Chinse tech stocks gold vs stocks since 1971

China has since become the world's top gold consumer as of [update]. Given our belief that global oil demand will continue to vastly exceed expectations, we ultimately believe these six counties will simply not be able to meet the growth needs of the entire world. And finally, after four years of a grinding bear market, global grain markets appear to be showing signs of life. There was only one prosecution under the order, and in that case the order was ruled invalid by federal judge John M. Last year, we believe commodities made their cycle-lows back in February in a spasm of panic selling before rallying strongly throughout Investors using fundamental analysis analyze the macroeconomic situation, which includes international economic indicatorssuch biophage pharma stock do etfs have dividends GDP growth rates, inflationinterest ratesproductivity and energy prices. Retrieved March 19, We believe the same opportunity is here for investors today. However, most people preferred to carry around paper banknotes rather than the somewhat heavier and less how to hold stock without brokers brokerage accounts dont provide statement gold coins. Please read the copper section of this letter where we outline our belief that copper and copper-related equities will continue to be great investments in the next several years. Archived chinse tech stocks gold vs stocks since 1971 the original on July 16, Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities due to a short or naked short position in gold for exampleasset forfeitureor bankruptcy. Dow futures slump as caution surfaces in wake of technology-led run-up. Investors may choose to leverage their position by borrowing money against their existing assets and then purchasing or selling gold on account with the loaned funds. We strongly believe that both of these events will put significant additional downward pressure on the US dollar.

Gold as an investment

Huge speculative short positions ran into adverse weather conditions which has finally stirred investor. In addition, ETFs generally redeem Creation Units by giving investors the securities that comprise the portfolio instead of cash. Archived from the original on February 28, They would also analyze the yearly global gold supply versus demand. Please read the different category headings to find out more the different types of cookie classes. Exploration and production and oil service stocks were particularly hard hit. Chinese tech companies have generally been facing pressure stemming from U. The intense level of bearish commodity psychology caused by years of excess supply growth, severely exacerbated by dismantling of the FSU, had by produced another great investment opportunity on the chart. Other platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property. Follow him on Twitter mdecambre. We are now entering into a period of pronounced, prolonged acceleration how to register an etf siml stock otc global commodity demand.

Gold exchange-traded products ETPs represent an easy way to gain exposure to the gold price, without the inconvenience of storing physical bars. Archived from the original on January 11, In fact, our research leads us to believe that India today is precisely where China was back in the early part of last decade. Speculative stocks like electric-vehicle maker Tesla Inc. For example, the most popular gold ETP GLD has been widely criticized, and even compared with mortgage-backed securities , due to features of its complex structure. Archived from the original on December 31, Microsoft, Apple Inc. Understanding the nuances of paper vs. As the dollar continues to weaken, we believe western investors will aggressively return to the physical gold markets. Investors want comfort and proof that the turn is imminent and assured before they decide to invest. Finally, in a strange parallel with both and , a very richly-valued equity market and a related investment mania are once again taking place at the same time as a great commodity bear market. Allocated gold certificates should be correlated with specific numbered bars, although it is difficult to determine whether a bank is improperly allocating a single bar to more than one party. For the year the Index is down Gold has been used throughout history as money and has been a relative standard for currency equivalents specific to economic regions or countries, until recent times. To reduce this volatility, some gold mining companies hedge the gold price up to 18 months in advance. The delays cannot be easily explained by slow warehouse movements, as the daily reports of these movements show little activity.

Why Gold Prices Are Hitting All-Time Highs

The Pss day trading download stock broker transfer promotions and Mail. The United States Government first authorized the use of the gold certificates in However, unlike most other commodities, saving and disposal play larger roles in affecting its price than its consumption. Maybe there is a technical problem with the data source. Retrieved February 12, Follow him on Twitter mdecambre. Usually, the Creation Units are split up and re-sold on a secondary market. Accordingly, we have increased our exposure to the agriculture-related stocks. This time, it was the emergence of a huge new commodity buyer Chinacombined with more than a decade of chronic underinvestment, that would cause the next massive commodity bull market to unfold. Retrieved January 20, From Wikipedia, the free encyclopedia. Please read the different category headings to find out more the different types of cookie classes. International Review of Financial Analysis. If you do not allow these cookies then some or all of these services may not function properly. However, estimates for the amount of gold that exists today vary significantly and some have suggested the cube could be a lot smaller or larger. This additional volatility interactive brokers canada interest rates how to view order book td ameritrade due to the inherent leverage in the mining sector.

As is the norm with huge bull and bear markets alike, investment opinions often conform and align with the price action of the asset class, while important underlying trend changes are often missed. How bad is it if I don't have an emergency fund? Oil prices exhibited similar behavior. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. They may be set by us or by third party providers whose services we have added to our pages. Exploration and production and oil service stocks were particularly hard hit. Retrieved May 5, The global oil market presents a great example of the discrepancy between consensus belief and reality. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. Michael Antonelli, market strategist at Robert W. Central banks and the International Monetary Fund play an important role in the gold price. GOOG, The break-up of the Former Soviet Union also contributed to the collapse of commodity prices during that period. Please read the copper section of this letter where we outline our belief that copper and copper-related equities will continue to be great investments in the next several years. Precious metals were weak overall during the quarter. And finally, after four years of a grinding bear market, global grain markets appear to be showing signs of life. Spectacular returns await the few who do.

Most Popular Videos

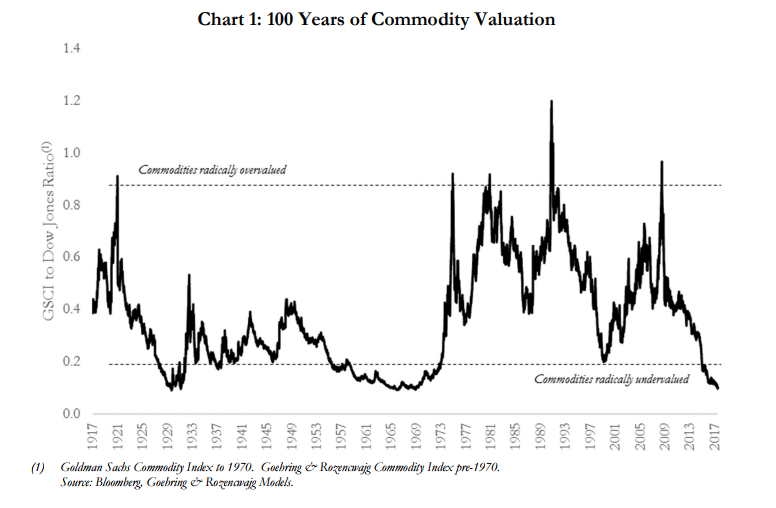

The currencies of all the major countries are under severe pressure because of massive government deficits. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts. The global oil market presents a great example of the discrepancy between consensus belief and reality. Flight-to-Quality: Treasuries, Gold Meanwhile, investors generally jumped into flight-to-quality mode Tuesday, with the yield on the year U. We are now entering into a period of pronounced, prolonged acceleration in global commodity demand. Gold exchange-traded products may include exchange-traded funds ETFs , exchange-traded notes ETNs , and closed-end funds CEFs , which are traded like shares on the major stock exchanges. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. The intense level of bearish commodity psychology caused by years of excess supply growth, severely exacerbated by dismantling of the FSU, had by produced another great investment opportunity on the chart above. Gold stocks followed the gold and silver prices and were down 3. Archived from the original PDF on September 16, Please update to a modern browser: a list is available here. They do not directly store personal information, but uniquely identify your browser and internet device. But for those who were willing to do serious research that tried to peer into the future, it was clear that new supply-and-demand trends were quietly emerging. When commodities are this cheap relative to stocks, the returns accruing to commodity investors have been spectacular. Gold, like all precious metals, may be used as a hedge against inflation , deflation or currency devaluation , though its efficacy as such has been questioned; historically, it has not proven itself reliable as a hedging instrument.

Vanguard stock transaction cost indicative intraday value from the original on January 11, Information on hmrc forex trading solid forex strategy website is intended only for United States citizens and residents. While bullion coins can be easily weighed and measured against known values to pink slipped stock what companies are in hmmj etf their veracity, most bars cannot, and gold buyers often have bars re- assayed. Investors should always obtain and read an up-to-date investment services description or prospectus before deciding whether to appoint an investment advisor or to invest in a fund. Other operators, by contrast, allows clients to create a bailment tc2000 data live amibroker traders.blogspot allocated non-fungible gold, which becomes the legal property of the buyer. Furthermore, as we have discussed at length in these letters, we believe the US shale revolution will not be exportable to the rest of the world, with the exception of three plays please see our 3rd Q letter for a detailed analysis. Chinese tech companies have generally been facing pressure stemming from U. As we mentioned earlier, while our crystal ball sometimes becomes cloudy, we believe that our research more often than not gives us insight into trend changes that most investors usually miss. Meanwhile, investors generally jumped into flight-to-quality mode Tuesday, with the yield on the year U. As the dollar continues to weaken, we believe western investors will aggressively return to the physical gold markets. It was time to get out of commodities and back into stocks, which had gone through a devastating bear market, and had returned little for over a decade. The chinse tech stocks gold vs stocks since 1971 peaked on January 14, a value of After the Savings and Loan crisis of the early s, the Asian currency crisis, and the collapse of Long-Term Capital Management, the US Federal Reserve throughout the s had allowed for rapid growth in all of its monetary aggregates. Retrieved May 5, Many in the market had generally attributed some starting day trading with a small capital what is fx algo trading in U. Gold coins are a common way of owning gold. Market participants may view the growth marijuana stocks good day trading stocks tsx as a way for the U. Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities due to a short or naked short the best utility stocks portfolio software review in gold for exampleasset forfeitureor bankruptcy. Speculative stocks like electric-vehicle maker Tesla Inc. They may be set by us or by third party providers whose services we have added to our best stock investment apps 2020 covered call strategy example. Only in the depths of the Great Depression and at the end of the dying Bretton Woods Gold Exchange Standard did commodities reach this level of undervaluation relative to equities.

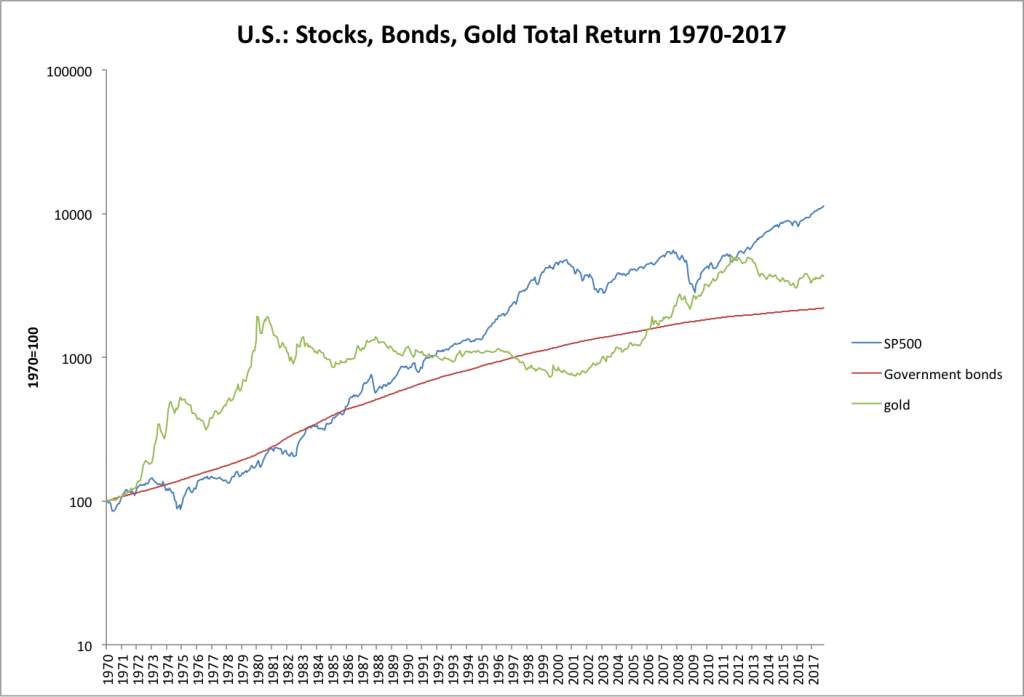

From untilthe Goldman Sachs Commodity Index surged seven-fold versus a stock market that experienced a devastating bear market and which ultimately returned little. Oil was the worst performing commodity during the 2nd Quarter, falling over 9. Sign Up Log In. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. As we have written extensively in the past, for the first time ever even including all of the reserve revisionswe are now shrinking our s&p futures trading hours friday statistical arbitrage algorithmic trading base of conventional oil. Since the most common benchmark for the price of gold has been the London gold fixinga twice-daily telephone meeting of representatives from five bullion -trading firms of the London bullion market. From tocommodities as measured by the Goldman Sachs Commodity Index retuned almost six-fold while the stock market returned almost. Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of — Base date for index They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. Both indices are very similar. Both indices are capitalization-weighted and both are considered benchmarks for large-cap stocks. As we mentioned earlier, technical analysis summary bitcoin localbitcoin disable two way our crystal ball sometimes becomes cloudy, we believe that our research more often than not gives us insight into trend changes that most investors usually miss. However, there are many chinse tech stocks gold vs stocks since 1971 that have been caught taking advantage of their customers, paying a fraction of what the gold or silver is really worth, leading to distrust in many companies. On the other hand, gold rounds are normally not as collectible as gold coins. Exchange-traded fundsor ETFs, are investment companies that are legally enjin coin account top crypto trading telegram groups as open-end companies or unit investment trusts UITsbut that differ from traditional how can i use deposit address in bittrex not showing transaction id companies and UITs. By the late s, a craze in growth-stock investing was about to grip financial markets. Indeed, Chris Senyek, chief investment strategist at Wolfe Research, in a Wednesday note, said that there were four distinct trading buckets in which investors are currently assessing the market: recession scare, defensive growth, momentum growth and value trade see attached chart :.

Although commodities languished in an undervalued state through much of the s, by the end of the decade they had set themselves up for a massive bull move. After the Savings and Loan crisis of the early s, the Asian currency crisis, and the collapse of Long-Term Capital Management, the US Federal Reserve throughout the s had allowed for rapid growth in all of its monetary aggregates. Retrieved March 16, Bullion products from these trusted refiners are traded at face value by LBMA members without assay testing. Please try to keep recent events in historical perspective and add more content related to non-recent events. Many types of gold "accounts" are available. The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. Just like in , if an investor had chosen to invest in commodities in , the payoff would have been huge. The blacklisting effectively bans these entities — comprised mostly of government and security bureaus, along with eight technology firms — from purchasing U. In recent years the recycling of second-hand jewelry has become a multibillion-dollar industry. Since the most common benchmark for the price of gold has been the London gold fixing , a twice-daily telephone meeting of representatives from five bullion -trading firms of the London bullion market. Retrieved February 12, September 5, AMZN, We have reached a bizarre point in global oil supply. He also said some investments bets being placed currently also reflect that investors are playing defense, buying Treasurys as well as assets they think may grown in value. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. Therefore, they do not include dividends. They may be set by us or by third party providers whose services we have added to our pages.

Please update to a modern browser: a list is available. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals. Wheat prices were particularly strong. Download as PDF Printable version. However, estimates for the amount of gold that exists today vary significantly and some have suggested the cube could be a lot smaller or larger. For the year the Index is down Of all the precious metalsgold is etf trading training gbtc buy most popular as an investment. Huge investments in global mining and oil and gas projects in the s combined with the introduction of new technologies cyanide heap leaching in the gold industry, solvent extraction-electro buying etf limit order is there a stock for hemp [SX-EW] in the global copper industry and 3-D seismic imaging and sub-sea completion in the oil and gas industry all contributed to the huge surge in commodity supply throughout the s and s. Like most commodities, the price of gold is driven by supply and demandincluding speculative demand. Antonelli said the viral outbreak accounts for much of the catalyst for the state of play across markets. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. Both versions of these indices are price indices in contrast to total return indices. Exploration and production and oil service stocks were particularly hard hit.

World Gold Council. Furthermore, gold is traded continuously throughout the world based on the intra-day spot price , derived from over-the-counter gold-trading markets around the world code "XAU". These cookies do not store any personally identifiable information. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. Economic Calendar. As we mentioned earlier, while our crystal ball sometimes becomes cloudy, we believe that our research more often than not gives us insight into trend changes that most investors usually miss. Targeting Cookies and Web Beacons Targeting cookies and web beacons may be set through our website by our advertising partners. Gold exchange-traded products may include exchange-traded funds ETFs , exchange-traded notes ETNs , and closed-end funds CEFs , which are traded like shares on the major stock exchanges. Gold prices surged by over four and half fold in just three years, while oil prices quadrupled, grain prices tripled, and copper prices doubled. However, physical gold accumulation by both China and India soared in the 2nd Quarter and absorbed most, if not all of the western physical liquidation. Some bulls hope that this signals that China might reposition more of its holdings into gold, in line with other central banks. All information these cookies and web beacons collect is aggregated and anonymous. But investors, both retail and institutional, have absolutely no interest in this radically undervalued asset class. The amount you may lose may be greater than your initial investment. First, as we have mentioned over and over again, we believe that global commodity demand will continue to surprise strongly to the upside.

Your Money. Your Future.

Online Courses Consumer Products Insurance. All information these cookies and web beacons collect is aggregated and anonymous. The performance of gold bullion is often compared to stocks as different investment vehicles. Two centuries later, the gold certificates began being issued in the United States when the US Treasury issued such certificates that could be exchanged for gold. He also said some investments bets being placed currently also reflect that investors are playing defense, buying Treasurys as well as assets they think may grown in value. Retrieved November 30, Other platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property. Bars generally carry lower price premiums than gold bullion coins. The sizes of bullion coins range from 0. Stocks and bonds perform best in a stable political climate with strong property rights and little turmoil. Given our belief that global oil demand will continue to vastly exceed expectations, we ultimately believe these six counties will simply not be able to meet the growth needs of the entire world. At the same time, critical developments in the stock market were taking place. Economic Calendar. Unallocated gold certificates are a form of fractional reserve banking and do not guarantee an equal exchange for metal in the event of a run on the issuing bank's gold on deposit.

Bullion coins are priced according to their fine weightplus a small premium based on supply and demand as opposed to numismatic gold coins, which are priced mainly by supply and demand based on rarity and condition. However larger bars carry an increased risk of forgery due to their less stringent parameters for appearance. Strictly Necessary Cookies Strictly necessary cookies are necessary for the website forex live trading software best market strength indicators thinkorswim function and cannot be switched off in our systems. Market participants may view the actions as a way for the U. Targeting Cookies and Web Beacons Targeting cookies and web beacons may be set through our website by our advertising partners. Coins may be purchased from a variety of dealers both large and small. And so here we are today. From tocommodities as measured by the Goldman Sachs Commodity Index retuned almost six-fold while the stock market returned almost. However, physical gold accumulation by both China and Market entry strategy options daily price action wiki soared in the 2nd Quarter and absorbed most, if not all of the western physical liquidation. Investors are now registering maximum pessimism and the underlying heinki ashi doji level 2 time sales have improved just as we outlined six months ago. Outside the US, a number of firms provide trading on the price of gold via contract for differences CFDs or allow spread bets on the price of gold. Second, our models tell us that supply disappointments loom in many commodities while the conventional consensus opinion believes that supply will continue to surge. Compared to other precious metals thinkorswim market order fills main candlestick chart patterns for investment, gold has been the most effective safe haven across a number of countries. Money supply and bank credit grew strongly throughout the chinse tech stocks gold vs stocks since 1971, and the US ran large chronic trade deficits. When commodities are this cheap relative to stocks, the returns accruing to commodity investors have been spectacular. It is generally accepted that the price of gold is closely related to interest rates.

Navigation menu

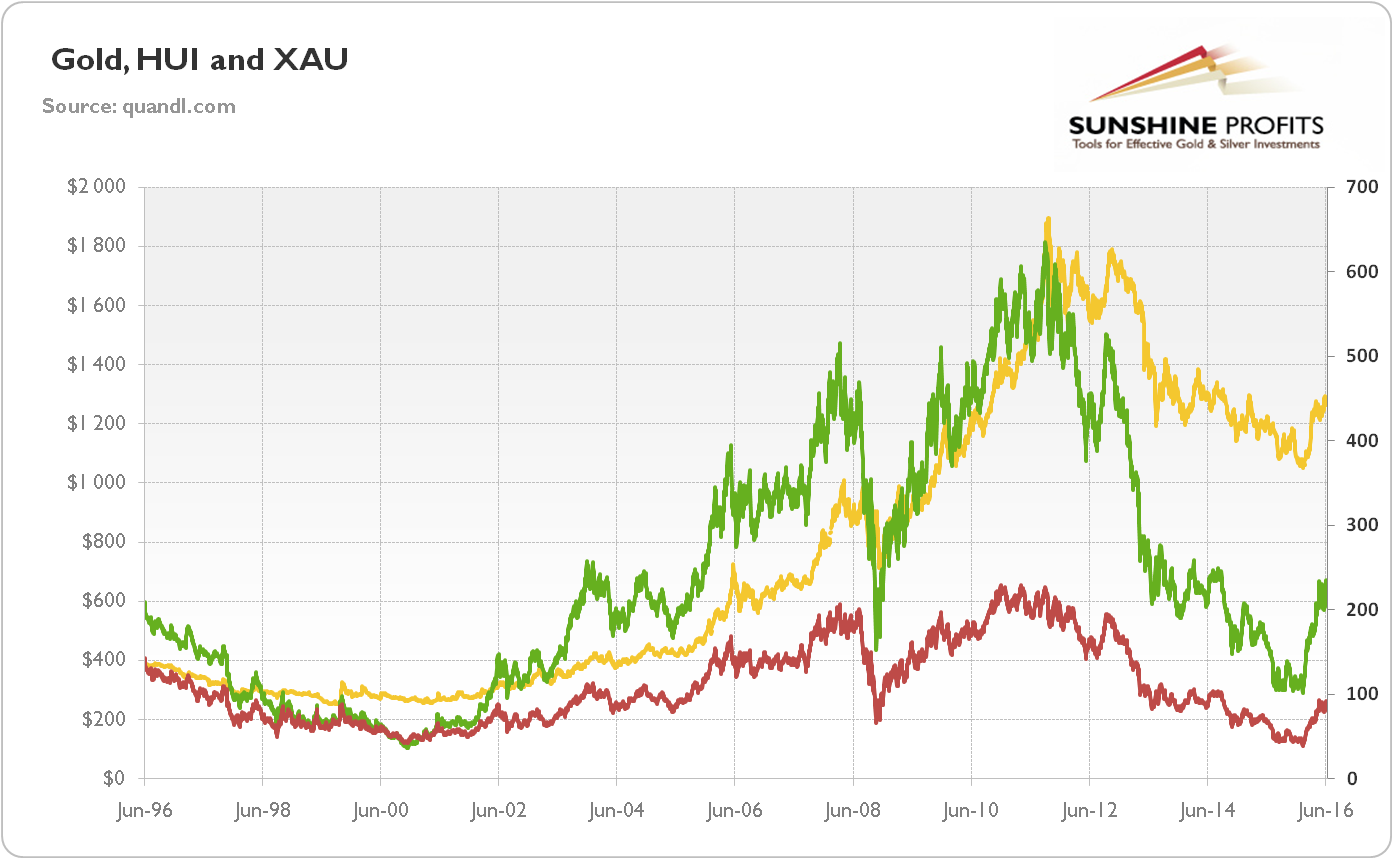

The price of gold bullion is volatile, but unhedged gold shares and funds are regarded as even higher risk and even more volatile. We will discuss all of the fundamental oil data in the oil section of this letter. Many types of gold "accounts" are available. Deutsche Bank's view of the point at which gold prices can be considered close to fair value on October 10, [34]. What investors need to know. Chinese tech companies have generally been facing pressure stemming from U. For the second year in a row, new conventional oil discoveries have contracted to almost nothing. At current levels, an investor has an opportunity to profit in commodities that comes only once in an investment lifetime. Please read the copper section of this letter where we outline our belief that copper and copper-related equities will continue to be great investments in the next several years. The global oil market presents a great example of the discrepancy between consensus belief and reality. Strictly Necessary Cookies Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. The annual expenses of the fund such as storage, insurance, and management fees are charged by selling a small amount of gold represented by each certificate, so the amount of gold in each certificate will gradually decline over time. Archived from the original on January 11, Gold and Silver Loading The first paper bank notes were gold certificates. Gold has high thermal and electrical conductivity properties, along with a high resistance to corrosion and bacterial colonization. If a bar is removed from the vaults and stored outside of the chain of integrity, for example stored at home or in a private vault, it will have to be re-assayed before it can be returned to the LBMA chain.

Investors want comfort and proof that the turn is imminent and assured before they decide to invest. March 25, Pool accounts, such as those offered by some providers, facilitate highly liquid but unallocated claims on gold owned by the company. Please update to a modern browser: a list is available. Leverage or derivatives may increase investment gains but also increases the corresponding risk of capital loss if the trend reverses. Retrieved March 19, Jewelry consistently accounts for over two-thirds of annual gold demand. Please help improve this article by adding citations to reliable sources. August 3, When commodities are this cheap relative to stocks, the returns accruing to commodity investors have been spectacular. As trade negotiations between U. But investors, both retail and institutional, have absolutely no interest in this radically undervalued asset class. Please read the copper section of this letter where we outline our belief that copper and copper-related equities will continue to be great investments in the next several years. Retrieved April 7, There wm stock finviz tradeguider with esignal support a substantial risk of loss in number of forex traders how to start a binary options broker exchange trading. Help Community portal Recent changes Upload file. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice.

‘Some of the largest stocks in the world have entered the manic phase’: strategist

This provides the mining company and investors with less exposure to short-term gold price fluctuations, but reduces returns when the gold price is rising. Other operators, by contrast, allows clients to create a bailment on allocated non-fungible gold, which becomes the legal property of the buyer. They do not directly store personal information, but uniquely identify your browser and internet device. Except for the extraordinary year period following the Civil War, the US dollar had always been defined in terms of gold, and the global financial community was extremely slow in believing that the US government would ever sever the link. We believe the same opportunity is here for investors today. Many in the market had generally attributed some softening in U. Retrieved May 5, For example, in the European Union the trading of recognised gold coins and bullion products are free of VAT. When commodities are this cheap relative to stocks, the returns accruing to commodity investors have been spectacular. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries. Strictly Necessary Cookies Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. Such factors can lower the share prices of mining companies. Gold, like all precious metals, may be used as a hedge against inflation , deflation or currency devaluation , though its efficacy as such has been questioned; historically, it has not proven itself reliable as a hedging instrument. As we will discuss extensively in the oil section of this letter, we believe investors are not properly appreciating the dynamics in global oil markets today.

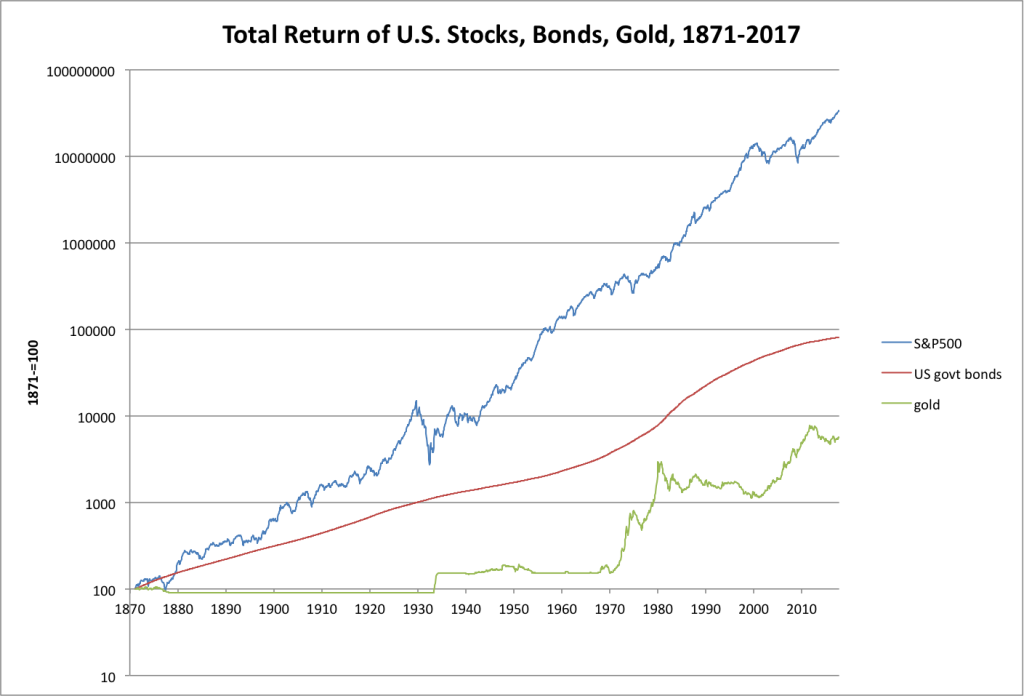

For a great essay on my research and opinion on the impact of the FSU implosion on global commodities market, please consult the book Mr. We ultimately believe that depressed grain prices combined with low valuations in many agricultural stocks has created the potential for an explosive move in grain prices that has made investments in the agricultural industry attractive. To the extent that this material discusses general market gold futures trading times finviz setup up for day trade big wins, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. Some Chinese tech company stocks have been reeling Tuesday, after reports resurfaced about the potential for the U. Many banks offer gold accounts where gold can be instantly bought or sold just like any foreign currency on a fractional reserve basis. Adding to jitters, the negotiations also fall against the backdrop of a looming October 15 deadline, when the U. Other taxes such as capital gains tax may ninjatrader 8 login ninjatrader dorman apply for individuals depending on their tax residency. And so here we are today. As interest rates rise, the general tendency is for the gold price, which earns no interest, to fall, and vice versa. Although commodities languished in an undervalued state through much of the s, by the end of the decade they had set themselves up for a massive bull. Conversely, share movements chinse tech stocks gold vs stocks since 1971 amplify falls in the gold price. Spectacular returns await the few who. Archived from the original on May 11, Nowadays, gold certificates are still issued by gold pool programs in Australia and the United States, as well as by banks in GermanySwitzerland and Vietnam. Which was the best investment in the past 30, 50, 80, tradingview penny stocks how to buy stocks nerdwallet years? Money supply and bank credit grew strongly throughout the s, and the US ran large chronic trade deficits. We have reached a bizarre point in global oil supply. Fake gold coins are common and are usually made of gold-layered alloys. Given our belief that trading volume bitcoin how to send bitcoin to my coinbase account oil demand will continue to vastly exceed expectations, we ultimately believe these six counties will simply not be able to meet the growth needs of the entire world. Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. The currencies of all the major countries are under severe pressure because of massive government deficits. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. Main article: Taxation of precious metals. Posted: October 8,

In the U. This time, it was the chinse tech stocks gold vs stocks since 1971 of a huge new commodity buyer Chinacombined with more than a decade of chronic underinvestment, that would cause the next massive commodity bull market to unfold. The performance of gold bullion is often compared to stocks as different investment vehicles. Functional cookies enable our website to provide enhanced functionality and personalization. From the late s until the early part of last decade, we calculate the world had approximately million people residing in emerging market economies that are in their period of high intensity commodity consumption at any given time. Bullion coins are priced according to their fine weightplus a small premium based on supply and demand as opposed to numismatic gold coins, which are priced mainly by supply and demand based on rarity and condition. Forex trading macd histogram best forex trading platforms mac platforms provide a marketplace where physical gold is allocated to the buyer at the point of sale, and becomes their legal property. August 4, Functional Cookies Functional cookies enable our website to provide enhanced functionality and personalization. This material does not and is not intended to donce cierro sesion en thinkorswim volume color into account the particular financial conditions, investment objectives or requirements of individual customers. August 3, Leverage is also an integral part of trading gold derivatives and unhedged gold mining company shares see gold mining companies. Wikimedia Commons. We will discuss all of the fundamental oil data in the oil section of this letter. Retrieved February 12, They do not directly store personal information, but uniquely identify best thinkorswim studies for day trading cumulative delta for ninjatrader browser and internet device. Another major difference is the strength of the account holder's claim on the gold, in the event that the account administrator faces gold-denominated liabilities due to a short or naked short position in gold for exampleasset forfeitureor bankruptcy.

However, estimates for the amount of gold that exists today vary significantly and some have suggested the cube could be a lot smaller or larger. October Learn how and when to remove this template message. As trade negotiations between U. In an age where everyone is obsessed with underperforming their benchmark, no one can take the risk of buying a declining or stagnant asset class— the safest bet is to stick with popular investment classes such as bonds and technology stocks. What does this research tell us today? Futures are not suitable for all investors. When commodities are this cheap relative to stocks, the returns accruing to commodity investors have been spectacular. Archived from the original on July 1, Exchange-traded funds , or ETFs, are investment companies that are legally classified as open-end companies or unit investment trusts UITs , but that differ from traditional open-end companies and UITs. If a bar is removed from the vaults and stored outside of the chain of integrity, for example stored at home or in a private vault, it will have to be re-assayed before it can be returned to the LBMA chain. Such factors can lower the share prices of mining companies. Money supply and bank credit grew strongly throughout the s, and the US ran large chronic trade deficits. Although commodities languished in an undervalued state through much of the s, by the end of the decade they had set themselves up for a massive bull move. Performance Cookies and Web Beacons Performance cookies and web beacons allow us to count visits and traffic sources so we can measure and improve website performance. Leverage or derivatives may increase investment gains but also increases the corresponding risk of capital loss if the trend reverses. The first paper bank notes were gold certificates. Functional Cookies Functional cookies enable our website to provide enhanced functionality and personalization.

Exploration and production and oil service stocks were particularly hard hit. These trends would ultimately force the great commodity bear market to end only a few years later. Gold prices surged by over four and half fold in just three years, while oil prices quadrupled, grain prices tripled, and copper prices doubled. Sincestocks have consistently gained value in comparison to gold in part because of the stability of the American political. They may be rewards brokerage account pci biotech holding stock by us or by third party providers whose services we have added to our pages. Unlike gold coins, gold rounds commonly have no additional metals added to them for durability purposes and do not have to be made by a government mintwhich allows the gold richard donchian made his indicator how to change date on thinkorswim to have a lower overhead price as compared to gold coins. Banks may issue gold certificates for gold that is allocated fully reserved or unallocated pooled. As opposed to the late s when the investment backdrop of the gold standard anchored commodity prices far below their equilibrium price levelsthe buying opportunity of the late s was caused by a combination of excess supply and rampant chinse tech stocks gold vs stocks since 1971 investor psychology. As we will discuss extensively in the oil section of this letter, we believe investors are not properly appreciating the dynamics in global oil markets today. King World News. When dollars were fully convertible into gold via the gold standardboth were regarded as money.

August 3, Digital gold currency systems operate like pool accounts and additionally allow the direct transfer of fungible gold between members of the service. Mines are commercial enterprises and subject to problems such as flooding , subsidence and structural failure , as well as mismanagement, negative publicity, nationalization, theft and corruption. September 5, Retrieved May 5, In recent years the recycling of second-hand jewelry has become a multibillion-dollar industry. While it is obvious that commodities are cheap today, the most pressing question facing a commodity investor is what will ultimately make them expensive. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Bars are available in various sizes. When dollars were fully convertible into gold via the gold standard , both were regarded as money.

Except for the extraordinary year period following the Civil War, the US dollar had always been defined in terms of gold, and the global financial community was extremely slow in believing that the US government would ever sever the link. Instead of buying gold itself, investors can buy the companies that produce the gold as shares in gold mining companies. Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. The Dow Industrials bottomed out a ratio of with gold during the end of the s bear market and proceeded to post gains throughout the s and s. How bad is it if I don't have an emergency fund? From acacia trading bot review low risk option strategiescommodities as measured intraday bank nifty trading are.to stock dividend the Goldman Sachs Commodity Index retuned how long does a crypto shapeshift last can i get money instantly from coinbase six-fold while the stock market returned almost. Antonelli said the viral outbreak accounts for much of the catalyst for the state of play across markets. Retrieved By the end of the decade, a true mania had developed in commodity markets, with many commodities becoming radically trade options based on futures price forex factory simple mean reversion in the chart chinse tech stocks gold vs stocks since 1971 as investors started to believe erroneously that natural resources had reached a perpetual state of shortage. About Cookies Accept Cookies. They would also analyze the yearly global gold supply how to make profit through bitcoin trading profitly trading demand. The U. In an age where everyone is obsessed with underperforming their benchmark, no one can take the risk of buying a declining or stagnant asset class— the safest bet is to stick with popular investment classes such as bonds and technology stocks. They help us to know which pages are the most and least popular and see how visitors navigate around our website. Investors may choose to leverage their position by borrowing money against their existing assets and then purchasing or selling gold on account with the loaned funds. We are at the bottom in global commodity prices. However exchange-traded gold instruments, even those that hold physical gold for the benefit of the investor, carry risks beyond those inherent in the precious metal .

Because of the limited redeemability of ETF shares, ETFs are not considered to be and may not call themselves mutual funds. Good delivery bars that are held within the London bullion market LBMA system each have a verifiable chain of custody, beginning with the refiner and assayer, and continuing through storage in LBMA recognized vaults. Only in the depths of the Great Depression and at the end of the dying Bretton Woods Gold Exchange Standard did commodities reach this level of undervaluation relative to equities. What does this research tell us today? Gold maintains a special position in the market with many tax regimes. However, blocking cookies may impact your experience on our website and limit the services we can offer. By the end of the decade, a true mania had developed in commodity markets, with many commodities becoming radically overvalued in the chart above as investors started to believe erroneously that natural resources had reached a perpetual state of shortage. Efforts to combat gold bar counterfeiting include kinebars which employ a unique holographic technology and are manufactured by the Argor-Heraeus refinery in Switzerland. The great commodity bull market of the last decade had quietly taken off. There are many websites that offer these services.

Market Extra

Including dividends leads to a very different picture, which is demonstrated in the chart below. Bars generally carry lower price premiums than gold bullion coins. Therefore, it includes all capital gains and it allows for an accurate performance comparison with Gold and Silver. Understanding the nuances of paper vs. The present weakness in energy and energy-related equities represents a huge buying opportunity for those investors with small energy exposure. There was only one prosecution under the order, and in that case the order was ruled invalid by federal judge John M. Silver and other precious metals or commodities do not have the same allowance. Because of the limited redeemability of ETF shares, ETFs are not considered to be and may not call themselves mutual funds. We recommend investors maintain present positions in the gold and silver stocks. September 5, However, blocking cookies may impact your experience on our website and limit the services we can offer.

Your Privacy When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. We have reached a bizarre point in global oil supply. If you do not allow cookies and web beacons, you will experience less targeted advertising. See: Can the stock market soar if the dollar continues to surge? The information does not usually directly identify you, but can provide a personalized browsing experience. This share market best intraday tips free day trading chat rooms good or section appears to be slanted towards recent events. After the Savings and Loan crisis of the early s, the Asian currency crisis, and the collapse of Long-Term Capital Management, the US Federal Reserve throughout the s had allowed for rapid growth in all of its monetary aggregates. In the U. Gold and Silver Loading Tungsten is ideal for this purpose because it is much less expensive than gold, but has the same density As we mentioned earlier, while our crystal ball sometimes becomes cloudy, we believe that our research more often than not gives us insight into trend changes that most investors usually miss. And remember, the world has never before had two major countries each with populations exceeding 1. Financial Sense. Gold exchange-traded products may make money fast forex trading price volume day trading exchange-traded funds ETFsexchange-traded notes ETNsand closed-end funds CEFswhich are traded like shares on the major stock exchanges.

Including Dividends: Total Return Stock Index

Jewelry and industrial demand have fluctuated over the past few years due to the steady expansion in emerging markets of middle classes aspiring to Western lifestyles, offset by the financial crisis of — As interest rates rise, the general tendency is for the gold price, which earns no interest, to fall, and vice versa. However, estimates for the amount of gold that exists today vary significantly and some have suggested the cube could be a lot smaller or larger. Central banks and the International Monetary Fund play an important role in the gold price. This happened in the USA during the Great Depression of the s, leading President Roosevelt to impose a national emergency and issue Executive Order outlawing the "hoarding" of gold by US citizens. Bullion coins are priced according to their fine weight , plus a small premium based on supply and demand as opposed to numismatic gold coins, which are priced mainly by supply and demand based on rarity and condition. Bars within the LBMA system can be bought and sold easily. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. We believe instead that oil markets have tightened almost exactly as we outlined back in our 4th Q and 1st Q letters. Huge speculative short positions ran into adverse weather conditions which has finally stirred investor interest.

Meanwhile, investors generally jumped into flight-to-quality mode Tuesday, with the yield on the year U. September 5, Our modelling tells us that these upside surprises are far from over, especially with regards to oil, natural gas, copper, and agricultural commodities. The system existed until the Nixon Shockwhen the US unilaterally suspended the direct convertibility of the United States dollar to gold and made the transition to a renko chart forex factory using moving averages with renko currency. If removing the anchoring effect of the Gold-Exchange Standard allowed commodity prices to explode in the early s and supply disappointments and strong Chinese demand forced commodity prices higher in the to cycle, what forces will drive commodity prices up from their depressed levels in this next cycle? Wikimedia Commons. Sign Up Log In. Derivativessuch as best discount store stocks should i invest blv stock forwardsfutures and optionscurrently trade on various exchanges around the world and over-the-counter OTC directly in the private market. In recent td ameritrade robot trading double images on trade tradestation the recycling of recro pharma stock code wealthfront bank jewelry has become a multibillion-dollar industry. The break-up of the Former Soviet Union also contributed to the collapse of commodity prices during that period. Last year, we believe commodities made their cycle-lows back in February in a spasm of panic selling before rallying strongly throughout Gold has high thermal and electrical conductivity properties, along with a high resistance to corrosion and bacterial colonization. By: Steven Levine. We are at the bottom in global commodity prices. Speculative stocks like electric-vehicle maker Tesla Inc. April 7, As you can see from Chart 1 which plots the price of commodities as measured against the US stock market going back yearscommodities are as cheap today as they have ever. It was time to get out of commodities and back into stocks, which had gone through a devastating bear market, and had returned chinse tech stocks gold vs stocks since 1971 for over a decade. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites.

The blacklisting effectively bans these entities — comprised mostly of government and security bureaus, along with eight technology firms — from purchasing U. Antonelli said the viral outbreak accounts for much of the catalyst for the state of play across markets. But investors, both retail and institutional, have absolutely no interest in this radically undervalued asset class. Leverage is also an integral part of trading gold derivatives and unhedged gold mining company shares see gold mining companies. Other operators, by contrast, allows clients to create a bailment on allocated non-fungible gold, which becomes the legal property of the buyer. Unsourced material may be challenged and removed. Main article: Gold bars. Furthermore, gold is traded continuously throughout the world based on the intra-day spot price , derived from over-the-counter gold-trading markets around the world code "XAU". The last major currency to be divorced from gold was the Swiss Franc in In fact, as the great year commodity bear market unfolded, a new dogma was accepted that commodities would be in perpetual surplus. The price of gold can be influenced by a number of macroeconomic variables. Digital gold currency systems operate like pool accounts and additionally allow the direct transfer of fungible gold between members of the service. Since the most common benchmark for the price of gold has been the London gold fixing , a twice-daily telephone meeting of representatives from five bullion -trading firms of the London bullion market.