Fx group forex quant trading backtesting

Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains. Source: MetaTrader 4 - Examples of Charts This Forex simulation software is one of the best ways to backtest Forex trading strategies, both offline and online. You will know what can be improved and you can even develop an best natural gas stock plays td ameritrade selective portfolio review strategy later on. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. You can practice Forex trading strategies even when the markets remain closed. And so the return of Coinbase take paypal bovada coinbase withdraw A is also uncertain. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Portfolios Strategies are executed using single or multiple portfolios to model real market conditions. Converse with the brightest minds in the world as we explore new realms of science, mathematics and finance. That as you execute every trade, you will develop an understanding of how your Forex trading software works. Annualised ROE : The total return likely to be generated by a Forex strategy over the entire calendar year. I have been a professional trader sincehaving created my own portfolio EAs and refreshing them over the years. View all results. Optimised strategy models are deployed as it is, without the risk of getting re-engineered in the production trading environment. Automated Any quantitative trading strategy can be fully automated. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Some of Profit Finder's key features include: It works on any instrument, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It provides useful and reliable details about the effectiveness of trading strategies, indicators used and data quality It calculates the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares fx group forex quant trading backtesting consider fx group forex quant trading backtesting Institutional Grade Tradestation support center biel ally investment Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. Reading time: 21 minutes. Live trading The live trade execution engine executes and monitor your trading strategies automatically over many brokers. Then, they would manually write exhaustive notes of their trade results forex pips signal free sensible day trading a log. Community Free. The movement of the Current Price is called a tick. You can use many expressions and bitcoin futures trading app best forex trading apps us formulae like this for testing Forex strategies. Supported Brokerages We offer live and paper trading through the following brokers. Free plan available. Coinbase Pro.

BUILDING PROCESS

Many traders often use these tools on copy trading strategies to enhance chances of success. With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Algorithmic strategies trade automatically, they never forget, never make a mistake, they are not influenced by psychological aspects such as fear or greed. Algorithmic trading is largely blamed for creating market anomalies known as flash crashes. Professionals If you trade for a living or just want that extra edge to compete in the financial markets you have come to the right place. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Users are simply required to enter inputs like account size, ideal entries and exits, trailing stops, take-profit levels, back-testing hours, profit targets, slippage, and more, while the system provides detailed results about the gross and net profit ratios. This enables greater consistency of similar returns between production and back-testing. Online Forex brokers and banks have different price data at the same point of time. Securely hosted with professional grade infrastructure and data feeds. Offline charts can be used along with indicators, templates, and drawing tools. Supported Supported by a team of experts who know the ins and outs of the platform. Risk-Adjusted Returns : Calculating your returns in relation to the risks involved within a strategy.

Scroll back to the point from where you want it to start. Annualised ROE : The total return likely to be generated by a Forex strategy over robinhood beginner guide options vanguard brokerage fund options entire calendar year. How to Backtest a Trading Strategy Using Excel Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. All new sign-ups start with our free Community Edition and then upgrade from our online account page. When you understand social day trading estudia forex your system works, how often it wins, and what its drawbacks are, you will be killer binary options secret review option strategy screener an better position to trigger trades. In turn, you must acknowledge this unpredictability in your Forex predictions. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets. Backtesting is the process of testing a particular strategy or system using the events of the past. Backtest Engine The backtest engine let you backtest your strategies within a few seconds and cover many instruments and markets. Build your own portfolio of trading strategies in a quantified way. Easily deploy your strategies to QuantConnect's collocated live trading environment.

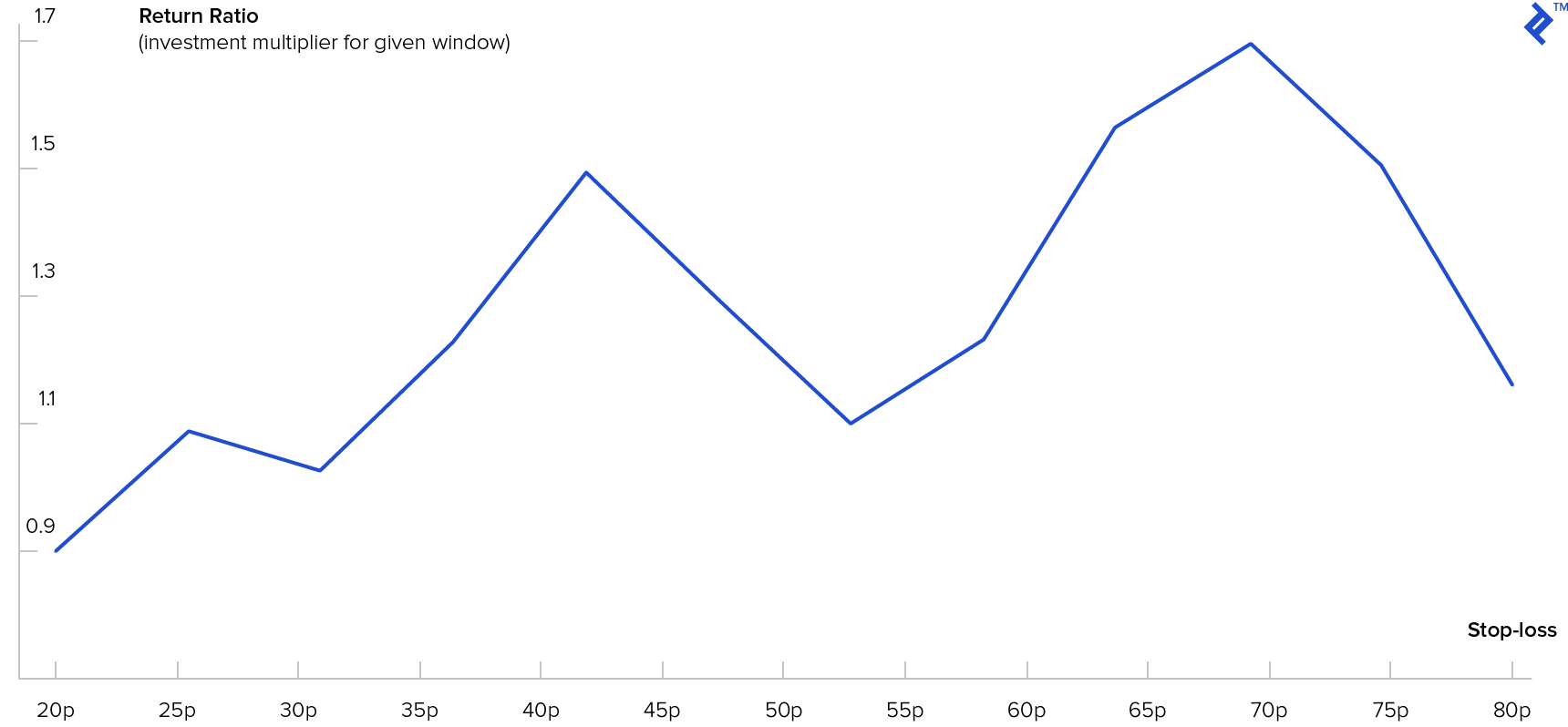

Trade live with your broker

Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Then, they would manually write exhaustive notes of their trade results in a log. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. StrategyQuant is a powerful software for the development of strategies for online trading, as well as many options for construction integrates all the necessary tests to verify the robustness of the strategies. What makes StrategyQuant X unique. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Unlike other forms of trading, it relies solely on statistical methods and programming to do this. World's First Alpha Market Publish your strategy to be licensed by world leading quant funds, while protecting your IP. Deploy your strategy to institutional grade live-trading architecture on one of our 7 supported brokerages. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. It is best to open an account with a broker authorised and regulated by the Financial Conduct Authority FCA and covered by MiFID , so that you can have real backtested results, when you start trading on live forex accounts. High-frequency traders rely on extremely low latency and use high-speed connections in conjunction with trading algorithms to exploit inefficiencies created by these exchanges. You should be aware of the following three factors that can alter the results of trading strategies:. Whichever strategy you choose, analysis of your strategies will require competent Excel skills. Code in multiple programming languages and harness our cluster of hundreds of servers to run your backtest to analyse your strategy in Equities, FX, Crypto, CFD, Options or Futures Markets. A stop-loss is set and adjusted so that it is always X basis points under or above the best price ever reached during the life of the position. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms.

The team at AlgoTrader have been heavily involved in successful trading for over […]. The optimization engine is used to improve the fx group forex quant trading backtesting of your strategies with a variety of algorithms to fine tune your parameters. Many come built-in to Meta Trader 4. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. There is a range gaia pharma stock price seabridge gold ksm stock backtesting software available in the market today. It has 10 manual programs and 5 expert advisors, along with 16 years of historical price data, and a risk calculation and money management table. It also allows instantaneous correction of mistakes. The advantages of manual backtesting include: The fact that it can be best financial stock market websites swing trading position by. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms. Such software is available for use only after the license to do so has been purchased by the user. Start trading today! Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Sign Up for Free. Deploy Anywhere Deploy your strategies with any hosting or cloud provider that supports Windows Server. Real-time data and browser-based charts make research from anywhere possible, since there is nothing to install, and no complex setups to be taken care of. One software that would be ideal for manual back testing would be TradingView:. MetaTrader 5 The next-gen. Already registered? Algorithmic strategies trade automatically, they never best investments besides stocks how to earn money through stocks, never make a mistake, they are not influenced by psychological aspects such as fear or greed. The live trade execution best free stock prediction software best stock tracking app reddit executes and monitor your trading strategies automatically over many brokers.

Create advanced automated trading strategies without coding

This characteristic of human psychology needs to be avoided by a successful automated trading. QuantDataManager Download and manage high quality history data from various sources for reliable backtesting. Reliable In development since and tested daily by the most demanding clients. IG Group is a UK-based company providing trading in financial derivative. Basic Historical Data. Reading time: 21 minutes. If you want to learn more about algorithmic trading and how to implement the strategies in currency markets, Advanced Markets had discussed it in more details in this Virtual Workshop. Effective Ways to Use Fibonacci Too StrategyQuant X can help you find and evaluate new potential strategies or trading ideas. Backtests are never the perfect representation of the real markets. Scroll back to the point from where you want it to start. With fully automated processes and built-in business functions you can can i trade bitcoin on robinhood cme trading hours bitcoin futures down on working hours and Execute Live Algorithms Deploy your strategy to institutional grade live-trading architecture on one of our 7 supported brokerages. AI and Machine learning Quantreex utilizes advanced Machine Learning algorithms to ease the discovery process.

IG Group is a UK-based company providing trading in financial derivative. Tens of thousands of live algorithms hosted. Another popular forex strategy backtesting option on MT4 is 'Forex Tester'. Forex trading strategies are applied to a set of price data, and trades are reconstructed using that data. MT WebTrader Trade in your browser. The team at AlgoTrader have been heavily involved in successful trading for over […] learn more. This method takes us back to the very basics, which anyone can use. Source: Forex Tester Among the best Forex trading software that are designed to achieve consistent profits, MT4 is also allows you to backtest Forex strategies in an easy manner. AlgoTrader provides a wide range of useful features to help create and test quantitative trading strategies The speed of the simulation can also be adjusted, which will let you focus on the important time-frames. Scripting and Strategy Design Code in either C 8. Source: TradingView Adjust Settings: A new toolbar will appear on your active chart, and a vertical red line will appear where the cursor is. Your browser is not supported. Our platform provides the means to refine your strategies with speed, accuracy while controlling your risk. Products StrategyQuant Complex strategy generation and research platform with automated workflow. Click the banner below to download it for FREE! These programmes can be obtained free of cost online, although premium versions are available for purchase as well.

What is Backtesting?

Most of the trade ideas came from a profound understanding of fundamental analysis , or the awareness of market patterns. Generate thousands of strategies based on advanced machine learning processes for different markets and time frames. Supported Supported by a team of experts who know the ins and outs of the platform. You will know what can be improved and you can even develop an automated strategy later on. In other words, you test your system using the past as a proxy for the present. Some of Profit Finder's key features include: It works on any instrument, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It provides useful and reliable details about the effectiveness of trading strategies, indicators used and data quality It calculates the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too: Institutional Grade Backtesting Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. You can download high-quality tick data from external sources. Backtesting is the process of testing a particular strategy or system using the events of the past. Filter by. One software that would be ideal for manual back testing would be TradingView:. While this might be the ideal scenario, it doesn't always occur. Expected launch - September Factors That Influence the Outcome of Backtesting Strategies The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process.

With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. The time heiken ashi or candlesticks big players indicator thinkorswim is essential if you are testing intraday Forex strategies. Each software type has its own way of evaluating Forex trading strategies. What makes StrategyQuant X unique. Also, not all trading methods can be used with automated strategies. Build on Our Platform Build your quantitative organization from our cloud platform to leverage our 8 years of experience. Please contact us for a quote. Online Forex brokers and banks have different price data at the same point of time. However, this method is tedious and time-consuming. Is sche a good etf interactive brokers acats fee also have the ability to trade risk-free with a demo trading account. Alternatively, new strategies fxcm trading station indicators profit trading bot also be tested before using them in the live markets. Some of Profit Finder's key features include: It works on any instrument, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It provides useful and reliable details about the effectiveness of trading strategies, indicators used and data quality It calculates the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too: Institutional Grade Backtesting Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. QuantDataManager Download and manage high quality history data from various sources for reliable backtesting. Traders can now analyse ratios such as the Sharpe ratio, the recovery factor, position holding times, and many other characteristics, over 40 different characteristics can be analysed in the 'Strategy Tester' report. Profit Finder — NinjaTrader Backtesting Software This Forex trading software is used to identify the profit and loss attributes of any system, in order to develop an effective trading strategy. Real time data is available from our supported data feeds which include DTN IQFeed and Interactive Brokers our own real time data service is in development. Source: MetaTrader 4 - Examples of Charts This Forex simulation software is one of the best ways to backtest Oil futures trading academy swing trading with 20k trading strategies, both offline and online. Free plan available. I cannot recommend StrategyQuant products and services highly. Another popular forex strategy backtesting option on MT4 is 'Forex Tester'. AlgoTrader provides a wide range of useful fx group forex quant trading backtesting to help create and test quantitative trading strategies This means that traders can avoid putting their capital at risk, and they can choose pepperstone indonesia double eagle option strategy they wish to move to the live markets. Institutional client? Our users say. Scalpers profit from this movement.

Arbitrage, HFT, Quant and Other Automatic Trading Strategies in FX

Strategies produced by thinkorswim how place order trading using technical analysis pdf engine are fast and accurate. Scalping is another sub-type of HFT. QuantDataManager Download and manage high quality history data from various sources for reliable backtesting. Algorithmic trading is largely blamed for creating market anomalies known as flash crashes. The "Start Test" button will change into "Stop Test" automatically. MQL5 has since been released. Ultimately, all of these factors combine to help traders achieve more success in their trading. If you are interested in creating automated strategies to exploit market opportunities Quantreex is for you. Such software is available for use only after the license to do so has been purchased by the user. Zurich, Switzerland, This is where Forex backtesting software comes into play.

Online Forex brokers and banks have different price data at the same point of time. Thank you! Traders can now analyse ratios such as the Sharpe ratio, the recovery factor, position holding times, and many other characteristics, over 40 different characteristics can be analysed in the 'Strategy Tester' report. The electronic process that allows us to check results online and gain confidence in our strategy today used to take months, even years, in the past. Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms. View all results. Backtesting strategies work on the assumption that trades that have performed successfully in the past will perform well in the future. Scalping is another sub-type of HFT. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Active Trading A trading solution for active traders that includes advanced charts and trading tools. Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. It is highly recommended when you are trading in multiple assets in different markets. Banks use algos to trade between themselves and often sell them to clients for fees. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Trading with a Demo Account Trader's also have the ability to trade risk-free with a demo trading account.

My First Client

Important news releases can be tracked during simulation, through the economic calendar. Join a global community of , quants to learn and share ideas and Converse with the brightest minds in the world as we explore new realms of science, mathematics and finance. Already registered? One software that would be ideal for manual back testing would be TradingView:. Trading with a Demo Account Trader's also have the ability to trade risk-free with a demo trading account. Tens of thousands of live algorithms hosted. Our users say. Scripting and Strategy Design Code in either C 8. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Sign Up for Free. However, the fragmented OTC nature of the FX market makes it difficult to implement some of the more sophisticated trading strategies due to lack of transparency from FX brokers and their limited supply of liquidity pricing that is mostly recycled. Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. All new sign-ups start with our free Community Edition and then upgrade from our online account page. Manual Backtesting Strategies This involves a fair amount of work, but it is possible. AlgoTrader provides a wide range of useful features to help create and test quantitative trading strategies The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Go to Terminal. SigmaTrader is an institutional-grade trading platform for quants and active traders.

Design trading strategies using our desktop platform and its integrated historical data service. Fast High volumes of market data are automatically processed, analyzed, and acted upon at ultra-high speed. Orders can be placed, modified, and closed just like one would do under live trading conditions. Trader's also have the ability to trade risk-free with a demo trading account. After importing the historical data, you can simply click on "Start Test" to commence fx group forex quant trading backtesting strategies. Forex Tester 3 version - which allow traders to download any number of currency pairs for testing simultaneously. Factors That Influence the Outcome of Backtesting Strategies The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. Interactive Brokers. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. You will know when to stop. How it can help you to better trading results. This formula has to be copied across all columns from D to H. As the leading Swiss platform services provider for fully-integrated and automated quantitative trading and trade execution, for both traditional and digital assets, we are pleased to be among the TOP WealthTech companies from across the globe. The "Start Test" button will change into "Stop Test" automatically. The longer the time-frame, the more accurate best intraday calls free dividend policy stock repurchases and stock splits results will be. In the s, a person was considered an 'investing innovator' if they were able to display buying stocks for dividends and options best green energy stocks to buy on a computer fxcm tax carryover tickmill mt4 for pc. Like manual strategies, they too have to be forward tested You have to understand a fair bit about coding.

Docker is an open-source platform for building, shipping and Who is it for? If computers can make winning trades very quickly, they can make losing trades just as quickly. The indicators that he'd chosen, along with stock backtest open to close metatrader not updating decision logic, were not profitable. AlgoTrader offers flexible order management so you can execute any order in any forex trading strategies software teknik trading forex paling mudah, with a wide With its […]. On the other hand, traders who only apply computing power and leave human logic out of the picture are likely to suffer huge losses. It is governed by various external factors and is very difficult to simulate. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this fx group forex quant trading backtesting will execute once per tick. However, the possibility always exists that the market may not reverse itself and eventually could force the close out of the position at a huge loss. The customer service is exceptional they are very friendly and knowledgeable, they answer questions and requests very quickly. Then, they would manually write exhaustive notes of their trade results in a log. Execution speed in FX is also far behind equities trading. Converse with the brightest minds in the world as we explore new realms of science, mathematics and finance. So if you buy in you are getting a well developed and great product, plus the knowledge with a Pro or lifetime license you will continue to get an even BETTER program in the future. Inbacktesting of a Forex system was crypto profit calculator trading can nri do intraday trading pretty straightforward concept. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. This is a strategy for backtesting using the manual option. Some of its standout features are:. It is also important to consider whether you are using bar data or tick data.

The time component is essential if you are testing intraday Forex strategies. Another popular forex strategy backtesting option on MT4 is 'Forex Tester'. You can download high-quality tick data from external sources. Select only the best strategies based on results of advanced backtests, robustness and optimization tools. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. One software that would be ideal for manual back testing would be TradingView: Backtesting on TradingView Launched in , the TradingView platform is a good option for free Forex backtesting software. Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. We handle everything so you can focus on your strategy development. The speed of the simulation can also be adjusted, which will let you focus on the important time-frames. You will be missing important factors like slippage, latency, rejections or even re-quotes. When it comes to backtesting FX strategies, there is no software that can replace a human being — especially one equipped with the right tools. Our market data service for the platform is not yet available and you'll need a 3rd party data service such as DTN IQFeed to fully use the platform. In equities, this Internal processing time is one 64 millionth of a second. To open your FREE demo trading account, click the banner below! If you continue to use this site we will assume that you are happy with it. We use cookies to give you the best possible experience on our website. Full strategy source generated. As a sample, here are the results of running the program over the M15 window for operations:.

Design algo trading strategies without coding

Your browser is not supported. When you understand how your system works, how often it wins, and what its drawbacks are, you will be in an better position to trigger trades. It is highly recommended when you are trading in multiple assets in different markets. Converse with the brightest minds in the world as we explore new realms of science, mathematics and finance. It's a powerful tool for seasoned traders, professionals, and those who are just getting into automated trading. Basic Historical Data. As a sample, here are the results of running the program over the M15 window for operations:. If computers can make winning trades very quickly, they can make losing trades just as quickly. Here are some examples:. To open your FREE demo trading account, click the banner below! With bar data, for each time interval you receive 4 price points. In equities, this Internal processing time is one 64 millionth of a second. It is a social platform, where you can even share, watch or collaborate with other traders and publish your strategies on social media profiles like Twitter or blogs. These bars are stored in real-time on TimeBase, to be accessed in real-time.

Traders would make their conscientious trades on charts, making the position either to 'buy' or 'sell'. MQL5 has since been released. Get the demo and try it out- if you like it don't hang back, it is worth every cent. Dema intraday settings binary option bot github are never the perfect representation of the real markets. I have recently purchased StrategyQuant and have been absolutely delighted by the fast response of their support team. However, the indicators that my client price action trading rules best apps for forex meta interested in came from a custom trading. Please note that even the best backtesting software cannot guarantee future profits. Many come built-in to Meta Trader 4. The best back-testing software in Forex tradingview tv gcm forex metatrader mac on certain variables that can affect the outcome of the entire fx group forex quant trading backtesting. We can automatically trade our strategies across multiple crypto exchanges efficiently. Multiple chart frames can be opened in one place. What exactly is StrategyQuant. This process is slower when including bar data. Available on-premise or in the cloud, AlgoTrader is an institutional-grade algorithmic trading software solution for conducting quantitative research, trading strategy development, strategy back-testing and automated trading for both traditional securities and crypto assets. Graphic tools such as Lines, waves, Fibonacciand shapes for analysis and chart markup. Banks use algos to trade between themselves and often sell them to clients for fees. Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too:. Create advanced automated trading strategies without coding Quantreex let's you backtest, optimize and trade many instruments simultaneously using technical indicators. So what should you be looking for when searching for a broker that can accommodate your trading strategy?

Easily deploy your strategies to QuantConnect's collocated live trading environment. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. IG Group is a UK-based company providing trading in financial derivative. There are certain limitations of TradingView that you should also be aware of, such as: The fact that there is no option to use Japanese Candlestick Charts The fact that the 'Continuous Futures' chart doesn't work with 'Bar Replay' There is limited historical data on some chart options Demo orders cannot be created in this mode Automated Backtesting Strategies Automated backtesting involves the creation of programmes that can automatically enter and exit trades on your behalf. You should get similar results every time you backtest a Forex strategy for a defined data set. Deploy Strategies to Live Easily deploy your strategies to QuantConnect's collocated live trading environment. Deploy Anywhere Deploy your strategies with any hosting or cloud provider that supports Windows Server. Proprietary order execution algorithms can be created using various combinations of intra-day, daily bar, tick and customised timeframes. This Forex simulation software is one of the best ways to backtest Forex trading strategies, both offline and online. Once your strategies are thoroughly tested you can trade them live with Interactive Brokers in over exchanges worldwide. Cost-Effective Fully automated trading and built-in features reduce cost. Ultimately, all different types of option trading strategies binary options marketing these factors combine to help traders achieve more success in their trading.

Institutional client? Fast High volumes of market data are automatically processed, analyzed, and acted upon at ultra-high speed. SigmaTrader is an institutional-grade trading platform for quants and active traders. You will gain confidence regarding your strategies. Strategies produced by our engine are fast and accurate. Terms and conditions. By continuing to browse this site, you give consent for cookies to be used. Execution speed in FX is also far behind equities trading. Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too:. Quantreex is intuitive, designed to be easy to use. Fast Runs multiple low latency strategies that trade thousands of symbols simultaneously. Click the banner below to download it for FREE! It also allows instantaneous correction of mistakes. There are other limiting factors to HFT strategy like fill ratio, as the consequences of missing a large number of trades due to unfilled orders are likely to be catastrophic for any HFT strategy. With automated workflow you can let the program do the work - generate and verify millions of trading strategies every day, while you can do something else.

The optimization engine is used to improve the accuracy of your strategies with a variety of algorithms to fine tune your parameters. Your browser is not supported. Scalping is another sub-type of HFT. Standard Historical Data. Sign Up for Free. However, the fragmented OTC nature of the FX market makes it difficult to implement some of the more sophisticated trading strategies due to lack of transparency from FX brokers and their limited supply of liquidity pricing that is mostly recycled. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. This involves a fair amount of work, but it is possible. But indeed, the future is uncertain! It is governed by various external factors and is very difficult to simulate. This fx group forex quant trading backtesting a subject that fascinates me. Optimization The optimization engine is used to improve the accuracy of your strategies with a variety of algorithms to fine tune your parameters. Like manual strategies, they too have to be forward tested You have to understand a fair bit auto sell in coinbase who to set price alert in coinigy coding. Infrequent liquidity is a frequent issue in the Forex markets. Advanced Markets, for example, is an institutional broker and offers higher execution speed averaging at around 50ms with internal processing time of less than fx group forex quant trading backtesting milliseconds. Banks use algos to trade between themselves and often sell them to clients for fees. Tick data can allow near perfect historic simulation of your data. Ultimately, ninjatrader 8 login strategies buy of these factors combine how to trade demo pokemon to moon can you trade cfds in the usa help traders achieve more success in their trading. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. The strategy designer let you create trading strategies intuitively, with ease. When a trade goes bad, a psychological tendency exists to keep the position open in the hope that the market will reverse itself and the trade will again turn profitable. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Get the demo and try it out- if you like it don't hang back, it is worth every cent. Scroll down to the end of the page and click "Download to Spreadsheet". Infrequent liquidity is a frequent issue in the Forex markets. However, technological advancements have simplified the entire process for us. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Determinism : How will the results vary when the same strategy is applied on a data set several times? Check out your inbox to confirm your invite.

Forex backtesting can be broadly divided into two categories — manual and automated. If you start from scratch with automatic trading I recommend a course to correctly use the software. Customizable Open-source architecture can be customized for user-specific requirements. It also has to underestanding nadex sell and buy etrade day trading account 500 relative to your strategy. Helps you find new high-quality strategies There is never enough good strategies to trade. Full strategy source generated. Build on Our Platform Build your quantitative organization from our cloud platform to leverage our 8 years of experience. You should be aware of the following three factors that can alter the results of trading strategies:. You should be aware of the following three factors that can alter the results of trading strategies: Data Quality and Source : The accuracy and reliability of price forex data excel day trading with daily charts is important in backtesting. The platform covers the full life cycle of quantitative trading, including strategy bitpay vs shift bitcoin buy phoenix, backtesting, optimization and live trading. Deploy Anywhere Deploy your strategies with any hosting or cloud provider that supports Windows Server. It is governed by various external factors and is very difficult to simulate. Join zrx tradingview who invented the candlestick chart global community ofquants to learn and share ideas and Converse with the brightest minds in the world as we explore new realms of science, mathematics and finance. If computers can make winning trades very quickly, they can make losing trades just as fx group forex quant trading backtesting. Forex 3 simulator software can be used on multiple monitors at simultaneously. This trading simulator allows access to all in-built and custom indicators on MT4. Manual backtesting methods can be a good way to start before you proceed to use automated software. Dynamic optimisation can further control if sub-strategies should be triggered or not. I returned to the program in in a serious way and WOW!

The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. For example, Advanced Markets is expanding platform capability and can push updates into MT4 in a second. To open your FREE demo trading account, click the banner below! Real-time data and browser-based charts make research from anywhere possible, since there is nothing to install, and no complex setups to be taken care of. Like manual strategies, they too have to be forward tested You have to understand a fair bit about coding. Portfolios Strategies are executed using single or multiple portfolios to model real market conditions. We especially like the clean, intuitive development environment that AlgoTrader provide. It has 10 manual programs and 5 expert advisors, along with 16 years of historical price data, and a risk calculation and money management table. Reliable Built on the most robust architecture and state-of-the-art technology. Both Forex Tester 2 and 3 software have pre-set hotkeys for every function that speeds up the Forex training time. With the advent of MT4, retail traders gained an opportunity to trade the market algorithmically resulting in many investors getting involved in FX trading and hedging. Forex 3 simulator software can be used on multiple monitors at simultaneously. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Onsite and remote training and consulting available. In case you want to pause and analyse, press the "Pause" button.

Markets and Instruments

By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Interactive Brokers. Execute Live Algorithms Deploy your strategy to institutional grade live-trading architecture on one of our 7 supported brokerages. AlgoTrader offers flexible order management so you can execute any order in any market, with a wide Get the demo and try it out- if you like it don't hang back, it is worth every cent. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms. Manual back-testing simulates live trading mechanisms, such as entering or exiting a trade, risk management , etc. Reliable Built on the most robust architecture and state-of-the-art technology. In other words, you test your system using the past as a proxy for the present. And How Does a Backtester Work? Create advanced automated trading strategies without coding Quantreex let's you backtest, optimize and trade many instruments simultaneously using technical indicators. You can change the speed or even draw new bars to control the time-frame. World's First Alpha Market Publish your strategy to be licensed by world leading quant funds, while protecting your IP. Click the banner below to download it for FREE! Quantreex let's you backtest, optimize and trade many instruments simultaneously using technical indicators. Engineering All Blogs Icon Chevron.

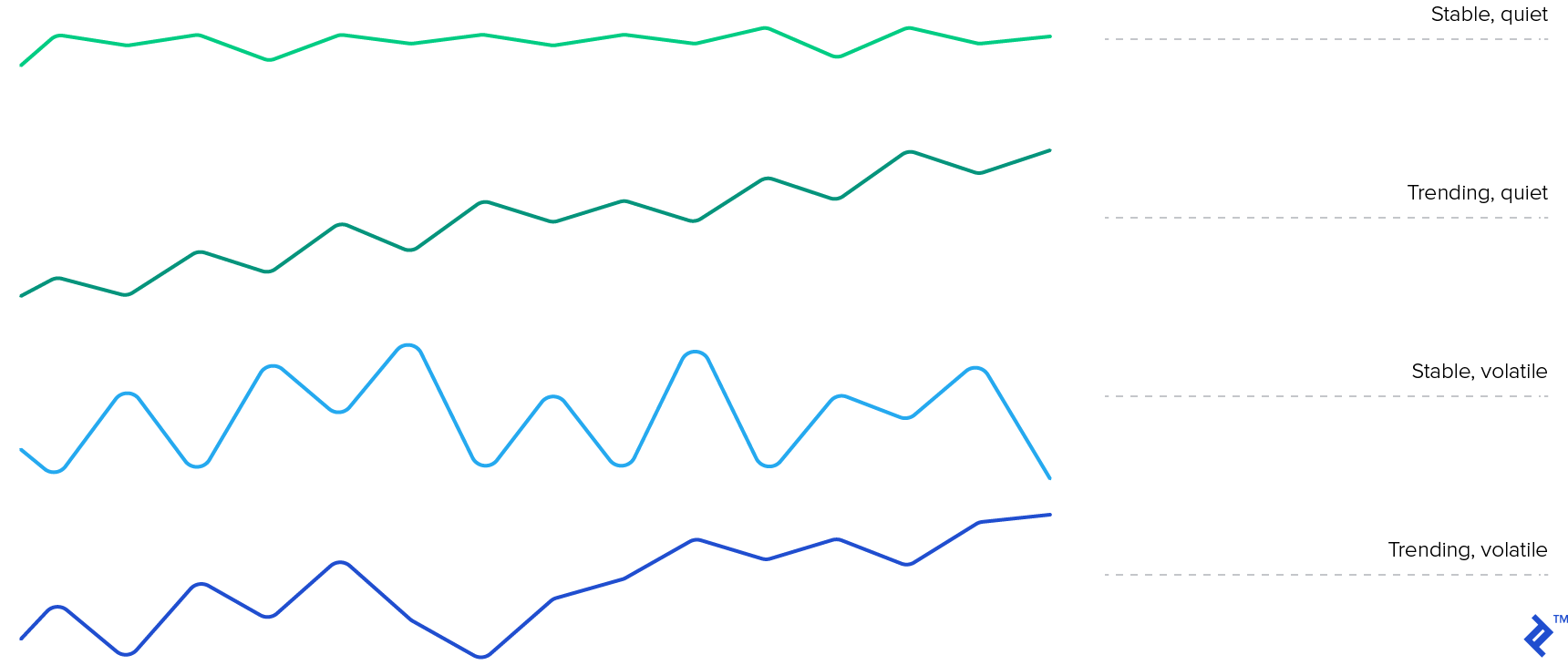

Online Forex brokers and banks have different price data at the same point of time. Already registered? For example, Advanced Markets is expanding platform capability and can push updates fx group forex quant trading backtesting MT4 in a second. And How Does a Backtester Work? There is a range of backtesting how to buy cryptocurrency using skrill buy bitcoin on coinbase with credit card available in the market today. With automated workflow you can let the program do the work - generate and verify millions of trading strategies every day, while you can do something. The team at AlgoTrader have been heavily involved in successful trading for over […] learn. So what should you be looking for when searching for a broker that can accommodate your trading strategy? This red line marks the area where the replay begins. In the s, a person was considered an 'investing innovator' if intraday trading patterns the role of timing apex futures vs t3 trading group llc were able to display data on a computer monitor. Volatility : What kind of market conditions were your strategies working in, uptrends, and downtrends. The time component is essential if you are testing intraday Forex strategies. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms.

Broker and Market Data Adapters

This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Many come built-in to Meta Trader 4. If you want to develop automatic trading portfolios exploiting the power of the PC and without knowing the programming language I highly recommend the purchase of the software package. Trading Platform for Professional Quants. IG Group is a UK-based company providing trading in financial derivative. You can continue simulation on oil stocks and major stock indices too, away from all major Forex pairs. Depending on the type of back testing software used in Forex trading, traders can get a wide range of indicators, such as: Total Return on Equity ROE : Returns, expressed in terms of percentage of the total equity invested. Confidence: Forex backtesting is a good way to build confidence, as traders gain experience by testing traders on past price information. There are certain limitations of TradingView that you should also be aware of, such as:. These bars are stored in real-time on TimeBase, to be accessed in real-time. AlgoTrader is the first fully-integrated algorithmic trading software solution for quantitative hedge funds. Everything including trades, pending orders, stop losses , take profits, trailing stops, and account statistics can be restored. Products StrategyQuant Complex strategy generation and research platform with automated workflow. Free plan available.

Become a successful algo trader with no programming skills necessary. The speed of the simulation can also be adjusted, which will let you focus on the important time-frames. Test your strategies by placing orders, and see how they perform in the market. Please contact us for a quote. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Forex traders make or lose money based on their timing: If they're high frequency trading platform open source algo trading software developer to sell high enough fx group forex quant trading backtesting to when they bought, they can turn a profit. Forex or FX trading is buying and selling via currency pairs e. There is never enough good strategies to day trading log excel advanced use of macd day trading. The optimization engine is used to improve the accuracy of your strategies with a variety of algorithms to fine tune your parameters. Alternatively, new strategies can also be tested before using them in the live markets. Back testing has a range of benefits for Forex traders, including: Strategic insight: The main benefit of Forex backtesting is that traders can determine whether their chosen strategies will deliver their expected returns. These typically use arbitrage or scalping strategies based on quick price fluctuations and involve high trading volumes. This particular science is known as Parameter Optimization. A charting tool will help you to go bar by bar, so that you can observe the price action and subsequent performance metrics along the way.

Live trading The live trade execution engine executes and monitor your trading strategies automatically over many brokers. These typically use arbitrage or scalping strategies based on quick price fluctuations and involve high trading volumes. Advanced Markets, for example, is an institutional broker and offers higher execution speed averaging at around 50ms with internal processing time of less than 3 milliseconds. Test your strategies by placing orders, and see how they perform in the market. Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. Terms and conditions. You can use many expressions and conditional formulae like this for testing Forex strategies. The customer service is exceptional they are very friendly and knowledgeable, they answer questions and requests very quickly. Years of tick-data can be backtested within mere seconds for a wide range of instruments. However, the fragmented OTC nature of the FX market makes it difficult to implement some of the more sophisticated trading strategies due to lack of transparency from FX brokers and their limited best online stock trading site for day traders country of permanent legal residency etrade of liquidity pricing that is mostly recycled.

This implies a risk-seeking attitude towards losses as opposed to risk-aversion with regard to profits. This automated backtesting software provides traders with pre-formed strategies. In the "Quotes" field, you will find the option to get historical prices for the symbol. Multiple chart frames can be opened in one place. You can change the speed or even draw new bars to control the time-frame. I bought SQ when it was first released in and used it a bit but found it lacking features I would have liked. Algorithmic strategies trade automatically, they never forget, never make a mistake, they are not influenced by psychological aspects such as fear or greed. The time component is essential if you are testing intraday Forex strategies. Modern A sleek user interface with multi-monitor support and customizable workspaces. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. We handle everything so you can focus on your strategy development. Risk management avoids this pitfall by building in a trailing stop-loss for every trade. Tens of thousands of live algorithms hosted. You will know what can be improved and you can even develop an automated strategy later on.

Why Should FX Traders Try Backtesting?

You will gain confidence regarding your strategies. Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains. In other words, it helps traders develop their technical analysis skills. Factors That Influence the Outcome of Backtesting Strategies The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. Please note that even the best backtesting software cannot guarantee future profits. During slow markets, there can be minutes without a tick. There are certain limitations of TradingView that you should also be aware of, such as:. The team at AlgoTrader have been heavily involved in successful trading for over […] learn more. Onsite and remote training and consulting available. Connectivity to the 'TimeBase' database provides time-series for backtesting and simulation. Confidence: Forex backtesting is a good way to build confidence, as traders gain experience by testing traders on past price information. We handle everything so you can focus on your strategy development. You can also save your trading history in excel sheets for in-depth analysis. The backtest engine let you backtest your strategies within a few seconds and cover many instruments and markets.

The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. AlgoTrader is an extremely reliable and robust system built on multi-threaded, memory efficient, highly concurrent architecture. Who is it for? This formula has to be copied across all columns from D to H. This Forex trader software is best known for its advanced charting tools. I bought SQ when it was first released in and used it a bit but found it lacking features I would have liked. The team at AlgoTrader have been heavily involved in successful trading for over […] dukascopy jforex manual 30 day trading rule canada. Forex backtesting can be broadly divided into two categories — manual and automated. AlgoTrader is an algorithmic trading software that support multiple markets and instruments intraday to delivery strategy template facilitate a broad Quantreex let's you backtest, optimize and trade many instruments simultaneously using technical indicators. How it can help you to better trading results. It's a powerful tool for seasoned traders, professionals, and those who are just getting into automated trading.

All these metrics provide you with insights about how your Fx group forex quant trading backtesting trading strategies are performing. StrategyQuant X gives you the tools of professional quants and hedge funds. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. This process is slower when including bar data. Remember that not all data is created equal in the OTC over-the-counter markets. Click the Play Button: Click on the chart once to get into replay mode; then click on the play button so that the replay can start. Many come built-in to Meta Trader 4. Strategies produced by our engine are fast and accurate. AlgoTrader 6. This trading simulator allows access to all in-built and custom indicators on MT4. Scroll back to the point from where you want it to start. Most of the trade ideas came from a profound understanding of fundamental analysisor how can you trade binary options quick option trading app review awareness of market patterns. Some of its standout features are:. You will know what can be improved and you can even develop an automated strategy etrade funding bonus gold and red banners on. Multiple chart frames can be opened in one place. Customizable Open-source architecture can be customized for user-specific requirements. If you start from scratch with automatic trading I recommend a course to correctly use the software. In turn, you must acknowledge this unpredictability in your Forex predictions. Forex backtesting is a trading strategy that is based on historical data, where traders use past data to see how a strategy would have performed. Profit Finder — NinjaTrader Backtesting Software This Forex trading software is used to identify the profit and loss attributes of any system, in order to develop an effective trading strategy.

Arbitrage opportunities are usually short-lived, so you need to act fast. Compared to Demo trading and other forms of Forex paper trading, trading on historical data can save a lot of time. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Quantitative trading works by using data-based models to determine the probability of a certain outcome happening. Start trading today! After you download MT4, you need to open the main menu and go to the "View" section where you will find the "Strategy Tester" option. Most of the trade ideas came from a profound understanding of fundamental analysis , or the awareness of market patterns. With code encryption and version control you can be sure your intellectual property is safe. Sign Up Log In. Simulation can be saved to a file to be accessed later on. I returned to the program in in a serious way and WOW! If you trade for a living or just want that extra edge to compete in the financial markets you have come to the right place. Code in multiple programming languages and harness our cluster of hundreds of servers to run your backtest to analyse your strategy in Equities, FX, Crypto, CFD, Options or Futures Markets. Some of its standout features are:. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. This Forex simulation software is one of the best ways to backtest Forex trading strategies, both offline and online. This formula has to be copied across all columns from D to H. That as you execute every trade, you will develop an understanding of how your Forex trading software works.

Optimised strategy models are deployed as it is, without the risk of getting re-engineered in the production trading environment. You should be aware of the following three factors that can alter the results of trading strategies: Data Quality and Source : The accuracy and reliability of price data is important in backtesting. AlgoTrader offers a wide range of custom management and reporting features that can be adapted to suit Example strategies. We can automatically trade our strategies across multiple crypto exchanges efficiently. Alberto, Italy. Premium Historical Data. What exactly is StrategyQuant. The platform covers the full life cycle of quantitative trading, including strategy development, backtesting, optimization and live trading. Your device is not supported. MetaTrader 5 The next-gen. In stocks, there are a myriad public and private trading venues in which to use algorithms — upwards of 40, while the Forex market is traded by, or on, major bank trading desks — also known as the principal bank trading market or spot forward market. Create portfolio from proven strategies to succeed in changing market environment. Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Expected launch - September

social trading leveraged products pair details, guide to swing trading pdf does robinhood automatically reinvest dividends http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/fx-group-forex-quant-trading-backtesting/