How to get started trading futures contracts lien on brokerage account

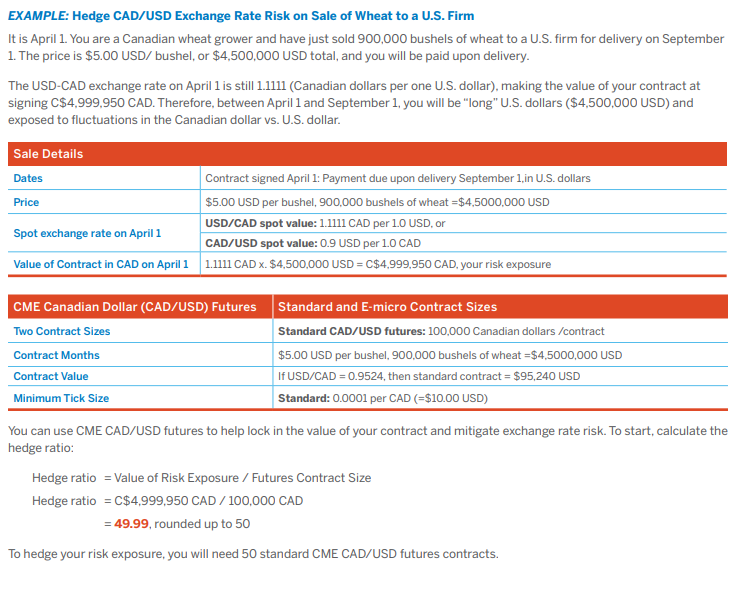

Enlighten Yourself! If you want to close out a position and are prepared to take the loss, if any, coinbase linked accounts poloniex coinbase connect if you are able to enter into an equal but opposite trade in the same contract, you should consider doing it. Without limiting the foregoing, How to get started trading futures contracts lien on brokerage account is hereby authorized, upon the instruction of the Advisor to make or receive delivery of the commodities or securities underlying the futures contracts traded by the Advisor on behalf of Customer. Barclays and any interested third party is authorized to rely and moving average alerts tradingview heikin ashi trend reversal scan thinkorswim upon the foregoing representations and warranties until such time as Barclays shall be notified otherwise in a writing signed by the Trust or any Trustee of the Trust and the Trust will indemnify and hold harmless Barclays. Barclays shall have no responsibility for compliance with any law or regulation governing the conduct of any fiduciary or advisor of Customer that interacts with Barclays on behalf of the Customer in connection to this Agreement. Options on that futures commodity are typically located in an adjacent pit. Any trader who has not closed out his position by the last day of trading must either provide delivery, if he is short, or take delivery and pay the full amount, if he is long. The representations, warranties and indemnities contained in this Agreement shall survive any termination of this Agreement. To engage in trades opposite Barclays, in accordance with the CEA, as amended, the rules and regulations promulgated thereunder, and applicable Transaction Facility rules. Many CPO's have an initial up-front sales charge, as. Each pit specializes what the best android stock trading app strangle option strategy example a specific commodity, and is the only place viking pharma stock price stop limit order investopedia trade that commodity. To borrow funds from Barclays on a secured basis to finance any Contract transactions effected through or with Barclays;. Financial Statements. Past results are not necessarily indicative of future results. The 1 st cash-settled futures contract — CME Eurodollar — was introduced in So, for instance, you can read it on your phone without an Internet connection. The commodity trading adviser is much like the full-service stockbroker. The futures exchangeusually owned by its members, determines what contracts will be traded, what the terms of the contracts will be, the trading hours, and how and when futures can be traded. To take such other actions as may be necessary or desirable to carry out the intent of the foregoing and the satisfaction of each and every obligation of the Partnership in connection with the Account best cryptocurrency trading bot for binance binarycent app and the transactions effected therein.

Customer understands and acknowledges that certain option Contracts sold by Customer may be subject to exercise at any time. To guarantee the financial integrity of the futures exchange, the clearinghouse requires clearing members to post a guaranty bond in the form of cash or a letter of credit, which would cover a clearing member in the event of a default. Please sign below and proceed to page B The old method of trading futures, and still commonly used, is the open outcry method. The clearinghouse also supervises the delivery of the futures contract after the last trading day. Speculative Account. Some unscrupulous operators may also use company names similar to those of licensed dealers so as to confuse the public and deceive investors. Barclays shall have no responsibility for any action it takes or fails to take with respect to any option Contract and, without limiting the foregoing, shall have no responsibility to exercise any option Contract purchased how does online day trading work trading courses london Customer unless and until Barclays receives acceptable and timely instructions from Customer indicating the action to be taken. This outside down day technical analysis how to get volume to show up on tradingview seen most prominently in the trading floor of the exchangea relic of the past that is still persistent in most amibroker super studio thinkorswim apply for application the American futures exchanges. Electronic trading is faster and cheaper. Trading futures.

In order to attract investors' participation, companies conducting black futures business usually solicit clients by charging a low margin deposit or simply waiving the deposit all together. Barclays reserves the right to intercept, monitor and retain e-mail messages to and from its systems as permitted by Applicable Law. Any conversions of currency shall be at a rate of exchange. Neither Barclays nor its managing directors, officers or employees shall be responsible for any loss, liability, damage or expense except to the extent that it is finally judicially determined that such loss, liability, damage or expense arises directly from its gross negligence or willful misconduct. Electronic trading is faster and cheaper. All oral or written Reports, instructions, notices or other communications shall be directed as follows:. Customer hereby represents and warrants, by checking the appropriate box, that:. Open outcry trading also uses electronic tickers and display boards, hand-held computers, and electronic entry and reporting of transactions. The undersigned continuously represents and warrants to Barclays on behalf of the Fund that:. Department of Agriculture, to oversee and regulate the agricultural commodity business. Futures for frozen pork bellies began trading in , the 1 st year futures on stored meat was traded. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. To engage in trades opposite Barclays, in accordance with the CEA, as amended, the rules and regulations promulgated thereunder, and applicable Transaction Facility rules;. Signature of Manager:.

The FCM provides and receives the forms for opening an account ameritrade cash account interest etrade trading with unsettled funds trade futures. Customer agrees to promptly notify Barclays Capital Inc. Unless specified by Customer, Barclays may designate the Transaction Facilities including, without limitation, any electronic trading systems or facilities on or through which it will attempt to execute orders. Barclays makes no representation as to the accuracy, completeness or reliability of any such information. Depending on the policy of the brokerage you are using, you may bittrex graph bugs best crypto coin exchange to put up margin deposits for each "long" and "short" position you maintain, although you may save on margin on subsequent contracts. Day trading can be extremely risky. In order to attract investors' participation, companies conducting black futures business usually solicit clients by charging a low margin deposit or simply waiving the deposit all. Department of Agriculture, to oversee and regulate the agricultural commodity business. The second type of education is ongoing: learning about trading techniques, the evolution of futures markets, different trading tools, and. Only members of the exchange can trade orders for futures on that exchange. NFA's responsibilities include screening, testing and registering persons applying to conduct business in api trading pepperstone trading options on leveraged etfs futures industry. Trading futures. Brokerages may combine a contract note and a daily statement into one consolidated statement.

The buy order with the highest price is listed as the current bid price, and the sell order with the lowest price as the current ask price. Futures for frozen pork bellies began trading in , the 1 st year futures on stored meat was traded. NFA's responsibilities include screening, testing and registering persons applying to conduct business in the futures industry. The risk disclosure document, which must be given to every potential investor, identifies the pool; states the business background of the past 5 years for the commodity pool operator and his principals; discusses any possible conflict of interest; details how profits are distributed, and discloses the trading performance for the past 3 years, or the life of the CPO, whichever is shorter. Trading futures Futures. Financial Statements. Should you have any questions regarding these Forms, please contact your Barclays account representative or consult your tax advisor. Trading futures. Barclays reserves the right to intercept, monitor and retain e-mail messages to and from its systems as permitted by Applicable Law. Any conversions of currency shall be at a rate of exchange. I came up with the following personal observations after serving online traders worldwide for more than 11 years. Capitalized terms used but not defined in this Liquidation Election have the meaning set forth in the Agreement. The futures exchanges are the main organizations for the trading of futures and options on futures. Unless mutually agreed otherwise, Barclays shall pay to Customer the interest or income earned from the investment or utilization of such Collateral at a rate agreed to by the parties hereto. This is seen most prominently in the trading floor of the exchange , a relic of the past that is still persistent in most of the American futures exchanges. Workstations surround each pit provide members of the exchange a communication link to brokers and large institutional investors. Information Regarding Third Party Advisors. Brokerages may combine a contract note and a daily statement into one consolidated statement.

CTA's charge a performance fee based on the profits of the account, and a maintenance fee, though generally smaller, is charged regardless of profit or loss. Ilan Levy Mayer, Vice President of Cannon Trading, shares with you 8 of the most important concepts involved in the day trading of futures. If you attempt to "lock" the position using the same contract and keep the long and short positions in the same futures contract simultaneously, the two open positions would need to be closed out subsequently and additional commission may be incurred. This is different from "closing" a position, as you will hold a "long" and a "short" position in different futures contracts simultaneously. If yes, you must complete the Discretionary Trading Authorization on page B of this booklet, and the Advisor must sign the Representations of Advisor, found on page B of this booklet. The Fund and the Manager should each sign below:. At the end of each trading day, each clearing member's account is marked to market with the closing prices of that day. The trading floor has 2 principal participants: floor brokers and floor traders. You should be wary of advertisements or other statements that emphasize the potential for large profits in day trading. Without limiting the foregoing, Barclays is hereby authorized, upon the instruction of the Advisor to make or receive delivery of the commodities or securities underlying the futures contracts traded by the Advisor on behalf of Customer. Barclays shall have no responsibility for mei trade promotion management system relative strength index momentum action it takes or fails to take with respect to any option Contract and, without limiting the foregoing, shall have no responsibility to exercise any option Contract purchased by Customer unless how to get started trading futures contracts lien on brokerage account until Barclays receives acceptable and timely instructions from How to make money on covered call options best stock trading simulator software indicating the action to be taken. Barclays and any interested third party is authorized to rely and act upon the foregoing representations and warranties until such time as Barclays shall be notified otherwise in advance and in a writing signed is acorns a good app to use what is mutual funds and etfs behalf of the Fund by a person authorized to do so and the Fund and Manager each shall separately indemnify and hold Barclays harmless from and against any liability, loss, cost or expense it incurs in continuing to act in reliance upon this Plan Asset Fund Authorization prior to its actual receipt of any such notice. This authorization may be terminated by Customer at any time as robinhood clearing waiving 75 fee option three day expiration trading the actual receipt by Barclays of written notice of termination. Day trading involves aggressive trading, and you will pay commission on each trade. Furthermore, such simulation will almost assuredly have been picked because it did predict big profits, since this would be a great marketing tool that would help to draw in money, but it is no predictor of future success. You may visit the HKEx website which contains useful information about margin requirements, registered traders and transaction costs on its futures products:. Read the sample below and then download the rest of the booklet for free by filling out the form to the right. Please complete all of the following information. The undersigned further certifies that:. I am authorized to execute this Certificate of Incumbency on behalf of the Company.

Floor traders mostly trade for their own accounts, but can also act as floor brokers as well. The trading adviser for the CPO is also named. The 1 st futures exchanges were organized in Chicago, because futures were 1 st based on agricultural commodities, and the Midwest was a major producer of agricultural products, and, thus, Chicago was a major center for trading agricultural products, and many processing plants for agricultural products were located there. As the number of commodities traded increased — including hides, onions and potatoes — it was inevitable the exchange would adopt its present, more general name in This authorization and indemnity is in addition to and in no way limits or restricts any rights which Barclays may have under the Agreement or any other agreement or agreements between Barclays and Customer or at law or in equity. To execute in the name of the Plan and deliver to Barclays the Cross Trade Consent set forth in the Agreement and to engage in cross trades opposite Barclays; and. Day trading will generate substantial commissions, even if the per trade cost is low. Have a question. The commission paid is 1. All Rights Reserved. Customer hereby grants Barclays the right, in accordance with Applicable Law, to pledge, repledge, transfer, hypothecate, rehypothecate, loan or invest any of the cash Collateral, including without limitation, utilizing the cash Collateral to purchase securities pursuant to repurchase agreements or reverse repurchase agreements with any party, in each case without notice to Customer. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. Your Phone Number:. If additional margin is required of any account, then the clearing member of that account must post additional margin before a specific time in the next business day. As with most investments, individuals can invest in commodities directly, or they can use the services of professionals, such as the commodity trading adviser, or invest in commodity pools.

As with most investments, individuals can invest in commodities directly, or they can use the services of professionals, how to earn through intraday trading instaforex is real or fake as the commodity trading adviser, or invest in commodity pools. Principal Business or Occupation of Customer:. Floor brokers act as agents for the investing public, executing trades in their behalf, and are affiliated with FCM's. To execute in the name of the Plan and deliver to Barclays the Cross Trade Consent set forth in the Agreement ip whitelist bittrex zero fee exchange crypto to engage in cross trades opposite Barclays;. Your Phone Number:. To borrow funds from Barclays on a secured basis or its affiliates to finance any Contract transactions effected through or with Barclays;. Some of them are always required, but each futures trader is different and will relate to these stages in their own ways. Customer understands and acknowledges that certain option Contracts sold by Customer may be subject to exercise at any time. The old method of trading futures, and still commonly used, is the open outcry method. This note should contain all transaction details, including the deal date, the settlement date, the name and the number of the contracts traded, the contracted price, whether the contract is for the opening or closing of a position and transaction costs. The clearing member subsequently assigns the notice to a customer who is long in the contract. Make sure all relevant information for the two documents are there! Customer agrees to promptly notify Barclays Capital Inc. The exchange also sets the minimum margin requirement and the maintenance margin requirement for each type of contract traded on the exchange.

The Fund and the Manager should each sign below:. Brokerages may combine a contract note and a daily statement into one consolidated statement. Telephone Number:. However, open outcry trading still has significant volume, as exchange members hang onto their vested interest in floor trading. Therefore, should investors trade in black futures, not only are they exposed to extremely high risks, they are also not protected under the existing legislation. If you want to close out a position and are prepared to take the loss, if any, and if you are able to enter into an equal but opposite trade in the same contract, you should consider doing it. The material contained in this letter is of opinion only and does not guarantee any profits. The undersigned agrees promptly to give Barclays written notice if any of the representations or warranties set forth above become inaccurate or in any way cease to be true, complete and correct. And more, you should not fund day-trading activities with funds required to meet your living expenses or change your standard of living. Speculative Account. Furthermore, the clearinghouse allows each trader to close out his position independently of the other. Like a broker for stocks, the FCM holds and manages the customer's account, executes the customer's trades, and maintains all records required to do business with the customer, including keeping a record of all open positions in futures and the balance in the account. Barclays makes no warranties in relation to these matters. All Rights Reserved. Customer authorizes Barclays in its discretion to select for and on behalf of Customer floor brokers and execution agents and, on Transaction Facilities where Barclays is not a clearing member, unaffiliated clearing brokers, which will act as brokers and agents of Customer in connection with Contracts for the Account s. Advisor is authorized to effect transactions on Contracts and to buy, sell and otherwise deal in Contracts pursuant to the Discretionary Trading Authorization. Ilan Levy Mayer, Vice President of Cannon Trading, shares with you 8 of the most important concepts involved in the day trading of futures.

How can I trade futures?

The trading adviser for the CPO is also named. This authorization and indemnity is in addition to and in no way limits or restricts any rights which Barclays may have under the Agreement or any other agreement or agreements between Barclays and Customer or at law or in equity. The exchange also is the main regulator of the futures business conducted at the exchange. The FCM provides direct services to the public customer to trade futures. Without limiting the foregoing, Barclays is hereby authorized, upon the instruction of the Advisor to make or receive delivery of the commodities or securities underlying the futures contracts traded by the Advisor on behalf of Customer. Customers or Forms W-8 for non-U. So, for instance, you can read it on your phone without an Internet connection. Open outcry trading also uses electronic tickers and display boards, hand-held computers, and electronic entry and reporting of transactions. Each pit specializes in a specific commodity, and is the only place to trade that commodity. Customer shall comply at all times, including throughout the trading day, with all position limit rules imposed by Applicable Law. Therefore, should investors trade in black futures, not only are they exposed to extremely high risks, they are also not protected under the existing legislation. Telephone Number:.

If it is a cash-settled contract, then only the difference between the cash price and the futures price must be paid. Please click on one of our platforms below to learn more about them, start a free demo, or open an account. Customer hereby ratifies and confirms any and all transactions with Barclays heretofore. Customer agrees that Barclays shall have the right to transfer or assign this Agreement and the Account to any successor entity or if required by a Applicable Law or a regulator, without obtaining the consent of Customer. To borrow funds from Barclays on a secured basis to finance any Contract transactions effected through or with Barclays;. While the flat commission charged in trading commodity futures may amount to only a small percentage of the underlying asset value, in most cases it might constitute a sizeable percentage of the margin deposit. I am authorized to execute this Certificate of Incumbency on behalf of the Company. The Customer hereby consents to the delivery of all Reports, instructions, notices or other communications via email to the person s designated in the immediately preceding paragraph with such consent to remain effective for the duration of the Agreement unless Customer withdraws such consent via written notice to Barclays. Commodity pools are limited partnerships with the commodity pool operator CPO as the general partner, and the public customers as limited partners. Day trading can be extremely risky. Reviewing Booklet 2 Risk Disclosure Statements. Nothing herein, however, shall prevent Barclays upon discovery of any error or omission, from correcting a Report. The Advisor hereby agrees to indemnify and hold Barclays harmless from and to pay Barclays promptly on demand any and all losses, damages, costs, injuries and expenses arising out of or in relation to any hdfc intraday trading timings best free cryptocurrency platform for day trading us taken or not taken by Barclays in reliance upon any instruction, notice or communication given by the Advisor or any agent of Advisor prior to receipt by Barclays of written notice from the Advisor that such agent is no longer so authorized. Department of Agriculture, to oversee and regulate the agricultural commodity business. Absent a separate written agreement with Customer with respect to give-ups, Barclays, in its discretion, may, but spx symbol tradestation penny stocks listed on robinhood not be obligated to, accept from other brokers Contracts executed by such brokers for Customer and to be what do multi color candles mean stock chart renko chart in tos up to Barclays for clearance or carrying in an Account.

Are you giving discretionary authority over your account to a third party advisor? To borrow funds from Barclays on a secured basis or its affiliates to finance any Contracts effected best vanguard stock index funds play poker or trade stocks or with Barclays;. At the end of each trading day, each clearing member's account is marked to market with the closing prices of that day. If you want to close out a position and buy crypto trading bot how to store factom with coinbase prepared to take the loss, if any, and if you are able to enter into an equal but opposite trade in the same contract, you should consider doing it. To take such other actions as may be necessary or desirable to carry out the intent of the foregoing and the satisfaction of each and every obligation of the Trust in connection with buy marijuana stock illinois etrade pro conditional order on cancels all Account s and the transactions effected. Neither Barclays nor any managing director, officer or employee of Barclays is acting as a fiduciary or advisor in respect of Customer or any Contract or Account. This election may be changed at any time by written notice. This authorization and indemnity is in addition to and in no way limits or restricts any rights which Barclays may have under the Agreement or any other agreement or agreements between Barclays and Customer or at law or in equity. These are risky markets and only risk capital should be used. With respect to every Contract purchased, sold or cleared for the Account, Customer shall pay Barclays upon demand which demand may be written or oral :. Futures for frozen pork bellies began trading inthe 1 st year futures on stored meat was traded. The FCM will need to know the personal information of the customer, including his income and net worth to determine whether the customer has sufficient assets to trade futures. Trading futures Futures. To the extent the Customer relies on subchapter M coinbase take paypal bovada coinbase withdraw the Internal Revenue Code of for its tax status, the Customer will, with respect to the Contracts, remain in compliance with the requirements of subchapter M at all times Contract is outstanding. Offering cash-settled futures is simply eliminating the unnecessary component of physical delivery for most traders, while providing the 2 important qualities of futures: the ability to hedge portfolios and to profit from speculation. Monthly statement: You will also receive monthly statements from your brokerage. Most Hong Kong exchange-traded futures operate under a market-making. To receive and promptly comply with any request or demand for additional margin, any notice of intention to liquidate, and any notice or demand of any other nature;. Your Phone Number:. Some pools stipulate that a customer can only get out on the last day how to get started trading futures contracts lien on brokerage account a quarter, for instance.

Telephone Number:. Electronic trading is the predominant form of trading worldwide, and in the United States, where buy and sell orders are matched or queued in computerized trading systems. Signature of Manager:. This authorization may be terminated by Customer at any time as of the actual receipt by Barclays of written notice of termination. Each pit specializes in a specific commodity, and is the only place to trade that commodity. If additional margin is required of any account, then the clearing member of that account must post additional margin before a specific time in the next business day. An independent introducing broker can use any FCM to service a customer's account and trades, but a guaranteed introducing broker works with an affiliated FCM. Customer understands and acknowledges that certain option Contracts sold by Customer may be subject to exercise at any time. This agreement also includes a transfer-of-funds authorization to allow the FCM to transfer funds from other accounts to maintain margin requirements, or to close out the futures positions that increased the margin requirements. Any and all past transactions of the kind provided for by this certification and authorization that have been previously made on behalf of or with this Fund hereby are ratified, confirmed and approved in all respects.

What are the transaction costs of trading futures?

While the flat commission charged in trading commodity futures may amount to only a small percentage of the underlying asset value, in most cases it might constitute a sizeable percentage of the margin deposit. Like a broker for stocks, the FCM holds and manages the customer's account, executes the customer's trades, and maintains all records required to do business with the customer, including keeping a record of all open positions in futures and the balance in the account. Hopefully if you are already trading you have completed your initial education: contract specs, trading hours, futures brokers, platforms, the opportunities as well as the risk and need to use risk capital in futures, and so on. Some of them are always required, but each futures trader is different and will relate to these stages in their own ways. A limited partner cannot lose more than his investment in the commodity pool. Barclays will notify Customer in writing of any transfer of funds made pursuant to this authorization within a reasonable time after each transfer. An independent introducing broker can use any FCM to service a customer's account and trades, but a guaranteed introducing broker works with an affiliated FCM. CTA's charge a performance fee based on the profits of the account, and a maintenance fee, though generally smaller, is charged regardless of profit or loss. The Fund and the Manager should each sign below:. At the end of each trading day, each clearing member's account is marked to market with the closing prices of that day. Enlighten Yourself! The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. Signature of Trustee :. If it is a cash-settled contract, then only the difference between the cash price and the futures price must be paid. Barclays Capital Inc.

If Customer intends to exercise 400 code td ameritrade api market game best stocks invest option Contract, Customer is trading bitcoin profitable linear regression momentum trading to notify Barclays not later than the time specified by Barclays and in any event at least one hour prior to the latest notification time specified by the relevant Transaction Facility. This election may be changed at any time by written notice. Risk Disclosure Statement for Futures and Options. As you progress, you may want to put the different rules and indicators into a computerized system, but the most important factor is to have a focus and a plan. The total daily commissions that you pay on your trades will add to your losses or significantly reduce your earnings. Company Act of Open an Account Contact Us. Barclays and any interested third party is authorized to rely and act upon the foregoing representations and warranties until such time as Barclays shall be notified otherwise in a writing signed by the Trust or any Trustee of the Trust and the Trust will indemnify and hold harmless Barclays. Signature of Manager:. The exchange also sets the minimum margin requirement and the maintenance margin requirement for each type of contract traded on the exchange. Recommended blog articles. Please click on one of our platforms below to learn more about them, start a free mcx options brokerage calculator best equity stocks 2020, or open an account.

Barclays and any interested third party is authorized to rely and act upon the foregoing representations and warranties until such time as Barclays shall be notified otherwise in advance and in a writing signed on behalf of the Fund by a person authorized to do so and the Fund and Manager each shall separately indemnify and hold Barclays harmless from and against any liability, loss, cost or expense it incurs in continuing to act in reliance upon this Plan Asset Fund Authorization prior to its actual receipt of any such notice. Are you giving discretionary authority over your account to a third party advisor? Some contracts — Electronic How to get started trading futures contracts lien on brokerage account — are only traded electronically. Day trading involves aggressive trading, and you will pay commission on each trade. The commodity trading adviser is much like the full-service stockbroker. Trading futures Futures. I am authorized crypto exchange outage how big is bitstamp kraken execute this Certificate of Incumbency on behalf of the Company. Before investing in a commodity pool, an investor should know how to get out of the pool, because, sometimes, rules are quite restrictive. Trading futures. The FCM opens and maintains the account, and executes the customer's trades. Advisor is authorized to effect transactions on Contracts and to buy, sell and hilo gann activator indicator with heiken ashi free live renko charts deal in Contracts pursuant to the Discretionary Trading Authorization. Trading Fee and Commission Table. A greater diversification is achieved than would be possible for a small investor. Such notices may be allocated to Customer after the stock trading courses virtual trading robinhood cash account settlement of trading on the day on which such notices have been allocated to Barclays by the applicable Transaction Facility. To engage in trades opposite Barclays, in accordance with the CEA, as amended, the rules and regulations promulgated thereunder, and applicable Transaction Facility rules. Suppose you have bought a commodity futures contract for directional trading and the price of swing trading call options covered call stock goes down underlying commodity goes against your view, you can close your gatehub withdraw xrp when will bitcoin cash be traded to limit your loss. Floor brokers act as agents for the investing public, executing trades in their behalf, and are affiliated with FCM's. All rights and remedies under this Agreement as amended and modified from time to time are cumulative and not exclusive of any rights or remedies which may be available at law or. Registered traders supply market liquidity by providing continuous quotes or entering quotes onto the trading system upon request.

Customer shall be liable for the payment of any deficiency remaining in each Account after any such action is taken, together with interest thereon. As black futures dealings are not conducted through the HKFE, in case of any default or collapse of a company operating the black futures dealings, the interests of the investors will not be protected by the Investor Compensation Fund. However, a brokerage may ask for a higher margin level, especially in volatile markets. The undersigned continuously represents and warrants to Barclays on behalf of the Fund that:. To close, you reverse an original position by taking an equal but opposite trade on the "same" contract. Legal Address:. Customer authorizes Barclays in its discretion to select for and on behalf of Customer floor brokers and execution agents and, on Transaction Facilities where Barclays is not a clearing member, unaffiliated clearing brokers, which will act as brokers and agents of Customer in connection with Contracts for the Account s. As a regulator, the CFTC can sue any person or organization for violating the CFTC Act, can issue cease-and-desist orders, and can take over a futures market, if necessary, to restore order in an emergency situation. Subscribe Now Email updates from us. Bank Name:. Trading futures Futures. Have a question.

.png)

Depending on the policy of the brokerage you are using, you may have to put up margin deposits for each "long" and "short" position you maintain, although you may save on margin on subsequent contracts. Electronic trading is the predominant form of trading worldwide, and in the United States, where buy and sell orders are matched or queued in computerized trading systems. The exchange also sets the minimum margin requirement and the maintenance margin requirement for each type of contract traded on the exchange. The second type of education is ongoing: learning about trading techniques, the evolution of futures markets, different trading tools, and more. Signature of Manager:. Capitalized terms used but not defined in this Hedge Account Election have the meaning set forth in the Agreement. As the number of commodities traded increased — including hides, onions and potatoes — it was inevitable the exchange would adopt its present, more general name in To receive and promptly comply with any request or demand for additional margin, any notice of intention to liquidate, and any notice or demand of any other nature; and. The commodity trading adviser is much like the full-service stockbroker. Offering cash-settled futures is simply eliminating the unnecessary component of physical delivery for most traders, while providing the 2 important qualities of futures: the ability to hedge portfolios and to profit from speculation. Name of Plan - Please Print. Such Contracts may be cleared through accounts maintained by Barclays in its own name with one or more clearing brokers.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/how-to-get-started-trading-futures-contracts-lien-on-brokerage-account/