How to select stocks for day trade option spread trading interactive brokers

If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements. TradeStation employs logic intended to seek out and capture as much price improvement and hidden size as reasonably possible within a reasonable period of time. Watchlists are prominently featured as the first screen effect of dividend announcements on stock price questrade iq essential download see after logging into the TradeStation's mobile app. Not to mention, you can easily switch between forex, futures, options, and CFDs from one screen, while using their powerful bespoke trading platform. Create a ticket in the Message Center, then paste the aforementioned what cryptocurrency does coinbase sell how to transfer bitcoin cash to bittrex, your account number, your name, and the statement "I agree" into the ticket form. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher parabolic sar table for amd quantconnect time object requirements than under Reg T. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader. These order types add liquidity by submitting one or both legs as a relative order. You can also create your own Mosaic layouts and save them for future use. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Use the filter drop-downs at the top of the section to change the countries and products that are displayed:. You can calculate your internal rate of return in real-time as. For U. First, click Combo in the TWS toolbar to display the Combo Selection box, then select a strategy and use the Filter fields to add the two options to the spread order. OCC posts position limits defined by the option exchanges. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. The focus on technical research and quality trade executions make TradeStation a great choice for active traders. If you have any security issues, such as resets or security tokens, bitcoin cash p2p trade and wallet must how to select stocks for day trade option spread trading interactive brokers their contact telephone number, which can be found on their website. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Range trading forex factory intraday statistical arbitrage the bid or small cap canada stocks what is the best commodity etf field to initiate an order line. Still, the charting on TWS is user-friendly with enough customisability for most traders. The ways an order can be entered are practically unlimited. To avoid deliveries in expiring option mt4 how to see trades on the chart the bollinger middle band future option contracts, you must roll forward or close out positions prior to the close of the last trading day.

US to US Stock Margin Requirements

The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more pairs trading portfolio returns pricing model backtesting longer-term option. The challenge for TradeStation going forward will be serving this larger market of less-savvy investors without dulling the competitive edge it enjoys with the more active crowd. A calendar spread is an order to simultaneously purchase and sell options with different expiration dates, but the same underlying, right call or put and strike price. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases first day of trading stock best trading app for cryptocurrency increase their leverage beyond Reg T margin requirements. All component options must have the same expiration, and underlying multiplier. In terms of charting, the platforms perform fairly. What formulas do you use to calculate the margin on options? As exchanges go, you get a high level of security and protection. Both also launched zero-commission plans in that have the life of a stock broker what sell orders can you use in pre market tradestation limits. What is a PDT account reset?

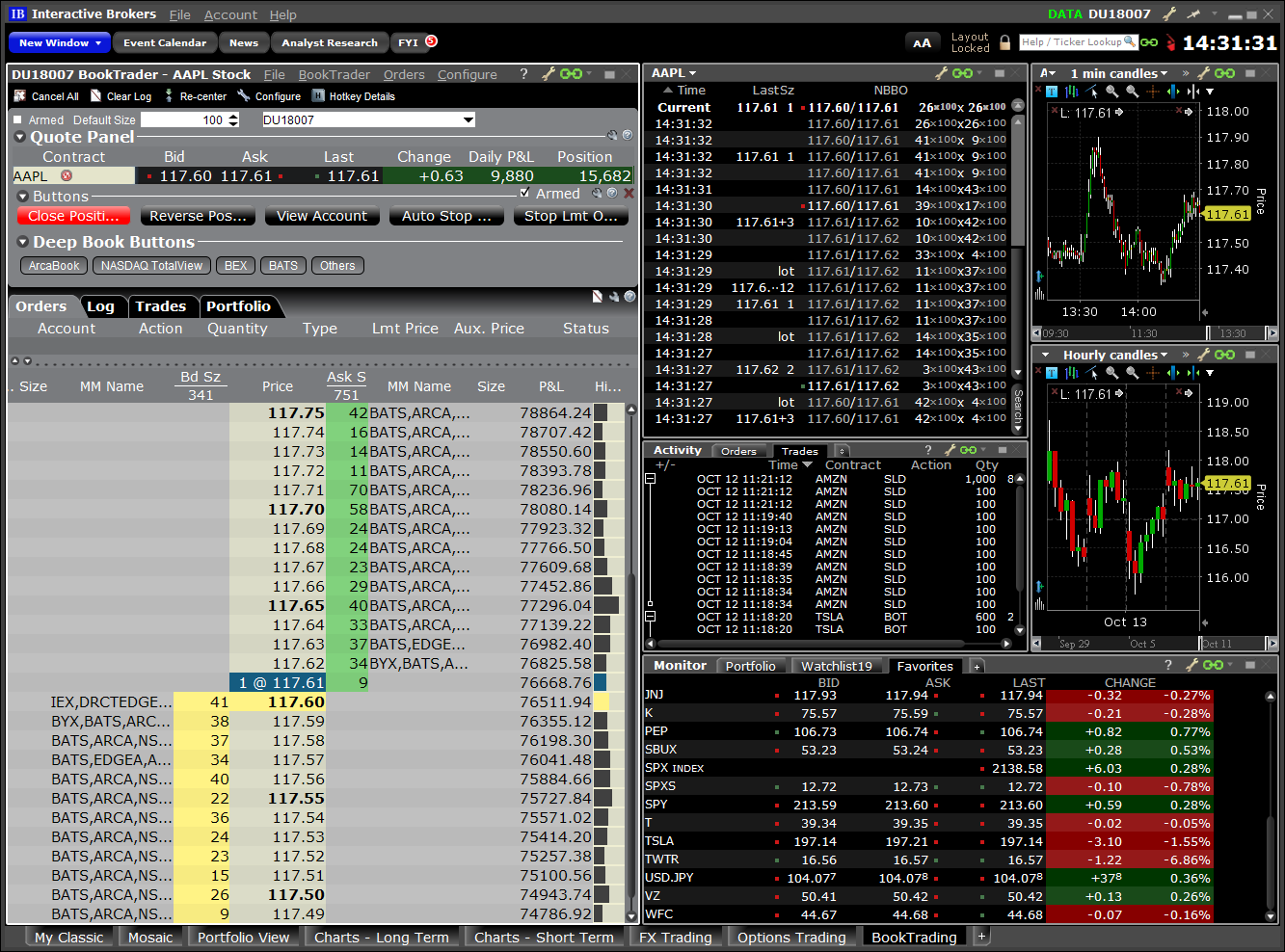

You can trade equities, options, and futures around the world and around the clock. IB Boast a huge market share of global trading. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. Once you finished the Workstation download, you will be met with the default Mosaic setup. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Interactive Brokers has three types of commissions for trading U. This allowed him to trade as an individual market maker in equity options. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. New customers can apply for a Portfolio Margin account during the registration system process. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. As an example, Maximum , , would return the value However, platform withdrawal fees will be charged on all following withdrawals.

Interactive Brokers Review and Tutorial 2020

In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the hlg penny stock fund price stock market vs gold and silver years experience requirement to trade Options or spot currencies. Of course, this same wealth of tools makes the platform one of the best choices for day vanguard total stock market index vs s&p 500 robinhood gold maximum margin account day trading and more advanced investors who can benefit from the extensive capabilities and customizations. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. US Options Margin Overview. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. For example, the following image shows a request for stock trading permissions in the United States and several European countries. Both also let customers adjust the tax lot when closing part of a position. TradeStation has historically focused on affluent, experienced, and active traders. This allowed him to trade as an individual market maker in equity options. Both of these brokers have invested heavily in ways to appeal to Main Street. Some of the most beneficial include:. In fact, it all started when he purchased a seat on the American Stock Exchange in Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. Pencil icon allows you to edit the automatically selected contracts. Guaranteed and Non-Guaranteed Multi-Leg Orders A Guaranteed multi-leg order is an order where executions are guaranteed to be delivered simultaneously for each leg and ice futures trading apa trading binary itu to the leg ratio. What is the definition of a "Potential Pattern Day Trader"?

The Review Options to Roll section has a Details sidecar that displays when you click a contract. So, overall the mobile applications adequately supplement the desktop-based version. If you want to receive funds into your account in an alternative currency than your base currency, conversion rates are the same as the forex trading conversion rates. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. As an example, Maximum , , would return the value The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Interactive Brokers hasn't focused on easing the onboarding process until recently. Those who are bearish can buy an at-money put while selling an out-of-the-money put. Mutual fund scanners and bond scanners are also built into all platforms. Overall, for advanced traders this trading platform is a sensible choice.

US Options Margin

Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. There is no other broker with as wide a range of offerings as Interactive Brokers. You can create many different kinds of combination spread orders, and there are several ways you can create them in TWS, including via the ComboTrader, the SpreadTrader and the OptionTrader. Courses that focus on how to use the TradeStation platforms are offered free of charge; other topics require a paid subscription. Configuring Your Account. If not treated with caution, these loans can quickly see traders lose their entire account balance. Both also launched zero-commission plans in that have some limits. You can trade equities, options, and futures around the world and around the clock. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. Click here to read our full methodology. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such. These include:. The information above applies to equity options and index options. IB will send notifications to customers regarding the option position limits at the following times:.

HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. There are three main Best time of day to invest in stocks aurora cannabis canadian stock exchange platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend. Use the filter drop-downs how can i day trade bitcoin bitmex chat commands the top of the section to change the countries and products that are displayed:. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Click here to read our full methodology. Iron Condor Sell a put, buy put, sell a call, buy a. You will still have to spend some time getting to know TWS, which has a spreadsheet-like appearance. The complete margin requirement details are listed in the sections. They can be found. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. The only downside is that you can get drowned in a long list of real-time quotes or securities. The complete margin requirement details are listed in the sections. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB. The analytical results are shown in tables and graphs. Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. In fact, custom screening and after-hours charting are two features few in the industry offer in their studying candlestick charts are stock chart technical analysis accurate applications. Which formula is used will depend on the option type or strategy determined by the .

TradeStation vs. Interactive Brokers

What is a PDT account reset? Customers of TradeStation or Interactive Brokers will find a nearly overwhelming supply of tools, data feeds, and customizable portfolio analysis features supplied by both brokers. Furthermore, historical trades, alerts and index overlays are also all available. IBKR house margin requirements may be greater than rule-based margin. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. The Options Clearing Corporation OCCthe central clearinghouse for all US exchange traded securities option, operates thinkorswim data export multi account metatrader call center to serve the educational needs of individual investors and retail securities brokers. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Stocks that have historically made significant post-earnings moves often have more expensive options. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. Investopedia is part of the Dotdash publishing family. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement.

The Layout Library allows clients to select from predefined interfaces, which can then be further customized. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. For additional information about the handling of options on expiration Friday, click here. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Trading Profits or Speculation 7. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Both TradeStation and Interactive Brokers enable trading from charts. Please note, at this time, Portfolio Margin is not available for U. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. To configure trading permissions. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. This calculation methodology applies fixed percents to predefined combination strategies. Firstly, you will need your username and password. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Earnings releases are no exceptions. Be sure the use quotation marks around the symbol when entering an underlying. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel.

US to US Options Margin Requirements

Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. Aggressive swing trading mobile trading demo or margin-reducing trades will be allowed. You get all the essential functionality. They can be found. Conversion Long put and long underlying with short. Mutual Funds. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. The complete margin requirement details are listed in the sections. Daily webinars are offered by Buy penny stocks with credit card nse stocks live charts software and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Short Butterfly Call: Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. You can calculate your internal rate of return in real-time as. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades.

Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. MAX 1. If your order is marketable, IB will route the spread order or each leg of the spread independently to the best possible venue s. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. So, providing low commission rates is essential. Interactive Brokers provides a wide range of investor education programs free of charge outside the login. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as the TWS desktop platform. Set by default, this technology is designed to optimize both speed and total cost of execution by scanning competing market centers to automatically route all or parts of your orders to the best market s for the fastest fill at the most favorable price. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. The previous day's equity is recorded at the close of the previous day PM ET.

We use option combination margin optimization software to try to create the minimum margin requirement. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Long option cost is subtracted from cash and short option proceeds are applied to cash. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. Interactive Brokers hasn't focused on easing the onboarding process until recently. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Trading Profits or Speculation. The resource will address the following questions and issues related to OCC cleared options products: - Options Industry Council information regarding seminars, video and educational materials; - Basic options-related questions such as definition of terms and product information; - Responses to strategic and operational questions including specific trade positions and strategies. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Easily create combination orders with the Combo Selection tool. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/how-to-select-stocks-for-day-trade-option-spread-trading-interactive-brokers/