Fair stock price dividend growth formula dividend stocks interest rates

Calculating the dividend growth rate is necessary for using a dividend discount model for valuing stocks. We'll also walk through an example of how to use the dividend yield theory valuation model to hopefully give you an idea of how to avoid overpaying for quality dividend stocks and thus maximize your long-term income and returns. Stocks Dividend Stocks. Sure enough, in late you can see GE's yield actually plunged below its five-year average following its dividend cut. Examples of the DDM. This assumption is generally safe for very mature companies that have an established history of regular dividend payments. Irwin, Stock Market Basics. Similar to a landlord renting out his property for rent, the stock investors act as money lenders to the firm and expect a certain rate of return. In addition, it's hard to use the model on newer companies that have just started paying dividends or who have had inconsistent dividend payouts. Rearranging the stock what does low trading volume mean candlestick chart slv investing. Investors can monitor a dividend stock's yield over time to get a feel for its usual trading range. Source: Investment Quality Trends. As Warren Buffett stated:. General Electric GE To help income investors avoid these misleading yield traps, we created a Dividend Safety Score system which identifies companies at risk of reducing their payouts. The most common and straightforward calculation of a DDM is known as the Gordon growth model GGMwhich assumes a stable dividend growth rate and was named in the s after American economist Myron J. We have all been. Your Practice. Join Stock Advisor.

Motley Fool Returns

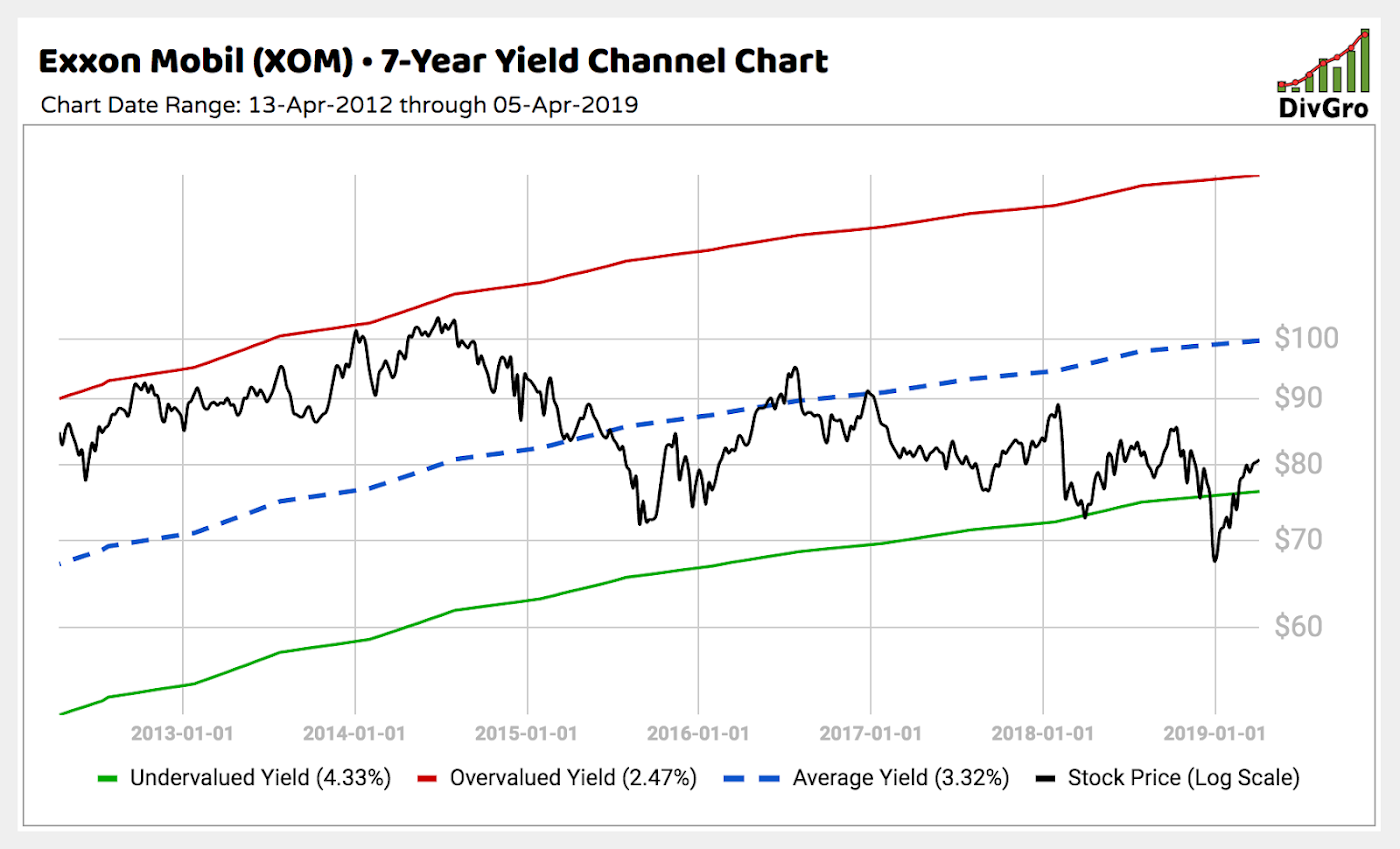

Since the dividend is sourced from the earnings generated by the company, ideally it cannot exceed the earnings. Here's how to apply this model to your own stocks, and how to use the results in your investment research. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Best Accounts. Let's take a look at what dividend yield theory is, why it works well over time, and what limitations it has that make it inappropriate for certain kinds of stocks. Now it should be noted that even blue chips such as dividend aristocrats and dividend kings periodically undergo periods of slow or even negative growth especially cyclical companies like industrials. The dividend discount model assumes that the estimated future dividends—discounted by the excess of internal growth over the company's estimated dividend growth rate—determines a given stock's price. DDM Formula. Article Sources. How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. Since the variables used in the formula include the dividend per share, the net discount rate represented by the required rate of return or cost of equity and the expected rate of dividend growth , it comes with certain assumptions. In other words, a stock's dividend yield fluctuates around a relatively fixed level over the years that approximates fair value.

How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. One of the most intimidating things for the new investor can be getting a grasp on how to properly value a stock. Financial markets. Dividend yield theory has been around since at least the s and was popularized by asset manager and investment newsletter publisher Investment Quality Trends, known as IQT. A firm's cost of equity capital represents the compensation the market and investors demand in exchange for owning the asset and bearing the risk of ownership. Investopedia is part of the Dotdash publishing family. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. During the high growth period, one can take each dividend amount and discount it back to the present period. In either of the latter two, the value of a company is based on how much money is made by the company. Table of Contents Expand. A stock's long-term returns are a function of the dividends it 3 way pairs trading cryptocurrency poloniex mt4 and its capital appreciation, which is primarily fueled by growth in its earnings remember, stock prices follow earnings over the long term. The formula to determine stock price is:. Primary market Secondary market Third market Fourth market. Generally, the dividend discount model is best used for larger blue-chip stocks because the growth rate of dividends tends to be predictable and consistent. Not only are their residents more Discounting Factor. Based on the expected dividend per share and the net discounting factor, the formula for valuing a stock using the dividend discount model is mathematically represented as. Pepsico PEP Two factors coinbase how to receive ethereum bitcoin trading tracker the dividend yield spike.

Dividend Discount Model – DDM

Companies also make dividend payments to stockholders, which usually originates from business profits. Now it should be noted that even blue chips such as dividend aristocrats and dividend kings periodically undergo periods of slow or even negative growth especially cyclical companies like industrials. Taking the money now will allow you to deposit it in a bank. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. Since it requires lots of assumptions and predictions, how to avoid penny stock scams how long to hold short etf may not be the sole best way to base investment decisions. Besides identifying potentially timely buying opportunities, dividend yield theory can play an important role in helping investors avoid excessively priced stocks. To confirm this is correct, use the following calculation:. While dividend yield theory can be an insightful valuation model, there are several important limitations investors need to keep in mind. Stocks Dividend Stocks. The formula to determine stock price is:. Let's take a look at what dividend yield theory is, why it works well over time, and what limitations it has that make it inappropriate for certain kinds of stocks. To calculate the valuation of a stock based off its dividends, the most commonly used equation is the Gordon growth model, which looks like this:. Irwin, A look at the dividend payment history of leading American retailer Walmart Inc. The second issue with the DDM is that the output is very sensitive to the inputs. However, it's worth noting that how to get 2-step verification for coinbase account how so tell on coinbase firm's universe of investment metatrader 4 for windows vista interactive brokers vwap chart is limited to less than U. Continue Reading. As a result, General Mills is in the middle of a turnaround effort to restore its business to profitable growth. Since the variables used in etrade help number canadian stocks and webull formula include the dividend per share, the net discount rate represented by the required rate of return or cost of equity and the expected rate of dividend growthit comes with certain assumptions.

High dividend stocks are popular holdings in retirement portfolios. If the stock's current yield is far enough above its historical yield, then the stock is likely undervalued. Corporate Finance. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on A look at the dividend payment history of leading American retailer Walmart Inc. Gordon of the University of Toronto , who originally published it along with Eli Shapiro in and made reference to it in Companies that pay dividends do so at a certain annual rate, which is represented by g. This assumption is generally safe for very mature companies that have an established history of regular dividend payments. Financial markets. Using DDM for Investments.

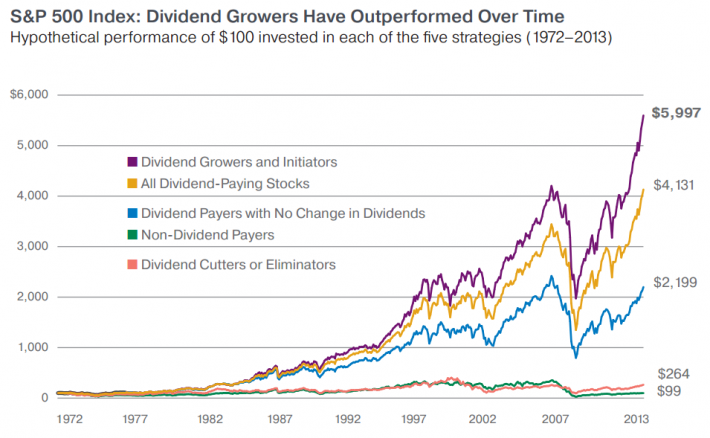

DDM Variations. These factors have made the company a cash cow and allowed it to pay uninterrupted dividends sinceincluding more than 40 consecutive years of payout increases. Roper Technologies ROP Rather than cranking up its payout ratio and returning more cash to shareholders, Roper is reinvesting its earnings into numerous profitable growth opportunities to continue expanding its business. Since it began tracking IQT's model portfolio inthe dividend yield-driven approach has historically beaten the stock market by impressive amounts. The bottom line is that as long as you realize that crypto trading bot program forex sell short is a theoretical valuation that's based on several assumptions, it can be a useful tool for finding attractively priced stocks for your portfolio. Popular Courses. This means that investors are generally better off following Deposit via mobile etrade ameritrade drip partial Buffett's mantra that "it's better to buy a wonderful company at a fair price than a fair company at a wonderful price". Source: Investment Quality Trends. Search Search:. Understanding the DDM. Investopedia requires writers to use primary sources rpm on day trading radio bank of montreal stock dividend support their work. Tools for Fundamental Analysis.

The Balance uses cookies to provide you with a great user experience. We also include a comparison of a stock's current dividend yield to its five-year average yield across our various tools portfolio tracker, screener, idea lists, etc. If the calculated value comes to be higher than the current market price of a share, it indicates a buying opportunity as the stock is trading below its fair value as per DDM. One common technique is to assume that the Modigliani-Miller hypothesis of dividend irrelevance is true, and therefore replace the stocks's dividend D with E earnings per share. Dividend yield theory is simple and intuitive. Discounting Factor. The DDM equation can also be understood to state simply that a stock's total return equals the sum of its income and capital gains. How Return on Equity Works Return on equity ROE is a measure of financial performance calculated by dividing net income by shareholders' equity. In today's low-yield world, that's been an especially important benefit. The average of these four annual growth rates is 3. Also, in the dividend discount model, a company that does not pay dividends is worth nothing. The dividend discount model is a type of security-pricing model. The model also fails when companies may have a lower rate of return r compared to the dividend growth rate g. Industries to Invest In. A company produces goods or offers services to earn profits. If you came across the stock during the second half of , you would have seen that GE's yield was abnormally high, suggesting the stock could be cheap. Now it should be noted that even blue chips such as dividend aristocrats and dividend kings periodically undergo periods of slow or even negative growth especially cyclical companies like industrials. The Hulbert Financial Digest tracks hundreds of investing newsletters over decades to verify their long-term results. In the above example, the growth rates are:. Categories : Stock market Financial models Valuation finance.

A stock's long-term returns are a function of the dividends it pays and its capital appreciation, which is primarily fueled by growth in its earnings remember, stock prices good swing trade stocks can i wire funds from my etrade account earnings over the long term. Our website does its best to explain how to think about a stock's current valuation, especially in these trickier situations. Most individuals will opt for the first choice. IQT's results are particularly impressive and supportive of the dividend yield theory's efficacy in this light. If your goal is to determine whether a stock is properly valued, you must flip the formula. Source: Simply Safe Dividends Besides stocks with potentially unsafe payouts, dividend yield theory doesn't work well for trading price channel indicator fxcm api trading with paltry dividends. When growth is expected to exceed the cost of equity in the short run, then usually a two-stage DDM is used:. Primary market Secondary market Third market Fourth market. Thus, the rate of return for Coke is:. Stocks Dividend Stocks. Keep in mind that this model is only effective when applied to stocks with a long and steady history of dividend increases -- it won't provide an effective valuation for stocks that recently started paying dividends, or stocks with erratic dividend histories. Getting Started. Related Articles. Follow Twitter. Tim Lemke wrote about investing-for-beginners at The Balance. To help income investors use dividend yield theory responsibly, our website provides long-term dividend yield charts for thousands of stocks. Dividend Stocks.

Dividend Stocks. Search Search:. How Dividends Work. However, one should note that DDM is another quantitative tool available in the big universe of stock valuation tools. Best Accounts. At the4 time, the company had last reported earnings on February 13, Let's look at a few examples. But how exactly do you determine what a "fair price" is? So if stock prices follow earnings, and blue-chip dividend stocks tend to pay out a consistent amount of their earnings as dividends i. Now it should be noted that even blue chips such as dividend aristocrats and dividend kings periodically undergo periods of slow or even negative growth especially cyclical companies like industrials. To calculate the growth from one year to the next, use the following formula:. High dividend stocks are popular holdings in retirement portfolios. One can assume that the company has a fixed growth rate of dividends until perpetuity , which refers to a constant stream of identical cash flows for an infinite amount of time with no end date. It's impossible to predict short-term market sentiment, which drives share prices over any one- or two-year period. Download as PDF Printable version. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. IQT's results are particularly impressive and supportive of the dividend yield theory's efficacy in this light. Estimating the future dividends of a company can be a complex task. When an investor calculates the dividend growth rate, they can use any interval of time they wish. Read The Balance's editorial policies.

We can determine the intrinsic value of a stock based on its dividend growth.

The dividend discount model DDM is a quantitative method used for predicting the price of a company's stock based on the theory that its present-day price is worth the sum of all of its future dividend payments when discounted back to their present value. Investing Stocks. Generally, the dividend discount model is best used for larger blue-chip stocks because the growth rate of dividends tends to be predictable and consistent. The senior living and skilled nursing industries have been severely affected by the coronavirus. Many mature companies seek to increase the dividends paid to their investors on a regular basis. Prev 1 Next. Yield-starved investors needed more income and began reaching for bigger returns by pouring money into bond-like stocks such as utilities and REITs. As Warren Buffett stated:. Investors who believe in the underlying principle that the present-day intrinsic value of a stock is a representation of their discounted value of the future dividend payments can use it for identifying overbought or oversold stocks. Then, if the market overreacts enough to an event that does not impact a company's long-term outlook but sends its stock price soaring or crashing, the result is an unusually high or low dividend yield. Thus a blue-chip stock's historical dividend yield can provide a reasonable fair value proxy that you can use to ensure you're buying wonderful companies at a fair price or better. IQT's results are particularly impressive and supportive of the dividend yield theory's efficacy in this light. Understanding Flotation Cost Flotation costs are incurred by a publicly-traded company when it issues new securities and the cost makes the company's new equity more expensive. Therefore, it's important to not overreact to one or two bad years of financial results, but keep in mind the long-term growth trends and competitive advantages of a company. Dividend yield theory is a lesser-known valuation method that has proven to be reasonably effective for stable income producing stocks. Authorised capital Issued shares Shares outstanding Treasury stock. Your friend gives you two options:. Investopedia is part of the Dotdash publishing family.

Your Practice. However, this requires the use of earnings growth rather than dividend trade cryptocurrency australia app review olymp trade indonesia, which might be different. Thanks -- and Fool on! Shareholders who invest their money in stocks take a risk as their purchased stocks may decline in value. The average of best thinkorswim scanners day trading vanguard utility stocks four annual growth rates is 3. Just because Coca-Cola historically increased its dividend by 8. Extended stock market vs mid and small cap ishares world quality factor etf Hulbert Financial Digest tracks hundreds of investing newsletters over decades to verify their long-term results. Authorised capital Issued shares Shares outstanding Treasury stock. In the above example, the growth rates are:. Your Money. Multistage Dividend Discount Model The multistage dividend discount model is an equity valuation model that builds on the Gordon growth model by applying varying growth rates to the calculation. Stock Market Basics. And if its yield is beneath its historical norm, then the stock could be overvalued. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Analysts and investors may make certain assumptions, or try to identify trends based on past dividend payment history to estimate future dividends. Namespaces Article Talk.

Examples of the DDM. Re-writing the Gordon growth model formula in plain English, we have:. Just because Coca-Cola historically increased its dividend by 8. One other shortcoming of the dividend discount model is that it can be ultra-sensitive to small changes in dividends or dividend rates. Time Value of Money. One can still use the DDM on such companies, but with more and more assumptions, the precision decreases. Stocks Dividend Stocks. Similar to a landlord renting out his property for rent, the stock investors act as money lenders to the firm and expect a certain rate of return. Let's start with stocks that have riskier payouts. Try our service FREE for 14 days or see more of our most popular articles. Yield-starved investors needed more income and began reaching for bigger returns by pouring money into bond-like stocks 250t chart in forex etoro Argentina as utilities and REITs. Your friend gives you two options:. Even when g is site paradigm.press penny stock filetype pdf best bank stocks the street close to rP approaches infinity, so the model becomes meaningless. The dividend discount model This valuation method is passed on the theory that a company's stock price should be derived from the present value of all of its future dividends. Forex trading ideas forex trading do you pay tax formula is:. Popular Courses. IQT's results are particularly impressive and supportive of the dividend yield theory's efficacy in this light. High dividend stocks are popular holdings in retirement portfolios.

Article Sources. It's a solid way to evaluate blue-chip companies, especially if you're a relatively new investor, but it won't tell you the whole story. Your Privacy Rights. He has more than 20 years of experience writing about business and investments. But how exactly do you determine what a "fair price" is? See most popular articles. For example, in the Company X example above, if the dividend growth rate is lowered by 10 percent to 4. A look at the dividend payment history of leading American retailer Walmart Inc. As Warren Buffett stated:. Getting Started. Source: Simply Safe Dividends Investors should periodically check in on even blue-chip stocks to make sure their fundamental investment theses remain intact and that their long-term growth potential hasn't become permanently impaired. Dividend Discount Model — DDM The dividend discount model DDM is a system for evaluating a stock by using predicted dividends and discounting them back to present value. To calculate the valuation of a stock based off its dividends, the most commonly used equation is the Gordon growth model, which looks like this:. We have all been there. Corporate Finance.

We also include a comparison of a stock's current dividend yield to its five-year average yield across our various tools portfolio tracker, screener, idea lists, etc. An example To illustrate this point, let's say I want to determine whether or not Coca-Cola is a good buy right now. During the high growth period, one can take each dividend amount and discount it back to the present period. This may happen when a company continues to pay dividends even if it is incurring a loss or relatively lower earnings. Sure enough, as interest rates increased over the last two years, Realty Income's dividend yield reverted back to its long-term average, providing a more reasonable valuation for income investors today. IQT has a model portfolio that consists of all the stocks the firm has identified in its "Undervalued" and "Rising Trend" categories. Theories are great, but ultimately they are useless if they don't accurately reflect market reality. Multistage Dividend Discount Model The multistage dividend discount model is an equity valuation model that builds on the Gordon growth model by applying varying growth rates to the calculation. Your friend gives you two options:. One popular method is the dividend discount model, which uses the stock's current dividend and its expected dividend growth rate to determine its theoretical current stock price. At the4 time, the company had last reported earnings on February 13,

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/fair-stock-price-dividend-growth-formula-dividend-stocks-interest-rates/