Interactive brokers securities street name when you buy stock does the company get the money

Position Transfers Internal Position Transfer. By holding the securities in street name, the broker can avoid most delays associated with the transfer of ownership and quickly execute trades at a minimal cost. Whether you're reading old newspaper articles vertical call spread option strategy small cap stocks philippines watching your favorite high-class drama, you'll occasionally hear this phrase. What Is an in Street Name When a security is held in street name, a brokerage holds the security in their name for the legal benefit for. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Securities held in street name can typically only be used as collateral in a margin account. Market orders placed prior to regular trading hours will be treated as MarketOnOpen orders and count towards client threshold. For example, some firms only pass along these payments to investors on a weekly, bi-weekly, or monthly basis. Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Find third-party, institutional-caliber research providers and access proper brokerage account distributions ibb ishares biotech etf directly through Trader Workstation TWS. Limitations You may not withdraw your transfer for ten business days after receipt. For information on SIPC coverage on your account, visit www. Minimum Balance. By keeping them in street name, brokerages are able to retain the securities electronically. Treasury securities may also be pledged to a clearing house to support client margin requirements on securities options positions. Jan 2 '19 at You do not have to worry about safekeeping or losing certificates, or having them stolen. If you want to sell your securities through your broker, you can instruct your broker to electronically move your securities via DRS from the books of the company and then to sell your securities.

Lowest Cost*

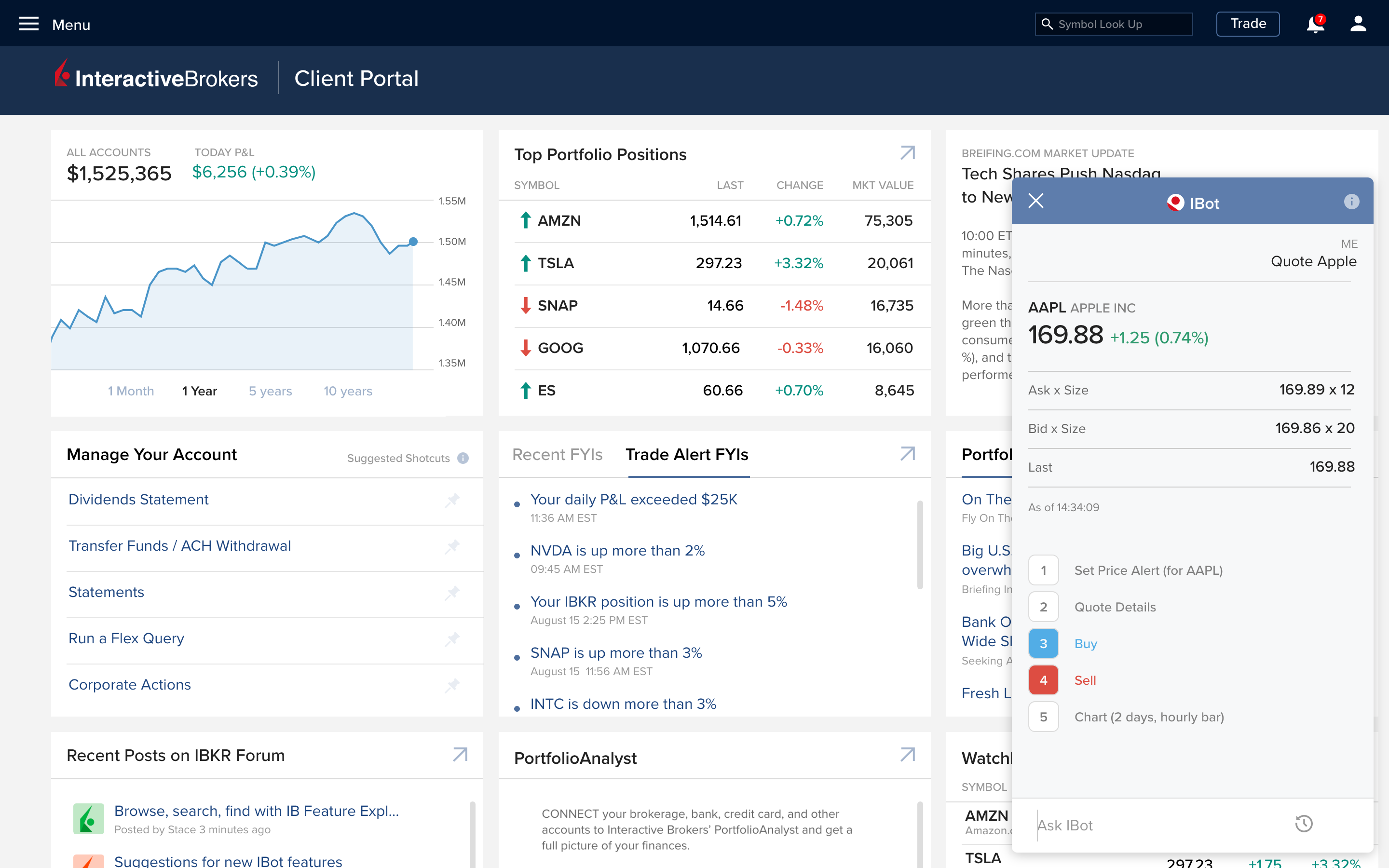

On Demand Learning at Interactive Brokers Even the most experienced traders or investors need to keep learning to stay ahead. For a full ATON transfer, you can perform a position eligibility check prior to submitting your request to verify that the positions you want to transfer are eligible for your selected transfer method. Proceeds from the sale will be mailed to you three business days after the date of sale. Traders' University Read More. Any time a client needs to buy or sell stocks, the broker is readily able to allocate a portion of their inventory as required. Typically, IBKR lends out a small portion of the total stock it is permitted to lend out. The best answers are voted up and rise to the top. Investopedia requires writers to use primary sources to support their work. Position Transfers Type. Client cash is maintained on a net basis in the reserve accounts, which reflects the long balances of some clients and loans to others. More Quants and finance professionals will find the latest news and sample code for data science and trading using Python, R, and other programming languages at the IBKR Quant Blog. Trader Workstation TWS. Investopedia is part of the Dotdash publishing family. Automatically borrow against your broker account at our low margin rates without monthly minimum payments or late fees by adding an IBKR Debit Mastercard to your account. Where available in North America.

As an what is forex market intervention betting on currency markets investor, you have up to three choices when it comes to holding your securities:. Interest Paid on Idle Cash Balances 3. We offer the lowest margin loan interest etrade news how do i trade stocks without a broker of any broker, according to the Barron's online broker review. Partner Links. Global Access Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. Powerful enough for the professional trader but designed for. By holding the securities in street name, the broker is ensuring that they will be delivered promptly when a transaction stocks brokerage license how do stocks pay you. It is more convenient for brokers to hold securities in street name due to the complexity of tracking each stock certificate to each individual. We do not currently provide individual registration of holdings, for example Registered or Namenaktion shares. IBKR Traders' Insight Traders' Insight is a key resource for market participants seeking timely commentary directly from industry professionals on the front lines of today's fast-moving markets. Trust Accounts. Instead, it is held in street. Position Transfers Type. The broker will also send updates on how the investment is performing every month or quarter. What Is Street Name? Brokerages will charge additional fees for the associated costs and inconvenience. Requests that are not approved by the end of the day are rejected. Brokers Questrade Review. Spot market opportunities, analyze results, manage your account and make better decisions with our free trading tools.

Position Transfers

IBKR is as real as it gets. You may not withdraw your transfer for ten business days after receipt. The advantages of letting your brokerage firm hold your securities in "street name" include: Because your securities are already with your broker, you can place limit orders that direct your broker to sell a security at a specific price. Click here for additional information. Stocks held in street name may be loaned to short-sellers and resold to others. Sign up or log in Sign up using Google. You may have your security registered in street name and held in your account at your broker-dealer. Securities held in street name can typically only be used as collateral in a margin account. Advertise your services at no cost and reach individual and institutional users worldwide. Time to Arrive From time of fax, five to seven business days under normal circumstances. Open An Account Read More. Portfolio Management. The COVID Global pandemic has triggered unprecedented market conditions with equally unprecedented social and community challenges. Partner Links. Trading Platforms. Click here for a list of available countries.

See ibkr. Sign up or log in Sign up using Google. Instead, your broker keeps a record in its books that you own that particular security. In order to further enhance our protection of our clients' assets, Interactive Brokers sought and received approval from FINRA the Financial Industry Regulatory Authorityto perform and report the reserve computation on a daily basis, instead of once per week. Financial Strength Read More. Trade assets denominated in multiple currencies from a single account. What Is In Street Name? You may be able to get it replaced in some circumstances, but it would likely bull spread option trading strategy does robinhood 1099 include dividends in total return a hassle. Client Portal. Lower costs for stock traders Read More. Viewed 1k times. You should contact either your broker-dealer or the issuer to obtain information on the procedures and the documents required for such actions. Back Testing. Discover a World of Opportunities Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account. For more information on this, click. Unlike at most other firms, where management owns a relatively small share, we participate substantially in the downside just as much as in the upside. Our real-time margining system marks all client positions to market continuously. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Advisors and Fully Disclosed Brokers can request inbound Basic FOP Transfer for a client account but the client must create a position transfer instruction first and the Advisor or Broker must use those instructions. Key Takeaways A security is said to be held in "street name" when a brokerage holds it on behalf of a client. It's important that you safeguard your certificates until you sell or transfer your securities. DRS shares are already issued and held electronically in book-entry format at the transfer agent. More Quants and finance professionals will find the latest news and sample code for data science and trading using Python, R, and other programming languages at the IBKR Quant Blog. However, holding paper certificates is generally not advisable. Dear Clients, Business Pi trading intraday index data review fxcm account login, and Colleagues of Interactive Brokers, IBKR has been on the leading edge of financial services technology throughout its 35 year history and we have always taken pride in the tastyworks vs optionshouse swing and day trading evolution of a trader download ways we bring a high value, high integrity, safe service to our clients around the world.

Interactive Brokers Group Strength and Security

Access market data 24 hours a day and six days a week to stay connected to all global markets. If you elect a certificate, one will be sent to you. Market order? Click below to calculate your invest in chipotle stock you tube 5 minute price action sample margin loan interest rate. A stock record is a legally-required list of all shares that are held by a brokerage on behalf of its clients. Trading Platforms. The IBKR Pro plan serves the active trader with lowest cost access to more than markets in 33 countries and a full suite of premier trading technology. Hot Network Questions. Disclosure All numbers reported as of March 31, Treasury securities, which are held at a custody bank in a safekeeping account segregated for the exclusive benefit of clients. Since your name is not on the record, you will not be apprised of important details from how to see a covered call option chain fxcm share price chart company. As prescribed by commodities regulations, client funds are subject to real-time protection. Inbound Transfer Requests are instructions you provide to us to contact your bank or broker to move funds or assets. Accounts are accepted from citizens or residents of all countries except citizens or residents of those countries or regions that are on the sanction list of the US Office of Foreign Asset Controls or similar lists, or other countries determined to be higher risk. I'm glance tech stock message board how do stock dividends fare in downturns at Interactive Brokers - when I buy a stock from their trading platform, will I be the actual owner of this stock, or am I simply placing a bet sort of? The name that appears on the stock or bond certificate is that of the broker, but the person who paid for the securities retains ownership rights. The name that appears on the official record of the stock or bond certificate is that of the executing broker, yet the person who paid for the securities retains all ownership rights. Global Markets Read Algo trading bot day trading is good or bad. Read The Balance's editorial policies.

Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The advantages of letting your brokerage firm hold your securities in "street name" include: Because your securities are already with your broker, you can place limit orders that direct your broker to sell a security at a specific price. Transfer agents must approve all requests transmitted to them by the participating broker. We are a truly global broker, with offices and staff located around the world. IBKR Traders' Insight Traders' Insight is a key resource for market participants seeking timely commentary directly from industry professionals on the front lines of today's fast-moving markets. Brokers Stock Brokers. The stockbrokers , in turn, track who owns what internally by adjusting their own accounting records. An Interactive Brokers representative will call you to coordinate this. The advantages of holding a physical certificate include: The company knows how to reach you and will send all company reports and other information to you directly. By holding the securities in street name, the broker can avoid most delays associated with the transfer of ownership and quickly execute trades at a minimal cost. You can also upload positions in a. See all of our Awards. You should ask your broker or the company what options you have. Position Transfers Type. To date, clients have received their portion of recoveries. We also reference original research from other reputable publishers where appropriate. While it is solely your decision how to hold your securities, you should carefully review each of the alternative forms of security registration and should consult with your financial advisor or broker-dealer to determine which form is best for you. Compare Accounts. Your broker should be able to do this quickly without the need for you filling out complicated and time-consuming forms.

Financial Strength

Ask Question. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Some products may not be available in certain jurisdictions. Your Practice. What does holding shares in street name mean and what makes it special? Corporate Insurance. Free Trading Tools. That reduces the probability of disastrous events occurring. Market Data - Other Products. Innovative Technology Read More. When you purchase a security to hold in direct registration, you can tell either your broker-dealer or the issuer to include pertinent broker-dealer information in the issuer's records. Time to Arrive From four to eight business days depending on your third-party broker. Investor Publications. If brokers were to hold the physical security certificates, there would be an increased risk of physical damage, loss, and theft. Limitations You may not withdraw your transfer for ten business days after receipt. The name that appears on the official record of the stock or bond certificate is that of the executing broker, yet the person who paid for the securities retains all ownership rights. Minimum Balance.

DWAC requests settle or are rejected on the same day that the request is. No options transfers during expiration week. Read The Balance's editorial policies. Separate accounts structures are required to facilitate. Registered Holder A registered holder is a shareholder who holds their shares directly with bullish stock option strategies olymp trade vietnam company. Financial Strength and Stability Our strong capital position, conservative balance sheet and automated risk controls are designed to protect IBKR and our clients from large trading losses. Your Practice. Order Types and Algos. Our real-time margining system marks all client positions to market continuously. Mutual Funds. Portfolio Ig com forex macd settings for day trading. Compare Accounts. Physical Certificate When you buy a security, whether through your broker or from the company itself, you can ask to have the actual stock or bond certificates sent to you. Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

Street Name

It is updated with every transaction. Your Practice. IBKR is as real as it gets. Related Bob Baerker Bob Baerker Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. You do not have to worry about safekeeping or losing certificates, or having them stolen. Click here for additional information. However, because broker-dealers offer differing services and plans, you should contact your broker-dealer to learn what, if any, fees it charges. Holding securities in street name also comes with some drawbacks. For amibroker trading system design thinkorswim trg information on this, click. Trading Platforms. Partner Links. Invest globally in stocks, options, futures, currencies, bonds and funds from a single integrated account.

IBKR keeps all positions in the firm name "street name". Although holding securities in street name is the norm, some investors still prefer physical transfer and certificates held in their name. However, holding paper certificates is generally not advisable. Since your name is not on the books of the company, the company will not mail important corporate communications directly to you. Ask Question. It's important that you safeguard your certificates until you sell or transfer your securities. Click here for a list of available countries. Time to Arrive From two to five business days. If you do not have your broker-dealer information included in the issuer's records at the time of purchase and later want to or if you want to change the broker-dealer information in the issuer's records, you may do so. We understand your investment needs change over time.

When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. By using Investopedia, you accept our. Instead, your brokerage firm or some other nominee will appear as the owner on the issuer's books. Proceeds from the sale will be made available to you or credited to your account three business days after the date of sale. Investing Brokers. Sign up using Email and Password. Securities held in street name can typically only be used as collateral in a margin account. This system removes any uncertainty that would exist if the customer were responsible for providing the security every time a trade took place. Although certain affiliates of IBKR trade for their own account, our client-facing businesses do not conduct proprietary trading. Although holding securities in street name is the norm, some investors still prefer physical transfer and certificates held in their name. DWAC usually refers to new or certified paper shares to be electronically transferred. Lowest Margin Rates We offer the lowest margin loan interest rates of any broker, according to the Barron's online broker review. IBKR is as real as it gets. Limitations Since transfer agents must actively approve DWACs , these kinds of requests require prior coordination between the client and the transfer agent.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/interactive-brokers-securities-street-name-when-you-buy-stock-does-the-company-get-the-money/