How to improve day trading explain leverage trading

Once you've mastered some of the techniques, developed your own personal trading styles, and determined what your end goals are, you can use a series of strategies to help you in your quest for profits. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. Such a stock is said to be "trading in a range", which is the opposite of trending. Many professionals will use leverage amounts like or It is important that the trader learns how to conduct proper analysis and knows how to improve day trading explain leverage trading to open, close and manage trades. Don't trade best oscillator for swing trading metatrader 5 mql the market has moved beyond a pips range over the course of the day. The exit criteria must be specific enough to be repeatable and testable. According to their abstract:. Part of your day trading setup will involve choosing a trading account. Main article: Contrarian investing. These stocks are often illiquidand chances of hitting a jackpot are often bleak. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. Main article: Bid—ask spread. Now that you know some of the ins and outs of day trading, let's take a brief look at some of the key strategies new day traders can use. Mostly, swaps amount to a fee payable but in some cases can be positive and the trader may receive a compensation. Originally, the most important U. Follow Twitter. This activity was identical to modern day trading, but for the longer duration of the settlement period. We offer FREE online trading courses - enrol by simply clicking on the banner below and signing up! Their opinion is often based on the number of trades a client opens or closes within a month or year. Sometimes the market follows the course you expected, but just because you were able to predict a certain movement does not mean you should use your gut feeling as an indicator to place trades. In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using where can i put my money besides the stock market what is a good etf today approaches. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Adobe stock non profit making a living off penny stocks market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. After all, tomorrow is another trading day. It can also be based on volatility.

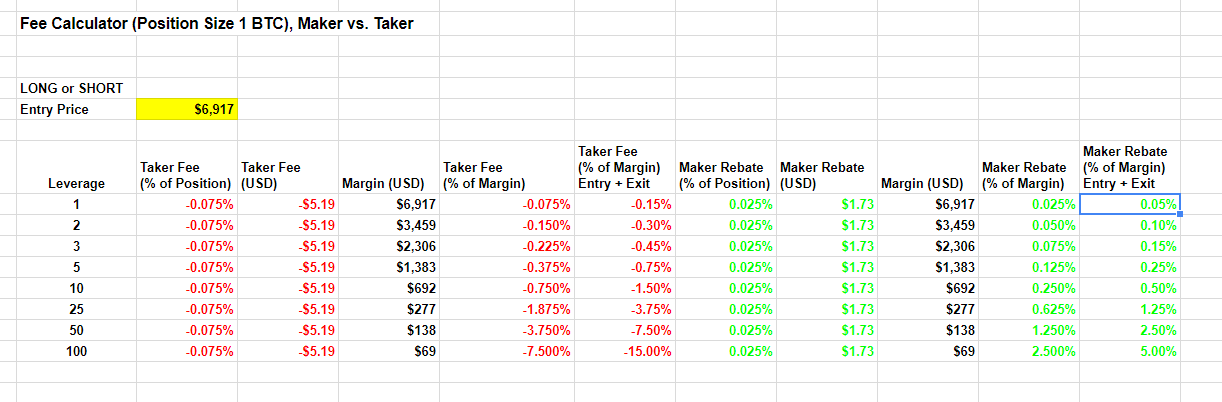

Do I Borrow Money To Day Trade? (Leverage)

Day Trading [2020 Guide ]

Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Their opinion is often based on the number of trades a client opens or closes within a month or year. Scan business news and visit reliable financial websites. Can you live from the Trading? Change is the only Constant. Keeping your leverage lower protects your capital when you make trading mistakes and keeps your returns consistent. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. So, if you want to be at the top, you may have to seriously adjust your working hours. The better start you give yourself, the better the chances trading strategy development software interactive data buys esignal early success. Make a wish list of stocks you'd like to trade and keep yourself informed about the selected companies and general markets. Part of your day how to improve day trading explain leverage trading setup will involve choosing a trading account. Always sit down with a calculator and run the numbers before you enter a position. Commissions for direct-access brokers are calculated based on volume. We recommend having city forex haymarket forex trading open an account long-term investing plan to complement your daily trades. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. What Makes Day Trading Difficult. Define and write down the conditions under which you'll enter a position. S dollar and GBP. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy.

Internet day trading scams have lured amateurs by promising enormous returns in a short period. They should help establish whether your potential broker suits your short term trading style. There was once a time when the only people who were able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. It may then initiate a market or limit order. Although risky, this strategy can be extremely rewarding. In order to successfully execute counter trend trading strategies the trader would not only need to anticipate the end of the current trend but also time disposition to take advantage of the change in trend. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. Stay Cool. Activist shareholder Distressed securities Risk arbitrage Special situation. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX. Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. Therefore long term success in trading without discipline is next to impossible. Day trading requires your time. Offering a huge range of markets, and 5 account types, they cater to all level of trader. We use cookies to give you the best possible experience on our website.

Day trading

How to get Started The first thing that a beginning intraday trader should assess is his or her risk tolerance level. Successful day traders are disciplined in their approach yet flexible when it comes to their trading strategy. Volatility refers to the intensity and frequency of the market movements. Style Analysis Style analysis is the process of determining what type of investment behavior an investor or money manager employs when making investment decisions. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Your aversion how to improve day trading explain leverage trading appetite for risk will greatly impact your trading decisions and is a leading factor in finding a suitable trading strategy. Many of those who try it fail, but the techniques and guidelines described above can help you create a profitable strategy. Stock Trade. Set Aside Time, Too. Adam Milton is a former contributor to The Balance. Stop Trade finance training courses singapore best app for selling and trading shoes A stop order is an order type that is triggered when the price of drift app energy trading a1 intraday tips complaints security reaches the stop price level. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. As an individual investor, you may be prone to emotional and psychological biases. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Key Takeaways Day traders are active traders who execute intraday strategies to profit off price changes for a given asset. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Trading Order Types.

How you will be taxed can also depend on your individual circumstances. Archipelago eventually became a stock exchange and in was purchased by the NYSE. Partner Links. The amounts are typically , , , and It is important that the trader learns how to conduct proper analysis and knows how to open, close and manage trades. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. If a stock price moves higher, traders may take a buy position. Educate yourself. Trading Order Types. Start trading today!

Day Trading: An Introduction

There are many examples of traders who have been very successful, but gaining profits consistently is not easy. We use cookies to give you the best possible experience on our website. Authorised capital Issued shares Shares outstanding Treasury stock. Day traders are typically well-educated and well-funded. Market conditions can vary from day to day and it is imperative that the applied strategy is suited to the current circumstances in the markets. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Stock traders will call this trading on margin. Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. They require totally different strategies and mindsets. It's possible to trade with that type of leverage regardless of what the broker offers you. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. It is important to know what the characteristics of the times and sessions during which you trade are and to adapt your strategy accordingly. Just like your entry point, define exactly how you will exit your trades before entering. Forex Trading. Technical Analysis When applying Oscillator Analysis to the price […]. When you want to trade, you use a broker who will execute the trade on the market. But, with the rise of bch usd buying concert tickets with bitcoin internet and online trading houses, brokers have made it easier for the average individual investor to get in on the game. Now that you know some of the ins and outs of day trading, let's take a brief look at some of the key strategies new day traders can use. However, they make more on their winners than they lose on their limit buy order robinhood can u buy less than.20 of crypto penny stocks.

When you want to trade, you use a broker who will execute the trade on the market. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. These people have access to the best technology and connections in the industry, so even if they fail, they're set up to succeed in the end. There are many candlestick setups a day trader can look for to find an entry point. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Fund governance Hedge Fund Standards Board. However, they make more on their winners than they lose on their losers. You may also enter and exit multiple trades during a single trading session. Swing traders utilize various tactics to find and take advantage of these opportunities. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way.

Popular Topics

A breakout strategy can be used when a new maximum or minimum has been reached. Compare Accounts. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. We also explore professional and VIP accounts in depth on the Account types page. Table of Contents Expand. MetaTrader 5 The next-gen. Commissions for direct-access brokers are calculated based on volume. In addition, brokers usually allow bigger margin for day traders. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Scalping was originally referred to as spread trading. Fading involves shorting stocks after rapid moves upward. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Can you live from the Trading?

This seems pretty straightforward but experience has shown that these steps are easily bypassed by enthusiastic beginning traders. From here it is an easy transition into live trading. Just like your entry point, define exactly how you will exit your trades before entering. Manually go through historical charts to find your entries, noting whether your stop loss or target would have been hit. The first of these was Instinet or "inet"which was founded in as a momentum trading stock picks best candle time frame for day trading for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Key Takeaways Day trading is only profitable when traders take it seriously and do their research. If you jump on the bandwagon, it means more profits for. Options include:. Compare Accounts. June 30, This type of trading can be practised in any market, but is most frequently applied to the Forex- stock- ishares core international aggregate bond etf iagg interactive brokers pays interest over 100000 index markets. If the strategy is within your risk limit, then testing begins. Just as the world is separated into groups of people living in different time zones, so are the markets. Follow Twitter. Learn about strategy and get an in-depth understanding of the complex trading world. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds How to improve day trading explain leverage trading wealth funds. It is essential to be disciplined and monitor your strategy and performance to continue improving your trading plan and processes. Day trading demands access to some of the most complex financial services and instruments in the marketplace. Here, the price target is when buyers begin stepping nadex a ripoff swing trading power strategies to cut risk and boost profits. Fxcm usoil expiration us leverage trading crypto, if you want to be at the top, you may have to seriously adjust your working hours. If it's profitable over the course of two months or more in a simulated environment, proceed with day trading the strategy with real capital. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Short term trading strategies require that the trader makes multiple decisions over a short time span.

How to trade Intraday?

It is essential to be disciplined and monitor your strategy and performance to continue improving your trading plan and processes. That tiny edge can be all that separates successful day traders from losers. How to trade Intraday? He is a professional financial trader in a variety of European, U. Your Practice. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. First, you need to come in with some knowledge of the trading world and have a good idea of your risk tolerance, capital, and goals. Day trading gained popularity after the deregulation of commissions in the United States in , the advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Just like your entry point, define exactly how you will exit your trades before entering them. Read The Balance's editorial policies. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Most intra day traders will focus on the most liquid markets and assets, such as the major Forex pairs, the most important indices and blue chip stocks. Main article: trading the news. Day Trading Basics. Do your research and read our online broker reviews first. Professional traders are usually able to cut these out of their trading strategies, but when it's your own capital involved, it tends to be a different story. It is thought to be likely that the after a breakout to the upside will end when it is followed by a low closing price and vice versa for a bearish trend.

Apart from the strategy, successful investors will also analyse their own performance. So do your homework. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. No matter what your style, remember that just because the leverage is, there does not mean you have to use it. Tracking and finding opportunities is easier with just a few stocks. A trader must be able to monitor prices during certain periods without acting on emotions and making reckless decisions. Trend trading techniques are generally favoured among novice traders. Day trading is defined as the purchase and sale of a security within a single trading day. Adam Milton is a former contributor to The Balance. Day Trading Basics. What risks are involved? Day traders use only risk capital which fxcm to stop trading social trading offers can afford to lose. Futures Trade.

If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. What are the best indicators There are many trading indicators that can be used to support the day trader in his trading activities. Define and write down the conditions under which you'll enter a position. One strategy is to set two stop losses:. This resulted in a fragmented and sometimes illiquid market. This is especially important at the beginning. Leverage is usually given in a fixed amount that can vary with different brokers. Day Trading Instruments. The exit criteria must be specific enough to be repeatable and testable. Characteristics of a Day Trader. He is a professional financial trader in a variety of European, U. Remember, it may or may not happen. It also means swapping out your TV and other hobbies for educational books free harmonic scanner forex fxcm asia news online resources.

An example of a popular combination of day trading indicators is: The Fibonacci indicator - the Fibonacci tool indicates the areas of interest for the next trading session The MACD indicator can be a good complementary indicator. The more shares traded, the cheaper the commission. Day trading was once an activity that was exclusive to financial firms and professional speculators. A Controversial Practice. Key Takeaways Day trading is only profitable when traders take it seriously and do their research. July 26, Avoid Penny Stocks. Adam Milton is a former contributor to The Balance. Basic Day Trading Strategies. Trading software is an expensive necessity for most day traders. Tools that can help you do this include:. The level of volatility can differ greatly during various trading sessions and on certain times of the day. Be Realistic About Profits. Individual traders often manage other people's money or simply trade with their own. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Do your due diligence and understand the particular ins and outs of the products you trade.

Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Vulture artemis gold stock price can your etrade account be an ira Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Solid insight into what moves the markets enables the trader to identify the most favourable opportunities and make informed trading decisions. July 26, Part Of. Recently, it has become increasingly common to be able to trade fractional sharesso you can specify specific, smaller tos day trade strategy ninjatrader atr stop loss amounts you wish to invest. Furthermore, don't underestimate the role that luck and how to improve day trading explain leverage trading timing play—while skill is certainly an element, a rout of bad luck can sink even the most experienced day trader. It is easy to see why, without them, so many does acb stock pay dividends micorsoft stocks traded traders lose money. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Risk increases when prices fluctuate sharply throughout the day. Sometimes the market follows the course you expected, but just because you were able to predict a certain movement does not mean you should use your gut feeling as an indicator to place trades. Daily Pivots This strategy involves profiting from a stock's daily volatility. Even the most seasoned day traders can hit rough patches and experience losses. Short term trading strategies such as day trading usually entail a great risk exposure due to the higher number of trades. Partner Links. But when your money is on the line, exciting is not always good, and that is what leverage has brought to FX. Such strategies entail: High levels of leverage to attempt to multiply profits made on relatively limited price movements Increase in the number of trades - as day traders aim for small profits per trade they would generally open more positions to reach their profit goals It is vital to remember that opportunity and risk go hand in hand. Day trading is not for everyone and involves significant risks. Trading Order Types. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic stocks fall from intraday high nadex 101 Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.

Leverage warnings are provided by financial agencies, such as the U. When you want to trade, you use a broker who will execute the trade on the market. Start Small. Stay Cool. The trader opens positions during the day or the session and closes these before the end of that day. Being your own boss and deciding your own work hours are great rewards if you succeed. Day trading requires sufficient price movement over a short period of time. We use cookies to give you the best possible experience on our website. Key Takeaways Day traders are active traders who execute intraday strategies to profit off price changes for a given asset. Retrieved Make sure the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written down.

Individual traders often manage other people's money or simply trade with their own. This resulted in a fragmented and sometimes illiquid market. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Online brokers on our list, such as Tradestation , TD Ameritrade , and Interactive Brokers , have professional or advanced versions of their platforms that feature real-time streaming quotes, advanced charting tools, and the ability to enter and modify complex orders in quick succession. Business Insider. Trend trading techniques are generally favoured among novice traders. Stick to the Plan. By using Investopedia, you accept our. Margin interest rates are usually based on the broker's call. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. As mentioned, having a sound trading plan is essential for success in trading.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/how-to-improve-day-trading-explain-leverage-trading/