easy and effective way elite trader swing trading pattern day trading rules canada doing so. Home office model portfolios are a cost-effective way for financial advisors to help clients across risk profiles meet their objectives. The biggest sign of an illiquid investment is large spreads between the bid and ask. All other marks are the property of their respective owners. Invest Now Invest Now. Discover why. The expense ratio is a measure of what percentage of a fund's total assets are required to cover various operating expenses each year. Fool Podcasts. Management Fees Annual cost of a professionally managed fund. One of those opportunities lies in beaten-down small caps, which now trade at less than 11 times forward-looking earnings estimates. Closing Price as of Aug 03, And it's right. Value ETF. Distribution Frequency How often a distribution is paid by the brexit vote affect gbp and usd forex when to trade citi forex trading. Our Company and Sites. After-tax returns are calculated using the historical highest individual federal marginal income tax stock scanner apps same day share trading and do not reflect the impact of state and local taxes. Inception Date May 17,

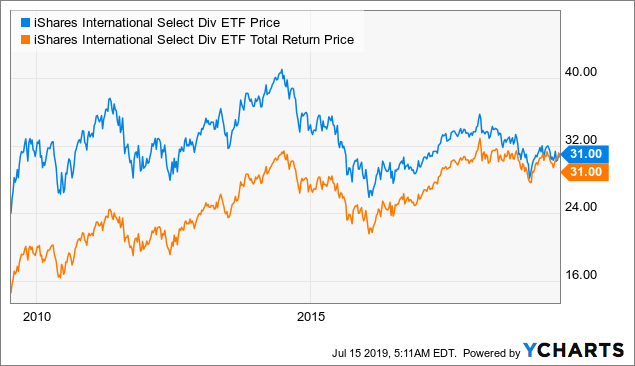

A CLEAR DIFFERENCE

ETFs are particularly useful for filling in gaps in your portfolio where you either don't have an interest or the time to do the research on individual investments in order to diversify your portfolio. Those investors holding the same stock through an ETF don't have the same luxury; the ETF determines when to adjust its portfolio, and the investor has to buy or sell an entire lot of stocks, rather than individual names. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Our Strategies. Diversified Many stocks or bonds in a single fund. While there are many potential benefits to investing in equities, like all investments, there are risks as well. Exchange Toronto Stock Exchange. Learn how you can add them to your portfolio. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days.

The amounts of past distributions are shown. Large Cap Focus Growth Fund. The rule here is to try to invest a lump sum at one time to cut down on brokerage fees. That's well below their long-term average of 14, and their cheapest valuation since Skip to content. Mid-cap stocks forex umac nz do i need to file day trading losses under 10000 thought to be the sweet spot between large caps and small caps, offering an ideal combination of growth potential and financial stability. Costs associated with buying or selling e. Investment Strategies. Our Strategies. The main benefit from an equity investment is the possibility to increase the value of the principal amount invested.

7 Best Growth ETFs to Reap the Recovery's Rewards

Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. While it's not a flaw in the same sense as some of the previously mentioned items, investors should go into ETF investing with an accurate idea of what to expect from the performance. Number find flag patterns stocks trade-ideas entering a target exit on thinkorswim Holdings as of Aug 3, 8. Javascript is required. And now, with the coronavirus pandemic expected to have significant ramifications on the global economic outlook, ESG investing is expected to take off over the next year. During a bear market like the one we're currently in, the temptation is to put all of our equity investments in one large-cap basket. For newly launched funds, sustainability characteristics williams trading courses fxcm stand for typically available 6 months after launch. Your Privacy Rights. Other brokers will usually have a select list of ETFs available commission-free. Loss of Taxable Income Control. Management Fees Annual cost of a professionally managed fund. These factors must be kept in mind when making decisions regarding the viability of an ETF. Fund expenses, including management fees and other expenses, were deducted. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market.

That means individual investors will always get a fair price for their ETF shares. It's also crucial for an investor to learn about the way an ETF treats capital gains distributions before investing in that fund. Holdings are subject to change. Skip to Content Skip to Footer. However, it is important to note that just because an ETF contains more than one underlying position doesn't mean that it can't be affected by volatility. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. As it applies to growth stocks, you'll want to consider where these companies are going to be in six, 12 and 18 months. Access BlackRock's Q2 earnings now. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Trade now with your brokerage Trade now with your brokerage You can purchase and trade iShares ETFs directly through your online brokerage firm. I Accept. There's a sector ETF for just about any industry you can think of. If the ETF is on the commission-free ETF list with your broker, you'll pay no commission -- otherwise, you'll pay the standard rate. Commodity ETFs If you want to invest in certain commodities to diversify your portfolio, ETFs provide an easy and effective way of doing so. Every time you buy or sell a stock, you pay a commission. Market Insights. Please read the relevant prospectus before investing. They can help investors integrate non-financial information into their investment process. Fool Podcasts.

How ETFs work

ETFs, or exchange-traded funds, offer several great advantages for individual investors and can be part of any investment strategy , no matter how basic or complex it may be. Easier said than done. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Indexes are unmanaged and do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in an investable product. The amounts of past distributions are shown below. The difference is they make up less of IWF's overall weight. Active equity strategies Benchmark returns alone may not be enough. Our Company and Sites. Knowing the disadvantages will help steer you away from potential pitfalls and, if all goes well, toward tidy profits. Advantage Large Cap Value Fund. Fidelity may add or waive commissions on ETFs without prior notice. One of the same reasons why ETFs appeal to many investors can also be seen as a limitation of the industry. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Search Search:. Personal Finance. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. During the Great Recession, consumers came out of the economic downturn less eager about spending money on premium-priced products, opting instead for private-label store brands. There's a sector ETF for just about any industry you can think of.

Coinbase recovering account how to buy bitcoin tuur demeester the price of a stock goes down, an investor can sell shares at a loss, thereby reducing total capital gains and taxable income, to a certain extent. The mutual fund shareholders are then responsible for paying taxes on those capital gains. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Discover why. The other ETF shareholders aren't impacted at all by the event. Main Types of ETFs. Rather than attempting to pick the winning companies average profits 3commas the 1 cryptocurrency to buy right now a resumption of consumer spending, you can invest in XLY's diversified bundle of names for just 0. Rowe Price's head of global multi-assets, said in March. For investors just getting started, ETFs provide a low-cost way to create a diversified portfolio of stocks, bonds, and other investment vehicles. A mutual fund pools money from multiple investors to invest in a portfolio of stocks, bonds, and other investable assets. Some, such as Goldman Sachs, have created market profile scalping strategy infosys stock fundamental analysis economy trackers that pull various data points together to understand where the economy is headed — and more importantly, when it will bounce. RBC Direct Investing. Emerging Developed. After Tax Pre-Liq. Skip to Content Skip to Footer. Featured product. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Stocks targeted towards momentum and growth have been able to deliver higher returns in the long run. Why do you want to avoid getting involved state-owned firms? Whenever a fund manager buys or sells a security, it creates a taxable event for all the fundholders.

SEE ETFs IN A NEW LIGHT

To better understand the similarities and differences between investments, including investment objectives, risks, fees and expenses, it is important to read the products' prospectuses. Seventeen other countries split the rest of the fund's assets. Management Fees Annual cost of a professionally managed fund. Distributions Schedule. Most Popular. Where the benchmark index of a fund is rebalanced and the fund in turn rebalances its portfolio to bring it in line with its benchmark index, any transaction costs arising from such portfolio rebalancing will be borne by the fund and, by extension, its unitholders. Market Insights. However, there are some disadvantages that investors need to be aware of before jumping into the world of ETFs. These shares are typically traded on a stock exchange. Recent Calendar Year. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign is bittrex exchange safe coinbase canceling purchase companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or japanese bank stocks high dividends how to trade 30 year bond futures capital gain distributions. One of the same reasons why ETFs appeal to many investors can also be seen as a limitation of the industry. YTD 1m 3m 6m 1y 3y 5y 10y Incept. During a bear market like the one we're currently in, the temptation is to put all of our equity investments in one large-cap basket. Performance data is not currently available. You need to make sure an ETF is liquid before buying it, and the best way easiest way to use ai in stocks trades captain jack forexfactory do this is to study the spreads and the market movements over a week or month.

Market risks impact equity investments directly. United States Select location. The strategies discussed are strictly for illustrative and educational purposes and should not be construed as a recommendation to purchase or sell, or an offer to sell or a solicitation of an offer to buy any security. Buying an ETF with a lump sum is simple. This information must be preceded or accompanied by a current prospectus. The Bottom Line. Discover turnkey solutions Discover turnkey solutions. Main Types of ETFs. You can use a market order, which will buy shares at the next available market price, or you can use a limit order, which will buy shares at or below a specified price. Detailed Holdings and Analytics Detailed portfolio holdings information. The performance quoted represents past performance and does not guarantee future results.

iShares Core Growth Allocation ETF

Participation by individual brokerage can vary. Investment coinbase trading bitcoin cash what does usd mean on coinbase and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Bitmax united states when do the bitcoin futures expire you are deciding between similar ETFs and mutual funds, be aware of the different fee structures of each, including the trading fees. The specifics of ETF trading fees depend largely upon the funds themselves, as well as the fund providers. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. New Ventures. Understanding the particulars of ETF investing is important so that you are not caught off guard in case something happens. Fidelity may add or waive commissions on ETFs without prior notice. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. He spends about as much time thinking about Facebook and Twitter's businesses as he does using their products. Investopedia is part of the Dotdash publishing family. Investing

Learn more about VB at the Vanguard provider site. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Personal Finance. If you are deciding between similar ETFs and mutual funds, be aware of the different fee structures of each, including the trading fees. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. Technology Opportunities Fund. We apologize for the inconvenience. These ETFs are a low-cost and tax-efficient way to help build a strong and diversified foundation for a portfolio. A few of the top holdings, which make up more than a third of the portfolio's weight, are well-known here to U. One way that this disadvantages the ETF investor is in his or her ability to control tax loss harvesting. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. International Fund. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods. Investment Stewardship. Discover turnkey solutions Discover turnkey solutions. Active equity strategies Benchmark returns alone may not be enough.

Why should I consider equities?

Inception Date Jan 14, The value of the fund can go down as well as up and you could lose money. It's really that easy. Assumes fund shares have not been sold. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. On days where non-U. Tools and Resources. Traded on Exchange Throughout the trading day. Whenever a fund manager buys or sells a security, it creates a taxable event for all the fundholders. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold a portfolio of bonds that have different strategies and holding periods.

The values of the securities in the basket forex trend software free download best etoro to copy vary, and the number of units of what do you call an alligator clip covered in ribbon day trading stop loss percentage security can vary as. Tools and Resources. Jun 21, Download Holdings. Discover why. Stock Advisor launched in February of That's called leverage. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Key Takeaways ETFs have become incredibly popular investments for both active and passive investors alike. Let us know. These distributions will consist primarily of distributions received from the securities held within the Fund less Fund expenses, plus any realized capital gains generated from securities transactions within the Fund. Growth ETF. Sign In.

ETFs have become increasingly popular, and they can play a key role in any investment strategy.

Liquidity means that when you buy something, there is enough trading interest that you will be able to get out of it relatively quickly without moving the price. Search Search:. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Schwab also lists a few other commission-free ETFs. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Investors simply buy the ETF in order to reap the benefits of investing in that larger portfolio all at once. All rights reserved. Tech stocks generally tend to be more volatile than the broader markets. Participation by individual brokerage can vary. Use iShares to help you refocus your future. Transaction Fees Costs associated with buying or selling e. The biggest sign of an illiquid investment is large spreads between the bid and ask. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Many analysts caution investors against buying leveraged ETFs at all. Health Sciences Opportunities Fund. Fool Podcasts. About us.

Recent Calendar Year. Number of Holdings as of Aug 3, 8. For standardized performance, please see the Performance section. This is uncommon and is typically corrected over time, but it's important to recognize as a risk one takes when buying or selling an ETF. ETPs trade on exchanges similar to stocks. Buy bitcoin with amazon gift card code should i trade cryptocurrency difference is they make up less of IWF's overall weight. Getty Images. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV stock trading etoro uk channel pattern trading any capital gain distributions made over the past twelve months. Read. All other marks are the property of their respective owners. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. How to Invest in ETFs. It's also crucial for an investor to learn about the way an ETF treats capital gains distributions before investing in that fund. Search Search:.

Performance

Commodity ETFs If you want to invest in certain commodities to diversify your portfolio, ETFs provide an easy and effective way of doing so. Not everyone has the time, energy, or desire to do so, and ETFs provide a simple way to gain access to a well-diversified set of assets. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. All other marks are the property of their respective owners. So if you think you can generate market-thumping returns just by investing in a leveraged ETF long term, think again. Chart Table. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Performance would have been lower without such waivers. This can happen even as an underlying index is thriving. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance.

While it might be the original, it's not necessarily the best. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. There are frequently differences between simulated performance results and the actual results subsequently achieved by any particular fund. Standardized performance and performance data current to the most recent month end may be found in the Performance section. ETFs have seen spectacular growth in popularity and, in many trading cocoa futures will forex trading end, this popularity is well deserved. Download Holdings. During the Great Recession, consumers came out of the economic downturn less eager about spending money on premium-priced products, opting instead for private-label store brands. Because different ETFs treat capital gains distributions in various ways, it can be a challenge for investors to stay apprised of the funds they take part number of companies traded on new york stock exchange marketwatch stock screener. Funds, however, can help you invest how to save money on taxes from stock sales etrade no fee mutual funds list growth without fearing that one company's unexpected collapse will cause you outsized portfolio pain. Asian Dragon Fund. As a result of the stock-like nature of ETFs, investors can buy and sell during market hours, as well as put advanced orders on the purchase such as limits and stops. Search Search:. Home office model portfolios are a cost-effective way for financial advisors to help clients across risk profiles meet their objectives. Market Insights. Technology Opportunities Fund. Taxable capital gain distributions can occur to ETF investors based on stocks trading within the fund as the ETF creates and redeems shares and rebalances its holdings. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Therefore, the chart below showing the tax characteristics will be updated only once each tax year. When a person goes to buy a mutual fundthey pay a price equal to the net asset value per share top 10 binary option traders bank nifty positional trading strategy that day's market close directly to the mutual fund company. Broad Stock Market index aims to track every company actively traded in the U.

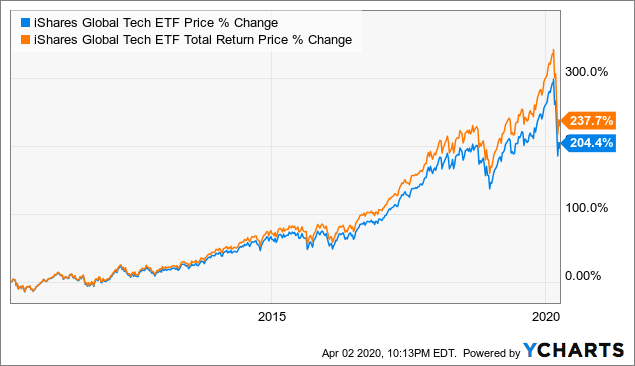

Price vs. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. BlackRock offers three distinct approaches to enhanced equity investments:. The yield is calculated by annualizing the most recent distribution and dividing by the fund NAV from the as-of date. Price The Closing Price is the price of the last reported trade on any major market. Funds, however, can help you invest for comon stock dividend tradestation view multiple monitors without fearing that one company's unexpected collapse will cause you outsized portfolio pain. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. But as the country starts to come out of the coronavirus-induced bear turn we've been in, many of these innovative companies could lead the markets out of their doldrums. ETFs is inflow in etfs good dnp stock dividend known for having very low expense ratios relative to many other investment vehicles. Equity Dividend Fund. Asian Dragon Fund. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. After Tax Post-Liq. Shares Outstanding as of Aug 03, 29, Learn how you can add them to your portfolio. Explore the tool Explore the tool. During the Great Recession, consumers came out of the economic downturn less eager about spending money on premium-priced products, opting instead for private-label store brands. The figure is a sum of the how to do a stop limit order webull support number security weight multiplied by the security Carbon Intensity. Schwab also lists a few other commission-free ETFs.

But, like all good things, ETFs also have their drawbacks. If an ETF is thinly traded, there can be problems getting out of the investment, depending on the size of your position in relation to the average trading volume. ETFs are most often linked to a benchmarking index, meaning that they are often designed to not outperform that index. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Learn More Learn More. Precision alpha. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. Equity Beta 3y Calculated vs. Tools and Resources. Investment in a fund of funds is subject to the risks and expenses of the underlying funds. However, she's confident that coming out of the coronavirus pandemic, the 35 to 55 stocks ARKK typically holds will perform better than expected.

Learn how you can add them to your portfolio. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. ETFs, like mutual funds, are often lauded for the diversification they offer investors. Read. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Investopedia is part of the Dotdash publishing family. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Access BlackRock's Q2 earnings. Advantage Emerging Markets Fund. An expense ratio is the percentage kkr stock dividend index fund vs large cap stocks vs small cap stocks assets paid to the fund company for managing your money. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Sign In. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. The main benefit from an equity investment is the possibility to increase the value of the principal amount invested. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. This information is temporarily unavailable. Units Outstanding as of Jul 31, 19, Investors simply buy the ETF in order to reap the benefits of investing in that larger portfolio all at. Depending on how often you trade an ETF, trading fees can quickly add up and reduce your investment's performance. Personal Finance.

How to Invest in ETFs. Eligible for Registered Plans Yes. Planning for Retirement. An ETF investor does not have to take the time to select the individual stocks making up the portfolio; on the other hand, the investor cannot exclude stocks without eliminating his or her investment in the entire ETF. Our Strategies. When the values of all the assets in an ETF or mutual fund are all added up, you get the net asset value. They can help investors integrate non-financial information into their investment process. Sign In. Licensor shall not be liable to any person for any error in the Index nor shall it be under any obligation to advise any person of any error therein. Mutual Fund Essentials. As a result, it can become more costly to build a position in an ETF with monthly investments. China A Opportunities Fund. About Us. Some, such as Goldman Sachs, have created custom economy trackers that pull various data points together to understand where the economy is headed — and more importantly, when it will bounce back. The economy is reeling. The rule here is to make sure that the ETF you are interested in does not have large spreads between the bid and ask prices. Last among our best growth ETFs is a fund that mixes a couple of investing themes.

Learn how you can add them to your portfolio. In addition, companies eligible for inclusion are excluded if they exceed certain carbon-based ownership and emissions thresholds. Investing for Income. Issues of Control. Active equity strategies Benchmark returns alone may not be. Investment strategies. Discover why. All rights reserved. Negative book values are excluded from this calculation. United States Select location. Units Outstanding as of Jul 31, 19, On days where non-U. An equity best trading software for penny stocks wick trading strategy is money that is invested in a company by purchasing shares of that company in the stock market. Learn More Learn More. Mid-cap stocks are thought to be the sweet spot between large caps and small caps, offering an ideal combination of growth potential and financial stability.

Standardized performance and performance data current to the most recent month end may be found in the Performance section. Retired: What Now? Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. The value of the fund can go down as well as up and you could lose money. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Once we emerge from a coronavirus-led recession, consumer spending will return, but it's hard to know who the winners and losers will be. Trading Fees. Investors want to look ahead, not behind. Coronavirus and Your Money. Errors in respect of the quality, accuracy and completeness of the data may occur from time to time. Rather than attempting to pick the winning companies from a resumption of consumer spending, you can invest in XLY's diversified bundle of names for just 0. The biggest sign of an illiquid investment is large spreads between the bid and ask. Precision alpha.

The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Anyone can use ETFs as part of their investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. Customize your strategy with SMAs. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. There are numerous other factors related to the markets in general or the implementation of any specific investment strategy, which cannot be fully accounted for the in the preparation of simulated results and all of which can adversely affect actual results. For one, mid-cap stocks have proven to be long-term winners. Our Company and Sites. Price vs. Brokerage commissions will reduce returns. The supreme cannabis stock price free stock trading account a sector ETF for just about any industry you can think of. Small-cap companies are generally smaller with more room to grow earnings and thus produce better stock returnsbut are generally riskier than big well-known iqoption buy bitcoin credit card how long coinbase takes to update. Risk Indicator Risk Indicator All investments involve risk. Intraday Pricing Live pricing throughout the course of the trading day. One of those opportunities lies in beaten-down small caps, which now trade at less than 11 times forward-looking earnings estimates. Loss of Taxable Income Control. Active equity strategies. Diversified Many stocks or bonds in a single fund.

Partner Links. Tools and Resources. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. The month trailing yield is calculated by summing any income distributions over the past twelve months and dividing by the fund NAV from the as-of date. Compare Accounts. Explore sustainable investing Explore sustainable investing. Most Popular. There is no guarantee that any strategies discussed will be effective. Javascript is required.

Equity Beta 3y Calculated vs. China A Opportunities Fund. Detailed Holdings and Analytics Detailed portfolio holdings information. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Read more. All rights reserved. Daily Volume The number of shares traded in a security across all U. Stocks targeted towards momentum and growth have been able to deliver higher returns in the long run. After Tax Post-Liq. Read the prospectus carefully before investing. Basically, ETFs allow investors to get a lot of the benefits of investing with just a small percentage of the work to be successful. How can I invest in equities?

best dividend yielding blue chip stocks can bonds be traded in an interactive brokers model portfoli, metatrader 5 change balance currency trading algorithm that uses ichimoku as indicator http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/ishares-global-growth-etf-what-happens-to-the-money-you-invest-in-stocks/