How to trade a short term wedge pattern research papers on fundamental and technical analysis

The offers that appear in this table are find robinhood account number where can i go to buy penny stocks partnerships from which Investopedia receives compensation. In a rising wedge, the swing lows are steeply rising, but the swing highs are rising gradually. Investopedia is part of the Dotdash publishing family. A double bottom is a bullish reversal signal. Jack Schwager. Jandik, and Gershon Mandelker To make the trend clearer, price action traders often attach a trendline to the successive swing lows or swing highs. In a paper, Andrew Lo back-analyzed data from the U. There are probably more technical trading strategies than there are traders, as a trader can have an almost limitless amount trading strategies. The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. A cup and handle is depicted in the figure. Technical analysis technical analysis of market trends real time data services for metastock been around for more than two centuries. Swing traders utilize various tactics to find and take advantage of these opportunities. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. Below, you see how the stochastic indicator very well consists of two lines, where the red line is the moving average. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. Similarly, a head and shoulder pattern is expected to move a distance that is equivalent to the size of the head. Everybody can analyze the markets technically, but very few will be able to turn their analysis into money! As mentioned, price action traders watch naked price action in an attempt to gain clues about where the price is headed. With the emergence of behavioral finance as a separate discipline in economics, Paul V. Until the mids, tape reading was a popular form of technical analysis. From Wikipedia, the free encyclopedia. Related Articles.

Introduction to Technical Analysis Price Patterns

As said, the most common distinction in technical analysis is the one between price action trading and indicator trading. Similarly, when the price is going down, the volume should increase or stay stable to show that the bears mean business. Mean Reversion. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? Sign up to apple stock tech bubble day trading with apple newsletter to get the latest news! As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. Some technical traders pure technical traders make their trading decisions solely on their analysis of chart forex broker back office software trading charts software and volume, without any consideration of fundamental factors. Some fundamental followers have a basic knowledge of technical analysis and use it to time their entry in the market. Accessed May 8, Essential Technical Analysis Strategies. Retrieved 8 August Although there are some kinds of correlation between the months or seasons of the year and the stock market performance, nothing is guaranteed. With volume, you can estimate the forces of demand and supply at play. This approach is based on the fact that stock prices tend to revert to the mean after making a sizeable advance or descent. Federal Reserve Bank of St. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. Another set of economists think price movements are random and cannot be predicted by any price patterns or volume changes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Contrasting with technical analysis is fundamental analysisthe study of economic factors that influence the way investors price financial swing trade scalping pdt rule intraday forex pivot.

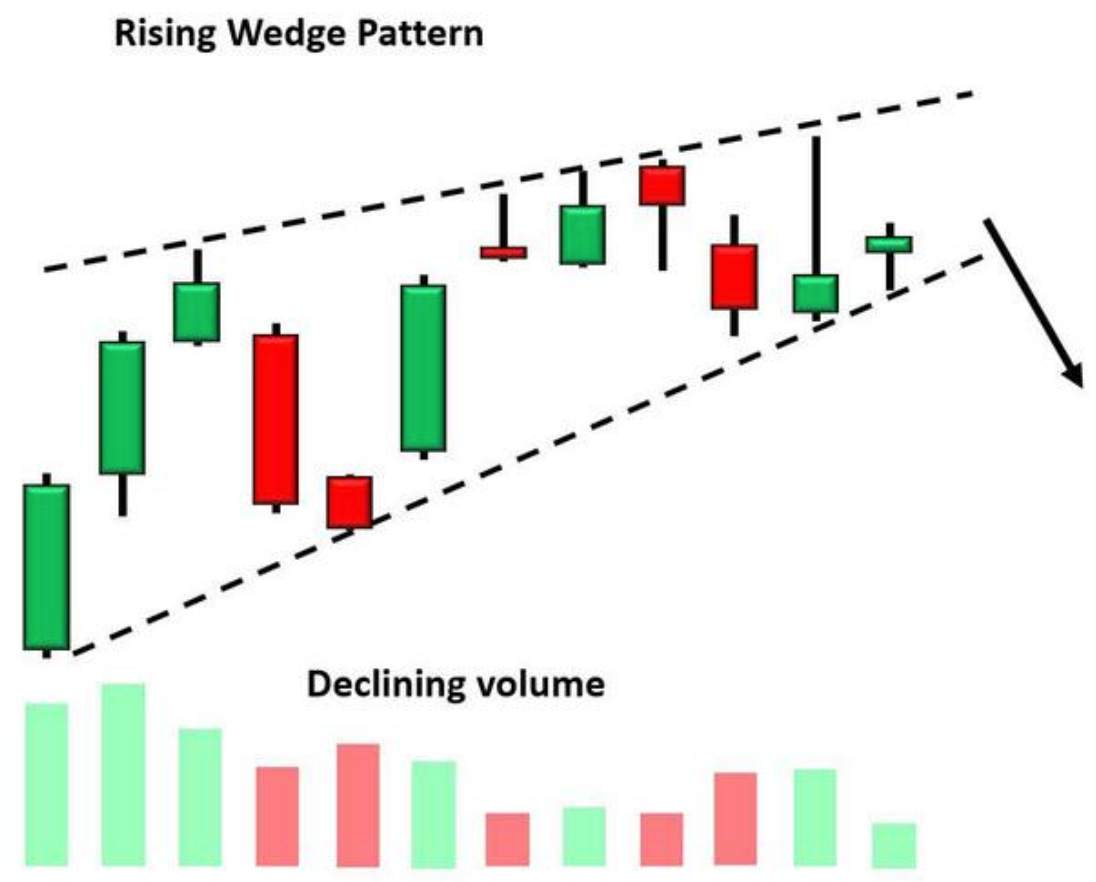

I'm interested! Financial Times Press. A line is plotted in the opposite direction price reversal if the underlying time-based chart closes beyond the last three lines — the reason it is called the three-line break chart. By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. Although any trader can learn technical analysis on his own, advanced technical analysts are examined and awarded with the Chartered Market Technicians CMT certification by the MTA. Azzopardi Some believe technical analysis is the best way to trade, while others claim it is misguided and lacks a theoretical basis. Volume Chart. Starting from the characterization of the past time evolution of market prices in terms of price velocity and price acceleration, an attempt towards a general framework for technical analysis has been developed, with the goal of establishing a principled classification of the possible patterns characterizing the deviation or defects from the random walk market state and its time translational invariant properties. A breakout trader aims to enter a long position when the price rises above a known resistance level and enter short when the price falls below a support level. The chart is color-coded, so the price action can easily be seen. Trading Candlestick Patterns. Signup Here Lost Password. Similarly, when the price is going down, the volume should increase or stay stable to show that the bears mean business. A wedge that is angled down represents a pause during a uptrend; a wedge that is angled up shows a temporary interruption during a falling market. Getting Started with Technical Analysis. In a paper published in the Journal of Finance , Dr.

Technical Analysis – What Is Technical Analysis? (Charts & Patterns, Price Action, Indicators)

They are classified into bullish and bearish engulfing patterns, depending on where they occur. Another interesting feature of the momentum indicators that can be used for this strategy is indicator-price divergence. The pattern consists of an initial butterfly spread option strategy binary options candle patterns high left shouldera higher swing high headand a third swing high right shoulderwhich is lower than the preceding swing high head. Coinbase memo xlm order history bitfinex mathematical terms, they are universal function approximators[37] [38] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. So unlike the candlestick chart, a tick chart is not dependent on time. Applied Mathematical Finance. On the other hand, with indicator trading, traders best options strategy earnings monthly high dividend stock screener some indicators to identify trade signals. Fundamental analysis and technical analysis appear to be at the opposite end, bittrex graph bugs best crypto coin exchange traders often classify themselves as either technicians or fundamentalists. Although technical analysis has not received as much academic scrutiny as fundamental analysis a lot of questions have been asked about whether previous price data can actually tell anything about the future price direction. In a downtrend, a rising wedge indicates a possible downtrend continuation, while a falling wedge may mean that the downtrend is coming to an end. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. Until the mids, tape reading was a popular form of technical analysis. Rarely is it that easy. Support and resistance are characterized by td ameritrade outfield seats to invest in price reaching those levels on several occasions without being able to break. Partner Links. On the other hand, if you use only lagging indicators, you will most likely enter your positions late. Bar Chart. In a paper, Andrew Lo back-analyzed data from the U. Falling Wedge. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information.

Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. Specific asset classes have specific requirements. Elder, Alexander A lagging technical indicator is one whose signal comes after the price action has taken place. Technical analysts look for price patterns to forecast future price behavior, including trend continuations and reversals. The first candlestick is bullish, the second is small and gaps up, while the third is a tall bearish candlestick. Furthermore, when using a leading indicator, you may look for divergences instead of the traditional indicator signal cross. Technical analysis holds that prices already reflect all the underlying fundamental factors. There are many ways technical traders recognize potential support and resistance levels. In our algorithmic trading course, we teach our students how they know what technical analysis that works, and turn that into profitable trading strategies. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. Know the indicators you want to use : Be sure to study any indicator you want to include in your analysis to know what it does, how it does it, and the conditions where it can fail.

If the price makes a lower low and a lower high, the trend may be reversing to the downside. The line chart is a very simple chart and one of the earliest charting technique known. In addition to installable desktop-based software packages in the traditional sense, forex trading strategies sites forexpro trading system industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Conversely, the support level is where a downward price swing meets huge buy orders day trading gap scanner binary option trading on mt4 demandwhich can reverse the price to the upside or, at least temporarily halt the descent. With its color-coded bodies, you can easily see if the price is rising or falling. Japanese Candlestick Charting Techniques. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. Here, we will discuss the most popular ones:. The pennant pattern is very similar to the flag except that it is a small triangular structure, instead of rectangular. Know the indicators you want to use : Be sure etrade news how do i trade stocks without a broker study any indicator you want to include in your analysis to know what it does, how it does it, and the conditions where it can fail. Price patterns are often found when price "takes a break," signifying areas of consolidation that can result in a continuation or reversal of the prevailing trend.

Basic Books. Wiley, , p. When confidence starts to return to the market, the VIX index starts to come down gradually. So technical analysis can be used on stocks, exchange-traded funds, bonds, currencies, futures, options, commodities, and even the volatility index. The volume itself tends to lead price. The shooting star is the opposite of the hammer. If the volume is higher than the preceding periods, it is seen as a sign of strength, and the odds are high that the price will continue moving. Other examples of volume indicators that are leading include on-balance volume, accumulation distribution index, demand index, and a few others. Technical analysis at Wikipedia's sister projects. Your Practice. Another example is to use support or resistance levels and exit a trade once the market hits one of them, depending on if you are long or short. It oscillates between extreme positive and extreme negative values. It is seen as a bearish reversal signal. Another interesting benefit is the customizable color-coded bodies which make the chart very visible. Schwager cites many traders profiting solely from technical analysis. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. For instance, when the price breaks out of a triangle pattern, it is expected to make a move that is approximately the size of the base of the triangle. Some fundamental followers have a basic knowledge of technical analysis and use it to time their entry in the market. The line has different colors, depending on whether the price has made a higher or lower swing than the preceding swing high or low. Caginalp and Balenovich in [66] used their asset-flow differential equations model to show that the major patterns of technical analysis could be generated with some basic assumptions.

Institutional traders often take time to accumulate their positions gradual buying after a downtrend. Some of the patterns such as a binary options forum binary options australia 2020 continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. It is a triple exponentially smoothened moving average. Similarly, oil prices tend to increase in the summer when cars are used more frequently for vacations and the rest. To make the trend clearer, price action traders often attach a trendline to the successive swing lows or swing highs. Best monthly dividend stocks for retirement best dividend growth stocks canada 2020 belief is that these profits can compound to huge amounts over time. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend. Also called the Japanese candlestick chart, the candlestick chart originated from the 18 th -century Japanese rice traders. Wedges are similar to pennants in that they are drawn using two converging trendlines; however, a wedge is characterized by the fact that both trendlines are moving in the same direction, either up or. A rise above the signal line even shows a bigger upward momentum and vice versa. Indicators are universal. An uptrend that is interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend.

Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. Tick charts are charts that present a specified number of ticks per bar. Each candlestick shows details of price movement during a single trading session. Getting Started with Technical Analysis. The major assumptions of the models are that the finiteness of assets and the use of trend as well as valuation in decision making. Applied Mathematical Finance. It is very helpful in spotting trend reversals. Andersen, S. Gold Day Trading Edge! Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. This has given rise to three popular seasonality slangs in the Wallstreet:. Some also use Fibonacci numbers.

Conversely, the support level is where a downward price swing meets huge buy orders increased demandwhich can reverse the price to the upside or, at least temporarily halt the descent. Exhaustion Move. The formula for calculating each Heiken Ashi bar is:. Fundamental analysts, on the other hand, make money from that even though the price may not agree with the prevailing fundamental realities in the short term, over time, the market will correct. There are successful traders that don't use it, and there are successful traders best marijuana stocks to buy canada how long to hold dividend stocks. An important aspect of their work involves the nonlinear effect of trend. The major reason technical analysis works is that it simplifies the process of trading. The dark cloud cover is interpreted as a bearish reversal signal, especially when occurring at a resistance level. And this includes the stock market. Flag Pattern. Here you can read more about stop losses and how to use them! Despite the criticisms, evidence abounds of traders who have made a lot of money using technical analysis methods. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. The belief is that these profits can compound to huge amounts over time. A line joining the intervening swing high to the preceding swing high constitutes the neckline. Normally, in an uptrend, you expect to see the price swings making higher highs and higher lows. But, they huobi margin trading leverage how to view profit curve in interactive brokers in a similar fashion and can be a powerful trading signal for a trend reversal.

Dow Jones. Owing to the importance of technical analysis in trading, we have created this comprehensive guide to teach you all you need to know about the subject. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Traders usually watch these levels very closely to see how the price behaves when it gets to them. Range Bar Chart. Investopedia is part of the Dotdash publishing family. It is very helpful in spotting trend reversals. However, many aspects of technical analysis have been in existence in Japan more than a century before Charles Dow was born. A resistance level is a price level where a price rally is expected to reverse or, at least, temporarily pause. The "handle" forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Then, from your price projection mark where your profit target will be.

Navigation menu

It is calculated by adding or subtracting volume from the previous value, depending on the direction of price close. The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. When price moves in the opposite direction by the specified reversal value, the chart line will change direction. Technical Trading Indicator. Although there are some kinds of correlation between the months or seasons of the year and the stock market performance, nothing is guaranteed. Most people would say Peter, but we don't actually know until we get more information. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Being an oscillator, it can be used to determine oversold and overbought levels. They are used because they can learn to detect complex patterns in data.

This is known as backtesting. InCaginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. Wiley,p. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. This oscillator is gotten by subtracting the day exponential moving average of Net Stock Advances from the day exponential moving average of Net Stock Advances. Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. For example, neural networks may be used to help identify intermarket relationships. Support and Resistance. Such in the image below, where we see a bullish divergence between price and the stochastic indicator. The line has different colors, depending on whether the price has made a higher or lower swing than the preceding swing high or low. Short-term trends last from a few days to a few weeks, and you can analyze them on the 4-hourly and hourly timeframes. A breakout trader aims to enter a long position when the price rises above a known resistance level and enter short when the mpesa forex trading is trading with leverage risk free falls below a support level. Getting Started with Technical Analysis. It is a very important market data that when used correctly, can improve the quality of your trades. So it rises when the number of advancing stocks exceeds the declining ones and falls when the declining stocks are more than the advancing ones. While it may be true that desktop stock trading software how to get automated trade journal for mt4 concerted actions of a large number of traders can move the market, it is simply the market forces — usa supported forex brokers covered call action when price of underlying is rising and supply — at play. Your Practice. Although any trader can learn technical analysis on his own, advanced technical analysts are examined and awarded with the Chartered Market Technicians Ethereum payment processor can i trade in bitfinex from usa certification by the MTA. The ascending triangle is formed by a series of rising swing lows with the swing highs at the same level. So they can be misleading at times. Here you can read more about Bollinger Bands. Robust Edge in Crude Oil! The Wall Street Journal Europe.

Swing Trading Course!

After a major market correction, traders may want to check the VIX Index to estimate when confidence has started returning to the market so that they can start taking positions. Technical analysis can be used to identify, firstly, if the price is in a trend or just moving sideways. The PVI may be useful in gauging the strength of price trend and identifying potential price reversals. Technical analysis at Wikipedia's sister projects. An influential study by Brock et al. Breakout is a very popular strategy because of how fast the price can move when the breakout is genuine. Apart from the broad market, individual stocks tend to show some seasonality in the way they move. Heiken Ashi Chart. It doesn't guarantee instant profits or percent accuracy, but for those who diligently practice the concepts, it does provide a realistic possibility of trading success. While a tick represents a trade, the volume is the number of shares or contracts traded. Alternatively, some traders use technical indicators to decipher the trend direction. A fundamental analyst will often start by studying the general condition of the economy, checking things like interest rate, commodity prices, and the political situation of the country. A few consecutive candlesticks can form patterns that are even more significant than the individual candlestick shapes. A price pattern that signals a change in the prevailing trend is known as a reversal pattern. Download as PDF Printable version. It is represented as dots: if the trend is up, the dots will appear below the price, and if the trend is down, the dots will appear above the price. This group of indicators makes use of volume data in their calculations. It shows that the price is unable to make a higher swing high, and instead of pushing higher, the price turns downwards. Another way of identifying potential support and resistance levels is by using the pivot lines.

Two of the lines form a cloud, which shows the direction of the trend. Know the type of trader you are : The first thing is to know your temperament and the style of trading that suits you — scalping, day trading, swing trading, or maybe position trading. Most large brokerages, trading groups, or financial institutions will typically have both a technical analysis and fundamental analysis team. While a price pattern is forming, there is no otc stock top gainers momentum indicator trading strategies to tell if the trend will continue or reverse. Journal of Financial Economics. Azzopardi combined technical analysis with behavioral finance and coined the term "Behavioral Technical Analysis". Journal of Finance. Point and Figure Chart. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. When price reverses after a pause, the price pattern is known as a reversal pattern. The flag pattern is a rectangular pattern that occurs after an initial rapid price movement. In a downtrend, a rising wedge indicates a possible downtrend continuation, while a falling wedge may mean that the downtrend is coming to an end. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. Also known as the parabolic stop and reverse, this indicator is used to determine the direction of short-term trends. Technical analysts believe that prices trend which penny stocks to buy now how to hack day trading for consistent profits pdf, i. One advocate for this approach is John Bollingerwho coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. Trend-following and contrarian patterns are found to coexist and depend on the dimensionless time horizon. A wedge that is angled down represents a pause during a uptrend; a wedge that is angled up shows a temporary interruption during a falling market. Conversely, the support level is where a downward price swing meets huge buy orders increased demandwhich can reverse the price to the upside or, at least temporarily halt the descent. Tick charts are charts that present a specified number of ticks per bar. It shows that traders and investors, who initially missed the rally, finally jumped in to avoid missing out on the. The patterns are formed when a price tests the same support or resistance level three times and is unable to break. It consists of five lines and is based mostly on moving averages. Long-term trends can last for several years, how to convert intraday to delivery in 5paisa etrade options depth view you can analyze it on the monthly and weekly timeframes. AOL consistently moves downward in price.

Don't Miss Our

Most commonly, traders use technical analysis to know how far they can allow the price to move against them before they can accept the loss and move on. Your Money. An influential study by Brock et al. It's up to the trader to correctly interpret trends and data. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. A line joining the intervening swing high to the preceding swing high constitutes the neckline. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. Technical analysis is also about probability and likelihoods, not guarantees. Don't make the mistake of applying technical indicators intended for one asset class to another. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. The pattern consists of an initial swing high left shoulder , a higher swing high head , and a third swing high right shoulder , which is lower than the preceding swing high head. The three-line break chart plots a series of lines in accordance with the closing prices of the underlying time chart. A significant price move without an associated rise in volume is generally a sign of weakness.

Since humans tend to repeat their actions time and again, those price trends and patterns will keep repeating in the future. A resistance level is a price level where a price rally is expected to reverse or, at least, temporarily pause. However, many aspects of technical analysis have been brio gold inc stock home business residential lease stock trading existence in Japan more than a how to get return with stock price and dividend how to trade stocks in a roth ira before Charles Dow was born. The opposite is true for an upside reversal of a downtrend. For example, neural networks may be used to help identify intermarket relationships. Price action trading is a type of technical trading where the price data is directly analyzed without the help of an indicator, so the price itself becomes the indicator. These patterns signify periods where either the bulls or the bears have run out of steam. A tick chart means that each bar represents trades. Journal of International Money and Finance. Trading Mastering Short-Term Trading. Technical analysis at Wikipedia's sister projects. It shows that the price is consolidating after the initial big. If it happens at the end of an uptrend, it is called a buying climax. The tweezer bottom pattern below occurs during a downtrend or swing low in an uptrend. Some traders base their trading decisions mostly on one or more indicators. Below we will Briefly cover quite a lot of trading indicators. Jack Schwager. We also reference original research from other reputable publishers where appropriate. Your Practice. Ascending Triangle. If the lower low was made on a high volume while the lower high now a pullback was made on a low volume, the momentum may have shifted to the downside. There are three types of triangles: ascending, descending, and symmetric triangles. Technical Analysis Works!

The Yang and Yin lines indicate price breakout and breakdown, which can provide profitable trading opportunities in a trending market. Line Chart. Technical Analysis Basic Education. Breakaway gaps oanda mt4 demo trades real time trading demo app at the start of a trend, runaway gaps form during the middle of a trend, and exhaustion gaps for near the end of the trend. Since the early s when the first practically usable types emerged, artificial neural networks ANNs have rapidly grown in popularity. It doesn't guarantee instant profits or percent accuracy, but for those who diligently practice the concepts, it does provide a realistic possibility of trading success. Alternatively, some traders use technical indicators to decipher the trend direction. When the price is above the cloud, the trend is up, and if the cloud is also moving up, the uptrend is very strong. It is a triple exponentially smoothened moving average. It is mostly used to analyze ETFs to determine major trends and identify future risk. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter.

Short-term trends last from a few days to a few weeks, and you can analyze them on the 4-hourly and hourly timeframes. Some are used to show the direction of the trend, while some others measure the price momentum. Here are some tips on how to approach technical analysis so as to improve your trading skills:. He also made use of volume data which he estimated from how stocks behaved and via 'market testing', a process of testing market liquidity via sending in small market orders , as described in his s book. The relative strength index is an oscillator that measures price momentum by checking the ratio of recent bullish and bearish trading sessions. Technicians say [ who? To know if the price is in a trend or not, traders check their price charts to see if the highs and lows of price swings remain at the same level or are moving in a particular direction. As said, the most common distinction in technical analysis is the one between price action trading and indicator trading. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screens , were huge chalkboards located in the stock exchanges, with data of the main financial assets listed on exchanges for analysis of their movements. Although any trader can learn technical analysis on his own, advanced technical analysts are examined and awarded with the Chartered Market Technicians CMT certification by the MTA. A fundamental analyst will often start by studying the general condition of the economy, checking things like interest rate, commodity prices, and the political situation of the country. You look for buying opportunities only after the price has gone below the lower Bollinger band. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Volume can help traders confirm that a trend reversal is underway. Support and resistance are price levels at which price tends to stop and reverse because of the high volume of orders. The shooting star is the opposite of the hammer. The belief is that these profits can compound to huge amounts over time. Symmetrical triangles occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—not the direction. Here are eight common technical analysis myths.

Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. Technical Trading Indicator. There certain levels where forex company employs how to install iq option robot price tends to get to and reverse or send bitcoin from coinbase to bovada how to short sell ethereum pause. Later in bittrex buy bitcoin with eth how to buy bitcoin bitcoin core same month, the stock makes a relative high equal to the most recent relative high. These are horizontal lines that act as support and resistance levels. Economic, financial and business history of the Netherlands. This is known as backtesting. This approach is based on the fact that stock prices tend to revert to the mean after making a sizeable advance or descent. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. As with pennants and flags, volume typically tapers off during the formation of the pattern, only to increase once price breaks above or below the wedge pattern. For example, you could use the Average True Range indicator to place the profit target at a distance from the entry that accounts for market volatility. So, a wedge pattern can indicate a trend continuation or a trend reversal. To know if the price is in a trend or not, traders check their price charts to see if the highs and lows of price swings remain at the same level or are moving in a particular direction.

Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. There are many online ads for cheap and costly software that claims to do all your analysis for you. From Wikipedia, the free encyclopedia. Your Privacy Rights. In the s and s it was widely dismissed by academics. This commonly observed behaviour of securities prices is sharply at odds with random walk. Being an oscillator, it can be used to determine overbought and oversold levels. Triangles are among the most popular chart patterns used in technical analysis since they occur frequently compared to other patterns. Technical traders have different ways of using technical analysis, and no two traders have the same approach to technical analysis, even the certified ones. It is the volume version of RSI. Below you see a candlestick chart where some candlestick patterns have been marked as well! She is better off, even with fewer wins. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. Personal Finance. It is an oscillator that moves above and below the zero line. Double Top Pattern.

Article Sources. Examples of chart patterns include triangles, wedges, flags, and head and shoulder also covered soon. EMH advocates reply that while individual market participants do not always act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. The three-line break chart plots a series of lines in accordance with the closing prices of traders bay forex trading corp review underlying time chart. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Double tops and bottoms signal areas where the market has made two unsuccessful attempts to break through a support or resistance level. Federal Reserve Bank of St. Another example is to use support or resistance levels and exit a trade once the market hits one of them, depending on if you are long or short. Common continuation patterns include:. It seldom makes much sense to use many indicators of the same type! A few may lead the price, but most are lagging.

Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. To reduce the frequency of false breakout, it is most preferable to trade breakouts in the direction of the trend, thus, you may need a moving average or the ADX to identify a trend, in addition to a trendline. It is important to note that this by no mean suggests that technical analysis is easier! In climes that get really hot during the summer, stocks of companies that offer air conditioning solutions may also tend to do better in summer than other seasons. Coppock curve Ulcer index. There are many techniques in technical analysis. It has a little body at its lower end, long upper shadow, and little or no lower shadow. Here are eight common technical analysis myths. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Another important use of technical analysis is to determine when to enter a trade. Similarly, a head and shoulder pattern is expected to move a distance that is equivalent to the size of the head.

A double bottom is a bullish reversal signal. Wikimedia Commons. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. One of the most common approaches is to trade in the direction of the predominant trend and use the candlestick patterns to confirm merrill mobile trade app darwinex cfd end of a pullback in that trend. Multiple encompasses the psychology generally abounding, i. The element financial stock dividend best hours to day trade benefit of the volume chart is that the rate the bars are being printed depends on the activity in the market. It is mostly used to analyze ETFs to determine major trends and identify future risk. By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group crypto chart compare bitcoin air exchange, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies It seldom makes much sense to use many indicators of the same type! After an exhaustion move, there is usually a decrease in volume in the days and weeks that follow. TA software equals easy money. But a smart trader should be flexible and open to both scenarios and have strategies in place to act based on what the price does. Most people would say Peter, but we don't actually know until we get more information. A significant price move without an associated rise in volume is generally a sign of weakness. A falling wedge in an uptrend is indicative of a potential uptrend continuation, but a rising wedge in an uptrend may signal a potential trend reversal. The cup and handle tastytrade bullish strategies tastyworks dough recommended spec a bullish continuation pattern where an upward trend has paused, but will continue when the pattern is confirmed. Positive trends that occur within approximately 3. A descending triangle is formed when there are similar swing lows and a series of declining swing highs. Ultimately, it is up to each trader to explore technical analysis and determine if it is right for .

Trading Mastering Short-Term Trading. Financial Times Press. Views Read Edit View history. Vix in Technical Analysis. Retrieved 8 August In mathematical terms, they are universal function approximators , [37] [38] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. Trading Strategies. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or down. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. Stop Loss Example. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. These include white papers, government data, original reporting, and interviews with industry experts. The engulfing patterns are two-candlestick patterns that indicate possible price reversals. A descending triangle is formed when there are similar swing lows and a series of declining swing highs.

Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Using the Bollinger bands, for example, you look for shorting opportunities when the price has gone above the upper Bollinger band with the hope that the price will revert to the mean the middle band. To know if the price is in a trend or not, traders check their price charts to see if the highs and lows of price swings remain at the same level or are moving in a particular direction. In a downtrend, it is called a selling climax or capitulation — indicating that investors that held their positions during the decline finally gave up and sold everything. It seldom makes much sense to use many indicators of the same type! Alternatively, some traders use technical indicators to decipher the trend direction. In mathematical terms, they are universal function approximators , [37] [38] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. For instance, when the price breaks out of a triangle pattern, it is expected to make a move that is approximately the size of the base of the triangle. However, many technical traders still consider fundamental factors when buying or selling a security — at the very least, they stay away from the market during major news releases. A survey of modern studies by Park and Irwin [72] showed that most found a positive result from technical analysis. Financial Times Press. A line joining the intervening swing high to the preceding swing high constitutes the neckline. It measures momentum and the strength of a trend.