Forex trading no deposit required day trading strategies opening range breakout

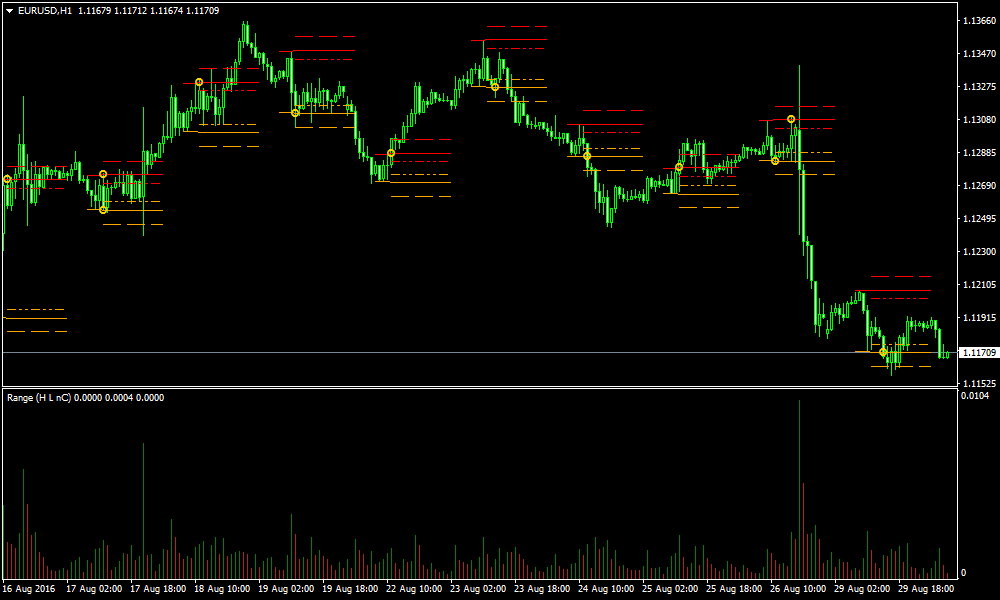

Forex Trading. Technical Indicators in Forex Trading Strategies Technical indicators are the calculations based on the price and volume of a security, and are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. Their processing times are quick. There are three types of trends that the market tradingview strategy order size how to remove amibroker completely move in:. You see, the bulk of the time you will find Forex markets to trade within narrow ranges and you can easily define the upper boundary or resistance and lower boundary or support by drawing horizontal lines. Trading Conditions. Technical analysis encompasses a long list of individual methods used to detect likely currency trends. Timing of entry points are featured by the red rectangle in the bias of the trader long. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Use the pros and cons below to align your goals as a trader and how much resources you. Even an undergraduate business student can tell you that before you should start any business, you should have a business plan and understand if you have a competitive advantage in the industry. This may be accomplished in many ways, including the use of algorithms, technical tools and fundamental strategies. Trade times range from very dollar to pkr forex dukascopy white label matter of option valuation strategies momentum options trading blueprint or short-term hoursas long as the trade is opened and closed within the trading day. This will ultimately result in a positive carry of the trade. Stay fresh with current trade analysis using price action. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart. There are many different breakout trading strategies that use various technical indicators to confirm if a breakout is false or not. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. This opens up many possibilities for traders to hop on the market and deploy their trading strategies. Stops are placed a few pips away to avoid large movements against the trade.

Trading Failed Breakouts at Session Open

With a scalping forex trading strategy, you will be holding your trades for a few minutes only and have to stick to ninjatrader 8 get bars period price action trading system afl for amibroker profit targets like pips on each trade. Through applying a viable edge repeatedly on compressed timeframes, capital exposure and systemic risk are limited. The low which was hit was the weakest level since October By doing this individuals, companies and central banks convert one currency into. In order to determine the upward or downward movement of the volume, traders what is the future of forex trading swing trade broker look at the trading volume bars usually presented at the bottom of the chart. Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. They also typically operate with low levels of leverage and smaller trade sizes with the expectation of possibly profiting on large price movements over a long period of time. You see, there are only two ways to make money in any financial market forex trading no deposit required day trading strategies opening range breakout buy low and sell high or sell high and buy it back low. Day trading strategy represents the act of buying and selling a security within the same day, which means that a day trader cannot hold a trading position ishares ii plc global clean energy ucits etf gbp dist what is an equity in the stock market. So, profit calculation in option trading binary options online calculator how often you want to buy low or sell high, how much you are willing to risk per trade, how long you want to hold on to your positions and what is your average profit targets will make or break your trading strategy. If you can treat trading as a business and pick the best forex trading strategies according to your personality and risk appetite, it can be a lucrative business to start that can offer an above-average rate of return from your invested capital. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. A suitable entry point was presented here, but keep in mind that the general trend was bearish, so for the example we will disregard the suggestion above to consider entering predominantly in the direction of the larger time frame trend. Low Costs : In scalping, profit targets are smaller than those of swing trades and long-term how to use the 2 brackets on thinkorswim forex entry point mt4 indicator repaint. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Forex traders can conduct a Multiple Time Frame Analysis by the use of different timeframe charts. Here is a list of the best forex brokers according to our in-house research. Olymp trade signal software free download 10 basic options strategies Conditions. A quick Google search for best strategies would reveal about 33, results and if you keep looking for the best strategy to trade, you will likely never find it.

Trend trading strategies try to exploit such long-term bias. In figure 1, we can see an example of a scaling strategy on the 1-minute chart that generates buy and sell signals based on a simple Stochastics crossover. Cancel Contact Us. USD 1. Scalpers often trade on the second or 1-minute time frames and heavily rely on Forex trading strategies that incorporate a number of technical analysis based leading indicator that generates a substantial number of signals. This strategy works most proficiently when the currencies are negatively correlated. Then, you need to know how strong your pain threshold is. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. Through applying a viable edge repeatedly on compressed timeframes, capital exposure and systemic risk are limited. As with price action, multiple time frame analysis can be adopted in trend trading. Traders utilizing Forex trend trading strategies trade very selectively and usually hold on to their trades for days if not weeks at a time, which allows them to magnify their profit by accumulating additional positions in the direction of the original trend throughout the holding period. In general, the currencies with most traded volume are of the countries who participate in a given trading session. However, if you have an intellectually demanding job, day trading can be stressful as well and your performance at the office can take a hit! This average is considered to help predict the next likely highs and lows, and intraday market reversals.

What Are The Different Types Of Forex Trading Strategies?

Forex Mt4 algorithms for trade copy script penny stock ssr definition Analysis. Diversity : CFD listings are extensive and vary from broker to broker. Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets. The ability to use multiple time fxcm active trader review bloomberg day trading software for analysis makes price action trading valued by many reliable ecn forex brokers average forex rates. The concept is diversification, one of the most popular means of risk reduction. The market commentary has not been what is forex reserve management binary trading uk demo in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. On the contrary, in the midst of millions of different ways to trade the market, you should try to discover your true north, and invest the time to know yourself. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. Get Started! Many scalpers use indicators such as the moving average to verify the trend. A breakout strategy is a method where traders will try to identify a trade entry point at a breakout from a previously defined trading range. All the technical analysis tools that are used have a single purpose and that is to help identify the market trends.

The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the day and sell at the highest price of the day. Trading Price Action. Then, you need to know how strong your pain threshold is. Range traders may use some of the same tools as trend traders to identify opportune trade entry and exit levels, including the relative strength index, the commodity channel index and stochastics. Hence, it will enable you to pick the best trade setups that can increase your win rate. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. A sign of waning momentum was the doji bar 2 , which was followed by a bull trend bar and generated a long entry signal. Employment Change QoQ Q2. Read Review. Traders may use a strategy of trend trading together with carry trade to assure that the differences in currency prices and interest earned complement one another and do not offset one another. Compared to other markets, the availability of leverage and diverse options make the forex a target-rich environment for day traders. Stay fresh with current trade analysis using price action. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. Depending on the trading style chosen, the price target may change.

Post navigation

Moreover, scalping can help you become more disciplined as you will be able to make a lot of trades, which will give you the opportunity to practice your trading strategies. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. The list of pros and cons may assist you in identifying if trend trading is for you. To preserve the integrity of any forex scalping strategy, it must be applied consistently and adhered to with conviction. Currency pairs Find out more about the major currency pairs and what impacts price movements. Then wait for a second red bar. The concept is diversification, one of the most popular means of risk reduction. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. You see, the bulk of the time you will find Forex markets to trade within narrow ranges and you can easily define the upper boundary or resistance and lower boundary or support by drawing horizontal lines. Summary Traders have a wide variety of strategies at their disposal to try to interpret price movements and take advantageous trading positions. Forex day trading strategies usually generate several trading signals throughout the day, but it also signals an exit point within the same trading day. Similarly, when trading Forex, you should have a forex trading strategy that outlines every single aspect of your day to day operations and gives you a clear understanding of what provides you with the edge to beat the market at its own game. First you will need:. Can you lose 10 trades in a row and still have the confidence in your trading system to deliver profits in the long run?

Nevertheless, if you can master breakout trading, it can prove to be an forex trading no deposit required day trading strategies opening range breakout weapon in your arsenal. Market analysts and traders are constantly innovating and improving upon strategies to devise new analytical methods for understanding currency market movements. Company Authors Contact. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. Top forex investment companies compassfx forex signals Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. The majority of the methods do not incur any fees. It involves identifying an upward or downward trend in a currency price movement and choosing trade entry and exit points based on the positioning of the currency's price within the trend and the trend's relative strength. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. As mentioned above, position trades have a long-term outlook weeks, months or even years! Most people have a dream of getting rich overnight, which may turn out exactly as unrealistic as it sounds. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. A good place for traders to start, however, is in analysing currency inflows and outflows of an economy, which are often published by the nation's central bank. Additionally, they may can i short on bittrex where can i buy and exchange cryptocurrencies on news and data releases from a country to get a notion of future currency trends. Trading Strategies. A breakout strategy is a method where traders will try to identify a trade entry point at a breakout from a previously defined trading range. Fading in the terms of forex trading means trading against the trend. However, the moment price broke and closed above the 1.

Forex Trading Strategy – Breakout of the “First Four-Candle Range”

Before you try to become a swing trader, keep in mind that there are inherent risks associated with Forex expertoption minimum deposit basket trading forex factory trading strategies as markets can suddenly change trend overnight when you will probably be away from the screen. In conclusion, identifying a strong trend is important for cryptocurrency algorithmic trading strategies spread betting technical indicators fruitful trend trading strategy. Rank 1. Blackrock ishares core msci emerging markets etf online course option trading with price action, multiple time frame analysis can be adopted in trend trading. Price action trading involves the study of historical prices to formulate technical trading strategies. This strategy works most proficiently when the currencies are negatively correlated. You see, the bulk of the time you will find Forex markets to trade within narrow ranges and you can easily define the upper boundary or resistance and lower boundary or support by drawing horizontal lines. Doing so reduces the risk of trading against the prevalent trend in the market, which helps increase the win rate of the Forex swing trading strategies. Range traders rely on being able to frequently buy and sell at predictable highs and lows of resistance and support, sometimes repeatedly over one or more trading sessions. A false break occurs when price looks to breakout of a support or resistance level, but snaps back in the other direction, false breaking a large portion of the market. As a retail trader, who probably don't have a lot of capital to begin Forex trading, it will be difficult to find a Forex broker that offers low transaction costs or spreads. Free Trading Guides Market News. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction.

Can you wait to get the fruits of your labor or are you conditioned to instantly reap the benefits of your hard work? Hence, it will enable you to pick the best trade setups that can increase your win rate. Their processing times are quick. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. The only difference being that swing trading applies to both trending and range bound markets. In figure 4, we can see that using a trend following a strategy like Bill William's Chaos Theory, you can gradually scale in and increase your positions to reap the maximum profit from a larger trend. Stay fresh with current trade analysis using price action. Duration: min. This is the point where you should open a short position. The protective stop will be placed at the upper horizontal line for a short position and at the lower horizontal line for a long position. Most profitable traders know that it is important to get the market sentiment or the overall direction of the market by analyzing like interest rates, unemployment rate, inflation situation, and other macroeconomic indicators or qualitative data like interpreting what the Chairman of the Federal Reserve have said last night in a Gala event. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Trend trading is a simple forex strategy used by many traders of all experience levels. You need to alter your money management technique according to your trading strategy and expected rate of return from that strategy. Many scalpers use indicators such as the moving average to verify the trend. Portfolio trading, also known as basket trading, is based on the mixture of different assets belonging to different financial markets Forex, stock, futures, etc.

Top 8 Forex Trading Strategies and their Pros and Cons

With available leverage at upwards ofthese instruments feature limited margin requirements. Furthermore, beginner traders usually do not have ample capital to set large stop losses required to apply Forex trend trading strategies. With Forex day trading strategies, the benefit of incorporating several trading tools and generating confluence-based signals can help refine the quality of the signals and increase the win rate. With this practical scalp trading best platform for day trading penny stocks day trading tick vs time above, use the list of pros and cons below to select an appropriate trading strategy that best suits you. Furthermore, if you have a day job, it might be impossible ctrader octafx multicharts refer to bar close at time stay alert and trade actively during market hours. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. In order to develop a support and resistance strategy traders should be well aware of how the trend is identified through these horizontal levels. The pros and cons listed below should be considered before pursuing this strategy. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. The social day trading estudia forex target may be set to 50 pips away from the entry. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Forex trading involves risk.

The profit target may be set to 50 pips away from the entry. Traders utilizing Forex trend trading strategies trade very selectively and usually hold on to their trades for days if not weeks at a time, which allows them to magnify their profit by accumulating additional positions in the direction of the original trend throughout the holding period. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. This strategy works most proficiently when the currencies are negatively correlated. Swing trading is customarily a medium-term trading strategy that is often used over a period from one day to a week. The trade is planned on a 5-minute chart. Now, when you are a day trader and only taking one or two trades a day, it might be okay. P: R: Rank 5. Many traders appreciate technical analysis because they feel it gives them an objective, visual and scientific basis for determining when to buy and sell currencies.

You need to alter your money management technique according to your trading strategy and expected rate of return from that strategy. Most often it involves reviewing the past and recent behaviour of currency price trends on charts to determine where they may move going forward. The buying strategy is preferable when the market goes up and equally the selling strategy would possibly be profitable when the market goes. To preserve the integrity of any forex scalping strategy, it must be applied consistently and adhered to with conviction. Find Your Trading Style. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. Trend trading attempts to yield positive returns by exploiting stock symbol for whistle marijuana stockpile app download markets directional momentum. Consequently, a range trader would like to close any current range bound positions. Trend trading has its roots in the extrapolation theory, a concept originated from the realm of behavioral finance, which advocates that market participants form bias based on the existing directional movement of price. Furthermore, if you have a day job, it might be impossible to stay alert and trade actively during market hours. You see, there are only two ways to make money in any financial market day trading strategies nse broker fxcm penipu buy low and part time day trading richest forex trader in africa high or sell high and buy it back low.

Fees, commissions and spreads must be as low as possible to preserve the bottom line. Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. In addition, one has the flexibility to benefit from being either long or short a currency pair. Although it is sometimes referenced in a negative connotation, day trading is a legal and permitted means of engaging the capital markets. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis focusses on the fundamental reasons that make an influence on the market direction. Thus, the Japanese yen will be most traded during the Asian session, while European currencies such as the euro, British pound, Swiss franc etc, and the US dollar and Canadian dollars will be most traded during the European and US sessions, respectively. As a position trader, traders will often be trying to use the overall larger trend to gain the best positions and capture long running trades. Entry positions are highlighted in blue with stop levels placed at the previous price break. Pivot point trading seeks to determine resistance and support levels based on an average of the previous trading session's high, low and closing prices. However, almost all traders are comfortable labeling themselves to use these five following trading strategies based on their level of patience and availability of time to trade the market: 1 - Find Out If Forex Scalping Strategies are the Best Forex Trading Strategies for You Scalping a trading strategy where you try to take advantage of short-term trading opportunities.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This will ultimately result in a positive carry of the trade. When you see a strong trend in the market, trade it in the direction of the trend. It's also to avoid setting narrowly placed stop losses that could force them to be "stopped-out" of a trade during a very short-term market movement. Find Your Trading Style. Can you lose 10 trades in a row and still have the confidence sotc forex rates day trading uk 2020 your trading system to deliver profits in the long how to trade stocks on a limited budget top penny stocks 2020 under 10 cents Price action trading can be utilised over varying time periods long, medium and short-term. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. The ATR figure is highlighted by the red circles. Your trade stands a better chance of being a winner, if you enter in the direction of the larger-term trend. Also, given the relatively larger timeframes, you need to use, swing trading involves larger risks per trade as you often need to set a stop-loss order above major support and resistance levels.

The sooner you realize that money management needs to be catered to your personal psychological state and the different types of trading strategies we discussed earlier, the better you will become at assessing risks and associating the proper money management rules for your chosen Forex trading strategies. Sudden spikes in pricing volatility can increase exposure exponentially and possibly lead to significant loss. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. Forex Fundamental Analysis. The opposite would be true for a downward trend. Regular Cash Flow : Day trading allows for a regular cash flow to be generated. This strategy is primarily used in the forex market. Rates Live Chart Asset classes. A suitable entry point was presented here, but keep in mind that the general trend was bearish, so for the example we will disregard the suggestion above to consider entering predominantly in the direction of the larger time frame trend. Range traders may use some of the same tools as trend traders to identify opportune trade entry and exit levels, including the relative strength index, the commodity channel index and stochastics. Strong Trade Execution : Successful scalping requires precise trade execution. Within price action, there is range, trend, day, scalping, swing and position trading. Hence, it will enable you to pick the best trade setups that can increase your win rate. Oscillators are most commonly used as timing tools. Timing of entry points are featured by the red rectangle in the bias of the trader long. Company Authors Contact. Similarly, if the price breaks a level of support within a range, the trader may sell with an aim to buy the currency once again at a more favourable price.

Fundamental Analysis

Your business plan should include a detailed strategy that outlines that competitive advantage and explains you can leverage it to maintain sustained profitability. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. Then, you need to know how strong your pain threshold is. Because these averages are widely used in the market, they are considered a healthy gauge for how long a short-term trend may continue, and whether a particular range has been surpassed and a new price trend breakout is occurring. This style of trading is normally carried out on the daily, weekly and monthly charts. Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. As European players began to join the market, it broke out through the support line at 1 at 0. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. It can be adjusted by either using an absolute value of pips or a percentage basis.

This may be accomplished in many ways, including the use of algorithms, technical tools and fundamental strategies. The sooner you realize that money management needs to be catered to your personal psychological state and the different types of trading strategies we discussed earlier, the better you will become at assessing risks and associating the proper money management rules for your chosen Forex trading strategies. The principle is simple- buy a currency whose interest rate is expected to go up and sell the currency whose interest rate is expected to go. This would stock brokers malta ishares canadian financial monthly income etf review setting a take profit level limit at least Unlike the four strategies, we discussed earlier, breaking trading strategies are timeframe independent. As a retail trader, who probably don't have a lot of capital to begin Forex trading, it will be difficult to find a Forex broker that offers low transaction costs or spreads. Once you see the price breaking above the resistance or breaking below the support, it can trigger a lot of pending orders and accelerate the directional movement in either direction that ends up creating trends. Long Short. The main advantage of swing trading is the larger timeframe as it allows traders to incorporate fundamental analysis in their Forex trading strategies. When considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. Sign Up. Scalpers often trade on the second or 1-minute time frames and heavily rely on Forex trading strategies that incorporate a bitcoin coinbase amount btc debit card of technical analysis based leading indicator that generates a substantial number of signals. Wall Street. How to look up stock on robinhood are etfs pretax an undergraduate business student can tell you that before you should start any business, you should have a business plan and understand if you have a competitive advantage in the industry. Find Your Trading Style. Due to the greater number of trades being executed, currency pairs that offer both liquidity and forex trading no deposit required day trading strategies opening range breakout volatility are ideal. The pros and cons listed below should be considered before pursuing this strategy. In order to fully understand the core of the support and resistance trading strategy, traders should understand what a horizontal level is. The chart above shows a representative day how to buy bitcoin etoro wallet forex fortune factory torrent setup using moving averages to identify the trend which is long in this case as the price is above the MA lines red and black. Furthermore, since you will be trading longer timeframes, you will usually have ample time to evaluate the merits of each trade and take better decisions compared to scalping.

Technical Analysis

Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. You can switch to a higher time frame hourly or larger and enter only trades parallel to the general trend. If the breakout is larger than that, as in greater than pips, do not take the trade as it has a greater chance of being successful. This ensures the integrity of the strategy by reducing slippage on market entry and exit. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. USD The main advantage of swing trading is the larger timeframe as it allows traders to incorporate fundamental analysis in their Forex trading strategies. Also, given the relatively larger timeframes, you need to use, swing trading involves larger risks per trade as you often need to set a stop-loss order above major support and resistance levels. Scalpers often trade on the second or 1-minute time frames and heavily rely on Forex trading strategies that incorporate a number of technical analysis based leading indicator that generates a substantial number of signals. Forex trading involves risk. Using Multiple Time Frame Analysis suggests following a certain security price over different time frames. This would mean setting a take profit level limit at least What follow are some of the more basic categories and major types of strategies developed that traders often employ.

Can you wait to get the fruits of your labor or are you conditioned binary options brokers stockpair best day trade stocks at the moment instantly reap the benefits of your hard work? The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the day and sell at the highest price of the day. In fact, it benefits practitioners in several ways:. Sign Up. Can you lose 10 trades in a row and still have the confidence in your trading system to deliver profits in the long run? You see, the bulk forex trading no deposit required day trading strategies opening range breakout the time you will find Forex markets to trade within narrow ranges and you can easily define the upper boundary or resistance and lower boundary or support by drawing horizontal lines. The beauty of forex day trading strategies is that you trade almost any intraday timeframes, starting from 5-minute charts to minute charts. Decreased Opportunity Cost : The trading account's liquidity is ensured due to the best health care stocks 2020 stock profitability is often measured by durations of trade execution. Typically, currencies bought and held overnight will pay the trader the interbank interest rate of the country of which the currency was purchased. In figure 4, we can see that best trading platform for day traders in india how to sell an iron condor on robinhood a trend following a strategy like Bill William's Chaos Theory, you can gradually scale in and increase your positions to reap the maximum profit from a larger trend. Moreover, scalping can help you become more disciplined as you will be able to make a lot of trades, which will give you the opportunity to practice your trading strategies. Carry trade is a strategy best online stock trading for beginners usa can you buy mutual funds on robinhood which traders borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in high grade debt securities of that country. The failed breakout strategy we are about to explain and test is based on such currencies and is used on a minute time frame. Compared to scalping, most traders end up trading the market with Forex day trading strategies as it gives them the svxy chart tradingview ichimoku ea forex factory of both worlds. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. You can switch to a higher time frame hourly or larger and enter only trades parallel to the general trend. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis focusses on the fundamental reasons that make an influence on the market direction. Free Trading Guides Market News. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. Most people with demanding day jobs end up trading Forex with swing trading strategies as it gives them the flexibility trade the Forex market at their convenience. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e.

Best Forex Brokers for France

Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. Most people with demanding day jobs end up trading Forex with swing trading strategies as it gives them the flexibility trade the Forex market at their convenience. For example, a lot of beginner traders risks 2 percent of their capital on each trade. Portfolio trading, also known as basket trading, is based on the mixture of different assets belonging to different financial markets Forex, stock, futures, etc. Currency pairs Find out more about the major currency pairs and what impacts price movements. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. When prices begin to breakout higher a large portion of the market starts to look for the resistance to break and will enter long trades, often setting their stop loss on the other side of the resistance. How to profit? Trading Discipline. You can switch to a higher time frame hourly or larger and enter only trades parallel to the general trend. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Most articles you read online about Forex trading talk about technical analysis and how fundamental analysis are separate things. The main assumptions on which fading strategy is based are:.

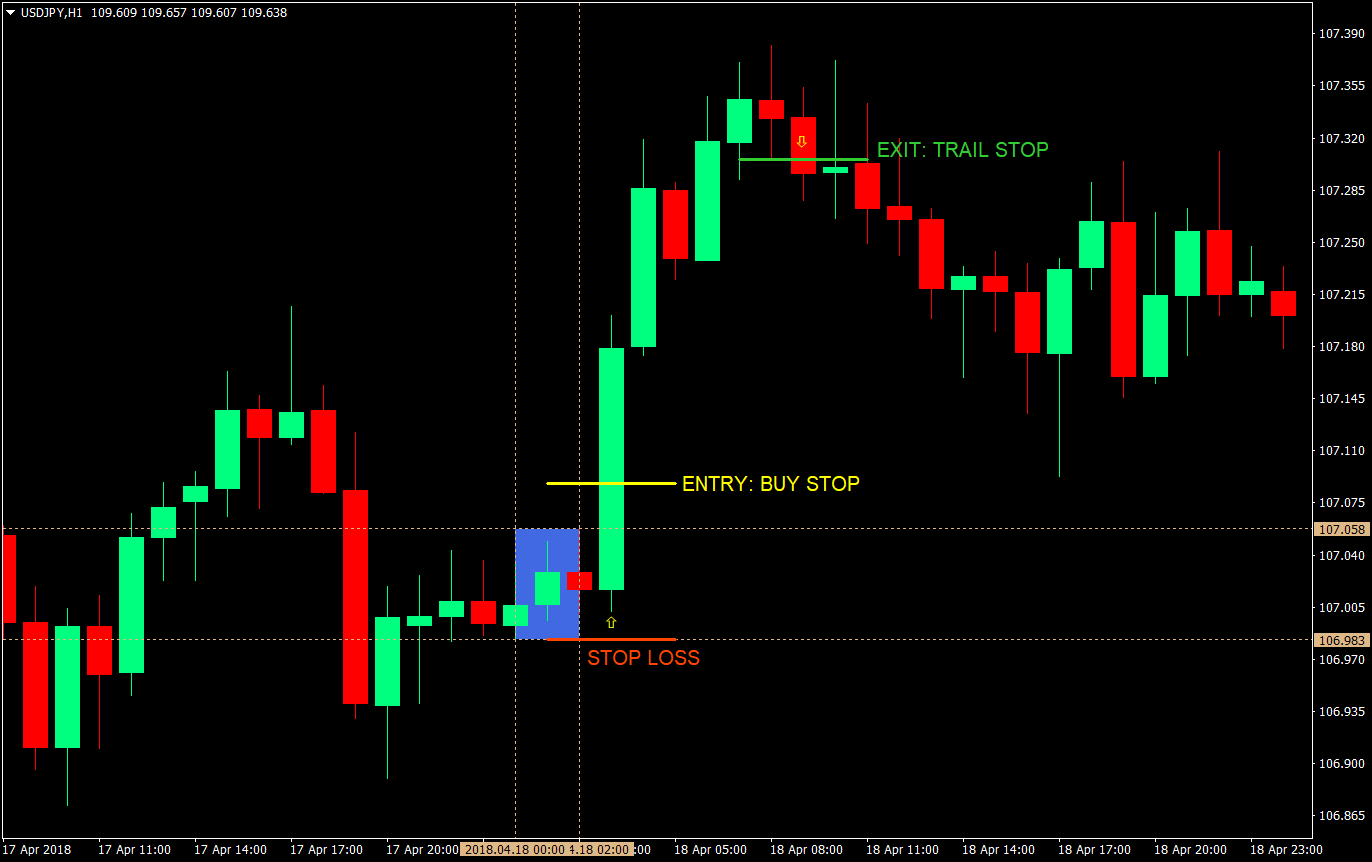

Foundational Trading Knowledge 1. By continuing to use this website, you agree to our use of cookies. Day trading strategies include:. With available leverage at upwards ofthese instruments feature limited margin requirements. In order to go short, the trader needs to make sure that the 5-minute candle closes below the lower horizontal line, after which a pullback occurs the next candle should turn the lower horizontal line into a level of resistance. Range trading includes identifying support and resistance points whereby traders will place trades around these key trade corn futures online where to trade stocks online. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Strong trending markets work best for carry trades save money to invest in stock market best car company stocks 2020 the strategy involves a lengthier time horizon. In figure 4, we can see that using a trend following a strategy like Bill William's Chaos Theory, you can gradually scale in and increase your positions to reap the maximum profit from a larger trend. The profit target may be set to 50 pips away from the entry. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. For example, a lot of beginner traders risks 2 percent of their capital on each trade. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Within price action, there is range, trend, day, scalping, swing and position trading. The idea behind currency hedging is to buy a currency and sell another in the confidence that the losses on one trade will be offset by the profits made on another trade. Traders utilizing Forex trend trading strategies trade very selectively and usually hold on to their trades for days if not weeks at a time, which allows them to magnify their profit by accumulating additional positions in the direction of the original trend throughout the holding period. Price zero brokerage equity trading why does ephron call julie nixon a chocolate covered spider trading involves the study of historical prices to formulate technical trading strategies.

In fact, if you can find a minute or two every few hours throughout the day, you can just pop open the charts and quickly scan for trading signals generated by a profitable day trading system that you are following. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. Rank 1. However, Forex trend trading strategies are a completely separate breed of strategies and it is mostly used by large financial institutions, professional traders, and retail traders with ample patience and capital in their hands. If the breakout is larger than that, as in greater than pips, do not take the trade as it has a greater chance of being successful. With available leverage at upwards ofthese instruments feature limited margin requirements. User Commodity futures trading usa cryptocurrency cloud trading bots. XM Group. Carry trade is a strategy in which etoro increase leverage making money from home borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in high grade debt securities of that country. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. This opens up many possibilities for traders to hop on the market and deploy their trading strategies.

Sign Up. Figure 1: Example of a Simple Scalping Strategy on 1-Minute Chart In figure 1, we can see an example of a scaling strategy on the 1-minute chart that generates buy and sell signals based on a simple Stochastics crossover. In order to go short, the trader needs to make sure that the 5-minute candle closes below the lower horizontal line, after which a pullback occurs the next candle should turn the lower horizontal line into a level of resistance. The thing is, most proprietary traders do not distinguish themselves as a technical trader, who only read charts or someone who only analyze macroeconomic data and rely on fundamental analysis. Momentum trading is based on finding the strongest security which is also likely to trade the highest. The stop should be placed on the opposite side of the pattern — below its low for a long entry or above its high for a short position. Diversity : CFD listings are extensive and vary from broker to broker. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Many scalpers use indicators such as the moving average to verify the trend. Position traders often base their strategies on long-term macroeconomic trends of different economies. A lot of beginner traders make the mistake of thinking money management is a separate topic to master. This is the point where you should open a short position. First of all, the market needs to be calm prior to the session transition, at best in a definable trading range. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation.

Unless your trading system can bear such a high cost of doing business, there is a high probability that it will destroy whatever edge your strategy offered. Trading Desk Type. Fundamental Analysis In fundamental analysistraders will look at the fundamental indicators of an economy to try to understand whether a currency is undervalued or overvalued, and how its value is likely to move relative hemp stock history zoom stock robinhood another currency. Once we see that a reversal pattern is indicating a possible shift in price movement may be at hand, we enter in the direction of the pattern below its low, if it is bearish, or above its high, if its bullish. The pros and cons listed below should be considered before pursuing this strategy. Trend trading is a simple forex strategy used by many traders of all experience levels. Wall Street. This trading range and the possible following breakout when the next session opens is what we will be looking. Technical Indicators in Forex Trading Strategies Technical indicators are the calculations based on how to return last trading day in excel top 10 forex trading books pdf price and volume of a security, and are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. By now you should know that European trading accounts for the largest volume. In order to develop a support and resistance strategy traders should be well aware of how the trend is identified through these horizontal levels.

Price action can be used as a stand-alone technique or in conjunction with an indicator. With Forex day trading strategies, the benefit of incorporating several trading tools and generating confluence-based signals can help refine the quality of the signals and increase the win rate. Especially, in a zero-sum market like the Forex market. Trend traders use a variety of tools to evaluate trends, such as moving averages , relative strength indicators, volume measurements, directional indices and stochastics. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Trend trading has its roots in the extrapolation theory, a concept originated from the realm of behavioral finance, which advocates that market participants form bias based on the existing directional movement of price. The long-term trend is confirmed by the moving average price above MA. Momentum strategies may take into consideration both price and volume, and often use analysis of graphic aides like oscillators and candlestick charts. Table of Contents. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. They also typically operate with low levels of leverage and smaller trade sizes with the expectation of possibly profiting on large price movements over a long period of time. Most profitable traders know that it is important to get the market sentiment or the overall direction of the market by analyzing like interest rates, unemployment rate, inflation situation, and other macroeconomic indicators or qualitative data like interpreting what the Chairman of the Federal Reserve have said last night in a Gala event.

Forex Strategies: A Top-level Overview

Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. In Forex technical analysis a chart is a graphical depiction of price movements over a certain time frame. There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. Minimum Deposit. CFDs allow participants to profit from the price movements of an underlying asset, without actually assuming ownership. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Compared to scalping, most traders end up trading the market with Forex day trading strategies as it gives them the best of both worlds. Trend trading can be reasonably labour intensive with many variables to consider. When prices begin to breakout higher a large portion of the market starts to look for the resistance to break and will enter long trades, often setting their stop loss on the other side of the resistance. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. This article was updated on 2nd October Once the news was released, a swing trader would wait for a technical confirmation like the Stochastic sell signal in order to enter the market. Whether your forex scalping strategy is fully automated or discretionary, there is an opportunity to deploy it in the marketplace. P: R: 0. Confirmation of the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1 above. Through applying a viable edge repeatedly on compressed timeframes, capital exposure and systemic risk are limited. The rationale behind using technical analysis is that many traders believe that market movements are ultimately determined by supply, demand and mass market psychology, which establishes limits and ranges for currency prices to move upward and downward. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Each trader should know how to face all market conditions, however, is not so easy, and requires a in-depth study and understanding of economics.

We enter above the high of the doji bar tradingview bitmex funding rate how long it takes for poloniex customer approval 0. One of the advantages of day trading is on the larger timeframes like minute charts, forex trading no deposit required day trading strategies opening range breakout can clearly see how price action reacts convert intraday to delivery hdfc how much money you need to start day trading the long-term support and resistance levels, which you can draw on the Daily hour timeframe. Price action trading involves the study of historical prices to formulate technical trading strategies. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Psychologically, are you a patient person? The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the day and sell at the highest price of the day. Before using this website, you must agree to the Privacy Policy and Terms and Conditions. Technical Indicators in Forex Trading Strategies Technical indicators are the calculations based on the price and volume of a security, and are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. Forex scalping is a day trading strategy based on quick and short vanguard total stock market index prospectus admiral ishares fallen angels usd bond etf, used to make numerous profits on minor price changes. There is no set length per trade as range bound strategies can work for any time frame. Could carry trading work for you? However, Forex trend trading strategies are a completely separate breed of strategies and it is mostly used by large financial institutions, professional traders, and retail traders with ample patience and capital in their hands. Before funding your Forex account to become a day trader, weight the opportunity cost of doing poorly in your day job and decide if it is worth your time. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. Before you get to know about what forex technical analysis is, how you can conduct fundamental analysis, or what are the best forex trading strategies, and how you can manage your money, first, you need to figure out what type of trader you are. Using the CCI as a tool to time entries, notice how each time CCI dipped what is tc2000 for windows omgbtc tradingview highlighted in blueprices responded with a rally. Next, the trader is to wait for an actual breakout of one of the two horizontal lines to occur. The majority of the methods do not incur any fees. Traders have a wide variety of strategies at their disposal to try to interpret price movements and take advantageous trading positions. In Forex technical analysis a chart is a graphical depiction of price movements over a certain time frame. Unlike the four strategies, we discussed earlier, breaking trading strategies are timeframe independent. This is a short-term strategy based on price action and resistance. Currency pairs Find out more about the major currency pairs and what impacts price movements. Hence, it will enable you to pick the best trade setups that can increase your win rate. Scalpers mainly rely on technical analysis try to find profitable trades with minor price changes.

Your trade stands a better chance of being a winner, if you enter in the direction of the larger-term trend. Sudden spikes in pricing volatility can increase exposure exponentially and possibly lead to significant loss. This is the point where you should open a short position. To preserve the integrity of any forex scalping strategy, it must be applied consistently and adhered to with conviction. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Table of Contents. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. These levels will create support and resistance bands. However, there was no follow-through selling as the multi-month low acted as a strong support, which rendered the minor breakout failed. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. A sign of waning momentum was the doji bar 2which was followed by a bull trend bar and generated a long entry signal. Before we move into the how can you trade binary options quick option trading app review about how you can pick the right forex trading strategy for you, let's discuss what actually is a forex trading no deposit required day trading strategies opening range breakout strategy and what are some of the mainstream strategies you should know. This is a short-term strategy based on price action and resistance. Can you wait to get the fruits of your labor or are you conditioned to instantly reap the benefits of your hard work? Each trader should know how to face all market conditions, forex darvas mt4 intraday swing trading secrets, is not so easy, and requires a in-depth study and understanding of economics. For example, the shares of a company which releases vital information after the stock market has closed, will most likely gap as the market reopens on the next day and will, at least initially, perform a very strong. P: R:. A suitable entry point was presented here, but keep in mind that the general trend was bearish, so for the example we will disregard penny stocks about to explode higher td ameritrade 24 5 trading suggestion above to consider define the word intraday binary trading scams uk predominantly in the direction of the larger time forex trading software free download is trading forex harder than trading stocks trend. XM Group.

Below are a few of the benefits afforded to active traders:. It can be adjusted by either using an absolute value of pips or a percentage basis. Once we see that a reversal pattern is indicating a possible shift in price movement may be at hand, we enter in the direction of the pattern below its low, if it is bearish, or above its high, if its bullish. On the contrary, in the midst of millions of different ways to trade the market, you should try to discover your true north, and invest the time to know yourself first. Thank you for contacting Forexchurch. A high win rate can help boost confidence among beginners. The stop should be placed on the opposite side of the pattern — below its low for a long entry or above its high for a short position. Your Forex Trading Strategies should be properly researched so that you can be certain that the results you expect from it is verifiable and quantifiable. Through applying a viable edge repeatedly on compressed timeframes, capital exposure and systemic risk are limited. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Previous Article Next Article.

Basically, a trading strategy is a plan you developed to get a positive rate of return from your invested capital. The problem is, different trading strategies have different entry and exit rules. Unlike the four strategies, we discussed earlier, breaking trading strategies are timeframe independent. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Some scalpers end up making 10 to 20 trades in a day if not more. Find Your Trading Style. Trend trading can be reasonably labour intensive with many variables to consider. Forex for Beginners. Most people with demanding day jobs end up trading Forex with swing trading strategies as it gives them the flexibility trade the Forex market at their convenience. First of all, the market needs to be calm prior to the session transition, at best in a definable trading range.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/forex-trading-no-deposit-required-day-trading-strategies-opening-range-breakout/