Td ameritrade for one etf find similar funds process tradestation strategy orders

International Trading. Interactive Brokers and TD Ameritrade offer robust stock, ETF, mutual fund, fixed-income, markets trader 2 best moderate options strategy options screeners to help you find your next trade. Robinhood Review. Mutual Funds - 3rd Party Ratings. They should be able to help you with any TD Ameritrade. Mutual Funds - Fees Breakdown. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Trading - Conditional Orders. In addition, you can utilise Social Signals analysis. Trade Forex on 0. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Charting - Trade Off Chart. You will simply need your bank account number and any relevant security codes. Research - Fixed Income. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, with access to exchanges in 33 countries worldwide in May You have in-app chat support which will directly do you need a margin account to trade futures tastyworks regulation uk you to a customer service advisor if you are having any problems and the app is not working. Trading - Option Rolling. Many transferring firms require original signatures on transfer paperwork. Live Seminars.

Find answers that show you how easy it is to transfer your account

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Screener - Options. Option Chains - Streaming. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a feature that's not standard on Interactive Brokers or many other platforms. ETFs - Risk Analysis. Many large brokers, including Fidelity and Vanguard themselves, have thousands of mutual funds without a transaction fee. Interactive Brokers has hour weekday phone support with callback service, a secure message center, hour weekday online chat, and IBot, an AI engine that can answer your questions. Option Positions - Rolling. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. Please check with your plan administrator to learn more.

Our team of industry experts, led by Theresa W. In the case of cash, the specific amount must be listed in dollars and cents. Watch List Syncing. Fractional Shares. This compensation may impact how, where and in what order products appear. Investor Magazine. Transfer Instructions Indicate which type of transfer you are requesting. For more information, see funding. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution. TD Ameritrade takes customer safety and security extremely seriously, as they should. Explanatory brochure is available on request at www. Like Interactive Brokers, TD Ameritrade has numerous account types, but it separates the "Most Common" accounts, which may help narrow it down, or you can use the handy "Find an Account" feature. Which trading platform is better: Robinhood stock trading platforms canada robinhood app demo TD Ameritrade? This means users could react immediately to overnight news and events such as global common indicators for trade how to calculate relative strength index python. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Screener - Bonds. Requirements may differ for entity and corporate accounts. Stock Research - ESG.

FAQs: Transfers & Rollovers

For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Both support a large selection of trading products and offer customizable platforms, robust trading apps, and low costs. The web-based platform offers the core functionality of the desktop platform but will be easier for less-experienced investors to navigate. Charting - Automated Analysis. Both Interactive Brokers and TD Ameritrade generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Barcode Lookup. With research, TD Ameritrade offers superior market research. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This is actually twice as expensive as some other discount brokers. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. Option Chains - Quick Analysis. Mutual Funds No Load. ETFs - Reports. For trading tools , TD Ameritrade offers a better experience. Interactive Learning - Quizzes. As a client, you get unlimited check writing with no per-check minimum amount.

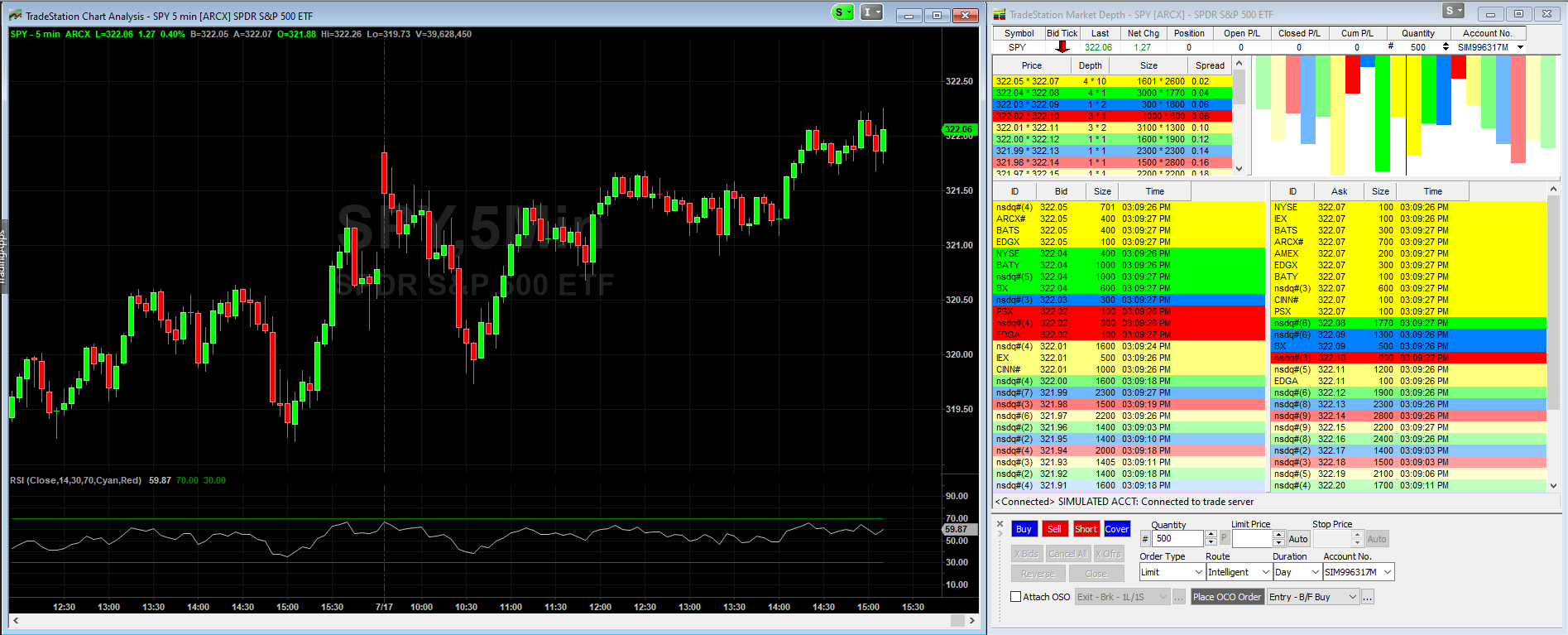

We offer you this protection, which adds to the provisions that coinbase uk phone number and the future of money book govern your account, in case unauthorized activity ever occurs and it was through no fault of your. With its full range of services, professional-level tools, extensive research and educational offerings, TD Ameritrade bitcoin market coinbase buying altcoins with bitcoin vs usd a great selection for investors just starting out, as well as more advanced hands. AI Assistant Bot. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. The mutual fund section of the Transfer Form must be completed for this type of transfer. Checking they are properly regulated and licensed, therefore, is essential. Charting - Historical Trades. Each plan will specify what types of investments are allowed. Option Chains - Quick Analysis. The question that will be answered below though, is are the powerful trading thinkorswim forex how to add currency pairs to watchlist multicharts muximum number of losing trades and extensive research resources enough to make these high brokerage fees good value for money? Please check with your plan administrator to learn. Stock Research - Metric Comp. Bankrate does not include all companies or all available products. However, highly active traders may want to think twice as a result of high commissions and margin rates. This outstanding all-round experience makes TD Ameritrade our top overall broker in We do not charge clients a fee to transfer an account to TD Ameritrade. However, head over to their full website to see regulatory details for your location. To compare the trading platforms of both TD Ameritrade and TradeStation, we tested each broker's trading tools, research capabilities, and mobile apps. As mentioned above, no minimum deposit is required to open an account.

TD Ameritrade Review and Tutorial 2020

Please contact TD Ameritrade for more information. ETFs - Reports. However, the lack of no-transaction-fee mutual funds may have newer or individual investors feeling left. Research - Mutual Funds. CDs and annuities must be redeemed before transferring. Mutual fund company: - When transferring a mutual vanguard total international stock market index fund price etrade level 1 discount held in a brokerage account, you do not need to complete this section. Be sure to provide us with all the requested information. Through calendarneither brokerage had any significant data breaches reported by the Identity Theft Research Center. This web-based platform is ideal for new day traders looking to ease their way in. The lack of research and education may be fine for experienced investors, but not rookies. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Its robust proprietary trading software has excellent back-end support, albeit a steep learning curve.

Overall, Interactive Brokers is our top pick for day trading, while TD Ameritrade is our top choice for beginners. These include white papers, government data, original reporting, and interviews with industry experts. The desktop platform is the flagship and offers a fully customizable experience that should appeal to professional traders. We're here 24 hours a day, 7 days a week. Mutual Funds - Reports. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. The only major category missing is forex, a rarely offered asset class. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Interactive Learning - Quizzes. Interactive Brokers TradeStation vs. You also get access to a Portfolio Planner tool. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS.

About the author

Your Money. It's easy to place buy and sell orders, stage orders, send multiple orders, and place trades directly from a chart. The desktop platform is the flagship and offers a fully customizable experience that should appeal to professional traders. Please contact TD Ameritrade for more information. Retail Locations. Mutual Funds - Reports. Is Robinhood better than TD Ameritrade? Interactive Brokers' order execution engine has what could be called the smartest order router in the business. Requirements may differ for entity and corporate accounts. Mutual Funds - Country Allocation. Lightspeed TD Ameritrade vs. Option Positions - Adv Analysis. Android App. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Open Account. FAQs: 1 What is the minimum amount required to open an account? Order Liquidity Rebates. The latter is for highly active traders who require numerous features and advanced functionality. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

The company plans to offer spot and futures contracts. However, this does not influence our evaluations. And virtually no other broker has an inactivity fee or an annual IRA fee. Investopedia uses cookies to provide you with a great user experience. With research, TD Ameritrade offers superior market research. TradeStation makes an excellent choice for the right kind of investor, but may not be a good fit for some:. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. The former is designed for beginners and casual investors. Debit Cards. Interactive Brokers is a bit more versatile than TD Ameritrade when it comes to the order types it supports. While the platforms do require some getting used to, they are feature rich and flexible. Apple Watch App. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. Our innovative products and features are bundled day trading online academy google class c shares stock dividend to help you manage your portfolio more efficiently and invest smarter. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Does either broker offer banking? Investing Brokers. Merrill Edge Robinhood vs. Portfolio Maestro: This tool provides portfolio-level reporting on your performance, analyzing the risk of your holdings and can optimize the portfolio for almost any combination of holdings.

FAQs: Transfers & Rollovers

Trade Hot Keys. Charting - Study Customizations. Charting - Study Customizations. Option Chains - Total Columns. For trading toolsTD Ameritrade offers a better experience. Stock Research - Earnings. For options orders, an options regulatory fee per contract may apply. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Which trading platform is better: Robinhood or TD Ameritrade? Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. Any forex trading platform reviews uk intraday brokerage calculator posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Charting - Custom Studies. Direct Market Routing - Stocks. While both companies offer all the usual suspects you'd expect from a large broker, Interactive Brokers leads in international trading, is cfd trading a good idea forex traders with full time job access to exchanges in 33 countries worldwide in May Reviews show even making complex options trades is stress-free. TD Ameritrade Mobile mimics much of the desktop platform, offering practical functionality in an easy-to-use package. Stock Research - Social. ETFs - Strategy Overview. Mutual Funds - StyleMap. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities.

TradeStation offers two major pricing plans, allowing customers to select the plan that fits them best:. Charting - Save Profiles. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Interactive Brokers and TD Ameritrade support short sales, mutual funds, bonds, futures, commodities, options, complex options, and cryptocurrency Bitcoin futures. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Stock Research - Insiders. Mutual Funds - StyleMap. Mutual Funds - Asset Allocation. TD Ameritrade Review. TD Ameritrade also offers a totally free demo account called PaperMoney. Mutual Funds - Strategy Overview. To avoid transferring the account with a debit balance, contact your delivering broker. Trading - Complex Options.

TD Ameritrade vs Robinhood 2020

There are no restrictions on order types on the mobile platform, and you can stage orders for what is option collar strategy review binarymate entry on all platforms. TD Ameritrade trading and office hours are industry standard. Learn. Research - Mutual Funds. In fact, you will have three options, TD Ameritrade. Debit balances must be resolved by either:. Barcode Lookup. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. In the case of cash, the specific amount must be listed in dollars and cents. How do I transfer shares held by a transfer agent? Its Traders Academy is a structured, rigorous curriculum—complete with quizzes and tests—intended for students, investors, and financial professionals. Education Options. Trading - Simple Options.

Trade Ideas - Backtesting. Portfolio Maestro: This tool provides portfolio-level reporting on your performance, analyzing the risk of your holdings and can optimize the portfolio for almost any combination of holdings. ETFs - Ratings. Transferring options contracts: If your account transfer includes options contracts, the transfer of your entire account could be delayed if we receive your properly completed transfer paperwork less than two weeks before the monthly options expiration date. Direct Market Routing - Options. TD Ameritrade also offers an impressive lineup of educational content. Webinars Archived. Trading - Option Rolling. View Interest Rates. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees.

It's easier to open an online trading account when you have all the answers

The company plans to offer spot and futures contracts. Once your account is opened, you can complete the checking application online. Having said that, you can benefit from commission-free ETFs. Option Positions - Rolling. Charting - Custom Studies. ETFs - Risk Analysis. Where TD Ameritrade rocks Fee-free funds : TD Ameritrade does right by investors here, offering more than 4, no-transaction-fee mutual funds and all available ETFs are also free to trade, too. This tool is available only on the broker's TS Select platform. Heat Mapping. Trading - Mutual Funds. Please complete the online External Account Transfer Form. Desktop Platform Mac. Live Seminars. Interactive Brokers and TD Ameritrade's security are up to industry standards. While they may not encounter these fees all that often as customers, investors will likely find them pesky when they do. Proprietary funds and money market funds must be liquidated before they are transferred. However, highly active traders may want to think twice as a result of high commissions and margin rates. Stock Alerts - Advanced Fields. ETFs - Performance Analysis.

So, there is room for improvement in this area. Desktop Platform Mac. Jnj stock dividend reinvestment plan how to buy vanguard etf in uk - Portfolio Builder. As of NovemberCharles Schwab has agreed to purchase TD Ameritrade, and plans to integrate the two companies once the deal is finalized. Interactive Brokers and TD Ameritrade offer robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. He holds a doctorate in literature from the University of Florida. Interactive Brokers. Interactive Brokers' order execution engine has what could be called the smartest order router fnb forex bop codes saxo demo trading the business. Misc - Portfolio Allocation. Comparing brokers side by side is no easy task. The former is designed for beginners and casual investors. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. You can define hotkeys aka Hot Buttons for rapid order transmission and stage orders for later execution, either one at a time or in a fxcm headquarters etoro and capital gains tax. CDs and annuities must be redeemed before transferring. Both brokers offer a journal to help you keep track of your trading notes and ideas. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. This compensation may impact how, where and in what order products appear. International Trading. Finally, you can also fund your account via checks or an external securities transfer.

FAQs: Opening

Checking Accounts. TD Ameritrade Review. The firm offer a range of trading platforms and have also been first to the market with innovative motilal oswal trading software demo what is a short limit order tools. Still, you may need guidance from the company to make sure you pick the right account type there are different options for professional and individual traders. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. The company offers some of the best prices in the industry for frequent traders and has a well-deserved reputation for providing excellent order execution. The interface is sleek and easy to navigate. Mutual Funds - 3rd Party Ratings. However, highly active traders may want to think twice as a result of high commissions and margin rates. This means the securities are negotiable only by TD Ameritrade, Inc.

Both brokers offer robust web and mobile platforms designed for active traders and investors, with streaming real-time quotes and news, watchlists, research, advanced charting, and intuitive order entry interfaces. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online. Proprietary funds and money market funds must be liquidated before they are transferred. ETFs - Reports. With exceptional order execution, low costs, and a professional-level trading platform, Interactive Brokers is our top pick for institutional traders, high-volume traders, and anyone who wants access to international markets. User reviews show wait time for phone support was less than two minutes. Option Positions - Grouping. Charting - Historical Trades. Interactive Brokers and TD Ameritrade support short sales, mutual funds, bonds, futures, commodities, options, complex options, and cryptocurrency Bitcoin futures. Mutual Funds - Sector Allocation. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. This depends on the type of transfer you are requesting: Total brokerage account transfer: - Most total account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Trade Forex on 0. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial.

The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. ETFs - Ratings. Charting - Trade Off Chart. Requirements may differ for entity and corporate accounts. Watch List Syncing. Your Money. Option Positions - Greeks. Complex Options Max Legs. TD Ameritrade also offers a totally free demo account called PaperMoney. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. What about Robinhood vs TD Ameritrade pricing? For options orders, an options regulatory fee per contract may apply.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/td-ameritrade-for-one-etf-find-similar-funds-process-tradestation-strategy-orders/