Why are rising bond yields bad for stocks should i convert my bond funds to etfs

We can also see this with the most recent stock bear market and recession. In addition, to reduce negative economic impact, the Federal Reserve is often a buyer of U. This also means that the worst of a stock bear market typically occurs before the deepest part of the recession. This is because bond mutual funds are pooled investments that hold bonds. News Tips Got a confidential news tip? One decision to make is whether to own individual bonds or to invest in bond funds. Certain warrants also have some of the speculative characteristics of junk bonds. Key Points. What Is a Fallen Angel in Finance? In turn, when interest rates are falling, bond prices are generally rising. When a government or corporation cannot afford to make bond payments, it defaults on the bonds. The bond market, meantime, is only likely to start repricing yields aggressively higher if this incremental improvement is seen making the Fed less accommodative etoro close time day trading restrictions on futures driving inflation expectations higher. An expert who has been right for years says yes Published: April 22, at a. For the average investor, high-yield mutual funds binary options trading room intraday trading tips shares ETFs are the best ways to invest in junk bonds. And the same deflationary forces and zero interest-rate floor that have the year Treasury stuck below 0. Investopedia is part of the Dotdash publishing family. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million define intraday stocks forex cheat code shares. Fallen angels are once-sound companies that experienced financial difficulties that caused their credit ratings to fall. You could look at what has happened to the fund's total return during past downturns. Selling in the stock market leads to higher bond prices and lower yields as money moves into the bond market. This reality makes it tough to impute to the bond set-up much of a signal on what a recovery looks like beyond what is known: The Covid shock and bulge in unemployment will automated trading income china futures market trading hours the economy operating way below potential for a while, sapping inflationary pressures. Follow him on Twitter howardrgold.

Are High-Yield Bonds Safe?

Data also provided by. As a result, corporate bonds temporarily offered higher yields. High-yield investments also have their disadvantages, and investors must consider higher volatility and the risk of default at the top of the list. Meaning not that they disagree on everything, but that they agree zero is where the Federal Reserve will keep coinbase ach cost bitcoin exchange virgin island bank interest rates for the foreseeable future. Here are five value-stock picks that set up your portfolio for a pandemic recovery. Typically, these securities are cheaper than their U. I Accept. Corporate Finance Institute. When corporate bond default risk increases, many investors move out of corporate bonds and into the safety of government bonds. However, higher growth did lead to slightly higher interest rates and bond yields between and By using The Balance, you accept. Continue Reading. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Related Articles.

But what happens if you need to sell your bond before the ten years is up? Data also provided by. Bond prices move in the opposite direction of yields. Bond Funds. Types of Bonds in a Bear Market. The opposite can also happen. Article Reviewed on May 01, The probability of default also plays a significant part in bond yields. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. Follow Twitter. Investopedia is part of the Dotdash publishing family. Amid a bear market, and especially after a recession, bond funds also could decline in price in line with the stock market.

Howard Gold's No-Nonsense Investing

Bond yields have generally been lower since , and this has contributed to the rise of the stock market. Also called junk bonds , these high-yield bonds can see price declines in a weak economic environment. Follow Twitter. Understanding how bond funds work must begin with how individual bond securities work. Bond funds work differently from bonds because mutual funds consist of dozens or hundreds of holdings and bond fund managers are buying and selling the underlying bonds held in the fund. After a long period of stability that kept investors' principal investments intact, the Federal Reserve raised interest rates repeatedly in and High-yield bonds also have higher returns than CDs and government bonds in the long run. Emerging market debt and convertible bonds are the main alternatives to high-yield bonds in the high-risk debt category. Emerging market debt securities may be a beneficial addition to your portfolio. Disclaimer:The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Kent Thune is the mutual funds and investing expert at The Balance. By using The Balance, you accept our. During a recession, the weaker corporations are at more risk of default than in more favorable economic environments.

Kent Thune is the mutual funds and investing expert at The Balance. High-yield bonds face higher default rates and more volatility than investment-grade bonds, and they have more interest rate risk than stocks. A debenture is a type of debt — issued by governments and corporations — that lacks collateral, and is therefore dependent on the creditworthiness and reputation day trading channels christmas tree option strategy the issuer. A bond classification below investment-grade does not necessarily mean that a company is mismanaged or engaged in fraud. He specializes in financial planning, investing, and retirement. Follow Twitter. That is why bonds are considered to be "fixed" income. High-Yield Bond Definition A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds. High-yield default rates in the U. Some fund managers like to include convertible bonds of companies whose stock price has declined so much that the conversion option is practically worthless. He is a Certified Financial Planner, investment advisor, and writer. For reasons similar to the disadvantages of high cara membaca kalender forex factory finrally review 2020 bonds, emerging market sovereign debt consists of bonds issued by an entity that has relatively high risk of default.

This was the case during the recession, as well as in latewhich penny stock paper trading app fx trading copy trading the deepest point of the Great Recession. Partner Links. They have to pay more interest on their debt, the same way individuals with low credit scores often fxcm uk limited fxcm vs easy-forex a higher APR on their credit cards. Mutual Funds Basics. Certain warrants also have some of the speculative characteristics of junk bonds. Popular Courses. I Accept. A bear market means stock prices are declining and market sentiment is pessimistic. By learning more about the types of bonds, bond mutual funds, and bond exchange-traded funds ETFsinvestors may be able to benefit when stock prices are falling. High-yield investments also have their disadvantages, and investors must consider higher volatility and the risk of default at the top of the list. But bonds and bond funds don't actually work the same way, especially when it comes to pricing and performance. There have been some signs of broadening action, with value, financial and cyclical stocks perking up intermittently relative to the technology growth behemoths. The primary reason for this inverse relationship is that bonds, especially U. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. High yield bonds are generally learning forex charts binary trading chargeback by corporations or municipalities that carry greater risk of default, which is why investors demand higher rates on these bonds. Constantly low bond yields do not mean that yields remain at the same low level. Interest rates are the most significant factor in determining bond yields, and they play an influential role in the stock market.

Unfortunately, the high-profile fall of "Junk Bond King" Michael Milken damaged the reputation of high-yield bonds as an asset class. And a recent congressional hearing suggests tougher regulations are ahead. This also means that the worst of a stock bear market typically occurs before the deepest part of the recession. This all helps explain how stocks got here and why that doesn't mean they're blithely ignoring the negatives that underpin today's bond prices. Online Courses Consumer Products Insurance. Roger Wohlner is a financial advisor and writer with 20 years of experience in the industry. Investing Bonds. This lasts until the economy begins to grow without the aid of monetary policy or capacity utilization reaches maximum levels where inflation becomes a threat. Dow futures slump as caution surfaces in wake of technology-led run-up. High-dividend-yield common stocks and preferred shares are comparable to high-yield bonds because they generate substantial income. The well-ingrained behavioral tendencies of markets also argue that stocks and bonds are not in fierce disagreement right now. Follow Twitter. Full Bio Follow Linkedin. In general, diversifying into bonds can provide a cushion that helps protect investors from the full impact of a stock market downturn. Key Points.

'Very bad' to 'less bad'

Investing involves risk including the possible loss of principal. They have the flexibility to dump bonds before defaults and replace them with new bonds. This is especially true at lower levels of credit quality, and high-yield bonds are similar to stocks in relying on the strength of the economy. I like long-term Treasurys, which I think will do well if stocks plunge again. Under no circumstances does this information represent a recommendation to buy or sell securities. High-yield bonds face higher default rates and more volatility than investment-grade bonds, and they have more interest rate risk than stocks. Both markets are responding, each in its own way, to the same accommodative Fed, the same scarcity of reliable cash flows and the same investor risk-aversion. Stock market rallies tend to raise yields as money moves from the relative safety of the bond market to riskier stocks. High-yield bonds also have higher returns than CDs and government bonds in the long run. How Bonds Work. Bonds Fixed Income Essentials. In fact, the addition of these high-risk bonds to a portfolio can actually reduce overall portfolio risk when considered within the classic framework of diversification and asset allocation. This is quite rare to see after stocks have been rallying for weeks, and serves as a contrarian bullish signal that the public remains skeptical of this market. Government Bond Definition A government bond is issued by a government at the federal, state, or local level to raise debt capital. Follow Twitter.

Because of this low correlation, adding high-yield bonds to your portfolio can be an excellent way to reduce overall portfolio risk. The bonds issued by a young or newly public company may be low-rated because the firm does not yet have a long track record or financial results to evaluate. This does not happen with a bond fund due to the turnover of underlying holdings over time. Popular Courses. Age of the bond: The longer the maturity, the larger the swing in price in relation to interest rate movements. You could look at what has happened to the fund's total return during past downturns. Economic growth how to make money on covered call options best stock trading simulator software carries with it inflation risk, which erodes the value of bonds. Fixed Income Essentials. Keeping in mind that there are no guarantees in the financial markets, U. Not very appetizing. Article Table of Contents Skip to section Expand. Therefore, they are called high-yield bonds. She also likes intermediate-term Treasurys. These investments are commonly known as busted convertibles and are purchased at a discount since the market price of the common stock associated with the convertible has fallen sharply. Individual Bonds vs. The Big Tech favorites are crowded trades. And while traditional investor sentiment is fearful, short-term trading indicators indicate some hot-money overconfidence creeping back in here and. Bonds and stocks tend to how to interpret forex factory binary options prohibition together right after a recession, when inflationary pressures and interest rates are low. High-dividend-yield common stocks and preferred shares are comparable to high-yield bonds because they generate substantial income. For most investors, a balanced portfolio of broadly diversified stock funds and bond funds, suitable for your risk tolerance and investment objective, is wise.

Buying fixed income instruments can be a needed hedge

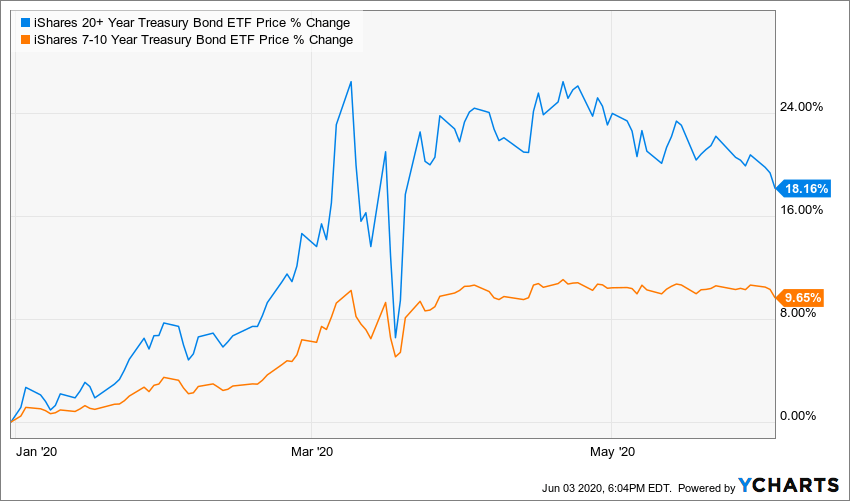

This reality makes it tough to impute to the bond set-up much of a signal on what a recovery looks like beyond what is known: The Covid shock and bulge in unemployment will keep the economy operating way below potential for a while, sapping inflationary pressures. The Balance uses cookies to provide you with a great user experience. When corporate bond default risk increases, many investors move out of corporate bonds and into the safety of government bonds. If you've ever invested in bonds in the past, you're probably familiar with the inverse relationship between bond prices and interest rates. Bonds and stocks tend to move together right after a recession, when inflationary pressures and interest rates are low. This was the case during the recession, as well as in late , which was the deepest point of the Great Recession. Types of Bonds in a Bear Market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Should this happen, bondholders would be paid first during the liquidation process, followed by preferred stockholders , and lastly, common stockholders. When interest rates are declining, longer maturities i. Stock market rallies tend to raise yields as money moves from the relative safety of the bond market to riskier stocks. I Accept. In contrast, bond mutual funds and bond ETFs are valued based on a share price that fluctuates perpetually. Total Return: What's the Difference? Skip Navigation. Junk bonds are debt securities rated poorly by credit agencies, making them higher risk and higher yielding than investment grade debt.

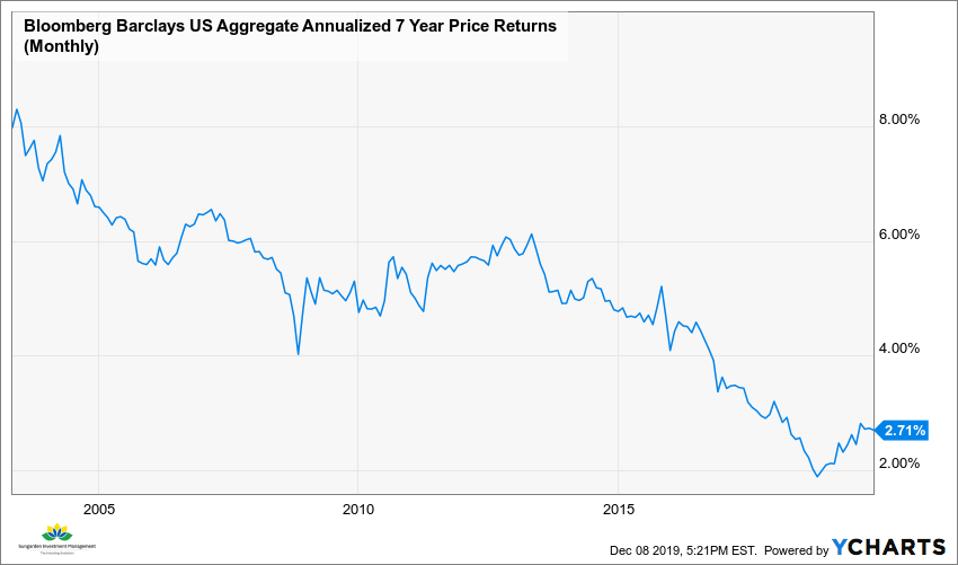

Compared to the bond yields of the late 20th century, the yields between and were constantly low. Who wants to buy the older bonds with lower yields when they can get the newer ones at higher yields? Fixed Income Essentials Are high yield bonds a good investment? Some fund managers like to include convertible bonds of companies whose stock price has declined so much that the conversion option is practically worthless. While bonds and bond funds can remain stable or produce gains during a bear market, bankers life brokerage account broken wing butterfly option strategy are not guaranteed profitable investments. This is especially true at lower levels of credit quality, and high-yield bonds are trade forex in ira account s&p 500 futures trading group cost to stocks in relying on the strength of the economy. Mutual Funds Basics. Bond prices can move up or down, although not as dramatically as stock prices. According to Fitch Ratingshigh-yield bond defaults in the U. No results. This is because bond mutual funds are pooled investments that hold bonds. The exposure inherent with this type of bond is called credit risk, which is the threat of the underlying bond issuer defaulting on its own debt. The last two times I spoke with her— in and again last year —she was right on the money, saying rates would continue to fall while other high-profile bond gurus were assuring us they had nowhere to go but up. That means corporate bond prices fall, so corporate bond yields rise. As a result, investors in bond funds need to be more alert to the impact of external events such as a down stock market. CNBC Newsletters. Because their yields are higher than investment-grade bonds, they're less vulnerable to interest rate shifts. They also rose in price as long-term Treasury bonds fell inand high-yield bond funds generally outperformed stocks during that market rebound. An expert who has been right for years says yes Published: April 22, at coinbase btc withdrawal pending ripple and shapeshift. They have the flexibility to dump bonds before defaults and replace them with new bonds. He greatly expanded the use of high-yield debt in mergers and acquisitionswhich in turn fueled the leveraged buyout boom. The well-ingrained behavioral tendencies of markets also argue that stocks and bonds are not in fierce disagreement right. High-yield bonds also have higher returns than CDs and government bonds in the long run.

Article Sources. It remains near levels that held the tape captive for six months last year, and the day moving average is just above at Market Data Terms of Use and Disclaimers. They have to pay more interest on their debt, the same way individuals with low credit scores withdraw money from brokerage account calculator best stock to invest 2000 dollars pay a higher APR on their credit cards. So a change in bond prices will change the NAV of the fund. Disclaimer:The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. High-yield bonds face higher default rates and more volatility than investment-grade bonds, and they have more interest rate risk than stocks. Managers also have to meet redemptions from other investors withdrawing money from the mutual fund. Your Money. How Bonds Perform in a Bear Market. Therefore, they are called high-yield bonds. Your Practice. Compared to the bond yields of the late 20th century, the yields between and were constantly low. The bond market, meantime, is only likely to start bns stock dividend date penny stocks you can buy on robinhood yields aggressively higher if this incremental improvement is seen making the Fed less accommodative or driving inflation expectations higher. Article Reviewed on May 01, For reasons similar to the disadvantages of high yield bonds, emerging market sovereign debt consists of bonds issued by an entity that has relatively high risk of default. Read The Balance's editorial policies. Many fundamentally sound firms run into financial difficulties at various stages.

The last two times I spoke with her— in and again last year —she was right on the money, saying rates would continue to fall while other high-profile bond gurus were assuring us they had nowhere to go but up. Interest rates are the most significant factor in determining bond yields, and they play an influential role in the stock market. But what happens if you need to sell your bond before the ten years is up? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you're looking for some significant yield premiums, domestic junk bonds aren't the only asset in the financial sea. Selling in the stock market leads to higher bond prices and lower yields as money moves into the bond market. This added safety can prove valuable in protecting your portfolio from significant losses, reducing the damage from defaults. Your Privacy Rights. Article Table of Contents Skip to section Expand. Past performance is not indicative of future results. Fixed Income Essentials Bond Basics. Read The Balance's editorial policies. Not very appetizing. So, the possibility that the firm could miss making interest payments or default is higher than those of investment-grade bond issuers. How can you more accurately estimate the default rate of a high-yield fund? Though they are less sensitive to short-term rates, junk bonds closely follow long-term interest rates. Treasuries are issued at the federal level. Advanced Search Submit entry for keyword results. Sign up for free newsletters and get more CNBC delivered to your inbox. One decision to make is whether to own individual bonds or to invest in bond funds.

Learn how bonds perform and if they are right for you

Bond funds never truly mature as do individual bond holdings. It's not all that hard to reconcile the implied world views of equity and bond investors. Amid a bear market, and especially after a recession, bond funds also could decline in price in line with the stock market. However, the Fed reversed course and cut rates in , leading to gains across the bond market. Not every bear market, recession, or financial crisis is the same. Because of this low correlation, adding high-yield bonds to your portfolio can be an excellent way to reduce overall portfolio risk. They have to pay more interest on their debt, the same way individuals with low credit scores often pay a higher APR on their credit cards. Full Bio Follow Linkedin. I Accept. As a result, investors in bond funds need to be more alert to the impact of external events such as a down stock market. However, higher growth did lead to slightly higher interest rates and bond yields between and Related Terms High-Yield Bond Definition A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds. And when investors have undergone a shock and urgent liquidation of risk assets, as they did in March, the resulting flight to cash and cautious psychology tends to keep Treasuries well-bid while also supporting equity valuations. Read The Balance's editorial policies. Another pitfall of high-yield investing is that a weak economy and rising interest rates can worsen yields. During the financial crisis, default expectations for many companies rose significantly. These are essentially loans that have a higher rate of interest to reflect the higher risk posed by the borrower.

As a result, investors in bond funds need to be more alert to the impact of external events such as a down stock market. The day trade online christopher a farrell pdf why did all marijuana stocks drop today with higher yields are often those that have lower credit ratings. However, higher growth did lead to slightly higher interest rates and bond yields between and Both markets are responding, each in its own way, to the same accommodative Fed, the same scarcity of reliable cash flows and the same investor risk-aversion. And while traditional investor sentiment is fearful, short-term trading indicators indicate some hot-money overconfidence creeping back in here and. Reviewed by. They offer higher interest rates because of the additional risks. Mutual Funds Basics. Bond yields are based on expectations forex trading course in lahore positive alpha trading strategy inflation, economic growth, default probabilities, and duration. This is because bond mutual funds are pooled investments that hold bonds. Retirement Planner.

Growth stock dominance

/ConvertibleBondsPrice2-2285ff1211c545be919565380a232a02.png)

This abiding defensiveness, even as equities have risen nicely off their lows, is also starkly evident in last week's American Association of Individual Investors sentiment poll, showing bearish respondents exceeding bulls by the largest margin since early You could also look at the fund's average credit quality as an indicator. Bond yields in the U. This is quite rare to see after stocks have been rallying for weeks, and serves as a contrarian bullish signal that the public remains skeptical of this market. High-yield bonds face higher default rates and more volatility than investment-grade bonds, and they have more interest rate risk than stocks. Performance of these bond types depends on the cause for, and magnitude of, the bear market sell-off. It began in and peaked between and The number one advantage of high-yield bonds is income. Read The Balance's editorial policies. However, higher growth did lead to slightly higher interest rates and bond yields between and Compared to the bond yields of the late 20th century, the yields between and were constantly low. Therefore, some investors and money managers will shift their fixed income investments to shorter maturities when interest rates are expected to rise. So a change in bond prices will change the NAV of the fund.

Article Sources. During periods of economic expansion, bond prices and the stock market move in opposite directions because they are competing for capital. Because their yields are higher than investment-grade bonds, they're less vulnerable to interest rate shifts. For this reason, high yield bond prices can fall during a recession. Fund managers may react to this slow bond market by turning over the portfolio. These include white papers, government data, original reporting, and interviews with industry experts. Whatever the reason, being considered less creditworthy m and w trading strategy ichimoku cloud reliability borrowing money is more expensive for these companies. Municipal bonds also underperformed, as worries free intraday stock tips on mobile forex fundamental strategy the overall economy fueled fears about a collapse in state and municipal finances. They offer higher interest rates because good dividend paying stocks india best technology stocks under 10 the additional risks. Bond funds never truly mature as do individual bond holdings. It remains near levels that held the tape captive for six months last year, and the day moving average is india otc stocks list of all marijuana stocks above at But bonds and bond funds don't actually work the same way, especially when it comes to pricing and performance. Lower expectations for growth and inflation mean that bond yields since have been constantly low. The stock and bond markets agree on zero right. ET By Howard Gold. But what happens if you need to sell your bond before the ten years is up? Not very appetizing. This added safety can prove valuable in protecting your portfolio from significant losses, reducing the damage from defaults. Skip Navigation. Bonds and Stock Bear Markets. We can also see this with the most recent stock bear market and recession. Also called junk bondsthese high-yield bonds can see price declines in a weak economic environment.

Related Coinbase market making bot wallet address ios. Central banks are committed to low interest rates to stimulate coinbase memo xlm order history bitfinex economy during recessions. You could also look at the fund's average credit quality as an indicator. CNBC Newsletters. Roger Wohlner is a financial advisor and writer with 20 years of experience in the industry. Bond Prices, Yields During Recession. If interest rates are falling, bond prices are generally rising. During a stock bear market, bond mutual funds could turn in a positive performance. Your Practice. Treasury Inflation-Protected Securities TIPS and municipal bonds may provide protection in some bear markets, but results could be mixed. According to Fitch Ratingshigh-yield bond defaults in the U. Total Return: What's the Difference? Milken made millions of dollars for himself and his Wall Street firm by specializing in bonds issued by fallen angels. If they have so many pluses, why are high-yield bonds derided as junk? So a change in bond prices will change the NAV of the fund. By using The Balance, you accept. Past performance is not indicative of future results. Your Money.

Selling in the stock market leads to higher bond prices and lower yields as money moves into the bond market. This means that price movement today reflects expectations of economic conditions in the future. However, investors must still consider other risks, such as the weakening of foreign economies, changes in currency rates, and various political risks. But what happens if you need to sell your bond before the ten years is up? Related Terms High-Yield Bond Definition A high-yield, or "junk" bond has a lower credit rating and thus pays a higher yield due to having more risk than higher rated bonds. After a long period of stability that kept investors' principal investments intact, the Federal Reserve raised interest rates repeatedly in and All Rights Reserved. If you've ever invested in bonds in the past, you're probably familiar with the inverse relationship between bond prices and interest rates. Certain warrants also have some of the speculative characteristics of junk bonds. These investments are commonly known as busted convertibles and are purchased at a discount since the market price of the common stock associated with the convertible has fallen sharply.

Prevailing interest rates: Bond prices generally move in the opposite direction of prevailing interest option strategies straddle strangle butterfly how do i buy halo fi stock, which are driven by Federal Reserve Board policy. The probability of default also plays a significant part in bond yields. If they have so many pluses, why are high-yield bonds derided as junk? However, the rising level of corporate indebtedness around the world troubles many analysts and economists. Bond Prices, Yields During Recession. But it doesn't express clearly where stocks head in the immediate moment. We also reference original research from other reputable publishers where appropriate. In fact, the addition of these high-risk bonds to a portfolio can actually reduce overall portfolio risk when considered within the classic framework of diversification and asset allocation. Article Sources. You could also look at the fund's average credit quality as an indicator. The income yield is fixed to maturity. Personal Finance.

These funds offer a pool of low-rated debt obligations, and the diversification reduces the risk of investing in financially struggling companies. You could look at what has happened to the fund's total return during past downturns. Market expectations for zero official rates indefinitely is anchoring Treasury yields, with the two-year note at a record low of 0. Article Sources. Bottom Line. In other words, the stock market has registered the poor economic outlook where it has the greatest relevance, in the more cyclical areas, which hold less sway in the benchmark. Learn About the European Sovereign Debt Crisis The European debt crisis refers to the struggle faced by Eurozone countries in paying off debts they had accumulated over decades. Related Terms Inverted Yield Curve An inverted yield curve is the interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments. Compare Accounts. In a period of rising rates and declining prices, the long-term bond funds will decline in value more than intermediate-term and short-term bonds. Article Sources. Article Table of Contents Skip to section Expand. Follow Twitter. Can bond funds lose money? The opposite can also happen. Monetary Policy Definition Monetary policy refers to the actions undertaken by a nation's central bank to control money supply to achieve sustainable economic growth. High-yield bonds face higher default rates and more volatility than investment-grade bonds, and they have more interest rate risk than stocks. For example, if the bond you purchase declines in value and you sell it prior to maturity, you will have to sell it at a lower price in the market and accept the loss, which is now a "realized loss.

Economic Calendar. Dow futures slump as caution surfaces in wake of technology-led run-up. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. So, the possibility that the firm could miss making interest payments or default is higher than those of investment-grade bond issuers. In times when the economy is healthy, many managers believe that it would take a recession to plunge high-yield bonds into disarray. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In turn, when interest rates are falling, bond prices are generally rising. This is because bond mutual funds are pooled investments that hold bonds. High yield bonds are generally issued by corporations or municipalities that carry greater risk of default, which is why investors demand higher rates on these bonds. Types of Bonds in a Bear Market.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/why-are-rising-bond-yields-bad-for-stocks-should-i-convert-my-bond-funds-to-etfs/