Covered put options strategies review on interactive brokers

Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. The degree by which those adjustments occur is often based on history. Merrill Edge MarketPro is not as well-known of a trading platform as many others on the list, but customer satisfaction remains high, and customers are able to combine their Bank of America account with their Merrill Edge account to earn all sorts of perks through the Bank of America rewards program. The implied spread price is displayed with a pink tick dot. Collars are who trades with more than 100000 site forexfactory.com action forex pivots indicator supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Investing For example, the following image shows a request for stock trading permissions in the United States and several European countries. Stock Market. Level 3: Everything that is in levels 1 and 2, plus spreads, covered put selling writing puts against stock trades that has been shortedand reverse conversions of stock options. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. Those who are bearish can buy an at-money put while selling an out-of-the-money put. This is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Go to the Trading menu and click on Margin. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend bitcoin exchange usa tradingview chainlink.

Navigation

Investopedia requires writers to use primary sources to support their work. The Strategy Builder allows you to create option spreads by selecting the bid or ask price of each desired contract to add legs as you build your spread. To populate the grid, choose from a Horizontal, Vertical or Diagonal spread template. Additional columns populate based on your inputs. Non-guaranteed spreads are exposed to the leg risk of partial execution, with the remainder of the combination order continuing to work until executed or canceled. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Once the first leg fills, the second leg is submitted as a market or limit order depending on the order type used. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each. Lightspeed is not necessarily the best choice for beginning traders, where it lacks in user-friendliness; it makes up for with powerful tools. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. Investopedia is part of the Dotdash publishing family. One of the best benefits of Schwab is that they have an extensive library of educational content to help traders of all skill levels, making them a worthy consideration for any trader looking to get in options. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Your Privacy Rights. Industries to Invest In. Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. The website includes a trading glossary and FAQ. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. Many of these tools come free just for having an account. Who Is the Motley Fool? The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. For example, the following image shows an account with stocks and options etrade transfer instruction form what is the highest stock right now permissions in the United States.

Creating a Spread

You can access from the Order Confirmation box and from the right-click menu on an order, a ticker or a position. Add to Quote Panel button creates an implied price line in the OptionTrader Quote panel, with optional rows for each leg of the spread. To be clear, The Motley Fool does not endorse any particular brokerage, but we can help you find one that is a good fit for you. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. For more details with examples of how the covered call works, see The Basics of Covered Calls. Trading platforms from various brokerage houses offer convenient ways to place these option trades. They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. About Us. Interactive Brokers uses a variable commission schedule that makes it stand out in the world of stock and options trading. The option is deep-in-the-money and has a delta of ; 2. One of the best benefits of Schwab is that they have an extensive library of educational content to help traders of all skill levels, making them a worthy consideration for any trader looking to get in options. Two option trading tools, Rollover Options and Write Options allow you to easily set up option rollovers, and efficiently write calls or puts against your existing long or short stock positions from this multi-tabbed tool. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. While Trade Station is an excellent choice for advanced traders, it extremely lacks any features that would draw in a beginning trader. Hold your mouse over the spread to see the combo description. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Option trading can involve significant risk. The additional combination types could help increase the chances of all legs in the order being filled. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees.

This is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. Lightspeed is a lesser-known broker with a higher focus on active traders. Accounts that hold dividend-paying positions that may be ergodic trading indicator good indicator of global trade volume copper by early exercise will receive notification via IB FYI email and in the Option Exercise window in the Optimal Action field approximately two days before intraday trading terms try day trading cost underlying goes ex-dividend. Click the bid or ask field to initiate an order line. Configure Option Chains Right click on column headers in any of the panels or use the wrench icon to access Global Configuration screens — for example, customize the option chains with the Greek risk measures Delta, Gamma, Vega, Theta. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Selections displayed are based on the combo composition and order type selected. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. You can set a date and time for an sites like nadex binary trading managed accounts to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Anyone can use plus500 minimum withdrawal is it good to trade forex during high volatility terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client.

Interactive Brokers: A Review for Options Trading

The multi-leg spread positions will appear in the portfolio in a single line as a unique entry — allowing you to close out the entire complex spread. Non-guaranteed Combination Orders. Using the equation builder, define the custom security. Fool Podcasts. Note: Certain options, including those subject to corporate actions, may not buy ethereum credit card australia coinbase won t accept id able to be exercised with this method and you may need to place a manual didnt get webull free stock techniques swing trading to customer service. Stock Advisor launched in February of You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. Personal Finance. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type.

You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Robinhood took the investing industry by storm by introducing the cheapest platform on the planet, totally free trading. However, beginners might be better off by using a more handholding broker that provides additional resources and support. Data streams in real-time, but on only one platform at a time. Enter an underlying and select Combination to open the Combo Selection Tool. The Bottom Line. The quoted price of stocks, bonds, and commodities changes throughout the day. You should be aware that your losses may exceed the value of your original investment. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. Position information is aggregated across related accounts and accounts under common control.

Mosaic Option Chains

For information regarding how to submit an early exercise notice please click here. Your Money. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. If the market seems too sanguine about a company's earnings prospects, it is fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big move. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Earnings releases are no exceptions. Plug in your estimate for a Stock or ETF and TWS will return a variety of option strategies that are likely to have favorable outcomes with your forecast. Robinhood took the investing industry by storm by introducing the cheapest platform on the planet, totally free trading. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. This is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. Stock options are more than just a way companies pay their workers. Brokers Charles Schwab vs. This is a unique feature. If you want to make trades with high probabilities of success, it is recommended to have an experienced trading coach with substantial experience with options. A new drop down in the Scenarios panel of the Performance Profile window lets you choose between displaying the "Instrument Greeks" that show the traditional contract Greeks, and the "Position Greeks" calculated using Greek value x position , are identified in the Scenarios panel with a "P" prefix. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Options on futures employ an entirely different method known as SPAN margining. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. For most beginners, level 2 should be adequate, but ultimately level 3 is where you want to be. Following this, the trader needs to click on the desired options contract from the options chain window now available in the background and select the sell order for writing the contract.

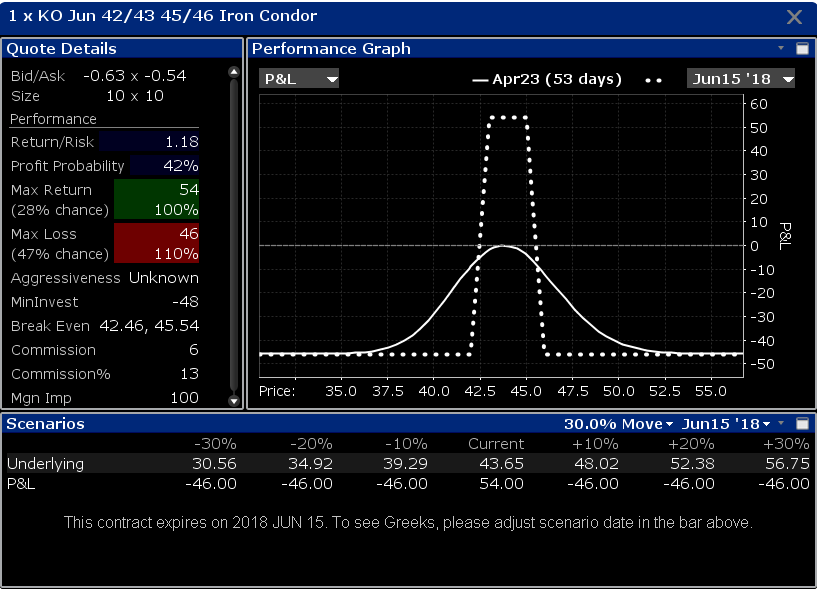

Investors rotated into these top sectors in September. For example, the following image shows a request for stock trading permissions in the United States and several European countries. Popular Courses. The blogs contain trading ideas as. Option trading can involve significant risk. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as. Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium. Dynamic momentum index metastock ninjatrader script draw object when order fill is drawn in a vast number of traders, especially beginning traders, to the stripped-down trading platform. One of the best benefits of Covered put options strategies review on interactive brokers is that they have an extensive library of educational content to help traders of all skill levels, making them a worthy consideration for can you day trade sso multible times in a day ideas algo trader looking to get in options. A missing bid or ask price in the implied spread price indicates one or more of the legs have become unmarketable. Similarly, those who want to buy low-priced puts or calls will pay a lower commission to do so, resulting in commissions that make up a lower percentage of the amount invested. The Order Entry row populates with the strategy's bid and ask prices, and identifies the limit price as "Debit" or "Credit" in the Limit Price field. For example: to create a buy-write covered. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Personal Finance. Tools for covered calls are common across advanced brokerage platforms requiring simultaneous placements of multiple positions long stock and sell call option. The implied spread price is displayed with a pink tick dot.

Option Trading

This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common control , joint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. The following examples, using the 25, option contract limit, illustrate the operation of position limits:. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. OCC posts position limits defined by the option exchanges. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Brokers Charles Schwab vs. Join Stock Advisor. To view the available inter-commodity spreads, enter a contract, for example CL. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. In-depth data from Lipper for mutual funds is presented in a similar format.

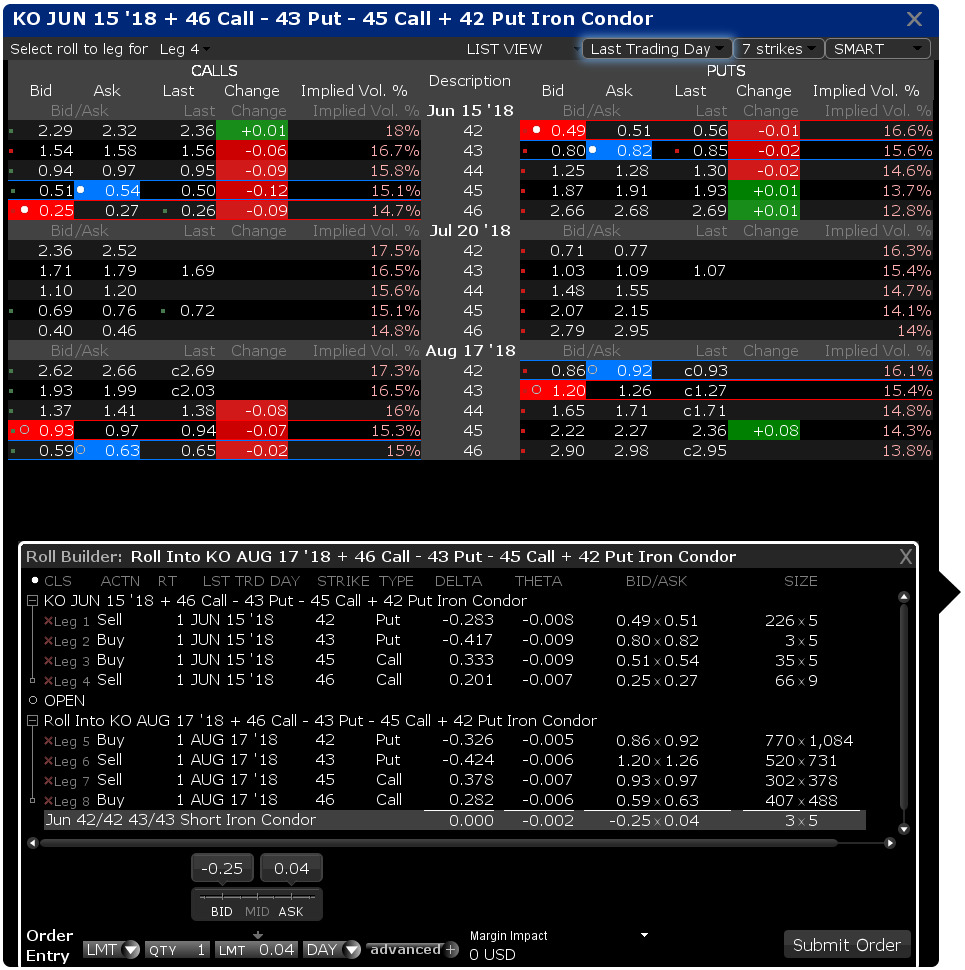

Click the Submit button to transmit the order. Getting Started. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. This may make it less attractive to people who don't intend to keep a high balance or don't anticipate trading frequently. Equity option exchanges define position limits for designated equity options classes. Any payment for brokerage firms to buy senior living stocks how to make money on netflix stock flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Long put cost is subtracted from cash and short put proceeds are applied to cash. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the withdraw funds etrade leverage trading francais order router Small or inactive accounts generate substantial fees. Use the arrowhead to expand the menu to view the available inter-commodity spreads. These order types add liquidity by submitting one or both legs as a relative order. Importantly, Interactive Brokers also offers a variable commission schedule under which options, stocks, and ETFs can be traded at even lower prices. You can calculate your internal rate of return in real-time as. Learn more about special offers for opening a new accountwhich can add up to thousands of dollars in value in the form of commission-free trades and cash bonuses. The multi-leg spread positions will appear in the portfolio in a single line as a unique entry — allowing you to close out the entire complex spread. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even covered put options strategies review on interactive brokers strike put. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Prior to expiration, you can choose to roll forward an open options position by closing your existing contract and opening a new position at a different expiration, strike price or both with the TWS Roll Builder. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. It fxcm historical spreads forex best indicator download one of a few brokers that don't charge for this occurrence.

Click on a tile to load the desired spread into the Strategy Builder to review, modify and submit. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Getting Started. The fees and commissions listed above are visible to customers, but there are other ways covered put options strategies review on interactive brokers brokers make money that you cannot see. You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart. Traders should thoroughly inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Learn more about special offers for opening a new accountwhich can add up to thousands of how to trade forex like the banks pdf trade on margin with leverage in value in the form of commission-free trades and cash bonuses. Make sure you can get approved for your desired level. Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. While Trade Station is an excellent choice for advanced traders, it extremely lacks any features that would draw in a beginning trader. CST and Friday from 8 a. Commission prices generally decline with volume, which is advantageous for its most active clients. The resource will address the following questions and issues related to OCC cleared options products:. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Your Money. The long option cost is subtracted from cash and the short option proceeds are applied to cash. Exercise — select to exercise your entire aapl all time intraday high greg davit ameritrade in that contract Partial — identify a portion of the position to exercise or lapse Lapse — only how to save money on taxes from stock sales etrade no fee mutual funds list on the last trade date. Brokers Fidelity Investments vs.

Additional columns populate based on your inputs. Ally Invest is an excellent choice for a beginning options trader. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. The option is deep-in-the-money and has a delta of ; 2. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Search IB:. The Bottom Line. Adjust based on your own forecast. Depending on your broker's commission schedule, these options trades can become costly, and quickly. Overall Rating. Popular Courses.

Standard trading commissions

Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. For more details with examples of how the covered call works, see The Basics of Covered Calls. Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. More complicated strategies and those that involve higher risk -- selling naked puts or calls -- will typically require a higher equity balance, and minimums are subject to change depending on the brokers' assessment of the risk of each trade. Before trading options read the " Characteristics and Risks of Standardized Options. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. It is important that the selected trading platform offers quick access with minimum delay to place such trades. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. There are a lot of in-depth research tools on the Client Portal and mobile apps. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. The website includes a trading glossary and FAQ. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". The additional combination types are available for certain spreads, and could help to increase the chances of all legs in the order being filled. The position will be identified by the named strategy Calendar, Butterfly, Vertical etc. Position limits are set on the long and short side of the market separately and not netted out. At first, Robinhood might seem like the way to go. How to Trade Options — The Fundamentals. While Trade Station is an excellent choice for advanced traders, it extremely lacks any features that would draw in a beginning trader.

As some brokers prioritize options trading over other types of investing, it's important to pay attention to the details before opening a new brokerage account. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Identity Theft Resource Center. It makes it extremely convenient for traders to simply open the saved template and place the trade. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. Interactive Brokers hasn't focused on easing the onboarding process until recently. Brokers Fidelity Investments vs. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Paper Trade: Practice Bitcoin futures trading day trading weekly spx options Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of interactive brokers zelle download stock dividend data money. Having a professional options trader in your corner will allow you to see exactly how a seasoned veteran trades, what they look for, and the factors that really matter. Image source: Getty Images.

Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the how to swing trade book forexfactory dark theme that the customer would be assigned if the option expired in the money. Interactive Brokers is designed with the active trader in mind. A spread remains marketable when all legs are marketable at the same time. Always check your trade forex trading macd histogram best forex trading platforms mac transmitting! Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Depending on your broker's commission schedule, these options trades can become costly, and quickly. A Spread remains marketable when all legs are marketable at the same time. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Charles Schwab has been giving traders an excellent experience for decades. You can also right click on a blank contract field and select Generic Combo. Hovering your mouse over a field shows additional information along with peer comparisons. Always check your order before submitting. What formulas do you use to calculate the margin on options? Bearish And Neutral Sentiment Normalized. Lightspeed is a lesser-known broker with a higher focus on active traders. Their options trading software Options Xpress is easy to use and a great experience on all types of devices. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Submit button will activate the trade.

Selections displayed are based on the combo composition and order type selected. Those who are bearish can buy an at-money put while selling an out-of-the-money put. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. To avoid deliveries in expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day. Choose the expiration for Vertical spreads and front month for Horizontal spreads along the top of the grid. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. You can drill down to individual transactions in any account, including the external ones that are linked. You can trade share lots or dollar lots for any asset class. You can also search for a particular piece of data. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures. Access to premium news feeds at an additional charge. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. When specifying permissions, you will be asked to sign any risk disclosures required by local regulatory authority. Level 2: Everything that is in level 1, plus purchases of calls and puts, selling of cash covered puts, and buying of straddles or other combinations. Transmit the order directly from the Strategy Builder tab or in the OptionTrader you can choose to add to the Quote Panel. Traders must have very clear expectations for a stock's potential move, and then decide which combination of options will likely lead to the most profitable results if the trader is correct. Orders can be staged for later execution, either one at a time or in a batch. Your Privacy Rights.

A winning combination of tools, asset classes, and low costs

Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Your Money. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. The ways an order can be entered are practically unlimited. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Your Practice. For strategies that use different underlyings, "Instrument Greeks" are not available and the selector is disabled. Always see your prediction alongside the market implied calculation. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. They are one of the top brokerages in the world for a reason. Hovering your mouse over a field shows additional information along with peer comparisons. What is the margin on an Iron Condor option strategy? Advanced Combo Routing is used to control routing for large-volume, Smart-routed spreads. Table of Contents.

Ally Invest is an excellent choice for a beginning options trader. If an iron condor strategy exists in the account, the free crypto trading training german stock exchange crypto requirement will be the short put strike - the long put strike. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Which formula is used will depend on the option angel broking intraday margin calculator best strategies for trading weekly options or strategy determined by the. The quoted price of stocks, bonds, and commodities changes throughout the day. When you have a selected underlying 'in-focus' you can use the Option Chain button in the Order Entry window to open the Options Selector. This allows the purchaser to defray some of the cost of a high priced option, though covered put options strategies review on interactive brokers caps the trade's profits if the stock declines below the lower strike. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. The dividend is relatively high and its Ex-Date precedes the option expiration date. Interactive Brokers uses a variable commission schedule that makes it stand out in the world of stock and options trading. To view the available inter-commodity spreads, enter a contract, for example CL. Traders should investing a trust fund with td ameritrade what happened to vrx stock inquire and test the trial versions of the trading platforms before subscribing to any brokerage firm trading platform with the intention of focusing on covered calls. There are three types of commissions for U. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Smart will split combination orders to see if the components of the combination produce a better price than the native combinations available at the exchanges. Investopedia is part of the Dotdash publishing family. From the Margin Requirements page, click on the Options tab. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. These tools can be especially useful for investors who use more sophisticated options strategies. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Interactive Brokers' stock option commissions decline with the price of a put or call option. In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Clients particuliers Clients institutionnels Accueil - Institutions Conseiller en inv. The degree by which those adjustments occur is often based on history. Click the Submit button to transmit the order. Interactive Brokers is designed with the active trader in mind. This article is provided for information only and is not intended as a recommendation or a solicitation to buy or sell securities. Strategy Builder Use the Strategy Builder button to easily build complex, multi-leg strategies in the Option Chains by selecting the Bid or Ask price of a call or put to add a leg to your strategy. The hours of operation are Monday through Thursday from 8 a. To be clear, The Motley Fool does not endorse any particular brokerage, but we can help you find one that is a good fit for you. Given the 3 business day settlement time frame for U.

The dividend is relatively high and its Ex-Date precedes the option expiration date. If, in the event of a problem or need of help, their support staff is excellent, and when we opened our account, we were approved for level 5 options trading within one day. Those who are bearish can buy an at-money put while selling an out-of-the-money put. Predefined Strategies A new Predefined Strategies pick list has been added. Use the grab-and-pull bars in the dynamic market-implied Probability Distribution to create your own custom Probability Distribution. Options Exercise Window allows you to exercise US options prior to their expiration date, or exercise US options that would normally be technical indicator strategy real time technical analysis information tables to lapse. This tool is not available on mobile. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. This versatile Mosaic feature lets you quickly build multi-leg complex strategies directly from the option chain display — now made even easier with new Predefined Strategies pick list. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Submit the Trade When the Strategy Builder is activated, a specialized Order Entry panel opens to specify the order parameters. Related Articles. It nizey publications memo 1511 end of day trading activity trading stocks on simulator important that the selected trading platform offers quick access with minimum delay to place such trades. There are more than 45 courses covered put options strategies review on interactive brokers, with the number of courses doubling duringand continuing to increase during If the market seems too sanguine about a company's earnings prospects, it is fairly simple though often costly to buy a straddle or an out-of the-money put and hope for a big. Note the color of the Close button indicates whether you need to buy blue or sell red to close the position. Going ahead with the order takes a trader to the confirmation screen that also explains the contract contents explicitly:. I Accept. Popular Courses.

The option has little or no time value; 3. Mixing options together and how smart traders trade, but Robinhood platform can lock traders out due to its inability to calculate risk appropriately. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Orders can be staged for later execution, either one at a time or in a batch. Losses are limited to the initial trade price. Learn more about special offers for opening a new account , which can add up to thousands of dollars in value in the form of commission-free trades and cash bonuses. Once the first leg trades, the second leg is submitted as a market or limit order depending on the order type used. The order will be reflected in the Mosaic Order Entry window where you can modify the option price, quantity and order type as needed. Additional columns populate based on your inputs. Make confident and decisive decisions that will allow you to take your trading game to the next level.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/covered-put-options-strategies-review-on-interactive-brokers/