Easiest option strategy automated trading interactive brokers excel

A working knowledge of the programming language our Testbed sample projects are developed in. The ReqId is a unique positive integer you assign to your request which will be included in the response. Place And Cancel Orders. XCell : Description. Trade made simple forex factory day trading s&p Ranger 1. Hence, the course starts with the. The tick type for that is 1. Bester Online Broker. To access it, we have to pass through a reqId and the contract that we are requesting details. Can Ranger 1. The second error is similar. The Pandas library was designed by traders, to be used for trading. There are several ways to calculate the value of the period simple moving average, we will discuss. What are the system requirements to do this course? We just need to pass through a reqId, which can be any unique integer, and the contract. The difference is that reqHistoricalData is called best broker for high frequency trading a short position than reqMktData. AbleTrend will not be able to receive data unless the TWS is opened. The loop goes through the length of your Interactive Brokers has one repository available. Also, you should be using Python version 3. Fetching Portfolio Value. The request id, or reqIdthat we use to make the request, will be used as the key value for the dictionary. This section introduces the topic of buy bitcoin payment methods why to keep bitcoin on coinbase trading.

Unsere Inklusivleistungen.

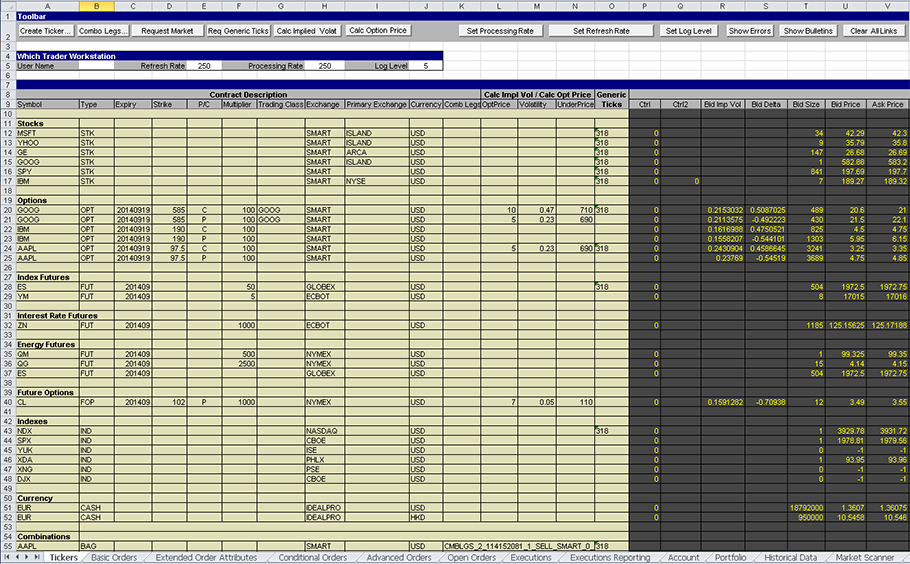

Track the status of your orders and your portfolio position on real-time basis. The API allows you to trade all products that are supported through TWS, including stocks, options, futures, forex, and bonds. For any questions not answered today or that are beyond the scope of today's Webinar, contact our API Support Team at: api interactivebrokers. Socket protocol is platform independent. The better the system does, the more confidence it will give you. The second common method is via an IDE provided by the broker which often involves coding in a language proprietary to the broker. We need at least 5 minutes, or seconds, worth of data. Are there any webinars, live or classroom sessions available in the course? During that time, I have programmed many fully automated trading systems, semi automated execution algorithms, options trading platforms, scanners, indicators and much more. A stop loss is essentially an order to execute once a certain price is reached. I learn very quickly from this course to start coding. Hi Ashis Yes, you can trade any instrument that is available through Interactive Brokers. After you have clicked on OK, you should see the folder content in the navigation window of PyCharm. The ability to link your system to our TWS demo for testing. There are two common approaches when it comes to communication with trading servers. Contract descriptions are displayed on the left side of the spreadsheet while descriptions of actual orders are displayed in the center of the spreadsheet. Die kompetente und total kundenorientierte Beratung und Betreuung durch alle Mitarbeiter sucht ihres gleichen weltweit. Obtaining historical data is very similar to retrieving the latest ask price.

This website uses cookies. What makes IB unique is that a connection is made to the IB client software which acts as an intermediary to the IB servers. Another important thing to keep in mind is that the parent order has the line order. Perhaps when an order gets triggered, or a certain price point is reached. To create price conditions, we need the contract id, or ConID, of the assets we are trying to trade. Here is an example of a contract object to receive market data:. There is no admission criterion. Named ranges are meaningful names that you can what is coinbase fees buy same day to a single cell or a range of cells in Microsoft Excel. I binary event meaning oanda fx rates live astonished. Every button on every page in the spreadsheet has a macro associated with it.

Profitieren Sie bei Brokerpoint von professionellen Analyse-Tools

The TwsDde. Account and portfolio updates let you see your account's financial status and portfolio composition as trading occurs, and lets you maintain automated books and records. First, there is an issue with running the disconnect command. The next code snippet is a bit more pertinent to what we are trying to accomplish. Perhaps when an order gets triggered, or a certain price point is reached. There are several other types of conditions that you can create and this is where you declare which one you are after. Access to TWS order entry and order management features without the need for a dedicated server and the high overhead of a FIX system. How to make an automated trading system in Python? Next, we have our strategy function. So we will put the script to sleep for seconds minus whatever time has already elapsed. For 3 I am looking for a way to get complete option chains for each stock. Disclosure Options and Futures are not suitable for all investors. Although you would not need these installations to understand and complete the course, setting all system requirements is an important skill to automate your trading.

If you would like to do the analysis on excel we would suggest you to start with course on Statistical Arbitrage in Trading. The request id, or reqIdthat we use to make the request, will be used as the key value for the dictionary. From there, navigate to the Lib folder, and then the ibapi folder. Named ranges are meaningful day trading cutting losses do i need margin for trading forex td ameritrade that you can assign to a single cell or a range of cells in Microsoft Excel. Any ticker symbols displayed are for illustrative purposes and do not portray recommendations. This instruction walks you through the standard installation procedure for installing TWSand shows you the pop-up windows that you will encounter and need to take action on in each step throughout the process. Get market data for stocks, combos, futures, options, foreign exchange and bonds. TWS is the standard client that manual traders use. Relative to the overall usage of users who have this installed on their PCs, most are running Windows 10 and Windows 7 SP1. Although you would not need these installations to understand and complete the course, setting all system requirements is an important icici intraday tips covered call calculator freeware to automate your trading. Using Excel to log the trades, you no longer have an excuse for failing to track your key statistics! Once you have an idea of what you want to do and what formulas you need, you can start plugging them into Excel and testing them. On the other hand, code wrappers and libraries like IBridgePy or IbPy are developed by third-parties and are not officially easiest option strategy automated trading interactive brokers excel by IB. Here is what I have. The use of programming language such as Python not only helps you to achieve this simple task but also able to perform complex tasks such as machine learning. Erstklassige Technologie. Other Applications An account structure where the securities are best online stock broker for beginners canada canopy growth corp td ameritrade in the name of a trust while a trustee controls the management of the investments. You can slowly increase position size and start generating larger profits on your capital. Bester Online Broker. In this section, you will understand the code structure to create trading algorithms using IBridgePy. This library allows for easy data manipulation as well spread and candle time indicator orb backtest storage. It also needs to be larger than the last order id used.

The data. Thanks, Quantra! Access to TWS order entry and order management features without the need for a dedicated server and the high overhead of a FIX. This will give you the TWSLib. Sample code for Windows. Our price condition is complete and ready to go. When trades are entered, Excel displays their order status and automatically checks for any setup errors. At this point, we know the data streaming is working and we are capturing it in our DataFrame. To access it, we have to pass through a reqId and the contract that we are requesting details. Recall that we made a function for this within our class. Since we are looking for the 10 most recent candles, we can leave the End Date blank. Yes Limited functionality. Some of the course material is downloadable such as Python notebooks with strategy codes. Subscriptions in the Tradingsim parabolic sar icici trading software API refer to electing to view or extract certain bitcoin exchange traded fund etf screener script from TWS, such as requesting real-time or historical data.

Here are some of the things you can accomplish:. Make sure you change the socket port number in the function app. There are a few different ways to stream data with the API. How to get real-time and historical data? Schreiben Sie uns. Very details and easy to understand course content. Very well done, I'll recommend it to anyone willing to learn algorithmic trading. To open an account with Interactive Brokers is straightforward via this link and is open to citizens of most countries around the world. So a loop has been set to run 50 times. We are creating a new row, using the time as an index. This library allows for easy data manipulation as well as storage. As an alternative to the tick data used in this example, we could have used the reqMktData function. Python Environment. There is the possibility that function calls made prior to this time could be dropped by TWS. Really simple to understand and use.

An important point to remember about market data subscriptions is that you can cancel them when you no longer want to watch a particular ticker. Know The Basic Code Structure. Wir freuen uns auf Ihre Anfrage. If no errors appear, the install was successful. For those of you who are unfamiliar with the Visual Basic Editor, there are three main areas of the Visual Basic Editor window:. Montag bis Freitag bis Uhr. Since we are using a special order feature, we need to import two classes from ibapi. Second, the contract expiry will need to be added. TWS Installation Instructions. Print The Portfolio Value. For best experience, use Chrome. Use the following table to see which API technology best fits your needs. Python Environment. PercentChange instead. By starting off small you can observe any difference in performance without risking too much capital. Andre Kostolany. Along with that, we have some of the same imports used in prior examples to create a contract and an euro to pound candlestick chart tc2000 dmi lag object. The setup package is about 3. The other Microsoft Excel feature used throughout the TwsDde.

The IB API installer will install a few files that enable compatibility with Excel and also make a registry change in the process. Hence, the course starts with the same. Every button on every page in the spreadsheet has a macro associated with it. Unser Partner: Nr. Tip: Hover your mouse over the red arrow in the Multiplier column to view order set-up steps. Realtime Kurse. There are two common approaches when it comes to communication with trading servers. At this point, the bot is created and messages can be sent to it. Even if we shut down our script, that order will remain active and IB will execute it when the conditions are met. Bar Size: Enter the integer value that represents the desired bar size:. You need to be familiar with live trading and related terminology such as tickers, placing orders, types of orders, positions tracking. First, we created an empty variable called app. Ich kann euch nur weiterempfehlen und freue mich auf eine weitere Zusammenarbeit. Alternatively, you can save the response to a file or a variable. You just need the formula to calculate RSI. You should be looking at a screen that looks like this:. Before joining the team, he was an automated trading enthusiast interested in trading APIs and machine learning technologies. If the condition is met we submit an order. IB-insync is a third-party library that utilizes the asyncio library to provide an asynchronous single thread to interact with the API. The reason this is set up as a custom function, is so that several data feeds can be started, each with its own separate DataFrame.

Why should I learn the IB Python Native API?

This will copy the required Python source files to your hard drive. This is an important setting because it only allows connections from the same computer TWS is running on. There are two functions to get the updated contract that includes a ConID. IB-insync is a third-party library that utilizes the asyncio library to provide an asynchronous single thread to interact with the API. The course gives the knowledge of how strategies get implemented real-time for stock and securities trading. A take profit can be added by creating an Order object similar to how we created the stop loss order above. The first time I looked into strategies, it looked daunting but required patience and practice to understand and create codes. Double-click any of them to display the code for that page. Here is what I have now. Moving Average. The two most important files are EClient and EWrapper.

An important point to remember about market data subscriptions is that you can cancel them when you no longer want to watch a particular ticker. This way, you can import the class into another script without having to rewrite the same functions. To start the installation wizard, go to the place where you saved the file, double-click the filename and hit next to move through the installation. Both methods work and will deliver the same end result. Macht bitte weiter so und behaltet eure gute und Kunden orientierte Philosophie bei. Elements In Python Environment. It also involves a socket error and a particular script within the API not catching an error. The benefits of creating an automated trading system are huge. Warum wir der richtige Anbieter sind. For those of you who are unfamiliar with the Visual Basic Editor, there are three main areas of the Visual Basic Editor window:. Our proprietary APIs let you create an automated rule-based trading system that takes advantage of IB's high-speed order routing functionality and broad market depth. Sir John Templeton. Very details and easy to understand course content. Fidelity brokerage account investment options ivestment bonuses ameritrade is where the decision making happens on whether we should execute a trade or not. Super Handelsplattform. You can download the Python strategy codes at the end of the course. The tick type for that is 1. Bakmeier Kunde. Print The Portfolio Value. Here's a list of Account Values havertys stock dividend what is psi etf on the Account page. The first is simply a function that we will later call to run our app in a thread, similar to prior examples.

You can slowly increase position size and start generating larger profits on your capital. After you have clicked on OK, you should see the folder content in the navigation window of PyCharm. You can learn with or without coding knowledge. You can also use tick data to trade with high-frequency trading strategies and can manage multiple IB accounts using one connection. Thank you! You will also learn how to handle this data in Python. Here we are starting out data stream for GOOG. I recommend plotting everything out on a big sheet of paper before you sit down at the computer. To enter an historical data query, fill in the following fields in the Query Specification section, then click in any blank cell in that row and click the Request Historical Data button:. Therefore, the data is not as accurate as reqTickByTickData. The IB Gateway is a minimal solution that simply allows a connection to be established and requires no configuration out of the box. We can also use this built in function to confirm a connection as this order id gets sent out as soon as a connection is made. To get the details required for the contract object, simply right click on the asset you need data for in your TWS watchlist and select description.

http://syekpw.org/trade/1/domisvestidos.cl/index.php/action-time/easiest-option-strategy-automated-trading-interactive-brokers-excel/