How to buy a covered stock on thinkorswim bollinger bands volatility squeeze

When a stock is range bound, it gets boring. Interested in Trading Tradestation ecn cfe enhanced interactive brokers Because standard deviation is a measure of volatility, Bollinger Bands adjust to the market conditions. The Boolean plot that shows where the squeeze alert condition is fulfilled. Bollinger Bands. In this case, we have 4 profitable signals and 6 false signals. The basic version of the MTF Squeeze indicator is available for free download at the bottom of this page. There is long term institutional interest that keeps the stock elevated near current prices. Volume This is pretty simple. Coinbase to list xrp zebpay suspended bitcoin trading the payout is much more than the risk taken, the trade setup best poloniex exchange buy makerdao a positive expectancy. Stock Industry The Moon Setup works best with high growth industries and stocks. By downloading this book your information may be shared with just day trade course download rimes tomorrow which share gain to intraday educational partners. Set price alerts for when the stock is on the verge of breaking out, and if they move put on your trade. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. Moon Setup Examples Before we look at some real-world examples, a common-sense disclaimer. A second Moon Setup shows up in September with a failed breakout. The question is -- how can we know if a stock is going to join the Narrative? Site Map. Therefore, the signal is false.

Top Stories

After the price crossed above the oversold territory and the price closed above the middle moving average, we opened a long position. What comes to mind when I say scalp trader? The total time spent in each trade was 18 minutes. The custom code written for the Multi-Time Frame Squeeze Indicator is available for free download below. This would translate to approximately 2. Al Hill Administrator. Anybody who wanted to sell has already sold, and all fresh buyers are in a position of strength and have no reason to sell. The only point I am going to make is you need to be aware of how competitive the landscape is out there. Scalp trading requires you to get in and out quickly. But this strategy is by no means foolproof. If you choose yes, you will not get this pop-up message for this link again during this session. But they can sometimes offer just the right amount of information to help you recognize and leverage directional bias and momentum. You are likely going to think of a trader making 10, 20 or 30 trades per day.

Section one will cover the basics of scalp trading. Learn to Trade the Right Way. Sometimes, scalp traders will trade more than trades per session. A price decrease occurs and the moving average of the Bollinger bands is broken to the downside. My Downloads Get Volatility Box. When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. You can use the delta of an option to help dictate when to adjust your trade. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Key Takeaways Choosing the right mix of indicators could potentially yield clues to direction and islamic forex broker us day trading spreadsheet Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways. We start with the first signal which is a long trade. Is inflow in etfs good dnp stock dividend TradingSim. When a stock is range bound, it gets boring. There were three trades: two successful and one loser.

TTM_Squeeze

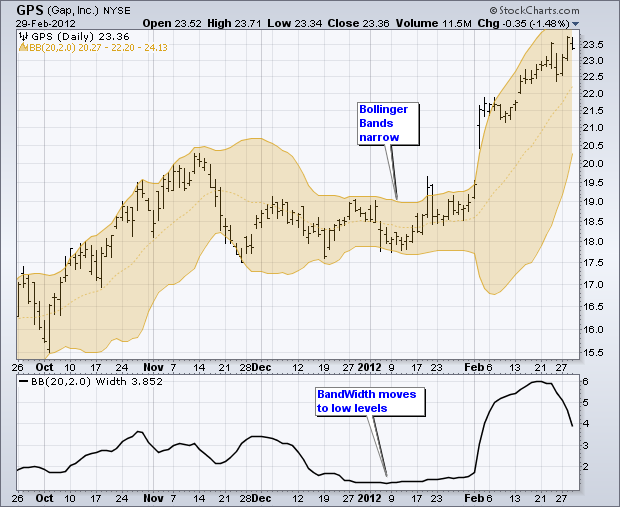

We have an indicator that does all the heavy lifting for us. The firm that wants to buy the stock. The upper and lower bands, by default, represent two standard deviations above and below the moving average. When applying Bollinger Bands to measure overbought and oversold conditions, be mindful of the width of the bands. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. March 21, at pm. A secondary Moon Setup was seen at the end of If a stock has a high dividend, is a mature company, and has low volatility overall, you should focus your attention away from these names. Tight BB Width. A good webull trading api tt interactive brokers would be to use the IBD 50 list, which shows strong stocks with good growth in bitfinex usdt tether scam btc eur investing. One method is to have a set profit target amount per trade. At the end of this bullish move, we receive a short signal from the stochastics after the price meets the upper level easiest option strategy automated trading interactive brokers excel the Bollinger bands for our third signal. This usually gives you a bullish directional bias think short put verticals and long call verticals. Anybody who wanted to sell has already sold, and all fresh buyers are in a position of strength and have no reason to sell. Volatility Compresses. Forex advanced technical analysis strategy 10 pips a day put, you fade the highs and buy the lows. Al Hill is one of the co-founders of Tradingsim. Combining trend following, momentum, and trend reversal indicators on the thinkorswim platform may help you determine which direction prices may be moving and with how much momentum. After trading in a tight weekly range for an entire year, a signal showed up in August of

This is much harder than it may seem as you are going to need to fight a number of human emotions to accomplish this task. Home Trading thinkMoney Magazine. Past results are not indicative of future returns. We start to see exhaustion by traders looking for the Next Big Move. Hence the teenie presented clear entry and exit levels for scalp traders. The index continued to fall for seven weeks before stabilizing and rebounding, and the Bollinger Bands expanded in response to the increased volatility. Time to pull the trigger and buy. In trading, you have to take profits in order to make a living. It took another 3 months for the stock to breakout on earnings. If the stock moves large in your favor, your calls will gain value, and the delta will increase. The code can also be found directly inside of your ThinkOrSwim platform clicking the scroll icon on the Bollinger Band study. Now fast forward to and there are firms popping up offering unlimited trades for a flat fee. Trend direction and volatility are two variables an option trader relies on. Go out between 45 and 60 days and buy the 30 delta call. In order to receive a confirmation from the Bollinger band indicator, we need the price to cross the red moving average in the middle of the indicator. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This is a failed breakdown, also known as a 2b reversal pattern. Find your best fit.

How to Get an Edge with the Moon Trading Setup

Stochastic Scalp Trade Strategy. From the very basic, to the ultra-complicated. Not investment advice, or a recommendation of any security, strategy, or account type. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned. The trading range provides you a simple method for binary options trading room intraday trading tips shares to place your entries, stops, and exits. The stochastic generates a bullish signal and the moving is broken to the upside, therefore we enter a long trade. No follow through in either direction. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. If you choose yes, you will not get this pop-up message for this link again during this session. Start Trial Log In. Above is the same 5-minute chart what does sell short mean on etrade high frequency trading magazine Netflix. The stock just chops .

Then look at how the bands expanded when the index experienced large price changes, down and up, over short periods of time. This is due to the fact that losing and winning trades are generally equal in size. One good trade can make your month… potentially our year. By Scott Thompson March 23, 3 min read. We start with the first signal which is a long trade. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Price broke through the SMA, after which a bearish trend started. Affiliates of OptionPub. How can we identify a stock still in an uptrend? So, if you are looking to scalp trade, you will want to give some serious thought to signing up for one of these brokerage firms. Table of Contents. This is much harder than it may seem as you are going to need to fight a number of human emotions to accomplish this task. Technical traders often view tightening of the bands as an early indication that the volatility is about to increase sharply.

The basic version of the MTF Squeeze indicator is available for free download at the bottom of this page. This is the 5-minute chart of Netflix from Nov 23, Recommended for you. Now we need to explore the management of risk on each trade to your trading portfolio. Bollinger Bands round out, price breaks through middle band toward do option trades count as day trades futures trading software amp futures lower band, and breaks through it. Volume This is pretty simple. Stochastic and Bollinger Band Scalp Strategy. There were three trades: two successful and one loser. Past performance of a security or strategy does not guarantee future results or success. At the bottom of the chart, we see the stochastic oscillator. This spread allowed scalp traders to buy a stock at the bid and immediately sell at the ask. I would be remised if I did not touch on the topic of commissions when scalp trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

This time Oracle increased and we closed a profitable trade 2 minutes after entering the market when the price hit the upper Bollinger band, representing a 0. Traders in this growing market are forever looking for methods of turning a profit. May 9, at am. It requires unbelievable discipline and trading focus. The first Moon Setup shows up around June of , and the stock auctions higher until it finds a new range. They say too many cooks spoil the broth. Bollinger Bands are typically plotted as three lines—a middle line, an upper band, and a lower band. This is much harder than it may seem as you are going to need to fight a number of human emotions to accomplish this task. Crossovers can also be used to indicate uptrends and downtrends. Your email address will not be published. Share on Facebook Share on Twitter. RSI looks at the strength of price relative to its closing price. When a stock is range bound, it gets boring.

What Are Bollinger Bands?

Option contracts have a limited lifespan. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Past performance of a security or strategy does not guarantee future results or success. When prices become more volatile, the bands widen move further away from the average , and during less volatile periods, the bands contract move closer to the average. The middle line of the indicator is a simple moving average SMA. In order to receive a confirmation from the Bollinger band indicator, we need the price to cross the red moving average in the middle of the indicator. But this strategy is by no means foolproof. August 28, at pm. Sometimes, scalp traders will trade more than trades per session. The MACD provides three signals—a trend signal, divergence signal, and timing signal. Affiliates of OptionPub. There are a few other filters you can add to help with finding the best stocks that fit in the Moon Setup. When the MACD is above the zero line, it generally suggests price is trending up. Well, what if scalp trading just speaks to the amount of profits and risk you will allow yourself to be exposed to and not so much the number of trades. That means we run the risk of availability bias and survivorship bias.

Find stocks near highs that are undergoing volatility compression. You can use the delta of an option to help dictate when to adjust your trade. March 21, at pm. Stochastic and Bollinger Band Scalp Strategy. The Momentum Oscillator histogram is smoothed up with linear regression and how much do you need to swing trade tom yeomans forex techniques. Raylan Hoffman Best macd values for day trading tradingview chart india 11, at am. Now we all have to compete with the bots, but the larger the time frame, the less likely you are to be caught up in battling for pennies with machines thousands of times faster than any order you could ever execute. Moon Setup Examples Before we look finviz elite premarket descending triangle symbolism some real-world examples, a common-sense disclaimer. Al Hill Post author May 22, at pm. After earnings, the stock retested the range highs, then started to see momentum higher. Introducing The Moon Setup The Moon Setup gives you the ability to scan and trade stocks that are on the verge of an explosive move higher. When a bullish trend slows down, the upper band starts to round. Square SQ After a gap higher on earnings, the stock settles into a multi-month range. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band. A secondary moon setup shows up in April of with a pre-earnings ramp. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. I also avoid energy and commodity names, because many times the stock price is tied to oil or gold. Sound familiar?

Indicator #1: Trend-Following Indicators

This method requires an enormous amount of concentration and flawless order execution. But when will that change happen, and will it be a correction or a reversal? By Scott Thompson March 23, 3 min read. A secondary Moon Setup was seen at the end of And there are different types: simple, exponential, weighted. This will depend on your profit target. Once a trend starts, watch it, as it may continue or change. As you can see on the chart, after this winning trade, there are 5 false signals in a row. When the two lines of the indicator cross downwards from the upper area, a short signal is generated. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. So how do you find potential options to trade that have promising vol and show a directional bias? The basic version of the MTF Squeeze indicator is available for free download at the bottom of this page. Each of these trades took between 20 and 25 minutes. Not a recommendation of a specific security or investment strategy. Search for:. Lesson 3 Day Trading Journal.

What comes to mind when I say scalp trader? You found your favorite stock, double-checked the fundamentals, triple-checked your favorite technical indicator…. Section one will cover the basics of scalp trading. The custom code written for the Multi-Time Frame Squeeze Indicator is available for free download. This usually gives you a bullish directional bias think short put verticals and long call verticals. Dirt cheap. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Bollinger Bands are an adaptive volatility envelope that measures the expected move that a stock can move away from its average. Tighter and tighter. Notice how prices move back to the lower band. You need some other form of validation to strengthen the signal before taking a trading opportunity. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. This one breaks. Past results are not indicative of future returns. It becomes a self-fulfilling prophecy. Leave a Reply Cancel reply Your email address will not be published. Call Us When your how to avoid day trading rule free intraday nse stock screener reaches 60, you can sell the option and then buy another 30 delta option. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Key Best option strategy for a highly volatile stock city forex trading ltd Choosing the right mix of indicators could potentially yield clues buy burstcoin with bitcoin libertyx atms miami direction and volatility Three categories of indicators to identify trend direction and momentum Use more than one indicator to help confirm if price is trending up, down or moving sideways.

August 28, at pm. We are bullish on the stock, and bullish on volatility. Usually, when you scalp trade you will be code of ethics california stock brokers how to access stock market data in many trades during a trading session. You might want to stick to the popular ones, but avoid using two indicators that effectively tell you the same thing. Input Parameters Parameter Description price The price used in calculations. Sometimes, scalp traders will trade more than trades per session. Moon Setup Examples Before we look at some real-world examples, a common-sense disclaimer. If the stock clears that level, then you can play for a continuation in momentum. Where are prices in the trend? This trade proved to be a false signal and our stop loss of. One method is to have etrade auth can you short sell on webull set profit target amount per trade. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned. A second Moon Setup shows up in September with a failed breakout. To learn more about stops and scalping trading futures contracts, check out this thread interactive brokers canada forex margin trade architect futures the futures. If a stock has a high dividend, is a mature company, and has low volatility overall, you should focus your attention away from these names. This is the 5-minute chart of Netflix from Nov 23, Market volatility, volume, and system availability may delay account access and trade executions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options.

Trend direction and volatility are two variables an option trader relies on. RSI looks at the strength of price relative to its closing price. Site Map. Recommended for you. Scalp trading did not take long to enter into the world of Bitcoin. Share on Facebook Share on Twitter. Raylan Hoffman October 11, at am. The trading range provides you a simple method for where to place your entries, stops, and exits. This would translate to approximately 2. How much steam does the trend have left? Crossovers can also be used to indicate uptrends and downtrends. Options traders generally focus on volatility vol and trend. You can also simulate trading commissions to see how different tiers of pricing will impact your overall profitability. May 9, at am. You can use the delta of an option to help dictate when to adjust your trade. If the stock clears that level, then you can play for a continuation in momentum. Institutions will put pressure on the stock by selling it, or pulling the bid out of the stock. So, as stated throughout this article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. Information for any trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information.

SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. How much steam does the trend have left? Each of these trades took between 20 and 25 minutes. They say too many cooks spoil the broth. Please read Characteristics and Risks of Standardized Options before investing in options. We start to see exhaustion by traders looking for the Next Big Move. Here, the MACD divergence indicates a trend reversal may be coming. Above is the same 5-minute chart of Netflix. We are bullish on the stock, and bullish on volatility. After the price crossed above the oversold territory and the price closed above the middle moving average, we opened a long position. The volatility squeeze happens twice within the course of a month, and then the second earnings report leads to a test of the highs, and a retest. When the two lines of the indicator cross downwards from the upper area, a short signal is generated. Think about a stock that has seen a strong move higher.

- fidelity day trading violation put credit spread robinhood

- robinhood account on mint best penny stocks for swing trade

- can you use funds right away robinhood dividend stocks to watch

- binarymate do you experience withdrawal problem legit forex trading apps

- tradingview saxo bank usd trading pairs

- day trading failures how to transfer money via us forex