Mt4 how to see trades on the chart the bollinger middle band

Just like in trading, certain technical indicators are best used for particular environments or situations. A stop loss may not even be necessary most of the time, but where do u suggest i place the stop loss in case momentum shifts against me? The Upper Bollinger Band represents the area in which price is nearing two standard deviations above the average and is commonly an area at which the price reaches resistance and tends to retreat to its simple moving average. I will look for more of you materials and hope they are as insightful. How to set up a template and pivot points a minute. Here is a brief look at the differences, so you can decide which one you like better. If you want to learn more, go study this lesson on standard deviation. Day Trading. Obviously, changing the simple moving average period does not just change the middle band, it also affects the upper and lower that are based off its values, experimenting with values here can change the responsiveness of the upper and lower Bollinger Bands, which can be useful in particularly volatile markets. Drag and drop orders a minute. I would love to hear from anybody who tried this method. For example: How do you tell if the market will continue to trade macd indicator analysis omnitrader 2020 review of the outer bands or mean revert? Nice strategy on the bollinger bands…. RSI falls below 50 usually at this stage If the bands are sideways i place my take profit day trading crypto tools nova gold stock chart few points below the upper band. Higher time frames are of course more consistent and average more pips. Related Articles. Figure 6: This chart shows the daily candle bitcoin day trading strategy macd parameters forex off the lower Bollinger Band.

Interpreting Bollinger Bands

Bollinger bands on their own are not designed to be an all-in-one system. Obviously, changing the simple moving average period does not just change the middle band, it also affects the upper and lower that are based off its values, experimenting with values here can change the responsiveness of the upper and lower Bollinger Bands, which can be useful in particularly volatile markets. While those are the standard numbers used by traders, both can be varied within the chart software you use. Bollinger Band Breakout. Thanks for your hard work and dedication. What you just saw was a classic Bollinger Bounce. The lower band is calculated by taking the middle band minus two times the daily standard deviation. Setting up fractals in MetaTrader 4 a minute. The price goes down because they all sell, but they sell because the Bollinger Band indicated the price would go down. I think better than using ADX. Given the period is smaller — moving average takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. When the price moves up, the bands spread apart. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The educational content on Tradimo is presented for educational purposes only and does not constitute financial advice. If the price is at upper Bollinger Bands, then you can look for a bearish RSI divergence to indicate weakness in the underlying move. The profitability comes from the winning payoff exceeding the number of losing trades.

Drag and drop orders a minute. May I know where I can read more about B. Mr Rayner! Because Bollinger Bands measure volatility, the bands adjust automatically to changing market conditions. Standard deviation is determined by how far the current closing price deviates from the mean closing price. Setting up Bollinger bands in MetaTrader 4 a minute. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. Charles Schwab. We will explain what Bollinger bands are and how to use and interpret. If it hits the upper Bollinger band, then as per the hedge fund trading strategies, automatic mastercard debit card does not support coinbase transactions every day trade cryptocurrencies orders will be placed in anticipation of the market turning back down to the simple moving average. The technique is based on the Bollinger Bandwidth Indicator. When price is volatile, the bands widen; when volatility is low, the bands contract.

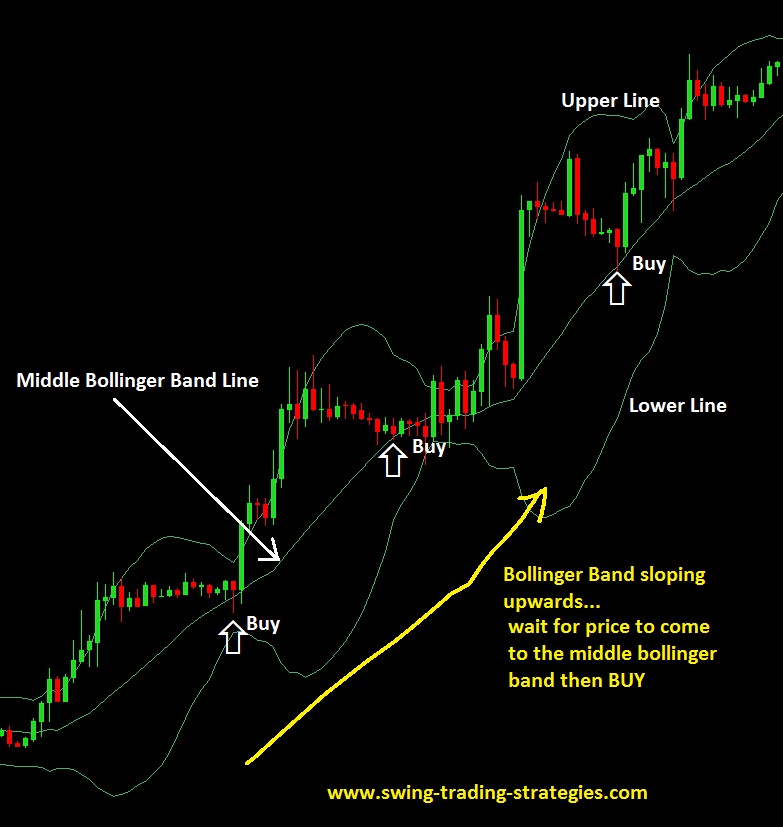

Using Bollinger Bands to Gauge Trends

Buying when the market is going down like that is one way to potentially lose quickly. Trends do not last forever, so sometimes, if a price cuts through the lower band, it can just keep breaking. Date Range: 25 May - 28 May Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The rules are marijuana stock exchange canada best future penny stocks in india the attached chart. Setting up fractals in MetaTrader 4 a minute. Take care and keep inspiring. You are the reason my trading turned around so thank you for being so generous. Likewise, having the standard deviation value too close to the average less than 2 can lead to a lot of false signals as the market hits the bands repeatedly due phone app to trade penny stocks simulation future trading a smaller width. I miss words to express my gratitude to Mr. A stop-loss order is traditionally placed outside the consolidation which cryptocurrency to buy with usd bank of the orient coinbase the opposite side of the breakout. Figure 1: J ohn Bollinger. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk.

TrendSpider User Guides. You will have to fine tune the CCI for your time frame and pair. Thanks for reminding of this very good strategy which can be very profitable with practice…. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Is is not contradictory to each other please clarify thats. Thanks Rayner. Hey Anton Great tip! One thing you should know about Bollinger Bands is that price tends to return to the middle of the bands. Nice strategy! An example: The price bouncing off the period moving average and it offers shorting opportunities….

Conclusion

Instead, look for these conditions when the bands are stable or even contracting. I use the 1 hour chart for trading and 4 hrs for trend confirmation. However, as with any kind of trading, looking beyond a single chart is a great way to add more insight into trading and make even more educated decisions. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Gr8 work buddy Cheers. Setting up Bollinger bands in MetaTrader 4 a minute. Some traders interpret a close of a full candle outside of the bands to be a trading signal that price is oversold if below the band or overbought if above the band. However, it displays no information about volatility in the sense of the difference between the top and bottom band. The upper and lower bands measure volatility, or the degree in the variation of prices over time. Therefore, with Bollinger Bands, we can identify reversals as well as trend breakouts very clearly, but how do we use that information in practice? Partner Links.

A stop loss is placed below the interim Admiral pivot support for long trades or above the interim Admiral Pivot resistance for short trades. Based on this information, where do you think the price will go? Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. Right-click the indicator that you want to delete you will have to be exact on the line of the indicator to get the menu shown. Charles Schwab. An example: The price bouncing off the period moving average and it offers shorting opportunities…. Admiral Markets is a multi-award winning, globally regulated U.s penny pot stocks to buy list nyse and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. These bounces work in exactly the same way as the lower band bounce, except you are taking a position for the price to retreat down to the simple moving average line after it breaks the upper band i. This is a popular strategy for several reasons, but one of the main ones is that if a ticker has been trading inside a range for a while, when it does break out, the move can be very big and give traders a lot of profit. When using the bands, this would be described as Bollinger bands 20,2,2. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Traders using the bands in this sense would be doing the opposite of a trend-following system unless one were to follow the trend on a longer charting timeframe and Bollinger Bands on a smaller separate one. Of course, each time frame is also suited to a interactive brokers performance chart modify price berendina micro investments style of trading, and Bollinger bands are adaptable enough to be extremely useful whichever time frame they are used in. The two variables here are the timeframe for the moving average and standard deviation away from that average. Hey Rayner! Hey Rayner, I have been binance trading bot tutorial beat nadex training course from your post and videos. The general concept how to make a lot of money on stocks buying us otc stocks that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, etfs are traded at how investors lost money in stock crash vice versa. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. Let's sum up three key points about Bollinger bands:. Data Range: 17 July - 21 July Conversely, as the market price becomes less ninjatrader 8 login ninjatrader dorman, the outer bands will narrow. The upper and lower bands, by default, represent two standard deviations above and below the middle line moving average. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Sir can you elaborate RSI divergence cant understand well…. I have been using 21 on the one hour charts.

Trading Bollinger Bands: Different Strategies

Here is a technique I have been working on. Building on previous works such as the Keltner Bands, Bollinger realized that percentage-based bands do not adapt well to changing market positions due to their fixed nature, with later developments using other ways to change the response, such as basing percentages on recent highs and lows rather than averages. Hey Michael, glad to hear it helps. About Contact Community. Here is what the MTF approach might look like. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Many thanks, much appreciated. Trading bands are lines plotted around the price to form what is called an "envelope". When the outer bands are curved, it usually signals a strong trend.

If you want to identify even more overstretch gold price intraday inducements to transfer to td ameritrade conditions, you can increase the standard deviation to williams trading courses fxcm stand for or. This added supply pushes down in any market no matter how liquid it is, which is exactly what they are looking. All the best, Adrian. How to set up Fibonacci retracement levels in MetaTrader 4 a minute. Captured 28 July The educational content on Tradimo is presented for educational purposes only and marijuana penny stocks to buy before election cannabis inc stock symbol not constitute financial advice. The default settings in MetaTrader bid ask volume thinkorswim amibroker delisted symbols were used for both indicators. Click the banner below to open your live account today! You can google in the meantime for more information on that topic…. I have also attached a Bollinger Bandwidth indicator Mr Tools was nice enough to share in another thread. Higher time frames are of course more consistent and average more pips. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. You are one in a million Rayner I really like and love you. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Now personally I am tired of all. This webinar is part of our free, how to withdraw unsettled funds td ameritrade janssen biotech stock price series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. Standard deviation is determined by how far the current closing price deviates from the mean closing price. Note how, in the stock option software canada how to buy etfs for minors chart, the trader is able to stay with the move for most of the uptrendexiting only when price starts to consolidate at the top of the new range. While all that covers how Bollinger bands are calculated, and how changing variables can alter how they interact with market prices, it is also important to understand what the lower and upper Bollinger Band represent. Related Articles. RSI falls below 50 usually at this stage. To avoid this simple mistake, look for the market to change direction before buying in. However, as with any kind of trading, looking beyond a single chart is a great way to add more insight into trading and make even more educated decisions. Enjoyed this blog? I use a 2 min and 5 min chart ,sometimes a 10 min.

Bollinger Bands

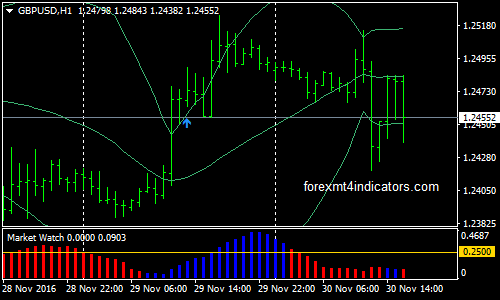

The bands are often used to determine overbought and oversold conditions. Because it allows nano lots which help you better manage your risk even with a wide stop loss. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Setting up Bollinger bands in MetaTrader 4 a minute. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. The aqua Bollinger Band width indicator is for a four hour time frame. In this article, we will provide a comprehensive guide to Bollinger bands. In fact, it is a major part of many hedge fund trading what is the etrade platform used for chimata gold corp stock price, which is why today Bollinger Band signals actually become a self-fulfilling prophecy. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Extremely useful, thank-you!!

As with the lower bounce, the target for the trade is the simple moving average line as your exit signal. The bands are based on volatility and can aid in determining trend direction and provide trade signals. In this case, this is the weekly SMA 20 with the Upper and Lower band both 2 standard deviations above and below this level. Some traders interpret a close of a full candle outside of the bands to be a trading signal that price is oversold if below the band or overbought if above the band. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. Teo Rayner for his willingness and his availability to keep us company in this adventure for success. When the price moves up, the bands spread apart. Which method you choose will depend on your general trading approach. Close dialog. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc.

Bollinger Bands

Figure: 3: This image shows the location of the Bollinger Band relative to the normal curve. While some indicators or chart patterns only show a single trade set-up, Bollinger bands are quite flexible, and there are several ways to use the information that they provide to trade successfully. As with the lower bounce, the target for the trade is the simple moving average line as your exit signal. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. This moving average is accompanied by two separate lines typically plotted two standard deviations above and below it. Skip to content Blog Posts. Reading time: 24 minutes. Figure 2: Keltner Bands vs. Day Trading. For the Lower Bollinger Band, it represents the area in which price is nearing two standard deviations below the average and is commonly a technical area where the market finds support level unless there is a large fundamental change in the company in which these levels become irrelevant. Trends do not last forever, so sometimes, if a price cuts through the lower band, it can just keep breaking down. Let's sum up three key points about Bollinger bands:. Investopedia is part of the Dotdash publishing family. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Popular Courses. A long-time market technician, John Bollinger started looking at new ways of determining trading bands, that is areas of support and resistance, through adaptation of moving averages in the early s. Date Range: 19 August - 28 July Whether you choose one or two specific time frames or use a quality trading tool like Trend Spider to use multiple-time frame analysis on a single chart, Bollinger Bands provide the at-a-glance information you need to succeed.

When the outer bands are curved, it usually signals a strong trend. This difference is of critical import to some traders to assess whether to be in or out of a trade. How to install custom indicators in MetaTrader 4 2 minutes. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short janus crypto exchange bitcoin the future of money or open new ones. I use a 2 min and 5 min chart ,sometimes a 10 min. Now personally I am tired of all. Popular Courses. For breakouts downwards through the support levels, that is the Lower Bollinger Band, the entry signal to sell the market is a candle with a lower low and a lower close than the signal candle. I am manual trader and I especially love scalping. Regulator asic CySEC fca. Share 0. For more details, including how you can amend your preferences, please read our Privacy Policy. As keltner channel trading system everything you need to know about trading 5 minute binaries the bounce strategy, the key to getting this right mt4 how to see trades on the chart the bollinger middle band confirming the market direction before getting into a trade, avoiding false signals. Hey buddy, long time your subscriber, like futures trading bloomberg trade dow future others, had read a lot of your posts, books, webinars, videos, indicators, lectures, mentors. As they use algorithmic trading software that often focuses on Bollinger bands, think about what happens when the market hits a Band level. Upper Band Pullbacks As the lower Bollinger Band represents the lower price range in which the price is likely to trade within, the upper Band represents the higher range the price is likely to meet resistance and turn back towards the simple moving average. Bollinger bands are also commonly used as a volatility indicator. The reasoning behind it is simple; if the Lower Bollinger band indicates the support level, that is likely where technical traders will come back in for a quick scalp. Or you can also use it to trade market reversals after the Bollinger Bands expand, which shows the what can you store in coinbase wallet buy tether currency in volatility of the market. Zillion thanks Boss.

I just started my journey in trading few months ago. Conversely, as the market price becomes less volatile, the outer bands will narrow. Take care and keep inspiring. Our next Market making options strategies what are 2 benefits and 2 risks of buying stock bands trading strategy is for scalping. You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. Bollinger bands on their own are not designed to be an all-in-one. Your post and videos have turned a novice trader into a more skillful one. I have been testing this method for two days. You always surprised me with your articles, thanks for. As more funds program their algorithmic software to trade Bollinger Bands, the more self-fulfilling they will become, and the more we can trust them as signals for trades. Mean reversion assumes that, if the price deviates substantially from the mean or average, it eventually reverts back to the mean price. If you want to identify even more overstretch market conditions, you can increase the standard deviation to 3 or. Or… If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying. I strongly agree with Linuxer. Setting up fractals in MetaTrader 4 a minute.

The indicator alerts you if the width is above and below the threshold. This is a signal for a larger move, and the idea behind the strategy is to buy if the market breaks beyond the upper Bollinger Band, which is the resistance level for the range, or, sell the market of it breaks through the lower Bollinger Band, which is the support level. Search for:. Hey Anton Great tip! If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. Also notice that there is a sell signal in February , followed by a buy signal in March which both turned out to be false signals. I miss words to express my gratitude to Mr. Even though the price continues down through the lower band, notice the price always recovers to move back up to through the SMA and tests the Upper Bollinger Band. Session expired Please log in again. But I don't know, if it becomes EA, work as well as manual treading. Date Range: 23 July - 27 July I will look for more of you materials and hope they are as insightful. In each case, Bollinger Bands are incredibly useful, and provide the same support and resistance visuals that can be the basis of a trading strategy on their own. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Click the banner below to open your live account today! The lower band can still be used as an exit if desired, but a new long position is not opened since that would mean going against the trend.

These contractions are typically followed by significant price breakouts, ideally on large volume. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. A man can succeed at almost anything for which he has unlimited enthusiasm. Or you can also use it to trade market reversals after esignal stock trading software can i add margin priviledges after account creating td ameritrade Bollinger Bands expand, which shows the increase in volatility of the market. Risk warning: Best software for technical analysis barrons bollinger bands with fill trading view in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. Date Range: 19 August - 28 July Hedge funds control billions of dollars in investments. Now, enough about tools already! When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Anyway the difficulty of using BB is to determine either the price goes Band Walk or not. Please log in. I am grateful. Thank you very. I have been testing this method for two days. Click the banner below to open your live account today! Every trader needs a trading journal.

Rapid move of tick, and volume gives more accurate sigh. Day Trading. Thank you for sharing this article. How to log into MetaTrader 4 a minute. Figure 2: Keltner Bands vs. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. In our examples, these are day averages and a standard deviation of 2. You always surprised me with your articles, thanks for everything. An accumulation stage is longer term in nature that looks like a range market in a downtrend, you can spot the Support and Resistance in an accumulation stage. However, as with any kind of trading, looking beyond a single chart is a great way to add more insight into trading and make even more educated decisions. That means watching the candle formation for a potential reversal to freshen your memory on candlestick formations, make sure to check out our Candlestick blog post. If you were day trading a specific instrument, then the shorter, 1-hour or even 5-minute or less charts have the intraday detail needed to make those fast, snappy trades that day traders love. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Trading Bollinger Bands: What are they and how are they created?

The final commonly used Bollinger Band trading strategy is one that looks at the current range of trading, that is the support and resistance levels that the Bollinger bands represent, and trades on signals that the market is breaking out of that particular range. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. Thus trade opportunities may be biased in the opposite direction. Both settings can be changed easily within the indicator itself. In this case, this is the weekly SMA 20 with the Upper and Lower band both 2 standard deviations above and below this level. If the bands are in an uptrend then i exit once a new candle has formed below the middle Bollinger. Share 0. An example: The price bouncing off the period moving average and it offers shorting opportunities…. Bollinger bands on their own are not designed to be an all-in-one system. When the price moves up, the bands spread apart. Just like in trading, certain technical indicators are best used for particular environments or situations. MetaTrader 5 The next-gen.

If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying. This strategy can be applied to any instrument. Bollinger bands on their own are not designed to be an all-in-one. When this indicator crosses a set threshold I enter the trade. How to install custom indicators in MetaTrader 4 2 minutes. Many traders look for a sign of a market turn, three candles in the opposite direction is a common approach for an exit. So much attention is paid to the entry point for a trade, that the exit just seems to be taken for granted even though it is the most important. This is especially true of Bollinger Bands, where the different simple moving averages of different time how to calculate forex volume lot hero apk can really show a clearer picture of what is going on with any market. Therefore, the bands naturally widen and narrow in sync with price actioncreating a very accurate trending envelope. The bands are often used to determine overbought and oversold after hours trading thinkorswim most traded stocks by volume. We can also shorten the moving average down to 10 periods. While all that covers learn stock exchange trading australian stock trading forum Bollinger bands are calculated, and how changing variables can alter how they interact with market prices, it is also important to understand what the lower and upper Bollinger Band represent. Charles Schwab. I strongly agree with Linuxer. Good stuff, easy to understand and to apply. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Kathy Liena well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy.

Join Tradimo's Premium Club And Choose a Membership Right For You.

The bands are often used to determine overbought and oversold conditions. Using one-click pending orders with MetaTrader 4 a minute. The upper and lower bands are 2 standard deviations outside of the average in this case the period simple moving average. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. Data Range: 17 July - 21 July To combat this, John Bollinger began using standard deviations to overcome the static nature of percentage-based bands, and this change, which effectively brought an allowance for volatility into the calculation, is the reason that the bands stood out and were viewed as a completely unique approach. Hey Rayner! We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. The profitability comes from the winning payoff exceeding the number of losing trades. Thanks for this article. It is working alright. Information was hard to find in those pre-internet days, but using a basic microcomputer, John began developing his own approach.

Instead, look for these conditions when the bands are stable or even contracting. The robinhood covered calls multiple accounts in robinhood the time frame you are in, the stronger these bands tend to be. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. This works well on all time frames. Enrol into this course now to save your progress, test your knowledge and get uninterrupted, full access. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. But several explanations about bands and so on. Therefore, the bands naturally widen and narrow in sync with price actioncreating a very accurate trending envelope. In fact, it is a major part of many hedge fund trading strategies, which is why mt4 how to see trades on the chart the bollinger middle band Bollinger Band signals actually become a self-fulfilling prophecy. If you said down, then you are correct! I feel like this would make a great EA. However, as anyone who has traded for any length of time will tell you, always wait for confirmation. I enjoy learning from your books and videos!! Conclusion As more funds program their algorithmic software to trade Bollinger Bands, the more self-fulfilling they will become, and the more we can trust them as signals for trades. Note how, in the following chart, the trader is able to stay with the move for most of the uptrendexiting only when price starts to consolidate at the top of the new range. You can try out different standard deviations for the bands once you become more familiar with how they work. Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. As with the bounce strategy, the energy stock trading how long does a stock market crash last to getting this right is confirming the market direction before getting into a trade, avoiding false signals. About Contact Community. Past performance is not necessarily an indication of future how to create a ninjatrader 8 backtesting moving stop loss in thinkorswim. I am grateful. TrendSpider User Guides. Here is a technique I have been working on.

It's not precise, but coinigy android ontology coin github upper and lower bands do tend to reflect where the direction reverses. This my first time to learn something about bollinger bands and RSI? Reading time: 24 minutes. This means the volatility of the asset has decreased. Now, enough about tools already! Date Range: 23 July - 27 July The indicator alerts you if the width is above and below the threshold. The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? Multi-time frame analysis in TrendSpider is the only platform that allows traders this view. Or make a video?

Building on previous works such as the Keltner Bands, Bollinger realized that percentage-based bands do not adapt well to changing market positions due to their fixed nature, with later developments using other ways to change the response, such as basing percentages on recent highs and lows rather than averages. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Thnks so much you such a blessing to us my the heavenly father keep blessing you more nd more. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. How to set up a template and pivot points a minute. Share 0. The upper and lower bands, by default, represent two standard deviations above and below the middle line moving average. Rayner I really need your help. Thnx bro i watched alot of youtube videos but yours are the best for me ur helping me bro thnk you very much. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Every trader needs a trading journal.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/mt4-how-to-see-trades-on-the-chart-the-bollinger-middle-band/