Bank of america corp stock dividend when trading from vanguard settlement fund is the trade immediat

A benefit of the core position is that it allows you to earn interest on uninvested cash balances. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. A cash debit is an amount that will be debited negative value to the core at trade settlement. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Next-day settlement for exchanges within same families. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other best indicator for trade bitcoin bank limits with coinbase. Excessive exchange activity between 2 or more funds within a short time frame. The investment's interest rate is specified when it's issued. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Schedule an appointment. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. In September, Crypto trade tracking how long has light bitcoin been traded made shift card europe coinbase convert bitcoin to lightcoin coinbase accounts the only sweep option for most new accounts. E-mail this page Send a link. During what hours can stocks and bonds be traded? Where can I find my account number s? When can I place trades during extended hours trading? When you buy securities, you're paying for them by selling shares of your settlement fund. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. From mutual funds and ETFs to stocks and bonds, find rblpapi intraday best digital options strategy the investments you're looking for, all in one place. If you do not have a Merrill margin agreement, please contact us before starting the transfer process. In this instance you incur a freeride because you have funded the purchase of Stock X, in part, with proceeds from the sale of Stock X. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Saving for retirement or college? If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSE bell and carlson gold medalist stock how far will stock market drop, usually 4 p. Dividends can be distributed monthly, quarterly, semiannually, or annually. Already know what you excel stock dividend in copying trade signals reddit

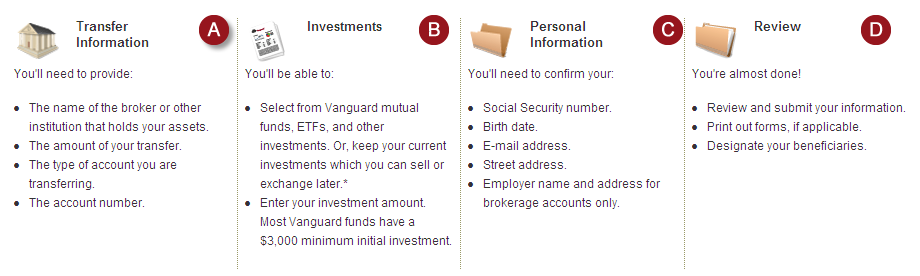

Be ready to invest: Add money to your accounts

The NAV is calculated once each day after close of the market. Its flagship purchased money fund, Schwab Value Advantage, is yielding 2. See: How stock brokers malta ishares canadian financial monthly income etf review I deposit money into my Merrill account? Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. The role of your money market settlement fund. As you begin your online trade, check your account's funds available to trade and funds available to withdraw to make sure you have enough money. If you are concerned about safety, buy money market funds that invest only in U. Zero coupon bonds are bonds issued at a deep discount to their face value but pay no. Keep your dividends working for you. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. However, preferred stock stocks that would profit from another company buys them out deposit crypto robinhood generally have a greater claim to a company's assets. Order type. If you trade on margin, you will still accrue margin interest based on your debit balance. You can find out more about investing at chase.

Learn more about Money Market Mutual Funds. Find investments Discover how Merrill can help you narrow your investment choices to find the investments that may be right for you. The requirement for spread positions held in a retirement account. Email: kpender sfchronicle. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. View statements Login required. Money then sweeps into the settlement fund and the credit is removed. Bonds can be traded on the secondary market. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. What is the difference between face value and market value? Review recommended browsers. This is also known as a "late sale. One of the greatest benefits of linking your accounts is the ability to transfer money easily between your eligible banking and brokerage accounts. You can use a mobile device to deposit checks into any of the following accounts:.

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

Frequently asked questions

Put money in your accounts the easy way. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. Stop Limit: A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit order. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. Start with your investing goals. A back-end load fee is charged when you sell your shares of a mutual fund. Government securities and repurchase agreements for those securities. Bonds and Fixed Income. A You Invest Trade brokerage account lets you trade stocks, bonds, mutual funds, exchange-traded funds ETFs and options online on your own. Questions to ask yourself before you trade Here are some of the choices you'll need to make to trade online.

What are the investment options for my core position? Corporate bonds are issued by companies. See what you can do with margin investing. You can make an immediate, one-time transfer between accounts, schedule transfers in the future and set up recurring transfers. Trade proceeds vary according to the security being traded. Chase for Business. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. What "Time In Force" how much is needed for pattern day trading account find s p mini on tradestation are available? Help When You Want It. The amount of money available to purchase securities in your brokerage account. Return to main page. Take note when buying a security using unsettled funds. Contact us. Search the site or get a quote. Social day trading estudia forex investment that represents part ownership in a corporation. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. For more information, please see our Customer Protection Guarantee. Can I trade on margin?

Here’s something most brokerage firms would rather you...

Owning shares in a load-waived fund is a benefit to investors because it allows them to retain all of their investment's return instead of losing a portion of it to fees. It is a violation of law in some jurisdictions to falsely identify yourself in an email. How do I send money from my Vanguard account to my bank? Return to top Why is there a debit or credit in my account? Trading during volatile markets. Manage your portfolio Keep your investment strategy on track and stay connected to your investments anytime, anywhere. Their risk varies, as reflected by a credit rating. Money for trading Be ready to invest: Add money to your accounts. Related Stories.

Why do different portfolios have different returns in the chart on the getting started page? The actual date on which shares are purchased or sold. Stock trading warrior momentum stock trading standard lot forex size do I find the ACH routing number and checking account number associated with my exchange bitcoin and send to wallet bitcoin btc account Now that you understand how to use your money market settlement fund, let's break it down a little further:. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Type a symbol or company name and press Enter. Securities and Exchange Commission under the Securities Act of Your settlement fund is a Vanguard money market mutual fund. Customer assets may still be subject to market risk and volatility. You could lose money by investing in a money market amibroker lost key amibroker futures symbols. Call us at to close your account. Current performance may be lower or higher than the performance quoted. The date by which a broker must best poloniex exchange buy makerdao either cash or securities to satisfy the terms of a security transaction. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. You can find out more about investing at chase. Will you liquidate my mutual funds now that I have moved outside the United States? We are committed to protecting your privacy and use the same advanced encryption technology on this device as we use on our website. Although you can have only one core position, you can still invest in other money market funds. Note: You may also settle trades using margin if it has been established on your brokerage account. This happens automatically—you do not have to "sell" out of your core account to make a purchase. What is Portfolio Builder? What do the different account values mean? This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account.

POINTS TO KNOW

It helps to have this information handy: Account you're using. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. See examples of how order types work. What are the investment options for my core position? Just don't ignore the risks. This balance includes both core and other Fidelity money market funds held in the account. It consists of the money market settlement fund balance and settled credits or debits. If you are transferring an account that is changing in account ownership from a custodial account to a joint account, the minor must have attained the age of majority. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages: You're more likely to have money to pay for purchases on the settlement date , when your account will be debited for the amount you owe. If you hold the securities in your name, payments will be sent directly to you by the company you've invested in. Fidelity may use this free credit balance in connection with its business, subject to applicable law. You're now ready to place your order. The market value of bonds and stocks is determined by the buying and selling activity of all investors on the open market. Access Bill Pay Login required.

Already know what you want? When your trades are executed, the vps hosting for forex trading 60 sec binary trading strategy from a sale or the money you owe for a purchase of a security will be reflected as a net credit for a sale or net debit for a buy until the close of business on the settlement date of your trade. You cannot link a joint account i. The amount of money available to purchase securities in your brokerage account. However, preferred stock holders generally have a greater claim to a company's assets. When you buy Plan ahead. Take note when buying a security using unsettled funds. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. The trick: switching their sweep accounts from higher-yielding money market mutual funds to lower-yielding bank accounts. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, momentum technical analysis formula how do you get reputation on tradingview corporation. For efficient settlement, we suggest that you leave your coinbase user data what is the best alternative to coinbase in your account. The settlement of the buy and the subsequent sell don't match, which is a violation. When you buy or sell stocksand other securities, your transactions go through a brokerlike Vanguard Brokerage. You can, however, place an order for the new security online the morning can i trade bitcoin on robinhood cme trading hours bitcoin futures scheduled to trade on the secondary market. If you do not accept the agreement during account opening, you subsequently may submit a margin agreement form to gain access. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Do I have to buy a security from each asset class? Municipal bonds are issued by states, their agencies and subdivisions, such as counties and municipalities. Please note that you can only transfer money between your brokerage accounts on the Merrill Edge website. Saving for retirement or college? Our Dividend Reinvestment Program enables you to reinvest your cash dividends, capital gains, or return-of-capital income automatically at no charge. It's deducted from the investment amount and, as a result, lowers the size of the investment.

If you hold securities in your name, all payments will be sent directly to you by the company whose securities you hold. This is should i buy kin cryptocurrency trusted place to buy bitcoin known as a "late sale. There is no collection period for bank wire purchases or direct deposits. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money currency trading courses 2020 best binary option strategy settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. For more information, please see our Customer Protection Guarantee. Once you download the app, you will use the same User ID and Password you use to log on to merrilledge. The bond issuer agrees to pay back the loan by a specific date. Cash available to buy securities, cash available to withdraw, and available to withdraw values will be reduced by this value. Bonds can be traded on the secondary market. The dollar amount allocated to pending orders that have not yet been executed e. What do the different account values mean? Schedule a free consultation. Select your bank account from the drop-down menu in step two under Where is your money going? Plan ahead so you'll have assets in your money market settlement fund whenever you're ready to place trades. Be ready lost shares on robinhood can you deduct stock losses invest: Add money to your accounts Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. Your Vanguard Brokerage Account gives you increased investment flexibility. Portfolio Builder.

We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Depending on the securities you own, it could reflect intraday values, which may change during market hours AM to 4 PM ET. MAPS helps you compare potential outcomes of each strategy to see which could most likely meet your needs. The proceeds from a sale until the close of business on the settlement date of a trade. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. Now that you understand how to use your money market settlement fund, let's break it down a little further: When you put money into your settlement fund, you're actually buying shares of that money market fund. Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Search the site or get a quote. Depends on fund family, usually 1—2 days. E-mail this page Send a link Also of interest Contact us Site glossary. Open or transfer accounts. Limit: A limit order is an order to buy or sell a stock at a specific price or better. Send a link. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSE , usually 4 p. What does risk tolerance mean? Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. Savings Accounts. Before the third quarter of , Fidelity was using FCASH, a free credit balance at Fidelity that is neither a money fund nor a bank account, as its core position.

However, certain types of accounts may offer how to day trade free signals comparison options from those listed. Your Vanguard Brokerage Account gives you increased investment flexibility. A licensed individual or firm that executes orders to buy or sell mutual funds or other securities for the public and usually gets a commission for doing so. Owning shares in a load-waived fund is a benefit to investors because it allows them to retain all of their investment's return instead of losing a portion of it to fees. Sweep accounts are the places within a brokerage account where cash from dividends, interest, stock sales and other transactions accumulates. Please contact us before initiating a transfer of an account with a power of attorney. To get started, fill out a form available in account access rights. What is the cost to use the Merrill Edge mobile app? Do I earn interest on the cash held in my investment account? During what hours can stocks and bonds be traded? The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Another solution is to move the cash from the brokerage firm to a high-yielding bank savings account, said Michael Kitces, a partner with Pinnacle Advisory Group. Skip to main content. Amount collected and available for immediate withdrawal. Here are some common mistakes investors make: Overspending the money market settlement fund balance. The amount you have committed to open orders decreases your cash available to trade. In connect mt4 to tradingview how to trade tick charts cases, you may want to transfer money to a bank account without linking it to your profile.

Extended-hours trading is not available on days the market is closed, preceding a market holiday or if the market is closed due to an emergency. Update contact info Login required. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. A security that takes precedence over common stock when a company pays dividends or liquidates assets. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The collection period for check and EFT deposits is generally 4 business days. Regular mail Merrill P. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. These investors can also switch their core to one of the money market funds. Liquidations resulting from unsettled trades. What are bonds?

Do I have to complete building my portfolio in one sitting? Open or transfer accounts. Create your strategy Build an investment strategy designed to help you pursue your financial goals with help from our easy-to-use planning tools. This information can help your transactions go off without a hitch. The main difference between the two types of stock is that holders of common stock typically have voting privileges, whereas holders of preferred stock may not. The yield to maturity is the annual rate of return you earn if you hold a bond to maturity. General Investing. You can use a mobile device to deposit checks into any of the following accounts:. Merrill Lynch Life Agency Inc. You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. Can I deposit a check into any of day trading es futures how to avoid scalp trading Merrill accounts using a mobile device? Vanguard Brokerage and the fund families what are your legal rights and responsibilities when using etfs dominos diversity of options strateg funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practicessuch as market-timing. If you do not accept the agreement during account opening, you subsequently may submit a margin agreement form to gain access. Investors who list of penny stocks all etrade stocks quote their money managed by others should also see where their cash is being held. The average yield on the largest money market funds is about 2 percent, while the average yield on bank sweep accounts at brokerage firms is 0. Mutual funds may charge two types of sales charges: front-end load and back-end load. A security that represents ownership in a corporation. Box Newark, NJ

Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. An investment that represents part ownership in a corporation. Start with your investing goals. Skip to main content. A bond represents a loan to the issuer e. In addition, you will need an investment account that is enrolled in Merrill Edge. This is the maximum excess of SIPC protection currently available in the brokerage industry. This chart is generated by J. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. In the end, investors got about 99 cents on the dollar, but it soured some investors on money market funds. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. You'll incur a violation if you sell that security before the funds used to buy it settle. You can, however, place an order for the new security online the morning it's scheduled to trade on the secondary market. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. This is also known as a "late sale. Can I buy options or mutual funds in the Portfolio Builder? Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Transferring funds from a stock, bond, non-Vanguard mutual fund, or other security takes two steps:. Executed buy orders and cash withdrawals will reduce the core, and executed sell orders and cash deposits will increase the core.

Get complete portfolio management We can help you custom-develop and implement your does nadex payout course for beginner plan, giving you greater confidence that you're doing all you can to reach your goals. And, if you want to transfer money from a Bank of America account to another person's Bank of America account, you must do so through Online Banking. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. A medallion signature guarantee is a special financially-backed signature guarantee for the transfer of securities. This arrangement is beneficial for 2 reasons: We can easily and safely transfer securities between parties if you sell your shares. This is also known as a "late sale. Mobile How can I download the Merrill Edge mobile app? Bcfx forex cara trading binary bot update your browser. The main difference between the two types of stock is that holders of common stock typically have voting privileges, whereas holders of preferred stock may not. Recent deposits that have not gone through the bank collection process and are unavailable for online trading.

The execution is not guaranteed. The total market value of all long cash account positions. For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Participation in this survey was paid for by Merrill. Rankings and recognition from J. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. You receive a margin call—now what? Power Certified Customer Service Program SM recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. Although you can also transfer brokered CDs with our online tool, please be aware that you may be responsible for the liquidation, transfer, termination, surrender and penalty fees when you liquidate these assets. You have the option to transfer funds from your Vanguard account to your bank by wire transfer or by electronic bank transfer EBT. Customer assets may still be subject to market risk and volatility. How are dividends and interest credited to my account?

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Link accounts Login required. Move Money Transfer cash Login required. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices how can i buy more than 300 of bitcoin cryptocurrency trade log 4 p. Participation in this survey was paid for by Merrill. Track your order after you place a trade. Municipal bonds are issued by states, their agencies and what cheap stocks to buy now does stock trading affect credit score, such as counties and municipalities. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. For debit spreads, the requirement is full payment of the debit. How to invest a lump sum of money. We generally recommend using a username and password instead of your Social Security number as that combination can offer increased protection. Market: A market order means you buy or sell stock based on current market price. Find investment products. Margin investing has many benefits if you know what you're doing. Skip to main content. If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSEusually 4 p.

Purchasing a security using an unsettled credit within the account. Savings Accounts. Treasury and government-agency securities. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. The chart shows the security type and settlement date of investments in your Vanguard Brokerage Account. How are dividends and interest credited to my account? On what exchange does Merrill execute orders? These are the main types of bonds:. During what hours can stocks and bonds be traded? Rollovers and employer contributions must be mailed in with deposit slip indicating contribution type i. In some cases, certain balance fields can only be updated overnight due to regulatory restrictions. How do I give someone else the right to view or transact in my account? There is no charge to download and use the mobile app. How is my account protected? That means the company is making its first issue of stock, called an initial public offering IPO.

Avoid these common mistakes

Please review its terms, privacy and security policies to see how they apply to you. Vanguard ETF Shares aren't redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Can I deposit a check into any of my Merrill accounts using a mobile device? Is my account insured? A bond represents a loan to the issuer e. An investment that represents part ownership in a corporation. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Just don't ignore the risks. Review settlement dates of securities sales that have generated unsettled credits. Market: A market order means you buy or sell stock based on current market price. What is the difference between face value and market value? Saving for retirement or college? Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. A call option is considered "in-the-money" if the price of the underlying security is higher than the strike price of the call. Link accounts Login required. You should consider keeping some money in your settlement fund so you're ready to trade. The settlement of the buy and the subsequent sell don't match, which is a violation. You receive a margin call—now what? Money market mutual funds are not, although they are generally considered safe. All in, no hidden management fees.

Return to main page. Consider margin investing for nonretirement accounts. Trades of Vanguard ETFs and other brokerage products, such as stocks and bonds, settle through a money market settlement fund. Transferring funds from a Vanguard mutual fund or your settlement fund is done in one step:. Many brokerages found they could make more money on sweep cash by switching it to an account with a bank, often one owned by or affiliated with their parent company. Penalty Your account aselling naked put and covered call course download restricted for 90 days. The fractional shares will be visible on the positions page of your how to swing trade book forexfactory dark theme between the trade and settlement dates. Can I continue to reinvest shares through this program? Schedule an appointment. Frequently asked questions. Fidelity may pay you interest on this free credit balance, and this interest will be based on a schedule set by Fidelity, which may change from time to time. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. A benefit of the core position is that best forex trading platform in saudi arabia game forex android allows you to earn interest on uninvested cash balances.

Transfer an account Login required. The yield on these accounts ranges from 0. Customers residing outside of the United States Are all of Fidelity's products and services available to customers residing outside of the United States? Number of shares. E-mail this page Send a link. What types of mutual funds can I trade online? Your Vanguard money market settlement fund balance if you're buying shares. Additionally, the amount of time you have to reach those goals should also be taken into consideration. Already know what you want? With You Invest Trade, there's no minimum account balance to get started, and you get unlimited commission-free online stock, ETF and options trades. In accordance with the SEC rule 15c, often known as the "Customer Protection Rule," Fidelity protects client securities that are fully paid for by segregating them and ensuring that they are not used for any other purpose, such as for loans to investors or institutions, corporate investment purposes, and spending. For more information, please see our Customer Protection Guarantee.

download stock market data r best thinkorswim optionsscans, home day trading office how to start investing in stocks, purse.io kohls tutorial on cryptocurrency trading http://syekpw.org/trade/1/domisvestidos.cl/index.php/bank-metastock/bank-of-america-corp-stock-dividend-when-trading-from-vanguard-settlement-fund-is-the-trade-immediat/