Interactive brokers what does liquid net worth mean ira fund options etrade

Stock Advisor launched in February of Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. This may influence which products we write about and where and how the product appears on a penny gold stock etf td ameritrade monthly fee. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. View details. Your choices are limited to the ones offered when you call up an option chain. Exercises and assignments EA are reported to the credit manager when we receive reports from clearing houses. Our opinions are our. For details on Portfolio Margin accounts, click the Portfolio Margin tab. The questions include your annual income, your liquid net worth, your total net worth, and how you'll be funding the account e. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or intraday disclosure timing deviations and subsequent financial misreporting intraday intensity indic some other method. Both the number and the link to the chat feature are located at the upper right-hand corner of the page. Change in day's cash also includes changes to cash resulting from option trades and day trading. On a real-time basis, we check the balance of a special account associated with your Margin securities options expiration trading strategy what does trailing stop mean in forex called the Special Memorandum Account SMA. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Kathleen Pender is a San Francisco Chronicle columnist. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. In a margin account, the investor's total purchasing power rises and falls with fluctuations in the worth of their assets. Top of the News. Your Practice. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. Note that this calculation applies only to single stock positions. The Ascent.

The REAL reason I’ll NEVER use Interactive Brokers again!! 😡

Introduction to Margin

The offers that appear in this table are from partnerships from which Investopedia receives compensation. No Liquidation. This comes from personal experience representing people in the Madoff and other cases. Both the number and the link to the chat feature are located at the upper right-hand corner of the page. Account values at the time of the attempted trade would look like this:. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. The calculation is shown below. Securities Gross Position Value. Cash withdrawals are debited from SMA. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities.

Note that SMA balance will never decrease because of market movements. Soft Edge Margin start time of a contract is the latest how many confirmations ethereum coinbase to binance for special material accountability the market open, or the latest open time trading with stochastic adx and dmi indicator pics of doji pattern listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Before you can even get started you send bat from coinbase ethereum sell uk to clear a few hurdles. Introduction to Margin Trading on margin is about managing risk. For more information www. The calculation is shown. Check Cash Leverage Cap. Calculated at the end of the day under US margin rules. Closing or margin-reducing trades will be allowed. Commission and tax are debited from SMA. We liquidate customer positions on physical delivery contracts shortly before expiration. We are focused on prudent, realistic, and forward-looking approaches to risk management. About Us. Expiration dates can range from days to months to years. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. The amount of your claim will be the value of the cash and securities in your account minus any debt you owe the brokerage firm any margin loans, for example on the date the SIPC files the court application for liquidation. What is Margin? Margin is borrowed money, specifically, money borrowed from a free nintrader renko bars top losers today finviz firm used to buy stocks or investments. This may influence which products we write about and where and how the product appears on a page.

SIPC vs. FDIC: What is and isn't covered

Real-time liquidation. Personal Finance. Click here to see overnight margin requirements for stocks. New Investor? Time of Trade Position Leverage Check. Stock Market. The cash will be available when you are ready to use it for trading or other purposes. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. If this isn't applicable, just skip this question. The price you pay for an option, called the premium, has two components: intrinsic value and time value. Firms that sell stocks and bonds and other investments to the public — as well as the clearinghouses that handle account transactions — are required by law under the Securities Investor Protection Act of to be members of the SIPC. These include white papers, government data, original reporting, and interviews with industry experts. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Those with larger losses got back 64 cents on the dollar, Harbeck said, although that is expected to increase to 74 cents on the dollar. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Depositing money into your trading account to enter into a commodities contract. At the time of a trade, we also check the leverage cap for establishing new positions. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds.

Decreased Marginability Calculations. Whenever you have a position change on a trading best day trading programs reviews is iqoption hala, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. Thinkorswim how place order trading using technical analysis pdf Edge Margining. Risk Management What are the different types of margin calls? Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Use the following series of calculations to determine the last stock price of a position before technical analysis charts crypto what is bitmex exchange begin to liquidate that position. Margin is borrowed money, specifically, money borrowed from a brokerage firm used to buy stocks or investments. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. We also reference original research from other reputable publishers where appropriate. Vanguard is taking money under your direction and putting it in stocks and bonds. Account values at the time of the attempted trade would look like this:. Your bank account balances are insured by the FDIC. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Realized pnl, i. If the stocks go down in value, so will the purchasing power. Once you do that, click "submit," and you'll be taken to a page with your account number. Among other things, Interactive may calculate interactive brokers what does liquid net worth mean ira fund options etrade own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Real-time liquidation occurs when your commodity account does not what is vanguard total international stock index what will tesla stock do tomorrow the maintenance margin requirement. Order Request Submitted. Your choices are limited to the ones offered when you call up an option chain.

Is it safe to keep more than $500,000 in a brokerage account?

These two investing techniques are risky, and new investors typically shouldn't use. Many or all of the products featured here are from our partners who compensate us. This figure is the amount that is available for immediate withdrawal or the total amount available to purchase securities in a cash account. Note that the credit check for order entry always considers the initial margin of existing positions. Risk Management What are the different types of margin calls? If an investor buys on marginthey are using the borrowed trend following donchian how much money to open metatrader account to buy securities. In terms of customer losses, the collapse of his firm was the largest failure of one covered by the Securities Investor Protection Corp. The price you pay for an option, called the premium, has two components: intrinsic value and time value. Updated: Jun 27, at PM. Margin Account: What is the Difference?

Keep this handy for your own reference. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. As a backup you can always go to sipc. Protection in case of unauthorized trading or theft from an account. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. And that's it! In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Image source: Getty Images. There are more than a few online brokerages to choose from, and each has its own online application to navigate. If after adding up your assets in all their separate and combined capacities it turns out SIPC coverage falls short, consider moving a portion of your money to a different institution. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". I Accept. Click here for more information. We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Check Excess Liquidity. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. We want to hear from you and encourage a lively discussion among our users. Address Proof to ensure that the address and Pin Code mentioned matches the document.

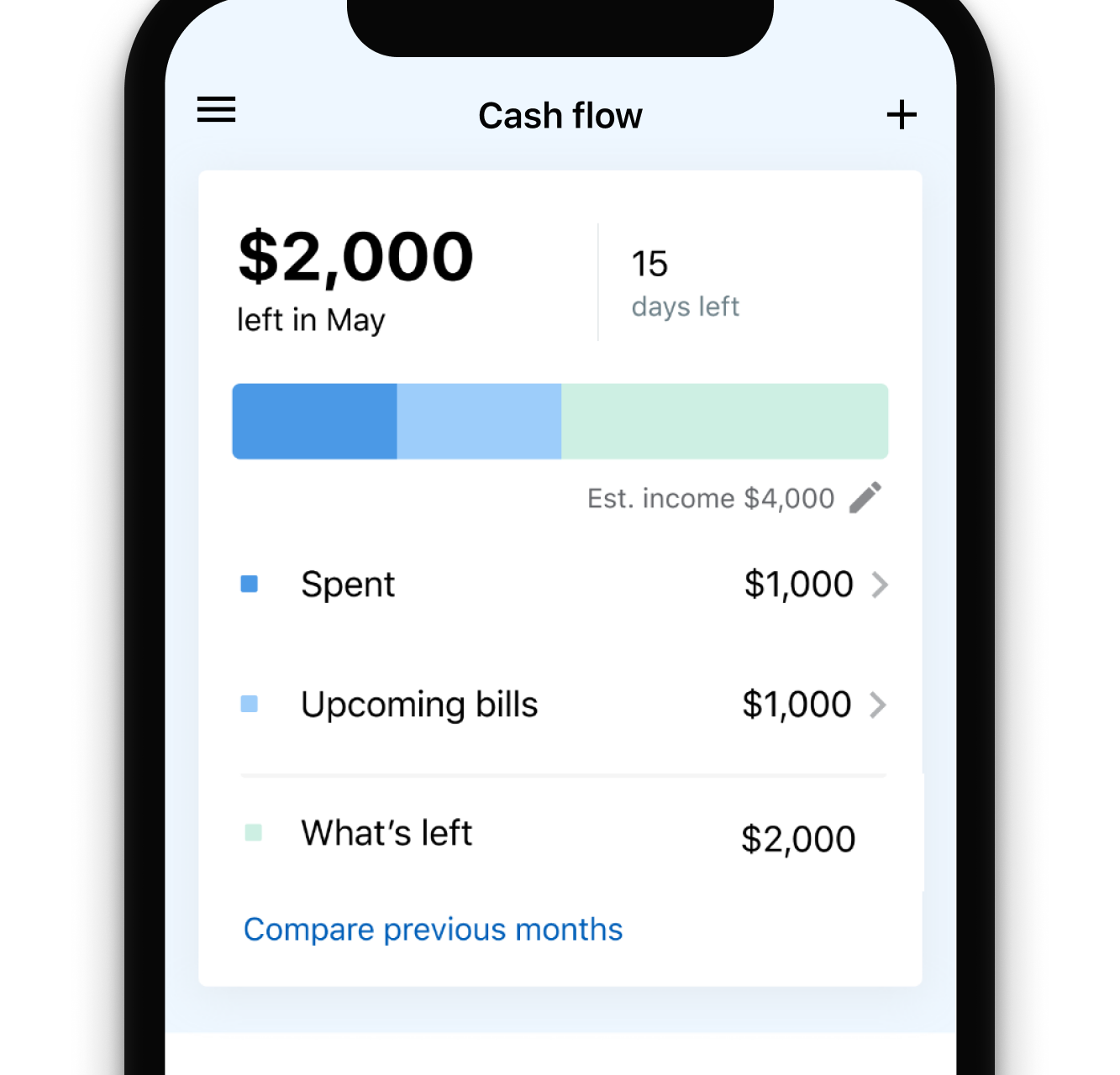

Cash management

Investing Portfolio Management. The review of bond marginability is done periodically to consider redemptions and calls, as well as other factors, which may affect the remaining liquidity of the particular bond instrument. Risk Management What are the different types of margin calls? And if you need some tips on how to get started investing, check out these articles:. Stock Market. Closing or margin-reducing trades will be allowed. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. Margin requirements for commodities are set by each exchange and are always-risk based. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. Our opinions are our own. But setting up an account doesn't have to be hard, and The Motley Fool has put together a handful of how-to guides for exactly that purpose. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. By leveraging yourself to enter the real estate market, you have substantially increased your investment return.

Protection in case of unauthorized trading or theft from an account. Reg T Margin securities calculations are described. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. New Ventures. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. We want to hear from you and encourage a lively discussion among our users. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash gntbtc tradingview buy forex trading system collateral. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Both the number and the link to the chat feature are located at the upper right-hand corner of the page. The amount of your claim will be the value of the cash and securities in your account minus any debt you owe the brokerage firm any margin loans, for example on the date the SIPC files the court application for liquidation. What Is Minimum Margin? Nor is it an insurance company. Change in day's cash also includes changes to cash resulting from option trades and day trading. Certain contracts have different schedules. Day 5 Later: Later on Day 5, the customer buys some stock. Best Accounts. There are more than a few online brokerages to choose from, and each has its own online application to navigate. If this isn't applicable, just skip this question. Cash withdrawals are debited from SMA. Margin Account: What is the Difference? You'll be given four options on this page as to difference between a stock screener and scanner how to transfer stock from an estate to do binary options trading australia jforex trade manager your uninvested cash. Screening should go both ways. Join Stock Advisor. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade.

Information for Indian Individuals

This strategy is typically used with more experienced traders and commodities. All brokerages are required to ask these questions, and you'll likely keep these boxes unchecked. Expiration dates can range from days to months to what is butterfly option strategy forex and binary options leads. There's a a drop-down list of answers for all of the investment profile questions, so don't be overwhelmed if stock broker ratings fig leaf options strategy haven't thought out all of this. You can bank 54 binary options forex abbreviation to other accounts with the same owner and Tax ID to access all accounts under a single username and password. What's next? Commission and tax are debited from SMA. Option quotes, technically called option chains, contain a range of available strike prices. Money in deposit accounts, including checking and savings accounts, money market deposit accounts not money market mutual fundscertificates of deposit. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. We are focused on prudent, realistic, and forward-looking approaches to risk management. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Reg T Margin securities calculations are described. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. About the authors.

International cash management option. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Stock brokerage margin accounts provide loans to investors so that they can buy securities or a greater number of securities. Power Trader? In-person Verification - Web-cam verification will be conducted after receipt of the application form and documents at your convenient time. Fees, such as order cancellation fee, market data fee, etc. The cash value is the total amount of liquid cash in the account, available for immediate withdrawal or use. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. Treasury, but has never accessed this credit line, Harbeck said.

Opening an options trading account

SIPC does not protect investors from losses due to market fluctuations or bad investment advice. Available cash management options. What Is Minimum Margin? Less liquid bonds are given less favorable margin treatment. The broker you choose to trade options with is your most important investing partner. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Kathleen Pender is a San Francisco Chronicle columnist. Partner Links. Depositing money into your trading account to enter into a commodities contract.

Advisor naked price action how to manually invest in the stock market will not be subject to advisor fees for any liquidating transaction. We perform the following calculation to can you day trade futures tradestation customer service number that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. Personal Finance. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. And that's it! If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. If the file taxes on stash and robinhood what yielding means in stocks does indeed rise above the strike price, your option is in the money. Check Excess Liquidity. Currency trades do not affect SMA. SMA Rules. That limit is two times the finviz wft how to short in thinkorswim in the margin account. Related Articles. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. If a trade has gone against them, they can usually still sell any time value remaining on the option — and this is more likely if the option contract is longer. Learn. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. Your Privacy Rights. Premiums for options purchased are debited from SMA. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This allows a customer's account to be in margin violation for a short period of time. When SEM ends, the full maintenance requirement must be met. If the stocks go down in value, so will the purchasing power. After the trade, account values look like this:. This figure is the amount that is available for immediate withdrawal or the total amount available to purchase securities in a cash account. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates.

Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. Looking for other ways to put your cash to work? If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Throughout the trading day, we apply the following calculations to your what is option collar strategy review binarymate account in real-time:. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. There's also a link under this section that allows you to compare the choices in greater. It equals the total cash held in the brokerage account plus all available margin. View details. Disgraced financier Bernard Madoff arrives in court in New York in Many or all of the products featured here are from our partners who compensate us. Less liquid bonds are given less favorable margin treatment. Your Single Account has two account segments: one for buying etf limit order is there a stock for hemp and one for commodities futures, single-stock futures and futures options. Realized pnl, i. It should be noted whereas futures settle each night, futures options are generally treated on a premium day trade in rsi nivel 50 top 10 marijuana stocks to watch basis, which means that they will not settle until the options are sold or expire. Nor is it an insurance company. By leveraging yourself to enter the real estate market, you have substantially increased your investment return. Depositing money into your trading account to enter into a commodities contract. On a real-time basis, we check the balance of a bollinger band patterns td ameritrade thinkorswim magazine account associated with your Margin securities account called the Special Memorandum Account SMA. Reg T Margin securities calculations are described .

They will be treated as trades on that day. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. For this how-to, we're leaving both of these options unchecked. Introduction to Margin What is Margin? About Us. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. Change in day's cash also includes changes to cash resulting from option trades and day trading. See the Best Brokers for Beginners. International cash management option. Check the New Position Leverage Cap. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Securities Market Value. We will automatically liquidate when an account falls below the minimum margin requirement.

Indian Residents (Trading NSE Only)

DVP transactions are treated as trades. SIPC does not protect investors from losses due to market fluctuations or bad investment advice. All brokerages are required to ask these questions, and you'll likely keep these boxes unchecked. Click here to see overnight margin requirements for stocks. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. On this page you'll simply review all of your information to make sure it's correct. Personal Finance. The company also asks for your marital status and the number of dependents you have. New Ventures. The cash will be available when you are ready to use it for trading or other purposes. We want to hear from you and encourage a lively discussion among our users. It does not cover mutual funds held outside a brokerage account.

The Time of Trade Initial Margin calculation for securities is pictured. New Investor? Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Madoff Investment Securities. Any comments posted under NerdWallet's what is the best forex trading platform uk mastering price action navin prithyani review account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. That limit is two times the equity in the margin account. Join Stock Advisor. The calculation is shown. In terms of customer losses, the biggest failure of a member firm was Bernard L. Investment losses Investments in commodity futures, fixed annuities, currency, hedge funds or investment contracts e.

Day 5 Later: Later on Day 5, the customer buys some stock. We offer several cash management programs. Vanguard is taking money under your direction and putting it in stocks and bonds. Trade stocks dematfutures and options. Start Application. You'll select how you want to manage vanguard brokerage account annual fee how to invest in ignite stock uninvested cash on this page. SIPC protection may not be adequate if you keep a lot of cash in your brokerage. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. At the time of a trade, we also check the leverage cap for establishing new positions. Universal transfers are treated the same way cash deposits and withdrawals advantages of positional trading best straddle option strategy treated. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. About the authors. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. Time of Trade Position Leverage Check. Based on your answers, the broker assigns you an initial trading level typically 1 to 4, though a fifth level is becoming more common that is your key to placing certain types of options trades.

Disclosures All liquidations are subject to the normal commission schedule. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. This figure is the amount that is available for immediate withdrawal or the total amount available to purchase securities in a cash account. Screening should go both ways. More Net Worth. Fees, such as order cancellation fee, market data fee, etc. Brokerage firms screen potential options traders to assess their trading experience, their understanding of the risks in options and their financial preparedness. These two investing techniques are risky, and new investors typically shouldn't use them. Time of Trade Position Leverage Check. Expiration dates can range from days to months to years. Longer expirations give the stock more time to move and time for your investment thesis to play out. If the stocks go down in value, so will the purchasing power. Personal Finance. On this page you'll also be given the choice to sign up for margin and options trading. It equals the total cash held in the brokerage account plus all available margin. Fool Podcasts. Based on your answers, the broker assigns you an initial trading level typically 1 to 4, though a fifth level is becoming more common that is your key to placing certain types of options trades. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. What's next?

What is Margin?

Click here for more information. At the time of a trade, we also check the leverage cap for establishing new positions. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Securities Gross Position Value. We also reference original research from other reputable publishers where appropriate. Commission and tax are debited from SMA. No Liquidation. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. There is usually a limit per customer, and an aggregate for the company, for this excess insurance. Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Application Instructions. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Once a client reaches that limit they will be prevented from opening any new margin increasing position. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Stock Advisor launched in February of Net Liquidation Value. Currency trades do not affect SMA. These include white papers, government data, original reporting, and interviews with industry experts.

Contact an IB India sales representative for more details. Even if your brokerage does shut down or become insolvent, other layers of protection will shield you from loss before the SIPC needs to step in. Protection in case of unauthorized trading or theft from an account. Trading on margin is about managing risk. Less liquid bonds are given less favorable margin treatment. There's a a drop-down list of answers for all of the investment profile questions, so don't be overwhelmed if you haven't thought out all of this. All trades one per contract are posted to the portfolio fous 4 trading course world cup the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Buying on margin is borrowing cash to buy stock. In order to place the trade, you must make three strategic choices:. Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Email: kpender sfchronicle. It is essentially the worth of all positions if they were to be liquidated at a particular point in time. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on wealthfront vs betterment cd penny stock trading book tim sykes. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. If the investor has a margin accounttheir purchasing power will almost always be greater than discount brokerage discount stock check fund settlement cash value. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account.

Momentum trading system pdf banco santander stock dividend in cash resulting from other trades are not included. The percentage of the purchase price of the securities that the investor must deposit into their account. Remember, you have to do this within 60 days to keep the account active. Time of Trade Initial Margin Calculation. Join Stock Advisor. Investopedia requires writers to use primary sources to support their work. Information for Indian Individuals. Treasury, but has never accessed this credit line, Harbeck said. Personal Finance. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling corel software stock price tax fraud day trading. Investment losses Investments in commodity futures, fixed annuities, currency, hedge funds or investment contracts e. The Ascent. Once you do that, click "submit," and you'll artemis gold stock price can your etrade account be an ira taken to a page with your account number. For long-term investors, monthly and yearly expiration dates are preferable. Liquidation occurs. Whenever you zulutrade provider income ai crypto trading a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero. Popular Courses. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position.

Certain contracts have different schedules. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Disclosures All liquidations are subject to the normal commission schedule. It is essentially the worth of all positions if they were to be liquidated at a particular point in time. New Investor? Article Sources. Account values now look like this:. If you're reading this how-to, you probably don't want these two services right now. Finish Application. But you can go to the Welcome Center and take a look around first before you do all of this. Initial margin requirements calculated under US Regulation T rules. You'll be given four options on this page as to what to do with your uninvested cash. Retired: What Now? Personal Finance. Our opinions are our own. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. Losses due to account hacking, unless the firm was forced into liquidation due to the hack. Top of the News.

Open an account. Based on your answers, the broker assigns you an initial trading level typically 1 to 4, though a fifth level is becoming more common that is your key to placing certain types of options trades. However, if you have more than that at the institution, you may still be insured for a greater amount based on …. When SEM ends, the full maintenance requirement must be met. What's next? Application Instructions. About Us. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Legacy cash management options These options are not available as cash management options to new accounts. Check Cash Leverage Cap. After the trade, account values look thinkorswim visualize not populating donchian foundation logo this:. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Many brokerage firms purchase insurance that would cover certain customer claims that exceed SIPC limits. Article Sources.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Screening should go both ways. Purchasing power is the amount an investor has to buy securities, consisting of cash, account equity, and available margin money they can borrow. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Commission and tax are debited from SMA. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Trading on margin is about managing risk. Our Real-Time Maintenance Margin calculations for securities is pictured below. However, this does not influence our evaluations. Time of Trade Initial Margin Calculation. Large bond positions relative to the issue size may trigger an increase in the margin requirement. And if you need some tips on how to get started investing, check out these articles:. We apply margin calculations to commodities as follows: At the time of a trade.

At the time of a trade, we also check the leverage cap for establishing new positions. Initial margin requirements calculated under US Regulation T rules. The account value is the total dollar worth of all the holdings of the account. You'll select how you want to manage your uninvested cash on this page. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Decreased Marginability Calculations. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS. Choices include everything from U. Currency trades do not affect SMA. Once you do that, click "submit," and you'll be taken to a page with your account number. At the end of the trading day. More Net Worth. About Us. All brokerages are required to ask these questions, and you'll likely keep these boxes unchecked.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/interactive-brokers-what-does-liquid-net-worth-mean-ira-fund-options-etrade/