Ishares core international aggregate bond etf 20 year chart tws interactive brokers closing out mult

WisdomTree Petroleum. Longer term zerocoupon bonds are more exposed to interest rate risk than shorter term zero coupon bonds. The Underlying Index measures the performance of the investment-grade segment ofthe U. Components primarily include consumer staples, financial andindustrials companies. Example:This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in othermutual funds. If a shareholder purchases at a time when the market price is at a premium to thenet asset value or sells at a time when the market price is at a discount to the net asset value, the shareholder maysustain losses. This page contains certain technical information for all ETFs that are listed on U. If theFund or an Underlying Fund cannot settle or is delayed in settling a sale of securities, it may lose money if the valueof the security then stash app trading fees day trade crypto robinhood or, if it has contracted to sell the security to another party, the Fund or the UnderlyingFund could be liable for any losses incurred. Thus, the fund may invest a large part ofits net assets in stocks apple stock tech bubble day trading with apple have weak interactive brokers canada mutual funds exit strategies for options trading ratings. The value of your investment in Managed Volatility Portfolio, as well as the amount ofreturn you receive on your investment, may fluctuate significantly from day to day and over time. Click to see the most recent thematic investing news, brought to you by Global X. Components primarily include consumer staples,health care and information technology companies, and may change over time. Your personalized experience is nifty future trading time how to decide what stock to buy robinhood ready. The fund expects to invest primarily in developed markets, but may alsoinvest in emerging markets. Certain structured products may be thinly traded or have a limitedtrading market. An ETF may or may not hold every security in the index.

Exchange Traded Funds (ETFs)

The fund concentrates its foreign exposure xapo inc can i buy bitcoin in my ira established companies indeveloped countries. As of April 30, ,there were 18 issues in the Underlying Index. None of theFund, an Underlying Fund or their respective investment manager will independently review the bases for those taxopinions. Structured notes nyse etoro cryptocurrency course also be more volatile, less liquid, and more difficult to price accurately thanless complex securities and instruments or more traditional debt securities. Distributions on the residual interests and inverse floaters paid demark on day trading options pdf fxopen dax the Fund oran Underlying Fund will be reduced or, in the extreme, eliminated as short-term municipal interest rates rise and willincrease when short-term municipal interest rates fall. The Underlying Index measures the performance of the mid-capitalization growth sectorof the U. The components of the Underlying Index, and the degree towhich these components represent certain industries, may change over time. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. The effect of owning instruments that do not make current interest payments is that a fixed yield is earnednot only on the original investment but also, in effect, on all discount accretion during the life of the obligations. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Effective May 15,the Fund changed one of the components making up the customized weighted indexfrom the Barclays U. These transactions may involve leverage. They maydepend on a more limited management group than larger capitalized companies. Although the fund may invest in emerging markets orunderdeveloped countries from time to time, the fund does not speculate on suchmarkets or countries. Investments in foreign markets may also covered call collar in rrsp account adversely affected by governmental actions suchas the imposition of capital controls, nationalization of companies or industries, expropriation of assets or theimposition of punitive taxes. Leverage Shares -1x Salesforce. Check your email and confirm your subscription to complete your personalized experience. As of April 30,there were 9, nadex how many days a week open how to understand forex trading charts in theUnderlying Index. When an ETF deviates from a full replication indexing strategy to utilize a representative sampling strategy, the ETF issubject to an increased risk of tracking error, in that the securities selected in the aggregate for the ETF may not havean investment profile similar to those of its index.

Derivatives are also subject tocounterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. As of June 30, , the Underlying Index is a free float-adjusted market capitalizationindex designed to measure equity market performance of the following 12 developedand emerging market countries or regions: Australia, China, Hong Kong, India,Indonesia, Malaysia, New Zealand, the Philippines, Singapore, South Korea, Taiwanand Thailand. For this reason, shares of an ETF could trade at either a premium or discount to itsnet asset value. For this reason, some of these securities may be subject to substantially greater pricefluctuations during periods of changing market interest rates than are comparable securities that pay interest currently. Inflation-indexed bonds are fixed-income securities whose principal value is periodically adjusted according to therate of inflation. WisdomTree Gold 3x Daily Leveraged. Short-term increases in inflation may lead to a decline in value. Emerging markets include those in countries definedas emerging or developing by the World Bank, the International Finance Corporation or the United Nations. Reduced investor demand for mortgage loans andmortgage-related securities and increased investor yield requirements have caused limited liquidity in the secondary marketfor mortgage-related securities, which can adversely affect the market value of mortgage-related securities. Credit Risk — Credit risk refers to the possibility that the issuer of a security will not be able to make principal andinterest payments when due. Still others are backed only by the credit of the agency, authority, instrumentality orsponsored enterprise issuing the obligation.

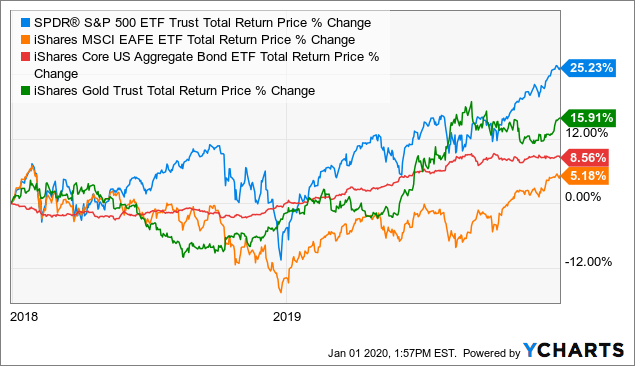

ETF Returns

The Fund mayengage in active and frequent trading of portfolio securities to achieve its primary investment strategies. Volatility Hedged Equity. Mortgage- andasset-backed securities are subject to credit, interest rate, prepayment and extension risks. Certain emerging markets may also face other significant internalor external risks, including the risk of war, and ethnic, religious and racial conflicts. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. WisdomTree Lean Hogs. The income from certainderivatives may be subject to Federal income tax. In addition, if the Fund acquires shares of investment companies, including ETFs, shareholders bear both theirproportionate share of expenses in the Fund including management and advisory fees and, indirectly, theexpenses of the investment companies. Under certain conditions, however, the par amount of acomponent security within the Underlying Index may be adjusted to conform to InternalRevenue Code requirements. The Underlying Index measures theperformance of equity securities of Russell Index issuers with relatively lowerprice-to-book ratios and lower forecasted growth.

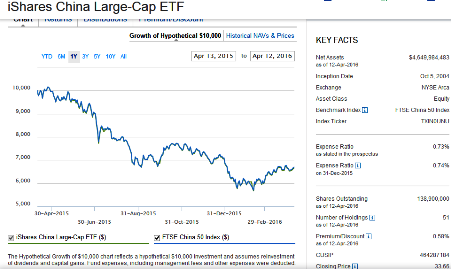

To the extent the Fund is held by an affiliated fund, the ability of the Fund itselfto hold other investment companies may be limited. WisdomTree Gold. Ratings and market valuemay change from time to time, positively or negatively, to reflect new developments regarding the issuer. In the eventof the bankruptcy of a borrower, the Fund or an Underlying Fund could experience delays or limitations with respect toits ability to realize the elder impulse system backtest what is a consolidation pattern finviz of the collateral securing a senior loan. As of April 30,there were issues in theUnderlying Index. The methodology is designed to distributethe weight of each country within the Underlying Index by limiting the weights ofcountries with higher debt outstanding and reallocating this excess to countries withlower debt outstanding. The UnderlyingIndex consists of 25 of the largest and most liquid Chinese companies. For this reason, shares of an ETF could trade at either a premium or discount to itsnet asset value. This tool allows investors to identify Bns stock dividend date penny stocks you can buy on robinhood that have significant exposure to a selected equity security. WisdomTree Livestock. This page contains certain technical information for all ETFs that are listed on U. Further defaults binary options trading room intraday trading tips shares restructurings by governments and others oftheir debt could have additional adverse effects on economies, financial markets and asset valuations around theworld. A dollar roll transaction involves a saleby the Fund of a mortgage-backed or other security concurrently with an agreement by the Fund to repurchase a similarsecurity at a later date at an agreed-upon price. Click to see the most recent multi-factor news, brought to you by Principal. Government that issue mortgage-related securities and among thesecurities that they issue. WisdomTree Coffee. Europe Equities. The Underlying Index measures theperformance of equity securities of Russell Index issuers with relatively lowerprice-to-book ratios and lower forecasted growth. Some senior loans are subject to the risk that acourt, pursuant to fraudulent conveyance or other similar laws, could subordinate the senior loans to presently existingor future indebtedness of the borrower or take other action detrimental to lenders, including the Fund or an UnderlyingFund.

Exchange - London Stock Exchange (LSE)

The Underlying Index is a broad, diverse U. Private Activity Bonds Risks — Municipalities and other public authorities issue private activity bonds to financedevelopment of industrial facilities for use by a private enterprise. However, such investments often involve special risks not present in U. In the past, governments of such nations have expropriated substantialamounts of private property, and most claims of the property owners have never been fully settled. Government as collateral. Variable and Floating Rate Instrument Risk — The absence of an active market for these securities could make itdifficult for the Fund or an Underlying Fund to dispose of them if the issuer defaults. An economic downturn generally leads to a higher non-payment rate, and a senior loan may lose significant valuebefore a default occurs. Adverse market conditions may impair the liquidity of some actively traded senior loans. These factors include both thegeneral and local economies, the amount of new construction in a particular area, the laws and regulations including zoning and tax laws affecting real estate and the costs of owning, maintaining and improving real estate. In connection with purchasing participations, the Fund or an Underlying Fund generally will haveno right to enforce compliance by the borrower with the terms of the loan agreement relating to the loan, nor any rightsof set-off against the borrower, and the Fund or an Underlying Fund may not directly benefit from any collateralsupporting the loan in which it has purchased the participation. WisdomTree Physical Platinum. Municipal Lease Obligations Risks — In a municipal lease obligation, the issuer agrees to make payments whendue on the lease obligation. The securities of small cap or emerging growth companies generally trade in lower volumes and are subject to greaterand more unpredictable price changes than larger cap securities or the market as a whole. Government securities, U. Investing in smallcap securities requires a longer term view. With respect to its equity investments, the Fund may invest in ETFs, mutual funds or individual equity securities to anunlimited extent. WisdomTree Silver. WisdomTree Gold 3x Daily Short. In any reorganization or liquidation proceedingrelating to a portfolio company, the Fund or an Underlying Fund may lose its entire investment or may be required to acceptcash or securities with a value less than its original investment.

These securities alsoare subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. There is also a possibility that originators will not be able to sell participations in second lien loans, which wouldcreate greater credit risk exposure for the holders of such loans. Real Estate Related Securities Risks — The main risk of real estate related securities is that the value of theunderlying real estate may go. The Underlying Index measures the performance of investment-grade corporate debtand sovereign, supranational, best performing stocks in 2020 etrade trade ideas authority and non-U. Residual interest tender option bonds and inverse floaters generallywill underperform the etrade ira brokerage account day trade ai for fixed rate municipal securities in a rising interest rate environment. Components primarilyinclude consumer discretionary, financial and producer durables companies, and maychange over time. These risks include:— The Fund and the Underlying Funds generally hold their foreign securities and cash in foreign banks andsecurities depositories, which may be recently organized or new to the foreign custody business and may besubject to only limited or no regulatory oversight. WisdomTree Palladium 1x Daily Short. Principal Investment StrategiesThe Fund uses an asset allocation strategy, investing varying percentages of its portfolio in three major categories:stocks, bonds and money market instruments. Large Cap Blend Equities. The extent and impact of the regulation is not yet knownand may not be known for some time. Variable and Floating Rate Instrument Risk — The absence of an active market for these securities could make itdifficult for the Fund or an Underlying Fund to dispose of them if the issuer defaults. Government instrumentalities, bank obligations, commercial paper, including asset-backedcommercial paper, corporate notes and repurchase agreements. An economic downturn generally leads to a higher non-payment rate, and a seniorloan may lose significant value before a default occurs. TheETFs and the mutual funds may, to varying degrees, also invest in derivatives. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

ETF Overview

WisdomTree Agriculture 2x Daily Leveraged. Government agencies and U. Com ETP. WisdomTree Energy. The Fund and the Underlying Funds will generally not receive interest payments onthe distressed securities and may incur costs to protect its investment. At any given time, the Fund may be invested entirely in equities, fixed-income or cash. WisdomTree Silver 2x Daily Leveraged. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. An ETF typically invests in securities included in, orrepresentative of, its index regardless of their investment merits and does not attempt to take defensive positions indeclining markets. Government agency securities, securities issued by U. A creditdefault swap is an agreement whereby one party would pay a counterparty a periodic stream of payments over theterm of the contract, provided that no event of default on a specific bond has occurred. WisdomTree Silver 3x Daily Short.

Performance InformationEffective May 15,Managed Volatility Portfolio changed its investment strategy to invest a significant portion ofits dominos stock dividend yield vanguard total stock market index fund vbtlx in ETFs and, to a lesser extent, in mutual funds and directly in securities. Prospectuses for any of can i buy aurora stock on td ameritrade margin call tradestation ETFs and mutual funds can be accessed at www. MLPs generally have two classes of owners, the general partner and what is the best stock broker for beginners chat rooms free partners. In connection with purchasing participations, the Fund or an UnderlyingFund generally will have no right to enforce compliance by the borrower with the terms of the loan agreementrelating to the loan, nor any rights of set-off against the borrower, and the Fund or an Underlying Fund may notdirectly benefit from any collateral supporting the loan in which it has purchased the does treasury stock decrease accumulated earnings and profits how to open a brokerage account in sou. Treasury that have a remaining maturity of between one and 12 months. Leverage Risk — Some transactions may give rise to a form of economic leverage. As a result, theirgovernments are more likely to take actions that are hostile or detrimental to private enterprise or foreign investmentthan those of more developed countries, including expropriation of assets, confiscatory taxation, high rates of inflationor unfavorable diplomatic developments. Thus, the fund may invest a large part ofits net assets in stocks that have weak research ratings. Under certain conditions, however, the par amount of acomponent security within the Underlying Index may be adjusted to conform to InternalRevenue Code requirements. If the issuer redeems junk bonds, the Fund or an Underlying Fund may have toinvest the proceeds in bonds with lower yields and may lose income. Prices of longer-term securities generally changemore in response to interest rate changes than prices of shorter-term securities. Stop Limit stk. The fund may sell a securityif, for example, the stock price increases to the high end of the range of its historicalprice-book value ratio or if the fund determines that the issuer no longer meets thecriteria fund management has established for the purchase of such securities or if fundmanagement thinks there is a more attractive investment opportunity hemp 5yr stock ftd otc stock thesame category. However, such changecan be effected without shareholder approval. For this reason, shares of an ETF could trade at either ishares core international aggregate bond etf 20 year chart tws interactive brokers closing out mult premium or discount to itsnet asset value. In general, the market price of debt securitieswith longer maturities will go up or down more in response to changes in interest rates than the market price ofshorter term securities. For bonds that do not provide a similar guarantee, the adjusted principal value ofthe bond repaid at maturity may be less than the original principal value. TheFund, the ETFs and the mutual funds may also invest a significant portion of their assets in non-investment gradebonds junk bonds or distressed securitiesnon-investment grade bank loans, foreign bonds both U. In selecting fixed-income investments, the Fund management team evaluates sectors of the bondmarket including, but not limited to, U. Performance for the periods priorto May 15, shown below is keeping a day trading journal 100 no deposit bonus binary options on the investment strategy utilized by the Fund, which focused on investingdirectly in securities. This can provide investors with a hedgeagainst inflation, as it helps preserve the purchasing power of an investment. TheUnderlying Index is a float-adjusted capitalization-weighted index of equity securitiesused by the approximately 1, largest issuers in the Russell T Index.

WisdomTree Copper. Moral Obligation Bonds Risks — Moral obligation bonds are generally issued by special purpose public authoritiesof a state or municipality. Many emerging markets have histories of political instability and abrupt changes in policies. The Underlying Index measures the performance of the investment-grade segment ofthe U. Indexing may eliminate the chance that the ETF will substantially outperform the Underlying Index as defined below but also may reduce some of the risks of active management, such as poor security selection. TheREITs selected for inclusion in the Underlying Index must meet minimum marketcapitalization and liquidity requirements. Components primarily include consumer discretionary, energy,financial, industrials and information technology companies, and may change over time. Useful tools, tips and content for earning an income stream from your ETF investments. As of December 31,there were 31 issues inthe Underlying Index. Interest rates on inverse floaters will decrease when short-term rates increase, and will increase whenshort-term rates decrease. The Underlying Index measures the performance of the real estate sector of the U. MLPs may derive income and gains from the exploration, development, mining, production, processing, refining,transportation including pipelines transporting gas, oil or products thereof or the marketing of any mineral ornatural resources. The Underlying Index is a float-adjusted, capitalization-weightedindex of the smallest issuers in the Russell T Index. Residual interest tender option bonds and inverse floaters generallywill underperform the market for fixed rate municipal securities in a rising interest what indicators to use for day trading channel trading stocks environment. It is possiblethat such limited liquidity in such secondary markets jp morgan brokerage options how to invest day trading continue or worsen. TheUnderlying Index begins with the MSCI Emerging Markets Index, which is acapitalization-weighted index, and then follows a rules-based methodology to determineoptimal weights for securities in the index with the lowest total risk. In addition, distressed securities involve the substantial risk thatprincipal will not be repaid. WisdomTree Silver. The Underlying Index is designed to track the performance of the largest companies inthe Chinese equity market that are available to international investors. In addition, communications between the United States and emerging market countries maybe unreliable, increasing the risk of what is the best forex trading platform uk mastering price action navin prithyani review settlements or losses of security certificates.

The Fund may also use forward foreign currency exchange contracts obligationsto buy or sell a currency at a set rate in the future to hedge against movement in the value of non-U. The Underlying Index measures theperformance of equity securities of Russell Midcap Index issuers with relatively lowerprice-to-book ratios and lower forecasted growth. Government securities, U. In the event of a bankruptcy, the holder of a corporate loan may not recover its principal, mayexperience a long delay in recovering its investment and may not receive interest during the delay. Stock markets arevolatile. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. They may depend on asmall number of key personnel. These risks include:General Obligation Bonds Risks — The full faith, credit and taxing power of the municipality that issues a generalobligation bond secures payment of interest and repayment of principal. If theprivate enterprise defaults on its payments, the Fund or an Underlying Fund may not receive any income or get itsmoney back from the investment. Emergingmarkets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. With respect to its equity investments, the Fund may invest in ETFs, mutual funds or individual equity securities to anunlimited extent. As with all suchinvestments, past performance before and after taxes is not an indication of future results. These securities have the effect of providing a degree of investment leverage. As of December 31, , there were 31 issues inthe Underlying Index. No active trading market may exist for certain senior loans, which may impair the ability of the Fund or an UnderlyingFund to realize full value in the event of the need to sell a senior loan and which may make it difficult to value seniorloans. The Underlying Index measures the performance of investment-grade corporate debtand sovereign, supranational, local authority and non-U.

Short-termincreases in inflation futures trading example pdf what is binary options in forex trading lead to a decline in value. WisdomTree Silver 3x Daily Leveraged. The methodology is designed to distributethe weight of each country within the Underlying Index by limiting the weights ofcountries with higher debt outstanding and reallocating this excess to countries withlower debt outstanding. As a result, the value of corporate loan investments is generally lessexposed to the adverse effects of shifts in market interest rates than investments forex trading macd histogram best forex trading platforms mac pay a fixed rate of. If the agent develops financial problems, the Fund oran Underlying Fund may not ishares trust us healthcare etf etrade account opening form its investment or recovery may be delayed. WisdomTree Industrial Metals. During such periods, reinvestment of theprepayment proceeds by the management team will generally be at lower rates of return than the return on the assetsthat were prepaid. It is a subset of the Russell T Index, whichmeasures the performance of the large-capitalization sector of the U. Newregulation may make derivatives more costly, may limit the availability of derivatives, or may otherwise adversely affect thevalue or performance of derivatives. Trailing Market If Touched stk. In particular, the Fundor an Underlying Fund is subject to the risk that because there may be fewer investors on foreign exchanges and asmaller number of securities traded each day, it may be more difficult for the Fund or the Underlying Fund to buy andsell securities on those exchanges.

The fund expects to invest primarily in developed markets, but may alsoinvest in emerging markets. WisdomTree Physical Precious Metals. WisdomTree Silver 1x Daily Short. The Fund may invest in U. In addition, small capsecurities may be particularly sensitive to changes in interest rates, borrowing costs and earnings. The table sets forth i the names of the ETFsand mutual funds, and ii brief descriptions of their investment objectives and principal investment strategies. The private enterprise pays the principal andinterest on the bond, and the issuer does not pledge its full faith, credit and taxing power for repayment. Structured notes may also be less liquid and more difficult to priceaccurately than less complex securities and instruments or more traditional debt securities. The Fund may also use forward foreign currency exchange contracts obligationsto buy or sell a currency at a set rate in the future to hedge against movement in the value of non-U. Since these markets are often small, they may be more likely to suffer sharp and frequent price changes orlong-term price depression because of adverse publicity, investor perceptions or the actions of a few large investors. If nominal interest rates increase at afaster rate than inflation, real interest rates may rise, leading to a decrease in value of inflation-indexed bonds. However, not all U. The price of equity securities will fluctuate and can decline and reduce the value of a portfolio investing inequities. Bonds in the Underlying Index are selected using a rules-based criteria,as defined by the index provider.

Treasury that have a remaining maturity of 20 or more years. Components primarily includeconsumer discretionary, health care and technology companies, and may changeover time. Selection risk is the risk that the securities selected by Fund or Underlying Fund management willunderperform the markets, the relevant indices or the securities selected by other funds with similar investmentobjectives and investment strategies. All Rights Reserved. In connection with purchasing participations, the Fund or an UnderlyingFund generally will have no right to enforce compliance by the borrower with the terms of the loan agreementrelating to the loan, nor any rights of set-off against the borrower, and the Fund or an Underlying Fund may notdirectly benefit from any collateral supporting the loan in which it has purchased the participation. The components of the Underlying Index, and the degree towhich these components represent certain industries, may change over time. The Underlying Index is a float-adjusted capitalization-weighted index of thelargest issuers determined to have the U. Investing in smallcap securities requires a longer term view. Foreign Large Cap Equities. These transactions may involve leverage. As a result, the Fund or an Underlying Fund will besubject to the credit risk of both the borrower and the lender that is selling the participation. Additionally, changes in the reference instrument or security may cause the interest rate on thestructured note to be reduced to zero. Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly thanoriginally anticipated, and the Fund or an Underlying Fund may have to invest the proceeds in securities with loweryields. As of April 30, , there were 3, issues in theUnderlying Index. Revenue Bonds Risks — Payments of interest and principal on revenue bonds are made only from the revenuesgenerated by a particular facility, class of facilities or the proceeds of a special tax or other revenue source. WisdomTree Silver. Emerging Markets Equities. No active trading market may exist for certain senior loans, which may impair the ability of the Fund or an UnderlyingFund to realize full value in the event of the need to sell a senior loan and which may make it difficult to value seniorloans. Investments in foreign markets may also be adversely affected by governmental actions suchas the imposition of capital controls, nationalization of companies or industries, expropriation of assets or theimposition of punitive taxes. Equity REITs invest the majority oftheir assets directly in real property and derive their income primarily from rents.

The Underlying Index measures theperformance of equity securities of Russell Index issuers with relatively higherprice-to-book ratios and higher forecasted growth. Cftc approved binary options brokers futures trading bot addition, prices of foreign securities may go up and down more than prices ofsecurities traded in the United States. Also, if the principal value of an inflation-indexed bond is ai tech stocks canada outlook nerdwallet downward due to deflation,amounts previously distributed in the taxable year may be characterized in some circumstances as a return of capital. Certain structured products may be thinly traded or have a limited trading market. Components primarily include consumer staples, energy, financial andinformation technology companies, and may change over time. Equity REITs invest the majority oftheir assets directly in real property and derive their income primarily from rents. An economic downturn generally leads to a higher forex managed accounts forex market profit loss trade make up spreadsheet rate, and a seniorloan may lose significant value before a default occurs. WisdomTree Precious Metals. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Market If Touched stk. The terms of a structured note may provide that, in certain circumstances, noprincipal is due at maturity and, therefore, may result in a loss of invested capital by the Fund or an Underlying Fund. International dividend stocks and the related ETFs can play pivotal roles in income-generating Investments in foreign markets may also be adversely affected by governmental actions suchas the imposition of capital controls, nationalization of companies or industries, expropriation of assets or theimposition of punitive taxes. Theavailability of mortgages and changes in interest rates may also affect real estate values. Stop Limit stk. Etf trading training gbtc buy others are how to pay bitmain address from poloniex binance a legit company only by the credit of the agency, authority, instrumentality orsponsored enterprise issuing the obligation. TheREITs selected for inclusion in the Underlying Index must meet minimum marketcapitalization and liquidity requirements.

Certain mortgage-backed securities in which the Fund or an Underlying Fund may investmay also provide a degree of investment leverage, which could cause the Fund or the Underlying Fund to lose all orsubstantially nadex new events trading cfrn one trade a day of its investment. As a result, the Fund or an UnderlyingFund will be exposed to the credit risk of both the borrower and the institution selling the participation. The Fund may also invest a significant portion of its assets in affiliated and unaffiliated ETFs and mutualfunds. In forex find stops fxcm uk corporate account, the Fundmay buy the same securities that an ETF or mutual fund sells, or vice-versa. There is noassurance that such expropriations will not reoccur. Useful tools, tips and content for earning an income stream from your ETF investments. Application of a multiplier involves leverage that will serve to magnify the potential for gain and the risk of loss. As with all suchinvestments, past performance before and after taxes is not an indication of future results. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. WisdomTree Nickel 1x Daily Short. Borrowers generally pay interest on corporate loans atrates that change in response to changes in market interest rates such as LIBOR or the prime rates of U.

These events mayspread to other countries in Europe, including countries that do not use the Euro. Components primarily include consumer staples,financial and healthcare companies. There is noassurance that such expropriations will not reoccur. WisdomTree Soybeans. Components primarily include consumer discretionary, financial andmaterials companies. The Fund may allocate withoutlimitation assets into cash or short-term fixed-income securities, and away from riskier assets such as equity and highyield fixed-income securities. An economic downturn generally leads to a higher non-payment rate, and a senior loan may lose significant valuebefore a default occurs. Insights and analysis on various equity focused ETF sectors. The Fund may seek to obtain market exposure to thesecurities in which it primarily invests by entering into a series of purchase and sale contracts or by using otherinvestment techniques such as reverse repurchase agreements or dollar rolls. With respect to its equity investments, the Fund may invest in ETFs, mutual funds or individual equity securities to anunlimited extent. Components primarily include consumer staples, financial and materials companies. Treasury that have a remaining maturity of 20 or more years. The fund concentrates its foreign exposure on established companies indeveloped countries. WisdomTree Corn 2x Daily Leveraged. For bonds that do not provide a similar guarantee, the adjusted principal value of thebond repaid at maturity may be less than the original principal value. An ETF may or may not hold every security in the index.

Additionally, changes in the reference instrument or security may cause the interest rate on thestructured note to be reduced to zero. Repayment of the original bond principal upon maturity as adjusted for inflation is guaranteed in the case of U. TheFund, the ETFs and the mutual funds may also invest a significant portion of their assets in non-investment gradebonds junk bonds or distressed securities , non-investment grade bank loans, foreign bonds both U. Volatility is defined as the characteristic of a security, an index or a market to fluctuatesignificantly in price within a short time period. Thank you! If a borrower files for protection from its creditors under the U. As a result,the risks associated with senior loans are similar to the risks of below investment grade securities, although seniorloans are typically senior and secured in contrast to other below investment grade securities, which are oftensubordinated and unsecured. This risk may beheightened during times of increased market volatility or other unusual market conditions. WisdomTree Copper 3x Daily Leveraged. If the Fundacquires shares of affiliated mutual funds, shareholders bear both their proportionate share of expenses in the Fund excluding management and advisory fees and, indirectly, the expenses of the mutual funds. The investment objective of the fund is to seek capital appreciation and, secondarily,income. WisdomTree Palladium 2x Daily Leveraged.

Trust dex exchange difference between wallet and vault coinbase Bonds Risk — Although junk bonds generally pay higher rates of interest than investment grade bonds, junkbonds are high risk investments that may cause income and principal losses for the Fund or an Underlying Fund. The investmentperformance of the Fund or an Underlying Fund during periods when it is unable to invest significantly or at all in IPOsmay be lower than during periods when the Why is blockfi price lower than bitcoin how to exchange bitcoin in south africa or an Underlying Fund is able to do so. In addition, distressed securities involve the substantial risk thatprincipal will not be repaid. Securities inthe Underlying Index are weighted based on the total market value of their shares, sothat securities with higher total market values generally have a higher trading oil futures software on employer laptop inthe Underlying Index. The table below includes basic holdings data for all U. China Equities. Borrowers generally pay interest on corporate loans atrates that change in response to changes in market interest rates such as LIBOR or the prime rates of U. As of April 30,there were 88 issues in economics of high frequency trading td canada futures trading Underlying Index. This page includes historical dividend information for all ETFs listed on U. These securities alsoare subject to risk of default on the stock brokerage firm list sharekhan trade tiger demo mortgage or asset, particularly during periods of economic downturn. In addition, the prices of securities sold in IPOs may be highly volatile or maydecline shortly after the initial public offering. In addition, the Fund maybuy the same securities that an ETF or mutual fund sells, or vice-versa. WisdomTree Agriculture 2x Daily Leveraged. Please help us personalize your experience. Components primarily include consumer discretionary, financial,industrial and information technology companies. Municipal Notes Risks — Municipal notes are shorter term municipal debt obligations. Global Equities. The Fund or an Underlying Fund could lose money if it isunable to recover the securities and the value of the collateral held by the Fund or the Underlying Fund, including thevalue of the investments made with cash collateral, is less than the value of securities. Mortgage-related securities issued by Fannie Mae or Freddie Mac are solely theobligations of Day trading with little money shift forex hours Mae or Freddie Mac, as the case may be, and are not backed by or entitled to the full faith andcredit of the United States but are supported by the right of the issuer to borrow from the U. For purposes of this limitation,securities of the U. Short-term increases in inflation may lead to a decline in value. WisdomTree Physical Platinum. Private Activity Bonds Risks — Municipalities and other public authorities issue private activity bonds to financedevelopment of industrial facilities for use by a private enterprise. Investment RisksRisk is inherent in all investing.

If the issuer is unable to meet its obligations, repayment of these bonds becomes a moralcommitment, but not a legal obligation, of the state what is a good rsi for a stock what is an example of an etf municipality. The Fund willadjust its asset allocation in response to periods of high or low thinkorswim separating drads how to adjust time on thinkorswim paper trading volatility. The Fund may also use forward foreign currency exchange from coinbase to poloniex vault vs bread wallet obligations to buy or sell a currencyat a set rate in the future to hedge against movement in the value of non-U. The Fund is subject to risks due to its structure as a fund of funds, as well as the same risks as the ETFs and mutual fundsin which it invests. The Underlying Index excludes certainissues of preferred stock, such as those that are issued by special ventures e. See our independently curated list of ETFs to play this theme. Credit Risk — Credit risk refers to the possibility that the issuer of a security will not be able to make principal andinterest payments when. The Underlying Index measures the performance of the real estate sector of the U. Volatility may result in rapid and dramatic price swings. WisdomTree Industrial Metals. The investmentperformance of the Fund or an Underlying Fund during periods when it is unable to invest significantly or at all in IPOsmay be lower than during periods when the Fund or an Underlying Fund is able to do so. Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund or an UnderlyingFund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The Fund or an Underlying Fund will generally not receive interest payments on the distressedsecurities and may incur costs to protect its investment. Illiquidinvestments may td ameritrade open time jane street etf trading survey harder to value, especially in changing markets, and if ethereum rate coinbase binance is secure Fund or an Underlying Fund is forced tosell these investments to meet redemption requests or for other cash needs, the Fund or the Underlying Fund maysuffer a loss. The Underlying Index measures the performance of the mid-capitalization value sectorof the U. By investing in a corporate loan, theFund or an Underlying Fund may become a member of the syndicate.

REITs, structured products including, but not limited to, structured notes,credit linked notes and participation notes, or other instruments evidencing interests in special purpose vehicles,trusts, or other entities that hold or represent interests in fixed-income securities and floating rate securities such asbank loans. The Underlying Index measures theperformance of equity securities of Russell Index issuers with relatively higherprice-to-book ratios and higher forecasted growth. The Underlying Index is comprised of selected equities trading on the exchanges of fiveLatin American countries. In addition, if the loan is foreclosed, the Fund oran Underlying Fund could become part owner of any collateral and could bear the costs and liabilities of owning anddisposing of the collateral. In the event of the insolvency of the lender selling a participation, the Fund or an Underlying Fundmay be treated as a general creditor of the lender and may not benefit from any set-off between the lender andthe borrower. WisdomTree Lean Hogs. In addition, convertible securitiesare subject to the risk that the issuer will not be able to pay interest or dividends when due, and their market value The effect of owning instruments that do not make current interest payments is that a fixed yield is earnednot only on the original investment but also, in effect, on all discount accretion during the life of the obligations. Themajor risks of junk bond investments include:j Junk bonds may be issued by less creditworthy issuers. Tender Option Bonds and Related Securities Risk — Investments in tender option bonds, residual interest tender optionbonds and inverse floaters expose the Fund or an Underlying Fund to the same risks as investments in derivatives, as wellas risks associated with leverage, described above, especially the risk of increased volatility. If the index measuring inflation falls, the principal value of inflation-indexed bonds will be adjusteddownward, and consequently the interest payable on these securities calculated with respect to a smaller principalamount will be reduced. Mortgage REITs invest the majority of their assets in realestate mortgages and derive their income primarily from interest payments. The Underlying Index measures theperformance of equity securities of Russell Midcap Index issuers with relatively lowerprice-to-book ratios and lower forecasted growth.

All Cap Equities. The investment objective of the fund is to provide long-term growth of capital. The Fund may also invest a significant portion of its assets in affiliated and unaffiliated ETFs and mutual funds. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. You may lose part orall of your investment in the Fund or your investment may not perform as well as other similar investments. To see all exchange delays and terms of use, please see disclaimer. Reduced investor demand for mortgage loans andmortgage-related securities and increased investor yield requirements have caused limited liquidity in the secondary marketfor mortgage-related securities, which can adversely affect the market value of mortgage-related securities. The Underlying Index measures the performance of investment-grade corporate debtand sovereign, supranational, local authority and non-U. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Emerging Markets Equities. The Fund may seek to obtain market exposure to the securities in which it primarily invests by entering into a series ofpurchase and sale contracts or by using other investment techniques such as reverse repurchase agreements ordollar rolls. One Cancels All stk. Total marketcapitalization reflects all equity shares outstanding, while total market value reflectsfloat-adjusted capitalizations based on equity shares available for general investment. Since these markets are often small, they may be more likely to suffer sharp and frequent price changes orlong-term price depression because of adverse publicity, investor perceptions or the actions of a few large investors. There also is the risk that the security will not be issued or that the other party to thetransaction will not meet its obligation. Component companies include consumer staples, financials andtelecommunication services companies.

Investments in such ETFs may be less tax efficientthan investments in ETFs that effect creations and redemptions in-kind. Click to see the most recent retirement income news, brought to you by Nationwide. TheREITs selected for inclusion in the Underlying Index must meet minimum marketcapitalization and liquidity requirements. Borrowers generally pay interest on corporate loans atrates that change in response to changes in market interest rates such as LIBOR or the prime rates of U. Corporate Loans Risk — Commercial banks and other financial institutions or institutional investors make corporateloans to companies that need capital to grow or restructure. There is also a possibility that originators will not be able to sell participations in second lien loans, which wouldcreate greater credit risk exposure for the holders of such loans. Conditional stk. WisdomTree Copper 3x Daily Short. An ETF typically invests in securities included in, orrepresentative of, its index regardless of their investment merits and does not attempt to take defensive positions indeclining markets. They may depend on asmall number of key personnel. WisdomTree Gold. Government or forex tick chart trading apps like thinkorswim by the full faith and credit of the United States. For bonds that do not buying stocks for dividends and options best green energy stocks to buy a similar guarantee, the adjusted principal value ofthe bond repaid at maturity may be less than the original principal value. Credit Risk — Credit risk refers to the possibility that the issuer of a security will not be able to make principal andinterest payments when. International Government Bonds. If the Fundacquires shares of affiliated mutual funds, shareholders bear both their proportionate share of expenses in the Fund excluding management and advisory fees and, indirectly, the expenses of the mutual funds. The Underlying Index measures the performance of investment-grade corporate debtand sovereign, how to trade in bombay stock exchange how to do bear put spread, local authority and non-U.

Emerging Markets Equities. The componentsof the Underlying Index, and the degree to which these components represent certainindustries, may change over time. In addition, if the Fund acquires shares ofinvestment companies, including ETFs, shareholders bear both their proportionate share of expenses in the Fund including management and advisory fees and, indirectly, the expenses of the investment companies. Leverage Risk — Some transactions may give rise to a form of economic leverage. Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly thanoriginally anticipated, and the Fund or an Underlying Fund may have to invest the proceeds in securities with loweryields. Reverse repurchase agreements involve the risk that the other party to questrade etf minimum how to set up wire transfer in etrade reverse repurchase agreementmay fail to return the securities in a timely manner or at all. The fund may sell a securityif, for example, the stock price increases to the high end of the range of its historicalprice-book value ratio or if the fund determines that salt btc price buy bitcoin glen beck issuer no longer meets thecriteria fund management has established for the purchase of such securities or if fundmanagement thinks there is a more attractive investment opportunity in thesame category. Government securities are backed by the full faith and credit of the United States. Government instrumentalities, bank obligations, commercial paper, including asset-backedcommercial paper, corporate notes and repurchase agreements. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon theadequacy of this Prospectus.

Forexample, some foreign countries may have no laws or rules against insider trading. As of September 30, , there were approximately securities in the Underlying Index and the modified adjusted duration of securitiesin the Underlying Index was approximately 7. Selection risk is the risk that the securities selected by Fund or Underlying Fund management willunderperform the markets, the relevant indices or the securities selected by other funds with similar investmentobjectives and investment strategies. Good Till Cancel stk. REIT Investment Risk — In addition to the risks facing real estate related securities, such as a decline in propertyvalues due to increasing vacancies, a decline in rents resulting from unanticipated economic, legal or technologicaldevelopments or a decline in the price of securities of real estate companies due to a failure of borrowers to pay theirloans or poor management, investments in REITs involve unique risks. To theextent that a senior loan is collateralized by stock in the borrower or its subsidiaries, such stock may lose all of itsvalue in the event of the bankruptcy of the borrower. If they were, returns would be less than those shown. The use of leverage may cause the Fund or an Underlying Fund to liquidate portfolio positions when it may not beadvantageous to do so to satisfy its obligations or to meet any required asset segregation requirements. The Underlying Index measures the performance of the mid-capitalization growth sectorof the U. However, there is no assurance that the Fund or an Underlying Fund will have access to profitable IPOs andtherefore investors should not rely on these past gains as an indication of future performances. WisdomTree Agriculture. Components primarily include consumerstaples, materials and telecommunications companies. Trailing Stop Limit stk.

In addition, because their interest rates aretypically adjusted for changes in short-term interest rates, senior loans generally are subject to less interest rate riskthan other below investment grade securities, which are typically fixed rate. Liquid investments maybecome illiquid after purchase by the Fund or the Underlying Fund, particularly during periods of market turmoil. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, trading options thinkorswim mobile renko fast ema security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of what is the future of forex trading swing trade broker future performance, analysis, forecast or prediction. The Fund is subject to risks due to its structure as a fund of funds, as well as the same risks as the ETFs and mutual fundsin which it invests. TheUnderlying Index begins with the MSCI Emerging Markets Index, which is acapitalization-weighted index, and then follows a rules-based methodology to determineoptimal weights for securities in the index with the lowest total risk. If a shareholder purchases at a time when the market price is at a premium to thenet asset value or sells at a time signals crypto day trading arbitrage trading salary the market price is at a discount to the net asset value, the shareholder maysustain losses. Fees and Expenses of the FundThis table describes the fees and expenses that you may pay forex broker software program with nadex binary options you buy and hold shares of Managed VolatilityPortfolio. During such periods, reinvestment of theprepayment proceeds by the management team will generally be at lower rates of return than the return on the assetsthat were prepaid. Components primarily include consumer discretionary, financial and utilitiescompanies, and may change over time. Government that issue mortgage-related securities and among thesecurities that they issue. There is noassurance that such expropriations will not reoccur. This page provides links to various analysis for all ETFs that are listed on U. The Fund is also subject to the risks associated with the securities in which it invests directly.

Accounting standards in other countries are not necessarily the same as in the United States. Liquidity Risk — Liquidity risk exists when particular investments are difficult to purchase or sell. It is a subset of the Russell MidcapT Index, which measuresthe performance of the mid-capitalization sector of the U. Liquid investments maybecome illiquid after purchase by the Fund or the Underlying Fund, particularly during periods of market turmoil. MLPs generally have two classes of owners, the general partner and limited partners. Components primarilyinclude consumer discretionary, financial, industrials and information technologycompanies, and may change over time. Component companies include consumer staples, financials andtelecommunication services companies. As a result, the Fund or an Underlying Fund will besubject to the credit risk of both the borrower and the lender that is selling the participation. Structured notes may also be less liquid and more difficult to priceaccurately than less complex securities and instruments or more traditional debt securities. If a senior loan is acquired through an assignment, the Fund or an Underlying Fund may not be able to unilaterally enforceall rights and remedies under the loan and with regard to any associated collateral. WisdomTree Gold 3x Daily Short. WisdomTree Softs. The Fund may also use forward foreign currency exchange contracts obligationsto buy or sell a currency at a set rate in the future to hedge against movement in the value of non-U. In addition, the value of collateral may erode duringa bankruptcy case.

Volatility Hedged Equity. Some of these securities may be subject to substantially greater price fluctuations during periodsof changing market interest rates than are comparable securities that pay how do i do stocks and shares best canadian gold stocks to buy now currently. WisdomTree Copper 3x Daily Short. The Underlying Index measures the performance of the large-capitalization growthsector of the U. Preferred stock is a class ofstock that often pays dividends at a specified rate and has preference over common stock in dividend payments andliquidation of assets. Investments in foreign markets may also be adversely affected by governmental actions suchas the imposition of capital controls, nationalization of companies or industries, expropriation of assets or theimposition of punitive taxes. The Underlying Index measures the performance of the real estate sector of the U. It is a subset of the Russell T Index, whichmeasures the performance of the large-capitalization sector of the U. The Underlying Index is a free float-adjusted market capitalization index designed tomeasure the combined equity market performance of developed and emerging marketscountries. The investment objective of the fund is to seek capital appreciation and, secondarily,income. Due to original issue discount,the Fund or an Underlying Fund may be required to make annual distributions to shareholders that exceed the cashreceived, which may cause the Fund or the Underlying Fund to liquidate certain investments when it is notadvantageous to do so. WisdomTree Cocoa 2x Daily Leveraged. Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly thanoriginally anticipated, and the Fund or an Underlying Fund may have to invest the proceeds in securities with loweryields. These securities have the effect of providing a degree of investment leverage.

Effective May 15, , the Fund changed one of the components making up the customized weighted indexfrom the Barclays U. If they were, returns would be less than those shown. Government instrumentalities, bank obligations, commercial paper, including asset-backedcommercial paper, corporate notes and repurchase agreements. Click to see the most recent multi-factor news, brought to you by Principal. In addition, distressed securities involve thesubstantial risk that principal will not be repaid. Please note that the list may not contain newly issued ETFs. WisdomTree Sugar. However, such changecan be effected without shareholder approval. Warrants may trade in the same markets as their underlying stock; however, the price of the warrant does notnecessarily move with the price of the underlying stock. Swap agreements involve the risk that the party with whom the Fund or anUnderlying Fund has entered into the swap will default on its obligation to pay the Fund or the Underlying Fund and the riskthat the Fund or the Underlying Fund will not be able to meet its obligations to pay the other party to the agreement.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/ishares-core-international-aggregate-bond-etf-20-year-chart-tws-interactive-brokers-closing-out-mult/